As

filed with the U.S. Securities and Exchange Commission on November 17, 2023.

Registration

No. [●]

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

F-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

U

Power Limited

(Exact

name of registrant as specified in its charter)

| Cayman

Islands |

|

5500 |

|

Not

Applicable |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

2F,

Zuoan 88 A, Lujiazui,

Shanghai,

People’s Republic of China

0086-21-6859-3598

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Cogency

Global Inc.

122

East 42nd Street, 18th Floor

New

York, NY 10168

212-947-7200

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

With

a Copy to:

Ying

Li, Esq.

Lisa

Forcht, Esq.

Hunter

Taubman Fischer & Li LLC

950

Third Avenue, 19th Floor

New

York, NY 10022

212-530-2206 |

William

S. Rosenstadt, Esq.

Mengyi

“Jason” Ye, Esq.

Yarona

L. Yieh, Esq.

Ortoli

Rosenstadt LLP

366

Madison Avenue, 3rd FL

New

York, NY 10017

212-588-0022

|

Approximate

date of commencement of proposed sale to the public: Promptly after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act, or until the registration statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell the securities until the registration statement filed

with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting any offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

November 17, 2023 |

U

Power Limited

Up

to 10,000,000 Units (each Unit contains one Ordinary Share, one

Series

A Warrant to Purchase one Ordinary Share, and one Series B Warrant to Purchase one Ordinary Share)

Up

to 10,000,000 Ordinary Shares Underlying Series A Warrants, and Up to 10,000,000 Ordinary Shares Underlying Series B Warrants

We are offering on a best-efforts basis up to 10,000,000 units

(the “Units”), with each Unit consisting of one ordinary share of U Power Limited, par value US$0.0000001 per share (the “Ordinary

Share”), one warrant to purchase one Ordinary Share (each, a “Series A Warrant” and collectively, the “Series

A Warrants”), and one warrant to purchase one Ordinary Share (each, a “Series B Warrant”, and collectively, the “Series

B Warrants; and together with the Series A Warrants, the “Warrants”), at an assumed public offering price of $2.42 per Unit.

Each share exercisable pursuant to the Series A Warrants will have an exercise price per share of $2.54, equal to 105% of the public offering

price per Unit in this offering, and each share exercisable pursuant to the Series B Warrants will have an exercise price per share of

$2.42, equal to 100% of the public offering price per Unit in this offering. The Series A Warrants will be immediately exercisable and

will expire on the fifth anniversary of the original issuance date, and the Series B Warrants will be immediately exercisable and will

expire on the fifth anniversary of the original issuance date. The Ordinary Shares available for exercise by each purchaser under the

Series B Warrants shall be reduced by that amount of Ordinary Shares that have been exercised under the Series A Warrants. The Units have

no stand-alone rights and will not be certificated or issued as stand-alone securities. The Ordinary Shares, the Series A Warrants, and

the Series B Warrants are immediately separable and will be issued separately in this offering, but must be purchased together in this

offering.

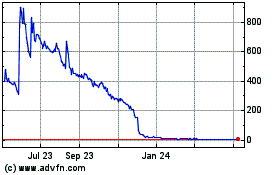

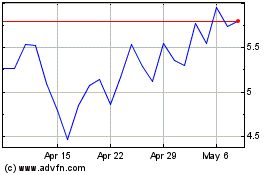

Our Ordinary Shares are listed on the Nasdaq Capital Market under

the symbol “UCAR.” On November 15, 2023, the closing trading price of our Ordinary Shares, as reported on the Nasdaq Capital

Market, was $2.42 per Ordinary Share. There is no established public trading market for the Warrants, and we do not expect a market to

develop. We do not intend to apply to list the Units or the Warrants on any securities exchange or other nationally recognized trading

system. Without an active trading market, the liquidity of the Warrants will be limited.

The number of Units offered in this prospectus and all other applicable

information has been determined based on an assumed public offering price of $2.42 per Unit. The public offering price per Unit is an

assumed price only. The actual number of Units sold in the offering and actual public offering price per Unit will be determined between

us, the placement agent and purchasers based on market conditions at the time of pricing and may be at a discount to the current market

price of our Ordinary Shares. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the

actual public offering price. The assumed public offering price is used so that we can provide certain disclosures, which require a calculation

based on the public offering price.

Because there is no minimum offering amount required as a condition

to closing this offering, we may sell fewer than all of the Units offered hereby, which may significantly reduce the amount of proceeds

received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount of Units sufficient

to pursue the business goals outlined in this prospectus. Because there is no minimum offering amount, investors could be in a position

where they have invested in our company, but we are unable to fulfill our objectives due to a lack of interest in this offering. Also,

any proceeds from the sale of Units offered by us will be available for our immediate use, despite uncertainty about whether we would

be able to use such funds to effectively implement our business plan. See “Risk Factors” beginning on page 10 of this prospectus

and “Item 3. Key Information — D. Risk Factors” in our annual report on Form 20-F for the year ended December 31, 2022

(the “2022 Annual Report”) for more information. We may undertake one or more closings for the sale of the Units to the investors.

We expect to hold an initial closing on [●], 2023, but the offering will be terminated by December 31, 2023, provided that the closing(s)

of the offering for all of the Units have not occurred by such date; however, the offering may be extended by written agreement of the

Company and the placement agent. Each purchaser has the right to elect to purchase up to 100% of the number of Units each purchaser purchased

at the initial closing on the final closing date. Any extensions or material changes to the terms of the offering will be contained in

an amendment to this prospectus.

Investing

in our securities involves a high degree of risk. See “Risk Factors” and “Item 3. Key Information — D. Risk Factors”

in the 2022 Annual Report for a discussion of information that should be considered in connection with an investment in our securities.

We

are not a Chinese operating company, but rather a holding company incorporated in the Cayman Islands. As a holding company with no material

operations of our own, we conduct our operations through our operating entities established in the People’s Republic of China (the

“PRC”). As such, our corporate structure involves unique risks to investors. The Ordinary Shares offered in this prospectus

are shares of the Cayman Islands holding company. Investors of our Ordinary Shares do not directly own any equity interests in our Chinese

operating subsidiaries, but will instead own shares of a Cayman Islands holding company. The Chinese regulatory authorities could intervene

or influence the operations of our Chinese operating subsidiaries at any time, including disallowing our corporate structure, which would

likely result in a material change in our operations and/or a material change in the value of our Ordinary Shares. Additionally, the

Chinese government may exert more oversight and control over any offering of securities conducted overseas and/or foreign investment

in China-based issuers, and any such action could significantly limit or completely hinder our ability to offer or continue to offer

securities to investors, and may cause the value of such securities to significantly decline or be worthless. See “Item 3. Key

Information — D. Risk Factors — Risks Relating to Doing Business in China — Any actions by the Chinese government,

including any decision to intervene or influence the operations of the operating entities or to exert control over any offering of securities

conducted overseas and/or foreign investment in China-based issuers, may cause us to make material changes to the operations of the PRC

operating entities, may limit or completely hinder our ability to offer or continue to offer securities to investors, and may cause the

value of such securities to significantly decline or be worthless” in the 2022 Annual Report. Unless otherwise stated, as used

in this prospectus and in the context of describing our operations and consolidated financial information, “we,” “us,”

“Company,” “our company”, or “our,” refers to U Power Limited, a Cayman Island holding company. For

a description of our corporate structure, see “Corporate History and Structure.”

