false

0001069530

0001069530

2023-12-12

2023-12-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) December 12, 2023

Cassava Sciences, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-29959

|

91-1911336

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification Number)

|

6801 N Capital of Texas Highway, Building 1; Suite 300

Austin, Texas 78731

(Address of principal executive offices, including zip code)

(512) 501-2444

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

|

SAVA

|

|

NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

8.01: Other Events

On December 12, 2023, Cassava Sciences, Inc., a Delaware corporation (the “Company”), issued a press release announcing that the Board of Directors of the Company declared a distribution to the holders of record of the Company’s shares of common stock, par value $0.001 per share (the “Common Shares”), in the form of warrants to purchase Common Shares (the “Warrants”). The Warrants will be distributed on or about January 3, 2024, to the holders of record of Common Shares as of the close of business on December 22, 2023 (the “Distribution Record Date”).

The foregoing description is only a summary and is qualified in its entirety by reference to the press release, which is filed as an exhibit to this Form 8-K and incorporated herein by reference.

7.01 Regulation FD Disclosure

In connection with the press release described above, the Company posted a Warrant Distribution Q&A on its website, a copy of which is attached as Exhibit 99.2.

No Offer or Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of, these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. A Form 8-A registration statement and prospectus supplement describing the terms of the Warrants will be filed with the Securities and Exchange Commission (the “SEC”) and will be available on the SEC’s website located at http://www.sec.gov. Holders of Company common stock should read the prospectus supplement carefully, including the Risk Factors section included and incorporated by reference therein. This communication contains a general summary of the warrants. Please read the warrant agreement when it becomes available as it will contain important information about the terms of the Warrants.

Forward Looking Statements

This Form 8-K contains forward-looking statements, including statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “may,” “anticipate,” “believe,” “could,” “expect,” “forecast,” “intend,” “plan,” “possible,” “potential,” and other words and terms of similar meaning. Such statements are based largely on our current expectations and projections about future events. Such statements speak only as of the date of this Form 8-K and are subject to a number of risks, uncertainties and assumptions, including, but not limited to, whether the Company will derive the anticipated benefits of the transaction described in this communication and any unanticipated impacts of the warrant distribution on the Company’s business operations, and including those described in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, and future reports to be filed with the SEC. In light of these risks, uncertainties and assumptions, the forward-looking statements and events discussed in this Form 8-K are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Except as required by law, we disclaim any intention or responsibility for updating or revising any forward-looking statements contained in this news release.

9.01: Financial Statements and Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

CASSAVA SCIENCES, INC.

|

|

| |

a Delaware corporation

|

|

| |

|

|

|

|

Date: December 12, 2023

|

|

|

|

| |

By:

|

/s/ ERIC J. SCHOEN

|

|

| |

|

Eric J. Schoen

|

|

| |

|

Chief Financial Officer

|

|

Exhibit 99.1

Cassava Sciences Announces Dividend Distribution of Warrants to Shareholders

| |

■

|

Shareholders of Record Will Receive Warrants to Purchase Shares of Common Stock

|

| |

■

|

All Warrants to Be Distributed to Shareholders Free of Charge

|

| |

■

|

Warrants Are Expected to List and Trade on Nasdaq

|

| |

■

|

Warrant Holders Who Choose to Exercise During an Early Period Will Also Receive an Additional 0.5 of a Common Share Per Warrant

|

AUSTIN, Texas, December 12, 2023 -- Cassava Sciences, Inc. (Nasdaq: SAVA) ("Cassava Sciences" or the "Company") today announced a pro rata dividend distribution of warrants to holders of the Company's common stock as of December 22, 2023 (the “Record Date”). Shareholders will receive 4 warrants for each 10 shares of common stock held as of the Record Date, subject to rounding. Cassava Sciences will distribute the warrants to shareholders on or about January 3, 2024 (the “Distribution Date”). After the Distribution Date, the warrants are expected to list and trade on Nasdaq, separate from Cassava Sciences’ common stock, under the ticker SAVAW.

