false

0001138978

0001138978

2023-11-21

2023-11-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest reported): November 21,

2023

Novo

Integrated Sciences, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40089 |

|

59-3691650 |

(State

or other jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification Number) |

11120

NE 2nd Street, Suite

200, Bellevue,

WA 98004

(Address

of principal executive offices)

(206)

617-9797

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2.)

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CF$ 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on which Registered |

| Common

Stock |

|

NVOS |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

November 21, 2023, Novo Integrated Sciences, Inc. (the “Company”) entered into a Purchase and Sale Agreement ("Ophir

Agreement") between the Company and Blake Alsbrook, solely in his capacity as Court-appointed successor receiver (the “Successor

Receiver”) in Ocean Thermal Energy Corporation v. C. Robert Coe II, et al., United States District Court for the Central District

of California (the “Court”) Case No. 2:19-cv-04299 VAP (JPRx) (the “Action”). Pursuant to the terms of the Ophir

Agreement, the Company agreed to purchase, and the Successor Receiver agreed to sell to the Company, the Ophir Collection (as hereinafter

defined), subject to the contingencies outlined in the Ophir Agreement, including Court approval. The Ophir Agreement was effective upon

execution by both parties; however, the Ophir Agreement is subject to approval by the Court. If the Court does not approve the Ophir

Agreement, the Ophir Agreement will be void pursuant to its terms.

Pursuant

to the Court’s July 2, 2019 order in the Action, as modified by the Court’s February 25, 2022 order in the Action, the Successor

Receiver has possession of and right to sell a certain collection of 43 gemstones, 42 of which are certified by the Gemological Institute

of America, known as the “Ophir Collection”. Together, the Court’s July 2, 2019 order appointing the original receiver,

the Court’s December 3, 2019, order appointing the Successor Receiver, and the Court’s February 25, 2022, order are referred

to collectively as the “Receivership Orders.” The Receivership Orders authorized the Successor Receiver to take sole custody,

possession, and control of the Ophir Collection and to sell, assign, transfer, convey and deliver title and rights in and to the Ophir

Collection subject to the approval of the Court to protect the interests of certain identified creditors.

Within

two business days following the Company’s execution of the Ophir Agreement, the Company was required to, and did, deposit $25,000

(the “Deposit”) with the Successor Receiver, which deposit will be refunded to the Company if the Successor Receiver

is unable to obtain the Court’s approval of the Ophir Agreement.

Pursuant

to the terms of the Ophir Agreement, the Company agreed to pay $60,000,000 to the Successor Receiver to purchase the Ophir Collection

as follows:

| |

(i) |

The

Company has the right, at all times after November 21, 2023, to conduct a full and unfettered inspection

of the Ophir Collection. While the Company has the right to inspect the Ophir Collection prior to closing, the Company’s

inspection will not be a contingency to closing and the inability of the Company to inspect (or the Company’s decision not

to inspect) the Ophir Collection prior to closing will not delay or prevent closing. |

| |

|

|

| |

(ii) |

After

the Successor Receiver obtains Court approval of the Ophir Agreement, the Company will cause $59,975,000 (representing the $60,000,000

purchase price, less the Deposit) to be paid to the Successor Receiver, on or before December 19, 2023. |

| |

|

|

| |

(iii) |

Within

one business day thereafter, the Successor Receiver will assign, transfer, convey and deliver free and clear title and interest in

and to, and possession of, the Ophir Collection to the Company. |

The

Ophir Agreement contains certain covenants, representations and warranties customary for an agreement of this type, and the parties agreed

to provide indemnification against certain liabilities.

