Form 8-K - Current report

November 27 2023 - 6:02AM

Edgar (US Regulatory)

0001409446false00014094462023-11-232023-11-23iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 23, 2023

NATE’S FOOD CO. |

(Exact name of registrant as specified in its charter) |

Colorado

(State or other jurisdiction of incorporation)

000-52831 | | 46-3403755 |

(Commission File No.) | | (IRS Employer Identification No.) |

15151 Springdale Huntington Beach, California 92649 |

(Address of principal executive offices) (zip code) |

(949) 381-1834 |

(Registrant’s telephone number, including area code) |

____________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, Par Value $0.0001 | NHMD | OTC |

Item 1.01 Entry into a Material Definitive Agreement.

See Item 8.01(b) below.

Item 8.01 Other Information.

| (a) | On November 23, 2023, the company successfully completed the registration process and obtained its unique General Administration of Customs China (GACC) registration number from the Bureau of Import and Export Food Safety in China. This Exporter Registration Number remains valid through November 24, 2028. |

| | |

| (b) | On November 23, 2023, the company initiated an agreement for the delivery of 650,000 metric tons of sugar to China and is currently in the final stages of contract completion, slated for this week. The agreement encompasses an initial shipment of 50,000 metric tons, followed by 12 monthly shipments of 50,000 metric tons each, resulting in a total of 650,000 metric tons. Importantly, this agreement is entirely independent of JP Energy Group and was successfully secured through the dedicated efforts of Nate Steck, with valuable guidance from a strategic advisor and an existing shareholder with expertise in the commodities sector. |

| | |

| | The company ensured the availability of the contracted sugar through a cash deposit. Furthermore, the agreement stipulates that buyers are required to make a 30% payment of the shipment order, approximately $6.2 million per month, upon execution, with the remaining 70% due upon presentation of the shipping documents. This payment structure obviates the necessity for letters of credit from banks, streamlining the execution process by the end of December 2023. While the company anticipates full execution of the contract this week and subsequent shipment in December 2023, it's important to note that the timing of the executed contract is subject to change. Despite the company's readiness to execute the contract under its agreed terms, there is an inherent risk that the counterparties may fail to fulfill their obligations, potentially impeding the company's ability to fully execute the contract as planned. |

| | |

| (c) | The company is actively engaged in securing additional contracts. One of which involves the sale of chicken paws, anticipated to be finalized within the next 4-6 weeks. These contracts, like the previous one mentioned above, are entirely separate from JP Energy Group. Nate Steck is spearheading these efforts, receiving valuable support from an existing shareholder with significant expertise in commodities. |

| | |

| (d) | The company has established a robust strategic partnership with a highly regarded commodities broker possessing extensive expertise in executing and fulfilling commodities contracts. This collaborative effort sees the broker actively supporting the company in procuring additional contracts across a diverse range of products. This strategic alliance underscores our steadfast commitment to portfolio expansion and market position reinforcement through strategic partnerships and a diversified array of offerings. |

| | |

| | Crucially, it should be emphasized that this strategic partnership is specifically tailored to enhance the company's burgeoning commodities business and stands independently from any agreements with JP Energy Group. |

| | |

| (e) | The Company is currently refining its cash dividend policy to seamlessly integrate its newly established commodities business. In this revised policy, dividends will be disbursed from the profits generated by the commodities business, echoing the approach employed for cash dividends originating from our bitcoin mining operation. |

| | |

| | A comprehensive breakdown of the new dividend policy, including specific parameters and procedures, will be disseminated upon its finalization before the close of the Company's third fiscal quarter. This proactive step underscores our commitment to providing stakeholders with transparent and clear insights into the evolving dividend structure aligned with our dynamic business activities. |

| | |

| (f) | The company initially planned an in-person meeting with John Park on November 28, 2023, but opted to postpone these discussions. This decision was driven by the company's heightened focus on finalizing its new sugar contract. Recent weeks have seen JP Energy attempting to renegotiate an already executed contract. In the course of these negotiations, it became apparent that JP Energy required over $400,000 to fulfill the signed contracts, a revelation significantly at odds with previous representations made to the company. This development raised substantial concerns about JP Energy's ability to successfully execute their contract. |

| | |

| | Consequently, the company proactively sought alternative solutions and reached out to a shareholder who offered their assistance in securing commodities contracts. This strategic move was aimed at allowing the company to independently secure contracts and proceed with the execution of its new commodities business, as detailed earlier. While the company is still exploring potential pathways forward with JP Energy, the current primary focus is on successfully executing its own commodities contracts and actively seeking additional commodity opportunities. |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Nate’s Food Co. | |

| | | |

Dated: November 27, 2023 | By: | /s/ Nate Steck | |

| Name: | Nate Steck | |

| Title: | CEO | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Nates Food (PK) (USOTC:NHMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

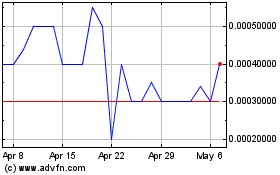

Nates Food (PK) (USOTC:NHMD)

Historical Stock Chart

From Apr 2023 to Apr 2024