“Many parties are deeply vested in the long-term success of Cassava Sciences, including its directors, management and employees,” said Remi Barbier, President & CEO. “We believe a warrant distribution underscores the inherent strength of the Company. It allows our shareholder base to participate in a process of raising capital. We intend to use the cash proceeds from the exercise of the warrants to support our ongoing Phase 3 clinical development of oral simufilam in people with Alzheimer’s disease.”

Details of Warrant Distribution

Stockholders will receive 4 warrants for each 10 shares of common stock held as of the Record Date, rounded down to the nearest whole number for any fractional warrant. As an example, a shareholder who owns 1,000 shares of Cassava Sciences will receive 400 warrants plus, as applicable and as described below, the Bonus Share Fraction. Each warrant will entitle the holder to purchase, at the holder’s sole and exclusive election, one share of common stock at an initial exercise price of $33.00 per share plus, as applicable and as described below, the Bonus Share Fraction.

After the Distribution Date, warrant holders may cash-exercise their warrants, or they may sell their warrants on the open market. The Company will receive cash proceeds only from warrant holders who exercise their warrants. Warrant holders may exercise their warrants as will be specified under the terms of a warrant agreement that is expected to be filed with the U.S. Securities and Exchange Commission (“SEC”) on or about January 3, 2024.

All warrants will expire on Friday, November 15, 2024, at 5:00 p.m. New York City time, unless redeemed by the Company before that date. The warrants will be redeemable by the Company on or after April 15, 2024, upon 20 calendar days’ notice.

A Q&A regarding this warrant distribution has been posted in the Investor’s section of the Company’s website, https://www.CassavaSciences.com

Details of Bonus Share Program

The Bonus Share Fraction entitles a holder to receive an additional 0.5 of a share of common stock for each warrant exercised (the “Bonus Share Fraction”) without payment of any additional exercise price. After the Distribution Date, the right to receive the Bonus Share Fraction will expire at 5:00 p.m. New York City time (the “Bonus Share Expiration Date”) upon the earlier of (i) the first business day following the last day of the first 30 consecutive trading day period in which the daily volume weighted average price (“VWAP”) of the shares of common stock has been at least equal to a specified price, initially $26.40 per share, for at least 20 trading days (whether or not consecutive) (the “Bonus Price Condition”) and (ii) the date specified by the Company upon not less than 20 business days’ public notice. Any warrant exercised after the Bonus Share Expiration Date will not be entitled to the Bonus Share Fraction.

The Company will make a public announcement of the Bonus Share Expiration Date (i) prior to market open on the Bonus Share Expiration Date in the case of a Bonus Price Condition and (ii) at least 20 business days prior to such date, in the case of the Company setting a Bonus Share Expiration Date.

The distribution of the warrants has not been registered under the Securities Act of 1933, as amended (the “Securities Act”), because the issuance of a distribution in the form of a warrant for no consideration is not a sale or disposition of a security or interest in a security for value pursuant to Section 2(a)(3) of the Securities Act. The Company expects to file with the SEC a prospectus supplement, under its existing shelf registration statement, registering the shares of common stock underlying the warrants.

B. Dyson Capital Advisors is serving as exclusive financial advisor on our distribution of warrants.

Gibson, Dunn & Crutcher LLP is serving as legal advisor to the Company.

About Cassava Sciences, Inc.

Cassava Sciences is a clinical-stage biotechnology company based in Austin, Texas. Our mission is to detect and treat neurodegenerative diseases, such as Alzheimer’s disease. Our novel science is based on stabilizing—but not removing—a critical protein in the brain. Simufilam, our lead product candidate, is in clinical testing in a pair of Phase 3 clinical trials in patients with Alzheimer’s disease dementia. Our product candidates have not been approved by any regulatory authority, and their safety, efficacy or other desirable attributes have not been established.

