0001373670false00013736702023-12-082023-12-080001373670us-gaap:CommonStockMember2023-12-082023-12-080001373670us-gaap:SeriesAPreferredStockMember2023-12-082023-12-08

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K

___________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 8, 2023

| | |

Green Brick Partners, Inc. |

_________________________________________________

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-33530 | | 20-5952523 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

| 5501 Headquarters Drive | , | Ste 300W | | | | | |

| Plano | , | TX | 75024 | | (469) | | 573-6755 |

| (Address of principal executive offices, including Zip Code) | | (Registrant’s telephone number, including area code) |

(Former name or former address, if changed since last report) Not applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | GRBK | The New York Stock Exchange |

Depositary Shares (each representing a 1/1000th interest in a share of 5.75% Series A Cumulative Perpetual Preferred Stock, par value $0.01 per share) | GRBK PRA | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 1.01 | Entry into a Material Definitive Agreement. |

On December 8, 2023, Green Brick Partners, Inc., a Delaware corporation (the “Company”), as borrower, entered into the Eleventh Amendment (the “Eleventh Amendment”) to the Credit Agreement, with the lenders named therein and Flagstar Bank, N.A., as administrative agent (as previously amended, the “Credit Agreement”). Pursuant to the Eleventh Amendment, the Credit Agreement was amended to revise certain financial covenants in order to appropriately reflect the Company’s size and growth. The Eleventh Amendment also extends the maturity of $300 million of the commitments under the credit facility through December 14, 2026, with the remaining $25 million commitment expiring December 14, 2025.

All other material terms of the Credit Agreement, as amended, remained unchanged. The description above is qualified in its entirety by the Eleventh Amendment, a copy of which is filed as Exhibit 10.11 to this Current Report on Form 8-K.

The Company and certain of its affiliates from time to time enter into commercial financial arrangements with the lenders under the Credit Agreement and/or their respective affiliates, and affiliates of certain of the lenders provide financial, advisory, investment banking and other services to the Company and its affiliates.

| | | | | |

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement. |

The information set forth above in Item 1.01 of this Current Report on Form 8-K is incorporated by reference herein.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

Exhibit No. | Description of Exhibit | |

| 10.11 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

GREEN BRICK PARTNERS, INC. |

| By: | /s/ Richard A. Costello |

| Name: | Richard A. Costello |

| Title: | Chief Financial Officer |

Date: December 13, 2023

Exhibit 10.11

EXECUTION VERSION

ELEVENTH AMENDMENT dated as of December 8, 2023 (this “Agreement”) by and among GREEN BRICK PARTNERS, INC. (the “Borrower”), the LENDERS party hereto, VERITEX COMMUNITY BANK, as documentation agent, and FLAGSTAR BANK, N.A. (“Flagstar”), as administrative agent (the “Administrative Agent”), to the CREDIT AGREEMENT dated as of December 15, 2015 (as amended by the First Amendment, dated as of August 31, 2016, the Second Amendment, dated as of December 1, 2016, the Third Amendment, dated as of September 1, 2017, the Fourth Amendment, dated as of December 1, 2017, the Fifth Amendment, dated as of November 2, 2018, the Sixth Amendment, dated as of December 17, 2019, the Seventh Amendment, dated as of December 22, 2020, the Eighth Amendment, dated as of May 28, 2021, the Ninth Amendment, dated as of December 10, 2021, and the Tenth Amendment, dated as of December 9, 2022, and as in effect prior to the effectiveness of this Agreement, the “Credit Agreement”), among the Borrower, the Lenders from time to time party thereto and the Administrative Agent. Capitalized terms used but not defined herein shall have the meanings assigned to such terms in the Credit Agreement.

WHEREAS, pursuant to Section 2.22 of the Credit Agreement, the Borrower has requested that the Termination Date be extended from December 14, 2025 to December 14, 2026;

WHEREAS, (a) those Lenders set forth on Schedule II hereto holding Revolving Credit Commitments immediately prior to the date hereof have agreed to extend their respective Revolving Credit Commitments upon the effectiveness of this Agreement on the Amendment Effective Date (as defined below), and (b) certain Lenders have not agreed to extend their respective Revolving Credit Commitments pursuant to this Agreement; and

WHEREAS, the Borrower and the Lenders party hereto desire that certain provisions of the Credit Agreement be amended as provided herein (as so amended, the “Amended Credit Agreement”).

NOW, THEREFORE, in consideration of the mutual agreements herein contained and other good and valuable consideration, the sufficiency and receipt of which are hereby acknowledged, the parties hereto hereby agree as follows:

SECTION 1. Consent to Extension Request. Pursuant to Section 2.22 of the Credit Agreement, each Lender so indicating on its signature page to this Agreement (each such Lender, an “Extending Lender”) agrees to extend the Termination Date (the “Maturity Extension”) with respect to its Commitments for a period of one year, to December 14, 2026. Pursuant to Section 2.22 of the Credit Agreement, each Lender that has not indicated its approval of the Maturity Extension (each such Lender a “Non-Extending Lender”) shall continue to have the rights and obligation set forth in the Credit Agreement until the Termination Date in effect immediately prior to the applicable Anniversary Date for all purposes of the Amended Credit Agreement. This Agreement to extend the Termination Date is subject in all respects to the terms of the Credit Agreement. For the avoidance of doubt, upon satisfaction of the applicable conditions set forth in Sections 2.22(e) and (f) of the Credit

Agreement, the Maturity Extension of each Extending Lender shall be effective on December 8, 2023 (the “Extension Effective Date”).

