false

0001444839

0001444839

2023-11-20

2023-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 20, 2023

BRAVO MULTINATIONAL INCORPORATED

(Name

of small business in its charter)

| |

|

|

|

|

| Wyoming |

|

000-53505 |

|

85-4068651 |

| (State

or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer Identification No.) |

| |

|

|

|

|

(Address

of principal executive offices)

2020 General Booth Blvd., Suite 230

Virginia Beach, VA 23454

|

Registrant’s

telephone number:

757-306-6090

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒

No

Item

2. – Material Agreement

As

previously reported, on July 03, 2023 Bravo Multinational, Inc. (“BRAVO”), a corporation formed under the laws of the State

of Wyoming, entered into a Share Exchange Agreement (“the Agreement”) with Recombinant Productions Inc. (“RPI”),

a corporation formed under the laws of the State of Nevada. Under the terms of the Agreement, the RPI shareholders were required to exchange

shares representing approximately 51% of the outstanding shares of RPI common stock to BRAVO in exchange for 8,500,000 shares of BRAVO

common stock. This transaction closed in accordance with the terms of the Stock Purchase Agreement on July 13, 2023. Subsequently,

on November 20, 2023, the parties agreed to terminate the contract and they entered into a rescission agreement which reversed all actions

previously taken on this matter and terminated the Share Exchange.

Certain

statements contained in this current report on Form 8-K are forward-looking statements and are based on future expectations, plans and

prospects for BRAVO’s business and operations and involve a number of risks and uncertainties. BRAVO’s forward-looking statements

in this report are made as of the date hereof and BRAVO disclaims any duties to supplement, update or revise such statements on a going

forward basis whether as a result of subsequent developments, change or expectations or otherwise. In connection with the “safe

harbor” provision of the Private Securities Litigation Reform Act of 1995, BRAVO is identifying certain forward-looking information

regarding, among other things, the Important factors that could cause further events or results to vary from those addressed in the forward-looking

statements, including, without limitation, risks and uncertainties arising from the ability of BRAVO to successfully manage the acquisition

of RPI; uncertainties relating to the ability to realize the expected benefits of the share exchange; unanticipated or unfavourable regulatory

matters; general economic conditions in the region and industry in which the companies operate, and other risk factors as discussed in

other BRAVO filings made from time to time with the United States Securities and Exchange Commission.

Item

9.01- Financial Statements and Exhibits.

| |

|

| Exhibit No. |

Description |

| 10.01 |

Rescission Agreement |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| |

|

| Dated:

November 22, 2023 |

BRAVO

MULTINATIONAL INCORPORATED |

| |

|

| |

By /s/

Richard Kaiser |

| |

Name: Richard Kaiser

|

| |

Title: Director/CFO |

EXHBIT 10.01

MUTUAL RESCISSION AGREEMENT

This Rescission Agreement (“Agreement”) is made as of November 15, 2023, by and between Bravo Multinational Inc., a publicly traded Wyoming Corporation ("BRVO"), Recombinant Production, Inc., a Nevada corporation ("RPI") and RPI’s shareholders, (collectively referred to as the “Parties,” and each a “Party”).

RECITALS

This Agreement is made in contemplation of the following facts:

A. The Parties entered into an Agreement to Exchange Stock dated as of July 3, 2023 (the “Exchange Agreement”) whereby the RPI Shareholders were to exchange 51% of their shares of capital stock in RPI (the “RPI Shares”) for 8,500,000 shares of the common stock of BRVO of the Exchange Agreement (the “Exchange”), which is attached hereto and made a part hereof by reference.

B. The Parties acknowledge that the Exchange was not concluded pursuant to all of the necessary terms and conditions set forth in the Exchange Agreement.

C. The Parties have determined that certain terms and conditions of the Exchange Agreement cannot be met, thereby rendering the Exchange Agreement null and void.

D. The parties have determined that it is in their best interest to formalize the voiding of the Exchange Agreement by mutually rescinding the Exchange Agreement, and thereby returning the Parties to their respective positions prior to the Exchange.

In consideration of the above recitals and the mutual benefits contained herein, the parties agree as follows:

1. Rescission. The Exchange Agreement and all agreements entered into by and among the Parties in connection therewith (the “Original Agreements”), are hereby unconditionally rescinded ab initio and each of the Parties to this Agreement will be restored to the position it was in immediately before the Original Agreements were executed. Without limiting the foregoing, the Parties represent and warrant that, as a result of this rescission, no interest in BRVO was transferred to RPI or its shareholders nor was any interest in RPI transferred to BRVO, whether by reason of the Exchange Agreement or otherwise, and BRVO and RPI agree that BRVO will have no interest in RPI and neither RPI nor its shareholders will have any interest in BRVO, or their income or assets.

2. Stock Certificates. The Parties acknowledge that no certificates representing any interest in BRVO and no certificates representing any interest in RPI to be issued in accordance with the Exchange Agreement have been issued, or if considered issued, they are returned and are no longer valid or outstanding.