For more information, please visit: https://www.CassavaSciences.com

For More Information Contact:

Eric Schoen, Chief Financial Officer

(512) 501-2450

ESchoen@CassavaSciences.com

The foregoing press release does not purport to be complete and is qualified in its entirety by reference to the full text of the warrant distribution related agreements to be filed with the SEC.

Cautionary Note Regarding Forward-Looking Statements:

This Press Release and the Q&A referenced in it contain forward-looking statements, including statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, that may include but are not limited to: the development of new treatment options for people with Alzheimer’s disease; the long-term success of the Company; the Company’s ability to raise additional capital while protecting stockholders from excessive dilution; the design, scope, completion, intended purpose, or future results of our warrant distribution; any expected clinical results of our on-going Phase 3 studies of simufilam in Alzheimer’s disease; the treatment of people with Alzheimer’s disease dementia; the safety or efficacy of simufilam in people with Alzheimer’s disease dementia; expected cash use of proceeds from the warrant distribution, if any; whether warrants will be traded on Nasdaq, the price of those warrants and the existence of a market for those warrants; whether and when warrants will be redeemed by the Company; whether the distribution of a warrant is a taxable event; comments made by our employees regarding the warrant distribution, simufilam, and potential benefits, if any, of our product candidates. These statements may be identified by words such as “may,” “anticipate,” “believe,” “could,” “expect,” “forecast,” “intend,” “plan,” “possible,” “potential,” and other words and terms of similar meaning.

Simufilam is our investigational product candidate. It is not approved by any regulatory authority in any jurisdiction and its safety, efficacy or other desirable attributes have not been established in patients.

Drug development and commercialization involve a high degree of risk, and only a small number of research and development programs result in commercialization of a product. Clinical results and analyses of our previous studies should not be relied upon as predictive of Phase 3 studies or any other study. Our clinical results from earlier-stage clinical trials may not be indicative of full results or results from later-stage or larger scale clinical trials and do not ensure regulatory approval. You should not place undue reliance on these statements or any scientific data we present or publish.

Forward looking statements are based largely on our current expectations and projections about future events. Such statements speak only as of the date of this news release and are subject to a number of risks, uncertainties and assumptions, including, but not limited to, those risks relating to the ability to conduct or complete clinical studies on expected timelines, to demonstrate the specificity, safety, efficacy or potential health benefits of our product candidates, any unanticipated impacts of the warrant distribution on our business operations, and including those described in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, and future reports to be filed with the SEC. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from expectations in any forward-looking statement. In light of these risks, uncertainties and assumptions, the forward-looking statements and events discussed in this Press Release and in the Q&A referenced in it are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Except as required by law, we disclaim any intention or responsibility for updating or revising any forward-looking statements contained in this news release. For further information regarding these and other risks related to our business, investors should consult our filings with the SEC, which are available on the SEC's website at www.sec.gov.

No Offer or Solicitation

This Press Release and the Q&A referenced in it shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of, these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. A Form 8-A registration statement and prospectus supplement describing the terms of the warrants will be filed with the Securities and Exchange Commission (the "SEC") and will be available on the SEC's website located at http://www.sec.gov. Holders of Company common stock should read the prospectus supplement carefully, including the Risk Factors section included and incorporated by reference therein. This press release contains a general summary of the warrants. Please read the warrant agreement when it becomes available as it will contain important information about the terms of the warrants.

###

Exhibit 99.2

Dear Stockholder –

I’m pleased to inform you that on December 12, 2023, Cassava Sciences announced a pro rata distribution of warrants to its stockholders. The warrants will allow the holder to purchase additional shares of Cassava Sciences common stock, if they wish to do so.

With this Q&A, I would like to make the warrant distribution a subject of conversation, and answer some of your questions.

