Filed Pursuant to Rule 424(b)(3)

Registration No. 333-273728

PROSPECTUS SUPPLEMENT NO. 3

(to prospectus dated August 10, 2023)

GOODNESS GROWTH HOLDINGS, INC.

15,000,000 Subordinate Voting Shares

Up to 80,670,773 Subordinate Voting Shares Underlying

Notes

Up to 6,250,000 Subordinate Voting Shares Underlying

Warrants

This prospectus supplement is being filed to update

and supplement the information contained in the prospectus dated August 10, 2023 (the “Prospectus”), with the information

contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on September 25,

2023. Accordingly, we have attached such report to this prospectus supplement.

The Prospectus and this prospectus supplement

relate to the resale by the selling security holders named in the Prospectus (the “Selling Shareholders”) of up to an aggregate

of 101,920,773 of our subordinate voting shares (“subordinate voting shares”), which consist of: (i) up to 15,000,000 subordinate

voting shares issued in a private offering to certain Selling Shareholders in connection with a Fifth Amendment to Credit Agreement and

First Amendment to Security Agreement by and among Goodness Growth Holdings, Inc., certain of its subsidiaries, the persons from time-to-time

party thereto as guarantors, the lenders party thereto, and Chicago Atlantic Admin, LLC, as administrative agent and as collateral agent,

dated as of March 31, 2023 (the “Fifth Amendment”); (ii) up to 80,670,773 subordinate voting shares that are issuable from

time to time to certain Selling Shareholders upon conversion of, and payment of interest on, convertible notes issued in a private offering

pursuant to a Sixth Amendment to the Credit Agreement by and among Goodness Growth Holdings, Inc., certain of its subsidiaries, the persons

from time-to-time party thereto as guarantors, the lenders party thereto, and Chicago Atlantic Admin, LLC, as administrative agent and

as collateral agent, dated as of April 28, 2023 (the “Sixth Amendment”); and (iii) up to 6,250,000 subordinate voting shares

that are issuable from time to time to certain of the Selling Shareholders upon the exercise of warrants to purchase our subordinate voting

shares that were issued in a private offering to Selling Shareholders in connection with the Sixth Amendment.

This prospectus supplement updates and supplements

the information in the Prospectus and is not complete without, any may not be delivered or utilized except in combination with, the Prospectus,

including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there

is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this

prospectus supplement.

Our subordinate voting shares are listed on the

Canadian Securities Exchange (the “CSE”) under the symbol “GDNS” and on the OTCQX under the symbol “GDNSF.”

On December 5, 2023, the closing sale price of our subordinate voting shares as reported on the CSE was C$0.325 and the closing sale price

of our subordinate voting shares on the OTCQX was $0.242.

Investing in our securities involves risks

that are described in the “Risk Factors” section beginning on page 13 of the Prospectus. Neither the SEC nor any state securities

commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus

supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is December

6, 2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 20, 2023

GOODNESS

GROWTH HOLDINGS, INC.

(Exact name of registrant as specified in its

charter)

British Columbia

(State or other jurisdiction of Incorporation)

| 000-56225 |

|

82-3835655 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

|

207 South 9th Street

Minneapolis, Minnesota |

|

55402 |

| (Address of principal executive offices) |

|

(Zip Code) |

(612) 999-1606

(Registrant’s telephone number, including

area code)

Not

Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| |

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| N/A |

N/A |

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 1.01. |

Entry into a Material Definitive Agreement |

First Amendment to Consulting Agreement

On September 20, 2023, Goodness Growth Holdings, Inc. (the “Company”),

entered into a First Amendment to Consulting Agreement (“First Amendment”) by and between the Company and Grown Rogue Unlimited

ULC (“Grown Rogue”), which First Amendment modified certain provisions of the Consulting Agreement dated May 24, 2023, between

the Company and Grown Rogue.

The First Amendment to Consulting Agreement modifies certain

aspects of the consulting fee due from the Company to Grown Rogue, including by increasing the “Baseline ANI” (adjusted

net income from operations) number used to calculate the fees payable to Grown Rogue. The First Amendment also adds a provision that

states that the warrants issued by Grown Rogue to the Company are immediately canceled if the Consulting Agreement is terminated

because of a “Company Insolvency Event.”

This summary of the First Amendment

to Consulting Agreement is qualified in its entirety by reference to the full text of the First Amendment to Consulting Agreement, a copy

of which, subject to any applicable confidential treatment, will be filed as an exhibit to the Company’s Quarterly Report on Form

10-Q for the quarter ending September 30, 2023.

| Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits.

Exhibit

No. |

|

Description |

| 104 |

|

Cover Page Interactive Data File (embedded within Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GOODNESS GROWTH HOLDINGS, INC.

(Registrant) |

|

| |

|

|

| |

By: |

/s/ J. Michael Schroeder |

|

| |

|

J. Michael Schroeder |

|

| |

|

General Counsel and Corporate Secretary |

|

Date: September 25, 2023

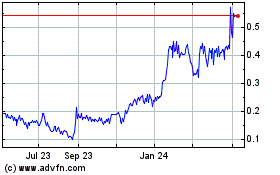

Goodness Growth (QX) (USOTC:GDNSF)

Historical Stock Chart

From Mar 2024 to Apr 2024

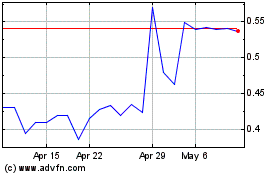

Goodness Growth (QX) (USOTC:GDNSF)

Historical Stock Chart

From Apr 2023 to Apr 2024