false

0001771706

A1

0001771706

2023-06-07

2023-06-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 7, 2023

GOODNESS

GROWTH HOLDINGS, INC.

(Exact name of registrant as specified in its

charter)

British Columbia

(State or other jurisdiction of Incorporation)

| 000-56225 |

|

82-3835655 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

|

207 South 9th Street

Minneapolis, Minnesota |

|

55402 |

| (Address of principal executive offices) |

|

(Zip Code) |

(612) 999-1606

(Registrant’s telephone number, including

area code)

Not

Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| |

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| N/A |

N/A |

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers |

Third Amendment to Employment Agreement with John Heller

On June 7, 2023, Goodness Growth Holdings, Inc. (the “Company”)

entered into the Third Amendment to Employment Agreement by and among the Company, Vireo Health, Inc. (“Vireo”), a wholly

owned subsidiary of the Company, and John Heller (the “Heller Third Amendment”), the Company’s former Chief Financial

Officer who separated from the Company on September 29, 2023. The Heller Third Amendment modified the Employment Agreement among

the parties first dated December 1, 2020 and as subsequently amended on February 2, 2022 and December 14, 2022. The Heller

Third Amendment amended the Employment Agreement between the parties to provide Mr. Heller with stock option grants.

Under the terms of the Heller Third Amendment, the first grant of stock

options (the “Heller First Option”) provided Mr. Heller a grant to the right to purchase 1,314,941 subordinate voting

shares of the Company (the “Shares”) at an exercise price equal to the volume weighted-average closing price of like Shares

on the Canadian Securities Exchange (the “CSE”) for the two trading days immediately preceding the grant date of June 7,

2023 (the “Grant Date”). The Heller First Option has a ten-year term. The Heller First Option immediately vested upon grant

as to 821,838 Shares. Options as to 82,184 Shares of the Heller First Option vested on June 30, 2023, and options as to 82,184 Shares

vest on the last day of each calendar quarter thereafter, until the Heller First Option is fully vested, on September 30, 2024. In

addition, the Heller Third Amendment also provided Mr. Heller a second grant of stock options (the “Heller Second Option”)

to purchase 287,888 Shares of the Company at an exercise price equal to the volume weighted-average closing price of like Shares on the

CSE for the two trading days immediately preceding the Grant Date. The Heller Second Option has a ten-year term. The Heller Second Option

immediately vested upon grant as to 71,972 Shares. Options as to 17,993 Shares of the Heller Second Option vested on June 30, 2023,

and options as to 17,933 Shares vest on the last day of each calendar quarter thereafter, until the Heller Second Option is fully vested,

on March 31, 2026.

The foregoing description of the Heller Third Amendment is qualified

in its entirety by reference to the Heller Third Amendment, which is attached as Exhibit 10.1 to this Current Report on Form 8-K

and is incorporated herein by reference.

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits.

| Exhibit No. |

|

Description |

| 10.1 |

|

Third Amendment to Employment Agreement by and among Goodness Growth Holdings, Inc., Vireo Health, Inc., and John Heller, dated June 7, 2023 |

| 10.2 |

|

Employment Agreement by and among Goodness Growth Holdings, Inc., Vireo Health, Inc., and J. Michael Schroeder, dated December 1, 2020 |

| 10.3 |

|

Amendment to Employment Agreement by and among Goodness Growth Holdings, Inc., Vireo Health, Inc., and J. Michael Schroeder, dated February 2, 2022 |

| 10.4 |

|

Third Amendment to Employment Agreement by and among Goodness Growth Holdings, Inc., Vireo Health, Inc., and J. Michael Schroeder, dated June 7, 2023 |

| 104 |

|

Cover Page Interactive Data File (embedded within Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

| |

GOODNESS GROWTH HOLDINGS, INC. |

| |

(Registrant) |

| |

|

| |

By: |

/s/ J. Michael Schroeder |

| |

|

J. Michael Schroeder |

| |

|

General Counsel and Corporate Secretary |

Date: December 12, 2023

Exhibit 10.1

THIRD AMENDMENT TO EMPLOYMENT AGREEMENT

This Third Amendment to Employment

Agreement (“Third Amendment”) is made effective as of June 7, 2023 (“Effective Date”)

by and among Goodness Growth Holdings, Inc., a British Columbia corporation (“Parent”), Vireo Health,

Inc., a Delaware corporation (the “Employer”) and John Heller, an individual residing in the State

of Minnesota (“Employee”) (collectively “Parties” or individually “Party”).

RECITALS

WHEREAS, the Employer

and Employee entered into an Employment Agreement dated December 1, 2020, a First Amendment to Employment Agreement dated February 2,

2022, and a Second Amendment to Employment Agreement dated December 14, 2022 (collectively, the “Current Agreement”);

and

WHEREAS, by unanimous

written consent execute on June 6, 2023, Parent Company authorized and directed Employer to grant compensation to Employee, consisting

of Parent company stock options, to incent Employee to continue his employment with Employer; and

WHEREAS, the Parties

wish to amend the Current Agreement as set forth in this Amendment.

NOW, THEREFORE, in

consideration of the mutual covenants and conditions contained herein, the receipt and sufficiency of which are hereby acknowledged, Parent,

Employer and Employee, intending legally to be bound, hereby agree as follows:

AGREEMENT

1.