But first, I’d like to address the strategic rationale for the warrant distribution. As you know, Cassava Sciences is a biotechnology company with an unwavering commitment to develop a new treatment option for people with Alzheimer’s disease. Many parties are deeply vested in the long-term success of Cassava Sciences, including its directors, management and employees. We believe a warrant distribution underscores the inherent strength of the Company. It allows our stockholder base to participate in a process of raising capital. We intend to use any proceeds from the exercise of warrants to support our ongoing Phase 3 clinical trials of oral simufilam in people with Alzheimer’s disease.

As with any Q&A, this one won’t answer all your questions, nor is it intended to. For full information, carefully read the warrant agreement to be filed with the U.S. Securities and Exchange Commission (SEC) and all other SEC filings that pertain to our Company and its current operations.

Please reach out if you have questions. I’d love to hear from you.

You may email questions directly to me to: WarrantQuestions@CassavaSciences.com

We’ll do our best to respond to respectful inquiries, within limits. Given the volume of expected emails, we may not be able to reply to all questions.

As we approach the holiday season, I also want to say how much I appreciate your support. It takes a monumental effort to develop a new treatment for Alzheimer's disease. It gives me tremendous joy to know you’re with us on the journey.

Respectfully,

Remi Barbier

Founder, Chairman of the Board

President & CEO

| |

1.

|

Why is Cassava Sciences doing a warrant distribution now?

|

In 2024 and beyond, Cassava Sciences’ strategic goal is to complete the clinical development of simufilam, our drug candidate for people with Alzheimer’s disease. In approximately December 2024, we expect to have top-line clinical results for one of two on-going Phase 3 trials of simufilam in Alzheimer’s disease.

| |

2.

|

Where can I find all the terms and conditions of the warrants?

|

The warrants allow the holder to purchase shares of common stock on terms and conditions as set forth in the warrant agreement to be filed with the SEC on or about January 3, 2024 (the “Distribution Date”). The warrant agreement will also be posted in the Investors section of the Company’s website at www.CassavaSciences.com. You should carefully read the warrant agreement and the other documents filed with the SEC by Cassava Sciences.

| |

3.

|

How does it work in practice?

|

Cassava Sciences’ stockholders will receive, free of charge, a certain number of warrants. That amount is proportional (“pro-rata”) to the holder’s existing ownership of Cassava Sciences common stock. Each warrant will entitle the holder to purchase, at the holder’s sole and exclusive election, at the exercise price, one share of common stock. Warrant holders may exercise their warrants, or they may sell their warrants on the open market for cash. It’s your choice.

A warrant gives the holder the right – but not the obligation – to buy shares of common stock of the issuer at a specified price for a specific period. Important terms and conditions for our warrant distribution will be fully disclosed in the warrant agreement that will be filed with the SEC. You should carefully read the warrant agreement and the other documents filed with the SEC by Cassava Sciences.

| |

5.

|

Is a warrant the same thing as a share of common stock?

|

A warrant and a share of common stock are different. A share of common stock represents equity ownership. A warrant entitles the holder to purchase, at the holder’s sole and exclusive election, at the exercise price, one share of common stock.

| |

6.

|

How many warrants will I receive on the Distribution Date?

|

Each stockholder will receive 4 warrants for each 10 shares of Cassava Sciences common stock held as of the Record Date (that is, 0.4 times the number of shares owned on the Record Date, rounded down to the nearest whole number). Any stockholder owning at least 3 shares on the record date will receive at least 1 warrant.

| |

7.

|

Will there be a market for the warrants?

|

We expect that the warrants will list and trade on Nasdaq separate from Cassava Sciences’ common stock. Once the warrants are listed on Nasdaq, the market will determine any market value of the warrants based on supply and demand or other factors. We cannot provide any assurances that an active trading market for the warrants will develop or continue or that there will be liquidity in the trading market for the warrants, or the price at which the warrants will be able to be resold.

| |

8.

|

How much cash will Cassava Sciences raise through this warrant distribution and what will it do with the proceeds?

