true

0001407878

0001407878

2023-01-01

2023-09-30

0001407878

dei:BusinessContactMember

2023-01-01

2023-09-30

0001407878

2022-12-31

0001407878

2021-12-31

0001407878

us-gaap:NonrelatedPartyMember

2022-12-31

0001407878

us-gaap:NonrelatedPartyMember

2021-12-31

0001407878

us-gaap:RelatedPartyMember

2022-12-31

0001407878

us-gaap:RelatedPartyMember

2021-12-31

0001407878

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001407878

us-gaap:SeriesBPreferredStockMember

2021-12-31

0001407878

us-gaap:SeriesEPreferredStockMember

2022-12-31

0001407878

us-gaap:SeriesEPreferredStockMember

2021-12-31

0001407878

2023-09-30

0001407878

us-gaap:NonrelatedPartyMember

2023-09-30

0001407878

us-gaap:RelatedPartyMember

2023-09-30

0001407878

us-gaap:SeriesBPreferredStockMember

2023-09-30

0001407878

us-gaap:SeriesEPreferredStockMember

2023-09-30

0001407878

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2022-12-31

0001407878

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2021-12-31

0001407878

us-gaap:SeriesEPreferredStockMember

us-gaap:PreferredStockMember

2022-12-31

0001407878

us-gaap:SeriesEPreferredStockMember

us-gaap:PreferredStockMember

2021-12-31

0001407878

2022-01-01

2022-12-31

0001407878

2021-01-01

2021-12-31

0001407878

2023-07-01

2023-09-30

0001407878

2022-07-01

2022-09-30

0001407878

2022-01-01

2022-09-30

0001407878

us-gaap:CommonStockMember

2021-12-31

0001407878

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001407878

us-gaap:RetainedEarningsMember

2021-12-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2020-12-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2020-12-31

0001407878

us-gaap:CommonStockMember

2020-12-31

0001407878

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001407878

us-gaap:RetainedEarningsMember

2020-12-31

0001407878

2020-12-31

0001407878

us-gaap:CommonStockMember

2022-12-31

0001407878

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001407878

us-gaap:RetainedEarningsMember

2022-12-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-03-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2023-03-31

0001407878

us-gaap:CommonStockMember

2023-03-31

0001407878

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001407878

us-gaap:RetainedEarningsMember

2023-03-31

0001407878

2023-03-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-06-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2023-06-30

0001407878

us-gaap:CommonStockMember

2023-06-30

0001407878

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001407878

us-gaap:RetainedEarningsMember

2023-06-30

0001407878

2023-06-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-03-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2022-03-31

0001407878

us-gaap:CommonStockMember

2022-03-31

0001407878

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001407878

us-gaap:RetainedEarningsMember

2022-03-31

0001407878

2022-03-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-06-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2022-06-30

0001407878

us-gaap:CommonStockMember

2022-06-30

0001407878

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001407878

us-gaap:RetainedEarningsMember

2022-06-30

0001407878

2022-06-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-01-01

2022-12-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2022-01-01

2022-12-31

0001407878

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001407878

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001407878

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2021-01-01

2021-12-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2021-01-01

2021-12-31

0001407878

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001407878

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001407878

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-01-01

2023-03-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2023-01-01

2023-03-31

0001407878

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001407878

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001407878

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001407878

2023-01-01

2023-03-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2023-04-01

2023-06-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-04-01

2023-06-30

0001407878

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001407878

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001407878

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001407878

2023-04-01

2023-06-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2023-07-01

2023-09-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-07-01

2023-09-30

0001407878

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001407878

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0001407878

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-01-01

2022-03-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2022-01-01

2022-03-31

0001407878

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001407878

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001407878

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001407878

2022-01-01

2022-03-31

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-04-01

2022-06-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2022-04-01

2022-06-30

0001407878

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001407878

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001407878

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001407878

2022-04-01

2022-06-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-07-01

2022-09-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2022-07-01

2022-09-30

0001407878

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0001407878

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2022-09-30

0001407878

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-09-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2023-09-30

0001407878

us-gaap:CommonStockMember

2023-09-30

0001407878

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001407878

us-gaap:RetainedEarningsMember

2023-09-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-09-30

0001407878

us-gaap:PreferredStockMember

us-gaap:SeriesEPreferredStockMember

2022-09-30

0001407878

us-gaap:CommonStockMember

2022-09-30

0001407878

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001407878

us-gaap:RetainedEarningsMember

2022-09-30

0001407878

2022-09-30

0001407878

srt:MinimumMember

2021-01-07

2021-01-07

0001407878

srt:MaximumMember

2021-01-07

2021-01-07

0001407878

srt:MinimumMember

2023-01-01

2023-09-30

0001407878

srt:MaximumMember

2023-01-01

2023-09-30

0001407878

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001407878

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001407878

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001407878

us-gaap:FairValueInputsLevel1Member

2021-12-31

0001407878

us-gaap:FairValueInputsLevel2Member

2021-12-31

0001407878

us-gaap:FairValueInputsLevel3Member

2021-12-31

0001407878

us-gaap:FairValueInputsLevel1Member

2023-09-30

0001407878

us-gaap:FairValueInputsLevel2Member

2023-09-30

0001407878

us-gaap:FairValueInputsLevel3Member

2023-09-30

0001407878

us-gaap:ConvertibleNotesPayableMember

2020-12-31

0001407878

us-gaap:SeriesBPreferredStockMember

2020-12-31

0001407878

DLOC:StockOptionsMember

2020-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

2021-01-01

2021-12-31

0001407878

DLOC:StockOptionsMember

2021-01-01

2021-12-31

0001407878

us-gaap:SeriesBPreferredStockMember

2021-01-01

2021-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

2021-12-31

0001407878

DLOC:StockOptionsMember

2021-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

2022-01-01

2022-12-31

0001407878

DLOC:StockOptionsMember

2022-01-01

2022-12-31

0001407878

us-gaap:SeriesBPreferredStockMember

2022-01-01

2022-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001407878

DLOC:StockOptionsMember

2022-12-31

0001407878

us-gaap:SeriesEPreferredStockMember

2022-01-01

2022-12-31

0001407878

us-gaap:SeriesEPreferredStockMember

2021-01-01

2021-12-31

0001407878

us-gaap:SeriesBPreferredStockMember

2022-01-01

2022-09-30

0001407878

us-gaap:SeriesEPreferredStockMember

2022-01-01

2022-09-30

0001407878

2021-01-01

2021-01-07

0001407878

2021-01-07

0001407878

DLOC:SCSLLCMember

2021-12-31

0001407878

DLOC:SCSLLCMember

2022-01-01

2022-12-31

0001407878

DLOC:BusinessAcquisitionMember

2021-12-31

0001407878

us-gaap:AccountsPayableMember

us-gaap:ConvertibleNotesPayableMember

2013-03-14

0001407878

us-gaap:AccountsPayableMember

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001407878

us-gaap:AccountsPayableMember

us-gaap:ConvertibleNotesPayableMember

2021-12-31

0001407878

us-gaap:AccountsPayableMember

us-gaap:ConvertibleNotesPayableMember

2022-01-01

2022-12-31

0001407878

us-gaap:RelatedPartyMember

us-gaap:ConvertibleNotesPayableMember

2012-12-31

0001407878

us-gaap:RelatedPartyMember

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001407878

us-gaap:RelatedPartyMember

us-gaap:ConvertibleNotesPayableMember

2021-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:NoteOneMember

us-gaap:RelatedPartyMember

2022-01-01

2022-12-31

0001407878

us-gaap:RelatedPartyMember

us-gaap:ConvertibleNotesPayableMember

DLOC:NoteOneMember

2022-12-31

0001407878

us-gaap:RelatedPartyMember

us-gaap:ConvertibleNotesPayableMember

DLOC:NoteOneMember

2021-12-31

0001407878

DLOC:AugustTwentyFourTwoThousandTwentyTwoMember

us-gaap:ConvertibleNotesPayableMember

2022-08-24

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:AugustTwentyFourTwoThousandTwentyTwoMember

