0001468666false00014686662023-12-072023-12-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 7, 2023

SecureWorks Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

Delaware | | 001-37748 | | 27-0463349 | |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) | |

| |

One Concourse Parkway NE | | | | | |

Suite 500 | | | | | |

Atlanta, | Georgia | | | | | 30328 | |

(Address of principal executive offices) | | | | | (Zip Code) | |

Registrant’s telephone number, including area code: (404) 327-6339

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, | SCWX | The Nasdaq Stock Market LLC |

| par value $0.01 per share | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On December 7, 2023, SecureWorks Corp. (the “Company”) issued a press release announcing its financial results for its fiscal quarter ended November 3, 2023. A copy of the press release is furnished as Exhibit 99.1 to this report.

In accordance with General Instruction B.2 to Form 8-K, the information contained in this report, including Exhibit 99.1 hereto, is being “furnished” with the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities under such section. Furthermore, such information shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, unless specifically identified as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following documents are herewith furnished or filed as exhibits to this report:

| | | | | | | | |

| Exhibit No. | | Exhibit Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document, which is contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | December 7, 2023 | SecureWorks Corp. |

| | | |

| | By: | /s/ Alpana Wegner |

| | | Alpana Wegner |

| | | Chief Financial Officer |

| | | (Duly Authorized Officer) |

Secureworks® Announces Third Quarter Fiscal 2024 Results

ATLANTA, Ga, Dec. 7, 2023 - Secureworks® (NASDAQ: SCWX), a global leader in cybersecurity, today announced financial results for its third quarter, which ended on November 3, 2023.

Key Highlights

•Secureworks Taegis™ annual recurring revenue (ARR) grew to $279 million, an increase of 25% on a year-over-year basis.

•Taegis third quarter revenue grew 41% year-over-year to $67.3 million.

•Taegis GAAP gross margin and non-GAAP gross margin continued to expand in the third quarter, reaching 70.4% and 72.7%, respectively.

“Our Taegis business is consistently delivering market-leading growth and Q3 was no exception. We expanded the breadth and depth of our Partner ecosystem, and recognition within the analyst community for our leadership in the XDR market accelerated. As we continue to enrich our partner experience and launch new product capabilities, we strengthen our ability to scale with partners, expand their addressable market and most importantly deliver superior customer outcomes,” said Wendy Thomas, CEO, Secureworks. “These elements lay the foundation for long-term Taegis growth.”

“We’ve made significant progress on our path to profitability, increasing our confidence in achieving breakeven adjusted EBITDA milestone in fourth quarter this year,” said Alpana Wegner, Chief Financial Officer, Secureworks. “The Taegis gross margin expansion we delivered this quarter demonstrates the scalability of our platform and longstanding use of AI in driving operational efficiencies.”

Third Quarter Fiscal 2024 Financial Highlights

•Total revenue for the third quarter was $89.4 million, compared to $110.9 million in the third quarter of fiscal 2023, reflecting the strategic wind-down of our Other MSS business.

•Taegis revenue for the third quarter was $67.3 million, compared to $47.9 million in the third quarter of fiscal 2023.

•GAAP gross profit was $54.7 million, compared with $65.4 million in the third quarter of fiscal 2023. Non-GAAP gross profit was $59.2 million, compared with $70.2 million during the same period last year.

•GAAP gross profit specific to Taegis was $47.4 million, compared with $31.3 million in the third quarter of fiscal 2023. Non-GAAP Taegis gross profit was $48.9 million, compared with $32.4 million during the same period last year.

•GAAP gross margin for the third quarter was 61.3%, compared with 58.9% in the same period last year. Non-GAAP gross margin was 66.3%, compared with 63.3% in the third quarter of fiscal 2023.

•GAAP gross margin specific to Taegis was 70.4% for the quarter, compared with 65.4% in the same period last year. Non-GAAP Taegis gross margin was 72.7%, compared with 67.6% in the third quarter of fiscal 2023.

•GAAP net loss was $14.4 million for the third quarter, or $0.17 per share, compared with GAAP net loss of $28.1 million, or $0.33 per share, in the same period last year. Non-GAAP net loss was $0.0 million, or $0.00 per share, compared with non-GAAP net loss of $13.7 million, or $0.16 per share, in the same period last year.

•Adjusted EBITDA loss for the quarter was $1.2 million, compared with adjusted EBITDA loss of $17.2 million in the third quarter of fiscal 2023.

•The company ended the third quarter with $58.1 million in cash and cash equivalents.

Business and Operational Highlights

•Published 2023 State of the Threat Report and completed the Secureworks 8th annual Global Threat Intelligence Summit, with keynote by Jen Easterly, Director of the Cybersecurity and Infrastructure Security Agency (CISA).

•Introduced new features in the Taegis platform to broaden our market reach, including enhanced cloud security, custom configurations and advanced tools for threat hunting.

