false

Q3

true

false

0001021435

--12-31

0001021435

2023-01-01

2023-09-30

0001021435

2023-11-20

0001021435

2023-09-30

0001021435

2022-12-31

0001021435

2023-07-01

2023-09-30

0001021435

2022-07-01

2022-09-30

0001021435

2022-01-01

2022-09-30

0001021435

us-gaap:LicenseMember

2023-07-01

2023-09-30

0001021435

us-gaap:LicenseMember

2022-07-01

2022-09-30

0001021435

us-gaap:LicenseMember

2023-01-01

2023-09-30

0001021435

us-gaap:LicenseMember

2022-01-01

2022-09-30

0001021435

us-gaap:TechnologyServiceMember

2023-07-01

2023-09-30

0001021435

us-gaap:TechnologyServiceMember

2022-07-01

2022-09-30

0001021435

us-gaap:TechnologyServiceMember

2023-01-01

2023-09-30

0001021435

us-gaap:TechnologyServiceMember

2022-01-01

2022-09-30

0001021435

us-gaap:ServiceOtherMember

2023-07-01

2023-09-30

0001021435

us-gaap:ServiceOtherMember

2022-07-01

2022-09-30

0001021435

us-gaap:ServiceOtherMember

2023-01-01

2023-09-30

0001021435

us-gaap:ServiceOtherMember

2022-01-01

2022-09-30

0001021435

us-gaap:ServiceMember

2023-07-01

2023-09-30

0001021435

us-gaap:ServiceMember

2022-07-01

2022-09-30

0001021435

us-gaap:ServiceMember

2023-01-01

2023-09-30

0001021435

us-gaap:ServiceMember

2022-01-01

2022-09-30

0001021435

us-gaap:ProductMember

2023-07-01

2023-09-30

0001021435

us-gaap:ProductMember

2022-07-01

2022-09-30

0001021435

us-gaap:ProductMember

2023-01-01

2023-09-30

0001021435

us-gaap:ProductMember

2022-01-01

2022-09-30

0001021435

us-gaap:CommonStockMember

2021-12-31

0001021435

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001021435

us-gaap:RetainedEarningsMember

2021-12-31

0001021435

2021-12-31

0001021435

us-gaap:CommonStockMember

2022-03-31

0001021435

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001021435

us-gaap:RetainedEarningsMember

2022-03-31

0001021435

2022-03-31

0001021435

us-gaap:CommonStockMember

2022-06-30

0001021435

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001021435

us-gaap:RetainedEarningsMember

2022-06-30

0001021435

2022-06-30

0001021435

us-gaap:CommonStockMember

2022-12-31

0001021435

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001021435

us-gaap:RetainedEarningsMember

2022-12-31

0001021435

us-gaap:CommonStockMember

2023-03-31

0001021435

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001021435

us-gaap:RetainedEarningsMember

2023-03-31

0001021435

2023-03-31

0001021435

us-gaap:CommonStockMember

2023-06-30

0001021435

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001021435

us-gaap:RetainedEarningsMember

2023-06-30

0001021435

2023-06-30

0001021435

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001021435

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001021435

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001021435

2022-01-01

2022-03-31

0001021435

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001021435

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001021435

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001021435

2022-04-01

2022-06-30

0001021435

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0001021435

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2022-09-30

0001021435

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0001021435

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001021435

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001021435

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001021435

2023-01-01

2023-03-31

0001021435

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001021435

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001021435

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001021435

2023-04-01

2023-06-30

0001021435

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001021435

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0001021435

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001021435

us-gaap:CommonStockMember

2022-09-30

0001021435

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001021435

us-gaap:RetainedEarningsMember

2022-09-30

0001021435

2022-09-30

0001021435

us-gaap:CommonStockMember

2023-09-30

0001021435

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001021435

us-gaap:RetainedEarningsMember

2023-09-30

0001021435

us-gaap:SalesRevenueNetMember

HPTO:ResellersOneMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001021435

us-gaap:SalesRevenueNetMember

HPTO:ResellersTwoMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001021435

us-gaap:SalesRevenueNetMember

HPTO:ResellersThreeMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001021435

us-gaap:SalesRevenueNetMember

HPTO:ResellersOneMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-09-30

0001021435

us-gaap:SalesRevenueNetMember

HPTO:ResellersTwoMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-09-30

0001021435

us-gaap:SalesRevenueNetMember

HPTO:ResellersThreeMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-09-30

0001021435

us-gaap:AccountsReceivableMember

HPTO:ResellersOneMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001021435

us-gaap:AccountsReceivableMember

HPTO:ResellersTwoMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001021435

us-gaap:AccountsReceivableMember

HPTO:ResellersThreeMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001021435

us-gaap:AccountsReceivableMember

HPTO:ResellersFourMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001021435

us-gaap:AccountsReceivableMember

HPTO:ResellersOneMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-12-31

0001021435

us-gaap:AccountsReceivableMember

HPTO:ResellersTwoMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-12-31

0001021435

us-gaap:AccountsReceivableMember

HPTO:ResellersThreeMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-12-31

0001021435

us-gaap:AccountsReceivableMember

HPTO:ResellersFourMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-12-31

0001021435

us-gaap:EquipmentMember

2023-09-30

0001021435

us-gaap:EquipmentMember

2022-12-31

0001021435

us-gaap:FurnitureAndFixturesMember

2023-09-30

0001021435

us-gaap:FurnitureAndFixturesMember

2022-12-31

0001021435

us-gaap:WarrantMember

2023-09-30

0001021435

us-gaap:WarrantMember

2022-12-31

0001021435

us-gaap:WarrantMember

2023-07-01

2023-09-30

0001021435

country:US

2023-07-01

2023-09-30

0001021435

country:US

2022-07-01

2022-09-30

0001021435

country:US

2023-01-01

2023-09-30

0001021435

country:US

2022-01-01

2022-09-30

0001021435

country:BR

2023-07-01

2023-09-30

0001021435

country:BR

2022-07-01

2022-09-30

0001021435

country:BR

2023-01-01

2023-09-30

0001021435

country:BR

2022-01-01

2022-09-30

0001021435

HPTO:OtherCountriesMember

2023-07-01

2023-09-30

0001021435

HPTO:OtherCountriesMember

2022-07-01

2022-09-30

0001021435

HPTO:OtherCountriesMember

2023-01-01

2023-09-30

0001021435

HPTO:OtherCountriesMember

2022-01-01

2022-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the Quarterly Period Ended September 30, 2023

Commission

File Number: 0-21683

hopTo

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

13-3899021 |

| (State

of incorporation) |

|

(IRS

Employer Identification No.) |

189

North Main St., Suite 102

Concord,

NH 03301

(Address

of principal executive offices)

Registrant’s

telephone number:

(800)

472-7466

(408)

688-2674

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common |

|

HPTO |

|

OTC

Market |

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulations S-T during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files).