SECTION 2. Revolving Commitments. Schedules I, II and III attached to the Credit Agreement shall be replaced with Schedules I and II attached hereto, which reflect the Revolving Credit Commitments of all Lenders and the applicable Termination Date of each of the Extending Lenders and the Non-Extending Lenders after giving effect to the Maturity Extension.

SECTION 3. Amendment. Effective as of the Amendment Effective Date (as defined below), the Credit Agreement is hereby amended as follows (collectively, the “Agreed Amendments”):

(a)The following defined terms will be added to Section 1.01:

“Available Liquidity”, at any date, means the sum of (i) up to $15,000,000 of Unrestricted Cash held by the Borrower and its Subsidiaries on such date and (ii) the undrawn availability under the Revolving Credit Facility on such date.”

“Insurance Subsidiary” means any Subsidiary of the Borrower that is engaged exclusively in the business of (a) providing title insurance, general liability, personal lines of coverage and/or builders risk coverage for the Borrower or any of its Subsidiaries, and/or (b) insurance agency or other ancillary or complementary services and that, in each case, is subject to state insurance regulation and/or licensing requirements.”

“Mortgage Subsidiary” means any Subsidiary of the Borrower that is engaged exclusively in mortgage banking (including mortgage origination on residential properties, loan servicing, mortgage broker and title and escrow businesses), master servicing, issuing securities backed by mortgage loans and related activities.”

“OFAC” means the U.S. Department of Treasury, Office of Foreign Assets Control.”

(b)The following definitions in Section 1.01 are amended as follows:

(i) The definition of “Borrowing Base” is amended in its entirety to read as follows:

“Borrowing Base” means, as of any date, an amount equal to the sum (without duplication) of the following assets of the Borrower and its Consolidated Subsidiaries (but only to the extent that such assets are not subject to (i) any Liens securing Non-Recourse Indebtedness, Inwood Indebtedness or Indebtedness incurred pursuant to Section 6.03(i) or (ii) any other Lien that is not a Permitted Lien):

(a) 100% of Unrestricted Cash to the extent it exceeds $15,000,000; plus

(b) subject to the limitations set forth below, 85% of the book value of Model Units; plus

(c) 85% of the book value of Construction in Progress; plus

(d) 85% of the book value of Sold Completed Units; plus

(e) subject to the limitations set forth below and in Section 6.01(d), 85% of the book value of Speculative Units; plus

(f) 65% of the book value of Finished Lots; plus

(g) subject to the limitations set forth below, 65% of the book value of Land Under Development; plus

(h) subject to the limitations set forth below, 50% of the book value of Entitled Land.

Notwithstanding the foregoing:

(i) the advance rate for Speculative Units shall decrease to (A) 65% for any Unit that has been a Speculative Unit for 180 days or more, but less than 360 days, (B) 25% for any Unit that has been a Speculative Unit for 360 days or more, but less than 540 days and (C) 0% for any Unit that has been a Speculative Unit for 540 days or more;

(ii) the advance rate for Model Units shall decrease to 0% for any Unit that has been a Model Unit for 180 days or more following the sale of the last production Unit in the applicable project relating to such Model Unit;

(iii) the Borrowing Base shall not include the book value of Entitled Land to the extent that the inclusion thereof would cause Entitled Land to exceed 25% of the total Borrowing Base; and

(iv) the Borrowing Base shall not include the book value of Land Under Development or Entitled Land to the extent that the inclusion thereof would cause Land Under Development and Entitled Land to exceed 50% of the total Borrowing Base.”

(ii) Clause (a) of the definition of “Consolidated Debt” is amended in its entirety to read as follows:

“(a) all funded debt of the Borrower and its Subsidiaries (other than warehouse lines or other debt of any Mortgage Subsidiary which is of the type that customarily is used for the funding of mortgage companies) determined on a consolidated basis;”.

(iii) The definition of “Consolidated EBITDA” is amended in its entirety to read as follows:

“Consolidated EBITDA” means, for any period, (a) the Consolidated Net Income (excluding any Net Income arising from a Mortgage Subsidiary, except to the extent distributed in cash to the Borrower or another Subsidiary), plus cash distributions received by the Borrower from any Subsidiaries not otherwise included in the determination of such Consolidated Net Income plus (b) to the extent deducted from revenues in determining Consolidated Net Income: (i) Consolidated Interest Expense, (ii) expense for income taxes paid or accrued, (iii) depreciation, (iv) amortization, (v)

non-cash (including impairment) charges, (vi) extraordinary losses, and (vii) loss on early extinguishment of indebtedness, minus (c) to the extent added to revenues in determining Consolidated Net Income, non-cash gains and extraordinary gains (including for the avoidance of doubt, gains relating to the release of any tax valuation asset reserves and gains on early extinguishment of indebtedness).

