0000014693false2024Q204/3000000146932023-05-012023-10-310000014693us-gaap:CommonClassAMember2023-05-012023-10-310000014693us-gaap:NonvotingCommonStockMember2023-05-012023-10-310000014693bfb:OnePointTwoPercentNotesDueinFiscalTwoThousandTwentySevenMember2023-05-012023-10-310000014693bfb:TwoPointSixPercentNotesDueinFiscalTwoThousandTwentyNineMember2023-05-012023-10-310000014693us-gaap:CommonClassAMember2023-11-30xbrli:shares0000014693us-gaap:NonvotingCommonStockMember2023-11-3000000146932022-08-012022-10-31iso4217:USD00000146932023-08-012023-10-3100000146932022-05-012022-10-31iso4217:USDxbrli:shares00000146932023-04-3000000146932023-10-310000014693us-gaap:CommonClassAMember2023-04-300000014693us-gaap:CommonClassAMember2023-10-310000014693us-gaap:NonvotingCommonStockMember2023-10-310000014693us-gaap:NonvotingCommonStockMember2023-04-3000000146932022-04-3000000146932022-10-310000014693bfb:ThreePointFivePercentNotesDueinFiscalTwoThousandTwentyFiveMember2023-10-31xbrli:pure0000014693bfb:ThreePointFivePercentNotesDueinFiscalTwoThousandTwentyFiveMember2023-04-300000014693bfb:ThreePointFivePercentNotesDueinFiscalTwoThousandTwentyFiveMember2023-05-012023-10-310000014693bfb:OnePointTwoPercentNotesDueinFiscalTwoThousandTwentySevenMember2023-10-310000014693bfb:OnePointTwoPercentNotesDueinFiscalTwoThousandTwentySevenMember2023-04-30iso4217:EUR0000014693bfb:TwoPointSixPercentNotesDueinFiscalTwoThousandTwentyNineMember2023-04-300000014693bfb:TwoPointSixPercentNotesDueinFiscalTwoThousandTwentyNineMember2023-10-31iso4217:GBP0000014693bfb:FourPointSevenFivePercentNotesDueInFiscalTwoThousandThirtyThreeMember2023-04-300000014693bfb:FourPointSevenFivePercentNotesDueInFiscalTwoThousandThirtyThreeMember2023-10-310000014693bfb:FourPointSevenFivePercentNotesDueInFiscalTwoThousandThirtyThreeMember2023-05-012023-10-310000014693bfb:FourPointZeroPercentNotesDueinFiscalTwoThousandEightMember2023-04-300000014693bfb:FourPointZeroPercentNotesDueinFiscalTwoThousandEightMember2023-10-310000014693bfb:FourPointZeroPercentNotesDueinFiscalTwoThousandEightMember2023-05-012023-10-310000014693bfb:ThreePointSevenFivePercentNotesDueInFiscalTwoThousandFortyThreeMember2023-10-310000014693bfb:ThreePointSevenFivePercentNotesDueInFiscalTwoThousandFortyThreeMember2023-04-300000014693bfb:ThreePointSevenFivePercentNotesDueInFiscalTwoThousandFortyThreeMember2023-05-012023-10-310000014693bfb:FourPointFivePercentNotesDueinFiscalTwoThousandFortySixMember2023-10-310000014693bfb:FourPointFivePercentNotesDueinFiscalTwoThousandFortySixMember2023-04-300000014693bfb:FourPointFivePercentNotesDueinFiscalTwoThousandFortySixMember2023-05-012023-10-310000014693us-gaap:CommercialPaperMember2023-04-300000014693us-gaap:CommercialPaperMember2023-10-310000014693us-gaap:CommercialPaperMember2022-05-012023-04-300000014693us-gaap:CommercialPaperMember2023-05-012023-10-310000014693us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-04-300000014693us-gaap:CommonStockMemberus-gaap:NonvotingCommonStockMember2022-04-300000014693us-gaap:AdditionalPaidInCapitalMember2022-04-300000014693us-gaap:RetainedEarningsMember2022-04-300000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-300000014693us-gaap:TreasuryStockCommonMember2022-04-300000014693us-gaap:RetainedEarningsMember2022-05-012022-07-3100000146932022-05-012022-07-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-05-012022-07-310000014693us-gaap:AdditionalPaidInCapitalMember2022-05-012022-07-310000014693us-gaap:TreasuryStockCommonMember2022-05-012022-07-310000014693us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-07-310000014693us-gaap:CommonStockMemberus-gaap:NonvotingCommonStockMember2022-07-310000014693us-gaap:AdditionalPaidInCapitalMember2022-07-310000014693us-gaap:RetainedEarningsMember2022-07-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-310000014693us-gaap:TreasuryStockCommonMember2022-07-3100000146932022-07-310000014693us-gaap:RetainedEarningsMember2022-08-012022-10-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-08-012022-10-310000014693us-gaap:AdditionalPaidInCapitalMember2022-08-012022-10-310000014693us-gaap:TreasuryStockCommonMember2022-08-012022-10-310000014693us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-10-310000014693us-gaap:CommonStockMemberus-gaap:NonvotingCommonStockMember2022-10-310000014693us-gaap:AdditionalPaidInCapitalMember2022-10-310000014693us-gaap:RetainedEarningsMember2022-10-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-310000014693us-gaap:TreasuryStockCommonMember2022-10-310000014693us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-04-300000014693us-gaap:CommonStockMemberus-gaap:NonvotingCommonStockMember2023-04-300000014693us-gaap:AdditionalPaidInCapitalMember2023-04-300000014693us-gaap:RetainedEarningsMember2023-04-300000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-300000014693us-gaap:TreasuryStockCommonMember2023-04-300000014693us-gaap:RetainedEarningsMember2023-05-012023-07-3100000146932023-05-012023-07-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-05-012023-07-310000014693us-gaap:AdditionalPaidInCapitalMember2023-05-012023-07-310000014693us-gaap:TreasuryStockCommonMember2023-05-012023-07-310000014693us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-07-310000014693us-gaap:CommonStockMemberus-gaap:NonvotingCommonStockMember2023-07-310000014693us-gaap:AdditionalPaidInCapitalMember2023-07-310000014693us-gaap:RetainedEarningsMember2023-07-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-310000014693us-gaap:TreasuryStockCommonMember2023-07-3100000146932023-07-310000014693us-gaap:RetainedEarningsMember2023-08-012023-10-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-012023-10-310000014693us-gaap:TreasuryStockCommonMember2023-08-012023-10-310000014693us-gaap:AdditionalPaidInCapitalMember2023-08-012023-10-310000014693us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-10-310000014693us-gaap:CommonStockMemberus-gaap:NonvotingCommonStockMember2023-10-310000014693us-gaap:AdditionalPaidInCapitalMember2023-10-310000014693us-gaap:RetainedEarningsMember2023-10-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-310000014693us-gaap:TreasuryStockCommonMember2023-10-310000014693us-gaap:AccumulatedTranslationAdjustmentMember2023-04-300000014693us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-04-300000014693us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-04-300000014693us-gaap:AccumulatedTranslationAdjustmentMember2023-10-310000014693us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-10-310000014693us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-10-310000014693bfb:July2023DividendPaymentMember2023-05-012023-10-310000014693bfb:October2023DividendPaymentMember2023-05-012023-10-310000014693bfb:January2024DividendPaymentMember2023-05-012023-10-310000014693country:US2022-08-012022-10-310000014693country:US2023-08-012023-10-310000014693country:US2022-05-012022-10-310000014693country:US2023-05-012023-10-310000014693bfb:DevelopedInternationalMember2022-08-012022-10-310000014693bfb:DevelopedInternationalMember2023-08-012023-10-310000014693bfb:DevelopedInternationalMember2022-05-012022-10-310000014693bfb:DevelopedInternationalMember2023-05-012023-10-310000014693bfb:EmergingMember2022-08-012022-10-310000014693bfb:EmergingMember2023-08-012023-10-310000014693bfb:EmergingMember2022-05-012022-10-310000014693bfb:EmergingMember2023-05-012023-10-310000014693bfb:TravelRetailMember2022-08-012022-10-310000014693bfb:TravelRetailMember2023-08-012023-10-310000014693bfb:TravelRetailMember2022-05-012022-10-310000014693bfb:TravelRetailMember2023-05-012023-10-310000014693bfb:NonbrandedandbulkMember2022-08-012022-10-310000014693bfb:NonbrandedandbulkMember2023-08-012023-10-310000014693bfb:NonbrandedandbulkMember2022-05-012022-10-310000014693bfb:NonbrandedandbulkMember2023-05-012023-10-310000014693bfb:WhiskeyMember2022-08-012022-10-310000014693bfb:WhiskeyMember2023-08-012023-10-310000014693bfb:WhiskeyMember2022-05-012022-10-310000014693bfb:WhiskeyMember2023-05-012023-10-310000014693bfb:ReadyToDrinkMember2022-08-012022-10-310000014693bfb:ReadyToDrinkMember2023-08-012023-10-310000014693bfb:ReadyToDrinkMember2022-05-012022-10-310000014693bfb:ReadyToDrinkMember2023-05-012023-10-310000014693bfb:TequilaMember2022-08-012022-10-310000014693bfb:TequilaMember2023-08-012023-10-310000014693bfb:TequilaMember2022-05-012022-10-310000014693bfb:TequilaMember2023-05-012023-10-310000014693bfb:WineMember2022-08-012022-10-310000014693bfb:WineMember2023-08-012023-10-310000014693bfb:WineMember2022-05-012022-10-310000014693bfb:WineMember2023-05-012023-10-310000014693bfb:VodkaMember2022-08-012022-10-310000014693bfb:VodkaMember2023-08-012023-10-310000014693bfb:VodkaMember2022-05-012022-10-310000014693bfb:VodkaMember2023-05-012023-10-310000014693bfb:NonbrandedandbulkMember2022-08-012022-10-310000014693bfb:NonbrandedandbulkMember2023-08-012023-10-310000014693bfb:NonbrandedandbulkMember2022-05-012022-10-310000014693bfb:NonbrandedandbulkMember2023-05-012023-10-310000014693bfb:RestofportfolioMember2022-08-012022-10-310000014693bfb:RestofportfolioMember2023-08-012023-10-310000014693bfb:RestofportfolioMember2022-05-012022-10-310000014693bfb:RestofportfolioMember2023-05-012023-10-310000014693us-gaap:PensionPlansDefinedBenefitMember2022-08-012022-10-310000014693us-gaap:PensionPlansDefinedBenefitMember2023-08-012023-10-310000014693us-gaap:PensionPlansDefinedBenefitMember2022-05-012022-10-310000014693us-gaap:PensionPlansDefinedBenefitMember2023-05-012023-10-310000014693us-gaap:ForeignExchangeContractMember2023-04-300000014693us-gaap:ForeignExchangeContractMember2023-10-310000014693us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-04-300000014693us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-10-310000014693us-gaap:ForeignExchangeContractMember2022-08-012022-10-310000014693us-gaap:ForeignExchangeContractMember2023-08-012023-10-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:SalesMember2022-08-012022-10-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:SalesMember2023-08-012023-10-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:OtherIncomeMember2022-08-012022-10-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:OtherIncomeMember2023-08-012023-10-310000014693bfb:ForeignCurrencyDenominatedDebtMember2022-08-012022-10-310000014693bfb:ForeignCurrencyDenominatedDebtMember2023-08-012023-10-310000014693us-gaap:ForeignExchangeContractMember2022-05-012022-10-310000014693us-gaap:ForeignExchangeContractMember2023-05-012023-10-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:SalesMember2022-05-012022-10-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:SalesMember2023-05-012023-10-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:OtherIncomeMember2022-05-012022-10-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:OtherIncomeMember2023-05-012023-10-310000014693bfb:ForeignCurrencyDenominatedDebtMember2022-05-012022-10-310000014693bfb:ForeignCurrencyDenominatedDebtMember2023-05-012023-10-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:OtherCurrentAssetsMember2023-04-300000014693us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:OtherCurrentAssetsMember2023-10-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:OtherAssetsMember2023-04-300000014693us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:OtherAssetsMember2023-10-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberbfb:AccruedExpensesMember2023-04-300000014693us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberbfb:AccruedExpensesMember2023-10-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherLiabilitiesMemberus-gaap:CashFlowHedgingMember2023-04-300000014693us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherLiabilitiesMemberus-gaap:CashFlowHedgingMember2023-10-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:OtherCurrentAssetsMember2023-04-300000014693us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:OtherCurrentAssetsMember2023-10-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberbfb:AccruedExpensesMember2023-04-300000014693us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberbfb:AccruedExpensesMember2023-10-310000014693us-gaap:FairValueInputsLevel2Member2023-04-300000014693us-gaap:FairValueInputsLevel2Member2023-10-310000014693us-gaap:FairValueInputsLevel3Member2023-04-300000014693us-gaap:FairValueInputsLevel3Member2023-10-310000014693us-gaap:AccumulatedTranslationAdjustmentMember2022-08-012022-10-310000014693us-gaap:AccumulatedTranslationAdjustmentMember2023-08-012023-10-310000014693us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-08-012022-10-310000014693us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-08-012023-10-310000014693us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-08-012022-10-310000014693us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-08-012023-10-310000014693us-gaap:AccumulatedTranslationAdjustmentMember2022-05-012022-10-310000014693us-gaap:AccumulatedTranslationAdjustmentMember2023-05-012023-10-310000014693us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-05-012022-10-310000014693us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-05-012023-10-310000014693us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-05-012022-10-310000014693us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-05-012023-10-310000014693bfb:GinMareMember2022-11-030000014693bfb:GinMareMember2022-11-032022-11-030000014693bfb:GinMareMember2023-05-012023-10-310000014693bfb:PriorAllocationMemberbfb:GinMareMember2022-11-030000014693bfb:AdjustmentsMemberbfb:GinMareMember2022-11-030000014693bfb:DiplomaticoMember2023-01-050000014693bfb:DiplomaticoMember2023-01-052023-01-050000014693bfb:AdjustmentsMemberbfb:DiplomaticoMember2023-01-050000014693bfb:DiplomaticoMember2023-05-012023-10-310000014693bfb:DiplomaticoMemberbfb:PriorAllocationMember2023-01-0500000146932023-06-012023-06-300000014693us-gaap:SubsequentEventMemberbfb:FinlandiaMember2023-11-010000014693us-gaap:SubsequentEventMemberbfb:SonomaCutrerMember2023-11-012023-11-30