The

foregoing summary of the Ophir Agreement does not purport to be complete and is qualified in its entirety by reference to the Ophir Agreement,

a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Novo

Integrated Sciences, Inc. |

| |

|

|

| Dated:

November 27, 2023 |

By: |

/s/

Robert Mattacchione |

| |

|

Robert

Mattacchione |

| |

|

Chief

Executive Officer |

Exhibit

10.1

PURCHASE

AND SALE AGREEMENT

This

PURCHASE AND SALE AGREEMENT (“Agreement”) is entered into on November 21, 2023 between Novo Integrated Sciences Inc. (“Buyer”)

and Blake Alsbrook (“Seller”), solely in Seller’s capacity as Court-appointed Successor Receiver in Ocean Thermal

Energy Corporation v. C. Robert Coe II, et al., United States District Court for the Central District of California (the “Court”)

Case No. 2:19-cv-04299 VAP (JPRx) (the “Action”). Buyer and Seller are each individually referred to as a “Party”

or collectively as the “Parties.”

RECITALS

WHEREAS,

Seller is a court-appointed receiver, pursuant to the orders issued by the United States District Court for the Central District of California

in the Action and attached hereto as Exhibit A. Specifically, on July 2, 2019, the Court issued an order in the Action appointing

David J. Pasternak as original Receiver. On December 3, 2019, after Mr. Pasternak passed away, the Court issued an order in the Action

appointing Seller as the Successor Receiver.

WHEREAS,

Buyer is a Nevada Corporation with its principal place of business in the State of Washington and is in good standing in the State of

Nevada.

WHEREAS,

pursuant to the Court’s July 2, 2019 order in the Action, as modified by the Court’s February 25, 2022 order in the Action,

Seller, as Successor Receiver, has possession of and right to sell a certain collection of 43 gemstones, 42 of which are certified by

the Gemological Institute of America (“GIA”), known as the “Ophir Collection” and individually identified in

the Receiver’s Initial Inventory filed in the Action on August 15, 2019, a copy of which along with all applicable GIA certificates

are attached hereto as Exhibit B.1

WHEREAS,

on Exhibit B, item 6, Blue Sapphire, GIA report 2141405655, 13,600 carats; was recertified by GIA on February 17, 2023, GIA report 2221833052,

13,400 carats. Report states under comments “this stone has preexisting fractures and is being held together with colorless tape.”

WHEREAS,

together, the Court’s July 2, 2019, order appointing the original Receiver, the Court’s December 3, 2019, order appointing

Seller as Successor Receiver, and the Court’s February 25, 2022, order are referred to collectively as the “Receivership

Orders.” The Receivership Orders authorized Seller to take sole custody, possession, and control of the “Ophir Collection”

and to sell, assign, transfer, convey and deliver title and rights in and to the Ophir Collection subject to the approval of the Court

to protect the interests of certain creditors identified in the Receivership Orders (the “Creditors”).

WHEREAS,

Seller desires to sell the Ophir Collection to Buyer and Buyer desires to buy the Ophir Collection from Seller subject to the contingencies

outlined herein.

WHEREAS,

the Seller is not prohibited from entering into this Purchase and Sale Agreement as a result of any other agreement previously entered

into by the Seller with any other party or potential buyer.

NOW,

THEREFORE, in consideration of the mutual representations, warranties, covenants, and agreements of the Parties hereinafter set forth,

the Parties agree as follows:

TERMS

AND CONDITIONS

1.

Court Approval. This Agreement shall be effective upon execution by Buyer and Seller. (The “Effective Date.”)

However, the Agreement shall be subject to approval by the Court. Upon receipt of the Deposit, as defined hereinbelow, from Buyer, Seller,

at its sole expense, and as quickly as practicable, shall file an ex parte motion with the Court seeking approval of this Agreement2.

In the event that the Court does not approve the Agreement, the Agreement shall be void.

1

The Ophir Collection does not include the "Ore" identified in the Receiver’s Initial Inventory.

2

Pursuant to the Courts Central District Local Rule 79-5.2.2, Successor Receiver is required to apply for an Order to permanently

seal any Motion filed for Court Approval of this Agreement, including the Buyer particulars, redacted in every instance referenced.

2.