(iv) The definition of “Consolidated Interest Incurred” is amended in its entirety to read as follows:

“Consolidated Interest Incurred” means, for any period, the aggregate amount (without duplication and determined in each case in accordance with GAAP) of interest (excluding (i) interest of the Borrower to any Subsidiary or of any Subsidiary to the Borrower or any other Subsidiary and (ii) any interest incurred by any Mortgage Subsidiary on warehouse lines or other debt of any Mortgage Subsidiary that is of the type that customarily is used for the funding of mortgage companies) incurred, whether such interest was expensed or capitalized, paid, accrued or scheduled to be paid or accrued during such period by the Borrower and its Subsidiaries during such period, including (a) the interest portion of all deferred payment obligations, and (b) all commissions, discounts, and other fees and charges (excluding premiums) owed with respect to bankers’ acceptances and letter of credit financings (including, without limitation, letter of credit fees) and Hedging Obligations, in each case to the extent attributable to such period. For purposes of this definition, interest on Capital Leases shall be deemed to accrue at an interest rate reasonably determined by the Borrower to be the rate of interest implicit in such Capital Leases in accordance with GAAP.”

(v) The definition of “Consolidated Tangible Net Worth” is amended in its entirety to read as follows:

“Consolidated Tangible Net Worth” means, at any date, the Consolidated stockholders equity, less Intangible Assets, of the Borrower on a Consolidated basis (after noncontrolling interests and excluding any stockholders equity of any Mortgage Subsidiary), all determined as of such date.”

(vi) The definition of “Eligible Assignee” is amended in its entirety to read as follows:

“Eligible Assignee” means (a) a Lender, (b) an Affiliate of a Lender, (c) an Eligible Institution approved by (i) the Agent and (ii) unless an Event of Default has occurred and is continuing, the Borrower (each such consent not to be unreasonably withheld or delayed; provided that it shall not be deemed unreasonable for the Borrower to withhold consent to any assignment that subjects the Borrower to any tax withholding requirement); provided, that such consent of the Borrower shall be deemed to have been given if the Borrower has not responded within ten Business Days of its receipt of a request for such consent, or (d) any other Person (other than a natural Person) approved by (i) the Agent and (ii) unless an Event of Default has occurred and is continuing, the Borrower (each such approval to be in their sole discretion); provided, that such approval of the Borrower shall be deemed to have been given

if the Borrower has not responded within ten Business Days of its receipt of a request for such approval, it being understood that neither the Borrower nor any Affiliate of the Borrower shall be an Eligible Assignee.”

(vii) The definition of “Permitted Liens” is amended as to replace in clause (u) “$25,000,000.” with “the greater of $35,000,000 and 3% of Consolidated Tangible Net Worth.”

(viii) The definition of “Unrestricted Cash” is amended in its entirety to read as follows:

“Unrestricted Cash” means cash and Cash Equivalents of the Borrower and its Subsidiaries (other than cash and Cash Equivalents held by any Mortgage Subsidiary) that are free and clear of all Liens and not subject to any restrictions on the use thereof to pay Indebtedness and other obligations of the applicable Loan Party.

(c)Section 4.15 is amended in its entirety to read as follows:

“SECTION 4.15 Insurance. The properties of the Borrower and its Subsidiaries are insured with reputable insurance companies and/or with Insurance Subsidiaries, in such amounts, with such deductibles and covering such risks as are customarily carried by companies engaged in similar businesses and owning similar properties in localities where the Borrower and its Subsidiaries operate.”

(d)The following is added as a new Section 4.19:

“SECTION 4.19 Foreign Assets Control Regulations and Anti-Money Laundering. The Borrower and its Subsidiaries will remain in compliance in all material respects with all United States economic sanctions laws, Executive Orders and implementing regulations as promulgated by OFAC, and all applicable anti-money laundering and counter-terrorism financing provisions of the Bank Secrecy Act and all regulations issued pursuant to it. Neither the Borrower nor any Subsidiary, to the knowledge of the Borrower or any Subsidiary, is (a) a Person designated by OFAC on the list of the Specially Designated Nationals and Blocked Persons with which a U.S. Person cannot deal with or otherwise engage in business transactions, (b) organized or located in Cuba, Iran, Sudan or Syria, or (c) 50 percent or more owned by any person or entity described in (a) or (b), such that the entry into, or performance under, this Credit Agreement would be prohibited under United States law.”