|

We don’t know yet. There are too many variables to accurately predict how much cash, if any, Cassava Sciences may raise through this distribution of warrants. Some key variables are beyond the control of the Company, such as the market value of warrants after they list on the Nasdaq exchange, how many warrant holders will exercise vs sell in the open market, the timing of cash proceeds from the exercise of warrants, etc.

| |

9.

|

How will Cassava Sciences use the cash proceeds?

|

We intend to use any proceeds from the exercise of warrants to support our ongoing Phase 3 clinical trials of oral simufilam in people with Alzheimer’s disease.

| |

10.

|

Will the exercise of the warrants result in the issuance of shares of common stock?

|

Cassava Sciences will not issue any shares of common stock at the time of the warrant distribution. However, the Company will issue shares of common stock to warrant holders who exercise their warrants for cash. Each warrant is exercisable for one share of our common stock. Stockholders who choose to exercise during a certain period will receive an additional 0.5 of a share of common stock per warrant, without any additional cost (see question #13).

| |

11.

|

When will the warrants expire?

|

All warrants will expire at 5:00 pm New York City time on Friday, November 15, 2024.

Importantly, however, the Company has the option of redeeming the warrants earlier than November 15, 2024, as will be set forth in the warrant agreement to be filed with the SEC and to be made publicly available in the Investors section of the Company’s website at www.CassavaSciences.com. You should carefully read the warrant agreement and the other documents filed with the SEC by Cassava Sciences.

| |

12.

|

What is the exercise price of the warrants?

|

Each warrant will initially allow holders to purchase one share of Cassava Sciences common stock for an exercise price of thirty-three dollars ($33.00) per warrant, plus, during the Bonus Share Fraction period, the Bonus Share Fraction. The Exercise Price must be paid only in cash and only via your financial institution. If you choose to exercise warrants, please do not send cash or checks to the Company, or to any party other than your financial institution.

| |

13.

|

What is the “Bonus Share” program?

|

We are offering a Bonus Share program to attract further investment in the Company and to reward stockholders who exercise warrants early on.

Stockholders can choose to exercise their warrants early, that is, during the defined Bonus Share Fraction period. Those who do so will receive an additional 0.5 of a common share per warrant as a “bonus” share, without additional cost. Holders who exercise their warrants early and receive a Bonus Share Fraction will have paid an effective price of approximately $22.00 per share of Cassava Sciences common stock.

| |

14.

|

When does the “Bonus Share” program begin and end?

|

The Bonus Share Fraction period begins on the Distribution Date of the warrants, which we anticipate will be on or about January 3, 2024.

The Bonus Share Expiration Date will be the earlier of (i) the first business day following the first 30 consecutive trading day period in which the daily volume-weighted average price (VWAP) of the shares of common stock has been at least equal to a specified price (initially, $26.40) for at least 20 trading days (whether or not consecutive) and (ii) the date specified by the Company upon not less than 20 business days’ notice. The full details of the Bonus Share feature will be set forth in the warrant agreement, which will be made available on the Investors section of the Company’s website at www.CassavaSciences.com. You should carefully read the warrant agreement and the other documents filed with the SEC by Cassava Sciences.

| |

15.

|

Will you issue fractional warrants or shares in the event the math does not work out to a whole number?

|

No warrants will be issued to any stockholder owning fewer than 3 shares on the Record Date. No fractional warrants will be issued.