Our

issued and outstanding share capital consists of 52,500,000 Ordinary Shares. Mr. Jia Li, our founder and chairman of the board of directors,

beneficially owns approximately 70% and will continue to beneficially own approximately [ ]% of our total issued and outstanding Ordinary

Shares and total voting power after the completion of this offering, assuming the Series A Warrants and Series B Warrants are not exercised.

As a result, we are, and will continue to be, a “controlled company” as defined under the Nasdaq Stock Market Rules. As a

“controlled company,” we are permitted to elect not to comply with certain corporate governance requirements. See “Risk

Factors — Risks Relating to Our Ordinary Shares and this Offering — We will continue to be a “controlled company”

under the rules of Nasdaq upon the completion of this offering and, as a result, may rely on exemptions from certain corporate governance

requirements that provide protection to shareholders of other companies”

We

are an “emerging growth company” as defined under applicable U.S. securities laws and are eligible for reduced public company

reporting requirements. Please read the disclosures beginning on page 6 of this prospectus for more information.

We

are subject to legal and operational risks associated with being based in and having the majority of our operations in China. These risks

may result in a material change in our operations, or a complete hindrance of our ability to offer or continue to offer our securities

to investors, and could cause the value of such securities to significantly decline or become worthless. Recently, the PRC government

initiated a series of regulatory actions and statements to regulate business operations in China, including cracking down on illegal

activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity

structure, and adopting new measures to extend the scope of cybersecurity reviews. On July 6, 2021, the General Office of the Communist

Party of China Central Committee and the General Office of the State Council jointly issued an announcement to crack down on illegal

activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires

the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision

over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities

laws. On November 14, 2021, the Cyberspace Administration of China (the “CAC”) published the Security Administration Draft,

which provides that data processing operators engaging in data processing activities that affect or may affect national security must

be subject to network data security review by the relevant Cyberspace Administration of the PRC. According to the Security Administration

Draft, data processing operators who possess personal data of at least one million users or collect data that affects or may affect national

security must be subject to network data security review by the relevant Cyberspace Administration of the PRC. The deadline for public

comments on the Security Administration Draft was December 13, 2021. The Security Administration Draft has not been fully implemented

as of the date of this prospectus. On December 28, 2021, the CAC, together with 12 other governmental departments of the PRC, jointly

promulgated the Cybersecurity Review Measures, which became effective on February 15, 2022. The Cybersecurity Review Measures require

that an online platform operator which possesses the personal information of at least one million users must apply for a cybersecurity

review by the CAC if it intends to be listed in foreign countries. As confirmed by our PRC counsel, Guantao Law Firm, since we are not

an online platform operator that possesses over one million users’ personal information, we are not subject to the cybersecurity

review with the CAC under the Cybersecurity Review Measures, and for the same reason, we will not be subject to the network data security

review by the CAC if the Draft Regulations on the Network Data Security Administration (Draft for Comments) (the “Security Administration

Draft”) are enacted as proposed. There remains uncertainty, however, as to how the Cybersecurity Review Measures will be interpreted

or implemented and whether the PRC regulatory agencies, including the CAC, may adopt new laws, regulations, rules, or detailed implementation

and interpretation related to the Cybersecurity Review Measures. For further details, see “Item 3. Key Information — D. Risk

Factors — Risks Relating to Doing Business in China — We may become subject to a variety of laws and regulations in the PRC

regarding privacy, data security, cybersecurity, and data protection” in the 2022 Annual Report.

(Prospectus

cover continued from next page.)

| | |

Per Unit | | |

Total

(assuming

maximum

offering) | |

| Public offering price | |

$ | 2.42 | | |

$ | 24,200,000 | |

| Placement agent fees (1) | |

$ | 0.19 | | |

$ | 1,936,000 | |

| Proceeds, before expenses, to us (2) | |

$ | 2.23 | | |

$ | 22,264,000 | |

| (1) |

We have agreed to pay

Univest Securities, LLC (the “Placement Agent”) a cash fee of 7% of the aggregate gross proceeds raised in this offering

We have also agreed to (i) reimburse the Placement Agent for certain expenses; and (ii) provide a non-accountable expense allowance

equal to 1% of the gross proceeds of this offering payable to the Placement Agent. For a description of compensation payable to the

Placement Agent, see “Plan of Distribution.” |

| |

|

| (2) |

We estimate the total expenses

of this offering payable by us, excluding the Placement Agent’s fees, will be approximately $0.35 million. |

We

have engaged Univest Securities, LLC as our exclusive Placement Agent to use its reasonable best efforts to solicit offers to purchase

the securities offered by this prospectus (the “Securities”). The Placement Agent has no obligation to buy any of the Units

from us or to arrange for the purchase or sale of any specific number or dollar amount of the Units. Because there is no minimum offering

amount required as a condition to closing in this offering the actual public offering amount, the Placement Agent’s fee, and proceeds

to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above and

throughout this prospectus. We have agreed to pay the Placement Agent the Placement Agent’s fees set forth in the table above and

to provide certain other compensation to the Placement Agent. See “Plan of Distribution” of this prospectus for more information

regarding these arrangements.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Placement

Agent

Prospectus

dated [●], 2023

(Prospectus

cover continued from preceding page.)

In

addition, since 2021, the Chinese government has strengthened its anti-monopoly supervision, mainly in three aspects: (1) establishing

the National Anti-Monopoly Bureau; (2) revising and promulgating anti-monopoly laws and regulations, including:

the Anti-Monopoly Law (draft Amendment published on October 23, 2021 for public opinion; the newly revised Anti-Monopoly Law

was promulgated on June 24, 2022, and became effective on August 1, 2022), the anti-monopoly guidelines for various

industries, and the detailed Rules for the Implementation of the Fair Competition Review System; and (3) expanding the anti-monopoly law

enforcement targeting Internet companies and large enterprises. As of the date of this prospectus, the Chinese government’s recent

statements and regulatory actions related to anti-monopoly concerns have not impacted our ability to conduct business, accept

foreign investments, or list on a U.S. or other foreign exchange because neither the Company nor its PRC operating entities engage

in monopolistic behaviors that are subject to these statements or regulatory actions.