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended October 31, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission File No. 001-00123

Brown-Forman Corporation

(Exact name of Registrant as specified in its Charter)

| | | | | | | | |

| Delaware | 61-0143150 |

| (State or other jurisdiction of | (IRS Employer |

| incorporation or organization) | Identification No.) |

| | |

| 850 Dixie Highway | |

| Louisville, | Kentucky | 40210 |

| (Address of principal executive offices) | (Zip Code) |

(502) 585-1100

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

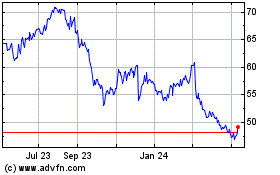

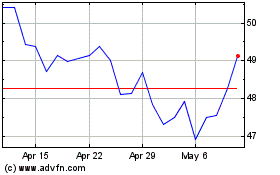

| Class A Common Stock (voting), $0.15 par value | BFA | New York Stock Exchange |

| Class B Common Stock (nonvoting), $0.15 par value | BFB | New York Stock Exchange |

| 1.200% Notes due 2026 | BF26 | New York Stock Exchange |

| 2.600% Notes due 2028 | BF28 | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: November 30, 2023

| | | | | |

| Class A Common Stock (voting), $0.15 par value | 169,144,979 | |

| Class B Common Stock (nonvoting), $0.15 par value | 306,475,348 | |

| | | | | | | | |

| BROWN-FORMAN CORPORATION |

| Index to Quarterly Report Form 10-Q |

| | |

| | Page |

| |

| | |

| Item 1. | | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| |

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| Item 5. | | |

| | |

| Item 6. | | |

| | |

| |

| | |

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

BROWN-FORMAN CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| October 31, | | October 31, |

| 2022 | | 2023 | | 2022 | | 2023 |

| Sales | $ | 1,384 | | | $ | 1,405 | | | $ | 2,672 | | | $ | 2,731 | |

| Excise taxes | 290 | | | 298 | | | 571 | | | 586 | |

| Net sales | 1,094 | | | 1,107 | | | 2,101 | | | 2,145 | |

| Cost of sales | 481 | | | 436 | | | 866 | | | 823 | |

| Gross profit | 613 | | | 671 | | | 1,235 | | | 1,322 | |

| Advertising expenses | 121 | | | 140 | | | 231 | | | 271 | |

| Selling, general, and administrative expenses | 180 | | | 192 | | | 355 | | | 392 | |

| | | | | | | |

| | | | | | | |

| Other expense (income), net | (1) | | | — | | | (7) | | | (7) | |

| Operating income | 313 | | | 339 | | | 656 | | | 666 | |

| Non-operating postretirement expense | — | | | — | | | — | | | 1 | |

| Interest income | (3) | | | (2) | | | (5) | | | (4) | |

| Interest expense | 18 | | | 31 | | | 37 | | | 60 | |

| Income before income taxes | 298 | | | 310 | | | 624 | | | 609 | |

| Income taxes | 71 | | | 68 | | | 148 | | | 136 | |

| Net income | $ | 227 | | | $ | 242 | | | $ | 476 | | | $ | 473 | |

| Earnings per share: | | | | | | | |

| Basic | $ | 0.47 | | | $ | 0.50 | | | $ | 0.99 | | | $ | 0.99 | |

| Diluted | $ | 0.47 | | | $ | 0.50 | | | $ | 0.99 | | | $ | 0.98 | |

See notes to the condensed consolidated financial statements.

