0001173204false00011732042023-12-082023-12-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): December 08, 2023 |

Cineverse Corp.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-31810 |

22-3720962 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

224 W. 35th St. Suite 500, #947 |

|

New York, New York |

|

10001 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 212 206-8600 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

CLASS A COMMON STOCK, PAR VALUE $0.001 PER SHARE |

|

CNVS |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 8, 2023, Cineverse Corp. (the "Company") amended its 2017 Equity Incentive Plan (the "Plan Amendment") to increase the number of shares authorized for issuance thereunder from 904,913 to 2,054,913.

The foregoing description of the Plan Amendment is qualified in its entirety by reference to such amendment, which is filed herewith as Exhibit 10.1.

Item 5.07 Submission of Matters to a Vote of Security Holders.

(a) At the Annual Meeting of Stockholders of the Company held on December 8, 2023 (the “Annual Meeting”), the stockholders of the Company voted on four proposals. Proxies for the Annual Meeting were solicited pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended. There was no solicitation of proxies in opposition to management’s nominees as listed in the proxy statement and all of management’s nominees were elected to our Board of Directors.

(b) Details of the voting are provided below:

Proposal 1:

To elect four (4) members of the Company’s Board of Directors to serve until the 2024 Annual Meeting of Stockholders (or until successors are elected or directors resign or are removed).

|

|

|

|

|

Votes For |

Votes Withheld |

Broker Non-Votes |

Christopher J. McGurk |

2,977,001 |

1,634,810 |

3,027,881 |

Peter C. Brown |

2,931,385 |

1,680,426 |

3,027,881 |

Mary Ann Halford |

3,331,361 |

1,280,450 |

3,027,881 |

Patrick W. O’Brien |

2,957,198 |

1,654,613 |

3,027,881 |

|

|

|

|

|

Proposal 2: |

|

|

|

|

|

Votes For |

Votes Against |

Abstentions |

Broker Non-Votes |

To approve by non-binding vote, executive compensation. |

2,845,595 |

1,739,214 |

27,002 |

3,027,881 |

Proposal 3: |

|

|

|

|

|

Votes For |

Votes Against |

Abstentions |

Broker Non-Votes |

To approve an amendment to the Company's 2017 Equity Incentive Plan to increase the total number of shares of Class A Common Stock available for issuance thereunder. |

3,352,290 |

1,195,620 |

63,901 |

3,027,881 |

|

|

|

|

|

Proposal 4: |

|

|

|

|

|

Votes For |

Votes Against |

Abstentions |

Broker Non-Votes |

To ratify the appointment of EisnerAmper LLP as our independent auditors for the fiscal year ending March 31, 2024. |

7,069,014 |

529,716 |

40,962 |

N/A |

Item 8.01 Other Events.

On December 8, 2023, Christopher J. McGurk, the Chairman and Chief Executive Officer of the Company, delivered remarks at the Annual Meeting. The remarks are attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

Exhibit No. Description

10.1 Amendment No. 6 to the 2017 Equity Incentive Plan.

99.1 Remarks delivered by Christopher J. McGurk on December 8, 2023.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

December 13, 2023 |

By: |

/s/ Gary Loffredo |

|

|

Name: Date: |

Gary S. Loffredo

Chief Legal Officer, Secretary and Senior Advisor |

Exhibit 10.1

AMENDMENT NO. 6

TO

CINEVERSE CORP. 2017 EQUITY INCENTIVE PLAN

AMENDMENT NO. 6, dated as of December 8, 2023 (this "Amendment"), to the 2017 Equity Incentive Plan (as amended, the "Plan") of Cineverse Corp., a Delaware corporation (the "Corporation").

WHEREAS, the Corporation maintains the Plan, effective as of August 31, 2017; and

WHEREAS, the Board of Directors of the Corporation deems it to be in the best interest of the Corporation and its stockholders to amend the Plan in order to increase the maximum number of shares of the Corporation's Class A Common Stock, par value $.001 per share, which may be issued and sold under the Plan from 904,913 shares to 2,054,913 shares.

NOW, THEREFORE, BE IT RESOLVED the Plan is hereby amended as follows:

1. The first sentence of Section 4.1(a) shall be revised and amended to read as follows:

"The maximum number of Shares available for issuance to Participants under this Plan, inclusive of Shares issued and Shares underlying outstanding awards granted on or after the Effective Date, is 2,054,913 Shares, which includes 6,414 unused Shares carried over from the Existing Incentive Plan."

