SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission file number: 001-35223

_______________________

BioLineRx Ltd.

(Translation of registrant’s name into English)

_______________________

2 HaMa’ayan Street

Modi’in 7177871, Israel

(Address of Principal Executive Offices)

_______________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

On November 20, 2023, the Registrant issued a press release announcing its financial results for the three and nine months ended

September 30, 2023. The Registrant is also publishing its unaudited interim consolidated financial statements, as well as its operating and financial review, as of September 30, 2023 and for the three and nine months then ended. Attached hereto are

the following exhibits:

This Form 6-K, the text under the heading “Third Quarter 2023 Financial Results” in Exhibit 1, Exhibit 2 and Exhibit 3 are hereby

incorporated by reference into all effective registration statements filed by the registrant under the Securities Act of 1933.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

BioLineRx Ltd.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Philip Serlin

|

|

|

|

|

Philip Serlin

|

|

|

|

|

Chief Executive Officer

|

|

Dated: November 20, 2023

Exhibit 1

FOR IMMEDIATE RELEASE

BioLineRx Reports Third Quarter 2023 Financial Results and Recent Corporate

and Portfolio Updates

- Received FDA Approval of APHEXDA® (motixafortide) in Combination with Filgrastim (G-CSF) to

Mobilize Hematopoietic Stem Cells for Collection and Subsequent Autologous Transplantation

in Patients with Multiple Myeloma -

- Closed Exclusive License Agreement for Motixafortide in Asia Region

with Concurrent Strategic Equity Investment -

- Presented Encouraging Data at AACR from Pilot Phase of Randomized Phase 2 Combination Trial with

Motixafortide in Patients with First Line PDAC -

- Began Enrollment of Phase 1 Trial Evaluating Motixafortide for CD34+ Hematopoietic Stem Cell

Mobilization for Gene Therapies in Sickle Cell Disease -

- Management to host conference call today, November 20, at 10:00 a.m. EST -

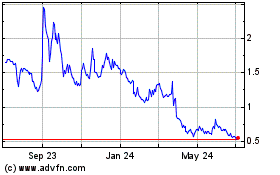

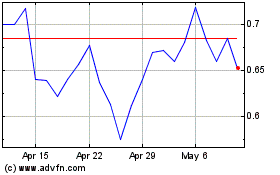

TEL AVIV, Israel, November 20, 2023 – BioLineRx Ltd. (NASDAQ/TASE: BLRX), a commercial stage biopharmaceutical company pursuing life-changing therapies in oncology and rare

diseases, today reported its unaudited financial results for the third quarter ended September 30, 2023, and provided corporate and portfolio updates.

“FDA approval of APHEXDA® in September was a transformative event for the company, and our U.S. commercial team is now working with payers and providers to make this important innovation available to patients,” said

Philip Serlin, Chief Executive Officer of BioLineRx. “We were pleased that APHEXDA® was recently added to the NCCN guidelines, and we believe that as centers adjust their protocols to include and gain experience with APHEXDA®, transplant teams

will gain a deep appreciation for the efficiencies that it can provide, and more importantly, the improved treatment journey patients experience as they navigate their essential transplant process.

“In addition, the company also closed its motixafortide licensing agreement covering the important Asia market. The agreement, which provided significant upfront funding, will first advance potential indications in

the region for stem cell mobilization and pancreatic cancer, areas of high unmet need. We continue to evaluate additional commercial partnership opportunities in other markets.

“Lastly, exciting data were presented at AACR from the single-arm pilot phase of the randomized Phase 2 combination clinical trial with motixafortide in first-line pancreatic cancer by the study’s lead investigator at

Columbia University. The highly encouraging data triggered a change in the protocol, from a small, single-arm study to a much larger randomized study. This study, as well as the enrolling Phase 1 study evaluating motixafortide for stem cell

mobilization in patients with sickle cell disease seeking gene therapy, highlight the potential versatility of motixafortide and the tremendous progress we are making to realize the full promise of this novel molecule for patients around the

world,” Mr. Serlin concluded.