2022-08-23

2022-08-24

0001407878

DLOC:AugustTwentyFourTwoThousandTwentyTwoMember

us-gaap:ConvertibleNotesPayableMember

2022-01-01

2022-12-31

0001407878

DLOC:AugustTwentyFourTwoThousandTwentyTwoMember

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001407878

DLOC:AugustTwentyNineTwoThousandNinenteenMember

us-gaap:ConvertibleNotesPayableMember

2019-08-29

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:AugustTwentyNineTwoThousandNinenteenMember

2019-08-28

2019-08-29

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:AugustTwentyNineTwoThousandNinenteenMember

2021-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:AugustTwentyNineTwoThousandNinenteenMember

2022-04-01

2022-04-30

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:AugustTwentyNineTwoThousandNinenteenMember

2022-04-30

0001407878

DLOC:JulyEightTwoThousandTwentyMember

us-gaap:ConvertibleNotesPayableMember

2020-07-08

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:JulyEightTwoThousandTwentyMember

2020-07-07

2020-07-08

0001407878

DLOC:JulyEightTwoThousandTwentyMember

us-gaap:ConvertibleNotesPayableMember

2022-08-23

2022-08-24

0001407878

DLOC:JulyEightTwoThousandTwentyMember

us-gaap:ConvertibleNotesPayableMember

2020-07-01

2020-07-08

0001407878

DLOC:JulyEightTwoThousandTwentyMember

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:JulyEightTwoThousandTwentyMember

2021-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:JulyEightTwoThousandTwentyMember

2022-01-01

2022-12-31

0001407878

DLOC:JulyTwelveTwoThousandTwentyOneMember

us-gaap:ConvertibleNotesPayableMember

2021-07-12

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:JulyTwelveTwoThousandTwentyOneMember

2021-07-11

2021-07-12

0001407878

DLOC:JulyTwelveTwoThousandTwentyOneMember

us-gaap:ConvertibleNotesPayableMember

2021-07-01

2021-07-12

0001407878

DLOC:JulyTwelveTwoThousandTwentyOneMember

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001407878

DLOC:JulyTwelveTwoThousandTwentyOneMember

us-gaap:ConvertibleNotesPayableMember

2021-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:JulyTwelveTwoThousandTwentyOneMember

2022-01-01

2022-12-31

0001407878

DLOC:AugustThirtyOneTwoThousandTwentyoneMember

us-gaap:ConvertibleNotesPayableMember

2021-08-31

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:AugustThirtyOneTwoThousandTwentyoneMember

2021-08-30

2021-08-31

0001407878

DLOC:AugustThirtyOneTwoThousandTwentyoneMember

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001407878

DLOC:AugustThirtyOneTwoThousandTwentyoneMember

us-gaap:ConvertibleNotesPayableMember

2021-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:AugustThirtyOneTwoThousandTwentyoneMember

2022-01-01

2022-12-31

0001407878

DLOC:OctoberSevenTwoThousandTwentyOneMember

us-gaap:ConvertibleNotesPayableMember

2021-10-07

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:OctoberSevenTwoThousandTwentyOneMember

2021-10-06

2021-10-07

0001407878

DLOC:OctoberSevenTwoThousandTwentyOneMember

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001407878

DLOC:OctoberSevenTwoThousandTwentyOneMember

us-gaap:ConvertibleNotesPayableMember

2021-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:OctoberSevenTwoThousandTwentyOneMember

2022-01-01

2022-12-31

0001407878

DLOC:NovemberEightTwoThousandTwentyOneMember

us-gaap:ConvertibleNotesPayableMember

2021-11-08

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:NovemberEightTwoThousandTwentyOneMember

2021-11-07

2021-11-08

0001407878

DLOC:NovemberEightTwoThousandTwentyOneMember

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001407878

DLOC:NovemberEightTwoThousandTwentyOneMember

us-gaap:ConvertibleNotesPayableMember

2021-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:NovemberEightTwoThousandTwentyOneMember

2022-01-01

2022-12-31

0001407878

DLOC:DecemberFourteenTwoThousandTwentyOneMember

DLOC:ConvertibleNotesPayableTwoMember

2021-12-14

0001407878

DLOC:DecemberFourteenTwoThousandTwentyOneMember

DLOC:AugustTwentyFourTwoThousandTwentyTwoMember

2021-12-14

0001407878

2021-12-12

2021-12-14

0001407878

DLOC:DecemberFourteenTwoThousandTwentyOneMember

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001407878

DLOC:DecemberFourteenTwoThousandTwentyOneMember

us-gaap:ConvertibleNotesPayableMember

2021-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:DecemberFourteenTwoThousandTwentyOneMember

2022-01-01

2022-12-31

0001407878

DLOC:JanuarySixTwoThousandTwentyTwoMember

DLOC:ConvertibleNotesPayableTwoMember

2022-01-06

0001407878

DLOC:JanuarySixTwoThousandTwentyTwoMember

DLOC:AugustTwentyFourTwoThousandTwentyTwoMember

2022-01-06

0001407878

DLOC:JanuarySixTwoThousandTwentyTwoMember

us-gaap:ConvertibleNotesPayableMember

2022-01-04

2022-01-06

0001407878

2022-01-04

2022-01-06

0001407878

DLOC:JanuarySixTwoThousandTwentyTwoMember

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:JanuarySixTwoThousandTwentyTwoMember

2022-01-01

2022-12-31

0001407878

DLOC:MarchOneTwoThousandTwentyTwoMember

DLOC:ConvertibleNotesPayableTwoMember

2022-03-01

0001407878

DLOC:MarchOneTwoThousandTwentyTwoMember

DLOC:AugustTwentyFourTwoThousandTwentyTwoMember

2022-03-01

0001407878

DLOC:MarchOneTwoThousandTwentyTwoMember

us-gaap:ConvertibleNotesPayableMember

2022-02-28

2022-03-01

0001407878

2022-02-28

2022-03-01

0001407878

DLOC:MarchOneTwoThousandTwentyTwoMember

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:MarchOneTwoThousandTwentyTwoMember