Yes

☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

Non-accelerated

filer |

☐ |

Smaller

reporting company |

☒ |

| |

Emerging

growth company |

☐ |

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of November 20, 2023, there were issued and outstanding 18,976,165 shares of the registrant’s common stock, par value $0.0001.

Table

of Contents

PART

I. FINANCIAL INFORMATION

ITEM

1. Financial Statements

hopTo

Inc.

Consolidated

Balance Sheets

(unaudited)

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | |

| |

| | |

| | |

| |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 5,605,400 | | |

$ | 5,037,300 | |

| Marketable securities | |

| - | | |

| 318,700 | |

| Accounts receivable, net | |

| 466,800 | | |

| 511,200 | |

| Prepaid expenses and other current assets | |

| 121,500 | | |

| 102,600 | |

| Total current assets | |

| 6,193,700 | | |

| 5,969,800 | |

| | |

| | | |

| | |

| Right-of-use assets | |

| 28,700 | | |

| 51,600 | |

| Property and equipment, net | |

| 2,900 | | |

| 5,300 | |

| Other assets | |

| 22,900 | | |

| 22,900 | |

| Total assets | |

$ | 6,248,200 | | |

$ | 6,049,600 | |

| | |

| | | |

| | |

| Liabilities and Stockholder’s Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 241,200 | | |

$ | 234,200 | |

| Accrued expenses | |

| 70,500 | | |

| 61,800 | |

| Accrued wages | |

| 236,600 | | |

| 150,000 | |

| Lease liabilities | |

| 28,400 | | |

| 10,300 | |

| Deferred revenue | |

| 1,336,500 | | |

| 1,206,100 | |

| Total current liabilities | |

| 1,913,200 | | |

| 1,662,400 | |

| Long-term liabilities | |

| | | |

| | |

| Lease liabilities | |

| - | | |

| 40,900 | |

| Deferred revenue | |

| 163,600 | | |

| 264,800 | |

| Total liabilities | |

| 2,076,800 | | |

| 1,968,100 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred stock, $0.01 par value, 5,000,000 shares authorized, no shares issued and outstanding as of September 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

| Common stock, $0.0001

par value, 195,000,000

shares authorized, 18,976,165

and 18,826,342

shares issued and outstanding, respectively as of September 30, 2023 and December 31, 2022 | |

| 1,900 | | |

| 1,900 | |

| Additional paid-in capital | |

| 82,145,100 | | |

| 82,145,100 | |

| Accumulated deficit | |

| (77,975,600 | ) | |

| (78,065,500 | ) |

| Total stockholders’ equity | |

| 4,171,400 | | |

| 4,081,500 | |

| Total liabilities and stockholders’ equity | |

$ | 6,248,200 | | |

$ | 6,049,600 | |

See

accompanying notes to unaudited consolidated financial statements

hopTo

Inc.

Consolidated

Statements of Operations

(unaudited)

| | |

| | |

| | |

| | |

| |

| | |

For

the Three Months Ended | | |

For

the Nine Months Ended | |

| | |

September

30, | | |

September

30, | | |

September

30, | | |

September

30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Software

licenses | |

$ | 98,400 | | |

$ | 135,500 | | |

$ | 335,000 | | |

$ | 449,000 | |

| Software

service fees | |

| 950,300 | | |

| 823,800 | | |

| 2,764,300 | | |

| 2,380,100 | |

| Other | |

| 20,900 | | |

| 20,900 | | |

| 71,800 | | |

| 62,900 | |

| Total

revenue | |

| 1,069,600 | | |

| 980,200 | | |

| 3,171,100 | | |

| 2,892,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost

of revenue: | |

| | | |

| | | |

| | | |

| | |

| Software

service costs | |

| 27,800 | | |

| 13,500 | | |

| 73,400 | | |

| 40,500 | |

| Software

product costs | |

| 39,500 | | |

| 36,300 | | |

| 148,500 | | |

| 135,500 | |

| Total

cost of revenue | |

| 67,300 | | |

| 49,800 | | |

| 221,900 | | |

| 176,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross

profit | |

| 1,002,300 | | |

| 930,400 | | |

| 2,949,200 | | |

| 2,716,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating

expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling

and marketing | |

| 211,000 | | |

| 248,600 | | |

| 879,400 | | |

| 687,600 | |

| General

and administrative | |

| 218,100 | | |

| 429,900 | | |

| 845,600 | | |

| 800,700 | |

| Research

and development | |

| 450,400 | | |

| 379,000 | | |

| 1,263,300 | | |

| 1,142,500 | |

| Total

operating expenses | |

| 879,500 | | |

| 1,057,500 | | |

| 2,988,300 | | |

| 2,630,800 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income

from operations | |

| 122,800 | | |

| (127,100 | ) | |

| (39,100 | ) | |

| 85,200 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other

income (loss): | |

| | | |

| | | |

| | | |

| | |

| Unrealized

gain (loss) in marketable securities | |

| - | | |

| (17,800 | ) | |

| 17,700 | | |

| (103,300 | ) |

| Interest

and other income | |

| 67,100 | | |

| 500 | | |

| 111,300 | | |

| 1,500 | |

| Other

income (loss) | |

| 67,100 | | |

| (17,300 | ) | |

| 129,000 | | |

| (101,800 | ) |

| Provision

for income taxes | |

| - | | |

| - | | |

| - | | |

| - | |

| Net

income (loss) | |

$ | 189,900 | | |

$ | (144,400 | ) | |

$ | 89,900 | | |

$ | (16,600 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net

income (loss)per share, basic | |

$ | 0.01 | | |

$ | (0.01 | ) | |

$ | 0.00 | | |

$ | (0.00 | ) |

| Net

income(loss) per share, diluted | |

$ | 0.01 | | |

$ | (0.01 | ) | |

$ | 0.00 | | |

$ | (0.00 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted

average number of common shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 18,976,165 | | |

| 18,846,664 | | |

| 18,899,957 | | |

| 18,848,658 | |

| Diluted | |

| 18,976,165 | | |

| 18,846,664 | | |

| 18,899,957 | | |

| 18,848,658 | |

See

accompanying notes to unaudited consolidated financial statements

hopTo

Inc.