•Recognition and awards received during the third quarter of fiscal 2024 include:

◦Leader in The Forrester Wave™: Managed Detection And Response Services In Europe, Q4 2023

◦#1 Marketshare in IDC Marketshare: Worldwide Cloud-Native XDR 2022 Share Snapshot, published September 2023

◦Leader in Innovation in Frost & Sullivan XDR Radar report, Open XDR category published August 2023

◦XDR Platform of the Year in Cybersecurity Breakthrough

Financial Outlook

For the fourth quarter of fiscal 2024, the Company expects:

•Revenue of $86 million to $88 million.

•GAAP net loss per share of $0.16 to $0.18 and non-GAAP net loss per share of $0.03 to $0.05.

Secureworks is providing the following updated guidance for full fiscal year 2024. The Company expects:

| | | | | |

Fiscal Year 2024 Guidance | |

| Taegis ARR | $280M or Greater |

| Other MSS ARR | $15M or Less |

| Total revenue | $363M to $365M |

| Taegis revenue | $264M to $266M |

| GAAP net loss | ($91M) to ($93M) |

| ($1.06) to ($1.08) per share |

| Non-GAAP net loss | ($28M) to ($30M) |

| ($0.33) to ($0.35) per share |

| Adjusted EBITDA | ($31M) to ($33M) |

| Cash from operations | ($70M) to ($80M) |

Conference Call Information

As previously announced, the Company will hold a conference call to discuss its third quarter fiscal 2024 results and financial guidance on December 7, 2023, at 8:00 a.m. U.S. ET. A live audio webcast of the conference call and the related supplemental financial information will be accessible on the Company’s website at https://investors.secureworks.com. The webcast and supplemental information will be archived at the same location.

Operating Metrics

The Company defines annual recurring revenue (ARR) as the value of its subscription contracts as of a particular date. Because the Company uses recurring revenue as a leading indicator of future annual revenue, it includes operational backlog. Operational backlog is defined as the recurring revenue associated with pending contracts, which are contracts that have been sold but for which the service period has not yet commenced.

Non-GAAP Financial Measures

This press release presents information about the Company’s non-GAAP revenue, non-GAAP subscription cost of revenue, non-GAAP professional services cost of revenue, non-GAAP Taegis Subscription Solutions cost of revenue, non-GAAP Managed Security Services cost of revenue, non-GAAP gross profit, non-GAAP subscription gross profit, non-GAAP professional services gross profit non-GAAP Taegis Subscription Solutions gross profit, non-GAAP Managed Security Services gross profit, non-GAAP operating expenses, non-GAAP research and development expenses, non-GAAP sales and marketing expenses, non-GAAP general and administrative expenses, non-GAAP operating income (loss), non-GAAP net income (loss), non-GAAP earnings (loss) per share, adjusted EBITDA, weighted average common shares outstanding - diluted (non-GAAP), non-GAAP gross margin, non-GAAP Taegis Subscription Solutions gross margin, non-GAAP Managed Security Services gross margin, non-GAAP subscription gross margin and non-GAAP professional services gross margin, which are non-GAAP financial measures provided as a supplement to the results provided in accordance with accounting principles generally accepted in the United States of America (“GAAP”). A reconciliation of each of the foregoing historical and forward-looking non-GAAP financial measures to the most directly comparable historical and forward-looking GAAP financial measure is provided below for each of the fiscal periods indicated.

Special Note Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. In some cases, you can identify these statements by such forward-looking words as “anticipate,” “believe,” “confidence,” “could,” “estimate,” “expect,” “guidance,” “intend,” “may,” “plan,” “potential,” “outlook,” “should,” and “would,” or similar words or expressions that refer to future events or outcomes. Such forward-looking statements include, but are not limited to, the statements in this press release with respect to the Company’s expectations regarding revenue, GAAP net loss per share and non-GAAP net loss per share for the fourth quarter of fiscal 2024, and Taegis ARR, other MSS ARR, total revenue, Taegis revenue, GAAP net loss, GAAP net loss per share, non-GAAP net loss, non-GAAP net loss per share, weighted average common shares outstanding - diluted (non-GAAP), adjusted EBITDA, capital expenditures, and cash from operations for full year fiscal 2024, all of which reflect the Company’s current analysis of existing trends and information. These forward-looking statements represent the Company’s judgment only as of the date of this press release.

Actual results and events in future periods may differ materially from those expressed or implied by these forward-looking statements because of risks, uncertainties and other factors that include, but are not limited to, the following: the Company’s ability to achieve or maintain profitability; the Company’s ability to enhance its existing solutions and technologies and to develop or acquire new solutions and technologies; the Company’s ability to navigate economic conditions, geopolitical uncertainty and financial market volatility; the Company’s reliance on personnel with extensive information security expertise; the Company’s ability to successfully implement its strategic plan to realign and optimize its investments with its priorities; intense competition in the Company’s markets; the Company’s ability to attract new customers, retain existing customers and increase its annual contract values; the Company’s