(e)Section 5.04 is amended in its entirety to read as follows:

“SECTION 5.04 Maintenance of Properties. Maintain all its properties and assets in good working order and condition and make all necessary repairs, renewals and replacements thereof so that its business carried on in connection therewith may be properly conducted at all times; and maintain or require to be maintained (a) adequate insurance, by reputable insurers, on all properties of the Loan Parties which are of character usually insured by Persons engaged in the same or a similar business against

loss or damage resulting from fire, defects in title or other risks insured against by extended coverage and of the kind customarily insured against by those Persons, (b) adequate public liability insurance against tort claims which may be incurred by any Loan Party, and (c) such other insurance as may be required by law, in each case, except where the failure to do so could not reasonably be expected to result in a Material Adverse Effect; provided, however, that the Lenders hereby agree that the provision of insurance required by this Section 5.04 by an Insurance Subsidiary shall be deemed to comply with this provision. Upon the request of the Agent, the Borrower will furnish to the Lenders full information as to the insurance carried.”

(f)Clause (a) of Section 5.07 is amended in its entirety as follows:

“SECTION 5.07 Addition and Removal of Guarantors. (a) Promptly secure the execution and delivery of the Guaranty (or a Supplemental Guaranty) to the Agent for the benefit of the Lenders from each Significant Subsidiary, whether now existing or formed and organized after the date hereof, if such Significant Subsidiary is a wholly-owned Subsidiary of the Borrower; provided that notwithstanding anything to the contrary herein, none of the following Significant Subsidiaries shall be required to execute or deliver a Guaranty (or a Supplemental Guaranty) or to become a Guarantor: (i) any Mortgage Subsidiary, (ii) any Insurance Subsidiary, (iii) any Significant Subsidiary hereafter formed or organized if federal or state regulatory requirements prohibit such Significant Subsidiary from being a Guarantor, (iv) any Significant Subsidiary as may be agreed by the Required Lenders. Each such Significant Subsidiary (other than the Significant Subsidiaries referenced in clause (i), (ii), (iii) or (iv) of the immediately foregoing sentence) that does not deliver the Guaranty on the Effective Date shall execute and deliver a Guaranty Supplement within 30 days after it meets the criteria set forth in the preceding sentence. Concurrently with the execution and delivery by such a Significant Subsidiary of a Guaranty Supplement, the Borrower will deliver to the Agent such legal opinions and evidence of corporate or other action and authority in respect thereof as shall be reasonably requested by the Agent.”

(g)Section 6.01 is amended to add clause (e) after the final clause (d) thereof:

“(e) Minimum Liquidity. As of the end of each fiscal quarter, commencing with the fiscal quarter ending December 31, 2023, fail to maintain Available Liquidity of at least $30,000,000.”

(h)Section 6.02 is amended in its entirety as follows:

“SECTION 6.02 Liens and Encumbrances. The Borrower shall not, nor shall it permit any of its Subsidiaries (other than Subsidiaries that are a Mortgage Subsidiary or an Insurance Subsidiary) to, grant or suffer or permit to exist any Liens, other than Permitted Liens, on any of its rights, properties or assets.”

(i)The introduction sentence for Section 6.03 is amended and restated in its entirety to read as follows:

“SECTION 6.03 Subsidiary Indebtedness. The Borrower shall not permit any Subsidiary (other than Subsidiaries that are a Loan Party, a Mortgage Subsidiary or an Insurance Subsidiary) to create, incur, assume or permit to exist any Indebtedness, except:”

(j)Clauses (i) and (j) of Section 6.03 are amended and restated in their entirety to read as follows:

“(i) Indebtedness of a Subsidiary, if (i) the Subsidiary has been (x) acquired after the date of this Agreement or (y) formed to acquire assets after the date of this Agreement and (ii) the proceeds of such Indebtedness are used by such Subsidiary to finance (A) the construction of Real Estate Inventory or (B) the production or acquisition of assets integrally related to the construction of Real Estate Inventory; provided that (i) the aggregate principal amount of Indebtedness incurred by any such Subsidiary pursuant to this Section 6.03(i) shall not exceed the Consolidated Tangible Net Worth of such Subsidiary at the time of incurrence of such Indebtedness and (ii) the aggregate principal amount of outstanding Indebtedness incurred pursuant to this Section 6.03(i) shall not at any time exceed $35,000,000 the greater of $55,000,000 and 5% of the Consolidated Tangible Net Worth; and

(j) other Indebtedness; provided that the sum, without duplication, of (i) the aggregate principal amount of outstanding Indebtedness incurred pursuant to this Section 6.03(j) and (ii) the aggregate principal amount of outstanding obligations secured by Liens incurred pursuant to clause (u) of the definition of Permitted Liens shall not at any time exceed $25,000,000 the greater of $35,000,000 and 3% of Consolidated Tangible Net Worth.”

