UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO

FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 1)1

eGain Corporation

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

28225C806

(CUSIP Number)

MR. DAVID L. KANEN

KANEN WEALTH MANAGEMENT, LLC

5850 Coral Ridge Drive, Suite 309

Coral Springs, FL 33076

(631) 863-3100

November 30, 2023

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g), check the following box ý.

Note. Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies

are to be sent.

(Continued on following pages)

1 The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on

the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange

Act of 1934 or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PHILOTIMO FUND, LP

|

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE

|

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

1,680,159*

|

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

1,680,159* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

1,680,159* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.3%

|

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IA,

PN |

|

* Includes 125,000 Shares underlying

certain currently exercisable call options.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PHILOTIMO

FOCUSED GROWTH AND INCOME FUND

|

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC

|

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE

|

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

496,155

|

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

496,155 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

496,155 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

1.6%

|

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IA,

OO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

KANEN WEALTH MANAGEMENT, LLC

|

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO; AF

|

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

FLORIDA

|

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

2,359,485* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

2,359,485* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

2,359,485* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

7.5%

|

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IA,

OO |

|

* Includes 125,000 Shares underlying certain currently exercisable

call options.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

DAVID L. KANEN

|

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

PF; OO

|

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA

|

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

22,429

|

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

2,359,485* |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

22,429 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

2,359,485* |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

2,381,914* |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

7.6%

|

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

* Includes 125,000 Shares underlying certain currently exercisable call

options.

The following constitutes Amendment

No. 1 to the Schedule 13D filed by the undersigned (the “Amendment No. 1”). This Amendment No. 1 amends the Schedule 13D as

specifically set forth herein.

| Item 3. | Source and Amount of Funds or Other Consideration. |

Item 3 is hereby amended and

restated as follows:

The Shares purchased by Philotimo

were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course

of business) in open market transactions. The Shares purchased by PHLOX were purchased with the funds for the accounts of its customers

(which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business) in open market transactions.

The Shares purchased by KWM were purchased with the funds for the accounts of its customers (which may, at any given time, include margin

loans made by brokerage firms in the ordinary course of business) in open market transactions. The Shares purchased by Mr. Kanen were

purchased with personal funds (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business)

in open market transactions. The aggregate purchase price of the 1,555,159 Shares beneficially owned by Philotimo is approximately $13,700,951,

including brokerage commissions. The aggregate purchase price of the call options beneficially owned by Philotimo, which are exercisable

into 125,000 Shares, is approximately $295,624, including brokerage commissions. The aggregate purchase price of the 496,155 Shares beneficially

owned by PHLOX is approximately $4,485,241, including brokerage commissions. The aggregate purchase price of the 183,171 Shares held in

the Managed Accounts is approximately $1,612,821, including brokerage commissions. The aggregate purchase price of the 22,429 Shares beneficially

owned by Mr. Kanen is approximately $194,684, including brokerage commissions.

| Item 4. | Purpose of the Transaction/ |

Item 4 is hereby

amended to add the following:

On December 4, 2023, the Reporting

Persons sent an open letter to the Issuer’s Board of Directors (the “Board”) detailing the Reporting Persons’

concerns with the Issuer’s performance to date under CEO Ashutosh Roy and requesting that the Board retain an investment bank and

form a special committee with the purpose of selling the Issuer to a third party (the “Open Letter”). A copy of the Open Letter

is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

| Item 5. | Interest in Securities of the Issuer. |

Items 5(a) – (c) are hereby

amended and restated as follows:

The aggregate percentage of

Shares reported owned by each person named herein is based upon 31,485,186 Shares outstanding as of November 2, 2023 as reported in the

Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on November 7, 2023.

| (a) | As of the close of business on December 4, 2023, Philotimo beneficially owned 1,680,159 Shares. |

Percentage: Approximately 5.3%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 1,680,159

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 1,680,159 |

| (c) | The transactions in the Shares by Philotimo during the past sixty days are set forth in Schedule A and

are incorporated herein by reference. |

| (a) | As of the close of business on December 4, 2023, PHLOX beneficially owned 496,155 Shares. |

Percentage: Approximately 1.6%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 496,155

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 496,155 |

| (c) | The transactions in the Shares by PHLOX during the past sixty days are set forth in Schedule A and are

incorporated herein by reference. |

| (a) | As of the close of business on December 4, 2023, KWM beneficially owned 2,359,485 Shares, consisting of

(i) the 1,680,159 Shares owned directly by Philotimo, which KWM may be deemed to beneficially own as the general partner of Philotimo,