2022-01-01

2022-12-31

0001407878

DLOC:MayThreeTwoThousandTwentyTwoMember

DLOC:ConvertibleNotesPayableTwoMember

2022-05-03

0001407878

DLOC:MayThreeTwoThousandTwentyTwoMember

DLOC:AugustTwentyFourTwoThousandTwentyTwoMember

2022-05-03

0001407878

DLOC:MayThreeTwoThousandTwentyTwoMember

us-gaap:ConvertibleNotesPayableMember

2022-05-01

2022-05-03

0001407878

2022-05-01

2022-05-03

0001407878

DLOC:MayThreeTwoThousandTwentyTwoMember

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

DLOC:MayThreeTwoThousandTwentyTwoMember

2022-01-01

2022-12-31

0001407878

DLOC:ConvertibleNotesPayableOneMember

2013-03-14

0001407878

DLOC:ConvertibleNotesPayableOneMember

2022-12-31

0001407878

DLOC:ConvertibleNotesPayableOneMember

2013-03-14

2013-03-14

0001407878

DLOC:TwoEmployeesMember

DLOC:ConvertibleNotesPayableTwoMember

2012-12-31

0001407878

DLOC:ConvertibleNotesPayableTwoMember

DLOC:EmployeeOneMember

2022-12-31

0001407878

DLOC:ConvertibleNotesPayableTwoMember

DLOC:TwoEmployeesMember

2012-12-31

2012-12-31

0001407878

DLOC:ConvertibleNotesPayableTwoMember

DLOC:EmployeeTwoMember

2022-12-31

0001407878

DLOC:ConvertibleNotesPayableThreeMember

2022-08-24

0001407878

DLOC:ConvertibleNotesPayableThreeMember

2022-08-24

2022-08-24

0001407878

DLOC:ConvertibleNotesPayableThreeMember

2023-09-30

0001407878

DLOC:ConvertibleNotesPayableThreeMember

2022-12-31

0001407878

DLOC:ConvertibleNotesPayableFourMember

2023-06-20

0001407878

DLOC:ConvertibleNotesPayableFourMember

2023-06-20

2023-06-20

0001407878

DLOC:ConvertibleNotesPayableFourMember

2023-07-31

0001407878

DLOC:ConvertibleNotesPayableFourMember

2023-07-31

0001407878

DLOC:ConvertibleNotesPayableFourMember

DLOC:LenderMember

2023-07-31

0001407878

DLOC:ConvertibleNotesPayableFourMember

DLOC:LenderMember

2023-09-30

0001407878

DLOC:ConvertibleNotesPayableFourMember

2023-07-31

2023-07-31

0001407878

DLOC:ConvertibleNotesPayableFourMember

2023-01-01

2023-09-30

0001407878

DLOC:ConvertibleNotesPayableFourMember

2023-09-30

0001407878

DLOC:TwoLongTermConvertibleNotesPayableMember

2021-01-07

0001407878

DLOC:TwoLongTermConvertibleNotesPayableMember

2021-01-06

2021-01-07

0001407878

DLOC:TwoLongTermConvertibleNotesPayableMember

2022-01-01

2022-12-31

0001407878

DLOC:TwoLongTermConvertibleNotesPayableMember

2022-12-31

0001407878

DLOC:TwoLongTermConvertibleNotesPayableMember

2021-12-31

0001407878

DLOC:TwoLongTermConvertibleNotesPayableMember

2023-01-01

2023-09-30

0001407878

DLOC:TwoLongTermConvertibleNotesPayableMember

2023-09-30

0001407878

us-gaap:SeriesBPreferredStockMember

DLOC:SecretaryMember

2016-03-02

0001407878

us-gaap:SeriesBPreferredStockMember

2016-03-01

2016-03-02

0001407878

us-gaap:SeriesBPreferredStockMember

2016-03-02

0001407878

us-gaap:SeriesBPreferredStockMember

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001407878

us-gaap:SeriesBPreferredStockMember

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001407878

us-gaap:SeriesEPreferredStockMember

2021-04-02

0001407878

us-gaap:SeriesEPreferredStockMember

DLOC:SecuritiesPurchaseAgreementMember

DLOC:AccreditedInvestorMember

2021-03-29

2021-04-02

0001407878

us-gaap:SeriesEPreferredStockMember

DLOC:SecuritiesPurchaseAgreementMember

DLOC:AccreditedInvestorMember

2021-04-02

0001407878

DLOC:SecuritiesPurchaseAgreementsMember

DLOC:SeriesEPreferredSharesMember

2022-12-31

0001407878

us-gaap:SeriesEPreferredStockMember

DLOC:SecuritiesPurchaseAgreementMember

DLOC:AccreditedInvestorMember

2021-09-01

2021-09-30

0001407878

us-gaap:SeriesEPreferredStockMember

DLOC:SecuritiesPurchaseAgreementMember

DLOC:AccreditedInvestorMember

2021-09-30

0001407878

us-gaap:SeriesEPreferredStockMember

DLOC:SecuritiesPurchaseAgreementMember

DLOC:AccreditedInvestorMember

2022-01-01

2022-12-31

0001407878

us-gaap:SeriesEPreferredStockMember

DLOC:SecuritiesPurchaseAgreementMember

DLOC:AccreditedInvestorMember

2022-12-31

0001407878

DLOC:ConvertiblePromissoryNotesMember

2022-12-31

0001407878

us-gaap:SeriesBPreferredStockMember

2023-01-01

2023-09-30

0001407878

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0001407878

us-gaap:SeriesEPreferredStockMember

DLOC:SecuritiesPurchaseAgreementMember

DLOC:AccreditedInvestorMember

2021-04-02

2021-04-02

0001407878

us-gaap:SeriesEPreferredStockMember

DLOC:SecuritiesPurchaseAgreementMember

DLOC:AccreditedInvestorMember

2023-01-01

2023-09-30

0001407878

us-gaap:SeriesEPreferredStockMember

DLOC:SecuritiesPurchaseAgreementMember

DLOC:AccreditedInvestorMember

2022-01-01

2022-09-30

0001407878

us-gaap:CommonStockMember

us-gaap:ConvertibleNotesPayableMember

2021-01-01

2021-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0001407878

us-gaap:ConvertibleNotesPayableMember

us-gaap:CommonStockMember

2023-09-30

0001407878

us-gaap:CommonStockMember

us-gaap:ConvertibleNotesPayableMember

2022-01-01

2022-09-30

0001407878

us-gaap:ConvertibleNotesPayableMember

us-gaap:CommonStockMember

2022-09-30

0001407878

DLOC:FiveOfficersandDirectorsandConsultantsMember

DLOC:OnOctoberNineteenTwentyTwentyAndDecemberTwentyTwoTwentyTwentyMember

2022-01-01

2022-12-31

0001407878

srt:MinimumMember

DLOC:FiveOfficersandDirectorsandConsultantsMember

2020-12-01

2020-12-22

0001407878

srt:MaximumMember

DLOC:FiveOfficersandDirectorsandConsultantsMember

2020-12-01

2020-12-22

0001407878

2020-10-19

0001407878

2020-12-22

0001407878

2021-01-01

2021-01-28

0001407878

2021-01-28

0001407878

DLOC:PreferredSeriesBSharesMember

2021-12-01

2021-12-31

0001407878

2021-12-01

2021-12-31

0001407878

2021-12-01

0001407878

