UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the Month of December 2023

Commission File Number 000-16050

TAT Technologies Ltd.

(Translation of registrant’s name into English)

5 Hamelacha Street, Netanya 4250540, Israel

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

This Form 6-K is incorporated by reference into the Registrant’s Form S-8 File Nos. 333-219031, 333-228345 and 333-268906.

Explanatory Note

On December 14, 2023, TAT Technologies Ltd., an Israeli company (the “Company”), received and

accepted commitments from Israeli institutional and accredited investors (as defined under Israel’s Securities Law, 5728-1968 (the “Investors”), to participate in a in a private placement

(the “Private Placement”) of Ordinary Shares, par value NIS 0.90 per share, of the Company (“Ordinary Shares”).

The Company is expected to issue and sell to the Investors an aggregate of 1,158,600 Ordinary Shares (the “Shares”), for a purchase price of NIS 31.70 per Share (approximately $8.60 per Share*). The newly issued Shares are expected to represent approximately 11.5% of the Company’s issued and

outstanding Ordinary Shares after the consummation of such sale. The closing of the transaction is subject to customary closing conditions and is expected to be completed by December 31, 2023.

The Company expects to receive net proceeds from the sale of the Shares, after deducting offering expenses, of

approximately NIS 36.2 million (or approximately $9.8 million*). The Company intends to use such proceeds for general corporate purposes.

The Private Placement is being made in Israel only and not to U.S. persons, as defined in Rule 902 of the U.S. Securities Act of 1933, as amended (the “Securities Act”), pursuant to a registration exemption afforded by Regulation S promulgated under the Securities Act, and the Shares will be subject to certain transfer restrictions. The Shares

will not be registered under the Securities Act and will not be offered or sold in the United States without registration or applicable exemption from the registration requirements according to the Securities Act.

A translated English copy of the form commitment letter is attached is Exhibit 99.1 to this report.

This report does not constitute an offer to sell or the solicitation of an offer to buy or subscribe for any securities or a

solicitation of any vote or approval nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation, sale, issuance or transfer would be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

* Calculated based on the exchange rate of $1.00:NIS 3.685, as published by the Bank of Israel on December 14, 2023.

Exhibits

99.1 Form of commitment letter (unofficial English translation from Hebrew)

99.2 Company press release, dated December 14, 2023, titled “TAT Technologies Announces Proposed Private

Placement to Israeli Institutional and Accredited Investors”.

Legal Notice Regarding Forward-Looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. Forward-looking statements generally relate to future events or our future financial or operating performance. Forward-looking statements in this report include, but are not limited to, statements related to our expectations regarding

the issuance and sale of the shares, the closing date of the transaction, and the Company’s intended use of the proceeds from the sale of the Shares. Our expectations and beliefs regarding these matters may not materialize, and actual results or

events in the future are subject to risks and uncertainties that could cause actual results or events to differ materially from those projected, including, without limitation, as a result of the war and hostilities between Israel and Hamas and Israel

and Hezbollah. The forward-looking statements contained in this report are subject to other risks and uncertainties, including those more fully described in our filings with the Securities and Exchange Commission, including our Annual Report on Form

20-F filed with the Securities and Exchange Commission on March 29, 2023. The forward-looking statements in this report are based on information available to the Company as of the date hereof, and the Company disclaims any obligation to update any

forward-looking statements, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

TAT Technologies Ltd.

| Title: |

Chief Financial Officer

|

Date: December 14, 2023

Exhibit Index

Exhibit 99.1

Unofficial translation from Hebrew

Full Name of the Investor: ___

To:

TAT Technologies Ltd.

(The “Company”)

|

To:

APEX Issuances Ltd. and Phoenix Underwriting Ltd.

(the “ Representatives” or “Private Placement Managers”)

|

Re: Private Placement of Shares of TAT

Technologies Ltd.

|

1. |

We hereby submit to you an irrevocable offer to purchase from the Company ordinary shares, par value NIS 0.90 per share, of the Company (the “ Shares”) in the amount that will be allocated to us in the private placement, as described below.

|

Our offer is for the purchase of ____ Shares for a price of NIS 31.70 per Share, Total consideration in NIS ____.

|

2. |

We hereby confirm that the Company and/or the Representatives may at their sole discretion give us a notice according to which the Company and/or the Representatives will

determine whether they accept our offer, in whole or in part, that the Company and/or the Representatives are not obliged to accept our offer, in whole or in part, to conduct a tender, tender-like or other procedure for accepting offers,

and no obligation of reasoning will apply to them if they choose not to accept our offer. It is hereby clarified that the Company and/or the Representatives shall be entitled to change the amount of Shares we are obligated to purchase, at

their sole discretion, provided that this amount does not exceed the maximum amount specified in this commitment letter (“Acceptance Notice”).