Deposit. Within two business days of Buyer’s execution of this Agreement, it shall deposit with Seller $25,000 in US

currency (the “Deposit”) by wire pursuant to the Wire Instructions attached hereto as Exhibit C. The Deposit

shall be refunded to Buyer only in the event that Seller is unable to obtain approval of this Agreement by the Court. ““

3.

Price. Buyer shall pay Sixty Million Dollars ($60,000,000) (the “Purchase Price”) to Seller to purchase the Ophir

Collection as follows:

| |

a. |

Buyer

shall have the right, at all times after the Effective Date, to conduct a full and unfettered inspection

of the Ophir Collection (“Buyer’s Inspection”). While Buyer shall have the right to inspect the Ophir Collection

prior to Closing, Buyer’s Inspection shall not be a contingency to Closing and the inability of Buyer to inspect (or Buyer’s

decision not to inspect) the Ophir Collection prior to Closing shall not delay or prevent Closing.). |

| |

|

|

| |

b. |

After

Seller obtains Court approval pursuant to Section 1, supra, Buyer shall cause the Purchase Price, less the Deposit ($59,975,000

for purposes of clarity), to be paid to Seller in U.S. Dollars by wire pursuant to the wire instructions attached hereto as Exhibit

C, on or before December 19, 2023.. |

| |

|

|

| |

c. |

Within

one (1) business day of the receipt of the Purchase Price, Seller shall assign, transfer, convey and deliver free & clear title

and interest in and-to-and possession of all the Ophir Collection to Buyer. |

4.

Buyer Representations and Warranties. Buyer represents and warrants to Seller as follows:

| |

a. |

Buyer

is a corporation duly organized, validly existing and in good standing under the laws of the jurisdiction of its incorporation. Buyer

has the power and authority and legal right to execute and deliver this Agreement and to perform its obligations hereunder. The execution

and delivery by Buyer of this Agreement and the performance of its obligations hereunder have been duly authorized by proper proceedings,

and this Agreement constitutes a legal, valid, and binding obligation of Buyer enforceable against Buyer in accordance with its terms.

Neither the execution and delivery of this Agreement by Buyer nor the performance of Buyer’s obligations hereunder will contravene,

conflict with, or result in a violation of any provision of Buyer’s articles or certificate of incorporation or its bylaws.

Buyer represents that neither its entry into this Agreement, use of funds to conclude the purchase, nor any other act taken by Buyer

related to this Agreement is contrary to any law of the United States of America or any state therein. |

| |

|

|

| |

b. |

No

information, exhibit or report furnished to Seller by Buyer in connection with the negotiation, execution, or performance of or compliance

with this Agreement contained any material misstatement or omittance of a material fact or any fact necessary to make the statements

contained therein not misleading. |

| |

|

|

| |

c. |

There

is no litigation, arbitration, governmental investigation, proceeding, or inquiry pending or, to the knowledge of any of Buyer’s

shareholders, directors, officers, members, managers, partners, employees, and agents threatened against or affecting Buyer which

could have a material adverse effect on Buyer’s performance of its obligations under this Agreement or which seeks to prevent,

enjoin, or delay the making or performance of this Agreement. |

| |

|

|

| |

d. |

Buyer

acknowledges and agrees that: (i) in making its decision to enter into this Agreement and to purchase the Ophir Collection, it has

relied solely upon the representations and warranties expressly set forth in Section 4 of this Agreement and hereby expressly

disclaims that it is relying upon or has relied upon any other representations or warranties made by or on behalf of Seller or any

Creditor; and (ii) none of Seller, any Creditor, or any other person on behalf of any of the foregoing, has made any representation

or warranty except as expressly set forth in Section 5 of this Agreement. |

| |

|

|

| |

e. |

Buyer

represents and warrants that it has no agreements, arrangements, or affiliations of any kind with any of the parties in this case

or any other individual or entity that claims an interest in the Ophir Collection. |

5.