2022-01-01

2022-02-08

0001407878

2022-02-08

0001407878

DLOC:OfficerDirectorsAndConsultantsMember

2023-09-30

0001407878

srt:MinimumMember

2022-01-01

2022-12-31

0001407878

srt:MaximumMember

2022-01-01

2022-12-31

0001407878

srt:MinimumMember

DLOC:DerivativeLiabilitiesMember

2022-01-01

2022-12-31

0001407878

srt:MaximumMember

DLOC:DerivativeLiabilitiesMember

2022-01-01

2022-12-31

0001407878

us-gaap:StockOptionMember

2022-12-31

0001407878

us-gaap:StockOptionMember

2021-12-31

0001407878

DLOC:MrBeifussMember

2021-12-31

0001407878

srt:ChiefExecutiveOfficerMember

2022-01-01

2022-12-31

0001407878

srt:ChiefExecutiveOfficerMember

2021-01-01

2021-12-31

0001407878

srt:ChiefExecutiveOfficerMember

2021-12-31

0001407878

DLOC:ChiefExecutiveOfficerAndChiefFinancialOfficerMember

DLOC:WrittenConsultingAgreementMember

2016-11-01

2016-11-01

0001407878

DLOC:MrBeifussMember

DLOC:WrittenConsultingAgreementMember

2022-01-01

2022-06-30

0001407878

DLOC:MrBeifussMember

DLOC:WrittenConsultingAgreementMember

2021-01-01

2021-06-30

0001407878

DLOC:MrBeifussMember

2022-12-31

0001407878

srt:ChiefExecutiveOfficerMember

DLOC:WrittenConsultingAgreementMember

2020-12-22

0001407878

srt:ChiefExecutiveOfficerMember

DLOC:WrittenConsultingAgreementMember

2020-12-22

2020-12-22

0001407878

srt:BoardOfDirectorsChairmanMember

DLOC:WrittenConsultingAgreementMember

2020-12-22

2020-12-22

0001407878

srt:ChiefExecutiveOfficerMember

2022-02-08

0001407878

DLOC:ConsultantMember

2022-02-08

0001407878

srt:ChiefExecutiveOfficerMember

2022-02-08

2022-02-08

0001407878

srt:ChiefExecutiveOfficerMember

DLOC:IndependentContractorAgreementMember

2021-12-01

2021-12-01

0001407878

srt:ChiefExecutiveOfficerMember

DLOC:IndependentContractorAgreementMember

2022-07-01

2022-09-30

0001407878

srt:ChiefExecutiveOfficerMember

DLOC:IndependentContractorAgreementMember

2022-01-01

2022-09-30

0001407878

srt:ChiefExecutiveOfficerMember

DLOC:IndependentContractorAgreementMember

2021-12-01

0001407878

srt:ChiefExecutiveOfficerMember

DLOC:IndependentContractorAgreementMember

DLOC:ShareBasedCompensationAwardAtTheEndOfSixMonthMember

2021-12-01

2021-12-01

0001407878

srt:ChiefExecutiveOfficerMember

DLOC:IndependentContractorAgreementMember

DLOC:ShareBasedCompensationAwardAtTheEndOfSevenMonthMember

2021-12-01

2021-12-01

0001407878

DLOC:ChiefExecutiveOfficerAndChiefFinancialOfficerMember

DLOC:WrittenConsultingAgreementMember

2022-07-01

2022-09-30

0001407878

DLOC:ChiefExecutiveOfficerAndChiefFinancialOfficerMember

DLOC:WrittenConsultingAgreementMember

2022-01-01

2022-09-30

0001407878

2022-02-01

0001407878

2022-02-01

2022-02-01

0001407878

srt:ChiefExecutiveOfficerMember

DLOC:IndependentContractorAgreementMember

2022-01-01

2022-12-31

0001407878

DLOC:ChiefExecutiveOfficerAndChiefFinancialOfficerMember

DLOC:WrittenConsultingAgreementMember

2023-08-01

2023-08-31

0001407878

DLOC:SeriesEPreferredSharesMember

us-gaap:SubsequentEventMember

2023-01-01

2023-01-05

0001407878

DLOC:SeriesEPreferredSharesMember

us-gaap:SubsequentEventMember

2023-02-01

2023-02-06

0001407878

DLOC:SeriesEPreferredSharesMember

us-gaap:SubsequentEventMember

2023-03-02

2023-03-08

0001407878

DLOC:SeriesEPreferredSharesMember

us-gaap:SubsequentEventMember

2023-03-01

0001407878

DLOC:SeriesEPreferredSharesMember

us-gaap:SubsequentEventMember

2023-02-25

2023-03-01

0001407878

DLOC:SeriesEPreferredSharesMember

us-gaap:SubsequentEventMember

2023-03-06

0001407878

DLOC:SeriesEPreferredSharesMember

us-gaap:SubsequentEventMember

2023-03-02

2023-03-06

0001407878

us-gaap:SubsequentEventMember

DLOC:ConvertiblePromissoryNoteMember

DLOC:LenderMember

2023-10-04

2023-10-04

0001407878

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001407878

us-gaap:StockOptionMember

2022-12-31

0001407878

us-gaap:ConvertibleNotesPayableMember

2023-01-01

2023-09-30

0001407878

us-gaap:StockOptionMember

2023-01-01

2023-09-30

0001407878

us-gaap:ConvertibleNotesPayableMember

2023-09-30

0001407878

us-gaap:StockOptionMember

2023-09-30

0001407878

srt:MinimumMember

us-gaap:MeasurementInputExpectedTermMember

2023-01-01

2023-09-30

0001407878

srt:MaximumMember

us-gaap:MeasurementInputExpectedTermMember

2023-01-01

2023-09-30

0001407878

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MinimumMember

2023-09-30

0001407878

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MaximumMember

2023-09-30

0001407878

us-gaap:MeasurementInputPriceVolatilityMember

srt:MinimumMember

2023-09-30

0001407878

us-gaap:MeasurementInputPriceVolatilityMember

srt:MaximumMember

2023-09-30

0001407878

us-gaap:SeriesBPreferredStockMember

2023-07-01

2023-09-30

0001407878

us-gaap:SeriesBPreferredStockMember

2023-01-01

2023-09-30

0001407878

us-gaap:SeriesEPreferredStockMember

2023-07-01

2023-09-30

0001407878

us-gaap:SeriesEPreferredStockMember

2023-01-01

2023-09-30

0001407878

us-gaap:ConvertibleNotesPayableMember

2023-07-01

2023-09-30

0001407878

us-gaap:ConvertibleNotesPayableMember

2023-01-01

2023-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1/A

Amendment

No. 1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Digital

Locations, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

4899 |

|

20-5451302 |

(State

of

Incorporation) |

|

(Primary

Standard Industrial

Classification

Number) |

|

(IRS

Employer

Identification

Number) |

1117

State Street

Santa

Barbara, California 93101

(805)456-7000

(Address,

including zip code, and telephone number, including area code,

of

registrant’s principal executive offices)