BROWN-FORMAN CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| October 31, | | October 31, |

| 2022 | | 2023 | | 2022 | | 2023 |

| Net income | $ | 227 | | | $ | 242 | | | $ | 476 | | | $ | 473 | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Currency translation adjustments | (6) | | | (104) | | | (11) | | | (65) | |

| Cash flow hedge adjustments | 6 | | | 12 | | | 10 | | | 7 | |

| Postretirement benefits adjustments | 2 | | | 1 | | | 4 | | | 3 | |

| Net other comprehensive income (loss) | 2 | | | (91) | | | 3 | | | (55) | |

| Comprehensive income | $ | 229 | | | $ | 151 | | | $ | 479 | | | $ | 418 | |

See notes to the condensed consolidated financial statements.

BROWN-FORMAN CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(Dollars in millions, except per share amounts)

| | | | | | | | | | | |

| April 30, 2023 | | October 31,

2023 |

| Assets | | | |

| Cash and cash equivalents | $ | 374 | | | $ | 373 | |

Accounts receivable, less allowance for doubtful accounts of $7 at April 30 and $7 at October 31 | 855 | | | 948 | |

| Inventories: | | | |

| Barreled whiskey | 1,262 | | | 1,356 | |

| Finished goods | 509 | | | 614 | |

| Work in process | 321 | | | 404 | |

| Raw materials and supplies | 191 | | | 211 | |

| Total inventories | 2,283 | | | 2,585 | |

| Assets held for sale | — | | | 117 | |

| Other current assets | 289 | | | 250 | |

| Total current assets | 3,801 | | | 4,273 | |

| Property, plant and equipment, net | 1,031 | | | 1,060 | |

| Goodwill | 1,457 | | | 1,461 | |

| Other intangible assets | 1,164 | | | 989 | |

| Deferred tax assets | 66 | | | 63 | |

| Other assets | 258 | | | 269 | |

| Total assets | $ | 7,777 | | | $ | 8,115 | |

| Liabilities | | | |

| Accounts payable and accrued expenses | $ | 827 | | | $ | 794 | |

| | | |

| Accrued income taxes | 22 | | | 36 | |

| Short-term borrowings | 235 | | | 456 | |

| | | |

| Liabilities held for sale | — | | | 11 | |

| Total current liabilities | 1,084 | | | 1,297 | |

| Long-term debt | 2,678 | | | 2,654 | |

| Deferred tax liabilities | 323 | | | 299 | |

| Accrued pension and other postretirement benefits | 171 | | | 171 | |

| Other liabilities | 253 | | | 240 | |

| Total liabilities | 4,509 | | | 4,661 | |

| Commitments and contingencies | | | |

| Stockholders’ Equity | | | |

| Common stock: | | | |

Class A, voting, $0.15 par value (170,000,000 shares authorized; 170,000,000 shares issued) | 25 | | | 25 | |

Class B, nonvoting, $0.15 par value (400,000,000 shares authorized; 314,532,000 shares issued) | 47 | | | 47 | |

| Additional paid-in capital | 1 | | | 8 | |

| Retained earnings | 3,643 | | | 3,916 | |

| Accumulated other comprehensive income (loss), net of tax | (235) | | | (290) | |

Treasury stock, at cost (5,215,000 and 5,893,000 shares at April 30 and October 31, respectively) | (213) | | | (252) | |

| Total stockholders’ equity | 3,268 | | | 3,454 | |

| Total liabilities and stockholders’ equity | $ | 7,777 | | | $ | 8,115 | |

See notes to the condensed consolidated financial statements.

BROWN-FORMAN CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(Dollars in millions)

| | | | | | | | | | | |

| Six Months Ended |

| October 31, |

| | 2022 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 476 | | | $ | 473 | |

| Adjustments to reconcile net income to net cash provided by operations: | | | |

| | | |

| | | |

| Depreciation and amortization | 39 | | | 41 | |

| Stock-based compensation expense | 9 | | | 11 | |

Deferred income tax benefit | (8) | | | (15) | |

| | | |

| Change in fair value of contingent consideration | — | | | (2) | |

| Other, net | 33 | | | — | |

Changes in assets and liabilities: | | | |

| Accounts receivable | (94) | | | (103) | |

| Inventories | (187) | | | (337) | |

| Other current assets | 9 | | | 46 | |

| Accounts payable and accrued expenses | 45 | | | (31) | |

| Accrued income taxes | (23) | | | 16 | |

| Other operating assets and liabilities | 17 | | | (2) | |

| Cash provided by operating activities | 316 | | | 97 | |

| Cash flows from investing activities: | | | |

| | | |

| | | |

| Additions to property, plant, and equipment | (61) | | | (79) | |

| | | |

| | | |

| | | |

| Proceeds from sale of property, plant, and equipment | 4 | | | 13 | |

| | | |

| Other, net | (1) | | | 5 | |

| Cash used for investing activities | (58) | | | (61) | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| Net change in short-term borrowings | 186 | | | 220 | |

| | | |

| | | |

| | | |

| | | |

| Payments of withholding taxes related to stock-based awards | (5) | | | (4) | |

| | | |

| Acquisition of treasury stock | — | | | (42) | |

| Dividends paid | (180) | | | (197) | |

| | | |

| | | |

| Cash provided by (used for) financing activities | 1 | | | (23) | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (37) | | | (7) | |

| Net increase in cash, cash equivalents, and restricted cash | 222 | | | 6 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 874 | | | 384 | |

| Cash, cash equivalents, and restricted cash at end of period | 1,096 | | | 390 | |

| Less: Restricted cash (included in other current assets) at end of period | (9) | | | (10) | |

Less: Cash included in assets held for sale at end of period | — | | | (7) | |

| Cash and cash equivalents at end of period | $ | 1,087 | | | $ | 373 | |

See notes to the condensed consolidated financial statements.

BROWN-FORMAN CORPORATION AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

In these notes, “we,” “us,” “our,” “Brown-Forman,” and the “Company” refer to Brown-Forman Corporation and its consolidated subsidiaries, collectively.

1. Condensed Consolidated Financial Statements

We prepared the accompanying unaudited condensed consolidated financial statements pursuant to the rules and regulations of the U.S. Securities and Exchange Commission for interim financial information. In accordance with those rules and regulations, we condensed or omitted certain information and disclosures normally included in annual financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). In our opinion, the accompanying financial statements include all adjustments, consisting only of normal recurring adjustments (unless otherwise indicated), necessary for a fair statement of our financial results for the periods presented in these financial statements. The results for interim periods are not necessarily indicative of future or annual results.

We suggest that you read these condensed financial statements together with the financial statements and footnotes included in our Annual Report on Form 10-K for the fiscal year ended April 30, 2023 (2023 Form 10-K). We prepared the accompanying financial statements on a basis that is substantially consistent with the accounting principles applied in our 2023 Form 10-K.

2. Earnings Per Share

We calculate basic earnings per share by dividing net income available to common stockholders by the weighted average number of common shares outstanding during the period. Diluted earnings per share further includes the dilutive effect of stock-based compensation awards. We calculate that dilutive effect using the “treasury stock method” (as defined by GAAP).