reliance on customers in the financial services industry; the Company’s ability to manage its growth effectively; the Company’s ability to maintain high-quality client service and support functions; terms of the Company’s service level agreements with customers that require credits for service failures or inadequacies; the Company’s recognition of revenue ratably over the terms of its Taegis SaaS applications and managed security services contracts; the Company’s long and unpredictable sales cycles; risks associated with expansion of the Company’s international sales and operations; the risks associated with proposed or currently enacted tax statutes, including Internal Revenue Code Section 174; the Company’s exposure to fluctuations in currency exchange rates or inflation; the effect of new governmental export or import controls on the Company’s business or any international sanctions compliance program applicable to the Company; the Company’s ability to expand its key distribution relationships; the Company’s technology alliance partnerships; real or perceived defects, errors or vulnerabilities in the Company’s solutions or the failure of its solutions to prevent a security breach; the risks associated with cyber-attacks or other data security incidents; the ability of the Company’s solutions to interoperate with its customers’ IT infrastructure; the Company’s ability to use third-party technologies; the effect of evolving information security and data privacy laws and regulations on the Company’s business; the Company’s ability to maintain and enhance its brand; risks associated with the Company’s acquisition of other businesses; the effect of natural disasters, public health issues, geopolitical conflict and other catastrophic events on the Company’s ability to serve its customers, including the Ukrainian/Russian conflict; the Company’s reliance on patents to protect its intellectual property rights; the Company’s ability to protect, maintain or enforce its non-patented intellectual property rights and proprietary information; claims by third parties of infringement of their proprietary technology by the Company; the Company’s use of open source technology; risks related to the Company’s relationship with Dell Technologies Inc. and Dell Inc. and control of the Company by Dell Technologies Inc., which include, but are not limited to, the effects of a potential deconsolidation of the Company as a part of the Dell Technologies Inc. consolidated tax group; and risks related to the volatility of the price of the Company’s Class A common stock.

This list of risks, uncertainties and other factors is not complete. The Company discusses these matters more fully, as well as certain risk factors that could affect the Company’s business, financial condition, results of operations and prospects, under the caption “Risk Factors” in the Company’s annual report on Form 10-K or in the Company’s first quarter fiscal 2024 Form 10-Q filing, as well as in the Company’s other SEC filings.

Any or all forward-looking statements the Company makes may turn out to be wrong and can be affected by inaccurate assumptions the Company might make or by known or unknown risks, uncertainties and other factors, including those identified in this press release. Accordingly, you should not place undue reliance on the forward-looking statements made in this press release, which speak only as of its date. The Company does not undertake to update, and expressly disclaims any obligation to update, any of its forward-looking statements, whether resulting from circumstances or events that arise after the date the statements are made, new information or otherwise.

About Secureworks

Secureworks (NASDAQ: SCWX) is a global cybersecurity leader that secures human progress with Secureworks® Taegis™, a SaaS-based, open XDR platform built on 20+ years of real-world detection data, security operations expertise, and threat intelligence and research. Taegis is embedded in the security operations of over 4,000 organizations around the world who use its advanced, AI-driven capabilities to detect advanced threats, streamline and collaborate on investigations, and automate the right actions.

www.secureworks.com

Contact Information

| | | | | | | | | | | |

Investor Inquiries: Kevin Toomey VP, Investor Relations 862-338-9046 ktoomey@secureworks.com | | Media Inquiries: Nicole Catalano Corporate Communications 415-295-5873 press@secureworks.com | |

(Tables Follow)

| | | | | | | | | | | | | | | | | | | | | | | |

| SECUREWORKS CORP. |

| Condensed Consolidated Statements of Operations and Related Financial Highlights |

| (in thousands, except per share data and percentages) |

| (unaudited) |

| Three Months Ended | | Nine Months Ended |

| November 3,

2023 | | October 28,

2022 | | November 3,

2023 | | October 28,

2022 |

| Net revenue: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Subscription | $ | 75,212 | | | $ | 87,191 | | | $ | 229,296 | | | $ | 271,926 | |

| Professional services | 14,152 | | | 23,751 | | | 47,429 | | | 76,213 | |

| Total net revenue | 89,364 | | | 110,942 | | | 276,725 | | | 348,139 | |

| Cost of revenue: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Subscription | 25,986 | | | 32,136 | | | 87,089 | | | 99,022 | |

| Professional services | 8,629 | | | 13,444 | | | 30,369 | | | 45,572 | |

| Total cost of revenue | 34,615 | | | 45,580 | | | 117,458 | | | 144,594 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross profit | 54,749 | | | 65,362 | | | 159,267 | | | 203,545 | |

| Operating expenses: | | | | | | | |

| Research and development | 26,358 | | | 35,263 | | | 85,766 | | | 102,232 | |

| Sales and marketing | 27,079 | | | 41,380 | | | 92,842 | | | 121,565 | |

| General and administrative | 20,565 | | | 24,725 | | | 63,194 | | | 74,359 | |

| Reorganization and other related charges | — | | | — | | | 14,232 | | | — | |

| Total operating expenses | 74,002 | | | 101,368 | | | 256,034 | | | 298,156 | |

| Operating loss | (19,253) | | | (36,006) | | | (96,767) | | | (94,611) | |

| Interest and other, net | 684 | | | (661) | | | (1,698) | | | (1,227) | |

| Loss before income taxes | (18,569) | | | (36,667) | | | (98,465) | | | (95,838) | |