Equity Grants.

| i. | The Employer shall cause the Parent Company to grant to Employee the rights to purchase (the “First

Option”) 1,314,941 subordinate voting shares of the Parent Company’s capital stock (“Shares”)

at an exercise price equal to the volume weighted-average closing price of like shares on the Canadian Securities Exchange for the two

trading days immediately preceding the Grant Date. The First Option shall have a ten-year term. The First Option will be immediately vested

upon grant as to 821,838 Shares. 82,184 Shares of the First Option will vest on June 30, 2023, and on the last day of each calendar quarter

thereafter, until the First Option is fully vested, on September 30, 2024. The foregoing description of some of the principal terms of

the First Option is not binding on the Employer or Parent Company. The terms and conditions of the First Option shall be as set forth

in the applicable grant agreement. |

| ii. | The Employer shall cause the Parent Company to grant to Employee the rights to purchase (the “Second

Option”) 287,888 subordinate voting shares of the Parent Company’s capital stock (“Shares”)

at an exercise price equal to the volume weighted-average closing price of like shares on the Canadian Securities Exchange for the two

trading days immediately preceding the Grant Date. The Second Option shall have a ten-year term. The Second Option will be immediately

vested upon grant as to 71,972 Shares. 17,993 Shares of the Option will vest on June 30, 2023, and on the last day of each calendar quarter

thereafter, until the Option is fully vested, on March 31, 2026. The foregoing description of some of the principal terms of the Option

is not binding on the Employer or Parent Company. The terms and conditions of the Option shall be as set forth in the applicable grant

agreement. |

2.

General. All capitalized terms used but not defined in this Third Amendment shall have the meanings ascribed in the Current

Agreement. All provisions of the Current Agreement not expressly modified by this Third Amendment are hereby ratified and confirmed.

THIS THIRD AMENDMENT TO

EMPLOYMENT AGREEMENT was voluntarily and knowingly executed by the Parties effective as of the Effective Date first set forth above.

| |

VIREO HEALTH, INC. |

|

| |

|

|

|

| Date: |

By: |

|

|

| |

Its: Interim CEO |

|

| |

|

|

|

| |

|

|

|

| |

EMPLOYEE: |

|

| |

|

|

|

| Date: |

|

|

|

| |

|

|

|

| |

|

|

|

| |

GOODNESS GROWTH HOLDINGS, INC. |

|

| |

|

|

|

| Date: |

By: |

|

|

| |

Its: Interim CEO |

|

Exhibit 10.2

EMPLOYMENT AGREEMENT

This Employment

Agreement (“Agreement”) is entered into on December 1, 2020 (“Effective Date”) by and between Vireo Health,

Inc., a Delaware corporation (the “Company”) and Michael Schroeder, an individual residing in the State of Florida

(“Employee”) (collectively “Parties” or individually “Party”).

RECITALS

WHEREAS, the Company

desires to employ Employee pursuant to the terms of this Agreement and Employee desires to accept such employment pursuant to the terms

of this Agreement; and

WHEREAS, during Employee’s

employment with the Company, Employee will become acquainted with technical and nontechnical information which the Company has developed,

acquired and uses, or which the Company will develop, acquire or use, and which is commercially valuable to the Company and which the

Company desires to protect, and Employee may contribute to such information through inventions, discoveries, improvements or otherwise.

NOW, THEREFORE, in

consideration of the employment of Employee by the Company, and further in consideration of the salary, wages or other compensation and

benefits to be provided by the Company to Employee, and for additional mutual covenants and conditions, the receipt and sufficiency of

which are hereby acknowledged, the Company and Employee, intending legally to be bound, hereby agree as follows:

AGREEMENT

In consideration of the above recitals and the

mutual promises set forth in this Agreement, the Parties agree as follows:

1. Nature

and Capacity of Employment.

1.1 Title

and Duties. Effective as of Effective Date, the Company will employ Employee as its Chief Financial Officer, or such other title as

may be assigned to Employee by the Company’s Chief Executive Officer or his or her designee from time to time, pursuant to the terms

and conditions set forth in this Agreement. Employee will perform such duties and responsibilities for the Company as the Company’s

Chief Executive Officer or his or her designee may assign to Employee from time to time consistent with Employee’s position. The

Employee hereby agrees to act in that capacity under the terms and conditions set forth in this Agreement. Employee shall serve the Company

faithfully and to the best of Employee’s ability and shall at all times act in accordance with the law. Employee shall devote Employee’s

full working time, attention and efforts to performing Employee’s duties and responsibilities under this Agreement and advancing

the Company’s business interests. Employee shall follow applicable policies and procedures adopted by the Company from time to time,

including without limitation the Company’s Code of Conduct, Employee Handbook and other Company policies, including those relating

to business ethics, conflict of interest, non-discrimination and non-harassment. Employee shall not, without the prior written consent

of the Company’s Board of Directors (the “Board”), accept other employment or engage in other business activities during

Employee’s employment with the Company that may prevent Employee from fulfilling the duties or responsibilities as set forth in

or contemplated by this Agreement. Employee may participate in civic, religious and charitable activities and personal investment activities

to a reasonable extent, so long as such activities do not interfere with the performance of Employee’s duties and responsibilities

hereunder.

1.2 No

Restrictions. Employee hereby represents and confirms that Employee is under no contractual or legal commitments that would prevent

Employee from fulfilling Employee’s duties and responsibilities as set forth in this Agreement.

1.3 Location.

Employee’s employment will be based at the Company’s corporate headquarters. Employee acknowledges and agrees that Employee’s

position, duties and responsibilities will require regular travel, both in the U.S. and internationally.

2. Term.

Unless terminated at an earlier date in accordance with Section 5, the term of Employee’s employment with the Company under the

terms and conditions of this Agreement will be for the period commencing on the Effective Date and ending on the two (2) year anniversary

of the Effective Date (the “Initial Term”). On the two (2) year anniversary of the Effective Date, and on each succeeding

one (1) year anniversary of the Effective Date (each an “Anniversary Date”), the Term shall be automatically extended until

the next Anniversary Date (each a “Renewal Term”), subject to termination on an earlier date in accordance with Section 5

or unless either Party gives written notice of non-renewal to the other Party at least one hundred eighty (180) days prior to the Anniversary

Date on which this Agreement would otherwise be automatically extended that the Party providing such notice elects not to extend the Term;

provided, however, that if a Change in Control (as defined in Section 6.5) occurs during the Initial Term or during any Renewal Term then

the Term will expire on the one (1) year anniversary of the date of the Change in Control. The Initial Term together with any Renewal

Terms is the “Term.” If Employee remains employed by the Company after the Term ends for any reason, then such continued employment

shall be according to the terms and conditions established by the Company from time to time (provided that any provisions of this Agreement

and the Restrictive Covenants Agreement (as defined in Section 3) that by their terms survive the termination of the Term shall remain

in full force and effect).