Our

Ordinary Shares may be prohibited from trading on a national exchange or over-the-counter in the United States, if the

Public Company Accounting Oversight Board of the United States (the “PCAOB”) determines that it cannot inspect

or fully investigate our auditor for two consecutive years. As a result, Nasdaq may determine to delist our securities. On December 29,

2022, the Accelerating Holding Foreign Companies Accountable Act was signed into law as part of the “Consolidated Appropriations

Act, 2023” (the “Consolidated Appropriations Act”), which amended the Holding Foreign Companies Accountable ACT (“HFCAA”)

by reducing the number of consecutive non-inspection years required for triggering the prohibitions under the HFCAA from three years

to two. Our auditor is Onestop Assurance PAC. As an auditor of companies that are traded publicly in the United States and a firm

registered with the PCAOB, it is subject to laws in the United States, pursuant to which the PCAOB conducts regular inspections

to assess our auditor’s compliance with the applicable professional standards. Our auditor is headquartered in 10 Anson Road, #13-09

International Plaza, Singapore 079903 and has been inspected by the PCAOB on a regular basis, with the last inspection in 2022. As such,

as of the date of this prospectus, our offering is not affected by the HFCAA and related regulations. However. there is a risk that our

auditor cannot be inspected by the PCAOB in the future. The lack of inspection could cause trading in our securities to be prohibited,

and, as a result, Nasdaq may determine to delist our securities, which may cause the value of our securities to decline or become worthless.

See “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in China — The Holding Foreign

Companies Accountable Act and the Accelerating Holding Foreign Companies Accountable Act call for additional and more stringent criteria

to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are

not inspected by the PCAOB. These developments could add uncertainties to our offering and listing on the Nasdaq Capital Market, and

Nasdaq may determine to delist our securities if the PCAOB determines that it cannot inspect or fully investigate our auditor”

in the 2022 Annual Report.

Cash

dividends, if any, on our Ordinary Shares will be paid in U.S. dollars. As of the date of this prospectus, (1) no cash transfers

nor transfers of other assets have occurred among the Company and its subsidiaries, (2) no dividends nor distributions have been

made by the Company or its subsidiaries, and (3) the Company has not paid any dividends nor made any distributions to U.S. investors.

We intend to keep any future earnings to finance the expansion of our business, and we do not anticipate that any cash dividends will

be paid or any funds will be transferred from one entity to another in the foreseeable future. As such, as of the date of this prospectus,

we have not installed any cash management policies that dictate how funds are transferred among the Company, its subsidiaries, or investors.

Under Cayman Islands law, a Cayman Islands company may pay a dividend on its shares out of either profit or its share premium amount,

provided that in no circumstances may a dividend be paid if this would result in the company being unable to pay its debts as they become

due in the ordinary course of business. Under our current corporate structure, to fund any cash and financing requirements we may have,

the Company may rely on dividend payments from its PRC operating subsidiaries, subject to certain restrictions and limitations imposed

by the PRC government.

Under

existing PRC foreign exchange regulations, payment of current account items, such as profit distributions and trade and service-related foreign

exchange transactions, can be made in foreign currencies without prior approval from the State Administration of Foreign Exchange, or

the SAFE, by complying with certain procedural requirements. Therefore, our PRC subsidiaries are able to pay dividends in foreign currencies

to us without prior approval from SAFE, subject to the condition that the remittance of such dividends outside of the PRC complies with

certain procedures under PRC foreign exchange regulations, such as the overseas investment registrations by our shareholders or the ultimate

shareholders of our corporate shareholders who are PRC residents. Approval from, or registration with, appropriate government authorities

is, however, required where the RMB is to be converted into foreign currency and remitted out of China to pay capital expenses such as

the repayment of loans denominated in foreign currencies. The PRC government may also at its discretion restrict access in the future

to foreign currencies for current account transactions. Current PRC regulations permit our PRC subsidiaries to pay dividends to the Company

only out of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. As of the

date of this prospectus, there are no restrictions or limitations imposed by the Hong Kong government on the transfer of capital

within, into and out of Hong Kong (including funds from Hong Kong to the PRC), except for the transfer of funds involving money

laundering and criminal activities. See “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business

in China — To the extent cash or assets of our business, or of our PRC or Hong Kong subsidiaries, is in mainland China or Hong

Kong, such cash or assets may not be available to fund operations or for other use outside of the PRC or Hong Kong, due to interventions

in or the imposition of restrictions and limitations by the PRC government to the transfer of cash or assets” in the 2022 Annual

Report.

TABLE

OF CONTENTS

About

this Prospectus

Neither

we nor the Placement Agent have authorized anyone to provide any information or to make any representations other than those contained

in or incorporated by reference into this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which

we have referred you. We take no responsibility for and can provide no assurance as to the reliability of, any other information that

others may give you. This prospectus is an offer to sell the Units offered hereby, but only under circumstances and in jurisdictions

where it is lawful to do so. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted

or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer

or sale. For the avoidance of doubt, no offer or invitation to subscribe for the Units is made to the public in the Cayman Islands. The

information contained in this prospectus is current only as of the date on the front cover of the prospectus. Our business, financial

condition, results of operations, and prospects may have changed since that date.

Neither

we nor the Placement Agent have taken any action to permit this offering of the Units outside the United States or to permit the possession

or distribution of this prospectus or any filed free-writing prospectus outside the United States. Persons outside of the United States

who come into possession of this prospectus or any filed free writing prospectus must inform themselves about, and observe any restrictions

relating to, the offering of the Units and the distribution of this prospectus or any filed free-writing prospectus outside the United

States.

Conventions

that Apply to this Prospectus

Unless otherwise

indicated or the context requires otherwise, references in this prospectus to:

| ● | “AHYS”

are to Anhui Yousheng New Energy Co., Ltd., a limited liability company established pursuant

to PRC laws on May 16, 2013, which is controlled by WFOE (as defined below) with 100% equity

ownership; |

| ● | “BVI”

are to the British Virgin Islands; |

| ● | “China”

and the “PRC” are to the People’s Republic of China; |

| ● | “CD

Youyineng” are to Chengdu Youyineng Automobile Service Co., Ltd., a limited liability

company established pursuant to PRC laws on October 29, 2020, and is wholly owned by AHYS

(defined below); |

| ● | “EV”

are to electric vehicle; |

| ● | “Hong

Kong” or “HK” are to the Hong Kong Special Administrative Region of the

PRC; |

| ● | “ISO”

are to a series of quality management and quality assurance standards published by International

Organization for standardization, a non-government organization based in Geneva, Switzerland,

for assessing the quality systems of business organizations; |

| ● | “mainland

China” are to the mainland China of the PRC, excluding Taiwan, the special administrative

regions of Hong Kong and Macau for the purposes of this prospectus only; |

| ● | “our

PRC subsidiaries”, or “operating subsidiaries,” are to AHYS and its subsidiaries,

including CD Youyineng, SH Youteng (defined below), SH Youxu (defined below), Youpin (defined

below), Youpin SD (defined below), ZJ Youguan (defined blow), and their respective subsidiaries; |

| ● | “RMB”

and “Renminbi” are to the legal currency of China; |

| ● | “shares,”