Seller Representations and Warranties. Seller represents and warrants to Buyer as follows:

| |

a. |

Upon

approval by the Court, (i) Seller shall have the power and authority and legal right to execute and deliver this Agreement and to

perform Seller’s obligations hereunder, and (ii) the execution and delivery by Seller of this Agreement and the performance

of Seller’s obligations hereunder shall be duly authorized, and (iii) this Agreement shall constitute a legal, valid, and binding

obligation of Seller enforceable against Seller in accordance with its terms. |

| |

|

|

| |

b. |

Seller

has the power and authority to sell, assign, transfer, convey and deliver right, title and interest in and to the Ophir Collection

and, upon receipt of the Purchase Price, will sell, assign transfer, convey, and deliver right, title, and interest in and to the

Ophir Collection to Buyer free and clear of all liens and encumbrances. |

| |

|

|

| |

c. |

Neither

Seller, nor any Creditor or any other person makes, or has made, any representations or warranties of any kind regarding the accuracy

or quality of any of the information, exhibits or reports furnished to Buyer regarding the Ophir Collection. Such information has

been provided for informational purposes only and should not be relied upon by Buyer. |

| |

|

|

| |

d. |

Apart

from the Action, Seller is not aware of any litigation, arbitration, governmental investigation, proceeding, or inquiry pending or

threatened against or affecting Seller which could have a material adverse effect on Seller’s performance of its obligations

under this Agreement or which seeks to prevent, enjoin, or delay the making or performance of this Agreement. |

| |

|

|

| |

e. |

There

shall be no material alteration or change in or to the GIA certifications and corresponding inventory of gems comprising the Ophir

Collection or the condition thereof between the date Buyer and Seller execute this Agreement and the Closing. |

6.

Commission. Any Party’s obligation to pay a commission in connection with the sale of the Ophir Collection shall

be such Party’s sole responsibility.

7.

Confidentiality. Each Party shall hold in confidence any and all information about this Agreement and the terms hereof, except

to the extent that such information: (a) is or becomes generally available to and known by the public through no violation by such Party

of this Agreement; or (b) is lawfully acquired by such Party from sources which are not prohibited from disclosing such information by

a legal, contractual, or fiduciary obligation. If any Party is required to disclose any information in connection with any judicial,

regulatory or administrative process or by other purported requirements of law, such Party shall, if not prohibited by law, promptly

notify the other Party in writing of such request and shall disclose only that portion of such information which the disclosing Party

is legally required to disclose, provided that such disclosing Party shall use reasonable efforts to obtain, and shall cooperate

with all efforts by the other Party to obtain an appropriate protective order or other reasonable assurance that confidential treatment

will be accorded such information.

8.

Release. Except for the Seller Representation and Warranties in Section 4, Buyer hereby releases and forever discharges

Receiver, each Creditor and their respective members, managers, directors, officers, shareholders, employees, predecessors, affiliates,

former and present, successors, and assigns (collectively, the “Seller Parties”) from any and all claims, demands, proceedings,

causes of action, orders, obligations, contracts, agreements, debts and liabilities whatsoever, whether known or unknown, suspected or

unsuspected, both at law and in equity on account of, arising out of or in connection with (a) the condition, value, suitability of the

Ophir Collection or any gem thereof, in so long as the condition, value and suitability were not altered from the date of the Buyer Inspection

to the date of Closing (b) Buyer’s purchase of the Ophir Collection (“Seller Released Claims”); provided, however,

that the foregoing release shall not include and shall not operate to release any obligations of the Seller arising under this Agreement.