3. Restrictive

Covenants Agreement. On the Effective Date, Employee is executing a Confidential Information, Intellectual Property Rights, Non-Competition

and Non-Solicitation Agreement, in the form of Exhibit A attached hereto and made a part hereof (the “Restrictive Covenants Agreement”).

Employee acknowledges and agrees that the Company’s execution of this Agreement and agreement to employ Employee are conditioned

upon Employee executing the Restrictive Covenants Agreement. Nothing in this Agreement is intended to modify, amend, cancel or supersede

the Restrictive Covenants Agreement in any manner.

4. Compensation,

Benefits and Business Expenses.

4.1. Base

Salary. As of the Effective Date, the Company agrees to pay Employee an annualized base salary of $307,500.00 (the “Base Salary”),

which Base Salary will be earned by Employee on a pro rata basis as Employee performs services and which shall be paid according to the

Company’s normal payroll practices. For each of the Company’s fiscal years during the Term, the Company’s Chief Executive

Officer will conduct a periodic review of Employee and, based on that review and the Chief Executive Officer’s discretion, establish

Employee’s Base Salary in an amount not less than the Base Salary in effect for the prior year, unless Employee’s Base Salary

is reduced as part of a general reduction in the base salaries for all officers of the Company and in substantially the same proportion

as the reduction in the base salaries for all officers of the Company. The review contemplated by this Section 4.1 need not be formal,

nor need it be conducted on or before a specific date.

4.2 Annual

Incentive Compensation. For each of the Company’s fiscal years during the Term, Employee may be eligible to earn an annualized

cash bonus if and in an amount determined by the Company’s Chief Executive Officer in his or her discretion and subject to the terms

of any written document addressing such annual cash bonus as the Company’s Chief Executive Officer may adopt in his or her sole

discretion. Unless specified otherwise a written annual cash bonus document applicable to Employee, Employee must be employed on the date

any annual cash bonus is paid in order to earn and receive each such bonus.

4.3 Incentive

Stock Option. Subject to (i) the approval of the Board and (ii) Employee being employed by the Company on the Effective Date, on such

date or as soon as the executives of the Company are not subject to a trading blackout pursuant to the Company’s then-applicable

insider trading policy, Employee shall be granted an incentive stock option to purchase 740,000 shares of the Company’s subordinate

voting shares or 7,400 multiple voting shares, at the Company’s discretion (the “Option”), pursuant to the Equity Incentive

Plan (as defined below). The Option shall have an exercise price equal to the closing price on the trading day immediately preceding the

date of grant of the Company’s subordinate voting shares and shall vest over a period of four hears and have a 10-year term. The

remaining terms of the Option will be governed by the Equity Incentive Plan and the applicable Incentive Stock Option Agreement issued

in accordance with the Equity Incentive Plan.

4.4. Employee

Benefits. While Employee is employed by the Company during the Term, Employee shall be entitled to participate in the retirement plans,

health plans, and all other employee benefits made available by the Company, and as they may be changed from time to time. Employee acknowledges

and agrees that Employee will be subject to all eligibility requirements and all other provisions of these benefits plans, and that the

Company is under no obligation to Employee to establish and maintain any employee benefit plan in which Employee may participate. The

terms and provisions of any employee benefit plan of the Company are matters within the exclusive province of the Board, subject to applicable

law.

4.5. Paid

Time Off. While Employee is employed by the Company during the Term, Employee shall have available unlimited personal time off in

accordance with the Company’s policies then in effect. Paid time off may be used for illness or other personal business, or as vacation

time off at such times so as not to materially disrupt the operations of the Company. Paid time off is intended to be used, not stored,

and these days shall in no event be converted to cash, nor shall any unused days be paid to Employee upon termination of his employment

under this Agreement.

4.6 Business

Expenses. While Employee is employed by the Company during the Term, the Company shall reimburse Employee for all reasonable and necessary

out-of-pocket business, travel and entertainment expenses incurred by Employee in the performance of Employee’s duties and responsibilities

hereunder, subject to the Company’s normal policies and procedures for expense verification and documentation.

5. Termination

of Employment.

5.1 Termination

of Employment Events. Employee’s employment with the Company is at-will. Employee’s employment with the Company will terminate

immediately upon:

| (a) | The date of Employee’s receipt of written notice from the Company of the termination of Employee’s

employment (or any later date specified in such written notice from the Company); |

| (b) | Employee’s abandonment of Employee’s employment or the effective date of Employee’s

resignation for Good Reason (as defined below) or any other reason (as specified in written notice from Employee); |

| (c) | Employee’s Disability (as defined below); or |

5.2 Termination

Date. The date upon which Employee’s termination of employment with the Company is effective is the “Termination Date.”

For purposes of Sections 6.1 or 6.2 only, with respect to the timing of the Pre-CIC Severance Payments or the Post-CIC Severance Payment

(as applicable), the Pre-CIC Benefits Continuation Payments or the Post-CIC Benefits Continuation Payments (as applicable), the Outplacement

Payments, the Termination Date means the date on which a “separation from service” has occurred for purposes of Section 409A

of the Internal Revenue Code, as amended, and the regulations and guidance thereunder (the “Code”).

5.3 Resignation

From Positions. Unless otherwise requested by the Board in writing, upon Employee’s termination of employment with the Company

for any reason Employee shall automatically resign as of the Termination Date from all titles, positions and appointments Employee then

holds with the Company, whether as an officer, director, trustee or employee (without any claim for compensation related thereto), and

Employee hereby agrees to take all actions necessary to effectuate such resignations.

6. Payments

Upon Termination of Employment.