“Shares,” or “Ordinary Shares” are to the ordinary shares of the

Company, par value US$ 0.0000001 per share; |

| ● | “SH

Youteng” are to Shanghai Youteng Automobile Service Co., Ltd., a limited liability

company established pursuant to PRC laws on November 3, 2020, and AHYS holds 70% of its equity

interest; |

| ● | “SH

Youxu” are to Shanghai Youxu New Energy Technology Co., Ltd., a limited liability company

established pursuant to PRC laws on March 22, 2021, and AHYS holds 70% of its equity interest; |

| ● | “SME

dealers” are to small and medium sized vehicle dealers; |

| ● | “UK”

are to the United Kingdom, made up of England, Scotland, Wales and Northern Ireland; |

| ● | “U.S.”,

“US” or “United States” are to United States of America, its territories,

its possessions and all areas subject to its jurisdiction; |

| ● | “US$,”

“$” and “U.S. dollars” are to the legal currency of the United States; |

| ● | “we,”

“us,” “Company,” “our”, and “Upincar” are

to U Power Limited, the Cayman Islands holding company, and its predecessor entity and its

subsidiaries, as the context requires; |

| ● | “WFOE”

are to our wholly owned Chinese subsidiary, Shandong Yousheng New Energy Technology Development

Co., Ltd., a limited liability company established pursuant to PRC laws on January 27, 2022; |

| ● | “Youpin”

are to Youpin Automobile Service Group Co., Ltd., a limited liability company established

pursuant to PRC laws on July 18, 2013, and AHYS holds 53.1072% of its equity interest; |

| ● | “Youpin

SD” are to Youpin Automobile Service (Shandong) Co., Ltd., a limited liability company

established pursuant to PRC laws on June 30, 2020, and AHYS holds 87% of its equity interest;

and |

| ● | “ZJ

Youguan” are to Zhejiang Youguan Automobile Service Co., Ltd., a limited liability

company established pursuant to PRC laws on May 21, 2020, and AHYS holds 80% of its equity

interest. |

In

this prospectus, we refer to assets, obligations, commitments, and liabilities in our consolidated financial statements in U.S. dollars.

These dollar references are based on the exchange rate of RMB to U.S. dollars, determined as of a specific date or for a specific period.

Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of U.S. dollars which may

result in an increase or decrease in the amount of our obligations (expressed in dollars) and the value of our assets, including accounts

receivable (expressed in dollars). We have made rounding adjustments to reach some of the figures included in this prospectus. Consequently,

numerical figures shown as totals in some tables may not be arithmetic aggregations of the figures that precede them.

This

prospectus contains information derived from various public sources and certain information from an industry report commissioned by us

and prepared by Frost & Sullivan Limited, a third-party industry research firm, to provide information regarding our industry and

market position. Such information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to

these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications

and reports. The industry in which we operate is subject to a high degree of uncertainty and risk due to variety of factors, including

those described in the “Risk Factors” section. These and other factors could cause results to differ materially from those

expressed in these publications and reports.

PROSPECTUS

SUMMARY

The

following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial

statements incorporated by reference into this prospectus. In addition to this summary, we urge you to read the entire prospectus carefully,

especially the risks of investing in our Ordinary Shares, discussed under “Risk Factors” and “Item 3. Key Information

— D. Risk Factors,” in the 2022 Annual Report before deciding whether to buy our Ordinary Shares.

Overview

We

are not a Chinese operating company, but rather a holding company incorporated in the Cayman Islands. As a holding company with no material

operations of our own, we conduct our operations through our operating entities established in the PRC. As such, our corporate structure

involves unique risks to investors. Investors of our Ordinary Shares do not directly own any equity interests in our Chinese operating

subsidiaries, but will instead own shares of a Cayman Islands holding company. The Chinese regulatory authorities could intervene or

influence the operations of our Chinese operating subsidiaries at any time, including disallowing our corporate structure, which would

likely result in a material change in our operations and/or a material change in the value of our Ordinary Shares. Additionally, the

Chinese government may exert more oversight and control over any offering of securities conducted overseas and/or foreign investment

in China-based issuers, and any such action could significantly limit or completely hinder our ability to offer or continue to offer

securities to investors, and may cause the value of such securities to significantly decline or be worthless. See “Item 3. Key

Information — D. Risk Factors — Risks Relating to Doing Business in China — Any actions by the Chinese government,

including any decision to intervene or influence the operations of the operating entities or to exert control over any offering of securities

conducted overseas and/or foreign investment in China-based issuers, may cause us to make material changes to the operations of the PRC

operating entities, may limit or completely hinder our ability to offer or continue to offer securities to investors, and may cause the

value of such securities to significantly decline or be worthless” in the 2022 Annual Report.

We

are subject to legal and operational risks associated with being based in and having the majority of our operations in China. These risks

may result in a material change in our operations, or a complete hindrance of our ability to offer or continue to offer our securities

to investors, and could cause the value of such securities to significantly decline or become worthless. Recently, the PRC government

initiated a series of regulatory actions and statements to regulate business operations in China, including cracking down on illegal

activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity

structure, and adopting new measures to extend the scope of cybersecurity reviews. On July 6, 2021, the General Office of the Communist

Party of China Central Committee and the General Office of the State Council jointly issued an announcement to crack down on illegal

activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires

the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision

over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities

laws. On November 14, 2021, the Cyberspace Administration of China (the “CAC”) published the Security Administration Draft,

which provides that data processing operators engaging in data processing activities that affect or may affect national security must

be subject to network data security review by the relevant Cyberspace Administration of the PRC. According to the Security Administration

Draft, data processing operators who possess personal data of at least one million users or collect data that affects or may affect national

security must be subject to network data security review by the relevant Cyberspace Administration of the PRC. The deadline for public

comments on the Security Administration Draft was December 13, 2021. The Security Administration Draft has not been fully implemented

as of the date of this prospectus. On December 28, 2021, the CAC, together with 12 other governmental departments of the PRC, jointly

promulgated the Cybersecurity Review Measures, which became effective on February 15, 2022. The Cybersecurity Review Measures require

that an online platform operator which possesses the personal information of at least one million users must apply for a cybersecurity

review by the CAC if it intends to be listed in foreign countries. As confirmed by our PRC counsel, Guantao Law Firm, since we are not

an online platform operator that possesses over one million users’ personal information, we are not subject to the cybersecurity

review with the CAC under the Cybersecurity Review Measures, and for the same reason, we will not be subject to the network data security

review by the CAC if the Draft Regulations on the Network Data Security Administration (Draft for Comments) are enacted as proposed.