-1-

3. No Assignment. Each of the Parties to this Agreement represents and warrants that it has not assigned or transferred or purported to assign or transfer, voluntarily or involuntarily, or by operation of law, any matters released pursuant to this Agreement or any portion of it, any interest in the Original Agreements or any interest in the BRVO Stock or RPI Stock. Each of the Parties further represents and warrants that none of the shares of the BRVO Stock or RPI Stock is subject to any lien, claim, charge, encumbrance, pledge, security interest or claim of others.

4. SEC Filings. Upon execution of this Agreement, BRVO shall amend any reports filed by it pursuant to Section 16 of the Securities Exchange Act of 1934 to reflect the return of any BRVO Shares and the related transfer of the RPI Shares.

5. State Filings. Upon execution of this Agreement, BRVO and RPI shall, to the extent necessary, file with the Secretary of State of Wyoming and the Secretary of State of Nevada any documents necessary to effect this Agreement.

6. Orders to Transfer Agent. To effect the recission of the BRVO shares, XXXXXXX and XXXXXXX shall and do hereby order the BRVO transfer agent, Transfer Online, 512 SE Salmon Street, Portland Oregon, 97140 to transfer the shares standing in their name back to Bravo. Such shares in the amount of 4,250,000 each in the name of XXXXXX and XXXXXX, currently in book entry form noted as BAL-624 and BAL-625, shall be transferred to Bravo with complete and current authorization.

7. Release by BRVO. BRVO, for itself and for any of its successors and assigns, releases and discharges RPI, and each of its respective successors and assigns, officers, directors and shareholders, from any and all claims, demands, damages, debts, liabilities, accounts, accounting, cause of action at law or in equity, known or unknown which BRVO ever had, now has or in any way arises from or is related to the Exchange Agreement and any events arising from that transaction.

8. Release by RPI. RPI, for itself and for any of its successors and assigns, releases and discharges BRVO, and each of its respective successors and assigns, officers, directors and shareholders, from any and all claims, demands, damages, debts, liabilities, accounts, accounting, cause of action at law or in equity, known or unknown which RPI ever had, now has or in any way arises from or is related to the Exchange Agreement or any events arising from the transaction.

9. Public Disclosure. The Parties agree that public disclosure of this Agreement shall be coordinated by BRVO, and RPI shall not directly or indirectly make any such disclosure without the prior written consent of BRVO.

10. Counterparts. This Agreement may be executed in any number of copies by the parties to it, in several counterparts, each of which will be deemed an original and all of which taken together will constitute a single instrument.

11. Authority. Each individual signing this Agreement in a representative capacity for the Party to the Agreement represents and warrants that he has full authority to execute this Agreement on behalf of the Party and in fact the Parties herein are the Parties or the successor Parties to all agreements being rescinded herein. The execution and delivery of this Agreement has been duly and validly authorized and approved by the respective boards of directors of BRVO and RPI.

-2-

12. Choice of Law. This Agreement will be enforced, governed and construed by and in accordance with the laws of the State of Nevada.

13. Headings; Interpretation. The descriptive headings herein are inserted for convenience of reference only and are not intended to be a part of or to affect the meaning or interpretation hereof. Words such as “herein,” “hereto,” “hereunder” or the like shall refer to this Agreement as a whole. The words “include” or “including” shall be by way of example rather than by limitation. The words “or,” “either” or “any” shall not be exclusive. Any pronoun used herein shall include the corresponding masculine, feminine or neuter forms. The Parties hereto have participated jointly in the negotiation and drafting hereof; accordingly, no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship hereof. In the event any Party to this Agreement brings any legal or equitable action against any other Party to this Agreement to enforce or interpret any provision of this Agreement, the prevailing Party, as determined in the court’s discretion, will be entitled to recover costs and attorney fees in the proceeding.

14. Other Documents. Each Party will, from time to time, at the request of any other Party to this Agreement, execute, acknowledge and deliver to the other, documents or instruments, and take any other actions as may be reasonably required or requested to more effectively carry out the terms of this Agreement. If required by BRVO to comply with regulatory requests, RPI will provide unaudited financial statements (including Income Statements, Balance Sheets and Statements of Cash Flows) for RPI for the periods ending December 31, 2022 and 2023.

15. Amendment. This Agreement may be amended by the agreement of all of the Parties hereto; provided, however, that this Agreement may not be amended except by an instrument in writing signed on behalf of all of the Parties hereto.

16. Confidentiality. The parties further agree that the terms and particulars regarding the parties shall remain confidential, except as required by law.

-3-

IN WITNESS WHEREOF, the Parties have caused this Agreement to be signed and delivered by their respective duly authorized officers as of the date first written above.

XXXXXXXXX

-4-

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

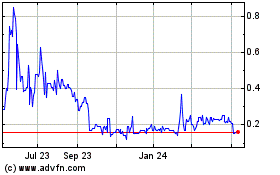

Bravo Multinational (PK) (USOTC:BRVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

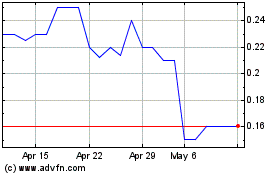

Bravo Multinational (PK) (USOTC:BRVO)

Historical Stock Chart

From Apr 2023 to Apr 2024