6.1. Termination

of Employment Without Cause or for Good Reason During the Term and Before the First Change in Control. If Employee’s employment

with the Company is terminated during the Term by the Company for any reason other than for Cause (as defined in Section 6.4), or by Employee

for Good Reason (as defined in Section 6.6), and the Termination Date occurs before the first Change in Control to occur during the Term,

then the Company shall, in addition to paying Employee’s Base Salary and other compensation earned through the Termination Date,

and subject to Section 6.9,

| (a) | pay to Employee as severance pay an amount equal to fifty percent (50%) of Employee’s annualized

Base Salary as of the Termination Date, less all legally required and authorized deductions and withholdings, payable in substantially

equal installments in accordance with the Company’s regular payroll cycle during the twelve (12) month period immediately following

the Termination Date, provided, however, that any installments that otherwise would be payable on the Company’s regular payroll

dates between the Termination Date and the 45th calendar day after the Termination Date will be delayed until the Company’s

first regular payroll date that is more than forty-five (45) days after the Termination Date and included with the installment payable

on such payroll date (the “Pre-CIC Severance Payments”); and |

| (b) | if Employee is eligible for and takes all steps necessary to continue Employee’s group health insurance

coverage with the Company following the Termination Date (including completing and returning the forms necessary to elect COBRA coverage),

pay for the portion of the premium costs for such coverage that the Company would pay if Employee remained employed by the Company, at

the same level of coverage that was in effect as of the Termination Date, through the earliest of: (i) the six (6) month anniversary of

the Termination Date, (ii) the date Employee becomes eligible for group health insurance coverage from any other employer, or (iii) the

date Employee is no longer eligible to continue Employee’s group health insurance coverage with the Company under applicable law

(“Pre-CIC Benefits Continuation Payments”). |

6.2. Termination

of Employment Without Cause or for Good Reason During the Term and Within Twelve (12) Months After the First Change in Control. If

Employee’s employment with the Company is terminated during the Term by the Company for any reason other than for Cause, or by Employee

for Good Reason, and the Termination Date occurs on the date of the first Change in Control to occur during the Term or before the twelve

(12) month anniversary of such Change in Control, then the Company shall, in addition to paying Employee’s Base Salary and other

compensation earned through the Termination Date, and subject to Section 6.9,

| (a) | pay to Employee as severance pay an amount equal to one hundred percent (100%) of Employee’s annualized

Base Salary as of the Termination Date, less all legally required and authorized deductions and withholdings, payable in a lump sum on

the Company’s first regular payroll date that is after the expiration of all rescission periods identified in the Release (as defined

in Section 6.9) but in no event later than seventy-five (75) days after the Termination Date (the “Post-CIC Severance Payment”);

provided, however, if the Post-CIC Severance Payment could be made in two different calendar years based on the date on which Employee

signs the Release and all rescission periods identified in the Release expire, then the Post-CIC Severance Payment shall be paid in a

lump sum in the second calendar year but no later than March 15 of such calendar year; |

| (b) | if Employee is eligible for and takes all steps necessary to continue Employee’s group health insurance

coverage with the Company following the Termination Date (including completing and returning the forms necessary to elect COBRA coverage),

pay for the portion of the premium costs for such coverage that the Company would pay if Employee remained employed by the Company, at

the same level of coverage that was in effect as of the Termination Date, through the earliest of: (i) the twelve (12) month anniversary

of the Termination Date, (ii) the date Employee becomes eligible for group health insurance coverage from any other employer, or (iii)

the date Employee is no longer eligible to continue Employee’s group health insurance coverage with the Company under applicable

law (“Post-CIC Benefits Continuation Payments”); and |

| (c) | pay up to $10,000.00 for outplacement services by an outplacement services provider selected by Employee,

with any such amount payable by the Company directly to the outplacement services provider or reimbursed to Employee, in either case subject

to Employee’s submission of appropriate receipts before the twelve (12) month anniversary of the Termination Date (the “Outplacement

Payments”). |

6.3. Other

Termination of Employment Events. If Employee’s employment with the Company is terminated by the Company or Employee for any

reason upon or following the expiration of the Term, or if Employee’s employment with the Company is terminated during the Term

by reason of:

| (a) | Employee’s abandonment of Employee’s employment or Employee’s resignation for any reason

other than Good Reason; |

| (b) | termination of Employee’s employment by the Company for Cause; or |

| (c) | Employee’s death or Disability, |

then the Company shall pay to Employee

or Employee’s beneficiary or Employee’s estate, as the case may be, Employee’s Base Salary and other compensation earned

through the Termination Date and Employee shall not be eligible or entitled to receive any severance pay or benefits from the Company.

6.4. Cause Defined.

“Cause” hereunder means:

| (a) | Employee’s material failure to perform his job duties competently as reasonably determined by the

Board; |

| (b) | gross misconduct by Employee which the Board reasonably determines is (or will be if continued) demonstrably

and materially damaging to the Company; |

| (c) | fraud, misappropriation, or embezzlement by Employee; |

| (d) | an act or acts of dishonesty by Employee and intended to result in gain or personal enrichment of Employee

at the expense of the Company; |

| (e) | Employee’s conviction of or plea of nolo contendere to a felony regardless of whether involving

the Company and whether or not committed during the course of Employee’s employment, other than with respect to any criminal penalties

related to the illegality of possessing or using Marijuana under the Controlled Substance Act, 21 U.S.C. Section 812(b); |

| (f) | Employee’s material violation of the Company’s Code of Conduct, Employee Handbook or other

written policy, as reasonably determined by the Board; or |

| (g) | the material breach of this Agreement of the Restrictive Covenants Agreement by Employee. |

With respect to Section 6.4(a) and Section

6.4(f), the Company shall first provide Employee with written notice and an opportunity to cure such breach, if curable, in the reasonable

discretion of the Board, and identify with specificity the action needed to cure within fifteen (15) days of Employee’s receipt

of written notice from the Company. If the Company terminates Employee’s employment for Cause pursuant to this Section 6.4, then

Employee shall not be eligible or entitled to receive any severance pay or benefits from the Company.