The following table presents information concerning basic and diluted earnings per share:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| October 31, | | October 31, |

| (Dollars in millions, except per share amounts) | 2022 | | 2023 | | 2022 | | 2023 |

| | | | | | | |

| | | | | | | |

| Net income available to common stockholders | $ | 227 | | | $ | 242 | | | $ | 476 | | | $ | 473 | |

| | | | | | | |

| Share data (in thousands): | | | | | | | |

| Basic average common shares outstanding | 479,138 | | | 479,200 | | | 479,106 | | | 479,262 | |

| Dilutive effect of stock-based awards | 1,411 | | | 915 | | | 1,388 | | | 972 | |

| Diluted average common shares outstanding | 480,549 | | | 480,115 | | | 480,494 | | | 480,234 | |

| | | | | | | |

| Basic earnings per share | $ | 0.47 | | | $ | 0.50 | | | $ | 0.99 | | | $ | 0.99 | |

| Diluted earnings per share | $ | 0.47 | | | $ | 0.50 | | | $ | 0.99 | | | $ | 0.98 | |

We excluded common stock-based awards for approximately 1,006,000 shares and 1,688,000 shares from the calculation of diluted earnings per share for the three months ended October 31, 2022 and 2023, respectively. We excluded common stock-based awards for approximately 959,000 shares and 1,486,000 shares from the calculation of diluted earnings per share for the six months ended October 31, 2022 and 2023, respectively. We excluded those awards because they were not dilutive for those periods under the treasury stock method.

3. Inventories

We value some of our consolidated inventories, including most of our U.S. inventories, at the lower of cost, using the last-in, first-out (LIFO) method or market value. If the LIFO method had not been used, inventories at current cost would have been $429 million higher than reported as of April 30, 2023, and $455 million higher than reported as of October 31, 2023. Changes in the LIFO valuation reserve for interim periods are based on an allocation of the projected change for the entire fiscal year, recognized proportionately over the remainder of the fiscal year.

4. Goodwill and Other Intangible Assets

The following table shows the changes in goodwill (which includes no accumulated impairment losses) and other intangible assets during the six months ended October 31, 2023:

| | | | | | | | | | | |

| (Dollars in millions) | Goodwill | | Other Intangible Assets |

Balance at April 30, 2023 | $ | 1,457 | | | $ | 1,164 | |

| Purchase accounting adjustment (Note 14) | 40 | | | (53) | |

| Reclassification to assets held for sale (Note 15) | (10) | | | (89) | |

| | | |

| Foreign currency translation adjustment | (26) | | | (33) | |

| | | |

Balance at October 31, 2023 | $ | 1,461 | | | $ | 989 | |

Our other intangible assets consist of trademarks and brand names, all with indefinite useful lives.

5. Contingencies

We operate in a litigious environment, and we are sued in the normal course of business. Sometimes plaintiffs seek substantial damages. Significant judgment is required in predicting the outcome of these suits and claims, many of which take years to adjudicate. We accrue estimated costs for a contingency when we believe that a loss is probable and we can make a reasonable estimate of the loss, and then adjust the accrual as appropriate to reflect changes in facts and circumstances. We do not believe it is reasonably possible that these existing loss contingencies, individually or in the aggregate, would have a material adverse effect on our financial position, results of operations, or liquidity. No material accrued loss contingencies were recorded as of October 31, 2023.

6. Debt

Our long-term debt (net of unamortized discount and issuance costs) consisted of:

| | | | | | | | | | | |

| (Principal and carrying amounts in millions) | April 30, 2023 | | October 31,

2023 |

| | | |

| | | |

3.50% senior notes, $300 principal amount, due April 15, 2025 | $ | 299 | | | $ | 299 | |

1.20% senior notes, €300 principal amount, due July 7, 2026 | 330 | | | 318 | |

2.60% senior notes, £300 principal amount, due July 7, 2028 | 375 | | | 362 | |

4.75% senior notes, $650 principal amount, due April 15, 2033 | 642 | | | 643 | |

4.00% senior notes, $300 principal amount, due April 15, 2038 | 295 | | | 295 | |

3.75% senior notes, $250 principal amount, due January 15, 2043 | 248 | | | 248 | |

4.50% senior notes, $500 principal amount, due July 15, 2045 | 489 | | | 489 | |

| | | |

| $ | 2,678 | | | $ | 2,654 | |

| | | |

| | | |

Our short-term borrowings consisted of borrowings under our commercial paper program, as follows:

| | | | | | | | | | | |

| (Dollars in millions) | April 30, 2023 | | October 31,

2023 |

| Commercial paper (par amount) | $235 | | $457 |

| Average interest rate | 5.17% | | 5.47% |

| Average remaining days to maturity | 21 | | 15 |

7. Stockholders’ Equity

The following table shows the changes in stockholders’ equity by quarter during the six months ended October 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Class A Common Stock | | Class B Common Stock | | Additional Paid-in Capital | | Retained Earnings | | AOCI | | Treasury Stock | | Total |

| Balance at April 30, 2022 | $ | 25 | | | $ | 47 | | | $ | — | | | $ | 3,242 | | | $ | (352) | | | $ | (225) | | | $ | 2,737 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net income | | | | | | | 249 | | | | | | | 249 | |

| Net other comprehensive income (loss) | | | | | | | | | 1 | | | | | 1 | |

| Declaration of cash dividends | | | | | | | (180) | | | | | | | (180) | |

| | | | | | | | | | | | | |

| Stock-based compensation expense | | | | | 4 | | | | | | | | | 4 | |

| Stock issued under compensation plans | | | | | | | | | | | 4 | | | 4 | |

| Loss on issuance of treasury stock issued under compensation plans | | | | | (4) | | | (4) | | | | | | | (8) | |

| Balance at July 31, 2022 | 25 | | | 47 | | | — | | | 3,307 | | | (351) | | | (221) | | | 2,807 | |

| Net income | | | | | | | 227 | | | | | | | 227 | |

| Net other comprehensive income (loss) | | | | | | | | | 2 | | | | | 2 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Stock-based compensation expense | | | | | 5 | | | | | | | | | 5 | |

| Stock issued under compensation plans | | | | | | | | | | | 1 | | | 1 | |

| Loss on issuance of treasury stock issued under compensation plans | | | | | (2) | | | | | | | | | (2) | |

| Balance at October 31, 2022 | $ | 25 | | | $ | 47 | | | $ | 3 | | | $ | 3,534 | | | $ | (349) | | | $ | (220) | | | $ | 3,040 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

The following table shows the changes in stockholders’ equity by quarter during the six months ended October 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Class A Common Stock | | Class B Common Stock | | Additional Paid-in Capital | | Retained Earnings | | AOCI | | Treasury Stock | | Total |

| Balance at April 30, 2023 | $ | 25 | | | $ | 47 | | | $ | 1 | | | $ | 3,643 | | | $ | (235) | | | $ | (213) | | | $ | 3,268 | |

| | | | | | | | | | | | | |

| Net income | | | | | | | 231 | | | | | | | 231 | |

| Net other comprehensive income (loss) | | | | | | | | | 36 | | | | | 36 | |

| Declaration of cash dividends | | | | | | | (197) | | | | | | | (197) | |

| | | | | | | | | | | | | |

| Stock-based compensation expense | | | | | 4 | | | | | | | | | 4 | |

| Stock issued under compensation plans | | | | | | | | | | | 3 | | | 3 | |

| Loss on issuance of treasury stock issued under compensation plans | | | | | (4) | | | (3) | | | | | | | (7) | |

| | | | | | | | | | | | | |

| Balance at July 31, 2023 | 25 | | | 47 | | | 1 | | | 3,674 | | | (199) | | | (210) | | | 3,338 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net income | | | | | | | 242 | | | | | | | 242 | |

| Net other comprehensive income (loss) | | | | | | | | | (91) | | | | | (91) | |

| | | | | | | | | | | | | |

| Acquisition of treasury stock | | | | | | | | | | | (42) | | | (42) | |

| Stock-based compensation expense | | | | | 7 | | | | | | | | | 7 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance at October 31, 2023 | $ | 25 | | | $ | 47 | | | $ | 8 | | | $ | 3,916 | | | $ | (290) | | | $ | (252) | | | $ | 3,454 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

The following table shows the change in each component of accumulated other comprehensive income (AOCI), net of tax, during the six months ended October 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Currency Translation Adjustments | | Cash Flow Hedge Adjustments | | Postretirement Benefits Adjustments | | Total AOCI |

Balance at April 30, 2023 | $ | (104) | | | $ | 10 | | | $ | (141) | | | $ | (235) | |

| Net other comprehensive income (loss) | (65) | | | 7 | | | 3 | | | (55) | |

Balance at October 31, 2023 | $ | (169) | | | $ | 17 | | | $ | (138) | | | $ | (290) | |

The following table shows the cash dividends declared per share on our Class A and Class B common stock during the six months ended October 31, 2023:

| | | | | | | | | | | | | | | | | | | | |

| Declaration Date | | Record Date | | Payable Date | | Amount per Share |

| May 25, 2023 | | June 8, 2023 | | July 3, 2023 | | $0.2055 |

| July 27, 2023 | | September 5, 2023 | | October 2, 2023 | | $0.2055 |

| | | | | | |

| | | | | | |

On November 16, 2023, our Board of Directors increased the quarterly cash dividend on our Class A and Class B common stock from $0.2055 to $0.2178 per share. The quarterly cash dividend is payable on January 2, 2024, to stockholders of record on December 1, 2023.

