false2024Q20000891024--04-27http://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#OtherNonoperatingIncomeExpense36431446326900008910242023-04-302023-10-2800008910242023-11-20xbrli:shares00008910242023-10-28iso4217:USD00008910242023-04-29iso4217:USDxbrli:shares00008910242023-07-302023-10-2800008910242022-07-312022-10-2900008910242022-05-012022-10-290000891024us-gaap:CommonStockMember2022-04-300000891024us-gaap:AdditionalPaidInCapitalMember2022-04-300000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-300000891024us-gaap:RetainedEarningsMember2022-04-300000891024us-gaap:NoncontrollingInterestMember2022-04-3000008910242022-04-300000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-05-012022-07-3000008910242022-05-012022-07-300000891024us-gaap:RetainedEarningsMember2022-05-012022-07-300000891024us-gaap:NoncontrollingInterestMember2022-05-012022-07-300000891024us-gaap:CommonStockMember2022-05-012022-07-300000891024us-gaap:AdditionalPaidInCapitalMember2022-05-012022-07-300000891024us-gaap:CommonStockMember2022-07-300000891024us-gaap:AdditionalPaidInCapitalMember2022-07-300000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-300000891024us-gaap:RetainedEarningsMember2022-07-300000891024us-gaap:NoncontrollingInterestMember2022-07-3000008910242022-07-300000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-312022-10-290000891024us-gaap:RetainedEarningsMember2022-07-312022-10-290000891024us-gaap:NoncontrollingInterestMember2022-07-312022-10-290000891024us-gaap:CommonStockMember2022-07-312022-10-290000891024us-gaap:AdditionalPaidInCapitalMember2022-07-312022-10-290000891024us-gaap:CommonStockMember2022-10-290000891024us-gaap:AdditionalPaidInCapitalMember2022-10-290000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-290000891024us-gaap:RetainedEarningsMember2022-10-290000891024us-gaap:NoncontrollingInterestMember2022-10-2900008910242022-10-290000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-302023-01-2800008910242022-10-302023-01-280000891024us-gaap:RetainedEarningsMember2022-10-302023-01-280000891024us-gaap:NoncontrollingInterestMember2022-10-302023-01-280000891024us-gaap:CommonStockMember2022-10-302023-01-280000891024us-gaap:AdditionalPaidInCapitalMember2022-10-302023-01-280000891024us-gaap:CommonStockMember2023-01-280000891024us-gaap:AdditionalPaidInCapitalMember2023-01-280000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-280000891024us-gaap:RetainedEarningsMember2023-01-280000891024us-gaap:NoncontrollingInterestMember2023-01-2800008910242023-01-280000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-292023-04-2900008910242023-01-292023-04-290000891024us-gaap:RetainedEarningsMember2023-01-292023-04-290000891024us-gaap:NoncontrollingInterestMember2023-01-292023-04-290000891024us-gaap:CommonStockMember2023-01-292023-04-290000891024us-gaap:AdditionalPaidInCapitalMember2023-01-292023-04-290000891024us-gaap:CommonStockMember2023-04-290000891024us-gaap:AdditionalPaidInCapitalMember2023-04-290000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-290000891024us-gaap:RetainedEarningsMember2023-04-290000891024us-gaap:NoncontrollingInterestMember2023-04-290000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-302023-07-2900008910242023-04-302023-07-290000891024us-gaap:RetainedEarningsMember2023-04-302023-07-290000891024us-gaap:NoncontrollingInterestMember2023-04-302023-07-290000891024us-gaap:CommonStockMember2023-04-302023-07-290000891024us-gaap:AdditionalPaidInCapitalMember2023-04-302023-07-290000891024us-gaap:CommonStockMember2023-07-290000891024us-gaap:AdditionalPaidInCapitalMember2023-07-290000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-290000891024us-gaap:RetainedEarningsMember2023-07-290000891024us-gaap:NoncontrollingInterestMember2023-07-2900008910242023-07-290000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-302023-10-280000891024us-gaap:RetainedEarningsMember2023-07-302023-10-280000891024us-gaap:NoncontrollingInterestMember2023-07-302023-10-280000891024us-gaap:CommonStockMember2023-07-302023-10-280000891024us-gaap:AdditionalPaidInCapitalMember2023-07-302023-10-280000891024us-gaap:CommonStockMember2023-10-280000891024us-gaap:AdditionalPaidInCapitalMember2023-10-280000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-280000891024us-gaap:RetainedEarningsMember2023-10-280000891024us-gaap:NoncontrollingInterestMember2023-10-280000891024pdco:MillerVetHoldingsLLCMember2023-04-302023-07-290000891024us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2023-04-302023-07-290000891024us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2022-10-302023-01-280000891024us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2023-01-280000891024pdco:ReceivablesPurchaseAgreementsMember2023-10-280000891024pdco:ReceivablesPurchaseAgreementsMember2023-04-290000891024pdco:ReceivablesPurchaseAgreementsMember2023-04-302023-10-280000891024pdco:ReceivablesPurchaseAgreementsMember2022-05-012022-10-290000891024pdco:ReceivablesPurchaseAgreementsMember2022-04-300000891024pdco:ReceivablesPurchaseAgreementsMember2022-10-29pdco:financingAgreement0000891024pdco:MitsubishiUFJFinancialGroupMember2023-04-302023-10-28xbrli:pure0000891024pdco:MitsubishiUFJFinancialGroupMember2023-10-280000891024pdco:FifthThirdNationalBankMember2023-04-302023-10-280000891024pdco:FifthThirdNationalBankMember2023-04-290000891024pdco:MitsubishiUFJFinancialGroupMember2023-07-290000891024pdco:CustomerFinanceContractsMember2023-07-302023-10-280000891024pdco:CustomerFinanceContractsMember2022-07-312022-10-290000891024pdco:CustomerFinanceContractsMember2023-04-302023-10-280000891024pdco:CustomerFinanceContractsMember2022-05-012022-10-290000891024pdco:UnsettledContractsMember2023-10-280000891024pdco:UnsettledContractsMember2023-04-290000891024pdco:CustomerFinanceContractsMember2023-04-290000891024pdco:CustomerFinanceContractsMember2022-04-300000891024pdco:CustomerFinanceContractsMember2023-10-280000891024pdco:CustomerFinanceContractsMember2022-10-290000891024us-gaap:InterestRateCapMember2023-10-280000891024pdco:InterestRateSwapAgreementMember2014-01-310000891024pdco:FivePointOneSevenPercentageSeniorNotesMember2014-01-310000891024pdco:A348SeniorNotesDue2025Member2015-03-250000891024pdco:InterestRateSwapAgreementMember2015-03-012015-03-310000891024us-gaap:InterestRateSwapMember2023-04-290000891024pdco:InterestRateSwapTwoMember2023-10-280000891024us-gaap:InterestRateSwapMember2023-10-280000891024pdco:InterestRateSwapAgreementMember2023-04-302023-10-280000891024pdco:InterestRateSwapAgreementMember2022-05-012022-10-290000891024us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:InterestRateContractMember2023-10-280000891024us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:InterestRateContractMember2023-04-290000891024us-gaap:OtherNoncurrentAssetsMemberus-gaap:InterestRateContractMember2023-10-280000891024us-gaap:OtherNoncurrentAssetsMemberus-gaap:InterestRateContractMember2023-04-290000891024pdco:OtherAccruedLiabilitiesMemberus-gaap:InterestRateContractMember2023-10-280000891024pdco:OtherAccruedLiabilitiesMemberus-gaap:InterestRateContractMember2023-04-290000891024us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:InterestRateContractMember2023-10-280000891024us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:InterestRateContractMember2023-04-290000891024us-gaap:InterestRateContractMember2023-07-302023-10-280000891024us-gaap:InterestRateContractMember2022-07-312022-10-290000891024us-gaap:InterestRateContractMember2023-04-302023-10-280000891024us-gaap:InterestRateContractMember2022-05-012022-10-290000891024us-gaap:NondesignatedMemberus-gaap:InterestRateContractMember2022-07-312022-10-290000891024us-gaap:NondesignatedMemberus-gaap:InterestRateContractMember2023-07-302023-10-280000891024us-gaap:NondesignatedMemberus-gaap:InterestRateContractMember2023-04-302023-10-280000891024us-gaap:NondesignatedMemberus-gaap:InterestRateContractMember2022-05-012022-10-290000891024us-gaap:FairValueInputsLevel1Member2023-10-280000891024us-gaap:FairValueInputsLevel2Member2023-10-280000891024us-gaap:FairValueInputsLevel3Member2023-10-280000891024us-gaap:FairValueInputsLevel1Member2023-04-290000891024us-gaap:FairValueInputsLevel2Member2023-04-290000891024us-gaap:FairValueInputsLevel3Member2023-04-290000891024pdco:VetsourceMember2023