Consolidated

Statements of Stockholders’ Equity

(unaudited)

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Common Stock | | |

Additional

Paid-In | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at December 31, 2021 | |

| 18,850,675 | | |

$ | 1,900 | | |

$ | 82,155,200 | | |

$ | (78,188,500 | ) | |

$ | 3,968,600 | |

| Net income | |

| - | | |

| - | | |

| - | | |

| 106,500 | | |

| 106,500 | |

| Balance at March 31, 2022 (unaudited) | |

| 18,850,675 | | |

$ | 1,900 | | |

$ | 82,155,200 | | |

$ | (78,082,000 | ) | |

$ | 4,075,100 | |

| Purchase of hopTo treasury stock | |

| (24,333 | ) | |

| - | | |

| (10,100 | ) | |

| - | | |

| (10,100 | ) |

| Net income | |

| - | | |

| - | | |

| - | | |

| 21,300 | | |

| 21,300 | |

| Balance at June 30, 2022 (unaudited) | |

| 18,826,342 | | |

$ | 1,900 | | |

$ | 82,145,100 | | |

$ | (78,060,700 | ) | |

$ | 4,086,300 | |

| Net income | |

| - | | |

| - | | |

| - | | |

| (144,400 | ) | |

| (144,400 | ) |

| Balance at September 30, 2022 (unaudited) | |

| 18,826,342 | | |

$ | 1,900 | | |

$ | 82,145,100 | | |

$ | (78,205,100 | ) | |

$ | 3,941,900 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at December, 2022 | |

| 18,826,342 | | |

$ | 1,900 | | |

$ | 82,145,100 | | |

$ | (78,065,500 | ) | |

$ | 4,081,500 | |

| Net income | |

| - | | |

| - | | |

| - | | |

| 34,600 | | |

| 34,600 | |

| Balance at March 31, 2023 (unaudited) | |

| 18,826,342 | | |

$ | 1,900 | | |

$ | 82,145,100 | | |

$ | (78,030,900 | ) | |

$ | 4,116,100 | |

| Warrant shares exercised | |

| 149,823 | | |

| - | | |

| - | | |

| - | | |

| - | |

| Net income | |

| - | | |

| - | | |

| - | | |

| (134,600 | ) | |

| (134,600 | ) |

| Balance at Jun 30, 2023 (unaudited) | |

| 18,976,165 | | |

$ | 1,900 | | |

$ | 82,145,100 | | |

$ | (78,165,500 | ) | |

$ | 3,981,500 | |

| Balance | |

| 18,976,165 | | |

$ | 1,900 | | |

$ | 82,145,100 | | |

$ | (78,165,500 | ) | |

$ | 3,981,500 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| 189,900 | | |

| 189,900 | |

| Net income (loss) | |

| - | | |

| - | | |

| - | | |

| 189,900 | | |

| 189,900 | |

| Balance at September 30, 2023 (unaudited) | |

| 18,976,165 | | |

$ | 1,900 | | |

$ | 82,145,100 | | |

$ | (77,975,600 | ) | |

$ | 4,171,400 | |

| Balance | |

| 18,976,165 | | |

$ | 1,900 | | |

$ | 82,145,100 | | |

$ | (77,975,600 | ) | |

$ | 4,171,400 | |

See

accompanying notes to unaudited consolidated financial statements

hopTo

Inc.

Consolidated

Statements of Cash Flows

(unaudited)

| | |

| | | |

| | |

| | |

For the Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Cash flows from operating activities | |

| | | |

| | |

| Net income (loss) | |

$ | 89,900 | | |

$ | (16,600 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by and used in

operating activities: | |

| | | |

| | |

| Depreciation | |

| 2,400 | | |

| 2,100 | |

| Changes in allowance for doubtful accounts | |

| (1,700 | ) | |

| 2,000 | |

| Realized and unrealized (gain) loss from marketable securities | |

| (17,600 | ) | |

| 103,400 | |

| | |

| | | |

| | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 46,100 | | |

| 192,400 | |

| Prepaid expenses and other current assets | |

| (18,900 | ) | |

| (261,500 | ) |

| Accounts payable and accrued expenses | |

| 102,300 | | |

| 31,000 | |

| Lease liabilities | |

| - | | |

| (400 | ) |

| Deferred revenue | |

| 29,200 | | |

| 23,800 | |

| Net cash provided by operating activities | |

| 231,700 | | |

| 76,200 | |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchase of hopTo common stock | |

| - | | |

| (10,100 | ) |

| Proceeds from sale of marketable securities | |

| 336,400 | | |

| - | |

| Net cash provided (used) by investing activities | |

| 336,400 | | |

| (10,100 | ) |

| | |

| | | |

| | |

| Net change in cash | |

| 568,100 | | |

| 66,100 | |

| Cash and cash equivalents, beginning of the period | |

| 5,037,300 | | |

| 4,755,300 | |

| Cash and cash equivalents, end of the period | |

$ | 5,605,400 | | |

$ | 4,821,400 | |

See

accompanying notes to unaudited consolidated financial statements

hopTo

Inc.

Notes

to Unaudited Consolidated Financial Statements

1.

Organization

hopTo

Inc., a Delaware corporation, through its wholly-owned subsidiary GraphOn Corporation (collectively, “we”, “us,”

“our” or the “Company”) are developers of application publishing software which includes application virtualization

software and cloud computing software for multiple computer operating systems including Windows, UNIX and several Linux-based variants.

The

Company sells a family of products under the brand name GO-Global, which is a software application publishing business and is the Company’s

sole revenue source at this time. GO-Global is an application access solution for use and/or resale by independent software vendors,

hosting service providers, corporate enterprises, governmental and educational institutions, and others, who wish to take advantage of

cross-platform remote access and Web-enabled access to their existing software applications, as well as those who are deploying secure,

private cloud environments.

2.

Significant Accounting Policies

Basis

of Presentation

The

unaudited consolidated financial statements include the accounts of hopTo Inc. and its wholly-owned subsidiaries. All significant intercompany

accounts and transactions are eliminated upon consolidation. The unaudited consolidated financial statements included herein have been

prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) applicable to interim

financial information and the rules and regulations promulgated by the Securities and Exchange Commission (the “SEC”). Accordingly,

such unaudited consolidated financial statements do not include all information and footnote disclosures required in annual financial

statements.

The

unaudited consolidated financial statements included herein reflect all adjustments, which include only normal, recurring adjustments,

that are, in our opinion, necessary to state fairly the results for the periods presented. This Quarterly Report on Form 10-Q should

be read in conjunction with our audited consolidated financial statements contained in our Annual Report on Form 10-K for the year ended

December 31, 2022, which was filed with the SEC on April 14, 2023 (“2022 10-K Report”). The interim results presented herein

are not necessarily indicative of the results of operations that may be expected for the full fiscal year ending December 31, 2023, or

any future period.