6.5. Change

in Control Defined. “Change in Control” hereunder has the same meaning such term has in the Vireo Health International

Inc. 2019 Equity Incentive Plan, as amended from time to time (the “Equity Incentive Plan”).

6.6. Good

Reason Defined. “Good Reason” hereunder means the initial occurrence of any of the following events without Employee’s

consent:

| (a) | a material diminution in the Employee’s responsibilities, authority or duties or a change in his

title; |

| (b) | a material diminution

in the Employee's salary, other than a general reduction in base salaries that affects all similarly situated Company employees in substantially

the same proportions; |

| (c) | a relocation of the Employee’s

principal place of employment to a location more than fifty (50) miles from his principal place of employment on the Effective Date;

or |

| (d) | the material breach of this Agreement by the Company. |

provided, however, that “Good

Reason” shall not exist unless Employee has first provided written notice to the Company of the initial occurrence of one or more

of the conditions under clauses (a) through (d) above within thirty (30) days of the condition’s occurrence, such condition is not

fully remedied by the Company within thirty (30) days after the Company’s receipt of written notice from Employee, and the Termination

Date as a result of such event occurs within ninety (90) days after the initial occurrence of such event.

6.7. Disability

Defined. “Disability” hereunder has the same meaning such term has in the Equity Incentive Plan.

6.8. The Company’s

Sole Obligation. In the event of termination of Employee’s employment, the sole obligation of the Company to provide Employee

with severance pay or benefits shall be its obligation to make the payments called for by Section 6.1 or Section 6.2, as the case may

be, and the Company shall have no other severance-related obligation to Employee or to Employee’s beneficiary or Employee’s

estate. For avoidance of doubt, nothing in this Section 6.8 affects Employee’s right to receive any amounts due under the terms

of any employee benefit plans or programs (other than any severance-related plan or program) then maintained by the Company in which Employee

participates.

6.9. Conditions

To Receive Payments. Notwithstanding the foregoing provisions of this Section 6, the Company will not be obligated to make the Pre-CIC

Severance Payments or Pre-CIC Benefits Continuation Payments under Section 6.1, or the Post-CIC Severance Payment, Post-CIC Benefits Continuation

Payments or Outplacement Payments under Section 6.2, to or on behalf of Employee unless (a) Employee signs a release of claims in favor

of the Company in a form to be prescribed by the Company (the “Release”), (b) all applicable consideration periods and rescission

periods provided by law with respect to the Release have expired without Employee rescinding the Release, and (c) Employee is in strict

compliance with the terms of this Agreement and the Restrictive Covenants Agreement and any other written agreement between Employee and

the Company.

7. Anticipatory

Termination without Cause. If Employee’s employment with the Company is terminated during the Term by the Company for any reason

other than for Cause or by Employee for Good Reason, and a Change in Control occurs (i) within six (6) months after Employee’s Termination

Date or (ii) within one year after Employee’s Termination Date, pursuant to an agreement executed within sixty (60) days after Employee’s

Termination Date, then Employee shall receive an additional cash payment equal to fifty percent (50%) of Employee’s annualized Base

Salary as of the Termination Date, less all legally required and authorized deductions and withholdings, payable in a single lump sum

no later than ten (10) days after the date of such Change in Control.

8. Section

409A and Taxes Generally.

8.1 Taxes.

The Company is entitled to withhold on and report the making of such payments as may be required by law as determined in the reasonable

discretion of the Company. Except for any tax amounts withheld by the Company from any compensation that Employee may receive in connection

with Employee’s employment with the Company and any employer taxes required to be paid by the Company under applicable laws or regulations,

Employee is solely responsible for payment of any and all taxes owed in connection with any compensation, benefits, reimbursement amounts

or other payments Employee receives from the Company under this Agreement or otherwise in connection with Employee’s employment

with the Company. The Company does not guarantee any particular tax consequence or result with respect to any payment made by the Company.

8.2 Section

409A. This Agreement is intended to provide for payments that satisfy, or are exempt from, the requirements of Section 409A, including

Sections 409A(a)(2), (3) and (4) of the Code and current and future guidance and regulations interpreting such provisions, and should

be interpreted accordingly. In furtherance of the foregoing, the provisions set forth below shall apply notwithstanding any other provision

in this Agreement:

| (a) | all payments to be made to Employee hereunder, to the extent they constitute a deferral of compensation

subject to the requirements of Section 409A (after taking into account all exclusions applicable to such payments under Section 409A),

shall be made no later, and shall not be made any earlier, than at the time or times specified in this Agreement or in any applicable

plan for such payments to be made, except as otherwise permitted or required under Section 409A; |

| (b) | the date of Employee’s “separation from service”, as defined in Section 409A (and as

determined by applying the default presumptions in Treas. Reg. §1.409A-1(h)(1)(ii)), shall be treated as the date of Employee’s

termination of employment for purposes of determining the time of payment of any amount that becomes payable to Employee related to Employee’s

termination of employment under Sections 10(a), 10(b) or 10(c), and any reference to Employee’s “Termination Date” or

“termination” of Employee’s employment in Section 6.1 or Section 6.2 shall mean the date of Employee’s “separation

from service”, as defined in Section 409A (and as determined by applying the default presumptions in Treas. Reg. §1.409A-1(h)(1)(ii)); |

| (c) | in the case of any amounts payable to Employee under this Agreement that may be treated as payable in

the form of “a series of installment payments”, as defined in Treas. Reg. §1.409A-2(b)(2)(iii), Employee’s right

to receive such payments shall be treated as a right to receive a series of separate payments for purposes of Treas. Reg. §1.409A-2(b)(2)(iii); |

| (d) | to the extent that the reimbursement of any expenses eligible for reimbursement or the provision of any

in-kind benefits under any provision of this Agreement would be considered deferred compensation under Section 409A (after taking into

account all exclusions applicable to such reimbursements and benefits under Section 409A): (i) reimbursement of any such expense shall

be made by the Company as soon as practicable after such expense has been incurred, but in any event no later than December 31st

of the year following the year in which Employee incurs such expense; (ii) the amount of such expenses eligible for reimbursement, or

in-kind benefits to be provided, during any calendar year shall not affect the amount of such expenses eligible for reimbursement, or

in-kind benefits to be provided, in any calendar year; and (iii) Employee’s right to receive such reimbursements or in-kind benefits

shall not be subject to liquidation or exchange for another benefit; |

| (e) | to the extent any payment or delivery otherwise required to be made to Employee hereunder on account of