-10-280000891024pdco:VetsourceMember2023-04-290000891024pdco:TechnologyPartnerInnovationsLLCMember2019-04-282019-07-270000891024pdco:TechnologyPartnerInnovationsLLCMember2022-05-012023-04-290000891024pdco:TechnologyPartnerInnovationsLLCMember2023-04-302023-10-280000891024pdco:TechnologyPartnerInnovationsLLCMember2023-07-302023-10-280000891024pdco:TechnologyPartnerInnovationsLLCMember2022-07-312022-10-290000891024pdco:TechnologyPartnerInnovationsLLCMember2022-05-012022-10-29pdco:Segment0000891024country:US2023-07-302023-10-280000891024country:US2022-07-312022-10-290000891024country:US2023-04-302023-10-280000891024country:US2022-05-012022-10-290000891024country:GB2023-07-302023-10-280000891024country:GB2022-07-312022-10-290000891024country:GB2023-04-302023-10-280000891024country:GB2022-05-012022-10-290000891024country:CA2023-07-302023-10-280000891024country:CA2022-07-312022-10-290000891024country:CA2023-04-302023-10-280000891024country:CA2022-05-012022-10-290000891024country:USpdco:DentalSupplyMember2023-07-302023-10-280000891024country:USpdco:DentalSupplyMember2022-07-312022-10-290000891024country:USpdco:DentalSupplyMember2023-04-302023-10-280000891024country:USpdco:DentalSupplyMember2022-05-012022-10-290000891024country:CApdco:DentalSupplyMember2023-07-302023-10-280000891024country:CApdco:DentalSupplyMember2022-07-312022-10-290000891024country:CApdco:DentalSupplyMember2023-04-302023-10-280000891024country:CApdco:DentalSupplyMember2022-05-012022-10-290000891024pdco:DentalSupplyMember2023-07-302023-10-280000891024pdco:DentalSupplyMember2022-07-312022-10-290000891024pdco:DentalSupplyMember2023-04-302023-10-280000891024pdco:DentalSupplyMember2022-05-012022-10-290000891024pdco:AnimalHealthMembercountry:US2023-07-302023-10-280000891024pdco:AnimalHealthMembercountry:US2022-07-312022-10-290000891024pdco:AnimalHealthMembercountry:US2023-04-302023-10-280000891024pdco:AnimalHealthMembercountry:US2022-05-012022-10-290000891024pdco:AnimalHealthMembercountry:GB2023-07-302023-10-280000891024pdco:AnimalHealthMembercountry:GB2022-07-312022-10-290000891024pdco:AnimalHealthMembercountry:GB2023-04-302023-10-280000891024pdco:AnimalHealthMembercountry:GB2022-05-012022-10-290000891024pdco:AnimalHealthMembercountry:CA2023-07-302023-10-280000891024pdco:AnimalHealthMembercountry:CA2022-07-312022-10-290000891024pdco:AnimalHealthMembercountry:CA2023-04-302023-10-280000891024pdco:AnimalHealthMembercountry:CA2022-05-012022-10-290000891024pdco:AnimalHealthMember2023-07-302023-10-280000891024pdco:AnimalHealthMember2022-07-312022-10-290000891024pdco:AnimalHealthMember2023-04-302023-10-280000891024pdco:AnimalHealthMember2022-05-012022-10-290000891024us-gaap:CorporateMembercountry:US2023-07-302023-10-280000891024us-gaap:CorporateMembercountry:US2022-07-312022-10-290000891024us-gaap:CorporateMembercountry:US2023-04-302023-10-280000891024us-gaap:CorporateMembercountry:US2022-05-012022-10-290000891024us-gaap:CorporateMember2023-07-302023-10-280000891024us-gaap:CorporateMember2022-07-312022-10-290000891024us-gaap:CorporateMember2023-04-302023-10-280000891024us-gaap:CorporateMember2022-05-012022-10-290000891024pdco:ConsumablesMember2023-07-302023-10-280000891024pdco:ConsumablesMember2022-07-312022-10-290000891024pdco:ConsumablesMember2023-04-302023-10-280000891024pdco:ConsumablesMember2022-05-012022-10-290000891024pdco:EquipmentAndSoftwareMember2023-07-302023-10-280000891024pdco:EquipmentAndSoftwareMember2022-07-312022-10-290000891024pdco:EquipmentAndSoftwareMember2023-04-302023-10-280000891024pdco:EquipmentAndSoftwareMember2022-05-012022-10-290000891024pdco:OtherProductMember2023-07-302023-10-280000891024pdco:OtherProductMember2022-07-312022-10-290000891024pdco:OtherProductMember2023-04-302023-10-280000891024pdco:OtherProductMember2022-05-012022-10-290000891024pdco:ConsumablesMemberpdco:DentalSupplyMember2023-07-302023-10-280000891024pdco:ConsumablesMemberpdco:DentalSupplyMember2022-07-312022-10-290000891024pdco:ConsumablesMemberpdco:DentalSupplyMember2023-04-302023-10-280000891024pdco:ConsumablesMemberpdco:DentalSupplyMember2022-05-012022-10-290000891024pdco:EquipmentAndSoftwareMemberpdco:DentalSupplyMember2023-07-302023-10-280000891024pdco:EquipmentAndSoftwareMemberpdco:DentalSupplyMember2022-07-312022-10-290000891024pdco:EquipmentAndSoftwareMemberpdco:DentalSupplyMember2023-04-302023-10-280000891024pdco:EquipmentAndSoftwareMemberpdco:DentalSupplyMember2022-05-012022-10-290000891024pdco:OtherProductMemberpdco:DentalSupplyMember2023-07-302023-10-280000891024pdco:OtherProductMemberpdco:DentalSupplyMember2022-07-312022-10-290000891024pdco:OtherProductMemberpdco:DentalSupplyMember2023-04-302023-10-280000891024pdco:OtherProductMemberpdco:DentalSupplyMember2022-05-012022-10-290000891024pdco:ConsumablesMemberpdco:AnimalHealthMember2023-07-302023-10-280000891024pdco:ConsumablesMemberpdco:AnimalHealthMember2022-07-312022-10-290000891024pdco:ConsumablesMemberpdco:AnimalHealthMember2023-04-302023-10-280000891024pdco:ConsumablesMemberpdco:AnimalHealthMember2022-05-012022-10-290000891024pdco:AnimalHealthMemberpdco:EquipmentAndSoftwareMember2023-07-302023-10-280000891024pdco:AnimalHealthMemberpdco:EquipmentAndSoftwareMember2022-07-312022-10-290000891024pdco:AnimalHealthMemberpdco:EquipmentAndSoftwareMember2023-04-302023-10-280000891024pdco:AnimalHealthMemberpdco:EquipmentAndSoftwareMember2022-05-012022-10-290000891024pdco:AnimalHealthMemberpdco:OtherProductMember2023-07-302023-10-280000891024pdco:AnimalHealthMemberpdco:OtherProductMember2022-07-312022-10-290000891024pdco:AnimalHealthMemberpdco:OtherProductMember2023-04-302023-10-280000891024pdco:AnimalHealthMemberpdco:OtherProductMember2022-05-012022-10-290000891024us-gaap:CorporateMemberpdco:OtherProductMember2023-07-302023-10-280000891024us-gaap:CorporateMemberpdco:OtherProductMember2022-07-312022-10-290000891024us-gaap:CorporateMemberpdco:OtherProductMember2023-04-302023-10-280000891024us-gaap:CorporateMemberpdco:OtherProductMember2022-05-012022-10-290000891024us-gaap:OperatingSegmentsMemberpdco:DentalSupplyMember2023-07-302023-10-280000891024us-gaap:OperatingSegmentsMemberpdco:DentalSupplyMember2022-07-312022-10-290000891024us-gaap:OperatingSegmentsMemberpdco:DentalSupplyMember2023-04-302023-10-280000891024us-gaap:OperatingSegmentsMemberpdco:DentalSupplyMember2022-05-012022-10-290000891024pdco:AnimalHealthMemberus-gaap:OperatingSegmentsMember2023-07-302023-10-280000891024pdco:AnimalHealthMemberus-gaap:OperatingSegmentsMember2022-07-312022-10-290000891024pdco:AnimalHealthMemberus-gaap:OperatingSegmentsMember2023-04-302023-10-280000891024pdco:AnimalHealthMemberus-gaap:OperatingSegmentsMember2022-05-012022-10-290000891024us-gaap:CorporateMemberus-gaap:OperatingSegmentsMember2023-07-302023-10-280000891024us-gaap:CorporateMemberus-gaap:OperatingSegmentsMember2022-07-312022-10-290000891024us-gaap:CorporateMemberus-gaap:OperatingSegmentsMember2023-04-302023-10-280000891024us-gaap:CorporateMemberus-gaap:OperatingSegmentsMember2022-05-012022-10-290000891024us-gaap:OperatingSegmentsMemberpdco:DentalSupplyMember2023-10-280000891024us-gaap:OperatingSegmentsMemberpdco:DentalSupplyMember2023-04-290000891024pdco:AnimalHealthMemberus-gaap:OperatingSegmentsMember2023-10-280000891024pdco:AnimalHealthMemberus-gaap:OperatingSegmentsMember2023-04-290000891024us-gaap:CorporateMemberus-gaap:OperatingSegmentsMember2023-10-280000891024us-gaap:CorporateMemberus-gaap:OperatingSegmentsMember2023-04-290000891024us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-04-290000891024us-gaap:AccumulatedTranslationAdjustmentMember2023-04-290000891024us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-04-302023-10-280000891024us-gaap:AccumulatedTranslationAdjustmentMember2023-04-302023-10-280000891024us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-302023-10-280000891024us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-10-280000891024us-gaap:AccumulatedTranslationAdjustmentMember2023-10-280000891024pdco:KevinMBarryMember2023-07-302023-10-280000891024pdco:KevinMBarryMember2023-09-010000891024pdco:LesBKorshMember2023-07-302023-10-280000891024pdco:LesBKorshMember2023-09-220000891024pdco:DonaldJZurbayMember2023-07-302023-10-280000891024pdco:SamanthaLBergesonMember2023-07-302023-10-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 10-Q