Use

of Estimates

The

preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the

reported amounts of revenues and expenses during the reported periods. Amounts could materially change in the future. These estimates

include the valuation of the allowances for doubtful accounts, depreciation of long-lived assets, timing of revenue recognized over time,

allowances for deferred tax assets and accruals of liabilities.

Revenue

Recognition

The

Company markets and licenses its products indirectly through channel distributors, value-added resellers, independent software vendors

(“ISVs”), hosting service providers, corporate enterprises, governmental and educational institutions and others. Our product

licenses are perpetual. We also separately sell intellectual property licenses, maintenance contracts, which are comprised of license

updates and customer service access, as well as other products and services.

The

Company recognizes revenue in accordance with Accounting Standards Codification (“ASC”) 606, “Revenue from Contracts

with Customers.” Revenues under ASC 606 are recognized when the promised goods or services are transferred to customers in an amount

that reflects the consideration to which the Company expects to be entitled to in exchange for those goods or services.

Product

Sales

All

of our licenses are delivered to the customer electronically. The Company sends the license key to the customer to download the related

software from the Company portal. We recognize revenue upon delivery of these licenses.

Services

Revenue

The

Company has maintenance contracts that entitle customers to support and certain updates to the product. Revenue from maintenance contracts

is recognized ratably over the related contract period, which generally ranges from one to five years.

Subscription

Revenue

The

Company sells subscription licenses that provide the customer with the right to use the software, maintenance and support and certain

updates to the product. Subscription licenses are delivered electronically by either the Company’s cloud licensing server or by

sending a term license key to the customer to download the related software from the Company portal. Revenue from subscription licenses

is recognized ratably over the related contract period, which generally ranges from one month to one year.

The

Company’s product sales by geographic area are presented in Note 5.

Cash

and Cash Equivalents

The

Company considers all highly liquid holdings with maturities of three months or less at the time of purchase to be cash equivalents.

Allowance

for Doubtful Accounts

We

maintain an allowance for doubtful accounts that reflects our best estimate of potentially uncollectible trade receivables. The allowance

is based on assessments of the collectability of specific customer accounts and the general aging and size of the accounts receivable.

We regularly review the adequacy of our allowance for doubtful accounts by considering such factors as historical experience, credit

worthiness, and current economic conditions that may affect a customer’s ability to pay. We specifically reserve for those accounts

deemed uncollectible. We also establish, and adjust, a general allowance for doubtful accounts based on our review of the aging and size

of our accounts receivable. As of September 30, 2023 and December 31, 2022, the allowance for doubtful accounts totaled $3,900 and $5,600,

respectively.

Concentration

of Credit Risk

For

the nine months ended September 30, 2023 and 2022, the Company had three resellers comprising 16.4%,15.3%,

and 12.9%,

and three resellers comprising 13.4%, 12.3% and 12.3%,

respectively, of total sales.

As

of September 30, 2023 and December 31, 2022, the Company had four resellers comprising 28.0%, 22.8%,19.4%

and 12.4%,

and four resellers comprising 18.5%, 18.3%, 17.4%

and 16.0%,

respectively, of net accounts receivable.

For

the purposes of this description, “sales” refers to the dollar value of orders received from these customers and partners

in the period indicated. The sales values do not necessarily equal recognized revenue for these periods due to our revenue recognition

policies which require deferral of revenue associated with prepaid software service fees. The loss of one of these resellers would not

have a material impact as the Company could take over the end customer relationship.

Basic

and Diluted Earnings Per Share

In

accordance with ASC 260, “Earnings Per Share,” the basic income (loss) per common share is computed by dividing the net

income (loss) available to common stockholders by the weighted average common shares outstanding during the period. Diluted income

(loss) per share reflects per share amounts that would have resulted if diluted potential common stock had been converted to common

stock. The company had no

dilutive common share equivalents as of September 30, 2023, compared to 248,216

of outstanding in-the-money warrants, were included in the computation of diluted net income per share using the Treasury Stock

Method during September 30, 2022. During the three months ended September 30, 2023 and 2022, the Company had total common stock

equivalents of 0

and 3,200,

respectively, which were excluded from the computation of net income per share because they are anti-dilutive.

Fair

Value of Financial Instruments

The

Company’s financial instruments consist of cash and cash equivalents, accounts receivable, accounts payable, and accrued expenses.

The carrying amount of these financial instruments approximates fair value due to the nature of the accounts and their short-term maturities.

3.

Property and Equipment

Property

and equipment consisted of the following.

Schedule

of Property and Equipment

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Equipment | |

$ | 162,400 | | |

$ | 164,100 | |

| Furniture and fixtures | |

| 1,600 | | |

| 1,600 | |

| Property and equipment gross | |

| 164,000 | | |

| 165,700 | |

| | |

| | | |

| | |

| Less: accumulated depreciation | |

| (161,100 | ) | |

| (160,400 | ) |

| Property

and equipment net | |

$ | 2,900 | | |

$ | 5,300 | |

Depreciation

expense amounted to $2,400 and $2,100 for the nine months ended September 30, 2023 and 2022, respectively.

4.

Stockholders’ Equity

Shares

of Common Stock Issued

During

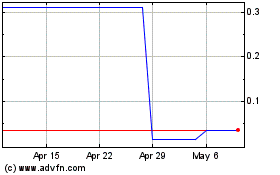

the three and nine-month periods ending September 30, 2023, the Company issued 0 and 149,216 shares and for the same periods ending 2022,

the Company did not issue any shares of common stock.

Warrants

As

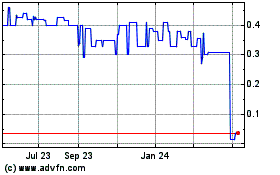

of September 30, 2023 and December 31, 2022, the Company had 0 and 248,216 warrants outstanding. There were no warrants exercised during

the three-month period ending September 30, 2023.

5.

Sales by Geographical Location

Revenue

by country for the three and nine months ended September 30, 2023 and 2022 was as follows:

Schedule

of Revenue by Country

| | |

| | | |

| | | |

| | | |

| | |

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue by Country | |

| | | |

| | | |

| | | |

| | |

| United States | |

$ | 458,100 | | |

| 388,900 | | |

| 1,308,300 | | |

| 1,180,000 | |

| Brazil | |

| 287,700 | | |

| 256,500 | | |

| 844,600 | | |

| 736,400 | |

| Other Countries | |

| 323,800 | | |

| 334,800 | | |

| 1,018,200 | | |

| 975,600 | |

| Total | |

$ | 1,069,600 | | |

$ | 980,200 | | |

| 3,171,100 | | |

| 2,892,000 | |

6.