| Income tax benefit | (4,148) | | | (8,521) | | | (20,715) | | | (21,375) | |

| Net loss | $ | (14,421) | | | $ | (28,146) | | | $ | (77,750) | | | $ | (74,463) | |

| | | | | | | |

| Loss per common share (basic and diluted) | $ | (0.17) | | | $ | (0.33) | | | $ | (0.90) | | | $ | (0.88) | |

| Weighted-average common shares outstanding (basic and diluted) | 86,278 | | | 84,584 | | | 85,943 | | | 84,277 | |

| | | | | | | |

Percentage of Total Net Revenue (1) | | | | | | | |

| | | | | | | |

| | | | | | | |

| Subscription gross margin | 65.4 | % | | 63.1 | % | | 62.0 | % | | 63.6 | % |

| Professional services gross margin | 39.0 | % | | 43.4 | % | | 36.0 | % | | 40.2 | % |

| Total gross margin | 61.3 | % | | 58.9 | % | | 57.6 | % | | 58.5 | % |

| Research and development expenses | 29.5 | % | | 31.8 | % | | 31.0 | % | | 29.4 | % |

| Sales and marketing expenses | 30.3 | % | | 37.3 | % | | 33.6 | % | | 34.9 | % |

| General and administrative expenses | 23.0 | % | | 22.3 | % | | 22.8 | % | | 21.4 | % |

| Reorganization and other related charges | — | % | | — | % | | 5.1 | % | | — | % |

| Operating expenses | 82.8 | % | | 91.4 | % | | 92.5 | % | | 85.6 | % |

| Operating loss | (21.5) | % | | (32.5) | % | | (35.0) | % | | (27.2) | % |

| Loss before income taxes | (20.8) | % | | (33.1) | % | | (35.6) | % | | (27.5) | % |

| Net loss | (16.1) | % | | (25.4) | % | | (28.1) | % | | (21.4) | % |

| Effective tax rate | 22.3 | % | | 23.2 | % | | 21.0 | % | | 22.3 | % |

| Note: Percentage growth rates are calculated based on underlying data in thousands | | | | |

(1) Financial measures as a percentage of revenue are calculated based on total GAAP net revenue, except for GAAP subscription gross margin and GAAP professional services gross margin measures, which are calculated based on each of their respective GAAP net revenue measures.

| | | | | | | | | | | | | | | | | | | | | | | |

| SECUREWORKS CORP. |

| Condensed Consolidated Statements of Financial Position |

| (in thousands) |

| (unaudited) |

| | | | | | | |

| | | | | November 3,

2023 | | February 3,

2023 |

| Assets: | | | | | |

| Current assets: | | | | | |

| Cash and cash equivalents | | | $ | 58,105 | | | $ | 143,517 | |

| Accounts receivable, net | | | 55,914 | | | 72,627 | |

| Inventories, net | | | 759 | | | 620 | |

| Other current assets | | | 12,865 | | | 17,526 | |

| | Total current assets | | | 127,643 | | | 234,290 | |

| Property and equipment, net | | | 2,626 | | | 4,632 | |

| Operating lease right-of-use assets, net | | | 5,262 | | | 9,256 | |

| Goodwill | | | 425,241 | | | 425,519 | |

| Intangible assets, net | | | 86,942 | | | 106,208 | |

| Other non-current assets | | | 72,236 | | | 60,965 | |

| | Total assets | | | $ | 719,950 | | | $ | 840,870 | |

| Liabilities and Stockholders' Equity: | | | | | |

| Current liabilities: | | | | | |

| Accounts payable | | | $ | 11,675 | | | $ | 18,847 | |

| Accrued and other current liabilities | | | 60,890 | | | 81,566 | |

| Short-term deferred revenue | | | 126,198 | | | 145,170 | |

| | Total current liabilities | | | 198,763 | | | 245,583 | |

| Long-term deferred revenue | | | 6,988 | | | 11,162 | |

| Operating lease liabilities, non-current | | | 8,800 | | | 12,141 | |

| Other non-current liabilities | | | 7,662 | | | 14,023 | |

| | Total liabilities | | | 222,213 | | | 282,909 | |

| Total stockholders' equity | | | 497,737 | | | 557,961 | |

| Total liabilities and stockholders' equity | | | $ | 719,950 | | | $ | 840,870 | |

| | | | | | | | | | | | | | |

| SECUREWORKS CORP. |

| Condensed Consolidated Statements of Cash Flows |

| (in thousands) |

| (unaudited) |

| | | | |

| | Nine Months Ended |

| | November 3, 2023 | | October 28, 2022 |

| Cash flows from operating activities: | | | | |

| Net loss | | $ | (77,750) | | | $ | (74,463) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | |

| Depreciation and amortization | | 26,028 | | | 27,728 | |

| Amortization of right of use asset | | 1,686 | | | 2,853 | |

| Reorganization and other related charges | | 3,272 | | | — | |

| Amortization of costs capitalized to obtain revenue contracts | | 12,964 | | | 13,319 | |