Please

send copies of all communications to:

BRUNSON

CHANDLER & JONES, PLLC

175

South Main Street, Suite 1410

Salt

Lake City, Utah 84111

801-303-5772

callie@bcjlaw.com

(Address,

including zip code, and telephone, including area code)

Approximate

date of proposed sale to the public: From time to time after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check one):

| |

Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| |

Non-accelerated

filer |

☐ |

|

Smaller

reporting company |

☒ |

| |

(do

not check if a smaller reporting company) |

|

Emerging

Growth Company |

☐ |

We

hereby amend this registration statement on such date or dates as may be necessary to delay our effective date until the registrant shall

file a further amendment which specifically states that this registration statement shall, thereafter, become effective in accordance

with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission,

acting pursuant to Section 8(a) may determine.

PRELIMINARY

PROSPECTUS SUBJECT TO COMPLETION DATED NOVEMBER ___, 2023

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

DIGITAL

LOCATIONS, INC.

300,000,000

Common Shares

The

selling stockholder identified in this prospectus may offer an indeterminate number of shares of its common stock, which will consist

of up to 300,000,000 shares of common stock to be sold by GHS Investments LLC (“GHS”) pursuant to an Equity Financing Agreement

(the “Financing Agreement”) dated September 7, 2023. If issued presently, the 300,000,000 of common stock registered for

resale by GHS would represent 40.88% of our issued and outstanding shares of common stock as of November 17, 2023, however, there

is an ownership limit for GHS of 4.99% at any point in time.

The

selling stockholder may sell all or a portion of the shares being offered pursuant to this prospectus at fixed prices and prevailing

market prices at the time of sale, at varying prices, or at negotiated prices.

We

will not receive any proceeds from the sale of the shares of our common stock by GHS. However, we will receive proceeds from our initial

sale of shares to GHS pursuant to the Financing Agreement. We will sell shares to GHS at a price equal to 92.5% of the lowest trading

price of our common stock during the ten (10) consecutive trading day period preceding on the date on which we deliver a put notice to

GHS (the “Market Price”) and one hundred twelve and one half percent (112.5%) of the put amount shall be delivered in shares

for each particular put.

GHS

is an underwriter within the meaning of the Securities Act of 1933, with respect to the shares being issued pursuant to the Financing

Agreement and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters”

within the meaning of the Securities Act of 1933 in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under

the Securities Act of 1933.

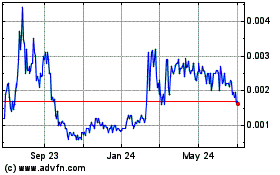

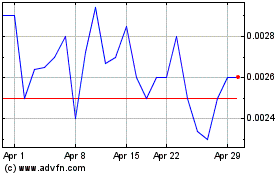

Our

common stock is traded on the OTC Pink Market under the symbol “DLOC”. On November 16, 2023 the last

reported sale price for our common stock was $0.0009 per share.

Prior

to this offering, there has been a very limited market for our securities. While our common stock is on the OTC Pink Market, there

has been negligible trading volume. There is no guarantee that an active trading market will develop in our securities.

This

offering is highly speculative, and these securities involve a high degree of risk and should be considered only by persons who can afford

the loss of their entire investment. See “Risk Factors” beginning on page 6. Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus.

Any representation to the contrary is a criminal offense.

The

date of this prospectus is ________________, 2023.

Table

of Contents

The

following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the

entire prospectus.

We

have not authorized any person to give you any supplemental information or to make any representations for us. You should not rely upon

any information about our company that is not contained in this prospectus. Information contained in this prospectus may become stale.

You should not assume the information contained in this prospectus or any prospectus supplement is accurate as of any date other than

their respective dates, regardless of the time of delivery of this prospectus, any prospectus supplement or of any sale of the shares.

Our business, financial condition, results of operations, and prospects may have changed since those dates. The selling stockholders

are offering to sell and seeking offers to buy shares of our common stock only in jurisdictions where offers and sales are permitted.

In

this prospectus, “Digital Locations,” “DLOC,” the “Company,” “we,” “us,”

and “our” refer to Digital Locations, Inc., a Nevada corporation.

Item

3. SUMMARY INFORMATION, RISK FACTORS, AND RATIO OF EARNINGS TO FIXED CHARGES

You

should carefully read all information in the prospectus, including the financial statements and their explanatory notes under the Financial

Statements prior to making an investment decision.

Corporate

Background

To

help connect a world of more than 8 billion people, the Company is developing a new technology that will enable high-speed Internet service

to be delivered from satellites directly to smartphones. We aim to redesign the link technology between satellites and smartphones, which

includes novel antenna designs, new integrated circuits, and innovative frequency management to support indoor and outdoor data connection.

On

June 6, 2023, the Company engaged Florida International University (FIU) to perform the research necessary to develop this technology.

Successful development and implementation of this technology will allow next generation smartphones, anywhere in the world, to access

high-speed Internet service and benefit from remote learning, health care, government services, telework, participation in public affairs

and various sources of entertainment.

In

a digitally divided world of “haves and have nots”, high Speed Internet is usually available only in densely populated areas

of the world. Much of the world is still underserved with terrestrial wireless phone and data connections. Connecting satellites directly

with smartphones to receive high speed internet service is technically very challenging but represents an extraordinary business opportunity.

FIU

has assembled a team of people with the background, experience and talent to perform such research. Located in Miami, the University

is one of the most respected in the communications field and has an impressive facility capable of designing the tools necessary to make

this research viable.

While

this research is under way, there are no guarantees that it will achieve anything of commercial value or patentable concepts. Every effort

is being made to develop technology, circuits, antenna designs and frequency compatibility and the Company is realistic about the time,

money and effort necessary for a breakthrough.

Previously,

the Company was engaged in the business of maintaining its portfolio of acquired small cell sites to help meet the then-expected demand

of rapidly growing 5G networks. We currently receive revenue from previously developed sites. We are no longer adding additional locations

to this business nor are we seeking more sites.

To

meet that objective, on January 7, 2021, through our wholly owned subsidiary SmallCellSite Inc. (“SCS”), we closed on the

acquisition of substantially all of the assets of SmallCellSite.com, LLC (“SCS LLC”), a source of more than 80,000 cell sites

offered by property owners for use by wireless network operators. The business acquisition has been accounted for as a purchase and the

accounts of SCS are consolidated with those of the Company.

On

June 29, 2021, the Company, through its wholly-owned subsidiary SCS, entered into a Master Asset Marketing and Agency Agreement (the

“Marketing Agreement”) with Smartify Media (“Smartify”) to add Smartify’s locations to the Company’s

small cell database. Smartify turns any storefront or physical location into a (MXP) Media Experience Platform for property owners which

could create recurring revenue and media value from programmatic and local media channels.