8. Net Sales

The following table shows our net sales by geography: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| October 31, | | October 31, |

| (Dollars in millions) | 2022 | | 2023 | | 2022 | | 2023 |

United States | $ | 534 | | | $ | 531 | | | $ | 1,016 | | | $ | 973 | |

Developed International1 | 288 | | | 292 | | | 582 | | | 602 | |

Emerging2 | 208 | | | 227 | | | 384 | | | 450 | |

Travel Retail3 | 40 | | | 37 | | | 78 | | | 80 | |

Non-branded and bulk4 | 24 | | | 20 | | | 41 | | | 40 | |

| Total | $ | 1,094 | | | $ | 1,107 | | | $ | 2,101 | | | $ | 2,145 | |

1Represents net sales of branded products to “advanced economies” as defined by the International Monetary Fund (IMF), excluding the United States. Our top developed international markets are Germany, Australia, the United Kingdom, France, Canada, and Japan.

2Represents net sales of branded products to “emerging and developing economies” as defined by the IMF. Our top emerging markets are Mexico, Poland, and Brazil.

3Represents net sales of branded products to global duty-free customers, other travel retail customers, and the U.S. military regardless of customer location.

4Includes net sales of used barrels, contract bottling services, and non-branded bulk whiskey and wine, regardless of customer location.

The following table shows our net sales by product category: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| October 31, | | October 31, |

| (Dollars in millions) | 2022 | | 2023 | | 2022 | | 2023 |

Whiskey1 | $ | 754 | | | $ | 739 | | | $ | 1,461 | | | $ | 1,436 | |

Ready-to-Drink2 | 122 | | | 132 | | | 248 | | | 270 | |

Tequila3 | 88 | | | 81 | | | 158 | | | 162 | |

Wine4 | 65 | | | 76 | | | 111 | | | 117 | |

Vodka5 | 24 | | | 23 | | | 47 | | | 49 | |

Non-branded and bulk6 | 24 | | | 20 | | | 41 | | | 40 | |

Rest of portfolio7 | 17 | | | 36 | | | 35 | | | 71 | |

| Total | $ | 1,094 | | | $ | 1,107 | | | $ | 2,101 | | | $ | 2,145 | |

1Includes all whiskey spirits and whiskey-based flavored liqueurs. The brands included in this category are the Jack Daniel's family of brands (excluding the “ready-to-drink” products outlined below), the Woodford Reserve family of brands, the Old Forester family of brands, GlenDronach, Benriach, Glenglassaugh, Slane Irish Whiskey, and Coopers’ Craft.

2Includes the Jack Daniel’s ready-to-drink (RTD) and ready-to-pour (RTP) products, New Mix, and other RTD/RTP products.

3Includes the Herradura family of brands, el Jimador, and other tequilas.

4Includes Korbel California Champagne and Sonoma-Cutrer wines.

5Includes Finlandia.

6Includes net sales of used barrels, contract bottling services, and non-branded bulk whiskey and wine.

7Includes Chambord, Gin Mare, Korbel Brandy, Diplomático, and Fords Gin.

9. Pension Costs

The following table shows the components of the net cost recognized for our U.S. pension plans. Similar information for other defined benefit plans is not presented due to immateriality.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| October 31, | | October 31, |

| (Dollars in millions) | 2022 | | 2023 | | 2022 | | 2023 |

| | | | | | | |

| Service cost | $ | 5 | | | $ | 5 | | | $ | 10 | | | $ | 9 | |

| Interest cost | 8 | | | 8 | | | 16 | | | 17 | |

| Expected return on plan assets | (11) | | | (10) | | | (22) | | | (19) | |

| | | | | | | |

| | | | | | | |

| Amortization of net actuarial loss | 3 | | | 2 | | | 5 | | | 3 | |

| | | | | | | |

| Net cost | $ | 5 | | | $ | 5 | | | $ | 9 | | | $ | 10 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

10. Income Taxes

Our consolidated interim effective tax rate is based on our expected annual operating income, statutory tax rates, and income tax laws in the various jurisdictions where we operate. Significant or unusual items, including adjustments to accruals for tax uncertainties, are recognized in the fiscal quarter in which the related event or a change in judgment occurs. The expected effective tax rate on ordinary income for the fiscal year is 21.7%, which is greater than the U.S. federal statutory rate of 21.0%, due to the effects of foreign operations and state taxes, partially offset by the impact of the foreign-derived intangible income deduction.

The effective tax rate of 22.4% for the six months ended October 31, 2023, was higher than the expected tax rate of 21.7% on ordinary income for the full fiscal year, primarily due to the impact of tax rate changes, which was partially offset by prior year adjustments and the reversal of a valuation allowance in the current period. The effective tax rate of 22.4% for the six months ended October 31, 2023, was lower than the effective tax rate of 23.7% for the same period last year, primarily due to decreased impact of state taxes, lower tax contingencies in the current period, and the beneficial impact of the foreign-derived intangible income deduction, which was partially offset by a lower benefit from the reversal of valuation allowances in the current period and the net impact of other discrete items.

11. Derivative Financial Instruments and Hedging Activities

We are subject to market risks, including the effect of fluctuations in foreign currency exchange rates, commodity prices, and interest rates. We use derivatives to help manage financial exposures that occur in the normal course of business. We formally document the purpose of each derivative contract, which includes linking the contract to the financial exposure it is designed to mitigate. We do not hold or issue derivatives for trading or speculative purposes.

We use currency derivative contracts to limit our exposure to the foreign currency exchange rate risk that we cannot mitigate internally by using netting strategies. We designate most of these contracts as cash flow hedges of forecasted transactions (expected to occur within two years). We record all changes in the fair value of cash flow hedges in AOCI until the underlying hedged transaction occurs, at which time we reclassify that amount to earnings.

Some of our currency derivatives are not designated as hedges because we use them to partially offset the immediate earnings impact of changes in foreign currency exchange rates on existing assets or liabilities. We immediately recognize the change in fair value of these contracts in earnings.

We had outstanding currency derivatives, related primarily to our euro, British pound, and Australian dollar exposures, with notional amounts for all hedged currencies totaling $747 million at April 30, 2023, and $634 million at October 31, 2023. The maximum term of outstanding derivative contracts was 24 months at both April 30, 2023 and October 31, 2023.

We also use foreign currency-denominated debt instruments to help manage our foreign currency exchange rate risk. We designate a portion of those debt instruments as net investment hedges, which are intended to mitigate foreign currency exposure related to non-U.S. dollar net investments in certain foreign subsidiaries. Any change in value of the designated portion of the hedging instruments is recorded in AOCI, offsetting the foreign currency translation adjustment of the related net investments that is also recorded in AOCI. The amount of foreign currency-denominated debt instruments designated as net investment hedges was $495 million at April 30, 2023, and $478 million at October 31, 2023.

At inception, we expect each financial instrument designated as a hedge to be highly effective in offsetting the financial exposure it is designed to mitigate. We assess the effectiveness of our hedges continually. If we determine that any financial instruments designated as hedges are no longer highly effective, we discontinue hedge accounting for those instruments.

We use forward purchase contracts with suppliers to protect against corn price volatility. We expect to take physical delivery of the corn underlying each contract and use it for production over a reasonable period of time. Accordingly, we account for these contracts as normal purchases rather than as derivative instruments.