(k)Clause (a)(i) of Section 6.04 is amended and restated in its entirety to read as follows:

“(i) sell, assign, lease or otherwise dispose of (whether in one transaction or in a series of transactions) all or any portion of the assets (whether now owned or hereafter acquired) of the Borrower and the Subsidiaries (taken as a whole on a Consolidated basis) except for (A) the sale of inventory in the ordinary course of business, (B) the sale of assets in the ordinary course of business by any Mortgage Subsidiary, and (C) other dispositions, sales, or assignments of properties, provided that the fair value of such dispositions, sales or transfers pursuant to this clause (bC) in any fiscal quarter does not exceed 15% of Consolidated Tangible Net Worth (determined as of the last day of the most recent fiscal quarter for which financial statements are available);”

(l)The introduction sentence for Section 6.05 is amended and restated in its entirety to read as follows:

“SECTION 6.05. Permitted Investments. The Borrower shall not, nor shall it permit any Subsidiary (other than Subsidiaries that are a Mortgage Subsidiary or

an Insurance Subsidiary) to, make any Investment or otherwise acquire any interest in any Person, except:”

(m)Section 6.07 is amended to add the following language to the end of the proviso:

“and (vii) agreements entered into by any Mortgage Subsidiary in the ordinary course of business.”

(n)Section 6.08 is amended to add the following language to the end of the section:

“and (d) prepayments in the ordinary course of business by any Mortgage Subsidiary of amounts due under a warehouse line of credit.”

(o)Section 6.09 is amended and restated in its entirety to read as follows:

“SECTION 6.09 Transactions with Affiliates. The Borrower shall not enter into any transaction (including, without limitation, the purchase or sale of any property or service) with, or make any payment or transfer to, any Affiliate (or permit any Subsidiary to do any of the foregoing), except (a) in the ordinary course of business and pursuant to the reasonable requirements of the Borrower’s, or a Loan Party’s or a Subsidiary’s business and upon fair and reasonable terms no less favorable to the Borrower, such Loan Party or such Subsidiary (or, in the case of the provision of insurance to the Borrower, a Loan Party or a Subsidiary by any Insurance Subsidiary, not materially less favorable) than the Borrower, such Loan Party or such Subsidiary would obtain in a comparable arms’-length transaction, (b) transactions between the Borrower and/or its Subsidiaries, (c) salary, bonuses, equity compensation and other compensation arrangements and indemnification arrangements with directors or officers consistent with past practices or current market practices, (d) Investments permitted under Section 6.05, and (e) transactions otherwise expressly permitted under this Agreement.”

(p)Clause (b)(i)(B) of Section 9.07 is amended and restated in its entirety to read as follows:

“in any case not described in paragraph (b)(i)(A) of this Section, the aggregate amount of the Revolving Credit Commitment (which for this purpose includes Revolving Credit Advances outstanding thereunder) or, if the applicable Revolving Credit Commitment is not then in effect, the principal outstanding balance of the Revolving Credit Advances of the assigning Lender subject to each such assignment (determined as of the date the Assignment and Assumption with respect to such assignment is delivered to the Agent or, if “Trade Date” is specified in the Assignment and Assumption, as of the Trade Date) shall not be less than $3,000,000 and increments of $1,000,000 in excess thereof, unless each of the Agent and, so long as no Event of Default has occurred and is continuing, the Borrower otherwise consents (each such consent not to be unreasonably withheld or delayed); provided, that such consent of the Borrower shall be deemed to have been given if the Borrower has not responded within ten Business Days of its receipt of a request for such consent.”

(q)Section 9.08 is amended to add the following sentence at the end thereof:

“In addition, the Agent and the Lenders may disclose the existence of this Agreement and information about this Agreement (but not, for the avoidance of doubt, Information) to market data collectors, providers of similar services to the lending industry and service providers to the Agent in connection with the administration and management of this Agreement and the other Loan Documents.”

(r)The final sentence of Section 9.13 is amended and restated in its entirety to read as follows:

“The Borrower also hereby agrees that (i) none of the Agent, any Lender or any of their respective Affiliates have advised and are advising the Borrower as to any legal, accounting, regulatory or tax matters, and that the Borrower is consulting its own advisors concerning such matters to the extent it deems appropriate and (ii) the Agent, the Lenders and their respective Affiliates may be engaged in a broad range of transactions that involve interests (including economic interests) that may differ from those of the Borrower and its Affiliates, and neither the Agent nor any Lender has any obligation to disclose any of such interests to the Borrower or its Affiliates.”

SECTION 4. Representations and Warranties. To induce the other parties hereto to enter into this Agreement, the Borrower hereby represents and warrants to the Administrative Agent and the Lenders party hereto that:

(a)This Agreement has been duly authorized, executed and delivered by the Borrower and constitutes its legal, valid and binding obligation, enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law.

(b)On the Amendment Effective Date, and after giving effect to this Agreement, the representations and warranties of the Borrower set forth in the Amended Credit Agreement are true and correct in all material respects (other than any representation or warranty qualified by materiality or Material Adverse Effect, which shall be true and correct in all respects), as though made on and as of the Amendment Effective Date.

(c)On and as of the Amendment Effective Date, no event has occurred and is continuing that constitutes a Default or Event of Default.

(d)On and as of the Amendment Effective Date, (A) the Borrower will be in compliance with the covenants set forth in Sections 6.01(a), (b), (c) and (e) of the Amended Credit Agreement and (B) the compliance certificate dated as of November 8, 2023 previously delivered to the Administrative Agent by the Borrower remains true and accurate on and as of the Amendment Effective Date.