____________________________________________________________ | | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED October 28, 2023. | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 0-20572

__________________________________________________________

PATTERSON COMPANIES, INC.

(Exact Name of Registrant as Specified in Its Charter)

____________________________________________________________ | | | | | | | | |

| Minnesota | 41-0886515 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer

Identification Number) |

| 1031 Mendota Heights Road | |

| St. Paul | Minnesota | 55120 |

| (Address of Principal Executive Offices) | (Zip Code) |

(651) 686-1600

(Registrant’s Telephone Number, Including Area Code)

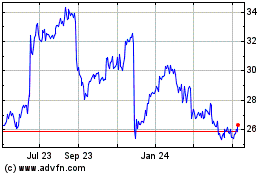

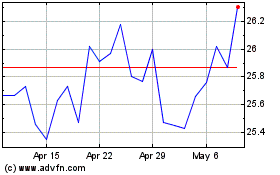

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Common Stock, par value $.01 | PDCO | NASDAQ Global Select Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ | | Non-accelerated filer | | ☐ |

| | | | | | |

| Smaller reporting company | | ☐ | | Emerging growth company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 20, 2023, there were 92,661,000 shares of Common Stock of the registrant issued and outstanding.

PATTERSON COMPANIES, INC.

PART I—FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

PATTERSON COMPANIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | |

| October 28, 2023 | | April 29, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 113,886 | | | $ | 159,669 | |

Receivables, net of allowance for doubtful accounts of $3,875 and $3,667 | 490,428 | | | 477,384 | |

| Inventory | 858,028 | | | 795,072 | |

| Prepaid expenses and other current assets | 328,334 | | | 351,011 | |

| Total current assets | 1,790,676 | | | 1,783,136 | |

| Property and equipment, net | 218,977 | | | 212,283 | |

| Operating lease right-of-use assets, net | 101,532 | | | 92,956 | |

| Long-term receivables, net | 121,030 | | | 121,717 | |

| Goodwill | 156,172 | | | 156,420 | |

| Identifiable intangibles, net | 212,179 | | | 231,873 | |

| Investments | 162,531 | | | 160,022 | |

| Other non-current assets, net | 126,593 | | | 120,739 | |

| Total assets | $ | 2,889,690 | | | $ | 2,879,146 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 688,687 | | | $ | 724,993 | |

| Accrued payroll expense | 54,718 | | | 82,253 | |

| Other accrued liabilities | 169,005 | | | 168,696 | |

| Operating lease liabilities | 30,132 | | | 28,390 | |

| Current maturities of long-term debt | 36,000 | | | 36,000 | |

| Borrowings on revolving credit | 170,000 | | | 45,000 | |

| Total current liabilities | 1,148,542 | | | 1,085,332 | |

| Long-term debt | 449,974 | | | 451,231 | |

| Non-current operating lease liabilities | 74,393 | | | 67,376 | |

| Other non-current liabilities | 161,692 | | | 156,672 | |

| Total liabilities | 1,834,601 | | | 1,760,611 | |

| Stockholders’ equity: | | | |

Common stock, $0.01 par value: 600,000 shares authorized; 94,089 and 96,350 shares issued and outstanding | 941 | | | 964 | |

| Additional paid-in capital | 249,490 | | | 233,706 | |

| Accumulated other comprehensive loss | (98,962) | | | (89,262) | |

| Retained earnings | 902,827 | | | 972,127 | |

| | | |

| Total Patterson Companies, Inc. stockholders' equity | 1,054,296 | | | 1,117,535 | |

| Noncontrolling interests | 793 | | | 1,000 | |

| Total stockholders’ equity | 1,055,089 | | | 1,118,535 | |

| Total liabilities and stockholders’ equity | $ | 2,889,690 | | | $ | 2,879,146 | |

See accompanying notes

PATTERSON COMPANIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND OTHER COMPREHENSIVE INCOME

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| Net sales | $ | 1,652,772 | | | $ | 1,626,204 | | | $ | 3,229,517 | | | $ | 3,149,469 | |

| Cost of sales | 1,313,746 | | | 1,298,115 | | | 2,571,436 | | | 2,509,247 | |

| Gross profit | 339,026 | | | 328,089 | | | 658,081 | | | 640,222 | |

| Operating expenses | 282,123 | | | 267,994 | | | 562,956 | | | 545,283 | |

| Operating income | 56,903 | | | 60,095 | | | 95,125 | | | 94,939 | |

| Other income (expense): | | | | | | | |

| | | | | | | |

| Other income, net | 7,096 | | | 18,203 | | | 18,997 | | | 19,983 | |

| Interest expense | (10,642) | | | (7,544) | | | (20,154) | | | (13,107) | |

| Income before taxes | 53,357 | | | 70,754 | | | 93,968 | | | 101,815 | |

| Income tax expense | 13,502 | | | 17,105 | | | 22,983 | | | 23,906 | |

| | | | | | | |

| | | | | | | |

| Net income | 39,855 | | | 53,649 | | | 70,985 | | | 77,909 | |

| Net loss attributable to noncontrolling interests | (103) | | | (424) | | | (207) | | | (754) | |

| Net income attributable to Patterson Companies, Inc. | $ | 39,958 | | | $ | 54,073 | | | $ | 71,192 | | | $ | 78,663 | |

| Earnings per share attributable to Patterson Companies, Inc.: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic | $ | 0.42 | | | $ | 0.56 | | | $ | 0.75 | | | $ | 0.81 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted | $ | 0.42 | | | $ | 0.55 | | | $ | 0.74 | | | $ | 0.81 | |

| Weighted average shares: | | | | | | | |

| Basic | 94,710 | | | 96,913 | | | 95,127 | | | 96,771 | |

| Diluted | 95,156 | | | 97,552 | | | 95,722 | | | 97,708 | |

| Dividends declared per common share | $ | 0.26 | | | $ | 0.26 | | | $ | 0.52 | | | $ | 0.52 | |

| Comprehensive income: | | | | | | | |

| Net income | $ | 39,855 | | | $ | 53,649 | | | $ | 70,985 | | | $ | 77,909 | |

| Foreign currency translation loss | (17,589) | | | (17,591) | | | (10,221) | | | (22,582) | |

| Cash flow hedges, net of tax | 260 | | | 260 | | | 521 | | | 521 | |

| Comprehensive income | $ | 22,526 | | | $ | 36,318 | | | $ | 61,285 | | | $ | 55,848 | |