Commitments and Contingencies

Profit

Sharing Plans

The

Company has adopted a 401(k) plan to provide retirement benefits for employees under which the Company makes discretionary matching contributions.

During the nine months ended September 30, 2023 and 2022, the Company contributed a total of $11,400 and $16,000, respectively.

Contingencies

During

the ordinary course of business, the Company is subject to various potential claims and litigation. Management is not aware of any outstanding

litigation which would have a significant impact on the Company’s financial statements.

Lease

Supplemental

balance sheet information related to leases as of September 30, 2023 is as follows:

Schedule

of Operating Leases Future Minimum Lease Payments

| | |

| | |

| Future annual minimum lease payments: | |

| | |

| 2023 | |

| 7,900 | |

| 2024 | |

| 20,700 | |

| Total future minimum lease payments | |

$ | 28,600 | |

| Less: Lease imputed interest | |

| 200 | |

| Total | |

$ | 28,400 | |

The

Company leases its’ headquarters office in Concord, New Hampshire under a thirty-six-month noncancelable operating lease agreement

which will expire on August 31, 2024. The terms of certain lease agreement provide for increasing rental payments at fixed twelve-month

intervals.

ITEM

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking

Information

This

report includes, in addition to historical information, “forward-looking statements”. All statements other than statements

of historical fact we make in this report are forward-looking statements. In particular, the statements regarding industry prospects

and our expectations regarding future results of operations or financial position (including those described in this Management’s

Discussion and Analysis of Financial Condition and Results of Operations) are forward-looking statements. Such statements are based on

management’s current expectations and are subject to a number of uncertainties and risks that could cause actual results to differ

significantly from those described in the forward-looking statements. Factors that may cause such a difference include the following:

| |

● |

the

success of products depends on a number of factors including market acceptance and our ability to manage the risks associated with

product introduction; |

| |

● |

local,

regional, national and international economic conditions and events, and the impact they may have on us and our customers; |

| |

● |

our

revenue could be adversely impacted if any of our significant customers reduces its order levels or fails to order during a reporting

period; customer demand is based on many factors out of our control; |

| |

● |

as

a result of the new revenue recognition standards, if any significant end user customer or reseller substantially changes its order

level, or fails to order during the reporting period, whether the order is placed directly with us or through one of our non-stocking

resellers, our software licenses revenue could be materially impacted; and |

| |

● |

other

factors, including, but not limited to, those set forth under Item 1A, “Risk Factors” in our Annual Report on Form 10-K

for the year ended December 31, 2022 which was filed with the Securities and Exchange Commission (the “SEC”) on April

14, 2023, and in other documents we have filed with the SEC. |

Statements

included in this report are based upon information known to us as of the date that this report is filed with the SEC, and we assume no

obligation to update or alter our forward-looking statements made in this report, whether as a result of new information, future events

or otherwise, except as otherwise required by applicable federal securities laws.

Introduction

hopTo,

Inc., through its wholly owned subsidiary GraphOn Corporation (collectively, “we”, “us,” “our” or

the “Company”), is a developer of application publishing software which includes application virtualization software and

cloud computing software for multiple computer operating systems including Windows, UNIX and several Linux-based variants. Our application

publishing software solutions are sold under the brand name GO-Global, which is our sole revenue source. GO-Global is an application

access solution for use by independent software vendors (“ISVs”), corporate enterprises, governmental and educational institutions,

and others who wish to take advantage of cross-platform remote access and Web-enabled access to their existing software applications,

as well as those who are deploying secure, private cloud environments.

Critical

Accounting Policies

We

believe that several accounting policies are important to understanding our historical and future performance. We refer to these policies

as “critical” because these specific areas require us to make judgments and estimates about matters that are uncertain at

the time when we make the estimates. Actual results may differ from these estimates. For a summary of our critical accounting policies,

please refer to our 2022 10-K Report and Note 2 to our unaudited consolidated financial Statements included under Item 1 – Financial

Statements in this Form 10-Q.

Results

of Operations for the Three-Month Periods Ended September 30, 2023 and 2022

The

following are the results of our operations for the three months ended September 30, 2023 as compared to the three months ended September

30, 2022.

| | |

For the Three Months Ended | | |

| |

| | |

September 30, | | |

September 30, | | |

| |

| | |

2023 | | |

2022 | | |

$ Change | |

| | |

(unaudited) | | |

(unaudited) | | |

| |

| | |

| | |

| | |

| |

| Revenues | |

$ | 1,069,600 | | |

$ | 980,200 | | |

$ | 89,400 | |

| Cost of revenues | |

| 67,300 | | |

| 49,800 | | |

| 17,500 | |

| Gross profit | |

| 1,002,300 | | |

| 930,400 | | |

| 71,900 | |

| | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | |

| Selling and marketing | |

| 211,000 | | |

| 248,600 | | |

| (37,600 | ) |

| General and administrative | |

| 218,100 | | |

| 429,900 | | |

| (211,800 | ) |

| Research and development | |

| 450,400 | | |

| 379,000 | | |

| 71,400 | |

| Total operating expenses | |

| 879,500 | | |

| 1,057,500 | | |

| (178,000 | ) |

| | |

| | | |

| | | |

| | |

| Income from operations | |

| 122,800 | | |

| (127,100 | ) | |

| 249,900 | |

| | |

| | | |

| | | |

| | |

| Other income (loss): | |

| | | |

| | | |

| | |

| Unrealized gain on marketable securities | |

| - | | |

| (17,800 | ) | |

| 17,800 | |

| Interest and other income | |

| 67,100 | | |

| 500 | | |

| 66,600 | |

| Other income (loss) | |

| 67,100 | | |

| (17,300 | ) | |

| 84,400 | |

| Income (loss) before provision for income taxes | |

| 189,900 | | |

| (144,400 | ) | |

| 334,300 | |

| Net income (loss) | |

$ | 189,900 | | |

$ | (144,400 | ) | |

$ | 334,300 | |

Revenues

Our

software revenue is entirely related to our GO-Global product line, and historically has been primarily derived from product licensing

fees and service fees from maintenance contracts. The majority of this revenue has been earned, and continues to be earned, from a limited

number of significant customers, most of whom are resellers. Many of our resellers purchase software licenses that they hold in inventory

until they are resold to the ultimate end user (a “stocking reseller”).

