false

0001662574

0001662574

2023-11-20

2023-11-20

0001662574

us-gaap:CommonStockMember

2023-11-20

2023-11-20

0001662574

us-gaap:WarrantMember

2023-11-20

2023-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of

earliest event reported): November

20, 2023

GROM SOCIAL

ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

| Florida |

001-40409 |

46-5542401 |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

2060 NW Boca Raton Blvd., Suite #6

Boca Raton, Florida 33431

(Address

of principal executive offices)

Registrant’s telephone number, including area code: (561)

287-5776

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbols |

Name of each exchange on which registered |

| Common Stock, par value $0.001 |

GROM |

The Nasdaq Capital Market |

Warrants

to purchase shares of Common Stock, par value $0.001 per share |

GROMW |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry Into Material Definitive Agreement. |

On November 20, 2023, Grom Social Enterprises,

Inc., a Florida corporation (the “Company”), entered into a first amendment agreement (the “Amendment”) to the

Securities Purchase Agreement originally dated November 9, 2023 (the “Original SPA” and together with the Amendment, the “SPA”)

with Generating Alpha Ltd., a Saint Kitts and Nevis Corporation (the “Investor”).

Pursuant to the Amendment, the Original SPA was

amended by deleting in its entirety Section 2.01(b) thereof, pursuant to which the Company was to issue to the Investor at (1) the First

Closing a Warrant for 1,514,073 shares of Common Stock with an exercise price of $1.78 per share of Common Stock and (2) the Second Closing

a Warrant for 1,514,073 shares of Common Stock with an exercise price of $0.001 per share of Common Stock, and replacing it with the current

Section 2.01(b) of the SPA, pursuant to which the Company shall issue to the Investor at (1) the First Closing (a) a Warrant for 757,036

shares of Common Stock with an exercise price of $1.78 per share of Common Stock and (b) a Warrant for 757,036 shares of Common Stock

with an exercise price of $.001 per share of Common Stock and (ii) the Second Closing (a) a Warrant for 757,036 shares of Common Stock

with an exercise price of $1.78 per share of Common Stock and (b) a Warrant for 757,036 shares of Common Stock with an exercise price

of $.001 per share of Common Stock. Capitalized words and phrases not otherwise defined herein have the meanings assigned thereto in the

SPA.

The foregoing description of the Amendment is

a summary only, does not purport to be complete, and is qualified in its entirety by reference to the full text of such document, which

is attached hereto as Exhibit 10.1, and incorporated herein by reference.

Cautionary Statements

This filing includes “forward-looking statements.”

All statements other than statements of historical facts included or incorporated herein may constitute forward-looking statements. Actual

results could vary significantly from those expressed or implied in such statements and are subject to a number of risks and uncertainties.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company can give no

assurance that such expectations will prove to be correct. The forward-looking statements involve risks and uncertainties that affect

the Company’s operations, financial performance, and other factors as discussed in the Company’s filings with the SEC. Among

the factors that could cause results to differ materially are those risks discussed in the periodic reports the Company files with the

SEC. You are urged to carefully review and consider the cautionary statements and other disclosures made in those filings, specifically

those under the heading “Risk Factors.” The Company does not undertake any duty to update any forward-looking statement except

as required by law.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GROM SOCIAL ENTERPRISES, INC. |

| |

|

| |

|

| Date: November 21,

2023 |

By: |

/s/ Darren Marks |

| |

|

Darren Marks

Chief Executive Officer |

Exhibit 10.1

FIRST AMENDMENT TO SECURITIES PURCHASE AGREEMENT

This FIRST AMENDMENT TO SECURITIES

PURCHASE AGREEMENT (this “Amendment”) is dated effective as of November 20, 2023 (the “Amendment

Effective Date”), by and among Grom Social Enterprises, Inc., a Florida corporation (the “Company”),

and Generating Alpha Ltd., a Saint Kitts and Nevis corporation (the “Buyer,” and together with the Company,

the “Parties”).

RECITALS

WHEREAS, the Company

and the Buyer entered into and executed that certain Securities Purchase Agreement, dated as of November 9, 2023 (such Securities Purchase

Agreement, together with all amendments, modifications, substitutions, or replacements thereof, collectively referred to as the “SPA”),

pursuant to which the Company has agreed to sell two convertible promissory notes of the Company (each, a “Note”

and collectively, the “Notes”), with each Note having an initial principal amount of $4,000,000, for a price

of $3,640,000 per Note;

WHEREAS, in connection

with the purchase and sale of the Notes, the Company has agreed to issue to the Buyer warrants (each, a “Warrant”

and collectively, the “Warrants”) to acquire a total of 3,028,146 shares of the Company’s Common Stock,

par value $0.001 per share (the “Common Stock”) (the issuance of the Warrants together with the purchase and

sale of the Notes, the “Transactions”);

WHEREAS, the issuance

of the Notes and the Warrants shall occur at two closings (the “First Closing” and the “Second Closing”,

each a “Closing”);

WHEREAS, currently,

pursuant to the SPA, the Warrant to be issued at the First Closing shall be a Warrant for 1,514,073 shares of Common Stock and shall have

an exercise price of $1.78 per share of Common Stock, and the Warrant to be issued at the Second Closing shall be a Warrant for 1,514,073

shares of Common Stock and shall have an exercise price of $0.001 per share of Common Stock;

WHEREAS, the Parties

wish (i) the Warrants to be issued at the First Closing to be (a) a Warrant A for 757,036

shares of Common Stock with an exercise price of $1.78 per share of Common Stock and (b) a Warrant B for 757,036

shares of Common Stock with an exercise price of $.001 per share of Common Stock (together, the “First Closing Warrants”),

and (ii) the Warrants to be issued at the Second Closing to be (a) a Warrant C for 757,036

shares of Common Stock with an exercise price of $1.78 per share of Common Stock and (b) a Warrant D for 757,036

shares of Common Stock with an exercise price of $.001 per share of Common Stock (together, the “Second Closing Warrants”);

and

WHEREAS, the Parties

have agreed to amend the SPA as provided herein.

