Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

November 28 2023 - 12:51PM

Edgar (US Regulatory)

Nuveen

Core

Plus

Impact

Fund

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

LONG-TERM

INVESTMENTS

-

154.6%

(99.2%

of

Total

Investments)

X

–

CORPORATE

BONDS

-

90.6%

(58.1%

of

Total

Investments)

X

306,965,836

Automobiles

&

Components

-

5.0%

$

4,000

Dana

Inc

4.250%

9/01/30

$

3,210,400

3,510

Ford

Motor

Co

3.250%

2/12/32

2,705,029

15,300

(b)

Harley-Davidson

Inc

4.625%

7/28/45

11,090,459

Total

Automobiles

&

Components

17,005,888

Banks

-

12.9%

5,000

Citigroup

Inc

2.014%

1/25/26

4,721,509

17,000

Intesa

Sanpaolo

SpA,

144A

4.950%

6/01/42

10,541,307

3,583

JPMorgan

Chase

&

Co

0.768%

8/09/25

3,412,750

5,000

Lloyds

Banking

Group

PLC

4.976%

8/11/33

4,437,135

10,000

(b)

Standard

Chartered

PLC,

144A

5.300%

1/09/43

8,120,563

15,000

UniCredit

SpA,

144A

5.459%

6/30/35

12,574,563

Total

Banks

43,807,827

Capital

Goods

-

4.1%

5,800

(b)

GATX

Corp

3.100%

6/01/51

3,358,934

5,000

Mueller

Water

Products

Inc,

144A

4.000%

6/15/29

4,354,528

5,000

Sociedad

de

Transmision

Austral

SA,

144A

4.000%

1/27/32

4,223,296

2,305

YMCA

of

Greater

New

York

5.021%

8/01/38

1,934,689

Total

Capital

Goods

13,871,447

Commercial

&

Professional

Services

-

0.5%

2,040

New

York

Public

Library

Astor

Lenox

&

Tilden

Foundations/

The

4.305%

7/01/45

1,596,859

Total

Commercial

&

Professional

Services

1,596,859

Consumer

Discretionary

Distribution

&

Retail

-

1.7%

10,000

Nordstrom

Inc

5.000%

1/15/44

5,901,000

Total

Consumer

Discretionary

Distribution

&

Retail

5,901,000

Consumer

Durables

&

Apparel

-

1.5%

5,000

EUR

Arcelik

AS

,

Reg

S

3.000%

5/27/26

4,889,190

Total

Consumer

Durables

&

Apparel

4,889,190

Consumer

Services

-

1.6%

6,160

YMCA

of

Greater

New

York

2.303%

8/01/26

5,533,453

Total

Consumer

Services

5,533,453

Diversified

Financials

-

1.4%

5,400

EUR

Power

Finance

Corp

Ltd

1.841%

9/21/28

4,758,063

Total

Diversified

Financials

4,758,063

Energy

-

3.5%

15,000

(b)

Santos

Finance

Ltd,

144A

3.649%

4/29/31

11,984,424

Total

Energy

11,984,424

Equity

Real

Estate

Investment

Trusts

(REITs)

-

4.3%

9,915

HAT

Holdings

I

LLC

/

HAT

Holdings

II

LLC,

144A

3.375%

6/15/26

8,812,782

2,000

HAT

Holdings

I

LLC

/

HAT

Holdings

II

LLC,

144A

3.750%

9/15/30

1,530,539

2,000

Host

Hotels

&

Resorts

LP

2.900%

12/15/31

1,537,121

3,000

Scentre

Group

Trust

2,

144A

5.125%

9/24/80

2,503,924

Total

Equity

Real

Estate

Investment

Trusts

(REITs)