Buyer understands it may later discover claims or facts that may be different from, or in addition to, those that Buyer now knows or

believes to exist regarding the subject matter of the release contained in this Section 7, and which, if known at the time of signing

this Agreement, may have materially affected Buyer’s decision to enter into it and grant the release contained in this Section

7, such information must not be known by the Seller, Creditor or any related party to either at the time of this Agreement. Buyer intends

to fully, finally, and forever settle and release all Seller Released Claims that now exist, may exist, or previously existed, as set

out in the release contained herein, whether known or unknown, foreseen, or unforeseen, or suspected or unsuspected, and the release

given herein is and will remain in effect as a complete release, notwithstanding the discovery or existence of such additional or different

facts with the exception of any facts known to the Seller, Creditors or related parties but not disclosed to the Buyer. Buyer hereby

waives any right or claim that might arise as a result of such mutually unknown different or additional claims or facts. Without limiting

the foregoing, with respect to those matters that are the subject of the releases given herein, Buyer expressly waives and relinquishes

any and all rights, benefits, and protections afforded by any state or federal statute or common law principle limiting the scope of

a general release or limiting the release of claims which the releasing party does not know or suspect to exist in his or her favor,

including California Civil Code Section 1542, and does so understanding and acknowledging the significance of such specific waiver of

Section 1542 and any other such applicable statute or common law principle. Section 1542 states as follows:

“A

GENERAL RELEASE DOES NOT EXTEND TO CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR

AT THE TIME OF EXECUTING THE RELEASE AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE

DEBTOR OR RELEASED PARTY.”

Thus,

notwithstanding the provisions of Section 1542 or any other such applicable statute or common law principle, and for the purposes of

implementing a full and complete release and discharge of the Seller Parties with respect to those matters that are the subject of this

release, Buyer expressly acknowledges that this release is intended to include in its effect claims that Buyer, Seller, Creditors and

related parties do not know or suspect to exist in their favor at the time of execution of this Agreement.

9.

Indemnification. The Parties shall indemnify, defend and hold harmless the other Party from and against, and shall pay and

reimburse the other Party for, any and all losses incurred or sustained by, or imposed upon, the other Party based upon, resulting from,

arising out of or relating to (a) any inaccuracy in or breach of any representation or warranty set forth in this Agreement, (b) any

breach of any covenant, agreement or obligation to be performed pursuant to this Agreement, and (c) any violation of law applicable to

either Party’s performance of this Agreement.

10.

No Liability. Buyer shall purchase the Ophir Collection free of any liens and encumbrances.

11.

Taxes. Each Party is solely responsible for its or his tax obligations to any taxing authority to which the Parties are subject.

No Party has relied on any information or representations of another Party concerning any tax liability arising out of this Agreement.

12.

Notice. Any notice provided or required under this Agreement shall be made via email and U.S. Mail to the applicable address

set forth below and shall be deemed to have been given when emailed (with confirmation of receipt) if sent before 5:00 p.m. on a business

day (otherwise the next business day):

| |

To

Buyer: |

To

Buyer Attorney: |

| |

|

|

| |

Robert

Mattacchione |

Laura

Anthony |

| |

Novo

Integrated Sciences Inc. |

Anthony

L.G., PLLC |

| |

11120

NE 2nd Street, Suite 100 |

1700

Palm Beach Lakes Blvd #820 |

| |

Bellevue,

Washington 98004 USA |

West

Palm Beach, FL 33401 |

| |

Robert.mattacchione@novointegrated.com |

LAnthony@anthonypllc.com |

| |

To

Seller: |

| |

|

| |

Blake

Alsbrook, Receiver |

| |

ERVIN

COHEN & JESSUP LLP |

| |

9401

Wilshire Boulevard, 9th Floor |

| |

Beverly

Hills, CA 90212-2974 |

| |

(310)

281-6349 |

| |

balsbrook@ecjlaw.com |

13.

Complete Agreement. This Agreement embodies the complete and only agreement between the Parties and supersedes and cancels

any and all previous understandings, agreements, negotiations, commitments and any other writings or communications pertaining to its

subject matter from the Buyer to the Seller.

14.