According

to the terms of the Marketing Agreement, which automatically renewed for one-year terms unless terminated by either party, SCS agreed

to provide marketing services and management of the co-location and utilization of equipment to operators (such as wireless service providers,

internet services providers and telecommunications operators) on Smartify’s existing assets. Smartify and SCS shall share all revenue

generated from operators with 70% of revenue to Smartify and 30% of revenue to SCS.

The

Company and Smartify agreed to cancel and terminate this Marketing Agreement as of November 9, 2023, and the Company has no plans to

pursue additional business opportunities in the space, focusing its efforts on enabling high-speed Internet service to be delivered from

satellites directly to smartphones.

Where

You Can Find Us

Our

principal business address is 1117 State Street, Santa Barbara, California 93101. We maintain our corporate website at https://digitallocations.com/

(this website address is not intended to function as a hyperlink and the information contained on our website is not intended to be

a part of this Report). Our phone number is (805)456-7000.

Summary

of the Offering

| Shares

currently outstanding: |

|

733,766,705 |

| |

|

|

| Shares

being offered: |

|

300,000,000 |

| |

|

|

| Offering

Price per share: |

|

The

selling stockholders may sell all or a portion of the shares being offered pursuant to this prospectus at fixed prices and prevailing

market prices at the time of sale, at varying prices or at negotiated prices. |

| |

|

|

| Use

of Proceeds: |

|

We

will not receive any proceeds from the sale of the shares of our common stock by the selling stockholder. However, we will receive

proceeds from our initial sale of shares to GHS, pursuant to the Financing Agreement. The proceeds from the initial sale of shares

will be used for the purpose of working capital and for potential acquisitions. |

| |

|

|

| OTC

Pink Market Symbol: |

|

DLOC |

| |

|

|

| Risk

Factors: |

|

See

“Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before

deciding to invest in shares of our common stock. |

Financial

Summary

The

tables and information below are derived from our consolidated financial statements for the twelve months ended December 31, 2022 and

2021.

| | |

December

31, 2022 | | |

December

31, 2021 | |

| | |

| | |

| |

| Cash | |

| 31,113 | | |

$ | 68,366 | |

| Total Assets | |

| 37,613 | | |

| 76,366 | |

| Total Liabilities | |

| 1,917,056 | | |

| 6,535,111 | |

| Total Stockholder’s Equity (Deficit) | |

| (7,363,543 | ) | |

| (11,444,945 | ) |

Statement

of Operations

| | |

Year

End December

31, 2022 | | |

Year

End December

31, 2021 | |

| | |

| | |

| |

| Revenue | |

| 23,068 | | |

| 24,029 | |

| Total Operating Expenses | |

| 3,658,684 | | |

| 4,723,970 | |

| Net Income (Loss) for the Period | |

| 969,014 | | |

| (13,120,527 | ) |

| Net Income (Loss) per Share | |

| 0.00 | | |

| (0.07 | ) |

RISK

FACTORS

This

investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and

the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial

condition could be harmed, and the value of our stock could go down. This means you could lose all or a part of your investment.

Special

Information Regarding Forward-Looking Statements

Some

of the statements in this prospectus are “forward-looking statements.” These forward-looking statements involve certain known

and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different

from any future results, performance or achievements expressed or implied by these forward-looking statements. These factors include,

among others, the factors set forth herein under “Risk Factors.” The words “believe,” “expect,” “anticipate,”

“intend,” “plan,” and similar expressions identify forward-looking statements. We caution you not to place undue

reliance on these forward-looking statements. We undertake no obligation to update and revise any forward-looking statements or to publicly

announce the result of any revisions to any of the forward-looking statements in this document to reflect any future or developments.

However, the Private Securities Litigation Reform Act of 1995 is not available to us as a non- reporting issuer. Further, Section 27A(b)(2)(D)

of the Securities Act and Section 21E(b)(2)(D) of the Securities Exchange Act expressly state that the safe harbor for forward-looking

statements does not apply to statements made in connection with an initial public offering.

Risks

Related to Our Business and Industry

We

are in the early stages of development and have limited operating history on which you can base an investment decision.

We

were formed in August 2006, but recently changed our business focus. We have generated no revenues, have no real operating history upon

which you can evaluate our business strategy or future prospects, and have negative working capital. As a result, our auditor issued

an opinion in connection with our December 31, 2022 financial statements, which expressed substantial doubt about our ability to continue

as a going concern unless we obtain additional financing.

Our ability to obtain additional financing and generate revenue will depend

on whether we can successfully develop and acquire a large portfolio of cell tower sites to make the transition from a development stage

company to an operating company. We expect to continue to incur losses. In making your evaluation of our business, you should consider

that we are a start-up business focused on developing and acquiring a portfolio of cell tower sites and operate in a rapidly evolving

industry. As a result, we may encounter many expenses, delays, problems, and difficulties that we have not anticipated and for which

we have not planned. There can be no assurance that at this time we will successfully develop or acquire a significant portfolio of cell

tower sites, operate profitably, or that we will have adequate working capital to fund our operations or meet our obligations as they

become due.

Our

proposed operations are subject to all of the risks inherent in the initial expenses, challenges, complications, and delays frequently

encountered in connection with the formation of any new business. Investors should evaluate an investment in our company in light of

the problems and uncertainties frequently encountered by companies attempting to develop markets for new products, services, and technologies.

Despite best efforts, we may never overcome these obstacles to achieve financial success. Our business is speculative and dependent upon

the implementation of our business plan, as well as our ability to successfully acquire cell tower sites for 5G services with third parties

on terms that will be commercially viable for us. There can be no assurance that our efforts will be successful or result in revenue

or profit. There is no assurance that we will earn significant revenues or that our investors will not lose their entire investment.

If

we are unable to effectively manage the transition from a development stage company to an operating company, our financial results will

be negatively affected.

For

the period from our inception, August 25, 2006, through December 31, 2022, we incurred an aggregate net loss, and had an accumulated

deficit, of $50,164,550. For the years ended December 31, 2022 and 2021, we incurred operating losses of $3,635,616 and $4,699,941, respectively.

We reported net income of $969,014 for the year ended December 31, 2022, resulting primarily from a gain on change in derivative liability,

and a net loss of $13,120,527 for the year ended December 31, 2021. Our operating losses are expected to continue to increase for at

least the next 48 months as we commence full-scale development of our new business plan, if feasible. We believe we will require significant

funding to make this transition if full-scale development is commercially justified. If we do make such transition, we expect our business

to grow significantly in size and complexity. This growth is expected to place significant additional demands on our management, systems,

internal controls, and financial and operational resources. As a result, we will need to expend additional funds to hire additional qualified

personnel, retain professionals to assist in developing appropriate control systems, and expand our operating infrastructures. Our inability

to secure additional resources, as and when needed, or manage our growth effectively, if and when it occurs, would significantly hinder

our transition to an operating company, as well as diminish our prospects of generating revenues and, ultimately, achieving profitability.