See accompanying notes

PATTERSON COMPANIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-in

Capital | | Accumulated

Other

Comprehensive

Loss | | Retained

Earnings | | | | Non-controlling Interests | | Total |

| Shares | | Amount | | | | | | |

| Balance at April 30, 2022 | 96,762 | | | $ | 968 | | | $ | 200,520 | | | $ | (81,516) | | | $ | 921,704 | | | | | $ | 959 | | | $ | 1,042,635 | |

| Foreign currency translation | — | | | — | | | — | | | (4,991) | | | — | | | | | — | | | (4,991) | |

| Cash flow hedges | — | | | — | | | — | | | 261 | | | — | | | | | — | | | 261 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 24,590 | | | | | (330) | | | 24,260 | |

| Dividends declared | — | | | — | | | — | | | — | | | (25,667) | | | | | — | | | (25,667) | |

| Common stock issued | 653 | | | 6 | | | (2,148) | | | — | | | — | | | | | — | | | (2,142) | |

| Repurchases of common stock | (516) | | | (5) | | | — | | | — | | | (14,995) | | | | | — | | | (15,000) | |

| Stock-based compensation | — | | | — | | | 7,159 | | | — | | | — | | | | | — | | | 7,159 | |

| Contribution from noncontrolling interest | — | | | — | | | — | | | — | | | — | | | | | 500 | | | 500 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Balance at July 30, 2022 | 96,899 | | | 969 | | | 205,531 | | | (86,246) | | | 905,632 | | | | | 1,129 | | | 1,027,015 | |

| Foreign currency translation | — | | | — | | | — | | | (17,591) | | | — | | | | | — | | | (17,591) | |

| Cash flow hedges | — | | | — | | | — | | | 260 | | | — | | | | | — | | | 260 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 54,073 | | | | | (424) | | | 53,649 | |

| Dividends declared | — | | | — | | | — | | | — | | | (25,138) | | | | | — | | | (25,138) | |

| Common stock issued | 150 | | | 1 | | | 2,178 | | | — | | | — | | | | | — | | | 2,179 | |

| | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 1,234 | | | — | | | — | | | | | — | | | 1,234 | |

| Contribution from noncontrolling interest | — | | | — | | | — | | | — | | | — | | | | | 500 | | | 500 | |

| Balance at October 29, 2022 | 97,049 | | | 970 | | | 208,943 | | | (103,577) | | | 934,567 | | | | | 1,205 | | | 1,042,108 | |

| Foreign currency translation | — | | | — | | | — | | | 14,197 | | | — | | | | | — | | | 14,197 | |

| Cash flow hedges | — | | | — | | | — | | | 261 | | | — | | | | | — | | | 261 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 53,929 | | | | | (82) | | | 53,847 | |

| Dividends declared | — | | | — | | | — | | | — | | | (25,581) | | | | | — | | | (25,581) | |

| Common stock issued | 659 | | | 7 | | | 14,626 | | | — | | | — | | | | | — | | | 14,633 | |

| | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 2,956 | | | — | | | — | | | | | — | | | 2,956 | |

| | | | | | | | | | | | | | | |

| Balance at January 28, 2023 | 97,708 | | | 977 | | | 226,525 | | | (89,119) | | | 962,915 | | | | | 1,123 | | | 1,102,421 | |

| Foreign currency translation | — | | | — | | | — | | | (403) | | | — | | | | | — | | | (403) | |

| Cash flow hedges | — | | | — | | | — | | | 260 | | | — | | | | | — | | | 260 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 74,965 | | | | | (123) | | | 74,842 | |

| Dividends declared | — | | | — | | | — | | | — | | | (25,276) | | | | | — | | | (25,276) | |

| Common stock issued | 146 | | | 2 | | | 2,987 | | | — | | | — | | | | | — | | | 2,989 | |

| Repurchases of common stock | (1,504) | | | (15) | | | — | | | — | | | (40,477) | | | | | — | | | (40,492) | |

| Stock-based compensation | — | | | — | | | 4,194 | | | — | | | — | | | | | — | | | 4,194 | |

| | | | | | | | | | | | | | | |

| Balance at April 29, 2023 | 96,350 | | | $ | 964 | | | $ | 233,706 | | | $ | (89,262) | | | $ | 972,127 | | | | | $ | 1,000 | | | $ | 1,118,535 | |

See accompanying notes

PATTERSON COMPANIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-in

Capital | | Accumulated

Other

Comprehensive

Loss | | Retained

Earnings | | | | Non-controlling Interests | | Total |

| Shares | | Amount | | | | | | |

| Balance at April 29, 2023 | 96,350 | | | $ | 964 | | | $ | 233,706 | | | $ | (89,262) | | | $ | 972,127 | | | | | $ | 1,000 | | | $ | 1,118,535 | |

| Foreign currency translation | — | | | — | | | — | | | 7,368 | | | — | | | | | — | | | 7,368 | |

| Cash flow hedges | — | | | — | | | — | | | 261 | | | — | | | | | — | | | 261 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 31,234 | | | | | (104) | | | 31,130 | |

| Dividends declared | — | | | — | | | — | | | — | | | (25,134) | | | | | — | | | (25,134) | |

| Common stock issued | 565 | | | 5 | | | 1,569 | | | — | | | — | | | | | — | | | 1,574 | |

| Repurchases of common stock | (1,109) | | | (11) | | | — | | | — | | | (29,497) | | | | | — | | | (29,508) | |

| Stock-based compensation | — | | | — | | | 7,015 | | | — | | | — | | | | | — | | | 7,015 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Balance at July 29, 2023 | 95,806 | | | 958 | | | 242,290 | | | (81,633) | | | 948,730 | | | | | 896 | | | 1,111,241 | |

| Foreign currency translation | — | | | — | | | — | | | (17,589) | | | — | | | | | — | | | (17,589) | |

| Cash flow hedges | — | | | — | | | — | | | 260 | | | — | | | | | — | | | 260 | |

| Net income (loss) | — | | | — | | | — | | | — | | | 39,958 | | | | | (103) | | | 39,855 | |

| Dividends declared | — | | | — | | | — | | | — | | | (24,897) | | | | | — | | | (24,897) | |

| Common stock issued | 180 | | | 2 | | | 3,226 | | | — | | | — | | | | | — | | | 3,228 | |

| Repurchases of common stock | (1,897) | | | (19) | | | (661) | | | — | | | (60,964) | | | | | — | | | (61,644) | |

| Stock-based compensation | — | | | — | | | 4,635 | | | — | | | — | | | | | — | | | 4,635 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Balance at October 28, 2023 | 94,089 | | | $ | 941 | | | $ | 249,490 | | | $ | (98,962) | | | $ | 902,827 | | | | | $ | 793 | | | $ | 1,055,089 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

See accompanying notes

PATTERSON COMPANIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| | Six Months Ended |

| October 28, 2023 | | October 29, 2022 |

| Operating activities: | | | |

| Net income | $ | 70,985 | | | $ | 77,909 | |

| | | |

| | | |

| Adjustments to reconcile net income to net cash used in operating activities: | | | |

| Depreciation | 23,583 | | | 22,412 | |

| Amortization | 19,253 | | | 18,678 | |

| | | |

| | | |

| | | |

| Non-cash employee compensation | 11,650 | | | 8,393 | |

| | | |

| | | |

| | | |

| Non-cash losses (gains) and other, net | 3,166 | | | 5,085 | |

| | | |

| Change in assets and liabilities: | | | |

| Receivables | (487,186) | | | (508,811) | |

| Inventory | (67,416) | | | (100,596) | |

| Accounts payable | (30,911) | | | 41,557 | |

| Accrued liabilities | (24,908) | | | (47,519) | |

| | | |

| Other changes from operating activities, net | (3,492) | | | (37,269) | |

| | | |

| | | |

| Net cash used in operating activities | (485,276) | | | (520,161) | |

| Investing activities: | | | |

| Additions to property and equipment and software | (33,467) | | | (26,779) | |

| Collection of deferred purchase price receivables | 489,452 | | | 489,639 | |

| Payments related to acquisitions, net of cash acquired | (1,108) | | | — | |

| Payments related to investments | — | | | (15,000) | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by investing activities | 454,877 | | | 447,860 | |

| Financing activities: | | | |

| Dividends paid | (50,331) | | | (50,732) | |

| Repurchases of common stock | (90,491) | | | (15,000) | |

| | | |

| | | |

| | | |

| Payments on long-term debt | (1,500) | | | — | |

| Draw on revolving credit | 125,000 | | | 145,000 | |

| Other financing activities | 4,141 | | | (1,766) | |

| Net cash provided by (used in) financing activities | (13,181) | | | 77,502 | |

| Effect of exchange rate changes on cash | (2,203) | | | (6,935) | |

| Net change in cash and cash equivalents | (45,783) | | | (1,734) | |

| Cash and cash equivalents at beginning of period | 159,669 | | | 142,014 | |

| Cash and cash equivalents at end of period | $ | 113,886 | | | $ | 140,280 | |

| | | |

| Supplemental disclosure of non-cash investing activity: | | | |

| Retained interest in securitization transactions | $ | 465,058 | | | $ | 479,797 | |

See accompanying notes

PATTERSON COMPANIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Dollars, except per share amounts, and shares in thousands)

(Unaudited)

Note 1. General

Basis of Presentation

In the opinion of management, the accompanying unaudited condensed consolidated financial statements contain all adjustments necessary to present fairly the financial position of Patterson Companies, Inc. (referred to herein as "Patterson" or in the first person notations "we," "our," and "us") as of October 28, 2023, and our results of operations and cash flows for the periods ended October 28, 2023 and October 29, 2022. Such adjustments are of a normal, recurring nature. The results of operations for the three and six months ended October 28, 2023 are not necessarily indicative of the results to be expected for any other interim period or for the year ending April 27, 2024. These financial statements should be read in conjunction with the financial statements included in our 2023 Annual Report on Form 10-K filed on June 21, 2023.