The following table presents the pre-tax impact that changes in the fair value of our derivative instruments and non-derivative hedging instruments had on AOCI and earnings:

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | October 31, |

| (Dollars in millions) | Classification | 2022 | | 2023 |

| | | | |

| Currency derivatives designated as cash flow hedges: | | | | |

| Net gain (loss) recognized in AOCI | n/a | $ | 22 | | | $ | 21 | |

| Net gain (loss) reclassified from AOCI into earnings | Sales | 15 | | | 5 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

|

| | | | |

| | | | |

| Currency derivatives not designated as hedging instruments: | | | | |

| Net gain (loss) recognized in earnings | Sales | $ | 3 | | | $ | 4 | |

| Net gain (loss) recognized in earnings | Other income (expense), net | 8 | | | (1) | |

| | | | |

| | | | |

| Foreign currency-denominated debt designated as net investment hedge: | | | | |

| Net gain (loss) recognized in AOCI | n/a | $ | 23 | | | $ | 26 | |

| | | | |

| | | | |

| | | | |

| Total amounts presented in the accompanying condensed consolidated statements of operations for line items affected by the net gains (losses) shown above: | | | |

| Sales | | $ | 1,384 | | | $ | 1,405 | |

| Other income (expense), net | | 1 | | | — | |

| | | | |

| | | | |

| | | | |

| | Six Months Ended |

| | October 31, |

| (Dollars in millions) | Classification | 2022 | | 2023 |

| | | | |

| Currency derivatives designated as cash flow hedges: | | | | |

| Net gain (loss) recognized in AOCI | n/a | $ | 36 | | | $ | 17 | |

| Net gain (loss) reclassified from AOCI into earnings | Sales | 23 | | | 8 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

|

| | | | |

| | | | |

| Currency derivatives not designated as hedging instruments: | | | | |

| Net gain (loss) recognized in earnings | Sales | $ | 8 | | | $ | 2 | |

| Net gain (loss) recognized in earnings | Other income (expense), net | 9 | | | 6 | |

| | | | |

| | | | |

| Foreign currency-denominated debt designated as net investment hedge: | | | | |

| Net gain (loss) recognized in AOCI | n/a | $ | 43 | | | $ | 17 | |

| | | | |

| | | | |

| | | | |

| Total amounts presented in the accompanying condensed consolidated statements of operations for line items affected by the net gains (losses) shown above: | | | |

| Sales | | $ | 2,672 | | | $ | 2,731 | |

| Other income (expense), net | | 7 | | | 7 | |

| | | | |

We expect to reclassify $15 million of deferred net gains on cash flow hedges recorded in AOCI as of October 31, 2023 to earnings during the next 12 months. This reclassification would offset the anticipated earnings impact of the underlying hedged exposures. The actual amounts that we ultimately reclassify to earnings will depend on the exchange rates in effect when the underlying hedged transactions occur.

The following table presents the fair values of our derivative instruments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | April 30, 2023 | | October 31, 2023 |

| (Dollars in millions) |

Classification | | Derivative Assets | | Derivative Liabilities | | Derivative Assets | | Derivative Liabilities |

| Designated as cash flow hedges: | | | | | | | | | |

| Currency derivatives | Other current assets | | $ | 20 | | | $ | (11) | | | $ | 24 | | | $ | (4) | |

| Currency derivatives | Other assets | | 5 | | | (1) | | | 4 | | | — | |

| Currency derivatives | Accrued expenses | | — | | | (1) | | | — | | | — | |

| Currency derivatives | Other liabilities | | — | | | (1) | | | — | | | — | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Not designated as hedges: | | | | | | | | | |

| Currency derivatives | Other current assets | | 3 | | | — | | | — | | | — | |

| | | | | | | | | |

| Currency derivatives | Accrued expenses | | — | | | — | | | — | | | (1) | |

| | | | | | | | | |

The fair values reflected in the above table are presented on a gross basis. However, as discussed further below, the fair values of those instruments subject to net settlement agreements are presented on a net basis in our balance sheets.

In our statements of cash flows, we classify cash flows related to cash flow hedges in the same category as the cash flows from the hedged items.

Credit risk. We are exposed to credit-related losses if the counterparties to our derivative contracts default. This credit risk is limited to the fair value of the contracts. To manage this risk, we contract only with major financial institutions that have investment-grade credit ratings and with whom we have standard International Swaps and Derivatives Association (ISDA) agreements that allow for net settlement of the derivative contracts. Also, we have established counterparty credit guidelines that we monitor regularly, and we monetize contracts when we believe it is warranted. Because of these safeguards, we believe we have no derivative positions that warrant credit valuation adjustments.

Our derivative instruments require us to maintain a specific level of creditworthiness, which we have maintained. If our creditworthiness were to fall below that level, then the counterparties to our derivative instruments could request immediate payment or collateralization for derivative instruments in net liability positions. The aggregate fair value of our derivatives with creditworthiness requirements that were in a net liability position was $1 million at April 30, 2023, and $1 million at October 31, 2023.

Offsetting. As noted above, our derivative contracts are governed by ISDA agreements that allow for net settlement of derivative contracts with the same counterparty. It is our policy to present the fair values of current derivatives (that is, those with a remaining term of 12 months or less) with the same counterparty on a net basis in our balance sheets. Similarly, we present the fair values of noncurrent derivatives with the same counterparty on a net basis. We do not net current derivatives with noncurrent derivatives in our balance sheets.

The following table summarizes the gross and net amounts of our derivative contracts:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Gross Amounts of Recognized Assets (Liabilities) | | Gross Amounts Offset in Balance Sheet | | Net Amounts Presented in Balance Sheet | | Gross Amounts Not Offset in Balance Sheet | | Net Amounts |

| April 30, 2023 | | | | | | | | | |

| Derivative assets | $ | 28 | | | $ | (12) | | | $ | 16 | | | $ | (1) | | | $ | 15 | |

| Derivative liabilities | (14) | | | 12 | | | (2) | | | 1 | | | (1) | |

| October 31, 2023 | | | | | | | | | |

| Derivative assets | 28 | | | (4) | | | 24 | | | — | | | 24 | |

| Derivative liabilities | (5) | | | 4 | | | (1) | | | — | | | (1) | |

No cash collateral was received or pledged related to our derivative contracts as of April 30, 2023, or October 31, 2023.

12. Fair Value Measurements

The following table summarizes the assets and liabilities measured or disclosed at fair value on a recurring basis:

| | | | | | | | | | | | | | | | | | | | | | | |

| April 30, 2023 | | October 31, 2023 |

| | Carrying | | Fair | | Carrying | | Fair |

| (Dollars in millions) | Amount | | Value | | Amount | | Value |

| Assets | | | | | | | |

| Cash and cash equivalents | $ | 374 | | | $ | 374 | | | $ | 373 | | | $ | 373 | |

| Currency derivatives, net | 16 | | | 16 | | | 24 | | | 24 | |

| | | | | | | |

| Liabilities | | | | | | | |

| Currency derivatives, net | 2 | | | 2 | | | 1 | | | 1 | |

| Short-term borrowings | 235 | | | 235 | | | 456 | | | 456 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Long-term debt | 2,678 | | | 2,556 | | | 2,654 | | | 2,345 | |

| Contingent consideration (Note 14) | 63 | | | 63 | | | 58 | | | 58 | |

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants at the measurement date. We categorize the fair values of assets and liabilities into three levels based on the assumptions (inputs) used to determine those values. Level 1 provides the most reliable measure of fair value, while Level 3 generally requires significant management judgment. The three levels are:

•Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities.

•Level 2 – Observable inputs other than those included in Level 1, such as quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets and liabilities in inactive markets; or other inputs that are observable or can be derived from or corroborated by observable market data.

•Level 3 – Unobservable inputs supported by little or no market activity.

We determine the fair values of our currency derivatives (forward contracts) using standard valuation models. The significant inputs used in these models, which are readily available in public markets or can be derived from observable market transactions, include the applicable spot exchange rates, forward exchange rates, and interest rates. These fair value measurements are categorized as Level 2 within the valuation hierarchy.

We determine the fair value of long-term debt primarily based on the prices at which identical or similar debt has recently traded in the market and also considering the overall market conditions on the date of valuation. These fair value measurements are categorized as Level 2 within the valuation hierarchy.

The fair values of cash, cash equivalents, and short-term borrowings approximate the carrying amounts due to the short maturities of these instruments.

We determine the fair value of our contingent consideration liability using a Monte Carlo simulation model, which requires the use of Level 3 inputs, such as projected future net sales, discount rates, and volatility rates. Changes in any of these Level 3 inputs could result in material changes to the fair value of the contingent consideration and could materially impact the amount of noncash expense (or income) recorded each reporting period.

The following table shows the changes in our contingent consideration liability during the six months ended October 31, 2023:

| | | | | | | |

| | | |

| | | |

| (Dollars in millions) | | | |

| Balance at April 30, 2023 | | | $ | 63 | |

| Purchase accounting adjustment (Note 14) | | | (1) | |

Change in fair value1 | | | (2) | |

| Foreign currency translation adjustment | | | (2) | |

Balance at October 31, 2023 | | | $ | 58 | |

| | | |

1Classified as “other expense (income), net” in the accompanying condensed consolidated statement of operations.