2. This Amendment shall be effective as of the date first set forth above.

3. In all respects not amended, the Plan is hereby ratified and confirmed and remains in full force and effect.

CINEVERSE CORP.

By: /s/Gary S. Loffredo

Name: Gary S. Loffredo

Title: Chief Legal Officer, Secretary and Senior Advisor

Exhibit 99.1

CINEVERSE CORP.

ANNUAL MEETING OF STOCKHOLDERS

December 8, 2023

Remarks delivered by Christopher J. McGurk, the Chairman and Chief Executive Officer of Cineverse Corp., at the 2023 Annual Meeting of Stockholders on December 8, 2023:

Let me now briefly provide a business update and outlook:

We made great strides this year toward achieving our goals of dramatically reduced costs, improved margins and sustained profitability.

We achieved this by leveraging one of our key competitive advantages; our more than 2-dozen enthusiast streaming channel portfolio. While most of our competitors have only a single streaming channel and revenue model, our multi-channel portfolio based on subscription, advertising and fast revenue models gives us the ability to implement an effective portfolio optimization strategy.

In implementing this strategy, we culled lower margin channels while focusing resources on higher return, higher margin performers. This had a significantly positive impact as both margins and profitability have shown significant improvement. In the last fiscal quarter just reported, our total operating margin increased to 64% versus 42% a year ago and our Adjusted EBITDA increased by 283% or $3.7 million to $2.4 million.

This significant improvement was also a result of our aggressive cost streamlining measures. In our last fiscal reported quarter, total operating costs decreased $6.3 million or 34% versus last year.

As we finalized the consolidation of the 8 key content and streaming acquisitions we made over the last 3 years, we made a concerted effort to realize synergies and pull costs out of the system. Most importantly, we also leveraged Cineverse services India, a unique competitive advantage that we enjoy versus everyone else in our space, to dramatically lower SG&A costs and improve work efficiencies by off-shoring domestic employment positions to our trusted and successful operating division in India.

In total, in this last reported quarter, we reduced SG&A by $2.8 million or 29%. This included a reduction of 30 employment positions.

We intend to continue these aggressive cost control efforts as we drive toward sustained profitability, with a goal of an $8 million reduction in SG&A.

We are also very focused on growing revenues now that we have completed the integration of the acquisitions we have made, worked to optimize our channel portfolio and developed new versions and features of our proprietary Matchpoint streaming, content management and ai technology.

By early next year, we expect to launch 6-8 new streaming channels, including the previously announced Gopro, Dog Whisperer and Sid and Marty Krofft channels.

We are also ramping up our sales and revenue-building efforts in advertising, podcasts, catalog sales, merchandising and with Matchpoint, where we just announced a ground-breaking business and sales partnership with Amagi, one of the biggest players in the streaming technology space.

We are leveraging our excellent engineering and development team at Cineverse India to rapidly expand our technology efforts, with a special focus on providing next-generation technology tools, including streaming AI, to the world’s largest media and technology companies.

We expect these revenue initiatives will have a significant positive impact on our topline growth and margins. Combined with our continued cost reduction efforts, we are confident that we can achieve a sustainably profitable growth business at Cineverse.

Thank you.

v3.23.3

Document And Entity Information

|

Dec. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 08, 2023

|

| Entity Registrant Name |

Cineverse Corp.

|

| Entity Central Index Key |

0001173204

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-31810

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

22-3720962

|

| Entity Address, Address Line One |

224 W. 35th St.

|

| Entity Address, Address Line Two |

Suite 500, #947

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10001

|

| City Area Code |

212

|

| Local Phone Number |

206-8600

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

CLASS A COMMON STOCK, PAR VALUE $0.001 PER SHARE

|

| Trading Symbol |

CNVS

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

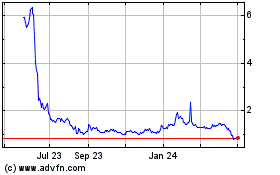

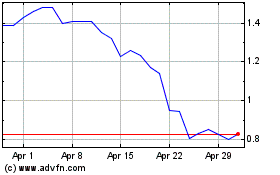

Cineverse (NASDAQ:CNVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cineverse (NASDAQ:CNVS)

Historical Stock Chart

From Apr 2023 to Apr 2024