When

a software license is sold directly to an end user by us, or by one of our resellers who does not stock licenses into inventory, revenue

is recognized immediately upon shipment, assuming all other criteria for revenue recognition are met. Consequently, if any significant

end user customer substantially changes its order level, or fails to order during the reporting period, whether the order is placed directly

with us or through one of our non-stocking resellers, our software licenses revenue could be materially impacted.

Almost

all stocking resellers maintain inventories of our Windows products; few stocking resellers maintain inventories of our UNIX products.

The

following is a summary of our revenues by category for the three months ended September 30, 2023 and 2022.

| | |

For the Three Months Ended | | |

| |

| | |

September 30, | | |

September 30, | | |

| |

| | |

2023 | | |

2022 | | |

$ Change | |

| Revenue | |

| | |

| | |

| |

| Software Licenses | |

| | | |

| | | |

| | |

| Windows | |

$ | 87,100 | | |

$ | 134,000 | | |

$ | (46,900 | ) |

| UNIX/Linux | |

| 11,300 | | |

| 1,500 | | |

| 9,800 | |

| Total | |

| 98,400 | | |

| 135,500 | | |

| (37,100 | ) |

| | |

| | | |

| | | |

| | |

| Software Service Fees | |

| | | |

| | | |

| | |

| Windows | |

| 922,900 | | |

| 795,200 | | |

| 127,700 | |

| UNIX/Linux | |

| 27,400 | | |

| 28,600 | | |

| (1,200 | ) |

| Total | |

| 950,300 | | |

| 823,800 | | |

| 126,500 | |

| | |

| | | |

| | | |

| | |

| Other | |

| 20,900 | | |

| 20,900 | | |

| - | |

| | |

$ | 1,069,600 | | |

$ | 980,200 | | |

$ | 89,400 | |

Software

Licenses

Windows

software licenses revenue decreased by $46,900 or 35.0% to $87,100 during the three months ended September 30, 2023, from $134,000 for

the same period in 2022. The decrease was primarily due to lower level of new standard Window licenses orders sold for the three months

ended September 30,2023.

Software

licenses revenue from our UNIX/Linux products increased by $9,800 or 653.3% to $11,300 for the three months ended Septembere 30, 2023

from $1,500 for the same periods of 2022. The increase was primarily due to higher revenue from standard licenses during the three months

ended September 30, 2023

Software

Service Fees

Service

fees attributable to our Windows product service increased by $127,700 or 16.1% to $922,900 during three months ended September 30, 2023,

from $795,200 for the same period in 2022. The increase was due to an increase in maintenance renewals from existing customers and higher

subscription license orders.

Service

fees revenue attributable to our UNIX products had no significant change for the three months ended September 30, 2023, compared to

the same periods in 2022.

Cost

of Revenues

Cost

of revenue is comprised primarily of software service costs, which represent the costs of customer service. Also included in cost of

revenue are software product costs, which are primarily comprised of the amortization of costs associated with licenses to third party

software included in our product offerings, and the required import tax withholdings from Brazil resellers. We incur no significant shipping

or packaging costs as virtually all of our deliveries are made via electronic means over the Internet.

Cost

of revenue for the three months ended September 30, 2023 increased by $17,500, or 35.1%, to $67,300 for the three months ended September

30, 2023 from $49,800 for the same period in 2022. Cost of revenue represented 6.3% of total revenue for the three months ended September

30, 2023 and 5.1% for the same period in 2022. The increase was due to some increase in personnel costs and combined with import tax

withholdings associated with higher revenue from Brazil resellers for the three-month period ended September 30, 2023.

Selling

and Marketing Expenses

Selling

and marketing expenses primarily consisted of employee, outside services and travel and entertainment expenses.

Selling

and marketing expenses decreased by $37,600, or 15.1%, to $211,000 for the three months ended September 30, 2023 from $248,600 for the

same period in 2022. Selling and marketing expenses represented approximately 19.7% and 25.4% of total revenue for the three months ended

Septembere 30 2023 and 2022, respectively. The decrease in selling and marketing expenses was due to decrease in consulting services

for the three months ended September 30, 2023.

General

and Administrative Expenses

General

and administrative expenses primarily consist of employee costs, legal, accounting, other professional services (including those related

to our patents), rent, travel and entertainment and insurance. Certain costs associated with being a publicly held corporation are also

included in general and administrative expenses, as well as bad debt expense.

General

and administrative expenses decreased by $211,800, or 49.3%, to $218,100 for the three months ended September 30, 2023 from $429,900

for the same period in 2022. General and administrative expenses represented approximately 20.4% and 43.9% of total revenue for the three

months ended September 30, 2023 and 2022, respectively.

The

decrease in general and administrative expense was primarily due to employee related expenses during the three months ended September

30, 2023.

Research

and Development Expenses

Research

and development expenses consist primarily of employee costs, payments to contract programmers, software subscriptions, travel and entertainment

for our engineers, and all rent for our leased engineering facilities.

Research

and development expenses increased by $71,400, or 18.8% to $450,400 for the three months ended September 30, 2023 from $379,000 for the

same period in 2022. This represented approximately 42.1% and 38.7% of total revenue for the three months ended September 30, 2023 and

2022, respectively.

The

increase in research and development expense was primarily due to an increase personnel and consulting services during the three months

ended September 30, 2023.

Other

Income

Other

income increased by $84,400 for the three months ended September 30, 2023, compared to the same periods in 2022. The increase primarily

due to interest earned for the three months ended September 30,2023, compared to an unrealized loss from a marketable securities account

during the same periods in 2022.