SECTION 5. Conditions to Effectiveness. This Agreement, the consent of each Extending Lender hereunder to the Maturity Extension and the consent of each Extending Lender and any other Lender signatory hereto to the Agreed Amendments shall become effective on the date and at the time (the “Amendment Effective Date”) on which each of the following conditions is first satisfied:

(a)The Administrative Agent shall have executed this Agreement and shall have received from the Borrower, each Extending Lender and the Lenders constituting Required Lenders under the Credit Agreement (i) a counterpart of this Agreement signed on behalf of such party or (ii) evidence satisfactory to the Administrative Agent (which may include a facsimile transmission or other electronic transmission of a signed counterpart of this Agreement) that such party has signed a counterpart of this Agreement.

(b)On such date and after giving effect to this Agreement, (i) no Default or Event of Default shall have occurred and be continuing, (ii) the Borrower shall be in compliance with the financial covenants set forth in Sections 6.01(a), (b), (c) and (e) of the Amended Credit Agreement, (iii) each of the representations and warranties made by any Loan Party in or pursuant to the Loan Documents shall be true and correct in all material respects; provided that to the extent any such representation or warranty is already qualified by materiality or reference to Material Adverse Effect, such representation or warranty shall be true and correct in all respects, and (iv) the Administrative Agent shall have received a certificate, dated as of the Amendment Effective Date and signed by an Authorized Financial Officer, confirming compliance with (x) clauses (i), (ii) and (iii) of this Section 5(b) and (y) the representations and warranties contained in Section 4 above.

(c)The Administrative Agent shall have received a favorable opinion (addressed to the Administrative Agent and the Lenders and dated the Amendment Effective Date) of Greenberg Traurig, PA, counsel to the Loan Parties, in form and substance reasonably satisfactory to the Administrative Agent.

(d)The Administrative Agent shall have received certified copies of resolutions of the Board of Directors (or its equivalent) of each Loan Party approving this Agreement, and the Maturity Extension, articles of incorporation and by-laws (or the equivalent) of each Loan Party and certificates of incumbency and good standing (or such other documents and certificates as the Administrative Agent or its counsel may reasonably request in lieu thereof), all in form and substance reasonably satisfactory to the Administrative Agent.

(e)The Lenders party hereto shall have received, to the extent requested, all documentation and other information required by regulatory authorities under applicable “know your customer” and anti-money laundering rules and regulations, including the Patriot Act.

(f)The Administrative Agent shall have received, in immediately available funds, payment of all fees and reimbursement or payment of all out-of-pocket expenses

required to be reimbursed or paid by the Borrower under the Credit Agreement or under Sections 6(a) and 6(b) hereof.

(g)The Administrative Agent shall notify the Borrower and the Lenders party hereto of the Amendment Effective Date, and such notice shall be conclusive and binding.

SECTION 6. Fees and Expenses.

(a)The Borrower agrees to reimburse the Administrative Agent for its reasonable out-of-pocket expenses in connection with this Agreement and the transactions contemplated hereby, including the reasonable fees, charges and disbursements of Cravath, Swaine & Moore LLP.

(b)The Borrower agrees to pay to each Extending Lender an upfront fee of 0.15 % of the aggregate amount of such Extending Lender’s extended Revolving Credit Commitments as set forth on Schedule II hereto which fee shall be due and payable on December 8, 2023 prior to the effectiveness of the Maturity Extension.

SECTION 7. Acknowledgement. Execution of this Agreement by a Lender and by the Borrower constitutes the acknowledgment (i) of the notice to such Lender and the Borrower, respectively, of the matters contemplated by Sections 2.22(a), (b) and (c), respectively, of the Amended Credit Agreement, (ii) in the case of the Administrative Agent, of the activation notice contemplated by Section 2.21 of the Amended Credit Agreement, and (iii) that, upon execution hereof by Flagstar Bank, N.A., Veritex Community Bank, Texas Capital Bank, Goldman Sachs Bank USA, The Huntington National Bank (as successor to TCF National Bank), Cadence Bank, Independent Bank and MidFirst Bank, the minimum extension requirement contemplated by Section 2.22(e) of the Amended Credit Agreement shall be satisfied.

SECTION 8. Effect of this Agreement. Except as expressly set forth herein, this Agreement shall not by implication or otherwise limit, impair, constitute a waiver of or otherwise affect the rights and remedies of the Administrative Agent or the Lenders under the Credit Agreement, the Amended Credit Agreement and the other Loan Documents, and shall not alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement, the Amended Credit Agreement or any of the other Loan Documents, all of which are ratified and affirmed in all respects and shall continue in full force and effect. Nothing herein shall be deemed to entitle the Borrower to a consent to, or a waiver, amendment, modification or other change of, any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement or the Amended Credit Agreement in similar or different circumstances. This Agreement shall constitute a “Loan Document” for all purposes of the Credit Agreement, the Amended Credit Agreement and the other Loan Documents.