See Note 14 for additional information about the contingent consideration liability.

We measure some assets and liabilities at fair value on a nonrecurring basis. That is, we do not measure them at fair value on an ongoing basis, but we do adjust them to fair value in some circumstances (for example, when we determine that an asset is impaired). No material nonrecurring fair value measurements were required during the periods presented in these financial statements.

13. Other Comprehensive Income

The following table shows the components of net other comprehensive income (loss):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Three Months Ended |

| October 31, 2022 | | October 31, 2023 |

| (Dollars in millions) | Pre-Tax | | Tax | | Net | | Pre-Tax | | Tax | | Net |

| Currency translation adjustments: | | | | | | | | | | | |

| Net gain (loss) on currency translation | $ | — | | | $ | (6) | | | $ | (6) | | | $ | (98) | | | $ | (6) | | | $ | (104) | |

| Reclassification to earnings | — | | | — | | | — | | | — | | | — | | | — | |

| Other comprehensive income (loss), net | — | | | (6) | | | (6) | | | (98) | | | (6) | | | (104) | |

| Cash flow hedge adjustments: | | | | | | | | | | | |

| Net gain (loss) on hedging instruments | 22 | | | (4) | | | 18 | | | 21 | | | (5) | | | 16 | |

Reclassification to earnings1 | (15) | | | 3 | | | (12) | | | (5) | | | 1 | | | (4) | |

| Other comprehensive income (loss), net | 7 | | | (1) | | | 6 | | | 16 | | | (4) | | | 12 | |

| Postretirement benefits adjustments: | | | | | | | | | | | |

| Net actuarial gain (loss) and prior service cost | — | | | — | | | — | | | — | | | — | | | — | |

Reclassification to earnings2 | 2 | | | — | | | 2 | | | 2 | | | (1) | | | 1 | |

| Other comprehensive income (loss), net | 2 | | | — | | | 2 | | | 2 | | | (1) | | | 1 | |

| | | | | | | | | | | |

| Total other comprehensive income (loss), net | $ | 9 | | | $ | (7) | | | $ | 2 | | | $ | (80) | | | $ | (11) | | | $ | (91) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Six Months Ended | | Six Months Ended |

| October 31, 2022 | | October 31, 2023 |

| (Dollars in millions) | Pre-Tax | | Tax | | Net | | Pre-Tax | | Tax | | Net |

| Currency translation adjustments: | | | | | | | | | | | |

| Net gain (loss) on currency translation | $ | (1) | | | $ | (10) | | | $ | (11) | | | $ | (61) | | | $ | (4) | | | $ | (65) | |

| Reclassification to earnings | — | | | — | | | — | | | — | | | — | | | — | |

| Other comprehensive income (loss), net | (1) | | | (10) | | | (11) | | | (61) | | | (4) | | | (65) | |

| Cash flow hedge adjustments: | | | | | | | | | | | |

| Net gain (loss) on hedging instruments | 36 | | | (8) | | | 28 | | | 17 | | | (4) | | | 13 | |

Reclassification to earnings1 | (23) | | | 5 | | | (18) | | | (8) | | | 2 | | | (6) | |

| Other comprehensive income (loss), net | 13 | | | (3) | | | 10 | | | 9 | | | (2) | | | 7 | |

| Postretirement benefits adjustments: | | | | | | | | | | | |

| Net actuarial gain (loss) and prior service cost | — | | | — | | | — | | | — | | | — | | | — | |

Reclassification to earnings2 | 5 | | | (1) | | | 4 | | | 4 | | | (1) | | | 3 | |

| Other comprehensive income (loss), net | 5 | | | (1) | | | 4 | | | 4 | | | (1) | | | 3 | |

| | | | | | | | | | | |

| Total other comprehensive income (loss), net | $ | 17 | | | $ | (14) | | | $ | 3 | | | $ | (48) | | | $ | (7) | | | $ | (55) | |

1Pre-tax amount for each period is classified as sales in the accompanying condensed consolidated statements of operations.

2Pre-tax amount for each period is classified as non-operating postretirement expense in the accompanying condensed consolidated statements of operations.

14. Acquisitions

During the first half of fiscal 2024, we updated the purchase price allocations for our Gin Mare and Diplomático acquisitions, both of which we acquired during the third quarter of fiscal 2023. Each acquisition was accounted for as a business combination.

On November 3, 2022, we acquired the Gin Mare and Gin Mare Capri brands through our purchase of 100% of the equity interests of Gin Mare Brand, S.L.U., a Spanish company, and Mareliquid Vantguard, S.L.U., a Spanish company (the “Gin Mare acquisition”). The purchase price of the Gin Mare acquisition was $523 million, which consisted of $468 million in cash paid at the acquisition date plus contingent consideration of $55 million. The purchase price for the Gin Mare acquisition decreased by $1 million as a result of certain fair value adjustments to the contingent consideration made during the first half of fiscal 2024, which were primarily a result of changes in the discount rates used to calculate the fair value as of the acquisition date.

We have allocated the purchase price based on management’s estimates and independent valuations as follows:

| | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Prior Allocation1 | | Adjustments | | Final Allocation |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Trademarks and brand names (indefinite-lived) | $ | 307 | | | $ | (24) | | | $ | 283 | |

| Goodwill | 289 | | | 17 | | | 306 | |

| | | | | |

| | | | | |

| Total assets | 596 | | | (7) | | | 589 | |

| | | | | |

| | | | | |

| Deferred tax liabilities | 72 | | | (6) | | | 66 | |

| | | | | |

| | | | | |

| | | | | |

| Net assets acquired | $ | 524 | | | $ | (1) | | | $ | 523 | |

| | | | | |

1As reported in Note 12 to our consolidated financial statements in our 2023 Form 10-K.

The adjustments to the prior Gin Mare purchase price allocation reflect revised valuations for the trademarks and brand names, which were driven by an increase in the discount rates used to calculate fair values as of the acquisition date, partially offset by higher projections of future cash flows. The Gin Mare purchase price allocation was finalized during the second quarter of fiscal 2024.

The contingent consideration of $55 million reflects the estimated fair value, at the acquisition date, of contingent future cash payments of up to €90 million to the sellers under an “earn-out” provision of the acquisition agreement. We determined the estimated fair value of the contingent consideration using a Monte Carlo simulation, which requires the use of assumptions, such as projected future net sales, discount rates, and volatility rates.

Any contingent consideration earned by the sellers will be payable in cash no earlier than July 2024 and no later than July 2027, depending on when the sellers choose to exercise the right to receive the payment. The amount payable will depend on the achievement of net sales targets for Gin Mare for the latest fiscal year completed prior to the date of exercise by the sellers. The possible payments range from zero to €90 million (approximately $89 million as of the acquisition date).

At the acquisition date, we also entered into a supply agreement with the sellers for the production and supply of Gin Mare products to us, at market terms, for an initial period of 10 years (subject to subsequent renewal periods).

On January 5, 2023, we acquired the Diplomático and Botucal rum brands through our purchase of (i) 100% of the equity interests of (a) International Rum and Spirits Distributors Unipessoal, Lda., a Portuguese company, (b) Diplomático Branding Unipessoal Lda., a Portuguese company, (c) International Bottling Services, S.A., a Panamanian corporation, and (d) International Rum & Spirits Marketing Solutions, S.L., a Spanish company; and (ii) certain assets of Destilerias Unidas Corp. (the “Diplomático acquisition”). The purchase price of the Diplomático acquisition consisted of cash of $723 million (net of a post-closing working capital adjustment of $4 million).

We have preliminarily allocated the purchase price based on management’s estimates and independent valuations as follows:

| | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Prior Allocation1 | | Adjustments | | Updated Allocation |

| Accounts receivable | $ | 11 | | | $ | — | | | $ | 11 | |

| Inventories | 36 | | | (2) | | | 34 | |

| Other current assets | 25 | | | — | | | 25 | |

| Property, plant, and equipment | 38 | | | — | | | 38 | |

| Trademarks and brand names (indefinite-lived) | 312 | | | (29) | | | 283 | |

| Goodwill | 363 | | | 23 | | | 386 | |

| Other assets | 2 | | | — | | | 2 | |

| Total assets | 787 | | | (8) | | | 779 | |

| | | | | |

| Accounts payable and accrued expenses | 13 | | | 1 | | | 14 | |

| Deferred tax liabilities | 45 | | | (5) | | | 40 | |

| Other liabilities | 2 | | | — | | | 2 | |

| Total liabilities | 60 | | | (4) | | | 56 | |

| | | | | |

| Net assets acquired | $ | 727 | | | $ | (4) | | | $ | 723 | |

| | | | | |

1As reported in Note 12 to our consolidated financial statements in our 2023 Form 10-K.