|

We hereby commit to transfer to the Company the full consideration for our Acceptance Notice, in consideration to the

issuance of the Shares in a transaction to be cleared off the exchange and without financial clearing, through the Company’s Registrar in the US - Equiniti Trust Company (formerly known as AST).

|

3. |

If we do not receive from the Company and/or the Representatives an Acceptance Notice detailing the amount of Shares that will be allocated within the private placement,

within one business day from the date of sending our offer, we will contact you by phone to verify that our offer has been received by you.

|

|

4. |

In connection with our offer, we undertake, declare and irrevocably confirm that the Shares are purchased by us for ourselves and not for the purpose of distribution or sale

to others, not on behalf of or for others. (A TASE-member ordering for its clients who are classified investors will also attach its signature to the attached form designated for this purpose).

|

|

5. |

We hereby represent and confirm that we are aware of the fact that the Shares that will be assigned to us, insofar as they are assigned, will be assigned without any

representations or indemnification (AS IS), free from any debt, foreclosure, encumbrance, and/or other third party rights., except for trading restrictions detailed below.

|

|

6. |

We hereby represent and confirm that we have the ability, experience and financial, economic and business tools to analyze the viability of investing in the Shares of the

Company and asses the risks and prospects of the transaction independently and commit to its execution, and that we have the ability to consider and understand the tax implications relating to the Shares that will be sold to us. The

purchase of Shares is being executed on the basis of our inspection and under our sole responsibility, we have not received any information, representations or commitments from the Company, the Representatives, or anyone on their behalf,

including in relation to the Company’s condition.

|

|

7. |

We are aware that the allocation of the Shares to us is conditional upon the fulfillment of a number of conditions, including among others: (1) the approval for listing for

trading by the Tel Aviv Stock Exchange and as may be required by Nasdaq; (2) additional conditions, including the approval of the Company’s general meeting as may be required. The actual transfer of the consideration will be carried out

after the fulfillment of the conditions. If the conditions are not fulfilled within 21 business days from the date of receipt of the Acceptance Notice, we will have the right to cancel our order. We will not have any claim against the

Company and/or their Representatives and/or officers and/or their proxy and/or any other party, if and to the extent the private placement does not occur or in the event that some of the conditions are not met.

|

|

8. |

The transfer and/or sale of Shares authorized to us by the Company on the Tel Aviv Stock Exchange and Nasdaq will be subject to the following: (a) restrictions on resale

specified in the Securities Law, 1968 (hereinafter: the “Law”) and the regulations established thereunder. We undertake to comply with the provisions of the Law applicable to holders of securities, including the provisions of Section 15C of

the Law and Securities Regulations (Details Regarding Sections 15A to 15C of the Law), 2000, and in particular the provisions of Section 5 of the aforementioned regulations, regarding restrictions on resale, and (b) restrictions on resale

in accordance with the provisions of the securities laws of the United States.

|

|

9. |

We confirm and agree as follows:

|

|

A) |

We are an Israeli investor who is one of the types of investors listed in the first supplement to the Securities Law 1968 (hereinafter: “Classified Investor” and “Securities Law”) for the purposes of Section 15A(b)(1).

We hereby confirm that the terms related to this classifications are met, and we are aware of the meaning of this confirmation and classification as classified investor, and agree to this, and are also aware that the Company and the

Representatives rely on our said approval and consent. We confirm and declare that there are no agreements, either written or oral, between us and a shareholder in the Company, or between us and other classified investors or between us and

others, regarding the purchase or sale of securities of the Company or regarding voting rights in the Company.

|

|

B) |

We are aware that the offer of Shares to investors in Israel is made in accordance with Regulation S (hereinafter: “Regulation S”) established by virtue of the US Securities Act of 1933. Accordingly, we declare that: (1) we are not a U.S. Person within the meaning of Regulation S and are not purchasing the

shares on behalf of a U.S. person; (2) we are not located in the United States at the time of submitting the application to purchase the Shares and/or with the intention of making a distribution (within the meaning of such term in the

securities laws of the United States).

|

|

C) |

We acknowledge that the offer of the securities was not made according to a prospectus submitted and/or approved in Israel and/or the United States. The offer of the

securities is not an offer to the public of securities in Israel and/or the United States.

|

|

D) |

We acknowledge that no offer of the Shares or will be made to a person in the United States by the undersigned, any affiliate of the undersigned, or any person acting on

their behalf for a period of 40 days from the closing of the sale of the Shares.