| Amortization of costs capitalized to fulfill revenue contracts | | 2,562 | | | 3,635 | |

| Stock-based compensation expense | | 24,852 | | | 27,504 | |

| Effects of exchange rate changes on monetary assets and liabilities denominated in foreign currencies | | 1,575 | | | 1,386 | |

| Income tax benefit | | (20,715) | | | (21,375) | |

| | | | |

| Provision for credit losses | | 232 | | | (552) | |

| Changes in assets and liabilities: | | | | |

| Accounts receivable | | 15,951 | | | 21,584 | |

| Net transactions with Dell | | 2,028 | | | (3,741) | |

| Inventories | | (139) | | | (178) | |

| Other assets | | (1,237) | | | (9,709) | |

| Accounts payable | | (7,462) | | | 4,550 | |

| Deferred revenue | | (24,011) | | | (33,171) | |

| Operating leases, net | | (4,031) | | | (4,086) | |

| Accrued and other liabilities | | (30,299) | | | (23,462) | |

| Net cash used in operating activities | | (74,494) | | | (68,178) | |

| Cash flows from investing activities: | | | | |

| Capital expenditures | | (865) | | | (1,609) | |

| Software development costs | | (4,106) | | | (3,352) | |

| Net cash used in investing activities | | (4,971) | | | (4,961) | |

| Cash flows from financing activities: | | | | |

| | | | |

| Taxes paid on vested restricted shares | | (5,947) | | | (8,484) | |

| | | | |

| | | | |

| Net cash used in financing activities | | (5,947) | | | (8,484) | |

| Net decrease in cash and cash equivalents | | (85,412) | | | (81,623) | |

| Cash and cash equivalents at beginning of the period | | 143,517 | | | 220,655 | |

| Cash and cash equivalents at end of the period | | $ | 58,105 | | | $ | 139,032 | |

Non-GAAP Financial Measures

This press release presents information about the Company’s non-GAAP revenue, non-GAAP subscription cost of revenue, non-GAAP professional services cost of revenue, non-GAAP Taegis Subscription Solutions cost of revenue, non-GAAP Managed Security Services cost of revenue, non-GAAP gross profit, non-GAAP subscription gross profit, non-GAAP professional services gross profit, non-GAAP Taegis Subscription Solutions gross profit, non-GAAP Managed Security Services gross profit, non-GAAP operating expenses, non-GAAP research and development expenses, non-GAAP sales and marketing expenses, non-GAAP general and administrative expenses, non-GAAP operating income (loss), non-GAAP net income (loss), non-GAAP earnings (loss) per share, adjusted EBITDA, weighted average common shares outstanding - diluted (non-GAAP), non-GAAP gross margin, non-GAAP Taegis Subscription Solutions gross margin, non-GAAP Managed Security Services gross margin, non-GAAP subscription gross margin and non-GAAP professional services gross margin, which are non-GAAP financial measures provided as a supplement to the results provided in accordance with GAAP. A detailed discussion of our reasons for including these non-GAAP financial measures, the limitations associated with these measures, the items excluded from these measures, and our reason for excluding those items are presented in “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures” in our periodic reports filed with the SEC. The Company encourages investors to review the non-GAAP discussion in these reports in conjunction with the presentation of non-GAAP financial measures.

(Tables Follow)

| | | | | | | | | | | | | | | | | | | | | | | |

| SECUREWORKS CORP. |

| Reconciliation of GAAP to Non-GAAP Financial Measures |

| (in thousands, except per share data) |

| (unaudited) |

| Three Months Ended | | Nine Months Ended |

| November 3,

2023 | | October 28,

2022 | | November 3,

2023 | | October 28,

2022 |

| GAAP net revenue: | | | | | | | |

| Taegis Subscription Solutions | $ | 67,346 | | | $ | 47,888 | | | $ | 196,368 | | | $ | 127,913 | |

| Managed Security Services | 7,866 | | | 39,303 | | | 32,928 | | | 144,013 | |

| Total Subscription revenue | 75,212 | | | 87,191 | | | 229,296 | | | 271,926 | |

| Professional services | 14,152 | | | 23,751 | | | 47,429 | | | 76,213 | |

GAAP net revenue(1) | $ | 89,364 | | | $ | 110,942 | | | $ | 276,725 | | | $ | 348,139 | |

| | | | | | | |

| GAAP Taegis Subscription Solutions cost of revenue | $ | 19,927 | | | $ | 16,558 | | | $ | 60,575 | | | $ | 44,550 | |

| Amortization of intangibles | (1,208) | | | (960) | | | (3,404) | | | (2,519) | |

| Stock-based compensation expense | (313) | | | (80) | | | (561) | | | (188) | |

| Non-GAAP Taegis Subscription Solutions cost of revenue | $ | 18,406 | | | $ | 15,518 | | | $ | 56,610 | | | $ | 41,843 | |

| | | | | | | |

| GAAP Managed Security Services cost of revenue | $ | 6,059 | | | $ | 15,578 | | | $ | 26,514 | | | $ | 54,472 | |