Currently,

we have generated minimal revenue from this new and unproven segment of our business. There is a risk that we will be unable to compete

with large, medium, and small competitors that are in (or may enter) the industry with substantially larger resources and management

experience than us.

The

evolving small cell site and tower market in which we expect to enter is intensely competitive requiring sophisticated technology and

constant innovation, both in the development and execution of our business financial model and the quality of our intellectual property.

There is no assurance that we will successfully compete to gain and retain customers and meet their requirements. Our current management

has little prior experience in conducting this business.

Our

technology that will enable high-speed Internet service to be delivered from satellites directly to smartphones is in early stages of

development and might never become commercially viable. We have never generated any revenue from product sales and may never be profitable.

We

are very early in our development efforts and only recently have commenced any significant research, with respect to our intended technology.

We currently generate no revenue and we may never be able to develop our technology or a marketable product. Our ability to generate

revenues, which we do not expect will occur for several years, if ever, may depend on obtaining regulatory approvals for, and successfully

commercializing our technology or product candidates, either alone or in collaboration with others, and we cannot guarantee that we will

ever obtain regulatory approval for our technology or any of our product candidates.

Our

business is subject to government regulation.

Aspects

of our small cell site and tower business are subject to and will be designed to comply with the regulations of the FCC. A change in

those regulations may have a material adverse effect on our operating results, financial condition, and business prospects and performance.

We are also subject to regulations applicable to businesses generally, including without limitation those governing employment, construction,

permit requirements, the environment, and health and safety, those governing the telecommunications industry, and the FCC. The adoption

of any additional laws or regulations may decrease the growth of our business, decrease the demand for services and increase our cost

of doing business. Changes in tax laws also could have a significant adverse effect on our operating results and financial condition.

As

we develop and acquire small cell sites and towers, we may be subject to additional and unexpected regulations, which could increase

our costs or otherwise harm our business.

As

we develop and acquire small cell sites and towers, we may become subject to additional laws and regulations, which could create unexpected

liabilities for us, cause us to incur additional costs or restrict our operations. From time to time, we may be notified of or otherwise

become aware of additional laws and regulations that governmental organizations or others may claim should be applicable to our business.

Our failure to anticipate the application of these laws and regulations accurately, or other failure to comply, could create liability

for us, result in adverse publicity, or cause us to alter our business practices, which could cause our net revenues to decrease, our

costs to increase, or our business otherwise to be harmed.

Our

ability to protect our intellectual property is uncertain.

As

a result of the APA, we acquired proprietary web-based software which provides a system and method for identifying wireless communication

assets. A provisional patent application for this technology was filed on May 31, 2017 and we were notified on or about January 11, 2021

by the United States Patent and Trademark Office that the patent will be granted. We cannot assure that this patent or any other patent

that may be granted to us, if any, in the future will be enforceable. We will have limited resources to fight any infringements on our

proprietary rights and if we are unable to protect our proprietary rights or if such rights infringe on the rights of others, our business

will be materially adversely affected.

The

current credit and financial market conditions may exacerbate certain risks affecting our business.

Due

to the continued disruption in the financial markets arising from the global recession and the slow pace of economic recovery, many of

our potential customers may be unable to access capital necessary to lease our cell towners once developed or acquired. Many are operating

under austerity budgets that make it significantly more difficult to take risks. As a result, we may experience increased difficulties

in convincing customers to lease our cell towers once developed or acquired.

The

future impact of the Covid-19 pandemic on companies is evolving and we are currently unable to assess with certainty the broad effects

of Covid-19 on our business.

The

future impact of the Covid-19 pandemic on companies continues to evolve and we are currently unable to assess with certainty the broad

effects of Covid-19 on our business. As of December 31, 2022, the Company had no material assets that would be subject to impairment

or change in valuation due to Covid-19. However, as of December 31, 2022, the reported values of the Company’s material convertible

debt and derivative liabilities are based on multiple factors, including the market price of our stock, interest rates, our stock price

volatility, variable conversion prices based on market prices as defined in the respective agreements and probabilities of certain outcomes

based on management projections. We believe these inputs will be subject to even more significant changes due to the impact on capital

markets of Covid-19, and the future estimated fair value of these liabilities may fluctuate materially from period to period.

Without

reliable sources of revenue, we are currently dependent on debt or equity financing to fund our operations and execute our business plan.

We believe that the impact on capital markets of Covid-19 may make it more costly and more difficult for us to access these sources of

funding.

We

do not maintain theft or casualty insurance, and only maintain modest liability and property insurance coverage and therefore we could

incur losses as a result of an uninsured loss.

We

cannot assure that we will not incur uninsured liabilities and losses as a result of the conduct of our business. Any such uninsured

or insured loss or liability could have a material adverse effect on our results of operations.

If

we lose key employees and consultants or are unable to attract or retain qualified personnel, our business could suffer.

Our

success is highly dependent on our ability to attract and retain qualified management personnel. Competition for these qualified personnel

is intense. We are highly dependent on our management and key consultants who have been critical to the development of our business.

The loss of the services of key employees and key consultants could have a material adverse effect on our operations. We do have employment

or consulting agreements with key individuals. However, there can be no assurance that any employees or consultants will remain associated

with us. The efforts of key employees and consultants will be critical to us as we continue to develop our technology and as we attempt

to transition from a development stage company to a company with commercialized products and services. If we were to lose key employees

or consultants, we may experience difficulties in competing effectively, developing our technology and implementing our business strategies.

Management

cannot guarantee that its relationship with the Company does not create conflicts of interest.

The

relationship of management and its affiliates to the Company could create conflicts of interest. While management has a fiduciary duty

to the Company, it also determines its compensation from the Company. Management’s compensation from the Company has not been determined

pursuant to arm’s-length negotiation.

We

may be subject to liabilities that are not readily identifiable at this time.

The

Company may have liabilities to affiliated or unaffiliated lenders. These liabilities would represent fixed costs we would be required

to pay, regardless of the level of business or profitability experienced by the Company. There is no assurance that the Company will

be able to pay all of its liabilities. Furthermore, the Company is always subject to the risk of litigation from customers, suppliers,

employees, and others. Litigation can cause the Company to incur substantial expenses and, if cases are lost, judgments, and awards can

add to the Company’s costs.

In

the course of business, the Company may incur expenses beyond what was anticipated.

Unanticipated

costs may force the Company to obtain additional capital or financing from other sources or may cause the Company to lose its entire

investment in the Company if it is unable to obtain the additional funds necessary to implement its business plan. There is no assurance

that the Company will be able to obtain sufficient capital to implement its business plan successfully. If a greater investment is required

in the business because of cost overruns, the probability of earning a profit or a return of shareholder investment in the Company is

diminished.

The

Company will rely on management to execute the business plan and manage the Company’s affairs.

Under

applicable state corporate law and the By-Laws of the Company, the officers and directors of the Company have the power and authority

to manage all aspects of the Company’s business. Shareholders must be willing to entrust all aspects of the Company’s business

to its directors and executive officers.

There

is no assurance the Company will always have adequate capital to conduct its business.