|

|

E) |

We acknowledge that no sale of the Shares will be made by means of a transaction or transactions executed in, on or through the facilities of the TASE or Nasdaq for a period

of 40 days from the closing of the sale of the Shares, and neither the undersigned, any affiliate of the undersigned, nor any person acting on their behalf has pre-arranged or will pre-arrange such transaction or transactions with a buyer

in the United States nor has or will have any knowledge of any such pre-arrangement, and in no other manner.

|

|

F) |

We acknowledge that no activity undertaken for the purpose of or that could reasonably be expected to have the effect of, conditioning the market in the United States for

any of the Shares has been made or will be made by the undersigned, any affiliate or the undersigned, or any person acting on their behalf.

|

|

10. |

We acknowledge that the Company and/or the Representatives will be entitled to take all appropriate measures to verify, at their sole discretion, as much as possible, that

we comply with the conditions of the first addendum to the Law (as defined above) and the conditions stipulated in sections 9(A) and 9(B) above, including. by obtaining attorney’s approvals and/or approvals of authorized agencies, and that

each of the Company and/or the Representatives t will be entitled, as it deems appropriate, to require us to provide the commitments/collaterals for the consideration specified by us in this offer form. Moreover, we also confirm that we

acknowledge that if and as required by the Company and/or by the Representatives to convince them that we meet the conditions of the first addendum of the Law and/or the conditions set forth in sections 9(A) and 9(B) above, if we are

required by them to provide collateral for our commitment according to this offer form as stated, and if we do not do so to the full satisfaction of the Company and/or the managers of the private placement, as the case may be, the Company

and/or Representatives will be entitled to cancel our offer according to this offer form and we will not have any claim and/or demand and/or claim that with that.

|

|

11. |

We confirm and declare that we are aware that the Shares have not been registered and are not allocated or sold through a prospectus in accordance with the U.S. securities

laws, and the Shares that will be allocated will be restricted shares, as the term is defined in the U.S, securities laws, and that the sale of the Shares will be subject to various transfer restrictions, including those arising from U.S.

securities laws.

|

|

12. |

We confirm that we are aware that the intention to carry out a private placement and/or the request to receive offers constitutes confidential information, and that the

information must not be shared with any other party and/or there shall be no trading in the Sares and/or other securities of the Company before the Company publicly discloses the private placement, and/or a notice will be given of the

cancellation of the intention to carry out the private placement.

|

|

13. |

We confirm that we are aware that the Company and/or the Representatives may determine and change the size of the private placement, as well as postpone and cancel the

allocation of the Shares, all at their sole discretion. Also, we confirm that we are aware that it is possible that the actual allocation will be lower than the total number of Shares that we offered in the offer. In the event that the

Company does not respond to our offer, we and/or anyone on our behalf will not have any claim and/or demand against the Company and/or the Representatives and/or their related parties, and/or their managers and/or or their employees and/or

consultants and/or anyone on their behalf. We confirm and acknowledge that to the extent that our offer will be approved by the Company, we may be required to sign an updated offer form and/or share purchase agreement relating to the

private placement, and the signing of these documents (as and when required) is a condition for our participation in the private placement.

|

|

14. |

We confirm and acknowledge that the Company and/or the Representatives rely on the statements, representations and commitments contained in this offer form, and that the

incorrectness of said representations and statements and/or non-compliance with our obligations according to this offer form, may cause the Company and/or the Representatives serious damages.

|

Exhibit 99.2

TAT Technologies Announces Proposed Private Placement to Israeli Institutional

and Accredited Investors

Netanya , Israel, December 14, 2023 - TAT Technologies Ltd. (NASDAQ: TATT - News) (“TAT” or the “Company”),

a leading provider of products and services to the commercial and military aerospace and ground defense industries, announced today that, following the approval of its Board of Directors, it has received and accepted commitments from Israeli

institutional and accredited investors (as defined under Israel’s Securities Law, 5728-1968 (the “Investors”), to participate in a in a private placement (the “Private Placement”) of Ordinary Shares, par value NIS 0.90 per share, of the Company (“Ordinary Shares”).

The Company is expected to issue and sell to the Investors an aggregate of 1,158,600 Ordinary Shares (the “Shares”), for a purchase price of NIS 31.70 per Share (approximately $8.60 per Share*). The newly issued Shares are expected to represent approximately 11.5% of the Company’s issued and outstanding Ordinary Shares

after the consummation of such sale. The closing of the transaction is subject to customary closing conditions and is expected to be completed by December 31, 2023.