| Amortization of intangibles | (2,576) | | | (3,411) | | | (9,397) | | | (10,232) | |

| Stock-based compensation expense | (53) | | | (87) | | | (160) | | | (269) | |

| Non-GAAP Managed Security Services cost of revenue | $ | 3,430 | | | $ | 12,080 | | | $ | 16,957 | | | $ | 43,971 | |

| | | | | | | |

| GAAP subscription cost of revenue | $ | 25,986 | | | $ | 32,136 | | | $ | 87,089 | | | $ | 99,022 | |

| Amortization of intangibles | (3,784) | | | (4,371) | | | (12,801) | | | (12,751) | |

| Stock-based compensation expense | (366) | | | (167) | | | (721) | | | (457) | |

| Non-GAAP subscription cost of revenue | $ | 21,836 | | | $ | 27,598 | | | $ | 73,567 | | | $ | 85,814 | |

| | | | | | | |

| GAAP professional services cost of revenue | $ | 8,629 | | | $ | 13,444 | | | $ | 30,369 | | | $ | 45,572 | |

| Stock-based compensation expense | (344) | | | (323) | | | (991) | | | (1,055) | |

| Non-GAAP professional services cost of revenue | $ | 8,285 | | | $ | 13,121 | | | $ | 29,378 | | | $ | 44,517 | |

| | | | | | | |

| GAAP gross profit | $ | 54,749 | | | $ | 65,362 | | | $ | 159,267 | | | $ | 203,545 | |

| Amortization of intangibles | 3,784 | | | 4,371 | | | 12,801 | | | 12,751 | |

| Stock-based compensation expense | 711 | | | 491 | | | 1,713 | | | 1,512 | |

| Non-GAAP gross profit | $ | 59,244 | | | $ | 70,224 | | | $ | 173,781 | | | $ | 217,808 | |

| | | | | | | |

| GAAP Taegis Subscription Solutions gross profit | $ | 47,419 | | | $ | 31,330 | | | $ | 135,793 | | | $ | 83,363 | |

| Amortization of intangibles | 1,208 | | | 960 | | | 3,404 | | | 2,519 | |

| Stock-based compensation expense | 313 | | | 80 | | | 561 | | | 188 | |

| Non-GAAP Taegis Subscription Solutions gross profit | $ | 48,940 | | | $ | 32,370 | | | $ | 139,758 | | | $ | 86,070 | |

| | | | | | | |

| GAAP research and development expenses | $ | 26,358 | | | $ | 35,263 | | | $ | 85,766 | | | $ | 102,232 | |

| Stock-based compensation expense | (3,794) | | | (3,077) | | | (9,077) | | | (8,460) | |

| Non-GAAP research and development expenses | $ | 22,564 | | | $ | 32,186 | | | $ | 76,689 | | | $ | 93,772 | |

| | | | | | | |

| GAAP sales and marketing expenses | $ | 27,079 | | | $ | 41,380 | | | $ | 92,842 | | | $ | 121,565 | |

| Stock-based compensation expense | (836) | | | (1,631) | | | (2,774) | | | (4,896) | |

| Non-GAAP sales and marketing expenses | $ | 26,243 | | | $ | 39,749 | | | $ | 90,068 | | | $ | 116,669 | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| GAAP general and administrative expenses | $ | 20,565 | | | $ | 24,725 | | | $ | 63,194 | | | $ | 74,359 | |

| Amortization of intangibles | (3,524) | | | (3,524) | | | (10,571) | | | (10,571) | |

| Stock-based compensation expense | (4,621) | | | (4,367) | | | (11,288) | | | (12,636) | |

| Non-GAAP general and administrative expenses | $ | 12,420 | | | $ | 16,834 | | | $ | 41,335 | | | $ | 51,152 | |

| | | | | | | |

| GAAP operating loss | $ | (19,253) | | | $ | (36,006) | | | $ | (96,767) | | | $ | (94,611) | |

| Amortization of intangibles | 7,308 | | | 7,895 | | | 23,372 | | | 23,322 | |

| Stock-based compensation expense | 9,962 | | | 9,566 | | | 24,852 | | | 27,504 | |

| Reorganization and other related charges | — | | | — | | | 14,232 | | | — | |

| Non-GAAP operating (loss) income | $ | (1,983) | | | $ | (18,545) | | | $ | (34,311) | | | $ | (43,785) | |

| | | | | | | |

| GAAP net loss | $ | (14,421) | | | $ | (28,146) | | | $ | (77,750) | | | $ | (74,463) | |

| Amortization of intangibles | 7,308 | | | 7,895 | | | 23,372 | | | 23,322 | |

| Stock-based compensation expense | 9,962 | | | 9,566 | | | 24,852 | | | 27,504 | |

| Reorganization and other related charges | — | | | — | | | 14,232 | | | — | |

| Aggregate adjustment for income taxes | (2,856) | | | (3,030) | | | (10,469) | | | (8,974) | |

| Non-GAAP net (loss) income | $ | (7) | | | $ | (13,715) | | | $ | (25,763) | | | $ | (32,611) | |