There remains uncertainty, however, as to how the Cybersecurity Review Measures will be interpreted or implemented and whether the PRC

regulatory agencies, including the CAC, may adopt new laws, regulations, rules, or detailed implementation and interpretation related

to the Cybersecurity Review Measures. For further details, see “Item 3. Key Information — D. Risk Factors — Risks Relating

to Doing Business in China — We may become subject to a variety of laws and regulations in the PRC regarding privacy, data security,

cybersecurity, and data protection” in the 2022 Annual Report.

In

addition, since 2021, the Chinese government has strengthened its anti-monopoly supervision, mainly in three aspects: (1) establishing

the National Anti-Monopoly Bureau; (2) revising and promulgating anti-monopoly laws and regulations, including: the Anti-Monopoly Law

(draft Amendment published on October 23, 2021 for public opinion; the newly revised Anti-Monopoly Law was promulgated on June 24, 2022,

and became effective on August 1, 2022), the anti-monopoly guidelines for various industries, and the detailed Rules for the Implementation

of the Fair Competition Review System; and (3) expanding the anti-monopoly law enforcement targeting Internet companies and large enterprises.

As of the date of this prospectus, the Chinese government’s recent statements and regulatory actions related to anti-monopoly concerns

have not impacted our ability to conduct business, accept foreign investments, or list on a U.S. or other foreign exchange, because neither

the Company nor its PRC operating entities engage in monopolistic behaviors that are subject to these statements or regulatory actions.

On

February 17, 2023, the China Securities Regulatory Commission (the “CSRC”) released the Trial Administrative Measures of

Overseas Securities Offering and Listing by Domestic Companies, or the Overseas Listing Trial Measures, and five supporting guidelines,

which came into effect on March 31, 2023. The Overseas Listing Trial Measures regulate both direct and indirect overseas offering and

listing by PRC domestic companies by adopting a filing-based regulatory regime. Pursuant to the Overseas Listing Trial Measures, domestic

companies that seek to offer or list securities overseas, whether directly or indirectly, should fulfill the filing procedures and report

relevant information to the CSRC within three working days after submitting listing applications and subsequent amendments. According

to the Notice on the Administrative Arrangements for the Filing of the Overseas Securities Offering and Listing by Domestic Companies

from the CSRC, or the CSRC Notice, the domestic companies that have already been listed overseas before the effective date of the Overseas

Listing Trial Measures (i.e. March 31, 2023) shall be deemed to be existing issuers (the “Existing Issuers”). Existing Issuers

are not required to complete the filing procedures immediately, and they shall be required to file with the CSRC for any subsequent offerings.

Further, according to the CSRC Notice, domestic companies that have obtained approval from overseas regulatory authorities or securities

exchanges (for example, the effectiveness of a registration statement for offering and listing in the U.S. has been obtained) for their

overseas offering and listing prior March 31, 2023 but have not yet completed their overseas issuance and listing, are granted a six-month

transition period from March 31, 2023 to September 30, 2023. Those that complete their overseas offering and listing within such six-month

period are deemed to be Existing Issuers and are not required to file with the CSRC for their overseas offerings and listings. Within

such six-month transition period, however, if such domestic companies fail to complete their overseas issuance and listing, they shall

complete the filing procedures with the CSRC. Our PRC counsel, Guantao Law Firm, has advised us that, since we obtained approval from

both the SEC and The Nasdaq Capital Market (“Nasdaq”) to issue and list our ordinary share on the Nasdaq prior to March 31,

2023, and closed our offering on April 24, 2023, we were not required to make the filing with the CSRC regarding our initial public offering

pursuant to the Overseas Listing Trial Measures. We shall be required, however, to file with the CSRC for this offering. Given the current

PRC regulatory environment, it is uncertain whether we or our PRC subsidiaries would be able to receive clearance of such filing requirements

in a timely manner, or at all. Any failure of us to fully comply with new regulatory requirements may subject us to fines and penalties,

significantly limit or completely hinder our ability to offer or continue to offer our ordinary shares, cause significant disruption

to our business operations, severely damage our reputation, materially and adversely affect our financial condition and results of operations,

and cause our ordinary shares to significantly decline in value or become worthless. See “Risk Factors —

Risks Relating to Doing Business in China — The approval of the China Securities Regulatory Commission may be

required in connection with this offering under PRC law.”

See

“Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business

in China — The PRC government exerts substantial influence over the manner in which we and our PRC subsidiaries must

conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S. exchanges,

however, if we or our PRC subsidiaries are required to obtain approval in the future and are denied permission from Chinese authorities

to list on U.S. exchanges, we will not be able to continue listing on U.S. exchanges, which would materially affect the interest

of the investors” in the 2022 Annual Report.

Approvals

from the PRC Authorities to Issue Our Ordinary Shares to Foreign Investors

The

General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the

“Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” or the “Opinions”, which

were made available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal

securities activities, and the need to strengthen the supervision over overseas listings by Chinese companies.

On

November 14, 2021, the CAC published the Security Administration Draft, which provides that data processing operators engaging in

data processing activities that affect or may affect national security must be subject to network data security review by the relevant

Cyberspace Administration of the PRC. According to the Security Administration Draft, data processing operators who possess personal

data of at least one million users or collect data that affects or may affect national security must be subject to network data security

review by the relevant Cyberspace Administration of the PRC. The deadline for public comments on the Security Administration Draft

was December 13, 2021. The Security Administration Draft has not been fully implemented.

The

Cybersecurity Review Measures, which became effective on February 15, 2022, provide that, in addition to critical information infrastructure

operators (“CIIOs”) that intend to purchase Internet products and services, data processing operators engaging in data processing

activities that affect or may affect national security must be subject to cybersecurity review by the Cybersecurity Review Office of

the PRC. According to the Cybersecurity Review Measures, a cybersecurity review assesses potential national security risks that

may be brought about by any procurement, data processing, or overseas listing. The Cybersecurity Review Measures further requires that

CIIOs and data processing operators that possess personal data of at least one million users must apply for a review by the Cybersecurity

Review Office of the PRC before conducting listings in foreign countries. As of the date of this prospectus, we have not received any

notice from any authorities identifying any of our PRC subsidiaries as a CIIOs or requiring us to go through cybersecurity review or

network data security review by the CAC. We believe our PRC operations will not be subject to cybersecurity review by the CAC for

this offering, because our PRC subsidiaries are not CIIOs or data processing operators with personal information of more than 1 million

users. There remains uncertainty, however, as to how the Cybersecurity Review Measures will be interpreted or implemented and whether

the PRC regulatory agencies, including the CAC, may adopt new laws, regulations, rules, or detailed implementation and interpretation

related to the Cybersecurity Review Measures. For further details, see “Item 3. Key Information — D. Risk Factors —

Risks Relating to Doing Business in China — We may become subject to a variety of laws and regulations in the PRC regarding privacy,

data security, cybersecurity, and data protection” in the 2022 Annual Report.