The unaudited condensed consolidated financial statements include the assets and liabilities of PDC Funding Company, LLC ("PDC Funding"), PDC Funding Company II, LLC ("PDC Funding II"), PDC Funding Company III, LLC ("PDC Funding III") and PDC Funding Company IV, LLC ("PDC Funding IV"), which are our wholly owned subsidiaries and separate legal entities formed under Minnesota law. PDC Funding and PDC Funding II are fully consolidated special purpose entities established to sell customer installment sale contracts to outside financial institutions in the normal course of their business. PDC Funding III and PDC Funding IV are fully consolidated special purpose entities established to sell certain receivables to unaffiliated financial institutions. The assets of PDC Funding, PDC Funding II, PDC Funding III and PDC Funding IV would be available first and foremost to satisfy the claims of its creditors. There are no known creditors of PDC Funding, PDC Funding II, PDC Funding III or PDC Funding IV. The unaudited condensed consolidated financial statements also include the assets and liabilities of Technology Partner Innovations, LLC, which is further described in Note 8.

Fiscal Year End

We operate with a 52-53 week accounting convention with our fiscal year ending on the last Saturday in April. The second quarter of fiscal 2024 and 2023 represents the 13 weeks ended October 28, 2023 and October 29, 2022, respectively. Fiscal 2024 will include 52 weeks and fiscal 2023 included 52 weeks.

Other Income, Net

Other income, net consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| Gain on interest rate swap agreements | $ | 2,786 | | | $ | 13,072 | | | $ | 9,561 | | | $ | 11,124 | |

| Investment income and other | 4,310 | | | 5,131 | | | 9,436 | | | 8,859 | |

| Other income, net | $ | 7,096 | | | $ | 18,203 | | | $ | 18,997 | | | $ | 19,983 | |

Comprehensive Income

Comprehensive income is computed as net income including certain other items that are recorded directly to stockholders’ equity. Significant items included in comprehensive income are foreign currency translation adjustments and the effective portion of cash flow hedges, net of tax. Foreign currency translation adjustments do not include a provision for income tax because earnings from foreign operations are considered to be indefinitely reinvested outside the U.S. The income tax expense related to cash flow hedges was $81 and $81 for the three months ended October 28, 2023 and October 29, 2022, respectively. The income tax expense related to cash flow hedges was $161 and $161 for the six months ended October 28, 2023 and October 29, 2022, respectively.

Earnings Per Share ("EPS")

The following table sets forth the computation of the weighted average shares outstanding used to calculate basic and diluted EPS:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| Denominator for basic EPS – weighted average shares | 94,710 | | | 96,913 | | | 95,127 | | | 96,771 | |

| Effect of dilutive securities – stock options, restricted stock and stock purchase plans | 446 | | | 639 | | | 595 | | | 937 | |

| Denominator for diluted EPS – weighted average shares | 95,156 | | | 97,552 | | | 95,722 | | | 97,708 | |

Potentially dilutive securities representing 1,427 shares and 1,299 shares for the three and six months ended October 28, 2023 and 1,572 shares and 1,166 shares for the three and six months ended October 29, 2022 were excluded from the calculation of diluted EPS because their effects were anti-dilutive using the treasury stock method.

Revenue Recognition

Revenues are generated from the sale of consumable products, equipment and support, software and support, technical service parts and labor, and other sources. Revenues are recognized when or as performance obligations are satisfied. Performance obligations are satisfied when the customer obtains control of the goods or services.

Consumable, equipment, software and parts sales are recorded upon delivery, except in those circumstances where terms of the sale are FOB shipping point, in which case sales are recorded upon shipment. Technical service labor is recognized as it is provided. Revenue derived from equipment and software support is recognized ratably over the period in which the support is provided.

In addition to revenues generated from the distribution of consumable products under arrangements (buy/sell agreements) where the full market value of the product is recorded as revenue, we earn commissions for services provided under agency agreements. The agency agreement contrasts to a buy/sell agreement in that we do not have control over the transaction, as we do not have the primary responsibility of fulfilling the promise of the good or service and we do not bill or collect from the customer in an agency relationship. Commissions under agency agreements are recorded when the services are provided.

Estimates for returns, damaged goods, rebates, loyalty programs and other revenue allowances are made at the time the revenue is recognized based on the historical experience for such items. The receivables that result from the recognition of revenue are reported net of related allowances. We maintain a valuation allowance based upon the expected collectability of receivables held. Estimates are used to determine the valuation allowance and are based on several factors, including historical collection data, current and forecasted economic trends and credit worthiness of customers. Receivables are written off when we determine the amounts to be uncollectible, typically upon customer bankruptcy or non-response to continuous collection efforts. The portions of receivable amounts that are not expected to be collected during the next twelve months are classified as long-term.

Net sales do not include sales tax as we are considered a pass-through conduit for collecting and remitting sales tax.

Contract Balances

Contract balances represent amounts presented in our condensed consolidated balance sheets when either we have transferred goods or services to the customer or the customer has paid consideration to us under the contract. These contract balances include accounts receivable, contract assets and contract liabilities.

Contract asset balances as of October 28, 2023 and April 29, 2023 were $2,321 and $1,338, respectively. Our contract liabilities primarily relate to advance payments from customers, upfront payments for software and support provided over time, and options that provide a material right to customers, such as our customer loyalty programs. At October 28, 2023 and April 29, 2023, contract liabilities of $40,131 and $36,850 were reported in other accrued liabilities, respectively. During the six months ended October 28, 2023, we recognized $20,814 of the amount previously deferred at April 29, 2023.

Recently Issued Accounting Pronouncements

We do not expect any of the recently issued accounting pronouncements to materially affect our financial statements.

Note 2. Acquisitions

During the first quarter of fiscal 2024, we used $1,108 to pay a holdback following our acquisition of substantially all of the assets of Miller Vet Holdings, LLC. The payment was due on the 24 month anniversary of the closing date.

During the third quarter of fiscal 2023, we acquired substantially all of the assets of Relief Services for Veterinary Practitioners and Animal Care Technologies (RSVP and ACT), Texas-based companies that provide innovative solutions to veterinary practices through data extraction and conversion, staffing and video-based training services. Also during the third quarter of fiscal 2023, we acquired substantially all of the assets of Dairy Tech, Inc., a Colorado-based company that provides pasteurizing equipment and single-use bags that allow dairy producers to produce, store and feed colostrum for newborn calves, as well as product offerings for beef cattle producers. These acquisitions expand our Companion Animal and Production Animal value-added platforms and add solutions to their suite of offerings.

The total purchase price for these acquisitions is $37,535, which includes holdbacks of $4,255 that will be paid on the 24 month anniversary of the closing dates and working capital adjustments of $23 which were paid in the fourth quarter of fiscal 2023. As of the acquisition date, we have recorded $17,300 of identifiable intangibles, $16,040 of goodwill and net tangible assets of $4,233 in our condensed consolidated balance sheets related to these acquisitions. Goodwill, which is deductible for income tax purposes, was increased by $272 subsequent to acquisition date as a result of working capital adjustments. Goodwill was recorded within the Animal Health segment and represents the expected benefit of integrating these value-added platforms with our existing operations. We have included their results of operations in our financial statements since the date of acquisition within the Animal Health segment. The accounting for the acquisitions was complete as of October 28, 2023. The acquisitions did not materially impact our financial statements, and, therefore, pro forma results are not provided.

Note 3. Receivables Securitization Program

We are party to certain receivables purchase agreements (the “Receivables Purchase Agreements”) with MUFG Bank, Ltd. ("MUFG") (f.k.a. The Bank of Tokyo-Mitsubishi UFJ, Ltd.), under which MUFG acts as an agent to facilitate the sale of certain Patterson receivables (the “Receivables”) to certain unaffiliated financial institutions (the “Purchasers”). The sale of these receivables is accounted for as a sale of assets under the provisions of ASC 860, Transfers and Servicing. We utilize PDC Funding III and PDC Funding IV to facilitate the sale to fulfill requirements within the agreement. We use a daily unit of account for these Receivables.