| | | | | | | |

| GAAP loss per share | $ | (0.17) | | | $ | (0.33) | | | $ | (0.90) | | | $ | (0.88) | |

| Amortization of intangibles | 0.08 | | | 0.10 | | | 0.27 | | | 0.28 | |

| Stock-based compensation expense | 0.12 | | | 0.12 | | | 0.29 | | | 0.33 | |

| Reorganization and other related charges | — | | | — | | | 0.17 | | | — | |

| Aggregate adjustment for income taxes | (0.03) | | | (0.04) | | | (0.12) | | | (0.11) | |

| Non-GAAP (loss) earnings per share * | $ | — | | | $ | (0.16) | | | $ | (0.30) | | | $ | (0.39) | |

| * Sum of reconciling items may differ from total due to rounding of individual components |

| | | | | | | |

| GAAP net loss | $ | (14,421) | | | $ | (28,146) | | | $ | (77,750) | | | $ | (74,463) | |

| Interest and other, net | (684) | | | 661 | | | 1,698 | | | 1,227 | |

| Income tax benefit | (4,148) | | | (8,521) | | | (20,715) | | | (21,375) | |

| Depreciation and amortization | 8,067 | | | 9,213 | | | 26,028 | | | 27,728 | |

| Stock-based compensation expense | 9,962 | | | 9,566 | | | 24,852 | | | 27,504 | |

| Reorganization and other related charges | — | | | — | | | 14,232 | | | — | |

| Adjusted EBITDA | $ | (1,224) | | | $ | (17,227) | | | $ | (31,655) | | | $ | (39,379) | |

(1) Historically the Company has presented non-GAAP net revenue as a financial measure. There are no such adjustments that give rise to non-GAAP net revenue for any of the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| SECUREWORKS CORP. |

| Reconciliation of GAAP to Non-GAAP Financial Measures |

|

| (unaudited) |

| | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| Percentage of Total Net Revenue | | November 3,

2023 | | October 28,

2022 | | November 3,

2023 | | October 28,

2022 |

| | | | | | | | |

| GAAP Taegis Subscription Solutions gross margin | | 70.4 | % | | 65.4 | % | | 69.2 | % | | 65.2 | % |

| Non-GAAP adjustment | | 2.3 | % | | 2.2 | % | | 2.0 | % | | 2.1 | % |

| Non-GAAP Taegis Subscription Solutions gross margin | | 72.7 | % | | 67.6 | % | | 71.2 | % | | 67.3 | % |

| | | | | | | | |

| GAAP Managed Security Services gross margin | | 23.0 | % | | 60.4 | % | | 19.5 | % | | 62.2 | % |

| Non-GAAP adjustment | | 33.4 | % | | 8.9 | % | | 29.0 | % | | 7.3 | % |

| Non-GAAP Managed Security Services gross margin | | 56.4 | % | | 69.3 | % | | 48.5 | % | | 69.5 | % |

| | | | | | | | |

| GAAP subscription gross margin | | 65.4 | % | | 63.1 | % | | 62.0 | % | | 63.6 | % |

| Non-GAAP adjustment | | 5.6 | % | | 5.2 | % | | 5.9 | % | | 4.8 | % |

| Non-GAAP subscription gross margin | | 71.0 | % | | 68.3 | % | | 67.9 | % | | 68.4 | % |

| | | | | | | | |

| GAAP professional services gross margin | | 39.0 | % | | 43.4 | % | | 36.0 | % | | 40.2 | % |

| Non-GAAP adjustment | | 2.5 | % | | 1.4 | % | | 2.1 | % | | 1.4 | % |

| Non-GAAP professional services gross margin | | 41.5 | % | | 44.8 | % | | 38.1 | % | | 41.6 | % |

| | | | | | | | |

| GAAP gross margin | | 61.3 | % | | 58.9 | % | | 57.6 | % | | 58.5 | % |

| Non-GAAP adjustment | | 5.0 | % | | 4.4 | % | | 5.2 | % | | 4.1 | % |

| Non-GAAP gross margin | | 66.3 | % | | 63.3 | % | | 62.8 | % | | 62.6 | % |

| | | | | | | | |

| GAAP research and development expenses | | 29.5 | % | | 31.8 | % | | 31.0 | % | | 29.4 | % |

| Non-GAAP adjustment | | (4.3) | % | | (2.8) | % | | (3.3) | % | | (2.5) | % |

| Non-GAAP research and development expenses | | 25.2 | % | | 29.0 | % | | 27.7 | % | | 26.9 | % |

| | | | | | | | |

| GAAP sales and marketing expenses | | 30.3 | % | | 37.3 | % | | 33.6 | % | | 34.9 | % |

| Non-GAAP adjustment | | (0.9) | % | | (1.5) | % | | (1.1) | % | | (1.4) | % |

| Non-GAAP sales and marketing expenses | | 29.4 | % | | 35.8 | % | | 32.5 | % | | 33.5 | % |

| | | | | | | | |

| GAAP general and administrative expenses | | 23.0 | % | | 22.3 | % | | 22.8 | % | | 21.4 | % |