We also will not issue fractional shares of common stock or pay cash in lieu thereof. If you are entitled to receive a non-whole number of shares of common stock upon exercise of the Warrants, we will round down the total number of shares of common stock to the nearest whole number. A whole number is any non-negative number, including zero, that is not a fraction or decimal. The Company’s calculation shall be determinative.

| |

16.

|

Is there any cost to stockholders, or any cash payment required from stockholders, to receive the warrant distribution?

|

Cassava Sciences will distribute warrants at no cost to stockholders who hold at least three shares on the Record Date.

| |

17.

|

Do I have to do anything to receive my warrants?

|

All holders of record of at least three shares of common stock as of Friday, December 22, 2023 will automatically receive the warrants in book-entry form on or about January 3, 2024. If you hold your shares through a brokerage account, bank or financial institution and are a holder in street name, contact your broker for further information. If your shares are held in a registered account with Cassava Science’s transfer agent, contact Client Services at Computershare Trust Company, N.A. 150 Royall Street, Canton, MA 02021 for further information.

| |

18.

|

Can I sell the warrants?

|

Yes, you can sell the warrants and pocket the proceeds. The warrants are transferable and are expected to be listed and trade on Nasdaq, as set forth in the warrant agreement to be filed with the SEC and to be made publicly available in the Investors section of the Company’s website at www.CassavaSciences.com. You should carefully read the warrant agreement and the other documents filed with the SEC by Cassava Sciences.

| |

19.

|

If I sell my common stock, must I also sell my warrants?

|

You choose what to hold and what to sell. The warrants and the Company’s common stock are separate securities and will trade independent of each other. You may sell your warrants and hold your common stock, or vice versa. You must be a holder of Cassava Sciences common stock as of December 22, 2023 to receive a distribution of warrants. Once you receive warrants, you do not need to be a holder of common stock to exercise, purchase or sell the warrants.

| |

20.

|

How soon can I exercise or sell my warrants?

|

Stockholders may exercise or sell their warrants immediately after the warrants are issued on the Distribution Date.

| |

21.

|

Must I exercise or sell my warrants by a particular date?

|

Yes. You may exercise or sell your warrants at any time before they expire. All warrants are set to expire at 5pm New York City time on Friday, November 15, 2024, if the Company chooses not to redeem them earlier.

However, and this is very important, the Company has the option of redeeming the warrants earlier than November 15, 2024. The warrants cannot be redeemed by the Company with a redemption date prior to April 15, 2024. After April 15, 2024, the Company can choose to redeem the warrants for a nominal amount (.01¢/warrant) upon a 20-calendar days’ notice. Such notice will be given by Company press release, as described in the warrant agreement to be filed with the SEC and to be made publicly available in the Investors section of the Company’s website at www.CassavaSciences.com You should carefully read the warrant agreement and the other documents filed with the SEC by Cassava Sciences.

| |

22.

|

What happens after the warrants are redeemed or expire?

|

After the warrants expire on November 15, 2024, or upon redemption of the warrants by the Company, whichever comes first, the right to exercise the warrants will no longer exist. At that point the warrants will have zero trading value and are expected to be delisted from Nasdaq. Of course, Cassava Sciences common stock will continue to trade on Nasdaq.

| |

23.

|

Will I owe taxes on this distribution?

|

Cassava Sciences intends to structure this warrant distribution as a non-taxable distribution under section 305(a) of the U.S. Internal Revenue Code. Tax law and accounting rules are complex and can vary from state to state and person-to-person. Cassava Sciences does not provide, and does not offer, any advice regarding the tax or accounting treatment of our warrant distribution or its impact on your personal finances. This Q&A is for informational purposes only, and is not intended, and should not be relied upon, for tax, legal or accounting advice. You should consult with and rely only on your tax, legal and accounting advisors prior to engaging in any transaction related to this warrant distribution.

| |

24.

|

What is the Record Date for the distribution of warrants?

|

Friday, December 22, 2023.

| |

25.

|

Where can I get more information regarding the warrant distribution?

|

Additional information regarding the terms of the warrants, including the warrant agreement, will be filed with the SEC on the Distribution Date and will be available in the Investors section of our website at www.CassavaSciences.com. You should carefully read the warrant agreement and the other documents filed with the SEC by Cassava Sciences.

The foregoing Q&A does not purport to be complete and is qualified in its entirety by reference to the full text of the warrant distribution related agreements to be filed with the SEC.

