Filed Pursuant to Rule 424(b)(3)

Registration No. 333-273728

PROSPECTUS SUPPLEMENT NO. 4

(to prospectus dated August 10, 2023)

GOODNESS GROWTH HOLDINGS, INC.

15,000,000 Subordinate Voting Shares

Up to 80,670,773 Subordinate Voting Shares Underlying

Notes

Up to 6,250,000 Subordinate Voting Shares Underlying

Warrants

This prospectus supplement is being filed to update

and supplement the information contained in the prospectus dated August 10, 2023 (the “Prospectus”), with the information

contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on September 27,

2023. Accordingly, we have attached such report to this prospectus supplement.

The Prospectus and this prospectus supplement

relate to the resale by the selling security holders named in the Prospectus (the “Selling Shareholders”) of up to an aggregate

of 101,920,773 of our subordinate voting shares (“subordinate voting shares”), which consist of: (i) up to 15,000,000 subordinate

voting shares issued in a private offering to certain Selling Shareholders in connection with a Fifth Amendment to Credit Agreement and

First Amendment to Security Agreement by and among Goodness Growth Holdings, Inc., certain of its subsidiaries, the persons from time-to-time

party thereto as guarantors, the lenders party thereto, and Chicago Atlantic Admin, LLC, as administrative agent and as collateral agent,

dated as of March 31, 2023 (the “Fifth Amendment”); (ii) up to 80,670,773 subordinate voting shares that are issuable from

time to time to certain Selling Shareholders upon conversion of, and payment of interest on, convertible notes issued in a private offering

pursuant to a Sixth Amendment to the Credit Agreement by and among Goodness Growth Holdings, Inc., certain of its subsidiaries, the persons

from time-to-time party thereto as guarantors, the lenders party thereto, and Chicago Atlantic Admin, LLC, as administrative agent and

as collateral agent, dated as of April 28, 2023 (the “Sixth Amendment”); and (iii) up to 6,250,000 subordinate voting shares

that are issuable from time to time to certain of the Selling Shareholders upon the exercise of warrants to purchase our subordinate voting

shares that were issued in a private offering to Selling Shareholders in connection with the Sixth Amendment.

This prospectus supplement updates and supplements

the information in the Prospectus and is not complete without, any may not be delivered or utilized except in combination with, the Prospectus,

including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there

is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this

prospectus supplement.

Our subordinate voting shares are listed on the

Canadian Securities Exchange (the “CSE”) under the symbol “GDNS” and on the OTCQX under the symbol “GDNSF.”

On December 5, 2023, the closing sale price of our subordinate voting shares as reported on the CSE was C$0.325 and the closing sale price

of our subordinate voting shares on the OTCQX was $0.242.

Investing in our securities involves risks

that are described in the “Risk Factors” section beginning on page 13 of the Prospectus. Neither the SEC nor any state securities

commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus

supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is December

6, 2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 26, 2023

GOODNESS

GROWTH HOLDINGS, INC.

(Exact name of registrant as specified in its

charter)

British Columbia

(State or other jurisdiction of Incorporation)

| 000-56225 |

|

82-3835655 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

|

207 South 9th Street

Minneapolis, Minnesota |

|

55402 |

| (Address of principal executive offices) |

|

(Zip Code) |

(612) 999-1606

(Registrant’s telephone number, including

area code)

Not

Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| |

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| N/A |

N/A |

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers |

On September 26, 2023, the registrant announced

that John Heller, Chief Financial Officer of the registrant, is resigning his employment effective September 30, 2023. In conjunction

with this event, the parties have entered into a separation agreement (“Separation Agreement”) that provides, among other

things, for payment of the sum of $100,000 and acceleration of vesting of 328,735 subordinate voting share options with an exercise price

of US$0.1757 and an expiration date of June 6, 2033.

This summary of the Separation Agreement is qualified

in its entirety by reference to the full text of the Separation Agreement, which will be filed as an exhibit to the Company’s Quarterly

Report on Form 10-Q for the quarter ending September 30, 2023.

| Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GOODNESS GROWTH HOLDINGS, INC. |

| |

(Registrant) |

| |

|

| |

By: |

/s/ Joshua Rosen |

| |

|

Joshua Rosen |

| |

|

Interim Chief Executive Officer |

Date: September 26, 2023

Exhibit 99.1

Goodness Growth Holdings Announces Departure

of Chief Financial Officer

MINNEAPOLIS – September 26, 2023

– Goodness Growth Holdings, Inc. ("Goodness Growth" or the "Company") (CSE: GDNS; OTCQX: GDNSF), today

announced that the Company’s Chief Financial Officer, John Heller, will depart the Company effective September 30 to accept a new

external opportunity. Interim Chief Executive Officer Josh Rosen will assume the additional role of Interim Chief Financial Officer.