| Non-GAAP adjustment | | (9.1) | % | | (7.1) | % | | (7.9) | % | | (6.7) | % |

| Non-GAAP general and administrative expenses | | 13.9 | % | | 15.2 | % | | 14.9 | % | | 14.7 | % |

| | | | | | | | |

| GAAP operating loss | | (21.5) | % | | (32.5) | % | | (35.0) | % | | (27.2) | % |

| Non-GAAP adjustment | | 19.3 | % | | 15.8 | % | | 22.6 | % | | 14.6 | % |

| Non-GAAP operating (loss) income | | (2.2) | % | | (16.7) | % | | (12.4) | % | | (12.6) | % |

| | | | | | | | |

| GAAP net loss | | (16.1) | % | | (25.4) | % | | (28.1) | % | | (21.4) | % |

| Non-GAAP adjustment | | 16.1 | % | | 13.0 | % | | 18.8 | % | | 12.0 | % |

| Non-GAAP net (loss) income | | — | % | | (12.4) | % | | (9.3) | % | | (9.4) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| SECUREWORKS CORP. |

| Reconciliation of GAAP to Non-GAAP Financial Measures |

| (in millions, except per share data) |

| (unaudited) |

| | | | | | | | |

| | Three Months Ending | | Fiscal Year Ending |

| | February 2, 2024 | | February 2, 2024 |

| | Low End of Guidance | | High End of Guidance | | Low End of Guidance | | High End of Guidance |

| GAAP net revenue | | $ | 86 | | | $ | 88 | | | $ | 363 | | | $ | 365 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| GAAP net loss | | $ | (16) | | | $ | (14) | | | $ | (93) | | | $ | (91) | |

| Amortization of intangibles | | 5 | | | 5 | | | 28 | | | 28 | |

| Stock-based compensation expense | | 10 | | | 10 | | | 35 | | | 35 | |

| Aggregate adjustment for income taxes | | (4) | | | (4) | | | (14) | | | (14) | |

| Reorganization and other related charges | | — | | | — | | | 14 | | | 14 | |

| Non-GAAP net loss* | | $ | (4) | | | $ | (2) | | | $ | (30) | | | $ | (28) | |

| | | | | | | | |

| GAAP net loss per share | | $ | (0.18) | | | $ | (0.16) | | | $ | (1.08) | | | $ | (1.06) | |

| Amortization of intangibles | | 0.05 | | | 0.05 | | | 0.33 | | | 0.33 | |

| Stock-based compensation expense | | 0.12 | | | 0.12 | | | 0.41 | | | 0.41 | |

| Aggregate adjustment for income taxes | | (0.04) | | | (0.04) | | | (0.16) | | | (0.16) | |

| Reorganization and other related charges | | — | | | — | | | 0.17 | | | 0.17 | |

| Non-GAAP net loss per share* | | $ | (0.05) | | | $ | (0.03) | | | $ | (0.35) | | | $ | (0.33) | |

| | | | | | | | |

| GAAP net loss | | | | | | $ | (93) | | | $ | (91) | |

| Interest and other, net | | | | | | 4 | | | 4 | |

| Income tax benefit | | | | | | (25) | | | (25) | |

| Depreciation and amortization | | | | | | 31 | | | 31 | |

| Reorganization and other related charges | | | | | | 14 | | | 14 | |

| Stock-based compensation expense | | | | | | 35 | | | 35 | |

| Adjusted EBITDA* | | | | | | $ | (33) | | | $ | (31) | |

| | | | | | | | |

| Other Items | | | | | | | | |

| Effective tax rate | | | | | | | | 21 | % |

| Weighted average shares outstanding (in millions) – diluted (non-GAAP) | | | | | | | | 86.2 |

| | | | | | | | |

| Cash flow from operations | | | | | | $(80) to $(70) |

| Capital expenditures | | | | | | | | $6 to $8 |

* Sum of reconciling items may differ from total due to rounding of individual components

Sum of quarterly guidance may differ from full year guidance due to rounding

v3.23.3

Cover Page

|

Dec. 07, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 07, 2023

|

| Entity Registrant Name |

SecureWorks Corp

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37748

|

| Entity Tax Identification Number |

27-0463349

|

| Entity Address, Address Line One |

One Concourse Parkway NE

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Atlanta,

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30328

|

| City Area Code |

404

|

| Local Phone Number |

327-6339

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock,

|

| Trading Symbol |

SCWX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001468666

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

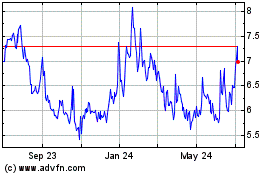

SecureWorks (NASDAQ:SCWX)

Historical Stock Chart

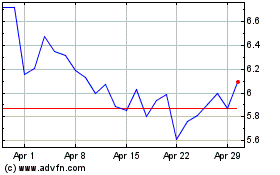

From Mar 2024 to Apr 2024

SecureWorks (NASDAQ:SCWX)

Historical Stock Chart

From Apr 2023 to Apr 2024