14,384,366

Nuveen

Core

Plus

Impact

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

Financial

Services

-

6.0%

$

9,000

Banco

BTG

Pactual

SA/Cayman

Islands,

144A

2.750%

1/11/26

$

8,229,378

2,400

Community

Preservation

Corp/The

2.867%

2/01/30

1,995,186

5,745

Starwood

Property

Trust

Inc,

144A

3.625%

7/15/26

5,094,522

5,710

Starwood

Property

Trust

Inc,

144A

4.375%

1/15/27

4,980,556

Total

Financial

Services

20,299,642

Materials

-

6.0%

1,550

Cemex

SAB

de

CV,

144A

9.125%

12/30/49

1,613,558

5,000

LG

Chem

Ltd,

144A

2.375%

7/07/31

3,896,732

5,000

LYB

International

Finance

III

LLC

3.800%

10/01/60

3,061,479

8,108

Star

Energy

Geothermal

Wayang

Windu

Ltd,

144A

6.750%

4/24/33

7,780,861

5,000

Teck

Resources

Ltd

5.200%

3/01/42

4,084,212

Total

Materials

20,436,842

Media

&

Entertainment

-

1.8%

10,000

Discovery

Communications

LLC

4.000%

9/15/55

5,999,722

Total

Media

&

Entertainment

5,999,722

Real

Estate

Management

&

Development

-

0.5%

2,250

EUR

GTC

Aurora

Luxembourg

SA

,

Reg

S

2.250%

6/23/26

1,573,812

Total

Real

Estate

Management

&

Development

1,573,812

Technology

Hardware

&

Equipment

-

3.3%

5,000

SK

Battery

America

Inc

,

Reg

S

2.125%

1/26/26

4,467,357

10,000

Vodafone

Group

PLC

5.125%

6/04/81

6,784,878

Total

Technology

Hardware

&

Equipment

11,252,235

Telecommunication

Services

-

0.8%

5,000

Verizon

Communications

Inc

2.987%

10/30/56

2,775,470

Total

Telecommunication

Services

2,775,470

Transportation

-

2.8%

5,000

Delta

Air

Lines

2019-1

Class

AA

Pass

Through

Trust2020

A

3.204%

4/25/24

4,917,788

7,000

Norfolk

Southern

Corp

4.100%

5/15/21

4,547,704

Total

Transportation

9,465,492

Utilities

-

32.9%

1,750

AES

Corp/The

2.450%

1/15/31

1,345,865

6,270

Atlantica

Sustainable

Infrastructure

PLC,

144A

4.125%

6/15/28

5,409,863

15,000

(b)

Brooklyn

Union

Gas

Co/The,

144A

4.273%

3/15/48

10,417,159

5,100

Clearway

Energy

Operating

LLC,

144A

3.750%

1/15/32

3,964,638

7,050

Colbun

SA,

144A

3.150%

1/19/32

5,690,399

2,244

Consolidated

Edison

Co

of

New

York

Inc

4.300%

12/01/56

1,648,814

5,000

EUR

EDP

-

Energias

de

Portugal

SA

1.875%

3/14/82

4,043,982

7,956

India

Cleantech

Energy2021

1,

144A

4.700%

8/10/26

6,893,874

6,650

Interchile

SA,

144A

4.500%

6/30/56

4,996,399

6,616

Inversiones

Latin

America

Power

Ltda,

144A

5.125%

6/15/33

3,456,639

2,000

Leeward

Renewable

Energy

Operations

LLC,

144A

4.250%

7/01/29

1,644,114

7,330

Liberty

Utilities

Finance

GP

1,

144A

2.050%

9/15/30

5,651,212

7,000

Pattern

Energy

Operations

LP

/

Pattern

Energy

Operations

Inc,

144A

4.500%

8/15/28

6,079,499

2,667

Solar

Star

Funding

LLC,

144A

5.375%

6/30/35

2,498,007

13,000

(b)

Southern

California

Edison

Co

3.650%

6/01/51

8,627,276

4,000

Southern

Co

Gas

Capital

Corp

3.150%

9/30/51

2,370,279

5,000

Star

Energy

Geothermal

Darajat

II

/

Star

Energy

Geothermal

Salak,

144A

4.850%

10/14/38

4,259,159

8,075

Sunnova

Energy

Corp,

144A

5.875%

9/01/26

6,921,082

9,695

Sweihan

PV

Power

Co

PJSC2022

1,

144A

3.625%

1/31/49

7,501,777

4,255

Topaz

Solar

Farms

LLC,

144A

5.750%

9/30/39

3,932,471

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

Utilities

(continued)

$

9,548

Topaz

Solar

Farms

LLC,

144A

4.875%

9/30/39

$

8,582,653

5,800

Vena

Energy

Capital

Pte

Ltd

,

Reg

S

3.133%

2/26/25

5,494,943

Total

Utilities

111,430,104

Total

Corporate

Bonds

(cost

$406,262,807)

306,965,836

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X

–

$1,000

PAR

(OR

SIMILAR)

INSTITUTIONAL

PREFERRED

-

22.6%

(14.5%

of

Total

Investments)

X

76,621,493

Banks

-

6.6%

$

10,375

Banco

Nacional

de

Comercio

Exterior

SNC/Cayman

Islands,

144A

2.720%

8/11/31

$

8,558,986

4,250

Citigroup

Inc

4.150%

N/A

(c)

3,401,619

3,250

JPMorgan

Chase

&

Co

3.650%

N/A

(c)

2,836,723

10,195

PNC

Financial

Services

Group

Inc/The

3.400%

N/A

(c)

7,541,991

Total

Banks

22,339,319

Capital

Goods

-

3.1%

12,000

Air

Lease

Corp

4.650%

N/A

(c)

10,567,664

Total

Capital

Goods

10,567,664

Financial

Services

-

1.7%

7,200

American

Express

Co

3.550%

N/A

(c)

5,716,721

Total

Financial

Services

5,716,721

Insurance

-

4.2%

15,000

(b)

Swiss

Re

Finance

Luxembourg

SA,

144A

5.000%

4/02/49

14,055,000

Total

Insurance

14,055,000

Utilities

-

7.0%

5,000

Algonquin

Power

&

Utilities

Corp

4.750%

1/18/82

4,075,000

2,500

CMS

Energy

Corp

4.750%

6/01/50

2,132,650

2,500

CMS

Energy

Corp

3.750%

12/01/50

1,877,625

8,000

EUR

Engie

SA

,

Reg

S

1.875%

N/A

(c)

6,406,935

4,600

Sempra

4.125%

4/01/52

3,720,843

5,000

Southern

Co/The

3.750%

9/15/51

4,360,986

1,500

Vistra

Corp,

144A

7.000%

N/A

(c)

1,368,750

Total

Utilities

23,942,789

Total

$1,000

Par

(or

similar)

Institutional

Preferred

(cost

$95,768,686)

76,621,493

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X–

MORTGAGE-BACKED

SECURITIES

-

18.3%

(11.7%

of

Total

Investments)

X

61,879,290

6,500

(d)

Alen

Mortgage

Trust,

(TSFR1M

reference

rate

+

4.114%

spread),

2021

ACEN,

144A

9.447%

4/15/34

$

3,382,834

5,000

(d)

BAMLL

Commercial

Mortgage

Securities

Trust

2021-JACX,

(TSFR1M

reference

rate

+

3.864%

spread),

2021

JACX,

144A

9.197%

9/15/38

4,014,434

4,000

BBCMS

Mortgage

Trust

2020-C6,

2020

C6,

144A

3.811%

2/15/53

2,540,463

3,840

Benchmark

2019-B10

Mortgage

Trust,

2019

B10,

144A

4.029%

3/15/62

2,444,681

7,887

COMM

2020-CX

Mortgage

Trust,

2020

CX,

144A

2.773%

11/10/46

4,917,614

45,881

Freddie

Mac

Multifamily

ML

Certificates,

2021

ML12,

(I/O)

1.303%

7/25/41

4,376,075

28,334

Freddie

Mac

Multifamily

ML

Certificates,

2021

ML10,

(I/O)

2.127%

1/25/38

4,298,604

64,977

Freddie

Mac

Multifamily

ML

Certificates,

2021

ML11,

(I/O),

144A

0.770%

3/25/38

3,502,926

Nuveen

Core

Plus

Impact

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X–

MORTGAGE-BACKED

SECURITIES

(continued)

$

680

Hudson

Yards

2016-10HY

Mortgage

Trust,

2016

10HY,

144A

2.835%

8/10/38

$

614,479

2,500

Hudson

Yards

Mortgage

Trust,

2019

55HY,

144A

3.041%

12/10/41

1,719,835

5,000

J.P.

Morgan

Chase

Commercial

Mortgage

Securities

Trust

2018-AON,

2018

AON,

144A

4.767%

7/05/31

1,069,206

10,000

MFT

Trust

2020-ABC,

2020

ABC,

144A

3.593%

2/10/42

4,078,263

700

(d)

Natixis

Commercial

Mortgage

Securities

Trust,

(TSFR1M

reference

rate

+

3.579%

spread),

2019

MILE,

144A

8.912%

7/15/36

501,894

5,661

(d)

Natixis

Commercial

Mortgage

Securities

Trust

2019-MILE,

(TSFR1M

reference

rate

+

2.829%

spread),

2019

MILE,

144A

8.162%

7/15/36

4,338,934

7,420

NYC

Commercial

Mortgage

Trust

2021-909,

2021

909,

144A

3.312%

4/10/43

3,425,719

3,860

SLG

Office

Trust,

2021

OVA,

144A

2.851%

7/15/41

2,682,436

80,369

SLG

Office

Trust,

2021

OVA,

144A

0.258%

7/15/41

1,138,805

8,000

SLG

Office

Trust

2021-OVA,

2021

OVA,

144A

2.851%

7/15/41

5,385,464

3,500

SUMIT

2022-BVUE

Mortgage

Trust,

2022

BVUE,

144A

2.989%

2/12/41

2,082,104

7,000

VNDO

Trust,

2016

350P,

144A

4.033%

1/10/35

5,364,520

Total

Mortgage-Backed

Securities

(cost

$97,135,023)

61,879,290

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X

–

SOVEREIGN

DEBT

-

6.2%

(4.0%

of

Total

Investments)

X

21,142,652

Benin

-

2.1%

$

10,000

EUR

Benin

Government

International

Bond

,

144A

4.950%

1/22/35

$

7,242,797

Total

Benin

7,242,797

Chile

-

1.0%

5,000

Chile

Government

International

Bond

3.100%

5/07/41

3,393,243

Total

Chile

3,393,243

Egypt

-

0.6%

2,500

Egypt

Government

International

Bond

,

144A

5.250%

10/06/25

1,918,270

Total

Egypt

1,918,270

Mexico

-

1.9%

5,000

EUR

Mexico

Government

International

Bond

2.250%

8/12/36

3,709,380

3,150

Mexico

Government

International

Bond

4.875%

5/19/33

2,822,586

Total

Mexico

6,531,966

Panama

-

0.6%

2,723

UEP

Penonome

II

SA

,

144A

6.500%

10/01/38

2,056,376

Total

Panama

2,056,376

Total

Sovereign

Debt

(cost

$30,876,030)

21,142,652

Shares

Description

(a)

Coupon

Value

X

–

$25

PAR

(OR

SIMILAR)

RETAIL

PREFERRED

-

5.9%

(3.8%

of

Total

Investments)

X

19,843,036

Capital

Goods

-

1.4%

269,000

Triton

International

Ltd

5.750%

$

4,893,110

Total

Capital

Goods

4,893,110

Financial

Services

-

1.4%

300,000

Affiliated

Managers

Group

Inc

4.200%

4,602,000

Total

Financial

Services

4,602,000

Shares

Description

(a)

Coupon

Value

Real

Estate

Management

&

Development

-

0.3%

77,904

Brookfield

Property

Partners

LP

5.750%

$

992,497

Total

Real

Estate

Management

&

Development

992,497

Utilities

-

2.8%

100,426

Brookfield

Infrastructure

Partners

LP

5.125%

1,751,429

200,000

Brookfield

Renewable

Partners

LP

5.250%

3,640,000

200,000

CMS

Energy

Corp

4.200%

3,964,000

Total

Utilities

9,355,429

Total

$25

Par

(or

similar)

Retail

Preferred

(cost

$28,938,056)

19,843,036

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X–

ASSET-BACKED

SECURITIES

-

4.2%

(2.7%

of

Total

Investments)

X

14,386,772

$

1,000

Frontier

Issuer

LLC,

2023

1,

144A

11.500%

8/20/53

$

964,011

1,000

Frontier

Issuer

LLC,

2023

1,

144A

8.300%

8/20/53

947,284

2,147

GoodLeap

Sustainable

Home

Solutions

Trust

2021-3,

2021

3CS,

144A

3.500%

5/20/48

1,402,929

2,311

GoodLeap

Sustainable

Home

Solutions

Trust

2021-4,

2021

4GS,

144A

3.500%

7/20/48

1,666,802

5,148

(e)

Mosaic

Solar

Loan

Trust,

2020

1A,

144A

0.000%

4/20/46

3,635,831

4,590

(e)

Mosaic

Solar

Loan

Trust,

2019

2A,

144A

0.000%

9/20/40

1,791,771

1,600

Tesla

Auto

Lease

Trust,

2021

A,

144A

1.020%

3/20/25

1,588,273

2,500

Tesla

Auto

Lease

Trust

2021-B,

2021

B,

144A

1.320%

9/22/25

2,389,871

Total

Asset-Backed

Securities

(cost

$17,935,271)

14,386,772

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(f)

Value

X

–

MUNICIPAL

BONDS

-

3.3%

(2.1%

of

Total

Investments)

X

11,127,775

Arizona

-

0.2%

$

810

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

KIPPC

NYC

Public

Charter

Schools

-

Gerard

Facility

Project,

Series

2021C,

3.250%,

7/01/31

No

Opt.

Call

$

678,340

Total

Arizona

678,340

District

of

Columbia

-

0.1%

254

District

of

Columbia

Water

and

Sewer

Authority,

Public

Utility

Revenue

Bonds,

Taxable

Senior

Lien

Green

Series

2014A,

4.814%,

10/01/14

No

Opt.

Call

217,088

Total

District

of

Columbia

217,088

Indiana

-

0.0%

235

Fort

Wayne,

Indiana

Economic

Development,

Solid

Waste

Facility

Revenue

Bonds,

Do

Good

Foods

LLC

Fort

Wayne,

Taxable

Series

2022A-2,

10.750%,

12/01/29

No

Opt.

Call

23

Total

Indiana

23

Michigan

-

1.4%

City

of

Detroit,

Michigan,

General

Obligation

Bonds,

Series

2021

:

1,000

2.960%,

4/01/27

No

Opt.

Call

868,777

500

3.110%,

4/01/28

No

Opt.

Call

420,681

2,245

3.244%,

4/01/29

No

Opt.

Call

1,830,972

425

3.344%,

4/01/30

No

Opt.

Call

335,334

1,575

Detroit,

Wayne

County,

Michigan,

General

Obligation

Bonds,

Taxable

Series

2021B,

3.644%,

4/01/34

4/31

at

100.00

1,157,494

Total

Michigan

4,613,258

Nuveen

Core

Plus

Impact

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(f)

Value

Montana

-

0.3%

$

1,000

County

of

Gallatin,

Montana,

Series

2022,

11.500%,

9/01/27,

144A

9/25

at

103.00

$

1,046,021

Total

Montana

1,046,021

New

York

-

1.3%

5,300

Metropolitan

Transportation

Authority,

New

York,

Transportation

Revenue

Bonds,

Taxable

Green

Climate

Certified

Series

2020C-2,

5.175%,

11/15/49

No

Opt.