The proceeds from the sale of these Receivables comprise a combination of cash and a deferred purchase price (“DPP”) receivable. The DPP receivable is ultimately realized by Patterson following the collection of the underlying Receivables sold to the Purchasers. The amount available under the Receivables Purchase Agreements fluctuates over time based on the total amount of eligible Receivables generated during the normal course of business, with maximum availability of $200,000 as of October 28, 2023, of which $200,000 was utilized.

We have no retained interests in the transferred Receivables, other than our right to the DPP receivable and collection and administrative service fees. We consider the fees received adequate compensation for services rendered, and accordingly have recorded no servicing asset or liability. As of October 28, 2023 and April 29, 2023, the fair value of outstanding trade receivables transferred to the Purchasers under the facility and derecognized from the condensed consolidated balance sheets were $403,848 and $429,853, respectively. Sales of trade receivables under this facility were $1,824,520 and $1,826,156, and cash collections from customers on receivables sold were $1,850,208 and $1,804,576 during the six months ended October 28, 2023 and October 29, 2022, respectively.

The DPP receivable is recorded at fair value within the condensed consolidated balance sheets within prepaid expenses and other current assets. The difference between the carrying amount of the Receivables and the sum of the cash and fair value of the DPP receivable received at time of transfer is recognized as a gain or loss on sale of the related Receivables inclusive of bank fees and allowance for credit losses. In operating expenses in the condensed consolidated statements of operations and other comprehensive income, we recorded losses of $3,736 and $3,211 during the three months ended October 28, 2023 and October 29, 2022, respectively, and $7,160 and

$4,646 during the six months ended October 28, 2023 and October 29, 2022, respectively, related to the Receivables.

The following rollforward summarizes the activity related to the DPP receivable:

| | | | | | | | | | | | | | | |

| | | Six Months Ended |

| | | | | October 28, 2023 | | October 29, 2022 |

| Beginning DPP receivable balance | | | | | $ | 227,946 | | | $ | 195,764 | |

| Non-cash additions to DPP receivable | | | | | 445,567 | | | 467,761 | |

| Collection of DPP receivable | | | | | (471,511) | | | (447,241) | |

| Ending DPP receivable balance | | | | | $ | 202,002 | | | $ | 216,284 | |

Note 4. Customer Financing

As a convenience to our customers, we offer several different financing alternatives, including a third party program and a Patterson-sponsored program. For the third party program, we act as a facilitator between the customer and the third party financing entity with no on-going involvement in the financing transaction. Under the Patterson-sponsored program, equipment purchased by creditworthy customers may be financed up to a maximum of $2,000. We generally sell our customers’ financing contracts to an outside financial institution in the normal course of our business. These financing arrangements are accounted for as a sale of assets under the provisions of ASC 860, Transfers and Servicing. We use a monthly unit of account for these financing contracts.

The portion of the purchase price for the receivables held by the conduits is deemed a DPP receivable, which is paid to the applicable special purpose entity, PDC Funding or PDC Funding II, as payments on the customers’ financing contracts are collected by Patterson from customers. The difference between the carrying amount of the receivables sold under these programs and the sum of the cash and fair value of the DPP receivable received at time of transfer is recognized as a gain or loss on sale of the related receivables and recorded in net sales in the condensed consolidated statements of operations and other comprehensive income. Expenses incurred related to customer financing activities are recorded in operating expenses in our condensed consolidated statements of operations and other comprehensive income.

Historically, we maintained two arrangements under which we sell these contracts.

We operate under an agreement to sell our equipment finance contracts to commercial paper conduits with MUFG serving as the agent. We utilize PDC Funding to fulfill a requirement of participating in the commercial paper conduit. We receive the proceeds of the contracts upon sale to MUFG. At least 15.0% of the proceeds are held by the conduit as security against eventual performance of the portfolio. This percentage can be greater and is based upon certain ratios defined in the agreement with MUFG. The capacity under the agreement with MUFG at October 28, 2023 was $575,000.

We formerly maintained an agreement with Fifth Third Bank ("Fifth Third") whereby Fifth Third purchased customers’ financing contracts. PDC Funding II sold its financing contracts to Fifth Third. We received the proceeds of the contracts upon sale to Fifth Third. At least 15.0% of the proceeds were held by the conduit as security against eventual performance of the portfolio.

During the first quarter of fiscal 2024, Fifth Third sold and assigned the remaining purchased customer financing contracts to the facility in which MUFG is the agent. We transferred and assigned the related DPP receivable of $15,400 from PDC Funding II to PDC Funding, and the DPP counterparty changed from Fifth Third to MUFG. We amended our agreement with MUFG as agent and expanded capacity under that agreement from $525,000 to $575,000. We thereby ended our agreement with Fifth Third.

We service the financing contracts for which we are paid a servicing fee. The servicing fees we receive are considered adequate compensation for services rendered. Accordingly, no servicing asset or liability has been recorded.

During the six months ended October 28, 2023 and October 29, 2022, we sold $115,266 and $111,612 of contracts under these arrangements, respectively. In net sales in the condensed consolidated statements of operations and other comprehensive income, we recorded losses of $3,953 and $8,456 during the three months ended October 28, 2023 and October 29, 2022, respectively, related to these contracts sold. In net sales in the condensed consolidated

statements of operations and other comprehensive income, we recorded losses of $12,880 and $7,468 during the six months ended October 28, 2023 and October 29, 2022, respectively, related to these contracts sold. Cash collections on financed receivables sold were $141,353 and $163,088 during the six months ended October 28, 2023 and October 29, 2022, respectively.

Included in cash and cash equivalents in the condensed consolidated balance sheets are $30,621 and $33,072 as of October 28, 2023 and April 29, 2023, respectively, which represent cash collected from previously sold customer financing contracts that have not yet been settled. Included in current receivables in the condensed consolidated balance sheets are $44,757 and $77,646 as of October 28, 2023 and April 29, 2023, respectively, of finance contracts we have not yet sold. A total of $546,042 of finance contracts receivable sold under the arrangements was outstanding at October 28, 2023. Since the internal financing program began in 1994, bad debt write-offs have amounted to less than 1% of the loans originated.

The following rollforward summarizes the activity related to the DPP receivable:

| | | | | | | | | | | | | | | | |

| | | | Six Months Ended |

| | | | | | October 28, 2023 | | October 29, 2022 |

| Beginning DPP receivable balance | | | | | | $ | 102,979 | | | $ | 125,332 | |

| Non-cash additions to DPP receivable | | | | | | 19,491 | | | 12,036 | |

| Collection of DPP receivable | | | | | | (17,941) | | | (42,398) | |

| Ending DPP receivable balance | | | | | | $ | 104,529 | | | $ | 94,970 | |

The arrangements require us to maintain a minimum current ratio and maximum leverage ratio. We were in compliance with those covenants at October 28, 2023.

Note 5. Derivative Financial Instruments

We are a party to certain offsetting and identical interest rate cap agreements entered into to fulfill certain covenants of the equipment finance contract sale agreements. The interest rate cap agreements also provide a credit enhancement feature for the financing contracts sold by PDC Funding and PDC Funding II to the commercial paper conduit.

The interest rate cap agreements are entered into periodically to maintain consistency with the dollar maximum of the sale agreements and the maturity of the underlying financing contracts. As of October 28, 2023, PDC Funding had purchased an interest rate cap from a bank with a notional amount of $575,000 and a maturity date of July 2031. We sold an identical interest rate cap to the same bank.

These interest rate cap agreements do not qualify for hedge accounting treatment and, accordingly, we record the fair value of the agreements as an asset or liability and the change in fair value as income or expense during the period in which the change occurs.

In January 2014, we entered into a forward interest rate swap agreement with a notional amount of $250,000 and accounted for it as a cash flow hedge, in order to hedge interest rate fluctuations in anticipation of refinancing the 5.17% senior notes due March 25, 2015. These notes were repaid on March 25, 2015 and replaced with new $250,000 3.48% senior notes due March 24, 2025. A cash payment of $29,003 was made in March 2015 to settle the interest rate swap. This amount is recorded in other comprehensive income (loss), net of tax, and is recognized as interest expense over the life of the related debt.

We utilize forward interest rate swap agreements to hedge against interest rate fluctuations that impact the amount of net sales we record related to our customer financing contracts. These interest rate swap agreements do not qualify for hedge accounting treatment and, accordingly, we record the fair value of the agreements as an asset or liability and the change in fair value as income or expense during the period in which the change occurs.