Successors and Assigns. Prior to approval, Buyer shall not assign or transfer all or any portion of its rights, duties, and

obligations hereunder without the written consent of Seller, who will seek Court approval prior to any such consent. Any attempt to do

so without written consent of Seller is null and void. Even if approved by Seller, no assignment by Buyer of any of its rights, interests

or obligations hereunder shall relieve Buyer of its obligations under this Agreement.

15.

Modification and Waiver. This Agreement may not be modified or amended, nor may any right or obligation set forth herein be

waived, except in a writing signed by the Parties with at least the same formalities as are observed herein; provided that Seller will

seek Court approval prior to any such modification, amendment, or waiver. A waiver as to any particular term shall not operate as a waiver

as to any other terms.

16.

Severability. In the event any provision of this Agreement shall be held to be invalid or unenforceable in any respect or

for any reason, such holding shall not impair the validity and enforceability of the remaining provisions of this Agreement, which shall

continue to be given full force and effect.

17.

Advice of Counsel. Each Party to this Agreement acknowledges that it has been represented by legal counsel of its own choice

throughout the negotiations that preceded the execution of this Agreement and that it has executed this Agreement with the consent and

on the advice of such legal counsel. Each Party further acknowledges that it and its counsel have had adequate opportunity to make whatever

investigation or inquiry they may deem necessary or desirable in connection with the subject matter of this Agreement prior to the execution

hereof and the delivery and acceptance of the consideration specified herein.

18.

Choice of Law and Venue. This Agreement shall be construed and interpreted in accordance with the laws of the State of California

without giving effect to the principles of conflicts of law thereof. Any proceedings, claims, actions, or litigation arising from this

Agreement shall be brought before the Court. The Parties agree that any dispute arising out of or related to this Agreement may be decided,

without a jury, through summary proceedings by motion practice, without the need for live testimony or discovery.

19.

Construction of Agreement. The language of this Agreement shall be construed as a whole according to their fair meaning, and

not strictly for or against any of the Parties.

20.

Attorneys’ Fees. Except as otherwise set forth herein, the Parties shall each pay their own attorneys’ fees and

expenses with respect to the making of this Agreement and the Parties performance of their obligations hereunder, including but not limited

to seeking Court approvals. In connection with any legal proceeding(s) arising or related to this Agreement, the prevailing Party shall

be entitled to recover its reasonable attorneys’ fees and costs incurred in connection with such legal proceeding(s), including

the attorneys’ fees incurred in enforcing any judgment.

21.

Counterparts. This Agreement may be executed in counterparts, and transmitted by email, facsimile, or U.S. mail, which, taken

together, shall constitute one and the same agreement and shall be effective as of the date first written thereon. This Agreement may

be executed by electronic means (including, without limitation, electronic signature, or portable document format (.pdf)), each of which

shall be deemed an original instrument.

22.

Captions and Headings. Captions and paragraph headings used in this Agreement are for convenience and shall not be used to

govern, construe, or interpret this Agreement.

23.

Binding Effect; Third Party Beneficiaries. The provisions of this Agreement shall be binding upon the Parties, their respective

heirs, members, managers, directors, officers, shareholders, employees, predecessors, affiliates, former and present, successors, and

assigns, and all persons acting by, though, under, or in concert with any of them, including any independent contractors hired by any

of them (collectively, the “Bound Parties”). Except that the Creditors may enforce the requirements of Seller to obtain Court

approval hereunder, nothing in this Agreement, whether express or implied, is intended to confer any rights or remedies under or by reason

of this Agreement on any other person other than the Parties and their respective Bound Parties.

24.

“AS-IS” Disclaimer.

Buyer

hereby assumes the risk that one or all of the stones that comprise the Ophir Collection may not have the value, quality or carat-weight

attributed to them.

The

Purchase Price is a negotiated purchase price representing the fact that the Ophir Collection is being purchased by Buyer on an “AS

IS,” “WHERE IS” and “WITH ALL FAULTS” basis. Buyer hereby expressly acknowledges and agrees that Buyer

shall be solely responsible for determining the quality, carat-weight, condition, and value of the gemstones that comprise the Ophir

Collection.