NOW, THEREFORE, in

consideration of the premises and the mutual covenants of the parties hereinafter expressed and other good and valuable consideration,

the receipt and sufficiency of which is hereby acknowledged, the parties hereto, each intending to be legally bound, agree as follows:

1. Recitals. The recitations

set forth in the preamble of this Amendment are true and correct and incorporated herein by this reference.

2. Capitalized Terms.

All capitalized terms used in this Amendment shall have the same meaning ascribed to them in the SPA, except as otherwise specifically

set forth herein.

3. Conflicts. In the

event of any conflict or ambiguity by and between the terms and provisions of this Amendment and the terms and provisions of the SPA,

the terms and provisions of this Amendment shall control, but only to the extent of any such conflict or ambiguity.

4. Amendment to SPA.

4.1. The SPA is

hereby amended by deleting Section 2.01(b) thereof in its entirety and replacing it with the following:

“In connection with the purchase and sale of the Notes,

the Company shall issue to the Buyer warrants to acquire a total of 3,028,146 shares of Common Stock, each substantially in the form as

attached hereto as Exhibits B-1, B-2, B-3, and B-4 (each, a “Warrant” and collectively, the “Warrants”). The Warrants

to be issued at the First Closing (as defined below) shall be (i) a Warrant A for 757,036 shares of Common Stock with an exercise price

of $1.78 per share of Common Stock (substantially in the form of Exhibit B-1 annexed hereto) and (ii) a Warrant B for 757,036 shares of

Common Stock with an exercise price of $.001 per share of Common Stock (substantially in the form of Exhibit B-2 annexed hereto) (together

with Warrant A, the “First Closing Warrants”). The Warrants to be issued at the Second Closing (as defined below) shall be

(i) a Warrant C for 757,036 shares of Common Stock with an exercise price of $1.78 per share of Common Stock (substantially in the form

of Exhibit B-3 annexed hereto) and (ii) a Warrant D for 757,036 shares of Common Stock with an exercise price of $.001 per share of Common

Stock (substantially in the form of Exhibit B-4 annexed hereto) (together with Warrant C, the “Second Closing Warrants”).”

4.2. The SPA is

hereby further amended by replacing all references therein to “First Closing Warrant” and “Second Closing Warrant,”

respectively, with “First Closing Warrants” and “Second Closing Warrants”, respectively.

4.3. Exhibit B of

the SPA is hereby deleted in its entirety.

4.4. Appendices

B-1, B-2, B-3, and B-4 of this Amendment are hereby added to the SPA as Exhibits B-1, B-2, B-3, and B-4, respectively.

5. Effect on Agreement

and Transaction Documents. Except as expressly amended by this Amendment, all of the terms and provisions of the SPA and the other

Transaction Documents shall remain and continue in full force and effect after the execution of this Amendment, are hereby ratified and

confirmed, and incorporated herein by this reference.

6. Execution. This

Amendment may be executed in one or more counterparts, all of which taken together shall be deemed and considered one and the same Amendment.

In the event that any signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf’ format file or other

similar format file, such signature shall be deemed an original for all purposes and shall create a valid and binding obligation of the

party executing same with the same force and effect as if such facsimile or “.pdf’ signature page was an original thereof.

[Signatures on the following page]

IN WITNESS WHEREOF, the parties

hereto have duly executed this Amendment as of the day and year first above written.

| |

Grom Social Enterprises, Inc. |

| |

|

| |

|

| |

By: /s/ Darren Marks |

| |

Name: Darren Marks |

| |

Title: Chief Executive Officer |

| |

|

| |

|

| |

|

| |

Generating Alpha Ltd. |

| |

|

| |

|

| |

By: /s/ Maria Cano |

| |

Name: Maria Cano |

| |

Title:

Director

|

| |

|

| |

|

| |

|

Appendix B-1

Exhibit B-1 to the SPA - Form of Warrant A

(Attached)

Appendix B-2

Exhibit B-2 to the SPA - Form of Warrant B

(Attached)

Appendix B-3

Exhibit B-3 to the SPA - Form of Warrant C

(Attached)

Appendix B-4

Exhibit B-4 to the SPA - Form of Warrant D

(Attached)

v3.23.3

Cover

|

Nov. 20, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 20, 2023

|

| Entity File Number |

001-40409

|

| Entity Registrant Name |

GROM SOCIAL

ENTERPRISES, INC.

|

| Entity Central Index Key |

0001662574

|

| Entity Tax Identification Number |

46-5542401

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Address, Address Line One |

2060 NW Boca Raton Blvd., Suite #6

|

| Entity Address, City or Town |

Boca Raton

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33431

|

| City Area Code |

(561)

|

| Local Phone Number |

287-5776

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001

|

| Trading Symbol |

GROM

|

| Security Exchange Name |

NASDAQ

|

| Warrant [Member] |

|

| Title of 12(b) Security |

Warrants

|

| Trading Symbol |

GROMW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

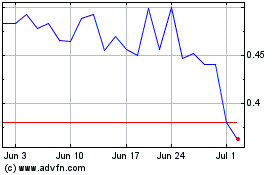

Grom Social Enterprises (NASDAQ:GROM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Grom Social Enterprises (NASDAQ:GROM)

Historical Stock Chart

From Apr 2023 to Apr 2024