As of April 29, 2023, the remaining notional amount for interest rate swap agreements was $551,504, with the latest maturity date in fiscal 2030. During the six months ended October 28, 2023, we entered into forward interest rate swap agreements with a notional amount of $97,387. As of October 28, 2023, the remaining notional amount for interest rate swap agreements was $533,943, with the latest maturity date in fiscal 2031.

Net cash receipts of $7,244 and $782 were received during the six months ended October 28, 2023 and October 29, 2022, respectively, to settle a portion of our assets and liabilities related to interest rate swap agreements. These payments and receipts are reflected as cash flows in the condensed consolidated statements of cash flows within net cash used in operating activities.

The following presents the fair value of derivative instruments included in the condensed consolidated balance sheets:

| | | | | | | | | | | | | | |

| Derivative type | Classification | October 28, 2023 | | April 29, 2023 |

| Assets: | | | | |

| Interest rate contracts | Prepaid expenses and other current assets | $ | 6,789 | | | $ | 5,875 | |

| Interest rate contracts | Other non-current assets, net | 28,018 | | | 23,210 | |

| Total asset derivatives | | $ | 34,807 | | | $ | 29,085 | |

| Liabilities: | | | | |

| Interest rate contracts | Other accrued liabilities | $ | 221 | | | $ | 267 | |

| Interest rate contracts | Other non-current liabilities | 16,787 | | | 12,993 | |

| Total liability derivatives | | $ | 17,008 | | | $ | 13,260 | |

The following tables present the pre-tax effect of derivative instruments on the condensed consolidated statements of operations and other comprehensive income:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Amount of Loss Reclassified from Accumulated Other Comprehensive Loss into Income (Effective Portion) |

| | | | Three Months Ended | | Six Months Ended |

| Derivatives in cash flow hedging relationships | | Statements of operations location | | October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| Interest rate contracts | | Interest expense | | $ | (341) | | | $ | (341) | | | $ | (682) | | | $ | (682) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Amount of Gain Recognized in Income on Derivatives |

| | | | Three Months Ended | | Six Months Ended |

| Derivatives not designated as hedging instruments | | Statements of operations location | | October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| Interest rate contracts | | Other income, net | | $ | 2,786 | | | $ | 13,072 | | | $ | 9,561 | | | $ | 11,124 | |

There were no gains or losses recognized in other comprehensive income (loss) on cash flow hedging derivatives during the three and six months ended October 28, 2023 or October 29, 2022.

We recorded no ineffectiveness during the three and six month periods ended October 28, 2023 and October 29, 2022. As of October 28, 2023, the estimated pre-tax portion of accumulated other comprehensive loss that is expected to be reclassified into earnings over the next twelve months is $1,363, which will be recorded as an increase to interest expense.

Note 6. Fair Value Measurements

Fair value is the price at which an asset could be exchanged in a current transaction between knowledgeable, willing parties. The fair value hierarchy of measurements is categorized into one of three levels based on the lowest level of significant input used:

Level 1 - Quoted prices in active markets for identical assets and liabilities at the measurement date.

Level 2 - Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

Level 3 - Unobservable inputs for which there is little or no market data available. These inputs reflect management’s assumptions of what market participants would use in pricing the asset or liability.

Our hierarchy for assets and liabilities measured at fair value on a recurring basis is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| October 28, 2023 |

| Total | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | |

| Cash equivalents | $ | 2,060 | | | $ | 2,060 | | | $ | — | | | $ | — | |

| DPP receivable - receivables securitization program | 202,002 | | | — | | | — | | | 202,002 | |

| DPP receivable - customer financing | 104,529 | | | — | | | — | | | 104,529 | |

| Derivative instruments | 34,807 | | | — | | | 34,807 | | | — | |

| Total assets | $ | 343,398 | | | $ | 2,060 | | | $ | 34,807 | | | $ | 306,531 | |

| Liabilities: | | | | | | | |

| Derivative instruments | $ | 17,008 | | | $ | — | | | $ | 17,008 | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | |

| April 29, 2023 |

| Total | | Level 1 | | Level 2 | | Level 3 |

| Assets: | | | | | | | |

| Cash equivalents | $ | 47,777 | | | $ | 47,777 | | | $ | — | | | $ | — | |

| DPP receivable - receivables securitization program | 227,946 | | | — | | | — | | | 227,946 | |

| DPP receivable - customer financing | 102,979 | | | — | | | — | | | 102,979 | |

| Derivative instruments | 29,085 | | | — | | | 29,085 | | | — | |

| Total assets | $ | 407,787 | | | $ | 47,777 | | | $ | 29,085 | | | $ | 330,925 | |

| Liabilities: | | | | | | | |

| Derivative instruments | $ | 13,260 | | | $ | — | | | $ | 13,260 | | | $ | — | |

Cash equivalents – We value cash equivalents at their current market rates. The carrying value of cash equivalents approximates fair value and maturities are less than three months.

DPP receivable - receivables securitization program – We value this DPP receivable based on a discounted cash flow analysis using unobservable inputs, which include the estimated timing of payments and the credit quality of the underlying creditor. Significant changes in any of the significant unobservable inputs in isolation would not result in a materially different fair value estimate. The interrelationship between these inputs is insignificant.

DPP receivable - customer financing – We value this DPP receivable based on a discounted cash flow analysis using unobservable inputs, which include a forward yield curve, the estimated timing of payments and the credit quality of the underlying creditor. Significant changes in any of the significant unobservable inputs in isolation would not result in a materially different fair value estimate. The interrelationship between these inputs is insignificant.

Derivative instruments – Our derivative instruments consist of interest rate cap agreements and interest rate swaps. These instruments are valued using inputs such as interest rates and credit spreads.

Certain assets are measured at fair value on a non-recurring basis. These assets are not measured at fair value on an ongoing basis, but are subject to fair value adjustments under certain circumstances. We adjust the carrying value of our non-marketable equity securities to fair value when observable transactions of identical or similar securities occur, or due to an impairment.

We have an investment in Vetsource, a commercial partner and leading home delivery provider for veterinarians. The investment was valued based on the selling price of the portion of the investment we sold in the first quarter of fiscal 2022. The carrying value of the investment we owned following this sale was $56,849 and $56,849 as of October 28, 2023 and April 29, 2023, respectively. Concurrent with the sale completed in the first quarter of fiscal 2022, we obtained rights that will allow us, under certain circumstances, to require another shareholder of Vetsource to purchase our remaining shares. The carrying value of this put option, which is subject to a floor, as of October 28, 2023 is $25,757, and is reported within investments in our condensed consolidated balance sheets. Concurrent with obtaining this put option, we also granted rights to the same Vetsource shareholder that would allow such

shareholder, under certain circumstances, to require us to sell our remaining shares at fair value. There were no fair value adjustments to such assets during the six months ended October 28, 2023.

Our debt is not measured at fair value in the condensed consolidated balance sheets. The estimated fair value of our debt as of October 28, 2023 and April 29, 2023 was $479,877 and $483,139, respectively, as compared to a carrying value of $485,974 and $487,231 at October 28, 2023 and April 29, 2023, respectively. The fair value of debt was measured using a discounted cash flow analysis based on expected market based yields (i.e., Level 2 inputs).

The carrying amounts of receivables, net of allowances, accounts payable, and certain accrued and other current liabilities approximated fair value at October 28, 2023 and April 29, 2023.

Note 7. Income Taxes

The effective income tax rate for the three months ended October 28, 2023 was 25.3% compared to 24.2% for the three months ended October 29, 2022. The increase in the rate was primarily due to an income tax reserve adjustment in the prior year quarter which was partially offset by excess tax benefits associated with stock-based compensation. The effective income tax rate for the six months ended October 28, 2023 was 24.5% compared to 23.5% for the three months ended October 29, 2022. The increase in the rate was primarily due to an income tax reserve adjustment in the prior year which was partially offset by excess tax benefits associated with stock-based compensation.

Note 8. Technology Partner Innovations, LLC ("TPI")

In fiscal 2019, we entered into an agreement with Cure Partners to form TPI, which offers a cloud-based practice management software, NaVetor, to its customers. Patterson and Cure Partners each contributed net assets of $4,000 to form TPI. Patterson and Cure Partners each contributed additional net assets of $1,000 during the fiscal year ended April 29, 2023, and no additional net assets were contributed during the six months ended October 28, 2023. We have determined that TPI is a variable interest entity, and we consolidate the results of operations of TPI as we have concluded that we are the primary beneficiary of TPI. Since TPI was formed, there have been no changes in ownership interests. As of October 28, 2023, we had noncontrolling interests of $793 on our condensed consolidated balance sheets.