|

• |

Received U.S. Food and Drug Administration approval of APHEXDA® (motixafortide) in combination with filgrastim (G-CSF) to mobilize hematopoietic stem cells to the peripheral blood for collection and subsequent autologous transplantation

in patients with multiple myeloma

|

|

• |

Closed exclusive license agreement to develop and commercialize motixafortide in Asia, alongside strategic equity investment:

|

|

o |

License agreement included $15 million upfront payment, up to $50 million in potential development and regulatory milestones, up to $200 million in potential commercial milestones, and

tiered double-digit royalties on sales

|

|

o |

Straight common equity investment of $14.6 million in BioLineRx American Depository Shares (ADSs)

|

|

o |

Gloria Biosciences expected to begin pivotal bridging study to support potential approval and commercialization of motixafortide in stem cell mobilization in China

|

|

o |

Gloria Biosciences planning randomized Phase 2/3 first-line pancreatic cancer clinical trial evaluating motixafortide in combination with PD-1 inhibitor zimberelimab and standard of care combination chemotherapy

|

Clinical Portfolio Updates

Motixafortide (selective inhibitor of CXCR4 chemokine receptor)

Multiple Myeloma

|

• |

Received inclusion of APHEXDA® in the National Comprehensive Cancer Network (NCCN) guidelines for Hematopoietic Cell Transplantation

|

|

• |

Received acceptance of an abstract on combination premedication benefits in the Phase 3 GENESIS trial, further educating on the use of APHEXDA at transplant centers. The poster will be

presented at the American Society of Hematology (ASH) 65th Annual Meeting on December 10, 2023, in San Diego, California

|

|

• |

Initiated pivotal bridging study preparation activities with Gloria Biosciences to support potential approval and commercialization of motixafortide in stem cell mobilization in China

|

Pancreatic Ductal Adenocarcinoma

|

• |

Presented data from the single-arm pilot phase of the investigator-initiated CheMo4METPANC Phase 2 combination clinical trial in first-line pancreatic cancer (PDAC) at the American

Association of Cancer Research (AACR) Special Conference on Pancreatic Cancer. Of 11 patients with metastatic pancreatic cancer enrolled, 7 patients (64%) experienced a partial response (PR), of which 5

(45%) were confirmed PRs with one patient experiencing resolution of the hepatic (liver) metastatic lesion. Three patients (27%) experienced stable disease, resulting in a disease control rate

of 91%. Based on these encouraging results, the study was substantially revised to a multi-institution, randomized trial of 108 patients

|

|

• |

Initiated preparation activities with Gloria Biosciences to support the development of a randomized Phase 2/3 clinical trial evaluating motixafortide in combination with the PD-1 inhibitor zimberelimab and standard of care combination

chemotherapy in first-line pancreatic cancer

|

Sickle Cell Disease & Gene Therapy

|

• |

Began enrollment in investigator-initiated Phase 1 pilot study led by Washington University School of Medicine in St. Louis evaluating motixafortide as monotherapy and in combination with natalizumab for CD34+ hematopoietic stem cell

mobilization for gene therapies in sickle cell disease. Anticipate data in 2H of 2024

|

AGI-134 (synthetic alpha-Gal glycolipid)

Solid Tumor Immunotherapy

|

• |

Evaluating next development pathways for AGI-134 program. The Phase 1/2a first-in-human, single-agent study, results of which were announced in Q4 2022, met the primary endpoint for safety and tolerability and demonstrated immune

activity across multiple biomarkers

|

Third Quarter 2023 Financial Results

|

• |

Research and development expenses for the three months ended September 30, 2023 were $2.7 million, a decrease of $1.6 million, or 37.6%, compared to $4.3 million for the three months ended September 30, 2022. The decrease resulted

primarily from lower expenses associated with NDA supporting activities related to motixafortide as well as lower expenses associated with the completed AGI-134 clinical trial

|

|

• |

Sales and marketing expenses for the three months ended September 30, 2023 were $8.1 million, an increase of $6.8 million, or 517.4% compared to $1.3 million for the three months ended September 30, 2022. The increase resulted primarily

from the ramp-up of pre-commercialization activities related to motixafortide

|

|

• |

General and administrative expenses for the three months ended September 30, 2023 were $1.5 million, an increase of $0.1 million, or 7.7% compared to $1.4 million for the three months ended September 30, 2022. The increase resulted from

small increases in a number of individual G&A expenses

|

|

• |

Non-operating expenses for the three months ended September 30, 2023 were $3.1 million, an increase of $3.5 million, compared to non-operating income of $0.4 million for the three months ended September 30, 2022. The increase relates

primarily to the revaluation of outstanding warrants resulting from an increase in the company’s share price during the 2023 period

|

|

• |

Net loss for the three months ended September 30, 2023 was $16.0 million, compared to $6.8 million for the three months ended September 30, 2022. Net loss for the nine months ended September 30, 2023 amounted to $46.7 million, compared

to $19.2 million for the nine months ended September 30, 2022. The increases in net loss for both the three- and nine-month periods in 2023 were primarily due to the significant non-operating expenses (which were also non-cash) related to