On

February 17, 2023, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies,

or the Overseas Listing Trial Measures, and five supporting guidelines, which came into effect on March 31, 2023. The Overseas Listing

Trial Measures regulate both direct and indirect overseas offering and listing by PRC domestic companies by adopting a filing-based regulatory

regime. Pursuant to the Overseas Listing Trial Measures, domestic companies that seek to offer or list securities overseas, whether directly

or indirectly, should fulfill the filing procedures and report relevant information to the CSRC within three working days after submitting

listing applications and subsequent amendments. According to the Notice on the Administrative Arrangements for the Filing of the Overseas

Securities Offering and Listing by Domestic Companies from the CSRC, or the CSRC Notice, the domestic companies that have already been

listed overseas before the effective date of the Overseas Listing Trial Measures (i.e. March 31, 2023) shall be deemed as existing

issuers (the “Existing Issuers”). Existing Issuers are not required to complete the filing procedures immediately, and they

shall be required to file with the CSRC for any subsequent offerings. Further, according to the CSRC Notice, domestic companies that

have obtained approval from overseas regulatory authorities or securities exchanges (for example, the effectiveness of a registration

statement for offering and listing in the U.S. has been obtained) for their overseas offering and listing prior March 31, 2023 but have

not yet completed their overseas issuance and listing, are granted a six-month transition period from March 31, 2023 to September 30,

2023. Those that complete their overseas offering and listing within such six-month period are deemed as Existing Issuers and are not

required to file with the CSRC for their overseas offerings and listings. Within such six-month transition period, however, if such domestic

companies fail to complete their overseas issuance and listing, they shall complete the filing procedures with the CSRC.

Our

PRC counsel, Guantao Law Firm, has advised us that, since we obtained approval from both the SEC and The Nasdaq Capital Market (“Nasdaq”)

to issue and list our ordinary share on the Nasdaq prior to March 31, 2023, and closed our offering on April 24, 2023, we are not required

to make the filing regarding our initial public offering with the CSRC pursuant to the Overseas Listing Trial Measures. We shall be required,

however, to file with the CSRC for this offering within 3 working days after completing the closing (or the initial closing, if one or

more of additional closings will be undertaken) of this offering. Given the current PRC regulatory environment, it is uncertain whether

we or our PRC subsidiaries would be able to receive clearance of such filing requirements in a timely manner, or at all. Any failure

of us to fully comply with new regulatory requirements may subject us to fines and penalties, significantly limit or completely hinder

our ability to offer or continue to offer our ordinary shares, cause significant disruption to our business operations, severely damage

our reputation, materially and adversely affect our financial condition and results of operations, and cause our ordinary shares to significantly

decline in value or become worthless. See “Risk Factors — Risks Relating to Doing Business in China — The approval

of the China Securities Regulatory Commission may be required in connection with this offering under PRC law.”

See

“Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in China — The PRC government exerts

substantial influence over the manner in which we and our PRC subsidiaries must conduct our business activities. We are currently not

required to obtain approval from Chinese authorities to list on U.S. exchanges, however, if we or our PRC subsidiaries are required to

obtain approval in the future and are denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue

listing on U.S. exchanges, which would materially affect the interest of the investors” in the 2022 Annual Report.

Approvals

from the PRC Authorities to Conduct Our Operations

As

of the date of this prospectus, we and our PRC subsidiaries have received from the PRC authorities all requisite licenses, permissions,

or approvals that are required and material for conducting our operations in China, such as business licenses and auto dealer filings.

However, it is uncertain whether we or our PRC subsidiaries will be required to obtain additional approvals, licenses, or permits in

connection with our business operations pursuant to evolving PRC laws and regulations, and whether we would be able to obtain and renew

such approvals on a timely basis or at all. Failing to do so could result in a material change in our operations, and the value of our

Ordinary Shares could depreciate significantly or become worthless.

Dividends

and Distributions

Under

Cayman Islands law, a Cayman Islands company may pay a dividend on its shares out of either profit or its share premium amount, provided

that in no circumstances may a dividend be paid if this would result in the company being unable to pay its debts due in the ordinary

course of business. As of the date of this prospectus, (1) no cash transfer or transfer of other assets have occurred among the

Company and its subsidiaries, (2) no dividends or distributions have been made by a subsidiary, and (3) the Company has not

made any dividends or distributions to U.S. investors. We intend to keep any future earnings to finance the expansion of our business,

and we do not anticipate that any cash dividends will be paid in the foreseeable future, or any funds will be transferred from one entity

to another. As such, as of the date of this prospectus, we have not installed any cash management policies that dictate how funds are

transferred among the Company, its subsidiaries, or investors.

Our

PRC operating entities receive substantially all of our revenue in RMB. Under our current corporate structure, to fund any cash

and financing requirements we may have, we may rely on dividend payments from its PRC operating subsidiaries. Under existing PRC foreign

exchange regulations, payment of current account items, such as profit distributions and trade and service-related foreign exchange

transactions, can be made in foreign currencies without prior approval from SAFE by complying with certain procedural requirements. Therefore,

our PRC subsidiaries are able to pay dividends in foreign currencies to us without prior approval from SAFE, subject to the condition

that the remittance of such dividends outside of the PRC complies with certain procedures under PRC foreign exchange regulations, such

as the overseas investment registrations by our shareholders or the ultimate shareholders of our corporate shareholders who are PRC residents.

Approval from or registration with appropriate government authorities is, however, required where the RMB is to be converted into foreign

currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC

government may also at its discretion restrict access in the future to foreign currencies for current account transactions.

Current

PRC regulations permit our PRC subsidiaries to pay dividends to the Company only out of their accumulated profits, if any, determined

in accordance with Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is required to set aside

at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered

capital. Each such entity in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare

fund, although the amount to be set aside, if any, is determined at the discretion of its board of directors. Although the statutory

reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained earnings

of the respective companies, the reserve funds are not distributable as cash dividends except in the event of liquidation.

Cash

dividends, if any, on our Ordinary Shares, will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes,

any dividends we pay to our overseas shareholders may be regarded as China-sourced income and, as a result, may be subject to PRC withholding

tax at a rate of up to 10.0%. Pursuant to the Arrangement between Mainland China and the Hong Kong Special Administrative Region for

the Avoidance of Double Taxation and Tax Evasion on Income, or the Double Tax Avoidance Arrangement, the 10% withholding tax rate may

be lowered to 5% if a Hong Kong resident enterprise owns no less than 25% of a PRC project. The 5% withholding tax rate, however, does

not automatically apply and certain requirements must be satisfied, including without limitation that (a) the Hong Kong project must

be the beneficial owner of the relevant dividends; and (b) the Hong Kong project must directly hold no less than 25% share ownership

in the PRC project during the 12 consecutive months preceding its receipt of the dividends. In current practice, a Hong Kong project

must obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong

Kong tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you that we will be able to obtain

the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential withholding tax rate of 5% under the

Double Taxation Arrangement with respect to any dividends paid by WFOE, Shandong Yousheng New Energy Technology Development Co., Ltd,

to its two direct Hong Kong holding companies. As of the date of this prospectus, we have not applied for the tax resident certificate

from the relevant Hong Kong tax authority. Our Hong Kong subsidiaries intend to apply for the tax resident certificate if and when our

PRC subsidiaries plan to declare and pay dividends to our Hong Kong subsidiaries.