Cautionary Note Regarding Forward-Looking Statements:

This Q&A contains forward-looking statements, including statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, that may include but are not limited to: the development of new treatment options for people with Alzheimer’s disease; the long-term success of the Company; the Company’s ability to raise additional capital while protecting stockholders from excessive dilution; the design, scope, completion, intended purpose, or future results of our warrant distribution; any expected clinical results of our on-going Phase 3 studies of simufilam in Alzheimer’s disease; the treatment of people with Alzheimer’s disease dementia; the safety or efficacy of simufilam in people with Alzheimer’s disease dementia; expected cash use of proceeds from the warrant distribution, if any; whether warrants will be traded on Nasdaq, the price of those warrants and the existence of a market for those warrants; whether and when warrants will be redeemed by the Company; whether the distribution of a warrant is a taxable event; comments made by our employees regarding the warrant distribution, simufilam, and potential benefits, if any, of our product candidates. These statements may be identified by words such as “may,” “anticipate,” “believe,” “could,” “expect,” “forecast,” “intend,” “plan,” “possible,” “potential,” and other words and terms of similar meaning.

Simufilam is our investigational product candidate. It is not approved by any regulatory authority in any jurisdiction and its safety, efficacy or other desirable attributes have not been established in patients.

Drug development and commercialization involve a high degree of risk, and only a small number of research and development programs result in commercialization of a product. Clinical results and analyses of our previous studies should not be relied upon as predictive of Phase 3 studies or any other study. Our clinical results from earlier-stage clinical trials may not be indicative of full results or results from later-stage or larger scale clinical trials and do not ensure regulatory approval. You should not place undue reliance on these statements or any scientific data we present or publish.

Such statements are based largely on our current expectations and projections about future events. Such statements speak only as of the date of this news release and are subject to a number of risks, uncertainties and assumptions, including, but not limited to, those risks relating to the ability to conduct or complete clinical studies on expected timelines, to demonstrate the specificity, safety, efficacy or potential health benefits of our product candidates, any unanticipated impacts of the warrant distribution on our business operations, and including those described in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, and future reports to be filed with the SEC. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from expectations in any forward-looking statement. In light of these risks, uncertainties and assumptions, the forward-looking statements and events discussed in this Q&A are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Except as required by law, we disclaim any intention or responsibility for updating or revising any forward-looking statements contained in this news release. For further information regarding these and other risks related to our business, investors should consult our filings with the SEC, which are available on the SEC's website at www.sec.gov.

No Offer or Solicitation

This Q&A shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of, these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. A Form 8-A registration statement and prospectus supplement describing the terms of the warrants will be filed with the Securities and Exchange Commission (the "SEC") and will be available on the SEC's website located at http://www.sec.gov. Holders of Company common stock should read the prospectus supplement carefully, including the Risk Factors section included and incorporated by reference therein. This press release contains a general summary of the warrants. Please read the warrant agreement when it becomes available as it will contain important information about the terms of the warrants.

###

v3.23.3

Document And Entity Information

|

Dec. 12, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Cassava Sciences, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 12, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-29959

|

| Entity, Tax Identification Number |

91-1911336

|

| Entity, Address, Address Line One |

6801 N Capital of Texas Highway, Building 1; Suite 300

|

| Entity, Address, City or Town |

Austin

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

78731

|

| City Area Code |

512

|

| Local Phone Number |

501-2444

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

SAVA

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001069530

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

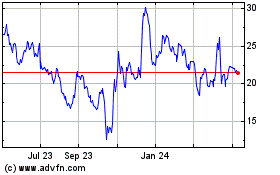

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

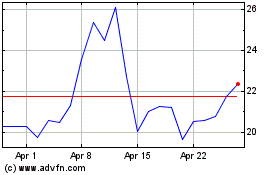

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

From Apr 2023 to Apr 2024