Executive Chairman Dr. Kyle Kingsley commented,

“We are sad to see John leave, but are grateful for his leadership and the contributions he made during his three-year tenure. John

has helped us establish an excellent finance and accounting team which maintains exemplary financial controls and reporting practices.

On behalf of our entire board and leadership team, we thank John and wish him well in his future endeavors.”

Interim Chief Executive Officer Josh Rosen said,

“The strength of the team John has established, combined with our increasingly less complex organization give us confidence that

we can fulfill our CFO responsibilities with existing internal resources. We’re excited to see some of the talent that John helped

develop take on greater responsibility including Joe Duxbury, Aaron Garrido, and Brandon Van Asten, who have been instrumental in supporting

our push toward more decentralized operations.”

Mr. Heller commented, “It has been a privilege

to serve as CFO at Goodness Growth. I have enjoyed the opportunity to work with great teammates through what’s been a turbulent

time in the industry. I’m proud of the finance and accounting team we’ve developed and believe I am leaving the Company in

very capable hands.”

About

Goodness Growth Holdings, Inc.

Goodness

Growth Holdings, Inc. is a cannabis company whose mission is to provide safe access, quality products and value to its customers while

supporting its local communities through active participation and restorative justice programs. The Company is evolving with the industry

and is in the midst of a transformation to being significantly more customer-centric across its operations, which include cultivation,

manufacturing, wholesale and retail business lines. Today, the Company is licensed to grow, process, and/or distribute cannabis in four

markets and operates 14 dispensaries in three states. For more information about Goodness Growth Holdings, please visit www.goodnessgrowth.com.

Contact Information

Investor Inquiries:

Sam Gibbons

Chief of Staff, VP Investor Relations

samgibbons@goodnessgrowth.com

(612) 314-8995

Media Inquiries:

Amanda Hutcheson

Senior Manager, Communications

amandahutcheson@goodnessgrowth.com

(919) 815-1476

Forward-Looking Statement Disclosure

This press release contains “forward-looking

information” within the meaning of applicable United States and Canadian securities legislation. Forward-looking information includes

both known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the

Company or its subsidiaries to be materially different from any future results, performance, or achievements expressed or implied by the

forward-looking statements or information contained in this press release. Forward-looking information is based upon a number of estimates

and assumptions of management, believed but not certain to be reasonable, in light of management’s experience and perception of

trends, current conditions, and expected developments, as well as other factors relevant in the circumstances, including assumptions in

respect of current and future market conditions, the current and future regulatory environment, and the availability of licenses, approvals

and permits.

Forward-looking information is subject to a variety

of risks and uncertainties that could cause actual events or results to differ materially from those projected in the forward-looking

information. Such risks and uncertainties include, but are not limited to, risks related to the timing of adult-use legislation in markets

where the Company currently operates; current and future market conditions, including the market price of the subordinate voting shares

of the Company; risks related to epidemics and pandemics, federal, state, local, and foreign government laws, rules, and regulations,

including federal and state laws and regulations in the United States relating to cannabis operations in the United States and any changes

to such laws or regulations; operational, regulatory and other risks; execution of business strategy; management of growth; difficulties

inherent in forecasting future events; conflicts of interest; risks inherent in an agricultural business; risks inherent in a manufacturing

business; liquidity risks and other risk factors set out in the Company’s Annual Report for the year ended December 31, 2022, which

is available on EDGAR with the U.S. Securities and Exchange Commission and filed with the Canadian securities regulators and available

under the Company’s profile on SEDAR at www.sedar.com.

The statements in this press release are made

as of the date of this release. Except as required by law, the Company undertakes no obligation to update any forward-looking statements

or forward-looking information to reflect events or circumstances after the date of such statements.

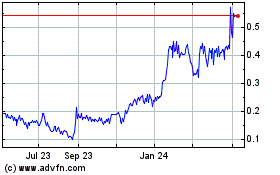

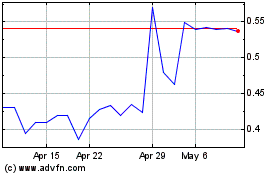

Goodness Growth (QX) (USOTC:GDNSF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Goodness Growth (QX) (USOTC:GDNSF)

Historical Stock Chart

From Apr 2023 to Apr 2024