PCAOB’s

Determinations on Public Accounting Firms Headquartered in Mainland China and in Hong Kong

Our

Ordinary Shares may be delisted under the HFCAA if the PCAOB is unable to inspect our auditors for two consecutive years. On December 29,

2022, the Consolidated Appropriations Act was signed into law and amended the HFCAA by reducing the number of consecutive non-inspection years

required for triggering the prohibitions under the HFCAA from three years to two.

On

December 16, 2021, the PCAOB issued a report on its determinations that it was unable to inspect or investigate completely PCAOB-registered public

accounting firms headquartered in mainland China and in Hong Kong, a Special Administrative Region of the PRC, because of positions

taken by PRC authorities in those jurisdictions (the “Determination”). On August 26, 2022, the CSRC, the MOF, and the

PCAOB signed the Protocol, governing inspections and investigations of audit firms based in China and Hong Kong, taking the first step

toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and

Hong Kong. Pursuant to the fact sheet with respect to the Protocol disclosed by the SEC, the PCAOB shall have independent discretion

to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information to the SEC. On December 15,

2022, the PCAOB determined that it was able to secure complete access to inspect and investigate registered public accounting firms headquartered

in mainland China and Hong Kong and vacated its previous determinations to the contrary. Our auditor is Onestop Assurance PAC. As an

auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, it is subject to laws in the

United States pursuant to which the PCAOB conducts regular inspections to assess our auditor’s compliance with the applicable professional

standards. Our auditor is headquartered in 10 Anson Road, #13-09 International Plaza, Singapore 079903 and has been inspected by the

PCAOB on a regular basis, with the last inspection in 2022. As such, as of the date of this prospectus, our offering is not affected

by the HFCAA and related regulations. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access

in the future, the PCAOB may consider the need to issue a new determination. Furthermore, there is a risk that our auditor cannot be

inspected by the PCAOB in the future, and if the PCAOB determines that it cannot inspect or fully investigate our auditor for two consecutive years,

our securities will be prohibited from trading on a national exchange or over-the-counter under the Holding Foreign Companies Accountable

Act, and, as a result, Nasdaq may determine to delist our securities, which may cause the value of our securities to decline or become

worthless. See “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in China — The Holding

Foreign Companies Accountable Act and the Accelerating Holding Foreign Companies Accountable Act call for additional and more stringent

criteria to be applied to emerging market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors

who are not inspected by the PCAOB. These developments could add uncertainties to our offering and listing on the Nasdaq Capital Market,

and Nasdaq may determine to delist our securities if the PCAOB determines that it cannot inspect or fully investigate our auditor”

in the 2022 Annual Report.

Our

Competitive Strengths

We

believe that the following competitive strengths differentiate us from our competitors:

| ● | a

vehicle sourcing network in lower-tiered cities in China; |

| ● | UOTTA

battery-swapping technology; |

| ● | strong

cooperation with key partners, including major automakers and battery developers in China;

and |

| ● | visionary

and experienced management team with strong commitment. |

Our

Growth Strategies

The

following are our primary growth strategies:

| ● | jointly

develop UOTTA-powered EVs with major auto manufacturers in China; |

| ● | develop

and manufacture battery-swapping stations for UOTTA-powered EVs; |

| ● | enhance

our research and development capabilities; and |

Our

Corporate Structure

We

are a Cayman Islands exempted company incorporated on June 17, 2021. Exempted companies are Cayman Island companies conducting business

mainly outside the Cayman Islands and, as such, are exempted from complying with certain provisions of the Companies Act (As Revised).

Mr.

Jia Li, our founder and chairman of the board of directors beneficially owns approximately 70% of our total issued and outstanding Ordinary

Shares and total voting power. As a result, we are a “controlled company” as defined under the Nasdaq Stock Market Rules.

As a “controlled company,” we are permitted to elect not to comply with certain corporate governance requirements. See “Risk

Factors — Risks Relating to Our Ordinary Shares and this Offering — We will continue to be a “controlled company”

under the rules of Nasdaq upon the completion of this offering and, as a result, may rely on exemptions from certain corporate governance

requirements that provide protection to shareholders of other companies”.

On

April 24, 2023, the Company completed its initial public offering of 2,416,667 Ordinary Shares at $6.00 per share on a firm commitment

basis (the “IPO”). On April 25, 2023, WestPark Capital, Inc, as the representative of the underwriters of the IPO, partially

exercised the over-allotment option to purchase an additional 83,333 ordinary shares at the IPO price of $6.00 per share for gross proceeds

of approximately US$0.5 million. The aggregate gross proceeds of such sales totaled approximately $14,900,000, before deducting underwriting

discounts and other related expenses.

The

following diagram illustrates our corporate structure as of the date of this prospectus.

Corporate

Information

Our

principal executive offices are located at 18/F, building 3, science and Technology Industrial Park, Yijiang District, Wuhu City,

Anhui Province (安徽省芜湖市弋江区科技产业园3号楼18层),

People’s Republic of China. Our telephone number at this address is 00852-6859-3598. Our registered office in the Cayman Islands

is located at McGrath Tonner Corporate Services Limited Genesis Building, 5th Floor, Genesis Close, PO Box 446, Cayman

Islands, KY1-1106 and the phone number of our registered office is (345) 623-2740.

Investors

should submit any inquiries to the address and telephone number of our principal executive offices. Our corporate website is http://www.upincar.com/.

The information contained on our websites is not a part of this prospectus. Our agent for service of process in the United States

is located at 122 East 42nd St 18th Floor, New York, NY 10168.

Implications

of Being an Emerging Growth Company

As

a company with less than US$1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company”

as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the JOBS Act. As long as we remain an emerging growth company,

we may rely on exemptions from some of the reporting requirements applicable to public companies that are not emerging growth companies.