Net loss attributable to the noncontrolling interest was $103 and $424 for the three months ended October 28, 2023 and October 29, 2022, respectively, and $207 and $754 for the six months ended October 28, 2023 and October 29, 2022, respectively.

Note 9. Segment and Geographic Data

We present three reportable segments: Dental, Animal Health and Corporate. Dental and Animal Health are strategic business units that offer similar products and services to different customer bases. Dental provides a virtually complete range of consumable dental products, equipment, software, turnkey digital solutions and value-added services to dentists, dental laboratories, institutions, and other healthcare professionals throughout North America. Animal Health is a leading, full-line distributor in North America and the U.K. of animal health products, services and technologies to both the production-animal and companion-pet markets. Our Corporate segment is comprised of general and administrative expenses, including home office support costs in areas such as information technology, finance, legal, human resources and facilities. In addition, customer financing and other miscellaneous sales are reported within Corporate results. Corporate assets consist primarily of cash and cash equivalents, accounts receivable, property and equipment and long-term receivables. We evaluate segment performance based on operating income. The costs to operate the fulfillment centers are allocated to the operating units based on the through-put of the unit.

The following table provides a breakdown of sales by geographic region:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| Consolidated net sales | | | | | | | |

| United States | $ | 1,383,152 | | | $ | 1,375,622 | | | $ | 2,674,523 | | | $ | 2,636,020 | |

| United Kingdom | 180,460 | | | 157,125 | | | 372,071 | | | 319,346 | |

| Canada | 89,160 | | | 93,457 | | | 182,923 | | | 194,103 | |

| Total | $ | 1,652,772 | | | $ | 1,626,204 | | | $ | 3,229,517 | | | $ | 3,149,469 | |

| Dental net sales | | | | | | | |

| United States | $ | 573,794 | | | $ | 575,520 | | | $ | 1,084,044 | | | $ | 1,075,355 | |

| Canada | 52,587 | | | 53,403 | | | 109,637 | | | 111,485 | |

| Total | $ | 626,381 | | | $ | 628,923 | | | $ | 1,193,681 | | | $ | 1,186,840 | |

| Animal Health net sales | | | | | | | |

| United States | $ | 807,589 | | | $ | 805,817 | | | $ | 1,590,255 | | | $ | 1,561,402 | |

| United Kingdom | 180,460 | | | 157,125 | | | 372,071 | | | 319,346 | |

| Canada | 36,573 | | | 40,054 | | | 73,286 | | | 82,618 | |

| Total | $ | 1,024,622 | | | $ | 1,002,996 | | | $ | 2,035,612 | | | $ | 1,963,366 | |

| Corporate net sales | | | | | | | |

| United States | $ | 1,769 | | | $ | (5,715) | | | $ | 224 | | | $ | (737) | |

| Total | $ | 1,769 | | | $ | (5,715) | | | $ | 224 | | | $ | (737) | |

The following table provides a breakdown of sales by categories of products and services:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| Consolidated net sales | | | | | | | |

| Consumable | $ | 1,319,363 | | | $ | 1,301,256 | | | $ | 2,635,088 | | | $ | 2,563,025 | |

| Equipment | 230,293 | | | 243,896 | | | 394,264 | | | 417,831 | |

| Value-added services and other | 103,116 | | | 81,052 | | | 200,165 | | | 168,613 | |

| Total | $ | 1,652,772 | | | $ | 1,626,204 | | | $ | 3,229,517 | | | $ | 3,149,469 | |

| Dental net sales | | | | | | | |

| Consumable | $ | 346,492 | | | $ | 337,489 | | | $ | 698,539 | | | $ | 675,329 | |

| Equipment | 200,127 | | | 214,006 | | | 337,676 | | | 360,516 | |

| Value-added services and other | 79,762 | | | 77,428 | | | 157,466 | | | 150,995 | |

| Total | $ | 626,381 | | | $ | 628,923 | | | $ | 1,193,681 | | | $ | 1,186,840 | |

| Animal Health net sales | | | | | | | |

| Consumable | $ | 972,871 | | | $ | 963,767 | | | $ | 1,936,549 | | | $ | 1,887,696 | |

| Equipment | 30,166 | | | 29,890 | | | 56,588 | | | 57,315 | |

| Value-added services and other | 21,585 | | | 9,339 | | | 42,475 | | | 18,355 | |

| Total | $ | 1,024,622 | | | $ | 1,002,996 | | | $ | 2,035,612 | | | $ | 1,963,366 | |

| Corporate net sales | | | | | | | |

| Value-added services and other | $ | 1,769 | | | $ | (5,715) | | | $ | 224 | | | $ | (737) | |

| Total | $ | 1,769 | | | $ | (5,715) | | | $ | 224 | | | $ | (737) | |

The following table provides a breakdown of operating income (loss) by reportable segment:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| October 28, 2023 | | October 29, 2022 | | October 28, 2023 | | October 29, 2022 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income (loss) | | | | | | | |

| Dental | $ | 55,277 | | | $ | 60,950 | | | $ | 93,947 | | | $ | 97,845 | |

| Animal Health | 26,346 | | | 28,316 | | | 56,039 | | | 50,175 | |

| Corporate | (24,720) | | | (29,171) | | | (54,861) | | | (53,081) | |

| Total | $ | 56,903 | | | $ | 60,095 | | | $ | 95,125 | | | $ | 94,939 | |

The following table provides a breakdown of total assets by reportable segment:

| | | | | | | | | | | |

| October 28, 2023 | | April 29, 2023 |

| Total assets | | | |

| Dental | $ | 924,784 | | | $ | 853,369 | |

| Animal Health | 1,578,789 | | | 1,570,760 | |

| Corporate | 386,117 | | | 455,017 | |

| Total | $ | 2,889,690 | | | $ | 2,879,146 | |

Note 10. Accumulated Other Comprehensive Loss ("AOCL")

The following table summarizes the changes in AOCL during the six months ended October 28, 2023:

| | | | | | | | | | | | | | | | | |

| Cash Flow Hedges | | Currency

Translation

Adjustment | | Total |

| AOCL at April 29, 2023 | $ | (2,412) | | | $ | (86,850) | | | $ | (89,262) | |

| Other comprehensive loss before reclassifications | — | | | (10,221) | | | (10,221) | |

| Amounts reclassified from AOCL | 521 | | | — | | | 521 | |

| AOCL at October 28, 2023 | $ | (1,891) | | | $ | (97,071) | | | $ | (98,962) | |

The amounts reclassified from AOCL during the six months ended October 28, 2023 include gains and losses on cash flow hedges, net of taxes of $161. The impact to the condensed consolidated statements of operations and other comprehensive income was an increase to interest expense of $682 for the six months ended October 28, 2023.

Note 11. Legal Proceedings

From time to time, we become involved in lawsuits, administrative proceedings, government subpoenas, and government investigations (which may, in some cases, involve our entering into settlement agreements or consent decrees), relating to antitrust, commercial, environmental, product liability, intellectual property, regulatory, employment discrimination, securities, and other matters, including matters arising out of the ordinary course of business. The results of any such proceedings cannot be predicted with certainty because such matters are inherently uncertain. Significant damages or penalties may be sought in some matters, and some matters may require years to resolve. We also may be subject to fines or penalties, and equitable remedies (including but not limited to the suspension, revocation or non-renewal of licenses). We accrue for these matters when it is both probable that a liability has been incurred and the amount of the loss can be reasonably estimated. Adverse outcomes may result in significant monetary damages or injunctive relief against us that could adversely affect our ability to conduct our business. There also exists the possibility of a material adverse effect on our financial statements for the period in which the effect of an unfavorable outcome becomes probable and reasonably estimable.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

The U.S. Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements to encourage companies to provide prospective information, so long as those statements are identified as forward-looking and are accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those disclosed in the statement.

This Form 10-Q contains certain “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including statements regarding future financial performance, and the objectives and expectations of management. Forward-looking statements often include words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “seeks” or words of similar meaning, or future or conditional verbs, such as “will,” “should,” “could” or “may.” Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions.

Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not place undue reliance on any of these forward-looking statements.

Any number of factors could affect our actual results and cause such results to differ materially from those contemplated by any forward-looking statements, including, but not limited to, the following: wide-spread public health concerns as we experienced, and may continue to experience, with the COVID-19 pandemic; our dependence on suppliers to manufacture and supply substantially all of the products we sell; potential disruption of distribution capabilities, including service issues with third-party shippers; our dependence on relationships with sales representatives and service technicians to retain customers and develop business; adverse changes in supplier rebates or other purchasing incentives; risks of selling private label products, including the risk of adversely