Employee’s separation from service is properly treated as a deferral of compensation subject to Section 409A after taking into account

all exclusions applicable to such payment and delivery under Section 409A, and if Employee is a “specified employee” under

Section 409A at the time of Employee’s separation from service, then such payment and delivery shall not be made prior to the first

business day after the earlier of (i) the expiration of six months from the date of Employee’s separation from service, or (ii)

the date of Employee’s death (such first business day, the “Delayed Payment Date”), and on the Delayed Payment Date,

there shall be paid or delivered to Employee or, if Employee has died, to Employee’s estate, in a single payment or delivery (as

applicable) all entitlements so delayed, and in the case of cash payments, in a single cash lump sum, an amount equal to aggregate amount

of all payments delayed pursuant to the preceding sentence. Except for any tax amounts withheld by the Company from the payments or other

consideration hereunder and any employment taxes required to be paid by the Company, Employee shall be responsible for payment of any

and all taxes owed in connection with the consideration provided for in this Agreement; and |

| (f) | the Parties agree that this Agreement may be amended, as may be necessary to fully comply with, or to

be exempt from, Section 409A and all related rules and regulations in order to preserve the payments and benefits provided hereunder without

additional cost to either Party. |

9. Miscellaneous.

9.1. Integration.

This Agreement and the Restrictive Covenants Agreement embody the entire agreement and understanding among the Parties relative to subject

matter hereof and combined supersede all prior agreements and understandings relating to such subject matter, including but not limited

to any earlier offers to Employee by the Company; provided, however, this Agreement and the Restrictive Covenants Agreement are not intended

to supersede or otherwise affect the Equity Incentive Plan or any Award Agreement (as defined in the Equity Incentive Plan), each of which

shall remain in effect in accordance with its terms.

9.2. Applicable

Law. All matters relating to the interpretation, construction, application, validity and enforcement of this Agreement are governed

by the laws of the State of Minnesota without giving effect to any choice or conflict of law provision or rule, whether of the State of

Minnesota or any other jurisdiction, that would cause the application of laws of any jurisdiction other than the State of Minnesota.

9.3. Choice

of Jurisdiction. Employee and the Company consent to jurisdiction of the courts of the State of Minnesota and/or the federal district

courts, District of Minnesota, for the purpose of resolving all issues of law, equity, or fact, arising out of or in connection with this

Agreement or Employee’s employment with the Company or the termination of such employment. Any action involving claims for interpretation,

breach or enforcement of this Agreement or related to Employee’s employment with the Company or the termination of such employment

shall be brought in such courts. Each party consents to personal jurisdiction over such party in the state and/or federal courts of Minnesota

and hereby waives any defense of lack of personal jurisdiction or inconvenient forum.

9.4. Employee’s

Representations. Employee represents that Employee is not subject to any agreement or obligation that would prevent or limit Employee

from entering into this Agreement or that would be breached upon performance of Employee’s duties under this Agreement, including

but not limited to any duties owed to any former employers not to compete. If Employee possesses any information that Employee knows or

should know is considered by any third party, such as a former employer of Employee’s, to be confidential, trade secret, or otherwise

proprietary, Employee shall not disclose such information to the Company or use such information to benefit the Company in any way.

9.5. Counterparts.

This Agreement may be executed in several counterparts and as so executed shall constitute one agreement binding on the Parties.

9.6. Assignment

and Successors. The rights and obligations of the Company under this Agreement shall inure to the benefit of and will be binding upon

the successors and assigns of the Company. Neither party may, without the written consent of the other party, assign or delegate any of

its rights or obligations under this Agreement except that the Company may, without any further consent of Employee, assign or delegate

any of its rights or obligations under this Agreement to any corporation or other business entity (a) with which the Company may merge

or consolidate, (b) to which the Company may sell or transfer all or substantially all of its assets or capital stock or equity, or (c)

any affiliate or subsidiary of the Company. After any such assignment or delegation by the Company, the Company will be discharged from

all further liability hereunder and such assignee will thereafter be deemed to be the “Company” for purposes of all terms

and conditions of this Agreement, including this Section 9.6. Employee may not assign this Agreement or any rights or obligations hereunder.

Any purported or attempted assignment or transfer by Employee of this Agreement or any of Employee’s duties, responsibilities, or

obligations hereunder is void.

9.7. Modification.

This Agreement shall not be modified or amended except by a written instrument signed by the Parties.

9.8. Severability.

The invalidity or partial invalidity of any portion of this Agreement shall not invalidate the remainder thereof, and said remainder shall

remain in fully force and effect.

9.9. Opportunity

to Obtain Advice of Counsel. Employee acknowledges that Employee has been advised by the Company to obtain legal advice prior to executing

this Agreement, and that Employee had sufficient opportunity to do so prior to signing this Agreement.