Results

of Operations for the Nine-Month Periods Ended September 30, 2023 and 2022

| | |

For the Nine Months Ended | | |

| |

| | |

September 30, | | |

September 30, | | |

| |

| | |

2023 | | |

2022 | | |

$ Change | |

| | |

(Unaudited) | | |

(Unaudited) | | |

| |

| | |

| | |

| | |

| |

| Revenues | |

$ | 3,171,100 | | |

$ | 2,892,000 | | |

$ | 279,100 | |

| Cost of revenues | |

| 221,900 | | |

| 176,000 | | |

| 45,900 | |

| Gross profit | |

| 2,949,200 | | |

| 2,716,000 | | |

| 233,200 | |

| | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | |

| Selling and marketing | |

| 879,400 | | |

| 687,600 | | |

| 191,800 | |

| General and administrative | |

| 845,600 | | |

| 800,700 | | |

| 44,900 | |

| Research and development | |

| 1,263,300 | | |

| 1,142,500 | | |

| 120,800 | |

| Total operating expenses | |

| 2,988,300 | | |

| 2,630,800 | | |

| 357,500 | |

| | |

| | | |

| | | |

| | |

| Income from operations | |

| (39,100 | ) | |

| 85,200 | | |

| (124,300 | ) |

| | |

| | | |

| | | |

| | |

| Other income: | |

| | | |

| | | |

| | |

| Realized gain on marketable securities | |

| 17,700 | | |

| (103,300 | ) | |

| 121,000 | |

| Interest and other income | |

| 111,300 | | |

| 1,500 | | |

| 109,800 | |

| | |

| 129,000 | | |

| (101,800 | ) | |

| 230,800 | |

| Income (loss) before provision for income taxes | |

| 89,900 | | |

| (16,600 | ) | |

| 106,500 | |

| Provision for income taxes | |

| - | | |

| - | | |

| - | |

| Net income (loss) | |

$ | 89,900 | | |

$ | (16,600 | ) | |

$ | 106,500 | |

Revenues

The

following is a summary of our revenues by category for the nine months ended September 30, 2023 and 2022.

| | |

For the Nine Months Ended | | |

| |

| | |

September 30, | | |

September 30, | | |

| |

| | |

2023 | | |

2022 | | |

$ Change | |

| Revenue | |

| | |

| | |

| |

| Software Licenses | |

| | | |

| | | |

| | |

| Windows | |

$ | 309,800 | | |

$ | 433,500 | | |

$ | (123,700 | ) |

| UNIX/Linux | |

| 25,200 | | |

| 15,500 | | |

| 9,700 | |

| Total | |

| 335,000 | | |

| 449,000 | | |

| (114,000 | ) |

| | |

| | | |

| | | |

| | |

| Software Service Fees | |

| | | |

| | | |

| | |

| Windows | |

| 2,683,000 | | |

| 2,286,400 | | |

| 396,600 | |

| UNIX/Linux | |

| 81,300 | | |

| 93,700 | | |

| (12,400 | ) |

| Total | |

| 2,764,300 | | |

| 2,380,100 | | |

| 384,200 | |

| | |

| | | |

| | | |

| | |

| Other | |

| 71,800 | | |

| 62,900 | | |

| 8,900 | |

| | |

$ | 3,171,100 | | |

$ | 2,892,000 | | |

$ | 279,100 | |

Software

Licenses

Windows

software licenses revenue decreased by $123,700 or 28.5% to $309,800 during the nine months ended September 30, 2023, from $433,500 for

the same period in 2022. The decrease for the nine months ended September 30,2023 was due to lower license orders from standard licenses.

Software

licenses revenue from our UNIX/Linux products increased by $9,700 or 62.6% to $25,200 for the nine months ended September 30, 2023 from

$15,500 for the same period of 2022. The increase was primarily higher revenue from higher standard license revenue.

Software

Service Fees

Service

fees attributable to our Windows product service increased by $396,600 or 17.3% to $2,683,000 during the nine months ended September

30, 2023, from $2,286,400 for the same period in 2022. The increase was due to an increase in maintenance renewals from existing customers

and higher subscription license orders.

Service

fees revenue attributable to our UNIX products decreased by $12,400 or 13.2% to $81,300 during the nine months ended September 30, 2023,

from $93,700 for the same period in 2022. The decrease was primarily the result of the lower level of UNIX product sales throughout the

prior year and an expiration of a long-term maintenance contract.

Other

Other

revenue consists of private labeling fees, professional services, and other non-recurring revenues. Other revenue increased by $8,900

or 14.1.% for the nine months ended September 30, 2023, compared to the same period in 2022. The increase was primarily due to an increase

in professional service revenue.

Cost

of Revenues

Cost

of revenue is comprised primarily of software service costs, which represent the costs of customer service. Also included in cost of

revenue are software product costs, which are primarily comprised of the amortization of costs associated with licenses to third party

software included in our product offerings, and the required import tax withholdings from Brazil resellers. We incur no significant shipping

or packaging costs as virtually all of our deliveries are made via electronic means over the Internet.

Cost

of revenue for the nine months ended September 30, 2022 increased by $45,900, or 26.1%, to $221,900 for the nine months ended September

30, 2023 from $176,000 for the same period in 2022. Cost of revenue represented 7.0% and 6.1% of total revenue for the nine months ended

September 30, 2023 and 2022, respectively. The primarily increase was due increase in personnel expense and import tax withholdings associated

with higher revenue from Brazil resellers for the six-month period ended September30, 2023.

Selling

and Marketing Expenses

Selling

and marketing expenses primarily consisted of employee, outside services and travel and entertainment expenses.

Selling

and marketing expenses increased by $191,800, or 27.9%, to $879,400 for the nine months ended September 30, 2023 from $687,600 for the

same period in 2022. Selling and marketing expenses represented approximately 27.7% and 23.8% of total revenue for the nine months ended

September 30, 2023 and 2022, respectively. The increase in selling and marketing expenses was due to an increase in personnel related

expenses and consulting services as we continue to expand our sales and marketing initiatives.

General

and Administrative Expenses

General

and administrative expenses primarily consist of employee costs, legal, accounting, board fees, other professional services (including

those related to our patents), rent, travel and entertainment and insurance. Certain costs associated with being a publicly held corporation

are also included in general and administrative expenses, as well as bad debt expense.

General

and administrative expenses increased by $44,900, or 5.6%, to $845,600 for the nine months ended September 30, 2023 from $800,700 for

the same period in 2022. General and administrative expenses represented approximately 26.7% and 27.7% of total revenue for the nine

months ended September 30, 2023 and 2022, respectively.

The

increase in general and administrative expense was primarily due to increase in personnel related expenses and patent maintenance fees.

Research

and Development Expenses

Research

and development expenses consist primarily of employee costs, payments to contract programmers, software subscriptions, travel and entertainment

for our engineers, and all rent for our leased engineering facilities.

Research

and development expenses increased by $120,800 or 10.6% to $1,263,300 for the nine months ended September 30, 2023 from $1,142,500 for

the same period in 2022. This represented approximately 39.8% and 39.5% of total revenue for the nine months ended September 30, 2023

and 2022, respectively.

The

increase in research and development expense was primarily due to increase in personnel related expenses, consulting services and software

subscriptions.

Other

Income

Other

income increased by $230,800 for the nine months ended September 30, 2023, compare to the same periods in 2022 was primarily related

to income earned for the nine months ended September 30,2023 while during prior year for the same periods, the Company had unrealized

losses from a marketable securities account.