The adjustments to the prior Diplomático purchase price allocation reflect revised valuations for the trademarks and brand names, which were driven by an increase in the discount rates used to calculate fair values as of the acquisition date, partially offset by higher projections of future cash flows. The adjustments also reflect certain other immaterial net working capital adjustments.

The Diplomático purchase price allocation is based on preliminary estimates, which we may further revise as asset valuations are finalized and we obtain further information on the fair value of liabilities. The primary matters to be finalized consist of the valuation of certain tangible assets and identifiable intangible assets, any related tax effects, and any resulting impact on residual goodwill. We expect to finalize the Diplomático purchase price allocation during the third quarter of fiscal 2024.

At the acquisition date, we also entered into a supply agreement with the sellers for their production and supply of rum to us, at market terms, for an initial period of 10 years (subject to subsequent renewal periods).

The amounts allocated to trademarks and brand names for each acquisition were estimated using the relief-from royalty method, which requires the use of significant assumptions, such as discount rates and projected future net sales.

Goodwill is calculated as the excess of the purchase price over the fair value of the net identifiable assets acquired. The goodwill recorded for each acquisition is primarily attributable to the value of leveraging our distribution network and brand-building expertise to grow sales of the acquired brands. For the Gin Mare acquisition, we expect none of the goodwill of $306 million to be deductible for tax purposes. For the Diplomático acquisition, we expect $108 million of the preliminary goodwill of $386 million to be deductible for tax purposes.

15. Assets Held for Sale

In June 2023, we reached an agreement to sell our Finlandia vodka business to Coca-Cola HBC AG (“CCH”) for $220 million in cash, subject to adjustments related to inventory and other working capital items. As of October 31, 2023, the estimated sales price (as adjusted for inventory and other working capital items) was $194 million.

The net carrying amount of the related business assets and liabilities as of October 31, 2023, was $106 million and consisted of the following:

| | | | | |

| (Dollars in millions) | October 31,

2023 |

Cash and cash equivalents | $ | 7 | |

| Accounts receivable | 2 | |

| Inventories | 5 | |

| Other current assets | 1 | |

| |

| Trademarks and brand names | 89 | |

| Goodwill | 10 | |

| Deferred tax assets | 3 | |

| |

| Total assets held for sale | 117 | |

| |

| Accounts payable and accrued expenses | 10 | |

| Accrued income taxes | 1 | |

| |

| |

| Total liabilities held for sale | 11 | |

| |

| Net assets held for sale | $ | 106 | |

| |

The total carrying amounts of the assets and liabilities held for sale are presented as separate line items in the condensed consolidated balance sheet as of October 31, 2023.

As discussed in Note 16, the transaction was completed on November 1, 2023.

16. Subsequent Events

On November 1, 2023, we completed the sale of our Finlandia vodka business to CCH for $194 million in cash.

Also, in November 2023, we reached an agreement to sell our Sonoma-Cutrer wine business to The Duckhorn Portfolio, Inc. in exchange for an ownership percentage of approximately 21.5% in The Duckhorn Portfolio, Inc. and cash of $50 million. The transaction, which is subject to certain customary closing adjustments and conditions, is expected to close in the fourth quarter of fiscal 2024.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis in conjunction with both our unaudited Condensed Consolidated Financial Statements and related notes included in Part I, Item 1 of this Quarterly Report and our Annual Report on Form 10-K for the fiscal year ended April 30, 2023 (2023 Form 10-K). Note that the results of operations for the six months ended October 31, 2023, are not necessarily indicative of future or annual results. In this Item, “we,” “us,” “our,” “Brown-Forman,” and the “Company” refer to Brown-Forman Corporation and its consolidated subsidiaries, collectively.

Presentation Basis

Non-GAAP Financial Measures

We use some financial measures in this report that are not measures of financial performance under U.S. generally accepted accounting principles (GAAP). These non-GAAP measures, defined below, should be viewed as supplements to (not substitutes for) our results of operations and other measures reported under GAAP. Other companies may define or calculate these non-GAAP measures differently.

“Organic change” in measures of statements of operations. We present changes in certain measures, or line items, of the statements of operations that are adjusted to an “organic” basis. We use “organic change” for the following measures: (a) organic net sales; (b) organic cost of sales; (c) organic gross profit; (d) organic advertising expenses; (e) organic selling, general, and administrative (SG&A) expenses; (f) organic other expense (income) net; (g) organic operating expenses1; and (h) organic operating income. To calculate these measures, we adjust, as applicable, for (1) acquisitions and divestitures and (2) foreign exchange. We explain these adjustments below.

•“Acquisitions and divestitures.” This adjustment removes (a) the gain or loss recognized on sale of divested brands and certain fixed assets, (b) any non-recurring effects related to our acquisitions and divestitures (e.g., transaction, transition, and integration costs), and (c) the effects of operating activity related to acquired and divested brands for periods not comparable year over year (non-comparable periods). Excluding non-comparable periods allows us to include the effects of acquired and divested brands only to the extent that results are comparable year over year.

During the third quarter of fiscal 2023, we acquired Gin Mare Brand, S.L.U. and Mareliquid Vantguard, S.L.U., which owned the Gin Mare brand (Gin Mare). Also, during the third quarter of fiscal 2023, we acquired (a) International Rum and Spirits Distributors Unipessoal, Lda., (b) Diplomático Branding Unipessoal Lda., (c) International Bottling Services, S.A., (d) International Rum & Spirits Marketing Solutions, S.L., and (e) certain assets of Destilerias Unidas Corp., which collectively own the Diplomático Rum brand and related assets (Diplomático). This adjustment removes the transaction, transition, and integration costs related to the acquisitions and operating activity for the non-comparable period, which is activity in the first and second quarters of fiscal 2024. We believe that these adjustments allow for us to better understand our organic results on a comparable basis.

During the second quarter of fiscal 2024, we recognized a gain of $7 million on the sale of certain fixed assets. This adjustment removes the gain from our organic other expense (income), net and organic operating income to present our organic results on a comparable basis.

•“Foreign exchange.” We calculate the percentage change in certain line items of the statements of operations in accordance with GAAP and adjust to exclude the cost or benefit of currency fluctuations. Adjusting for foreign exchange allows us to understand our business on a constant-dollar basis, as fluctuations in exchange rates can distort the organic trend both positively and negatively. (In this report, “dollar” means the U.S. dollar unless stated otherwise.) To eliminate the effect of foreign exchange fluctuations when comparing across periods, we translate current-year results at prior-year rates and remove transactional and hedging foreign exchange gains and losses from current- and prior-year periods.

We use the non-GAAP measure “organic change,” along with other metrics, to: (a) understand our performance from period to period on a consistent basis; (b) compare our performance to that of our competitors; (c) calculate components of management incentive compensation; (d) plan and forecast; and (e) communicate our financial performance to the Board of Directors, stockholders, and investment community. We provide reconciliations of the “organic change” in certain line items of the statements of operations to their nearest GAAP measures in the tables under “Results of Operations - Fiscal 2024 Year-to-Date Highlights” and “Results of Operations - Year-Over-Year Period Comparisons.” We have consistently applied the adjustments within our reconciliations in arriving at each non-GAAP measure. We believe these non-GAAP measures are useful to readers and investors because they enhance the understanding of our historical financial performance and comparability between periods.

1 Operating expenses include advertising expense, SG&A expense, and other expense (income), net.

Definitions

Aggregations.

From time to time, to explain our results of operations or to highlight trends and uncertainties affecting our business, we aggregate markets according to stage of economic development as defined by the International Monetary Fund (IMF), and we aggregate brands by beverage alcohol category. Below, we define the geographic and brand aggregations used in this report.

Geographic Aggregations.

In “Results of Operations - Fiscal 2024 Year-to-Date Highlights,” we provide supplemental information for our top markets ranked by percentage of reported net sales. In addition to markets listed by country name, we include the following aggregations:

•“Developed International” markets are “advanced economies” as defined by the IMF, excluding the United States. Our top developed international markets were Germany, Australia, the United Kingdom, France, Canada, and Japan. This aggregation represents our net sales of branded products to these markets.