Call

4,573,045

Total

New

York

4,573,045

Total

Municipal

Bonds

(cost

$15,204,057)

11,127,775

Principal

Amount

(000)

Description

(a)

Coupon

(g)

Reference

Rate

(g)

Spread

(g)

Maturity

(h)

Value

X

–

VARIABLE

RATE

SENIOR

LOAN

INTERESTS

-

3.2%

(2.1%

of

Total

Investments)

(g)

X

10,921,446

Commercial

&

Professional

Services

-

2.9%

$

10,391

Liberty

Tire

Recycling

Holdco,

LLC,

Term

Loan

9.931%

1

+

3-Month

LIBOR

4.500%

5/07/28

$

9,851,107

Total

Commercial

&

Professional

Services

9,851,107

Utilities

-

0.3%

1,072

ExGen

Renewables

IV,

LLC,

Term

Loan

8.184%

SOFR90A

2.500%

12/15/27

1,070,339

Total

Utilities

1,070,339

Total

Variable

Rate

Senior

Loan

Interests

(cost

$11,426,710)

10,921,446

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X

–

U.S.

GOVERNMENT

AND

AGENCY

OBLIGATIONS

-

0.3%

(0.2%

of

Total

Investments)

X

944,844

$

1,000

United

States

Treasury

Note/Bond

3.875%

8/15/33

$

944,844

Total

U.S.

Government

and

Agency

Obligations

(cost

$973,902)

944,844

Total

Long-Term

Investments

(cost

$704,520,542)

523,833,144

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

SHORT-TERM

INVESTMENTS

-

1.2% (0.8%

of

Total

Investments)

X

–

REPURCHASE

AGREEMENTS

-

1.2%

(0.8%

of

Total

Investments)

X

4,300,000

$

4,300

Repurchase

Agreement

with

Fixed

Income

Clearing

Corporation,

dated

9/30/23,

repurchase

price

$4,301,892,

collateralized

by

$5,505,500,

U.S.

Treasury

Bond,

3.375%,

due

11/15/48,

value

$4,386,045

5.280%

10/02/23

$

4,300,000

Total

Repurchase

Agreements

(cost

$4,300,000)

4,300,000

Total

Short-Term

Investments

(cost

$4,300,000)

4,300,000

Total

Investments

(cost

$708,820,542

)

-

155.8%

528,133,144

Borrowings

-

(31.1)%

(i),(j)

(105,500,000)

Reverse

Repurchase

Agreements,

including

accrued

interest

-

(13.6)%(k)

(46,111,252)

TFP

Shares,

Net

-

(20.6)%(l)

(69,670,710)

Other

Assets

&

Liabilities,

Net

- 9.5%

32,038,135

Net

Assets

Applicable

to

Common

Shares

-

100%

$

338,889,317

Investments

in

Derivatives

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Forward

Foreign

Currency

Contracts

Currency

Purchased

Notional

Amount

(Local

Currency)

Currency

Sold

Notional

Amount

(Local

Currency)

Counterparty

Settlement

Date

Unrealized

Appreciation

(Depreciation)

U.S.

Dollar

7,649,226

Euro

6,858,671

Barclays

Bank

PLC

10/13/23

$

394,946

Cross

Currency

Swaps

-

OTC

Uncleared

Counterparty

Terms

of

payments

to

be

paid

Terms

of

payments

to

be

received

Currency

Maturity

Date

Notional

Amount

(Local

Currency)

Value

Upfront

Premiums

Paid

(Received)

Unrealized

Appreciation

(Depreciation)

Citibank

N.A.

Fixed

annual

2.250%

Fixed

semi-annual

3.562%

USD

EUR

6/23/26

2,725,875

2,250,000

$

360,510

$

25,226

$

335,284

Citibank

N.A.

Fixed

semi-annual

1.875%

Fixed

annual

3.472%

USD

EUR

7/02/31

5,904,500

5,000,000

818,845

16,206

802,639

Citibank

N.A.

Fixed

semi-annual

1.875%

Fixed

annual

3.493%

USD

EUR

7/02/31

3,543,900

3,000,000

497,653

(7,036)

504,689

Citibank

N.A.