Liquidity

and Capital Resources

As

of September 30, 2023, we had cash of $5,605,400 and a working capital position of $4,280,500 as compared to cash of $5,037,300 and a

working capital position of $4,307,400 at December 31, 2022. The increase in cash as of September 30, 2023 was the result of cash provided

by operations and cash provided by investing activities. We expect our results from operations and capital resources will be sufficient

to fund our operations for at least the next 12 months.

The

following is a summary of our cash flows from operating, investing and financing activities for the nine months ended September 30, 2023

and 2022.

| | |

For the Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | |

| Cash flows provided by operating activities | |

$ | 231,700 | | |

$ | 76,200 | |

| Cash flows provided (used) by investing activities | |

$ | 336,400 | | |

$ | (10,100 | ) |

| Cash flows provided by financing activities | |

$ | - | | |

$ | - | |

Net

cash flows provided by operating activities for the nine months ended September 30, 2023 was $231,700 while net cash flows provided for

the same periods ended September 30,2022 was $76,200. The increase in cash flows provided by operating activities is the result of net

income, increase in accrued expenses and accounts receivable and change in value in marketable securities compared to the prior year

period.

The

Company had net cash flows of $336,400 provided by investing activities from the proceeds of the sale of marketable securities for the

nine months ended September 30, 2023, while the Company had net cash outflows of $10,100 used in marketable securities for the same periods

ended September 30, 2022.

ITEM

3. Quantitative and Qualitative Disclosures About Market Risk

Not

applicable.

ITEM

4. Controls and Procedures

Under

the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, we evaluated

the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934)

as of the end of the period covered by this report. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer

concluded that our disclosure controls and procedures were effective as of September 30, 2023.

There

has not been any change in our internal control over financial reporting (as defined in Rule 13a-15(f) under the Exchange Act) during

the quarter ended September 30, 2023 that has materially affected, or is reasonably likely to materially affect, our internal control

over financial reporting.

PART

II. OTHER INFORMATION

ITEM

1. Legal Proceedings

Not

applicable

ITEM

1A. Risk Factors

There

have been no material changes in our risk factors from those set forth under Item 1A, “Risk Factors” in our Annual Report

on Form 10-K for the year ended December 31, 2022, which was filed with the Securities and Exchange Commission on April 14, 2023.

ITEM

2. Unregistered Sales of Equity Securities and Use of Proceeds

None.

ITEM

3. Defaults Upon Senior Securities

Not

applicable

ITEM

4. Mine Safety Disclosures

Not

applicable

ITEM

5. Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

| |

hopTo

Inc. |

| |

(Registrant) |

| |

|

|

| |

Date: |

November

20, 2023 |

| |

|

|

| |

By: |

/s/

Jonathon R. Skeels |

| |

|

Jonathon

R. Skeels |

| |

|

Chief

Executive Officer (Principal Executive Officer) and |

| |

|

Interim

Chief Financial Officer |

| |

|

(Principal

Financial Officer and |

| |

|

Principal

Accounting Officer) |

EXHIBIT

31

CERTIFICATIONS

I,

Jonathon R. Skeels, certify that:

| 1. |

I

have reviewed this Quarterly Report on Form 10-Q of hopTo Inc. (“registrant”); |

| |

|

| 2. |

Based

on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to

the period covered by this report; |

| |

|

| 3. |

Based

on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material

respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in

this report; |

| |

|

| 4. |

The

registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures

(as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange

Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| |

a) |

Designed

such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision,

to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others

within those entities, particularly during the period in which this report is being prepared; |

| |

|

|

| |

b) |

Designed

such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our

supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles; |

| |

|

|

| |

c) |

Evaluated

the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about

the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation;

and |

| |

|

|

| |

d) |

Disclosed

in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s

most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of the annual report) that has materially affected,

or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. |

The

registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over

financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or

persons performing the equivalent functions): |

| |

a) |

All

significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are

reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information;

and |

| |

|

|

| |

b) |

Any

fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s

internal control over financial reporting. |

Dated:

November 20, 2023

| By: |

/s/

Jonathon R. Skeels |

|

| |

Jonathon

R. Skeels |

|

| |

Chief

Executive Officer and Interim Chief Financial Officer |

|

Exhibit 32

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report on Form 10-Q

of hopTo Inc. (the “Company”) for the quarter ending September 30, 2023, as filed with the Securities and Exchange Commission

on the date hereof (the “Report”), I Jonathon R. Skeels, Chief Executive Officer and Interim Chief Financial Officer of the

Company, hereby certifies, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

(1) The report fully complies with the requirements

of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

(2) The information contained in the Report fairly

presents, in all material respects, the financial condition and results of operations of the Company.

| Dated: November 20, 2023 |

By: |

/s/ Jonathon R. Skeels |

| |

|

Jonathon R. Skeels |

| |

|

Chief Executive Officer, Interim Chief Financial Officer |

v3.23.3

Cover - shares

|

9 Months Ended |

|

Sep. 30, 2023 |

Nov. 20, 2023 |

| Cover [Abstract] |

|

|

| Document Type |

10-Q

|

|

| Amendment Flag |

false

|

|

| Document Quarterly Report |

true

|

|

| Document Transition Report |

false

|

|

| Document Period End Date |

Sep. 30, 2023

|

|

| Document Fiscal Period Focus |

Q3

|

|

| Document Fiscal Year Focus |

2023

|

|

| Current Fiscal Year End Date |

--12-31

|

|

| Entity File Number |

0-21683

|

|

| Entity Registrant Name |

hopTo

Inc.

|

|

| Entity Central Index Key |

0001021435

|

|

| Entity Tax Identification Number |

13-3899021

|

|

| Entity Incorporation, State or Country Code |

DE

|

|

| Entity Address, Address Line One |

189

North Main St.

|

|

| Entity Address, Address Line Two |

Suite 102

|

|

| Entity Address, City or Town |

Concord

|

|

| Entity Address, State or Province |

NH

|

|

| Entity Address, Postal Zip Code |

03301

|

|

| City Area Code |

(800)

|

|

| Local Phone Number |

472-7466

|

|

| Title of 12(b) Security |

Common

|

|

| Trading Symbol |

HPTO

|

|

| Entity Current Reporting Status |

Yes

|

|

| Entity Interactive Data Current |

Yes

|

|

| Entity Filer Category |

Non-accelerated Filer

|

|

| Entity Small Business |

true

|

|

| Entity Emerging Growth Company |

false

|

|

| Entity Shell Company |

false

|

|

| Entity Common Stock, Shares Outstanding |

|

18,976,165

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an quarterly report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-Q

-Number 240

-Section 308

-Subsection a

| Name: |

dei_DocumentQuarterlyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |