UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

Information

Statement Pursuant to Section 14(c) of the Securities

Exchange

Act of 1934

| |

Check

the appropriate box: |

| |

|

| ☒ |

Preliminary

Information Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-5(d)(2)) |

| ☐ |

Definitive

Information Statement |

HUMBL,

INC.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

| |

Payment

of Filing Fee (Check the appropriate box): |

| |

|

| ☒ |

No

fee required. |

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

|

|

| |

(5) |

Total

fee paid: |

| |

|

|

| |

|

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

(1) |

Amount

Previously Paid: |

| |

|

|

| |

|

|

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

|

|

| |

|

|

| |

(4) |

Date

Filed: |

| |

|

|

| |

|

|

HUMBL,

INC.

101

W. Broadway

Suite

1450

San

Diego, CA 92101

(786)

738-9012

Notice

of Action by Written Consent of Stockholders to be Effective January __, 2024

Dear

Stockholder:

HUMBL,

Inc., a Delaware corporation (the “Company”), hereby notifies our stockholders of record on December 5, 2023 that the majority

of stockholders have approved, by written consent in lieu of a special meeting on December 5, 2023 the following proposal:

To

amend our Certificate of Incorporation to increase our authorized shares of common stock, $.00001 par value, from 12,500,000,000 to 22,500,000,000.

This

Information Statement is first being mailed to our stockholders of record as of the close of business on December __, 2023. The action

contemplated herein will not be effective until January __, 2024, a date which is at least 20 days after the date on which this Information

Statement is first mailed to our stockholders of record. You are urged to read the Information Statement in its entirety for a description

of the action taken by the majority stockholders of the Company.

WE

ARE NOT ASKING YOU FOR A PROXY AND

YOU

ARE REQUESTED NOT TO SEND US A PROXY.

The

corporate action is taken by consent of the holder of a majority of the voting shares outstanding, and pursuant to Delaware law and the

Company’s Bylaws that permit holders of a majority of the voting power to take a stockholder action by written consent. Proxies

are not being solicited because the majority stockholders holding the majority of the voting power of the issued and outstanding voting

capital stock of the Company have voted in favor of the proposals contained herein.

Exhibit

A Amendment to the Company’s Certificate of Incorporation

| /s/

Brian Foote |

|

| President

and CEO |

|

| December

6, 2023 |

|

HUMBL,

INC.

101

W. Broadway

Suite

1450

San

Diego, CA 92101

INFORMATION

STATEMENT

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

General

Information

This

Information Statement is being furnished to the stockholders of HUMBL, Inc., a Delaware corporation (the “Company”), in connection

with the adoption of a Certificate of Amendment to our Certificate of Incorporation by written consent of our Board of Directors and

the holders of a majority of our issued and outstanding voting securities in lieu of a special meeting. On December 5, 2023 our Board

of Directors and the holders of a majority of our voting capital stock approved an amendment to our Certificate of Incorporation to increase

our authorized shares of common stock, $.00001 par value per share (“Common Stock”), from 12,500,000,000 to 22,500,000,000

(the “Amendment”). The Amendment will become effective 20 calendar days after the definitive Schedule 14C is first mailed

to our shareholders in accordance with SEC Rule 14c-2 of the Securities Exchange Act of 1934, as amended.

Voting

Securities

As

of the date of this Information Statement, our voting securities consist of our Common Stock, of which 10,886,379,223 shares are outstanding,

7,000,0000 shares of Series A preferred stock, par value $0.0001 and 383,380 shares of Series B preferred stock, par value $0.00001 per

share (the Series A preferred stock and the Series B preferred stock collectively the “Preferred Stock”, and collectively

with the Common Stock, the “Voting Stock”) that vote on an as-converted basis. Approval of the Amendment requires the affirmative

consent of a majority of the shares of our Voting Stock issued and outstanding at December 4, 2023 (the “Record Date”). The

quorum necessary to conduct business of the stockholders consists of a majority of the Voting Stock issued and outstanding as of the

Record Date.

Our

shareholders representing 11,018,359,940 shares of Voting Stock voted in favor of the proposed action set forth herein, which number

exceeds the majority of the issued and outstanding shares of our Voting Stock on the date of this Information Statement. The consenting

stockholders consented to the proposed action set forth herein and had the power to pass the proposed corporate action without the concurrence

of any of our other stockholders.

The

approval of this action by written consent is made possible by Section 228 of the Delaware General Corporation Law, which provides that

the written consent of the holders of outstanding shares of voting stock, having not less than the minimum number of votes that would

be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted, may be

substituted for such a meeting. To eliminate the costs involved in holding a special meeting, our Board of Directors elected to utilize

the written consent of the holders of more than a majority of our Voting Stock.

This

Information Statement will be mailed on or about December __, 2023 to stockholders of record as of the Record Date and is being delivered

to inform you of the corporate action described herein before such action takes effect in accordance with Rule 14c-2 of the Securities

Exchange Act of 1934, as amended.

The

entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians,

fiduciaries and other like parties to forward this Information Statement to the beneficial owners of our voting securities held of record

by them, and we will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

Dissenters’

Right of Appraisal

The

Delaware General Corporation Law does not provide for dissenter’s rights of appraisal in connection with the proposed actions nor

have we provided for appraisal rights in our Certificate of Incorporation or Bylaws.

PROPOSAL

1 - AMENDMENT TO OUR CERTIFICATE OF INCORPORATION

TO

INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

Our

Board of Directors unanimously approved and adopted, subject to stockholder approval, an amendment to our Certificate of Incorporation

to increase the authorized shares of Common Stock from 12,500,000,000 to 22,500,000,000. Attached as Exhibit A and incorporated

herein by reference is the text of the Certificate of Amendment to our Certificate of Incorporation (the “Amended Certificate”)

as approved by the Consenting Stockholder to effect this change.

Certificate

of Incorporation and Bylaws

Certain

provisions of Delaware law, our Certificate of Incorporation and our Bylaws, which are summarized below, may have the effect of delaying,

deferring or discouraging another person from acquiring control of us. They are also designed, in part, to encourage persons seeking

to acquire control of us to negotiate first with our Board of Directors. We believe that the benefits of increased protection of our

potential ability to negotiate with an unfriendly or unsolicited acquirer outweigh the disadvantages of discouraging a proposal to acquire

us because negotiation of these proposals could result in an improvement of their terms.

Board

of Directors Vacancies

Our

Certificate of Incorporation and Bylaws authorize only our Board of Directors to fill vacant directorships, including newly created seats.

In addition, the number of directors constituting our Board of Directors will be permitted to be set only by a resolution adopted by

a majority vote of our entire Board of Directors. These provisions would prevent a stockholder from increasing the size of our Board

of Directors and then gaining control of our Board of Directors by filling the resulting vacancies with its own nominees. This will make

it more difficult to change the composition of our Board of Directors and will promote continuity of management.

Stockholder

Action; Special Meeting of Stockholders

Our

Certificate of Incorporation provides that special meetings of our stockholders may be called only by a majority of our Board of Directors,

the chairperson of our Board of Directors, our Chief Executive Officer or our President, thus prohibiting a stockholder from calling

a special meeting. These provisions might delay the ability of our stockholders to force consideration of a proposal or for stockholders

controlling a majority of our capital stock to take any action, including the removal of directors.

Advance

Notice Requirements for Stockholder Proposals and Director Nominations

Our

Bylaws provide advance notice procedures for stockholders seeking to bring business before our annual meeting of stockholders or to nominate

candidates for election as directors at our annual meeting of stockholders. Our also specify certain requirements regarding the form

and content of a stockholder’s notice. These provisions might preclude our stockholders from bringing matters before our annual

meeting of stockholders or from making nominations for directors at our annual meeting of stockholders if the proper procedures are not

followed. We expect that these provisions may also discourage or deter a potential acquirer from conducting a solicitation of proxies

to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of our company.

No

Cumulative Voting

The

Delaware General Corporation Law provides that stockholders are not entitled to cumulate votes in the election of directors unless a

corporation’s Certificate of Incorporation provides otherwise. Our Certificate of Incorporation does not provide for cumulative

voting.

Amendment

of Charter and Bylaws Provisions

Amendments

to our Certificate of Incorporation will require the approval of the holders of at least a majority of the voting power of the outstanding

shares of Common Stock and Preferred Stock. Our Bylaws provide that they can be amended or repealed by our Board of Directors or the

approval of the holders of at least a majority of the voting power of the stockholders that includes our Series A and Series B preferred

voting together with the holders of Common Stock as a single class.

Issuance

of Undesignated Preferred Stock

Our

Board of Directors has the authority, without further action by our stockholders, to issue up to 10,000,000 shares of undesignated preferred

stock with rights and preferences, including voting rights, designated from time to time by our Board of Directors. The existence of

authorized but unissued shares of preferred stock would enable our Board of Directors to render more difficult or to discourage an attempt

to obtain control of us by means of a merger, tender offer, proxy contest or other means.

Exclusive

Forum

Our

Bylaws provide that, unless we consent in writing to the selection of an alternative forum, the sole and exclusive forum for (i) any

derivative action or proceeding brought on our behalf, (ii) any action asserting a claim of breach of a fiduciary duty owed by any of

our directors, officers, or other employees to us or our stockholders, (iii) any action asserting a claim against the company or any

director or officer of the company arising pursuant to any provision of the Delaware General Corporation Law, (iv) any action to interpret,

apply, enforce, or determine the validity of our amended and restated Certificate of Incorporation or amended and restated Bylaws, or

(v) any other action asserting a claim that is governed by the internal affairs doctrine shall be the Chancery Court of the State of

Delaware, in all cases subject to the court’s having jurisdiction over indispensable parties named as defendants. Our Bylaws also

provide that the federal district court in the State of Delaware will be the exclusive forum for resolving any complaint asserting a

cause of action under the Securities Act and the Exchange Act.

Any

person or entity purchasing or otherwise acquiring any interest in our securities shall be deemed to have notice of and consented to

these provisions. We note that stockholders cannot waive compliance (or consent to non-compliance) with the federal securities laws and

the rules and regulations thereunder.

We

are not aware of any attempt to take control of the Company and are not presenting this proposal with the intent that it be utilized

as a type of anti−takeover device.

VOTING

SECURITIES AND PRINCIPAL STOCKHOLDERS

The

column entitled “Percentage of Class” is based on 10,886,379,223 shares of common stock outstanding as of December 4, 2023.

Beneficial ownership is determined in accordance with the rules and regulations of the SEC and includes voting or investment power with

respect to our common stock. Shares of our common stock subject to options that are currently exercisable or exercisable within 60 days

of December 4, 2023 are considered outstanding and beneficially owned by the person holding the options for the purpose of calculating

the percentage ownership of that person but not for the purpose of calculating the percentage ownership of any other person. Except as

otherwise noted, we believe the persons and entities in this table have sole voting and investing power with respect to all of the shares

of our common stock beneficially owned by them, subject to community property laws, where applicable.

Each

share of Series A preferred stock and Series B preferred stock entitles the holder to vote on all matters submitted to a vote of our

shareholders with each share of Series A preferred having 1,000 votes and each share of Series B preferred having 10,000 votes.

| Name

and Address of Beneficial Owner |

|

Class

of Securities |

|

#

of Shares |

|

|

%

of Class |

|

|

%

of Voting Stock(2) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Brian

Foote(1) |

|

Common |

|

|

11,894,304 |

|

|

|

* |

|

|

|

* |

|

| |

|

Series

A Preferred |

|

|

7,000,000 |

|

|

|

100 |

% |

|

|

32.23 |

% |

| |

|

Series

B Preferred |

|

|

198,421 |

|

|

|

51.76 |

% |

|

|

9.14 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Jeffrey

Hinshaw(1) |

|

Common |

|

|

100,060,000 |

|

|

|

* |

|

|

|

* |

|

| |

|

Series

B Preferred |

|

|

30,263 |

|

|

|

7.89 |

% |

|

|

1.39 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Peter

Schulte |

|

Common |

|

|

287,422 |

|

|

|

* |

|

|

|

* |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| All

Officers and Directors as a Group (3 persons) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common |

|

|

|

|

112,441,726 |

|

|

|

* |

% |

|

|

*

|

|

| Series

A Preferred |

|

|

|

|

7,000,000 |

|

|

|

100 |

% |

|

|

32.23 |

% |

| Series

B Preferred |

|

|

|

|

228,684 |

|

|

|

59.65 |

% |

|

|

10.54 |

% |

| (1) |

Officer

and/or director of our Company. |

| (2) |

Voting

control is based on a total of 21,720,179,223 voting rights attributable to shares of our commons stock with one vote per share,

shares of our Series A Preferred stock with 1,000 votes per share and shares of our Series B Preferred stock with 10,000 votes per

share. |

*Less

than 1%

DELIVERY

OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

Only

one Information Statement is being delivered to multiple security holders sharing an address unless the Company has received contrary

instructions from one or more of its security holders. The Company undertakes to deliver promptly upon written or oral request a separate

copy of the Information Statement to a security holder at a shared address to which a single copy of the documents was delivered and

provide instructions as to how a security holder can notify the Company that the security holder wishes to receive a separate copy of

the Information Statement.

Security

holders sharing an address and receiving a single copy may request to receive a separate Information Statement at HUMBL, Inc., 101 W.

Broadway, Suite 1450, San Diego, CA 92101. Security holders sharing an address can request delivery of a single copy of the Information

Statement if they are receiving multiple copies may also request to receive a separate Information Statement at HUMBL, Inc, 101 W. Broadway,

Suite 1450, San Diego, CA 92101, telephone: (786) 738-9012.

WHERE

YOU CAN OBTAIN ADDITIONAL INFORMATION

We

are required to file annual, quarterly and special reports, proxy statements and other information with the SEC. You may read and copy

any document we file at the SEC’s public reference rooms at 100 F Street, N.E, Washington, D.C. 20549. You may also obtain copies

of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Room 1580, Washington,

D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information on the operation of the public reference rooms. Copies of our

SEC filings are also available to the public from the SEC’s web site at www.sec.gov.

We

will provide, upon request and without charge, to each shareholder receiving this Information Statement a copy of our filings with the

SEC and other publicly available information. A copy of any public filing is also available, at no charge, by contacting HUMBL, Inc.,

101 W. Broadway, Suite 1450, San Diego, CA 92101, telephone: (786) 738-9012.

| Date:

December 6, 2023 |

HUMBL,

Inc. |

| |

|

| |

|

By

Order of the Board of Directors |

| |

|

|

| |

By: |

/s/

Brian Foote |

| |

|

Brian

Foote |

| |

|

President

and CEO |

Exhibit

A

CERTIFICATE

OF AMENDMENT TO

CERTIFICATE

OF INCORPORATION OF

HUMBL,

INC.

HUMBL,

Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”),

does hereby certify as follows:

1.

The name of the corporation is HUMBL, Inc. The date of the filing of its original Certificate of Incorporation (the “Certificate

of Incorporation”) with the Secretary of State of the State of Delaware was November 23, 2020.

2.

This Certificate of Amendment to Certificate of Incorporation (this “Certificate of Amendment”) amends of the Certificate

of Incorporation of the Corporation (the “Certificate”) to increase the number of authorized shares of Common Stock from

12,500,000,000 to 22,500,000,000.

3.

The number “12,500,000,000” in the first sentence of Paragraph FOURTH of the Certificate is hereby amended to read “22,500,000,000”.

4.

The remaining provisions of the Certificate not affected by the aforementioned amendment shall remain in full force and shall not be

affected by this Certificate of Amendment.

5.

This Certificate of Amendment was duly adopted by the Board of Directors of the Corporation on December 5, 2023 and by the stockholders

of the corporation on December 5, 2023 in accordance with the applicable provisions of Sections 141, 228 and 242 of the General Corporation

Law of the State of Delaware.

IN

WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be executed by its duly authorized officer this __ day of

December, 2023.

| |

HUMBL,

Inc. |

| |

|

|

| |

By: |

|

| |

|

Brian

Foote, CEO |

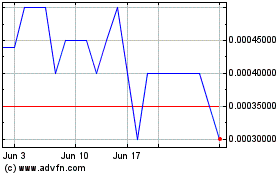

HUMBL (PK) (USOTC:HMBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

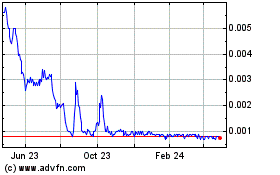

HUMBL (PK) (USOTC:HMBL)

Historical Stock Chart

From Apr 2023 to Apr 2024