Fixed

semi-annual

2.250%

Fixed

annual

3.775%

USD

EUR

8/12/36

5,909,000

5,000,000

924,080

12,317

911,763

JPMorgan

Chase

Bank,

N.A.

Fixed

semi-annual

1.875%

Fixed

annual

3.431%

USD

EUR

6/14/29

5,905,000

5,000,000

708,801

(3,275)

712,076

Morgan

Stanley

Capital

Services

LLC

Fixed

semi-annual

3.000%

Fixed

annual

4.330%

USD

EUR

5/27/26

6,088,500

5,000,000

862,804

4,250

858,554

Morgan

Stanley

Capital

Services

LLC

Fixed

semi-annual

1.841%

Fixed

annual

3.337%

USD

EUR

9/21/28

6,376,320

5,400,000

725,333

(3)

725,336

Total

$

4,898,026

$

47,685

$

4,850,341

Nuveen

Core

Plus

Impact

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

The

following

is

a

reconciliation

of

the

Fund’s

Level

3

investments

held

at

the

beginning

and

end

of

the

measurement

period:

The

valuation

techniques

and

significant

unobservable

inputs

used

in

recurring

Level

3

fair

value

measurements

of

assets

as

of

the

end

of

the

reporting

period,

were

as

follows:

The

table

below

presents

the

transfers

in

and

out

of

the

three

valuation

levels

for

the

Fund

as

of

the

end

of

the

reporting

period

when

compared

to

the

valuation

levels

at

the

end

of

the

previous

fiscal

year.

Changes

in

valuation

inputs

or

methodologies

may

result

in

transfers

into

or

out

of

an

assigned

level

within

the

fair

value

hierarchy.

Transfers

in

or

out

of

levels

are

generally

due

to

the

availability

of

publicly

available

information

and

to

the

significance

or

extent

the

Adviser

determines

that

the

valuation

inputs

or

methodologies

may

impact

the

valuation

of

those

securities.

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Corporate

Bonds

$

–

$

306,965,836

$

–

$

306,965,836

$1,000

Par

(or

similar)

Institutional

Preferred

–

76,621,493

–

76,621,493

Mortgage-Backed

Securities

–

61,879,290

–

61,879,290

Sovereign

Debt

–

21,142,652

–

21,142,652

$25

Par

(or

similar)

Retail

Preferred

19,843,036

–

–

19,843,036

Asset-Backed

Securities

–

8,959,170

5,427,602

14,386,772

Municipal

Bonds

–

11,127,775

–

11,127,775

Variable

Rate

Senior

Loan

Interests

–

10,921,446

–

10,921,446

U.S.

Government

and

Agency

Obligations

–

944,844

–

944,844

Short-Term

Investments:

Repurchase

Agreements

–

4,300,000

–

4,300,000

Investments

in

Derivatives:

Forward

Foreign

Currency

Contracts*

–

394,946

–

394,946

Cross

Currency

Swaps*

–

4,850,341

–

4,850,341

Total

$

19,843,036

$

508,107,793

$

5,427,602

$

533,378,431

*

Represents

net

unrealized

appreciation

(depreciation).

Level

3

Core

Plus

Impact

Fund

Asset-Backed

Securities

Balance

at

the

beginning

of

period

$-

Gains

(losses):

-

Net

realized

gains

(losses)

-

Change

in

net

unrealized

appreciation

(depreciation)

-

Purchases

at

cost

-

Sales

at

proceeds

-

Net

discounts

(premiums)

-

Transfers

into

5,427,602

Transfers

(out

of)

-

Balance

at

the

end

of

period

$5,427,602

Change

in

net

unrealized

appreciation

(depreciation)

during

the

period

of

Level

3

securities

held

as

of

period

end

$(189,020)

Fund

Asset

Class

Market

Value

Techniques

Unobservable

Inputs

Range

NPCT

Asset-Backed

Securitie

s

5,427,602

Third

Party

Vendor

Broker

Quote

$39.04

-

$70.62

Level

1

Level

2

Level

3

Transfers

In

(Transfers

Out)

Transfers

In

(Transfers

Out)

Transfers

In

(Transfers

Out)

Asset-Backed

Securiites

$-

$-

$-

$-

$5,427,602

$-

Principal

denominated

in

U.S.