revaluation of outstanding warrants, as well as the significant increases in sales and marketing expenses related to pre-commercialization and commercialization activities, which were partially offset by a decrease in research and

development expenses

|

|

• |

As of September 30, 2023, we held $26.0 million of cash, cash equivalents and short-term bank deposits. We anticipate that this amount, as well as the consideration from the exclusive license agreement and the securities purchase

agreement of $29.6 million that was received in October 2023, will be sufficient to fund operations, as currently planned, into 2025

|

Conference Call and Webcast Information

To access the conference call, please dial +1-888-281-1167 from the U.S. or +972-3-918-0685 internationally. A live webcast and a replay of the call can be accessed through the event page on the Company's

website. Please allow extra time prior to the call to visit the site and download any necessary software to listen to the live broadcast. The call replay will be available approximately two hours after completion of the live conference call. A

dial-in replay of the call will be available until November 22, 2023; please dial +1-888-295-2634 from the US or +972-3-925-5904 internationally.

About BioLineRx

BioLineRx Ltd. (NASDAQ/TASE: BLRX) is a commercial stage biopharmaceutical company pursuing life-changing therapies in oncology and rare diseases. The company’s first approved product is APHEXDA® (motixafortide) with

an indication in the U.S. for stem cell mobilization for autologous transplantation in multiple myeloma. BioLineRx is advancing a pipeline of investigational medicines for patients with sickle cell disease, pancreatic cancer, and other solid

tumors. Headquartered in Israel, and with operations in the U.S., the company is driving innovative therapeutics with end-to-end expertise in development and commercialization, ensuring life-changing discoveries move beyond the bench to the

bedside.

Learn more about who we are, what we do, and how we do it at www.biolinerx.com, or on Twitter and LinkedIn.

Forward Looking Statement

Various statements in this release concerning BioLineRx's future expectations constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements include words such as "anticipates," "believes," "could," "estimates," "expects," "intends," "may," "plans," "potential," "predicts," "projects," "should," "will," and "would," and describe opinions about future events.

These include statements regarding management’s expectations, beliefs and intentions regarding, among other things, the potential benefits of APHEXDA, the execution of the launch of APHEXDA and the plans and objectives of management for future

operations and expectations and commercial potential of motixafortide, as well as its potential investigational uses. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual

results, performance or achievements of BioLineRx to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Factors that could cause BioLineRx's actual results to

differ materially from those expressed or implied in such forward-looking statements include, but are not limited to: the initiation, timing, progress and results of BioLineRx's preclinical studies, clinical trials and other therapeutic candidate

development efforts; BioLineRx's ability to advance its therapeutic candidates into clinical trials or to successfully complete its preclinical studies or clinical trials; whether the clinical trial results for APHEXDA will be predictive of

real-world results; BioLineRx's receipt of regulatory approvals for its therapeutic candidates, and the timing of other regulatory filings and approvals; the clinical development, commercialization and market acceptance of BioLineRx's therapeutic

candidates, including the degree and pace of market uptake of APHEXDA for the mobilization of hematopoietic stem cells for autologous transplantation in multiple myeloma patients; whether access to

APHEXDA is achieved in a commercially viable manner and whether APHEXDA receives adequate reimbursement from third-party payors; BioLineRx's ability to establish, operationalize and maintain corporate collaborations; BioLineRx's ability to

integrate new therapeutic candidates and new personnel; the interpretation of the properties and characteristics of BioLineRx's therapeutic candidates and of the results obtained with its therapeutic candidates in preclinical studies or clinical

trials; the implementation of BioLineRx's business model and strategic plans for its business and therapeutic candidates; the scope of protection BioLineRx is able to establish and maintain for intellectual property rights covering its

therapeutic candidates and its ability to operate its business without infringing the intellectual property rights of others; estimates of BioLineRx's expenses, future revenues, capital requirements and its needs for and ability to access

sufficient additional financing, including any unexpected costs or delays in the commercial launch of APHEXDA; risks related to changes in healthcare laws, rules and regulations in the United States or elsewhere; competitive companies,

technologies and BioLineRx's industry; statements as to the impact of the political and security situation in Israel on BioLineRx's business; and the impact of the COVID-19 pandemic, the Russian invasion of Ukraine, the declared war by Israel

against Hamas and the military campaigns against Hamas and other terrorist organizations, which may exacerbate the magnitude of the factors discussed above. These and other factors are more fully discussed in the "Risk Factors" section of

BioLineRx's most recent annual report on Form 20-F filed with the Securities and Exchange Commission on March 22, 2023. In addition, any forward-looking statements represent BioLineRx's views only as of the date of this release and should not be

relied upon as representing its views as of any subsequent date. BioLineRx does not assume any obligation to update any forward-looking statements unless required by law.