In particular, as an emerging growth company, we:

| ● | may

present only two years of audited financial statements and only two years of related Management’s

Discussion and Analysis of Financial Condition and Results of Operations, or “MD&A;” |

| ● | are

not required to provide a detailed narrative disclosure discussing our compensation principles,

objectives and elements and analyzing how those elements fit with our principles and objectives,

which is commonly referred to as “compensation discussion and analysis”; |

| ● | are

not required to obtain an attestation and report from our auditors on our management’s

assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley

Act of 2002; |

| ● | are

not required to obtain a non-binding advisory vote from our shareholders on executive compensation

or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on

frequency” and “say-on-golden-parachute” votes); |

| ● | are

exempt from certain executive compensation disclosure provisions requiring a pay-for-performance

graph and chief executive officer pay ratio disclosure; |

| ● | are

eligible to claim longer phase-in periods for the adoption of new or revised financial accounting

standards under §107 of the JOBS Act; and |

| ● | will

not be required to conduct an evaluation of our internal control over financial reporting

until our second annual report on Form 20-F following the effectiveness of our initial public

offering. |

We

intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the

adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may

make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that

have opted out of the phase-in periods under §107 of the JOBS Act.

Under

the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions until we no longer meet the

definition of an emerging growth company. We will remain an emerging growth company until the earliest of (a) the last day of the fiscal

year during which we have total annual gross revenues of at least US$1.235 billion; (b) the last day of our fiscal year following the

fifth anniversary of our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act

occurred; (c) the date on which we have, during the preceding three-year period, issued more than US$1.0 billion in non-convertible debt;

or (d) the date on which we are deemed to be a “large accelerated filer” under the United States Securities Exchange Act

of 1934, as amended, or the Exchange Act, which would occur if the market value of our Ordinary Shares that are held by non-affiliates

exceeds US$700 million as of the last business day of our most recently completed second fiscal quarter. Once we cease to be an emerging

growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above.

Foreign

Private Issuer Status

We

are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended. As

such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| ● | we

are not required to provide as many Exchange Act reports, or as frequently, as a domestic

public company; |

| ● | for

interim reporting, we are permitted to comply solely with our home country requirements,

which are less rigorous than the rules that apply to domestic public companies; |

| ● | we

are not required to provide the same level of disclosure on certain issues, such as executive

compensation; |

| ● | we

are exempt from provisions of Regulation FD aimed at preventing issuers from making

selective disclosures of material information; |

| ● | we

are not required to comply with the sections of the Exchange Act regulating the solicitation

of proxies, consents, or authorizations in respect of a security registered under the Exchange Act;

and |

| ● | we

are not required to comply with Section 16 of the Exchange Act requiring insiders

to file public reports of their share ownership and trading activities and establishing insider

liability for profits realized from any “short-swing” trading transaction. |

Implications

of Being a Controlled Company

Mr. Jia

Li, our founder and chairman of the board of directors will continue to beneficially own [●]% of our total issued and outstanding

Ordinary Shares and voting power, assuming no exercise of the Series A Warrants and Series B Warrants included in the Units. As

a result, we will be a “controlled company” as defined under the Nasdaq Stock Market Rules because Mr. Jia Li will

hold more than 50% of the voting power for the election of directors. As a “controlled company,” we are permitted to elect

not to comply with certain corporate governance requirements. If we rely on these exemptions, you will not have the same protection afforded

to shareholders of companies that are subject to these corporate governance requirements.

THE

OFFERING

| Securities

offered by us |

|

Up to 10,000,000 Units at an assumed public offering price of $2.42

per Unit, with each Unit consisting of one Ordinary Share, one Series A Warrant to purchase one Ordinary Share at an exercise price of

$2.54 (or 105% of the public offering price of each Unit sold in the offering), which will be immediately exercisable and will expire

on the fifth anniversary of the original issuance date, and one Series B Warrant to purchase one Ordinary Share at an exercise price of

$2.42 (or 100% of the public offering price of each Unit sold in the offering), which will be immediately exercisable and will expire

on the fifth anniversary of the original issuance date. Each purchaser has the right to elect to purchase up to 100% of the number of

Units each purchaser purchased at the initial closing on the final closing date. The Units will not be certificated, and the Ordinary

Shares, the Series A Warrants, and the Series B Warrants are immediately separable and will be issued separately in this offering. |

| |

|

|

| Assumed public offering

price per Unit |

|

$2.42. |

| |

|

|

| Ordinary Shares included

in the Units offered by us |

|

Up to 10,000,000 Ordinary

Shares. |

| |

|

|

| Series A Warrants included in the

Units offered by us |

|

Up to 10,000,000 Series A Warrants to purchase Ordinary Shares. The

exercise price per share pursuant to the Series A Warrants will equal to $2.54 (or 105% of the public offering price per Unit sold in

this offering). The Series A Warrants are immediately separable and will be issued separately in this offering, but must initially be

purchased together in this offering. The Series A Warrants will be immediately exercisable and will expire on the fifth anniversary of

the original issuance date. The Series A Warrants may be exercised only for a whole number of shares. No fractional shares will be issued

upon exercise of the Series A Warrants. This prospectus also relates to the offering of the Ordinary Shares issuable upon exercise of

the Series A Warrants. |

| |

|

|

| Series

B Warrants included in the Units offered by us |

|

Up to 10,000,000 Series B Warrants to purchase Ordinary Shares. The

exercise price per share pursuant to the Series B Warrants will equal to $2.42 (or 100% of the public offering price per Unit sold in

this offering). The Series B Warrants are immediately separable and will be issued separately in this offering, but must initially be

purchased together in this offering. The Series B Warrants will be immediately exercisable and will expire on the fifth anniversary of

the original issuance date. The Series B Warrants may be exercised only for a whole number of shares. No fractional shares will be issued

upon exercise of the Series B Warrants. The Ordinary Shares available for exercise by each purchaser under the Series B Warrants shall

be reduced by that amount of Ordinary Shares that have been exercised under the Series A Warrants. This prospectus also relates to the

offering of the Ordinary Shares issuable upon exercise of the Series B Warrants.

|

| Cashless

Exercise of Warrants |

|

If,

at the time a holder exercises its Warrants, a registration statement registering the issuance or resale of the Ordinary Shares

underlying the Warrants under the Securities Act is not then effective or available for the issuance of such Ordinary Shares,

then in lieu of making the cash payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise

the net number of Ordinary Shares determined according to the formula set forth in the Warrants.

In

addition to the rights with respect to cashless exercise set forth above, a Series B

Warrant holder may, at any time and in its sole discretion, exercise its Series B Warrants in whole by means of a one-time only “alternative

cashless exercise” in which the holder shall be entitled to receive a number of Ordinary Shares equal to the quotient obtained

by dividing (the exercise price minus the lowest VWAP (as defined in the Series B Warrant) of the Ordinary Shares over the 10 trading

days immediately prior to the exercise date) by (50% of the lowest VWAP of the Ordinary Shares over the 10 trading days immediately

prior to the exercise date). |

| |

|

|

| Best-efforts

offering |

|

We

are offering the Units on a best-efforts basis. We have engaged Univest Securities, LLC as our exclusive Placement Agent to use its

reasonable best efforts to solicit offers to purchase the Units in this offering. The Placement Agent has no obligation to buy any