Buyer

has had the opportunity to thoroughly inspect and examine the Ophir Collection to the extent deemed necessary by Buyer in order to enable

Buyer to evaluate the purchase of the Ophir Collection and Buyer is relying solely upon such inspection, examination, and evaluation

in entering into this Agreement on an “AS IS,” “WHERE IS” and “WITH ALL FAULTS” basis, without (except

as provided in Section 4 of this Agreement) representations, warranties or covenants, express or implied, of any kind or nature. Buyer

hereby waives and relinquishes all rights and privileges arising out of, or with respect or in relation to, any representations, warranties,

and covenants (except as provided in Section 4 of this Agreement), which may have been made or given, or which may be deemed to have

been made or given, regarding the Ophir Collection or the transaction contemplated herein.

Buyer

hereby further acknowledges and agrees that warranties of merchantability and fitness for a particular purpose are excluded from the

transaction contemplated hereby, as are any warranties arising from a course of dealing or usage of trade, and that no person has warranted,

and no person does hereby warrant, that the Ophir Collection now or in the future will meet or comply with the requirements of any law

or regulation of any applicable governmental authority or jurisdiction. Except as specifically set forth in Section 4 of this Agreement,

Buyer acknowledges and agrees that no person is authorized to make, and by the execution hereof Buyer hereby acknowledges that no person

has made, any representation, agreement, statement, warranty, guaranty or promise regarding the Ophir Collection, or the transaction

contemplated herein, and no representation, warranty, agreement, statement, guaranty or promise, if any, made by any person that is not

contained in Section 4 of this Agreement shall be valid or binding.

25.

Definitions.

| |

a. |

“Action”

the United States District Court for

the Central District of California Case No. 2:19-cv-04299 VAP (JPRx) and any other claims related to the Receiver with respect to

the Ophir Collection. |

| |

|

|

| |

b. |

“Agreement”

the purchase and sale agreement as identified in the recitals. |

| |

|

|

| |

c. |

“Buyer”

Novo Integrated Sciences Inc. or any of its subsidiaries. |

| |

|

|

| |

d. |

“Buyer’s

Inspection” any inspection conducted by Buyer pursuant to Buyer’s right to inspect the Ophir Collection after the Effective

Date prior to Closing. |

| |

|

|

| |

e. |

“Closing”

the date that Seller assigns, transfers,

conveys and delivers free & clear title and interest in and-to-and possession of all the Ophir Collection to Buyer. |

| |

f. |

“Creditors”

the secured parties identified in the Receivership Orders. |

| |

|

|

| |

g. |

“Purchase

Price” the total all inclusive amount of Sixty Million United States Dollars. |

| |

|

|

| |

h. |

“Seller”

Receiver as appointed by the Federal Court of California. |

| |

|

|

| |

i. |

“Ophir

Collection” a set of 43 gems identified as the Receiver’s Initial Inventory. |

| |

|

|

| |

j. |

“Deposit”

the $25,000 deposit funded by Buyer within two business days of executing Agreement. |

IN

WITNESS WHEREOF, the Parties have executed and delivered this Agreement as of the date first set forth above.

SELLER:

Court Appointed Successor Receiver

| By:

|

/s/

Blake Alsbrook |

|

| |

Blake

Alsbrook, solely in his capacity as Receiver |

|

BUYER:

Novo Integrated Sciences Inc.

| By:

|

/s/

Robert Mattacchione |

|

| |

Robert

Mattacchione, its Chief Executive Officer |

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

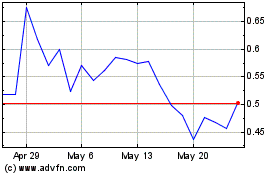

Novo Integrated Sciences (NASDAQ:NVOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Novo Integrated Sciences (NASDAQ:NVOS)

Historical Stock Chart

From Apr 2023 to Apr 2024