9.10. 280G

Limitations. In the event that the severance and other benefits provided for in this Agreement or otherwise payable to Employee (a)

constitute “parachute payments” within the meaning of Section 280G of the Code and (b) would be subject to the excise tax

imposed by Code Section 4999, then such benefits shall be either be: (i) delivered in full, or (ii) delivered as to such lesser extent

which would result in no portion of such severance benefits being subject to excise tax under Code Section 4999, whichever of the foregoing

amounts, taking into account the applicable federal, state and local income and employment taxes and the excise tax imposed by Code Section

4999, results in the receipt by Employee, on an after-tax basis, of the greatest amount of benefits, notwithstanding that all or some

portion of such benefits may be subject to excise tax under Code Section 4999. Any determination required under this Section 9.10 will

be made in writing by an accounting firm selected by the Company or such other person or entity to which the parties mutually agree (the

“Accountants”), whose determination will be conclusive and binding upon Employee and the Company for all purposes. For purposes

of making the calculations required by this Section 9.10, the Accountants may make reasonable assumptions and approximations concerning

applicable taxes and may rely on reasonable, good faith interpretations concerning the application of Code Sections 280G and 4999. The

Company and the Employee shall furnish to the Accountants such information and documents as the Accountants may reasonably request in

order to make a determination under this Section. The Company shall bear all costs the Accountants may reasonably incur in connection

with any calculations contemplated by this Section 9.10. Any reduction in payments and/or benefits required by this Section 9.10 shall

occur in the following order: (A) cash payments shall be reduced first and in reverse chronological order such that the cash payment owed

on the latest date following the occurrence of the event triggering such excise tax will be the first cash payment to be reduced; (B)

accelerated vesting of stock awards, if any, shall be cancelled/reduced next and in the reverse order of the date of grant for such stock

awards (i.e., the vesting of the most recently granted stock awards will be reduced first), with full-value awards reversed before any

stock option or stock appreciation rights are reduced; and (C) deferred compensation amounts subject to Section 409A shall be reduced

last.

[Signature Page Follows]

THIS EMPLOYMENT AGREEMENT

was voluntarily and knowingly executed by the Parties effective as of the Effective Date first set forth above.

| |

|

VIREO HEALTH, INC. |

|

| |

|

|

|

| Date: December 1, 2020 |

|

/s/ Kyle Kingsley |

|

| |

|

By: Kyle Kingsley |

|

| |

|

Its: Chief Executive Officer |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

EMPLOYEE: |

|

| |

|

|

|

| Date: December 1, 2020 |

|

/s/ J. Michael

Schroeder |

|

| |

|

J. Michael Schroeder |

|

| |

|

General Counsel and Chief Compliance Officer |

|

[Signature Page to Employment Agreement]

Exhibit A

to Employment Agreement

Confidential Information, Intellectual Property

Rights, Non-Competition and

Non-Solicitation Agreement

Exhibit 10.3

AMENDMENT TO EMPLOYMENT AGREEMENT

This Amendment to Employment

Agreement (“Amendment”) is made effective as of February 2, 2022 (“Effective Date”) by and among

Goodness Growth Holdings, Inc., a British Columbia corporation (“Parent”), Vireo Health, Inc., a Delaware

corporation (the “Employer”) and Jacob Michael Schroeder, an individual residing in the State/Commonwealth of

Florida (“Employee”) (collectively “Parties” or individually “Party”).

RECITALS

WHEREAS, the Employer

and Employee entered into an Employment Agreement (the “Original Agreement”) dated December 1, 2020;

WHEREAS, the board

of directors of Parent is exploring the potential sale or other disposition of Parent (a “CIC Transaction”) that, if

approved by Parent’s shareholders and effected, would amount to a Change in Control as defined in the Original Agreement;

WHEREAS, Employer wishes

to retain the services of Employee through the date of closing of a CIC Transaction (the “CIC Closing Date”) to ensure

continuity in the operations of Employer and its subsidiary and affiliated companies; and

WHEREAS, the Parties

wish to amend the Original Agreement as set forth in this Amendment.

NOW, THEREFORE, in

consideration of the mutual covenants and conditions contained herein, the receipt and sufficiency of which are hereby acknowledged, Parent,

Employer and Employee, intending legally to be bound, hereby agree as follows:

AGREEMENT

1.

Retention Bonus. Employee will receive a retention bonus (the “Retention Bonus”) in an amount equal to

fifty percent (50%) of Employee’s annual base salary (“Base Salary”) on the CIC Closing Date, subject to the

conditions and on the terms described in this Amendment. If Employer terminates Employee’s employment without Cause prior to the

CIC Closing Date, Base Salary will be defined as Employee’s annual base salary immediately prior to the date of termination of employment.

If Employee voluntarily terminates employment with Good Reason prior to the CIC Closing Date, Base Salary will be defined as Employee’s

annual base salary immediately prior to the occurrence of the initial event that would give rise to Good Reason. Employer will pay the

Retention Bonus to Employee only if Employee’s employment is not terminated by the Employer for Cause or by Employee without Good

Reason. The Retention Bonus will be paid within thirty (30) days after the date of the CIC Closing Date and will be subject to required

withholdings and deductions.

2.

Options and Restricted Stock Units. The provisions of this paragraph 2 apply if Employee has been granted any stock options

(“Options”) or restricted stock units (“RSUs”) under the Vireo Health, Inc. 2018 Equity Incentive

Plan (the “2018 Plan”), the Vireo Health International, Inc. 2019 Equity Incentive Plan (the “2019 Plan”),

or both, which Options and/or RSUs have not vested as of the CIC Closing Date.

a.

Accelerated Vesting. All unvested Options and RSUs held by Employee will vest immediately prior to the CIC Closing Date,

provided that Employee’s employment shall not have been terminated by Employer for Cause or by Employee without Good Reason on or

prior to such date.

b.

Time to Exercise. Consistent with and confirming a resolution of Parent’s board of directors that was unanimously

approved on August 10, 2021, and notwithstanding the provisions of the 2018 Plan, the 2019 Plan, or the incentive option agreement or

other instrument by which Employer or Parent granted Options to Employee (“Grant Agreement”), provided that Employee’s

employment shall not have been terminated for Cause, Employee shall be entitled to exercise, by completing all steps listed in the respective

Grant Agreement, any vested, unexercised Option or Options, through the day that is the earlier of (i) the day that is two (2) years after

the last date of employment of Employee by Employer or any parent, subsidiary or affiliated company of Employer and (ii) the expiration

date applicable to such Option.

c.