The Company expects to receive net proceeds from the sale of the Shares, after deducting offering expenses, of approximately NIS 36.2

million (or approximately $9.8 million*). The Company intends to use such proceeds for general corporate purposes.

The Private Placement is being made in Israel only and not to U.S. persons, as defined in Rule 902 of the U.S. Securities Act of 1933,

as amended (the “Securities Act”), pursuant to a registration exemption afforded by Regulation S promulgated under the Securities Act, and the Shares will be subject to certain transfer

restrictions. The Shares will not be registered under the Securities Act and will not be offered or sold in the United States without registration or applicable exemption from the registration requirements according to the Securities Act.

This press release does not constitute an offer to sell or the solicitation of an offer to buy or subscribe for any

securities or a solicitation of any vote or approval nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation, sale, issuance or transfer would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

* Calculated based on the exchange rate of $1.00:NIS 3.685, as published by the Bank of Israel on December 14, 2023.

Legal Notice Regarding Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements generally relate to future events or our future financial or operating

performance. Forward-looking statements in this press release include, but are not limited to, statements related to our expectations regarding the issuance and sale of the shares, the closing date of the transaction, and the Company’s intended use

of the proceeds from the sale of the Shares. Our expectations and beliefs regarding these matters may not materialize, and actual results or events in the future are subject to risks and uncertainties that could cause actual results or events to

differ materially from those projected, including, without limitation, as a result of the war and hostilities between Israel and Hamas and Israel and Hezbollah. The forward-looking statements contained in this press release are subject to other risks and uncertainties, including those more fully described in our filings with the Securities and Exchange Commission, including

our Annual Report on Form 20-F filed with the Securities and Exchange Commission on March 29, 2023. The forward-looking statements in this press release are based on information available to the Company as of the date hereof, and the Company

disclaims any obligation to update any forward-looking statements, except as required by law.

About TAT Technologies Ltd.

TAT Technologies Ltd. is a leading provider of services and products to the commercial and military aerospace and ground defense

industries. TAT operates under four segments: (i) Original equipment manufacturing (“OEM”) of heat transfer solutions and aviation accessories through its Gedera facility; (ii) MRO services for heat transfer components and OEM of heat transfer

solutions through its Limco subsidiary; (iii) MRO services for aviation components through its Piedmont subsidiary; and (iv) Overhaul and coating of jet engine components through its Turbochrome subsidiary. TAT controlling shareholders is the FIMI

Private Equity Fund.

TAT’s activities in the area of OEM of heat transfer solutions and aviation accessories primarily include the design, development and

manufacture of (i) broad range of heat transfer solutions, such as pre-coolers heat exchangers and oil/fuel hydraulic heat exchangers, used in mechanical and electronic systems on board commercial, military and business aircraft; (ii) environmental

control and power electronics cooling systems installed on board aircraft in and ground applications; and (iii) a variety of other mechanical aircraft accessories and systems such as pumps, valves, and turbine power units.

TAT’s activities in the area of MRO Services for heat transfer components and OEM of heat transfer solutions primarily include the MRO

of heat transfer components and to a lesser extent, the manufacturing of certain heat transfer solutions. TAT’s Limco subsidiary operates an FAA-certified repair station, which provides heat transfer MRO services for airlines, air cargo carriers,

maintenance service centers and the military.

TAT’s activities in the area of MRO services for aviation components include the MRO of APUs, landing gears and other aircraft

components. TAT’s Piedmont subsidiary operates an FAA-certified repair station, which provides aircraft component MRO services for airlines, air cargo carriers, maintenance service centers and the military.

TAT’s activities in the area of overhaul and coating of jet engine components includes the overhaul and coating of jet engine

components, including turbine vanes and blades, fan blades, variable inlet guide vanes and afterburner flaps.

For more information of TAT Technologies Ltd., please visit our web-site: www.tat-technologies.com

Contact:

Mr. Ehud Ben-Yair

Chief Financial Officer

Tel: 972-8-862-8503

ehudb@tat-technologies.com

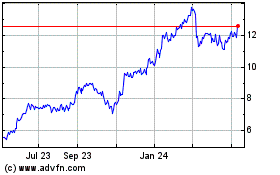

TAT Technologies (NASDAQ:TATT)

Historical Stock Chart

From Mar 2024 to Apr 2024

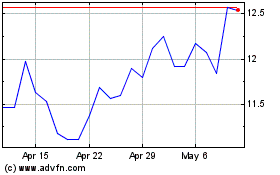

TAT Technologies (NASDAQ:TATT)

Historical Stock Chart

From Apr 2023 to Apr 2024