The

Company will have limited capital available to it. If the Company’s entire original capital is fully expended and additional costs

cannot be funded from borrowings or capital from other sources, then the Company’s financial condition, results of operations and

business performance would be materially adversely affected.

The

Company is required to indemnify its directors and officers.

The

Company’s By-Laws provide that the Company will indemnify its officers and directors to the maximum extent permitted by Nevada

law. If the Company were called upon to indemnify an officer or director, then the portion of its assets expended for such purpose would

reduce the amount otherwise available for the Company’s business.

Risks

Relating to Our Common Stock

We

may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share

value.

Our

Articles of Incorporation authorize the issuance of 2,000,000,000 shares of common stock, par value $0.001 per share, of which 733,766,705

shares are issued and outstanding as of November 17, 2023. The future issuance of common stock may result in substantial dilution

in the percentage of our common stock held by our then-existing shareholders. We may value any common stock issued in the future on an

arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting

the value of the shares held by our investors and might have an adverse effect on any trading market for our common stock.

Our Board of Directors may issue and fix the

terms of shares of our preferred stock without stockholder approval, which could adversely affect the voting power of holders of our

common stock or any change in control of our Company.

Our Articles of Incorporation

authorize the issuance of up to 20,000,000 shares of “blank check” preferred stock, with such designation rights and preferences

as may be determined from time to time by the Board of Directors. Our Board of Directors is empowered, without shareholder approval,

to issue shares of preferred stock with dividend, liquidation, conversion, voting or other rights which could adversely affect the voting

power or other rights of the holders of our common stock. In the event of such issuances, the preferred stock could be used, under certain

circumstances, as a method of discouraging, delaying or preventing a change in control of our company.

Series B Preferred Stock issued to an investor

with certain preferential rights, upon conversion thereof, will cause significant dilution to existing stockholders.

There are 14,241 shares of Series B non-voting, convertible preferred stock, (the “Series B Preferred Stock”)

issued and outstanding. Each one share

of Series B Preferred Stock has as a stated value of $100 per share and is convertible, at the option of the holder, into Common Stock

of the Company at any time, at the election of the holder, at a rate of $0.0015 per share; provided, however, that such conversion may

only occur at a time when the Company has sufficient authorized shares of common stock under its articles of incorporation to satisfy

such conversion. The common stock issuable upon conversion of the Series B Preferred Stock may represent overhang that may also adversely

affect the market price of our common stock. Overhang occurs when there is a greater supply of a company’s stock in the market

than there is demand for that stock. When this happens the price of the Company’s stock will decrease, and any additional shares

which stockholders attempt to sell in the market will only further decrease the share price. In the event of such overhang, the Series

B Preferred stockholders will have an incentive to sell their common stock as quickly as possible. If the share volume of our common stock cannot

absorb the discounted shares, then the value of our common stock will likely decrease. The Stock Purchase Agreement for the Series B

Preferred Stock contains an issuance limitation of 4.99% of the outstanding shares of Common Stock at the time of conversion, but that

limitation can be waived by the holder with sixty-one days’ notice. On a fully-diluted basis, without factoring in the 4.99% limitation,

the Series B Preferred Stock may be converted into 949,400,000 shares of common stock, an amount that would cause significant dilution

to the issued and outstanding shares of the Company.

Series B Preferred Stock issued to an investor

with certain preferential rights, upon conversion thereof, will cause significant dilution to existing stockholders.

Bountiful Capital, LLC

currently owns 45,000 shares of Series E non-voting, convertible preferred stock, (the “Series E Preferred Stock”). Each

one share of Series E Preferred Stock has as a stated value of $100 per share and is convertible, at the option of the holder, into

Common Stock of the Company at any time, at the election of the holder, at a rate of $0.0015 per share; provided, however, that such

conversion may only occur at a time when the Company has sufficient authorized shares of common stock under its articles of

incorporation to satisfy such conversion. The common stock issuable upon conversion of the Series E Preferred Stock may represent

overhang that may also adversely affect the market price of our common stock. Overhang occurs when there is a greater supply of a

company’s stock in the market than there is demand for that stock. When this happens the price of the Company’s stock

will decrease, and any additional shares which stockholders attempt to sell in the market will only further decrease the share

price. In the event of such overhang, the Series E Preferred Stock will have an incentive to sell their common stock as quickly as

possible. If the share volume of our common stock cannot absorb the discounted shares, then the value of our common stock will

likely decrease. The Stock Purchase Agreement for the Series E Preferred Stock contains an issuance limitation of 4.99% of the

outstanding shares of Common Stock at the time of conversion, but that limitation can be waived by the holder with sixty-one

days’ notice. On a fully-diluted basis, without factoring in the 4.99% limitation, the Series E Preferred Stock may be

converted into 3,000,000,000 shares of common stock, an amount that would cause significant dilution to the issued and outstanding

shares of the Company.

We have issued stock options to individuals

that, if exercised, will cause significant dilution to existing shareholders.

We have issued to various

individuals stock options to purchase 904,177,778 shares of our common stock. The weighted average exercise prices for these stock options

is $0.004, although the exact exercise prices vary by grant. If the option holders were to choose to exercise their stock options, a

total of up to 904,177,778 would be issued, an amount that would cause significant dilution to the issued and outstanding shares of the

Company.

We have outstanding convertible promissory

notes and substantial dilution could occur if the lenders choose to convert the promissory note.

We

have issued several convertible promissory notes that are convertible into shares based on a discount to the market price of our common

stock. Since the conversion rate results in the issuance of shares at a discounted rate, significant dilution of our common stock could

occur if the lenders choose to convert the debt into common stock. One of those convertible promissory notes, issued on March 14, 2013,

is in default. A conversion of this convertible debt

into Common Stock could cause our stockholders to experience additional dilution, and any such issuances may result in downward pressure

on the price of our common stock. The issuance of additional shares of common stock in the future via conversion of debt will reduce

the proportionate ownership and voting power of then current stockholders. More

information regarding the convertible promissory notes outstanding can be found in Note 3 to our financial statements.

Our

common shares are subject to the “Penny Stock” rules of the SEC, and the trading market in our securities will likely be

limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The

Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes

relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00

per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| |

● |

That

a broker or dealer approve a person’s account for transactions in penny stocks; and |

| |

● |

The

broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quality of the

penny stock to be purchased. |

In

order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

| |

● |

Obtain

financial information and investment experience objectives of the person; and |

| |

● |

Make

a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge

and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The

broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating

to the penny stock market, which, in highlight form:

| |

● |

Sets

forth the basis on which the broker or dealer made the suitability determination; and |

| |

● |

That

the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally,

brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more

difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure

also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions

payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies

available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent

price information for the penny stock held in the account and information on the limited market in penny stocks.

There

is a very limited market for our securities. While our common stock is on the OTC Pink Market, there has been negligible trading

volume. There is no guarantee that an active trading market will develop in our securities and if a trading market does not develop,

purchasers of our securities may have difficulty selling their shares.

There