0000700764

false

0000700764

2023-12-01

2023-12-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 4, 2023 (December 1, 2023)

| Victory Oilfield Tech, Inc. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

002-76219-NY |

|

87-0564472 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 3355 Bee Caves Road, Suite 608, Austin, Texas |

|

78746 |

| (Address of principal executive offices) |

|

(Zip Code) |

| (512) 347-7300 |

| (Registrant’s telephone number, including area code) |

| |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed, on July 25, 2023, Victory

Oilfield Tech, Inc. (the “Company”), and Victory H2EG Merger Sub Inc., a Delaware corporation and wholly owned subsidiary

of the Company (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with H2 Energy

Group Inc., a Delaware corporation (“H2EG”, and collectively with the Company and Merger Sub, the “Parties”).

Pursuant to the Merger Agreement, Merger Sub agreed to merge with and into H2EG, which will survive in the merger and become a wholly

owned subsidiary of the Company (the “Merger”), in exchange for the issuance of at least 400,335,526 shares of the Company’s

common stock, par value $0.001 per share (the “Common Stock”), to the H2EG stockholders which, in the aggregate, constitutes

at least 70% of the Company’s issued and outstanding capital stock on a fully diluted basis after the closing of the Merger Agreement

(the “Closing”).

As a condition of the Merger Agreement, the Company

engaged in a private placement offering of Common Stock at $0.059 per share under Regulation D of the Securities Act of 1933, and Rule

506(b) promulgated thereunder (the “Financing”), seeking to raise $5,000,000, and the investors therein were to receive the

right to appoint a director to the board of directors of the Company. Additionally, within 30 days of the Closing, the Company agreed

to enter a definitive agreement with its affiliate, Visionary Private Equity Group I, LP (“Visionary”), in which it would

transfer ownership of Pro-Tech Hardbanding Services, Inc. (“Pro-Tech”) to Visionary. The Merger Agreement also contemplates

the conversion of all the Company’s convertible notes held by Visionary (the “Visionary Convertible Notes”) for 50,961,957

shares of Common Stock.

On December 1, 2023, the Parties entered into

Amendment No. 1 to the Merger Agreement (“Amendment No. 1”) with respect to the Merger contemplated thereby. Among other things,

Amendment No. 1 amends the Merger Agreement to provide that:

| (i) | the H2EG stockholders will receive 243,000,000 shares of Common Stock upon the Closing, and 175,822,708

shares of Common Stock upon a future increase to the Company’s authorized capital stock; |

| (ii) | upon conversion of the Visionary Convertible Notes at the Closing, Visionary will receive: (a) 7,866,034

shares of Common Stock; and (b) 43,095,923 pre-funded warrants to purchase Common Stock, in a form mutually agreed upon by the Parties,

provided that the pre-funded warrants will contain an exercise limitation that prohibits the exercise of such pre-funded warrants until

Victory has increased its authorized capital stock (the “Pre-funded Warrants”). |

| (iii) | the holder of all the issued and outstanding shares of the Company’s Series D Preferred Stock has

agreed to the cancelation of his 8,333 shares of Series D Preferred Stock in exchange for 3,961,539 Pre-funded Warrants at the Closing; |

| (iv) | the Company’s equity ownership interest in Pro-Tech shall be transferred to Pro-Tech Holdings, LLC,

a Texas limited liability company (“Pro-Tech Holdings”), instead of Visionary, so long as Flagstaff International, LLC (“Flagstaff”),

a Delaware limited liability company, and an affiliate of Pro-Tech Holdings, commits pursuant to a binding agreement to purchase $4,000,000

worth of a new series of preferred stock to be designated by the Company, on terms to be mutually agreed upon by Flagstaff and Victory,

which will include the right to appoint a director to the board of directors of Victory; |

| (v) | the Company will sell $1,212,000 worth of Common Stock in the Financing and that the investors therein

will not receive a right to appoint a director to the Company’s board of directors; and |

| (vi) | as soon as practicable after the Closing, the H2EG stockholders, as owners of a majority of the issued

and outstanding Common Stock on a post-Closing basis, shall vote in favor of, and shall cause the Company and its board of directors to

take all necessary actions to effect, an amendment to the Company’s articles of incorporation to increase its authorized capital

stock thereunder to at least 1,170,318,154 shares of Common Stock. |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit

No. |

|

Description of Exhibit |

| 10.1 |

|

Agreement and Plan of Merger, dated July 25, 2023, by and among Victory Oilfield Tech, Inc., Victory H2EG Merger Sub Inc., and H2 Energy Group Inc. (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed on July 26, 2023) |

| 10.2 |

|

Amendment No. 1 to Agreement and Plan of Merger, dated December 1, 2023, by and among Victory Oilfield Tech, Inc., Victory H2EG Merger Sub Inc., and H2 Energy Group Inc. |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: December 4, 2023 |

Victory Oilfield Tech, Inc. |

| |

|

| |

/s/ Kevin DeLeon |

| |

Name: |

Kevin DeLeon |

| |

Title: |

Chief Executive Officer |

2

Exhibit 10.2

AMENDMENT NO. 1 TO

THE AGREEMENT AND PLAN OF MERGER

This Amendment No. 1 (the

“Amendment”) to the Agreement and Plan of Merger dated July 25, 2023, by and among Victory Oilfield Tech, Inc., Victory

H2EG Merger Sub Inc., and H2 Energy Group Inc. (the “Merger Agreement”) is made and entered into as of December 1,

2023 (the “Effective Date”), by and among Victory Oilfield Tech, Inc.,

a Nevada corporation (“Victory”), Victory H2EG Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary

of Victory (“Merger Sub”) and H2 Energy Group Inc., a Delaware

corporation (“H2EG” and collectively with Victory and Merger Sub, the “Parties”). Capitalized terms

used herein but not defined below shall have the meanings ascribed to such terms in the Merger Agreement.

BACKGROUND

A. On

July 25, 2023, Victory and Merger Sub entered into the Merger Agreement with H2EG, pursuant to which Merger Sub agreed to merge with

and into H2EG, which will survive in the merger and become a wholly owned subsidiary of Victory, in a transaction that is intended

to qualify for tax-free treatment under the Code.

B. The

Merger Agreement requires the:

| (1) | conversion of the Visionary Convertible Notes in the aggregate principal amount of $3,815,926.39 with

accrued interest thereon through June 15, 2023, that are held by Visionary Private Equity Group I, LP, at a conversion price of $0.1777,

and the transfer of all the equity interests in Pro-Tech that are held by Victory to Visionary in consideration for the conversion of

the Visionary Convertible Notes at the Closing; |

| (2) | filing of an information statement on Schedule 14F-1 with the SEC that discloses the requisite information

about the New Board Members who will serve as board members of Victory at the Effective Time; |

| (3) | issuance of Victory Common Stock to the H2EG Stockholders which, in the aggregate, constitutes at least

70% of the issued and outstanding capital stock of Victory on a fully diluted basis after the Closing;; (or at least 400,335,526 shares

of Victory Common Stock); |

| (4) | reissuance of up to 2,882,634 Reissue Warrants (defined below) to holders of existing expired warrants

of Victory in consideration for a release by such holders of any and all claims against Victory; |

| (5) | issuance of 3,350,000 Victory warrants to current employees of Victory as compensation for services provided

thereto; |

| (6) | investment in Victory of up to $5,000,000 by investors in a private placement offering in exchange for

Victory Common Stock constituting up to 15% of Victory’s outstanding Common Stock on a fully diluted basis (assuming the full amount

of $5,000,000 is raised in the Financing); and |

| (7) | the granting of a right to select a director to serve on the board of directors of Victory to the investors

in the Financing. |

C.

The Merger Agreement also states that: (1) Victory’s authorized capital stock consists of (i) 300,000,000 shares of Common

Stock, of which 28,591,593 shares are issued and outstanding as of the date thereof (or 85,786,184 shares on a fully diluted basis); and

(ii) 20,000 shares of Series D Preferred Stock, of which 8,333 are issued and outstanding as of the date hereof; and that (2) for their

investments in Victory, the Financing investors will receive, in the aggregate, roughly $5,000,000 worth of Victory Common Stock (or up

to 85,786,184 shares of Victory Common Stock which are reserved for issuance thereunder).

D. With

respect to the provisions referenced in paragraphs (B)(3) and (C) above, only 128,427,632 shares of Victory Common Stock remain

available for issuance under Victory’s articles of incorporation, which is insufficient to account for the 400,335,526 shares

of Victory Common Stock which the H2EG Stockholders are due under the Merger Agreement, together with the 50,961,957 shares of

Victory Common Stock which are due to Visionary at the Effective Time upon conversion of the Visionary Convertible Notes according

to the Merger Agreement.

E.

To allow Victory to consummate the Merger Agreement prior to amending its articles of incorporation to sufficiently increase its

authorized capital stock, the Parties desire to amend the Merger Agreement to provide that: (i) Victory will sell $1,212,000 worth of

Victory Common Stock (or 20,542,373 shares of Common Stock) in the Financing; (ii) the H2EG Stockholders will receive 243,000,000 shares

of Common Stock at the Effective Time, and 175,822,708 shares of Common Stock following an increase to Victory’s authorized capital

stock, and (iii) Visionary will receive 7,866,034 shares of Victory Common Stock at the Closing, and 43,095,923 pre-funded warrants to

purchase Victory Common Stock, in a form mutually agreed upon by the Parties, provided that the pre-funded warrants will contain an exercise

limitation that prohibits the exercise of such pre-funded warrants until Victory has increased its authorized capital stock (the “Pre-funded

Warrants”).

F.

The Parties also desire to amend the Merger Agreement to:

| (1) | correct the disclosure concerning Victory’s authorized capital stock; |

| (2) | clarify that as soon as practicable after the Closing, the H2EG Stockholders, as owners of 81% of the

issued and outstanding Victory Common Stock on a post-Closing basis, shall vote in favor of, and shall cause Victory to take all necessary

actions to effect, an amendment to Victory’s articles of incorporation to increase the Authorization Limit thereunder to at least

1,170,318,154 shares of Common Stock; |

| (3) | provide that Victory’s equity ownership interest in Pro-Tech shall be transferred to Pro-Tech Holdings,

LLC, a Texas limited liability company, instead of Visionary, so long as Flagstaff International, LLC, a Delaware limited liability company

and the owner of Pro-Tech Holdings commits pursuant to a binding agreement to invest at least $4,000,000 in Victory on terms to be mutually

agreed upon by Flagstaff and Victory, which will include the right to appoint a director to the board of directors of Victory; |

| (4) | correct the disclosure regarding the Reissue Warrants which Victory intends to issue so that the number

thereof contains a certain amount of warrants of Victory that are set to expire by December 31, 2024; |

| (5) | provide that the Series D Holder (defined below) has agreed to convert his 8,333 shares of Series D Preferred

Stock, constituting all of the issued and outstanding shares thereof, for 3,961,539 Pre-funded Warrants at the Closing. |

| (6) | clarify that the 3,350,000 new warrants being issued to current employees of Victory are exercisable on

a cashless basis; |

| (7) | provide that the Schedule 14F-1 Filing can occur after the Effective Time; |

| (8) | change the conversion price of the Visionary Convertible Notes from $0.1777 to $0.075914, such that at

the Closing, the principal amount and accrued interest thereunder will convert to Victory Common Stock at a price that is approximately

equal to the price in the Financing; |

| (9) | provide that the investors in the Financing will not have the right to appoint a director to Victory’s

board of directors; and |

| (10) | provide that the Merger is intended as a transaction that qualifies as a tax-free reorganization under

Section 368(a)(2)(E) of the Code. |

G. In accordance with

Section 10.1 of the Merger Agreement, the same may be amended by an instrument in writing signed on behalf of Victory, Merger Sub,

and H2EG.

H. This

Amendment has been authorized by Victory’s board of directors, Merger Sub’s board of directors, and H2EG’s board

of directors and is being executed by the Parties on the Effective Date hereof.

AGREEMENT

NOW, THEREFORE,

in consideration of the mutual covenants, agreements, representations, and warranties contained in the Merger Agreement and this Amendment

thereto, the parties hereto agree to amend the Merger Agreement as follows:

1. Amendment

to Section 1.1(cc). Section 1.1(cc) of the Merger Agreement is hereby amended and restated in its entirety as

follows:

(cc) [Reserved]

2. Amendments

to Section 1.1. Section 1.1 of the Merger Agreement is hereby amended to add the following additional definitions:

“Authorization

Limit” means the 300,000,000 authorized shares of Common Stock of Victory available for issuance

under Victory’s articles of incorporation.

“Flagstaff”

means Flagstaff International, LLC, a Delaware limited liability company that has committed to investing in Victory per the Flagstaff

Financing Agreement.

“Flagstaff

Financing Agreement” means the agreement between Victory and Flagstaff by which Flagstaff has

agreed to invest at least $4,000,000 in Victory in exchange for the transfer of all of the equity of Pro-Tech to Pro-Tech holdings according

to the Merger Agreement.

“New

Board Members” means the Board members of Victory as of the Effective Time which are named in

Section 7.1(f) of the Merger Agreement.

“Pre-funded

Warrants” means the Pre-funded Warrants for the purchase of Victory Common Stock which are being

issued to Visionary and the Series D Holder according to the Amendment, in a form mutually agreed upon by the Parties, provided that the

Pre-funded Warrants will contain an exercise limitation that prohibits the exercise of such Pre-Funded warrants until Victory has increased

its authorized capital stock.

“Pro-Tech

Holdings” means Pro-Tech Holdings, LLC, a Texas limited liability company and an affiliate of

Flagstaff that will acquire all of Victory’s equity ownership in Pro-Tech.

“Schedule

14F-1 Filing” means the information statement on Schedule 14F-1 which Victory will file with the

SEC to disclose the requisite information about the New Board Members who will serve as board members of Victory at the Effective Time.

“Series

D Holder” means David McCall, the holder of all of the issued and outstanding Series D Preferred

Stock of Victory.

“Series

D Preferred Stock” means Victory’s Series D Preferred Stock, of which 8,333 are issued and

outstanding and held by the Series D Holder, which will be canceled in exchange for Pre-funded Warrants at the Effective Time, according

to Section 5.8(b).

“Visionary”

means Visionary Private Equity Group I, LP, the holder of the Visionary Convertible Note.

“Visionary

Convertible Note” means the convertible note(s) issued to Visionary by Victory, which are convertible

into Victory Common Stock.

3. Amendments

to Section 2.1(b). Section 2.1(b) of the Merger Agreement is hereby amended and restated as follows:

(b) Tax-Free

Merger. The Parties to this Agreement intend, for federal income Tax purposes, that the Merger

qualify as reorganization governed by Section 368(a)(2)(E) of the Code and the applicable Treasury Regulations promulgated with

respect thereto, and Victory and H2EG will file all Tax Returns (including amended returns and claims for refunds) in a manner

consistent with such treatment and will use their commercially reasonable efforts to sustain such treatment in any subsequent tax

audit or dispute.

4. Amendments

to Section 2.3(b). Section 2.3(b) of the Merger Agreement is hereby amended and restated in its entirety as

follows:

“(b) H2EG

Capital Stock. At the Effective Time, each share of H2EG Capital Stock issued and outstanding

immediately prior to the Effective Time, subject to and upon the terms and conditions set forth in this Agreement, will be cancelled

and extinguished and be converted automatically into the right to receive 418,822,708 shares of Victory Common Stock, of which: (i)

243,000,000 shares of Victory Common Stock will be issued upon the Closing (“H2EG’s Post-Closing Issuance),

and; (i) 175,822,708 shares of Victory Common Stock will be issued after an amendment to Victory’s articles of incorporation

increasing the Authorization Limit according to Section 5.8(c). For clarity, according to this Section 2.3(b), the H2EG Stockholders

will own 81% of Victory’s issued and outstanding Common Stock on a post-Closing basis.”

5.

Amendments to Section 4.2. Section 4.2 of the Merger Agreement

is hereby amended and restated in its entirety as follows:

“4.2 Capital Structure

(a) Except

as set forth on Schedule 4.2(a) of the Victory Disclosure Schedule, the authorized capital stock of Victory immediately prior to

the Closing consists of: (i) 300,000,000 shares of Common Stock, par value $0.001 per share, of which 28,591,593 shares are issued and

outstanding, and (ii) 20,542,373 shares are reserved for issuance in the Financing, and (ii) 20,000 shares of Series D Preferred Stock,

par value $0.001 per share, of which 8,333 shares are issued and outstanding. All outstanding shares of Victory Capital Stock are duly

authorized, validly issued, fully paid and non-assessable and are not subject to preemptive rights created by statute, the Charter Documents,

or any agreement to which Victory is a party or by which it is bound, have been issued in compliance in all material respects with all

applicable federal and state securities Laws. As of the date hereof, there are no declared and unpaid dividends with respect to any shares

of Victory Capital Stock.

(b) Except

as set forth on Schedule 4.2(b) of the Victory Disclosure Schedule, Victory has never adopted, sponsored, or maintained any stock

option plan or any other plan or agreement, providing for equity compensation to any person. Victory has not reserved shares of Victory

Common Stock under the Victory Plan for issuance to employees and directors of, and consultants to, Victory upon the exercise of options

or other awards granted under the Victory Plan or any other plan, agreement, or arrangement (whether written or oral, formal or informal),

of which no shares are issuable, as of the date hereof, upon the exercise of outstanding, unexercised options or other awards.

(c) Except

as set forth in Schedule 4.2(c) of the Victory Disclosure Schedule, there are no (i) options, warrants, calls, rights, convertible

securities, commitments or agreements of any character, written or oral, to which Victory is a party or by which Victory is bound obligating

Victory to issue, deliver, sell, repurchase or redeem, or cause to be issued, delivered, sold, repurchased or redeemed, any shares of

Victory Capital Stock or obligating Victory to grant, extend, accelerate the vesting of, change the price of, otherwise amend or enter

into any such option, warrant, call, right, commitment or agreement; (ii) outstanding or authorized stock appreciation, phantom stock,

profit participation, or other similar rights with respect to Victory; (iii) voting trusts, proxies, or other agreements or understandings

with respect to the voting securities of Victory; (iv) Contracts to which Victory is a party relating to the registration, sale or transfer

(including agreements relating to rights of first refusal, co-sale rights or “drag-along” rights) of any Victory Capital Stock.”

6. Amendments

to Section 5.5. Section 5.5 of the Merger Agreement is hereby amended and restated in its entirety as follows:

“5.5 Schedule

14F-1. As soon as reasonably practicable following the Closing and the determination by the

Parties of the New Boards Members in accordance with Section 7.1(f), Victory shall file with the U.S. Securities and Exchange

Commission the Schedule 14F-1 Filing disclosing the requisite information regarding the New Board Members.”

7. Amendments

to Section 5.6. Section 5.6 of the Merger Agreement is hereby amended and restated in its entirety as follows:

“5.6 Flagstaff

Financing; Pro-Tech Disposition. Before the Effective Time, Victory will enter into a

financing agreement with Flagstaff International, LLC, under which Flagstaff will commit to invest $4,000,000.00 in Victory, as a

single sum or in separate tranches, in exchange for (i) Victory Preferred Stock and (ii) the transfer to Pro-Tech Holdings of all

the equity interests held by Victory in Pro-Tech or the transfer to Pro-Tech Holdings of all or substantially all of the assets of

Pro-Tech (the “Pro-Tech Disposition”). Each of the Parties acknowledges that

the Pro-Tech Disposition pursuant to the Flagstaff Financing Agreement is a material term of the Merger Agreement contemplated

hereby.”

8. Amendments

to Section 5.7. Section 5.7 of the Merger Agreement is hereby amended and restated in its entirety as follows:

“5.7 Financing.

The Parties shall use reasonable best efforts to complete a private placement financing for gross proceeds of up to $1,212,000, or

the sale of up to 20,542,373 shares of Victory Common Stock (the “Financing Shares”)

at a purchase price of $0.059 per share (the “Financing”). The Financing shall

be promptly disbursed to H2EG when received and shall be represented by a note or a series of notes in a form reasonably

satisfactory to the Parties (the “Financing Notes"). The Financing Notes shall

be forgiven upon consummation of the Merger, provided however that the Financing Notes shall be payable by H2EG to Victory in

accordance with its terms if the Merger is not completed.”

9. Amendments

to Section 5.8. Section 5.8 of the Merger Agreement is hereby amended and restated in its entirety as follows:

“5.8

Closing and Post-Closing Matters.

(a) Conversion

of Visionary Convertible Notes. Visionary will convert the Visionary Convertible Notes at the Effective

Time according to this Section 5.8(a), and will receive: (i) 7,866,034 shares of Victory Common Stock, and (ii) 43,095,923 Pre-funded

Warrants, each with an exercise price of $0.000001, which contain a provision prohibiting the exercise thereof until Victory’s shareholders

approve an amendment to the Victory articles of incorporation, increasing the Authorization Limit to a number of shares that is sufficient

to allow for the exercise of such Victory Pre-funded Warrants in full.

(b) Cancelation

and Exchange of the Series D Preferred Stock. The Series D Holder has agreed to the cancellation

and exchange of his 8,333 shares of Series D Preferred Stock for 3,961,539 Pre-funded Warrants at the Effective Time.

(c) Amendment

Increasing the Authorization Limit. As soon as practicable after the Closing, the H2EG Stockholders,

as owners of 81% of the issued and outstanding Victory Common Stock on a post-Closing basis, shall vote in favor of, and shall cause Victory

to take all necessary actions to effect, an amendment to Victory’s articles of incorporation to increase the Authorization Limit

thereunder to at least 1,170,318,154 shares of Common Stock, which is an amount that is sufficient to allow for the issuance of:

(1)

175,822,708 shares of Victory Common Stock to the H2EG Stockholders according to Section 2.3(b);

(2) 43,095,923

shares of Victory Common Stock upon exercise of the Pre-funded Warrants being issued to Visionary according to Section 5.8(a);

(3) 67,797,000

shares of Victory Common Stock upon the conversion of Victory Preferred Stock being granted to Flagstaff according to the Flagstaff Financing

Agreement;

(4) 3,961,539

shares of Victory Common Stock upon exercise of the Victory Pre-funded Warrants being issued to the Series D Holder according to Section

5.8(b);

(5)

3,350,000 shares of Victory Common Stock upon the cashless exercise of 3,350,000 warrants which

Victory will issue to current employees and Victory board members to compensate each for services provided;

(6)

2,882,634 shares of Victory Common Stock upon the exercise of up to 2,882,634 Reissue Warrants

(defined below); and

(7)

the reservation of Common Stock for issuance under Victory’s 2014 Long Term Incentive

Plan, and the 2017 Equity Incentive Plan, as the same may be amended from time to time.

(d) Victory

Reissue Warrants. As soon as practicable following the Closing, Victory will solicit the holders

of 2,881,871 warrants to purchase Victory Common Stock that were previously issued and have since expired, and 763 warrants to purchase

Victory Common Stock that are currently outstanding but which Victory expects will expire before the exercise thereof, the latest of which

having an expiration date of December 31, 2024, and issue up to 2,882,634 new warrants (the “Reissue Warrants”)

to such holders in exchange for a release by such holders of any and all claims against Victory. The Reissue Warrants will contain an

exercise limitation that prohibits the exercise of such Reissue Warrants until Victory has increased its Authorization Limit to a number

of shares that is sufficient to allow for the exercise of such Reissue Warrants in full.”

10. Amendments

to Section 7.1(f). Section 7.1(f) of the Merger Agreement is hereby amended and restated in its entirety as

follows:

“(f) Board

Nominees. In accordance with Section 5.5 of the Merger Agreement and subject to compliance with

Rule 14F-1 of the Exchange Act, the size of the Board of Directors of Victory will be increased to five (5) members and will consist of

the following directors: Chris Headrick, who will serve as Chairman of the board of directors, Kevin DeLeon, Jim McGinley, Neil Goulden

and one director to be selected by Flagstaff according to the terms of the Flagstaff Financing Agreement. H2EG will provide an agreement

of each such individual to perform such background and credit checks of such individual. Unless removed for cause, death or disability,

the two individuals who are presently serving on the board of directors of Victory and who will continue to serve on the board of directors

of Victory will so serve until the next annual meeting of the stockholders of Victory; provided, however, that unless such individuals

fail to provide his consent or unless such individuals have committed a “bad actor” disqualification event of the type described

in Rule 506(d) of the Securities Act, Victory shall nominate such individuals to serve as directors at such next annual meeting of the

stockholders.”

11.

Addition of Schedule 4.2(a). Schedule 4.2(a), attached hereto as Exhibit A to this Amendment

is added to the Victory Disclosure Schedule attached to the Merger Agreement.

12.

Addition of Schedule 4.2(b). Schedule 4.2(b), attached hereto as Exhibit B to this Amendment

is added to the Victory Disclosure Schedule attached to the Merger Agreement.

13.

Amendments to Schedule 4.2(c). Schedule 4.2(c) of the Merger Agreement is hereby amended and restated

in its entirety, and attached hereto as Exhibit C.

14.

Representations and Warranties. Each party represents and warrants that it has all necessary rights

and authority to enter into this Amendment, and that this Amendment has been duly and validly executed and delivered and, assuming due

authorization and execution by the other parties hereto, constitutes its legal, valid, and binding obligation enforceable against it

in accordance with its terms.

15.

Defined Terms; Conflict. Capitalized terms used but not defined herein shall have the meaning assigned

to them in the Merger Agreement. In the event of any conflict between the Merger Agreement and this Amendment, this Amendment will control.

16. No

Other Modification. The Merger Agreement shall not be modified by this Amendment in any respect except as expressly set forth

herein.

17.

Governing Law. This Amendment will be governed by and construed in accordance with the Laws of the

State of New York, regardless of the Laws that might otherwise govern under applicable principles of conflicts of laws thereof. Each

of the parties hereto irrevocably consents to the exclusive jurisdiction and venue of any court within the State of New York in connection

with any matter based upon or arising out of this Amendment or the matters contemplated herein, agrees that process may be served upon

them in any manner authorized by the Laws of the State of New York for such persons and waives and covenants not to assert or plead any

objection which they might otherwise have to such jurisdiction, venue and such process.

18. Counterparts.

This Amendment No.1 may be executed in counterparts, each of which shall constitute an original and all of which taken together

shall constitute one and the same instrument. This Amendment may be executed by facsimile, scan, PDF, or other electronic means

(e.g., DocuSign), and each counterpart, facsimile or electronic copy shall have the same force and effect as an original and

shall constitute an effective, binding agreement on the part of each of the undersigned.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties

hereto have caused this Amendment to be duly executed as of the date first set forth above.

| |

H2 ENERGY GROUP INC. |

| |

|

| |

By: |

/s/ Christopher L. Headrick |

| |

Name: |

Christopher L. Headrick |

| |

Title: |

Founder & Chairman |

| |

|

|

| |

Address: |

810 Woodbine Ave. |

| |

|

Oak Park, IL 60302 |

| |

|

| |

Email: |

c.headrick@h2eg.com |

| |

|

| |

VICTORY OILFIELD TECH, INC. |

| |

|

| |

By: |

/s/ Kevin DeLeon |

| |

Name: |

Kevin DeLeon |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

Address: |

3355 Bee Caves Road, Suite 608, |

| |

|

Austin, Texas 78746 |

| |

|

| |

Email: |

kdeleon@vpeg.net |

| |

|

| |

VICTORY H2EG MERGER SUB INC. |

| |

|

| |

By: |

/s/ Ronald Zamber |

| |

Name: |

Ronald Zamber |

| |

Title: |

Director |

| |

|

|

| |

Address: |

3355 Bee Caves Road, Suite 608, |

| |

|

Austin, Texas 78746 |

| |

|

| |

Email: |

rzamber@vpeg.net |

[Exhibits Follow]

EXHIBIT A

SCHEDULE 4.2(a)

(See Attached)

Schedule 4.2(a)

The authorized capital stock of the Company immediately

prior to the Closing is as follows:

| | |

Authorized (1) | | |

Shares

Outstanding | | |

Shares

Outstanding

Fully Diluted | | |

% Owned

Fully Diluted | |

| Stock: | |

| | |

| | |

| | |

| |

| Common Stock | |

| 300,000,000 | | |

| 28,591,593 | | |

| 28,591,593 | | |

| 33 | % |

| Subtotal: | |

| 300,000,000 | | |

| 28,591,593 | | |

| 28,591,593 | (2) | |

| 33 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Convertible Securities: | |

| | | |

| | | |

| | | |

| | |

| New Warrants to Victory Board and Employees | |

| | | |

| | | |

| 3,350,000 | (3) | |

| 4 | % |

| Reissued Warrants | |

| | | |

| | | |

| 2,882,634 | (3),

(4) | |

| 3 | % |

| Visionary Convertible Note | |

| | | |

| | | |

| 50,961,957

| (5) | |

| 60 | % |

| Subtotal: | |

| | | |

| | | |

| 85,786,184 | | |

| 67 | % |

| | |

| | | |

| | | |

| | | |

| | |

| TOTALS: | |

| 300,000,000 | | |

| 28,591,593 | | |

| 85,786,184 | (6) | |

| 100.00 | % |

| (1) | Victory has reserved 2,000,000, and 570,000,000 shares of Common Stock for issuance upon exercise of awards

issued pursuant to the Company’s 2014 Long Term Incentive Plan, or the 2017 Equity Incentive Plan, respectively. However, due to

the Authorization Limit, the Company’s Board of Directors has adopted a resolution that they will not issue any more awards under

the plans until the Company has enough authorized capital stock. |

| (2) | Does not include: (i) 20,000 shares of Series D Preferred Stock, par value $0.001 per share, of which

8,333 shares are issued and outstanding, and which the holder thereof has agreed to the conversion of such Series D Preferred Stock into

3,961,539 Victory Pre-funded Warrants at the Effective Time. The Victory Pre-funded Warrants contain a provision prohibiting the exercise

thereof until Victory’s shareholders approve an amendment to the Victory articles of incorporation, increasing the Authorization

Limit; |

| (3) | The New Warrants and Reissued Warrants will contain a provision which prohibits the exercising thereof

until Victory’s shareholders approve an amendment to the Victory articles of incorporation, increasing the Authorization Limit. |

| (4) | Includes 2,881,871 warrants to purchase Victory Common Stock that were previously issued and have since

expired, and 763 warrants to purchase Victory Common Stock that are currently outstanding but which Victory expects will expire before

the exercise thereof, the latest of which having an expiration date of December 31, 2024. |

| (5) | Visionary will receive an amount of Victory Common Stock and Victory Pre-funded Warrants which will equal

50,961,957 shares of Victory Common Stock on a fully diluted basis after the Closing. The Victory Pre-funded Warrants contain a provision

prohibiting the exercise thereof until Victory’s shareholders approve an amendment to the Victory articles of incorporation, increasing

the Authorization Limit. |

| (6) | This value does not account for 19,440,678 shares of Common Stock which are reserved for issuance in the

Financing. |

EXHIBIT B

SCHEDULE 4.2(b)

(See Attached)

Schedule 4.2(b)

The following is a list of all Victory Benefit Plans:

| 1. | The Victory Oilfield Tech. Inc. 2014 Long Term Incentive Plan; |

| 2. | The Victory Oilfield Tech. Inc. 2017 Equity Incentive Plan. |

EXHIBIT C

AMENDED AND RESTATED SCHEDULE 4.2(c)

(See Attached)

Schedule 4.2(c)

All Victory securities, and

agreements or commitments that result in the issuance thereof, that are required to be disclosed in this Schedule 4.2(c) which were issued

or executed prior to November 24, 2017, the effective date of the Company’s 1-for-38 reverse stock split according to the filing

of the Company’s Amended and Restated Articles of Incorporation on November 21, 2017, will be disclosed on a post-split basis. 1

The following is a complete

list of Victory’s outstanding options for the purchase of an aggregate of 211,186 shares of common stock:

| Issuance Date | |

Name | |

Number

of Shares | | |

Strike

Price | | |

Vesting

(months) | | |

Vesting

Complete | |

Vested

Shares | | |

Term

(years) | | |

Expiration

Date | |

LTIP? | |

| 4/23/2014 | |

Kenny Hill | |

| 3,948 | | |

$ | 13.30 | | |

36 | | |

4/23/2014 | |

| 3,948 | | |

10 | | |

4/23/2024 | |

Yes | |

| 8/28/2015 | |

Kenny Hill | |

| 9,869 | | |

$ | 10.26 | | |

36 | | |

8/28/2018 | |

| 9,869 | | |

10 | | |

8/28/2025 | |

Yes | |

| 8/21/2017 | |

Kenny Hill | |

| 197,369 | | |

$ | 1.52 | | |

36 | | |

8/31/2020 | |

| 197,369 | | |

10 | | |

8/21/2027 | |

Yes | |

| TOTAL | |

| |

| 211,186 | | |

| | | |

| | |

| |

| 211,186 | | |

| | |

| |

| |

The following is a complete

list of Victory’s outstanding warrants for the purchase of an aggregate of 2,882,6342,3 shares of common stock:

| Purpose | |

Holder | |

Issuance

Date | |

Exercise

Price | | |

Warrants

Outstanding | | |

Expiration

Date |

| Services | |

James Capital Consulting | |

12/31/2008 | |

$ | 9.50 | | |

| 472 | | |

12/31/23 |

| Services | |

James Capital Consulting | |

3/31/2009 | |

$ | 9.50 | | |

| 188 | | |

3/30/24 |

| Services | |

James Capital Consulting | |

6/30/2009 | |

$ | 9.50 | | |

| 43 | | |

6/29/24 |

| Services | |

James Capital Consulting | |

9/30/2009 | |

$ | 9.50 | | |

| 8 | | |

9/29/24 |

| Services | |

James Capital Consulting | |

12/31/2009 | |

$ | 9.50 | | |

| 52 | | |

12/30/24 |

| Re-issuance | |

| |

| |

$ | 0.075914 | | |

| 2,881,871 | | |

|

| TOTAL | |

| |

| |

| | | |

| 2,882,634 | | |

|

The following is a complete list of Victory’s outstanding convertible

notes:

| Purpose | |

Holder | |

Issuance

Date | |

Principal Plus

Accrued Interest | | |

Conversion

Price | | |

Shares Issuable

Upon Conversion | |

| Financing | |

Visionary Private Equity Group I, LP | |

9/3/2021 | |

$ | 3,868,726.00 | | |

$ | 0.075914 | 4 | |

| 50,961,957 | 5 |

| 1 | In addition to the securities described in this Schedule 4.2(c)

and the footnotes thereto, Victory intends to compensate two key Pro-Tech employees for their service, and amount to be determined. |

| 2 | This number includes 2,881,871 expired warrants that Victory

intends to reissue at an exercise price of $0.075914 and such warrants will be exercisable on a cashless basis, and the unexpired warrants

listed in the table which Victory expects to reissue as a part of the Reissued Warrants. These Reissued Warrants will not be exercisable

until Victory has sufficient authorized capital stock after giving effect to the Meger Agreement. |

| 3 | Victory intends to issue 3,350,000 of warrants: (i) the current

directors of Victory as compensation for services, and (ii) Kevin DeLeon as a finder’s fee in connection with the Merger Agreement,

in each case at an exercise price of $0.075914 and exercisable on a cashless basis. Any warrants issued to the current directors of Victory

as compensation or to Kevin DeLeon as a finder’s fee will not be exercisable until Victory has sufficient authorized capital stock

after giving effect to the Meger Agreement. |

| 4 | The principal and accrued interest of the Visionary Private

Equity Group I, LP Note as of June 15, 2023 will be convertible into common stock at an assumed exercise price of $0.075914 after an

amendment to the note. |

| 5 | Visionary will receive an amount of Victory Common Stock and

Victory Pre-funded Warrants which will equal 50,961,957 shares of Victory Common Stock on a fully diluted basis after the Closing. The

Victory Pre-funded Warrants will contain a provision that prohibits the exercising thereof until Victory’s shareholders approve

an amendment to the Victory articles of incorporation, increasing the Authorization Limit. |

Schedule 4.2(c) Cont.

Pro-Tech Hardbanding Services,

Inc.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

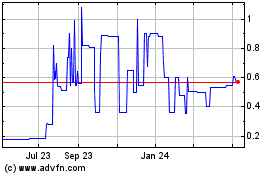

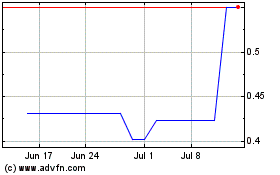

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Apr 2023 to Apr 2024