The provisions of this Section 2 shall survive the expiration or earlier termination of the Original Agreement and/or this Amendment.

3.

Termination. If the Employer terminates Employee’s employment for Cause or Employee voluntarily terminates Employee’s

employment without Good Reason, in each case prior to the CIC Closing Date, Employee shall forfeit any right or claim to the Retention

Bonus or any portion thereof.

4.

General. All capitalized terms used but not defined in this Amendment shall have the meanings ascribed in the Original Agreement.

All provisions of the Original Agreement not expressly modified by this Amendment are hereby ratified and confirmed.

THIS AMENDMENT TO EMPLOYMENT

AGREEMENT was voluntarily and knowingly executed by the Parties effective as of the Effective Date first set forth above.

| |

|

VIREO HEALTH, INC. |

|

| |

|

|

| Date: February 2, 2022 |

/s/ Kyle Kingsley |

|

| |

|

By: Kyle Kingsley |

|

| |

|

Its: CEO |

|

| |

|

|

|

| |

|

|

|

| |

|

EMPLOYEE: |

|

| |

|

|

|

| Date: February 2, 2022 |

/s/ Jacob Michael

Schroeder |

|

| |

|

Jacob Michael Schroeder |

|

| |

|

|

|

| |

|

|

|

| |

|

GOODNESS GROWTH HOLDINGS, INC. |

| |

|

|

|

| Date: February 2, 2022 |

/s/ Kyle Kingsley |

|

| |

|

By: Kyle Kingsley |

|

| |

|

Its: CEO |

|

Exhibit 10.4

THIRD AMENDMENT TO EMPLOYMENT AGREEMENT

This Third Amendment to Employment

Agreement (“Third Amendment”) is made effective as of June 7, 2023 (“Effective Date”)

by and among Goodness Growth Holdings, Inc., a British Columbia corporation (“Parent”), Vireo Health,

Inc., a Delaware corporation (the “Employer”) and J. Michael Schroeder, an individual residing in

the State of Florida (“Employee”) (collectively “Parties” or individually “Party”).

RECITALS

WHEREAS, the Employer

and Employee entered into an Employment Agreement dated December 1, 2020, a First Amendment to Employment Agreement dated February 2,

2022, and a Second Amendment to Employment Agreement dated December 14, 2022 (collectively, the “Current Agreement”);

and

WHEREAS, by unanimous

written consent executed on June 6, 2023, Parent Company authorized and directed Employer to grant compensation to Employee, consisting

of Parent company stock options, to incent Employee to continue his employment with Employer; and

WHEREAS, the Parties

wish to amend the Current Agreement as set forth in this Amendment.

NOW, THEREFORE, in

consideration of the mutual covenants and conditions contained herein, the receipt and sufficiency of which are hereby acknowledged, Parent,

Employer and Employee, intending legally to be bound, hereby agree as follows:

AGREEMENT

1.

Equity Grants.

| i. | The Employer shall cause the Parent Company to grant to Employee the rights to purchase (the “First

Option”) 400,000 subordinate voting shares of the Parent Company’s capital stock (“Shares”)

at an exercise price equal to the volume weighted-average closing price of like shares on the Canadian Securities Exchange for the two

trading days immediately preceding the Grant Date. The First Option shall have a ten-year term. The First Option will be immediately vested

upon grant as to 225,000 Shares. 25,000 Shares of the First Option will vest on June 30, 2023, and on the last day of each calendar quarter

thereafter, until the First Option is fully vested, on December 31, 2024. The foregoing description of some of the principal terms of

the First Option is not binding on the Employer or Parent Company. The terms and conditions of the First Option shall be as set forth

in the applicable grant agreement. |

| ii. | The Employer shall cause the Parent Company to grant to Employee the rights to purchase (the “Second

Option”) 239,907 subordinate voting shares of the Parent Company’s capital stock (“Shares”)

at an exercise price equal to the volume weighted-average closing price of like shares on the Canadian Securities Exchange for the two

trading days immediately preceding the Grant Date. The Second Option shall have a ten-year term. The Second Option will be immediately

vested upon grant as to 59,977 Shares. 14,994 Shares of the Option will vest on June 30, 2023, and on the last day of each calendar quarter

thereafter, until the Option is fully vested, on March 31, 2026. The foregoing description of some of the principal terms of the Option

is not binding on the Employer or Parent Company. The terms and conditions of the Option shall be as set forth in the applicable grant

agreement. |

2.

General. All capitalized terms used but not defined in this Third Amendment shall have the meanings ascribed in the Current

Agreement. All provisions of the Current Agreement not expressly modified by this Third Amendment are hereby ratified and confirmed.

THIS THIRD AMENDMENT TO

EMPLOYMENT AGREEMENT was voluntarily and knowingly executed by the Parties effective as of the Effective Date first set forth above.

| |

VIREO HEALTH, INC. |

|

| |

|

|

|

| Date: |

By: |

/s/ Joshua Rosen |

|

| |

Its: Interim CEO |

|

| |

|

|

|

| |

|

|

|

| |

EMPLOYEE: |

|

| |

|

|

|

| Date: |

/s/ J. Michael Schroeder |

|

| |

|

|

|

| |

|

|

|

| |

GOODNESS GROWTH HOLDINGS, INC. |

|

| |

|

|

|

| Date: |

By: |

/s/ Joshua Rosen |

|

| |

Its: Interim CEO |

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

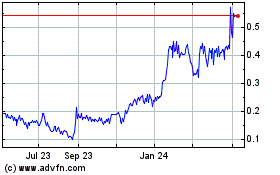

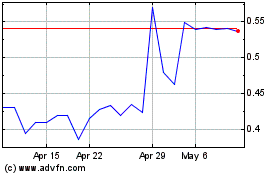

Goodness Growth (QX) (USOTC:GDNSF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Goodness Growth (QX) (USOTC:GDNSF)

Historical Stock Chart

From Apr 2023 to Apr 2024