SECTION 9. Applicable Law. THIS AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED AND INTERPRETED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

SECTION 10. Counterparts. This Agreement may be executed by one or more of the parties hereto on any number of separate counterparts, and all of said counterparts taken together shall be deemed to constitute one and the same instrument. The exchange of copies of this Agreement and of signature pages by facsimile or PDF transmission shall constitute effective execution and delivery of this Agreement as to the parties hereto and may be used in lieu of the original Agreement for all purposes. Any signature to this Agreement may be delivered by facsimile, electronic mail (including pdf) or any electronic signature complying with the U.S. federal ESIGN Act of 2000 or the New York Electronic Signature and Records Act or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes to the fullest extent permitted by applicable law. Each of the parties represents and warrants to the other parties that it has the corporate capacity and authority to execute this Agreement through electronic means and there are no restrictions for doing so in that party’s constitutive documents.

SECTION 11. Headings. The Section headings used herein are for convenience of reference only, are not part of this Agreement and are not to affect the construction of, or to be taken into consideration in interpreting, this Agreement.

SECTION 12. Arranger. Flagstar shall act as the sole lead arranger and sole book runner in connection with this Agreement and the transactions contemplated hereby and, for the avoidance of doubt, shall be considered an “Arranger” for all purposes of the Amended Credit Agreement.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the parties hereto have duly executed this Agreement as of the day and year first above written.

| | | | | |

| GREEN BRICK PARTNERS, INC. |

| By |

| /s/ Richard A. Costello |

| Name: Richard A. Costello |

| Title: Chief Financial Officer |

[Signature Page to Eleventh Amendment]

| | | | | |

| FLAGSTAR BANK, N.A., as Administrative Agent, an Extending Lender and a Lender |

By |

| /s/ Jerry Schillaci |

| Name: Jerry Schillaci |

| Title: First Vice President |

[Signature Page to Eleventh Amendment]

| | | | | |

VERITEX COMMUNITY BANK,

as Documentation Agent, an Extending Lender, and a Lender |

By |

| /s/ Ben Weimer |

| Name: Ben Weimer |

| Title: Senior Vice President |

[Signature Page to Eleventh Amendment]

| | | | | |

TEXAS CAPITAL BANK,

as an Extending Lender and a Lender |

By |

| /s/ Jason Williams |

| Name: Jason Williams |

| Title: Executive Director |

[Signature Page to Eleventh Amendment]

| | | | | |

GOLDMAN SACHS BANK USA,

as an Extending Lender and a Lender |

By |

| /s/ Jonathan Dworkin |

| Name: Jonathan Dworkin |

| Title: Authorized Signatory |

[Signature Page to Eleventh Amendment]

| | | | | |

THE HUNTINGTON NATIONAL BANK, as successor to TCF NATIONAL BANK,

as an Extending Lender and a Lender |

By |

| /s/ Erin L. Mahon |

| Name: Erin L. Mahon |

| Title: Assistant Vice President |

[Signature Page to Eleventh Amendment]

| | | | | |

CADENCE BANK,

as an Extending Lender and a Lender |

By |

| /s/ Alyssa Pratka |

| Name: Alyssa Pratka |

| Title: Senior Vice President |

[Signature Page to Eleventh Amendment]

| | | | | |

WOODFOREST NATIONAL BANK,

as a Lender |

By |

| /s/ Michael Sparks |

| Name: Michael Sparks |

| Title: Assistant Vice President |

[Signature Page to Eleventh Amendment]

| | | | | |

INDEPENDENT BANK, DBA INDEPENDENT FINANCIAL,

as an Extending Lender and a Lender |

By |

| /s/ Wendell Gamble |

| Name: Wendell Gamble |

| Title: Executive Vice President |

[Signature Page to Eleventh Amendment]

| | | | | |

MIDFIRST BANK, a federally chartered savings association

as an Extending Lender and a Lender |

By |

| /s/ Jeff Thompson |

| Name: Jeff Thompson |

| Title: Vice President |

[Signature Page to Eleventh Amendment]

REAFFIRMATION

December 8, 2023

Reference is made to the Eleventh Amendment, dated as of December 8, 2023 (the “Eleventh Amendment”), by and among Green Brick Partners, Inc. (the “Borrower”), the lenders party thereto and Flagstar Bank, N.A., as administrative agent (the “Administrative Agent”), to the Credit Agreement, dated as of December 15, 2015 (as amended by the First Amendment, dated as of August 31, 2016, the Second Amendment, dated as of December 1, 2016, the Third Amendment, dated as of September 1, 2017, the Fourth Amendment, dated as of December 1, 2017, the Fifth Amendment, dated as of November 2, 2018, the Sixth Amendment, dated as of December 17, 2019, the Seventh Amendment, dated as of December 22, 2020, the Eighth Amendment, dated as of May 28, 2021, the Ninth Amendment, dated as of December 9, 2022 and the Tenth Amendment, dated as of December 9, 2022, as amended, amended and restated, supplemented, restated or otherwise modified from time to time, the “Credit Agreement”), among the Borrower, the lenders from time to time party thereto and the Administrative Agent. Capitalized terms used but not defined herein shall have the meanings assigned to such terms in the Credit Agreement.