(ii) the 496,155 Shares owned directly by PHLOX, which KWM may be deemed to beneficially own as the investment manager of PHLOX and (iii)

183,171 Shares held in the Managed Accounts. |

Percentage: Approximately 7.5%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 2,359,485

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 2,359,485 |

| (c) | The transactions in the Shares by KWM during the past sixty days are set forth in Schedule A and are incorporated

herein by reference. The transactions in the Shares by Philotimo and PHLOX are also set forth in Schedule A and incorporated by reference. |

| (a) | As of the close of business on December 4, 2023, Mr. Kanen beneficially owned 2,381,914 Shares, consisting

of (i) 22,429 Shares directly owned by him and (ii) 2,359,485 Shares beneficially owned by KWM, which Mr. Kanen may be deemed to beneficially

own as the managing member of KWM. |

Percentage: Approximately 7.6%

| (b) | 1. Sole power to vote or direct vote: 22,429

2. Shared power to vote or direct vote: 2,359,485

3. Sole power to dispose or direct the disposition: 22,429

4. Shared power to dispose or direct the disposition: 2,381,914 |

| (c) | Mr. Kanen has not entered into transactions in the Shares during the past sixty days. |

KWM, in its role as investment

manager to the Managed Accounts, to which it furnishes investment advice, and Mr. Kanen, as the managing member of KWM, may each be deemed

to beneficially own shares of the Issuer’s Shares held in the Managed Accounts.

| (d) | No person other than the Reporting Persons is known to have the right to receive, or the power to direct

the receipt of dividends from, or proceeds from the sale of, the Shares. |

| Item 6. | Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Item 6 is hereby amended to

add the following:

Philotimo has purchased in the

over-the-counter market American-style call options referencing an aggregate of 125,000 Shares, which have a strike price of $5 and expire

on May 17, 2024.

Item 7. Material to be

Filed as Exhibits.

99.1 Open

Letter, dated December 4, 2023.

SIGNATURES

After reasonable inquiry and

to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: December 4, 2023

| |

Kanen Wealth Management, LLC |

| |

|

| |

By: |

/s/ David L. Kanen |

| |

|

Name: |

David L. Kanen |

| |

|

Title: |

Managing Member |

| |

Philotimo Fund, LP |

| |

|

| |

By: |

Kanen Wealth Management, LLC, its general partner |

| |

|

|

| |

By: |

/s/ David L. Kanen |

| |

|

Name: |

David L. Kanen |

| |

|

Title: |

Managing Member |

| |

Philotimo Focused Growth and Income Fund |

| |

|

| |

By: |

Kanen Wealth Management, LLC, its investment adviser |

| |

|

|

| |

By: |

/s/ David L. Kanen |

| |

|

Name: |

David L. Kanen |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

/s/ David L. Kanen |

| |

David L. Kanen |

SCHEDULE A

Transactions in the Shares of the Issuer

During the Past Sixty Days

| Nature of the Transaction |

Amount of Shares

Purchased/(Sold) |

Price ($) |

Date of

Purchase/Sale |

PHILOTIMO

FUND, LP

| Purchase of Common Stock |

392 |

5.8000 |

10/27/2023 |

| Purchase of Common Stock |

42,580 |

7.1150 |

11/17/2023 |

| Purchase of Call Options ($5.00 Strike Price) |

125,000 |

2.3498 |

11/17/2023 |

| Purchase of Common Stock |

42,900 |

7.3512 |

11/20/2023 |

| Purchase of Common Stock |

6,519 |

7.4642 |

11/21/2023 |

| Purchase of Common Stock |

7,609 |

7.4950 |

11/22/2023 |

| Purchase of Common Stock |

4,453 |

7.4808 |

11/28/2023 |

| Purchase of Common Stock |

6,172 |

7.4960 |

11/29/2023 |

| Purchase of Common Stock |

9,486 |

7.5317 |

11/30/2023 |

PHILOTIMO

FOCUSED GROWTH AND INCOME FUND

| Purchase of Common Stock |

18,386 |

7.3512 |

11/20/2023 |

| Purchase of Common Stock |

2,794 |

7.4642 |

11/21/2023 |

| Purchase of Common Stock |

3,261 |

7.4950 |

11/22/2023 |

| Purchase of Common Stock |

1,908 |

7.4808 |

11/28/2023 |

| Purchase of Common Stock |

2,645 |

7.4960 |

11/29/2023 |

| Purchase of Common Stock |

4,065 |

7.5317 |

11/30/2023 |

KANEN

WEALTH MANAGEMENT, llC (through the Managed Accounts)

| Sale of Common Stock |

7,921 |

7.69261 |

11/27/2023 |

1

The reported price represents a weighted average sale price. The range of prices at which the Shares were sold was $7.67 to $7.77 per

share. The Reporting Person undertakes to provide to the Staff, the Issuer or a security holder full information regarding the number

of shares sold at each separate price.