Dollars,

unless

otherwise

noted.

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

reverse

repurchase

agreements.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$57,353,429

have

been

pledged

as

collateral

for

reverse

repurchase

agreements.

(c)

Perpetual

security.

Maturity

date

is

not

applicable.

(d)

Variable

rate

security.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(e)

For

fair

value

measurement

disclosure

purposes,

investment

classified

as

Level

3.

(f)

Optional

Call

Provisions:

Dates

(month

and

year)

and

prices

of

the

earliest

optional

call

or

redemption.

There

may

be

other

call

provisions

at

varying

prices

at

later

dates.

Certain

mortgage-backed

securities

may

be

subject

to

periodic

principal

paydowns.

(g)

Senior

loans

generally

pay

interest

at

rates

which

are

periodically

adjusted

by

reference

to

a

base

short-term,

floating

lending

rate

(Reference

Rate)

plus

an

assigned

fixed

rate

(Spread).

These

floating

lending

rates

are

generally

(i)

the

lending

rate

referenced

by

the

London

Inter-Bank

Offered

Rate

("LIBOR"),

or

(ii)

the

prime

rate

offered

by

one

or

more

major

United

States

banks.

Senior

loans

may

be

considered

restricted

in

that

the

Fund

ordinarily

is

contractually

obligated

to

receive

approval

from

the

agent

bank

and/or

borrower

prior

to

the

disposition

of

a

senior

loan.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(h)

Senior

loans

generally

are

subject

to

mandatory

and/or

optional

prepayment.

Because

of

these

mandatory

prepayment

conditions

and

because

there

may

be

significant

economic

incentives

for

a

borrower

to

prepay,

prepayments

of

senior

loans

may

occur.

As

a

result,

the

actual

remaining

maturity

of

senior

loans

held

may

be

substantially

less

than

the

stated

maturities

shown.

(i)

Borrowings

as

a

percentage

of

Total

Investments

is

20.0%.

(j)

The

Fund

may

pledge

up

to

100%

of

its

eligible

investment

(excluding

any

investments

pledged

as

collateral

to

specific

investments

in

derivatives,

when

applicable)

in

the

Portfolio

of

Investments

as

collateral

for

borrowings.

(k)

Reverse

Repurchase

Agreements,

including

accrued

interest

as

a

percentage

of

Total

investments

is

8.7%.

(l)

TFP

Shares,

Net

as

a

percentage

of

Total

Investments

is

13.2%.

144A

Investment

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

investments

may

only

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

EUR

Euro

I/O

Interest

only

security

LIBOR

London

Inter-Bank

Offered

Rate

Reg

S

Regulation

S

allows

U.S.

companies

to

sell

securities

to

persons

or

entities

located

outside

of

the

United

States

without

registering

those

securities

with

the

Securities

and

Exchange

Commission.

Specifically,

Regulation

S

provides

a

safe

harbor

from

the

registration

requirements

of

the

Securities

Act

for

the

offers

and

sales

of

securities

by

both

foreign

and

domestic

issuers

that

are

made

outside

the

United

States.

REIT

Real

Estate

Investment

Trust

SOFR

90A

90

Day

Average

Secured

Overnight

Financing

Rate

TSFR

1M

CME

Term

SOFR

1

Month

TSFR

3M

CME

Term

SOFR

3

Month

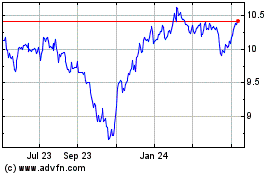

Nuveen Core Plus Impact (NYSE:NPCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

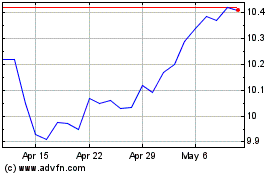

Nuveen Core Plus Impact (NYSE:NPCT)

Historical Stock Chart

From Apr 2023 to Apr 2024