Each of the undersigned Loan Parties (which, for the avoidance of doubt, collectively constitute the Loan Parties to the Credit Agreement as of the date hereof) hereby consents to the Eleventh Amendment and the transactions contemplated thereby. Each of the undersigned Loan Parties further (a) affirms and confirms its respective guarantees, pledges, grants of security interests and other obligations under the Credit Agreement and each of the other Loan Documents to which it is a party, in respect of, and to secure, the Obligations, (b) agrees that, notwithstanding the effectiveness of the Eleventh Amendment and the transactions contemplated thereby, the Loan Documents to which it is a party, and such guarantees, pledges, grants of security interests and other obligations thereunder, shall continue to be in full force and effect in accordance with the terms thereof and (c) represents and warrants that as of the date hereof that this reaffirmation and the transactions contemplated hereby have been duly authorized, executed and delivered by such Loan Party and constitutes its legal, valid and binding obligation, enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law. Borrower reaffirms and acknowledges its obligations to the Administrative Agent with respect to the Loan Documents.

[Signature page follows]

| | | | | |

| GREEN BRICK PARTNERS, INC. |

| By |

| /s/ Richard A. Costello |

| Name: Richard A. Costello |

| Title: Chief Financial Officer |

| | | | | |

GRBK EDGEWOOD LLC JBGL BUILDER FINANCE LLC JBGL OWNERSHIP LLC SGHDAL LLC TSHH, LLC |

| By |

| /s/ Richard A. Costello |

| Name: Richard A. Costello |

| Title: President or Vice President,

as applicable |

[Signature Page to Reaffirmation Agreement]

Revolving Credit Commitments

| | | | | | | | |

| Lenders | Revolving Credit Commitments | Termination Date |

| Flagstar Bank, N.A. | $80,000,000 | December 14, 2026 |

| Veritex Community Bank | $50,000,000 | December 14, 2026 |

| Texas Capital Bank | $40,000,000 | December 14, 2026 |

| Goldman Sachs Bank USA | $30,000,000 | December 14, 2026 |

| The Huntington National Bank (as successor to TCF National Bank) | $30,000,000 | December 14, 2026 |

| Cadence Bank (as successor to BancorpSouth Bank) | $25,000,000 | December 14, 2026 |

| Woodforest National Bank | $25,000,000 | December 14, 2025 |

| Independent Bank, DBA Independent Financial | $25,000,000 | December 14, 2026 |

| MidFirst Bank, a federally chartered savings association | $20,000,000 | December 14, 2026 |

Total | $325,000,000 | |

Extended Commitments

| | | | | | | | |

| Lenders | Revolving Credit Commitments | Termination Date |

| Flagstar Bank, N.A. | $80,000,000 | December 14, 2026 |

| Veritex Community Bank | $50,000,000 | December 14, 2026 |

| Texas Capital Bank | $40,000,000 | December 14, 2026 |

| Goldman Sachs Bank USA | $30,000,000 | December 14, 2026 |

| The Huntington National Bank (as successor to TCF National Bank) | $30,000,000 | December 14, 2026 |

| Cadence Bank (as successor to BancorpSouth Bank) | $25,000,000 | December 14, 2026 |

| Independent Bank, DBA Independent Financial | $25,000,000 | December 14, 2026 |

| MidFirst Bank, a federally chartered savings association | $20,000,000 | December 14, 2026 |

Total | $300,000,000 | |

v3.23.3

Document and Entity Information Document And Entity Information

|

Dec. 08, 2023 |

| Entity Information [Line Items] |

|

| Document Period End Date |

Dec. 08, 2023

|

| Written Communications |

false

|

| Written Communications |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Registrant Name |

Green Brick Partners, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33530

|

| Entity Tax Identification Number |

20-5952523

|

| Entity Address, Address Line One |

5501 Headquarters Drive

|

| Entity Address, Address Line Two |

Ste 300W

|

| Entity Address, City or Town |

Plano

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75024

|

| City Area Code |

(469)

|

| Entity Central Index Key |

0001373670

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Local Phone Number |

573-6755

|

| Entity Emerging Growth Company |

false

|

| Series A Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares (each representing a 1/1000th interest in a share of 5.75% Series A Cumulative Perpetual Preferred Stock, par value $0.01 per share)

|

| Trading Symbol |

GRBK PRA

|

| Security Exchange Name |

NYSE

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

GRBK

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

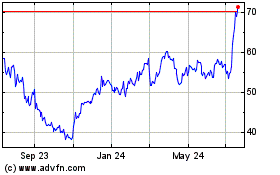

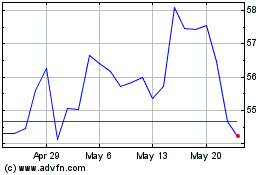

Green Brick Partners (NYSE:GRBK)

Historical Stock Chart

From Apr 2024 to May 2024

Green Brick Partners (NYSE:GRBK)

Historical Stock Chart

From May 2023 to May 2024