CORAL SPRINGS, Fla., December 4, 2023

Dear EGAN Board of Directors,

We, Kanen Wealth Management, LLC, owner of approximately 7% of eGain

Corporation’s (“EGAN” or the “Company”) common shares, are calling on the board to formally hire an investment

banker and form a special committee to pursue a sale of the Company. Under CEO Ashu Roy’s leadership, EGAN’s stock is down

approximately 40% since the Company’s IPO 24 years ago in 1999 versus the NASDAQ gain of approximately 500%. The above scorecard

speaks for itself! We will attempt to provide some insight into the various reasons we believe the Company has materially underperformed

and how Mr. Roy is incapable, in our opinion, of realizing the potential of EGAN for shareholders, despite the Company’s high-quality

products, the Company’s position in the “magic quadrant,” and recent momentum in EGAN’s sales funnel. We believe

the problem is Ashu Roy and he has failed shareholders!

Some examples of his arrogant, ineffective, and unsuccessful behavior

for shareholders are below:

| 1. | FAILURE IN BUILDING A THRIVING SALES ORGANIZATION |

We have spoken with several former EGAN sales representatives and have

received negative feedback on how Mr. Roy consistently micromanages, is overly involved in deals, is not responsive enough, is not flexible

enough on pricing, is difficult to deal with, and is highly rigid. One can debate the above as opinion or conjecture, however the Company’s

failure to close new deals up until recently corroborates this feedback.

| 2. | HOLDING A MAJOR SALES CONFERENCE ON YOM KIPPUR |

This fall, under Mr. Roy’s leadership, he chose to hold what

is likely the most important sales event for the year on a holiday that excluded Jewish people. At best, this was an ignorant, obtuse

decision, which seems to be consistent with Mr. Roy’s other behaviors, but regardless of “why,” it remains a moronic

decision!

| 3. | ASHU’S OBTUSE, UNENGAGED BEHAVIOR WITH COUNTERPARTIES, WHEN INTRODUCTIONS WERE MADE EARLIER THIS YEAR |

Earlier this year, KWM made several introductions via email to private

equity firms interested in acquiring EGAN. We made these introductions with his consent and approval. What we witnessed thereafter was

an arrogant CEO who could not be bothered to reply to an email or even get on the phone. Rather, for the most part, he delegated to his

CFO, despite Mr. Roy owning 29% of the company. As the saying goes, “actions speak louder than words.” Mr. Roy’s actions

shout, “I don’t give a crap!”

| 4. | IMPROPER HANDLING OF A RECENT INTRODUCTION TO A BOARD CANDIDATE THAT IS A PROVEN SOFTWARE CEO AND ROCKSTAR |

This candidate, in four years, built a SaaS company from $50M to $500M,

with half of the growth being organic and the other half inorganic. Mr. Roy cannot hold a candle to this person. Sadly, again, Mr. Roy’s

actions speak loud and clear! Instead of personally speaking with him, he had one board member conduct a phone interview a month ago,

with ZERO FOLLOW UP!

Mr. Roy, is this how you engage with sales prospects and your sales

personnel? YOU NEED TO GO, ASHU! YOU DON’T KNOW HOW TO WIN!

In summary, EGAN directors, we ask that you kindly act on your fiduciary

responsibility to shareholders and run a legitimate process to sell the company – a process that doesn’t rely exclusively

on Mr. Roy’s lack of talent in generating a positive outcome. Form a committee!

Sincerely,

David Kanen

President/CEO

Kanen Wealth Management

dkanen@kanenadvisory.com

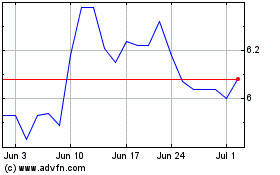

eGain (NASDAQ:EGAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

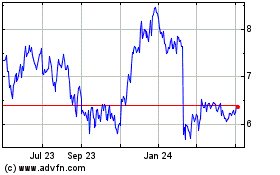

eGain (NASDAQ:EGAN)

Historical Stock Chart

From Apr 2023 to Apr 2024