Contacts:

United States

John Lacey

BioLineRx

IR@biolinerx.com

Israel

Moran Meir

LifeSci Advisors, LLC

moran@lifesciadvisors.com

BioLineRx Ltd.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF FINANCIAL POSITION

(UNAUDITED)

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

Assets

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

10,587

|

|

|

|

7,727

|

|

|

Short-term bank deposits

|

|

|

40,495

|

|

|

|

18,241

|

|

|

Inventory

|

|

|

-

|

|

|

|

1,352

|

|

|

Prepaid expenses

|

|

|

198

|

|

|

|

1,170

|

|

|

Other receivables

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

726

|

|

|

|

561

|

|

|

Right-of-use assets, net

|

|

|

1,772

|

|

|

|

1,462

|

|

|

Intangible assets, net

|

|

|

|

|

|

|

|

|

|

Total non-current assets

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and equity

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Current maturities of long-term loan

|

|

|

1,542

|

|

|

|

3,078

|

|

|

Accounts payable and accruals:

|

|

|

|

|

|

|

|

|

|

Trade

|

|

|

6,966

|

|

|

|

8,438

|

|

|

Other

|

|

|

1,744

|

|

|

|

2,683

|

|

|

Current maturities of lease liabilities

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

|

|

|

|

|

|

|

NON-CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Warrants

|

|

|

4,509

|

|

|

|

15,287

|

|

|

Long-term loan, net of current maturities

|

|

|

8,626

|

|

|

|

8,458

|

|

|

Lease liabilities

|

|

|

|

|

|

|

|

|

|

Total non-current liabilities

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

EQUITY

|

|

|

|

|

|

|

|

|

|

Ordinary shares

|

|

|

27,100

|

|

|

|

28,332

|

|

|

Share premium

|

|

|

338,976

|

|

|

|

345,462

|

|

|

Warrants

|

|

|

1,408

|

|

|

|

1,408

|

|

|

Capital reserve

|

|

|

14,765

|

|

|

|

16,070

|

|

|

Other comprehensive loss

|

|

|

(1,416

|

)

|

|

|

(1,416

|

)

|

|

Accumulated deficit

|

|

|

|

|

|

|

|

)

|

|

Total equity

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity

|

|

|

|

|

|

|

|

|

BioLineRx Ltd.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF COMPREHENSIVE LOSS

(UNAUDITED)

| |

|

Three months ended

September 30,

|

|

|

Nine months ended

September 30,

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

RESEARCH AND DEVELOPMENT EXPENSES

|

|

|

(4,369

|

)

|

|

|

(2,727

|

)

|

|

|

(14,199

|

)

|

|

|

(9,417

|

)

|

|

SALES AND MARKETING EXPENSES

|

|

|

(1,317

|

)

|

|

|

(8,131

|

)

|

|

|

(3,112

|

)

|

|

|

(17,609

|

)

|

|

GENERAL AND ADMINISTRATIVE EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING LOSS

|

|

|

(7,078

|

)

|

|

|

(12,357

|

)

|

|

|

(20,759

|

)

|

|

|

(31,128

|

)

|

|

NON-OPERATING INCOME (EXPENSES), NET

|

|

|

389

|

|

|

|

(3,141

|

)

|

|

|

2,115

|

|

|

|

(13,790

|

)

|

|

FINANCIAL INCOME

|

|

|

109

|

|

|

|

312

|

|

|

|

256

|

|

|

|

1,289

|

|

|

FINANCIAL EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS AND COMPREHENSIVE LOSS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

LOSS PER ORDINARY SHARE - BASIC AND DILUTED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF SHARES USED IN CALCULATION OF LOSS PER ORDINARY SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BioLineRx Ltd.

CONDENSED INTERIM STATEMENTS OF CHANGES IN EQUITY

(UNAUDITED)

| |

|

Ordinary

|

|

|

Share

|

|

|

|

|

|

Capital

|

|

|

Other

comprehensive

|

|

|

Accumulated

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

BALANCE AT JANUARY 1, 2022

|

|

|

21,066

|

|

|

|

339,346

|

|

|

|

975

|

|

|

|

13,157

|

|

|

|

(1,416

|

)

|

|

|

(305,041

|

)

|

|

|

68,087

|

|

|

CHANGES FOR NINE MONTHS ENDED

SEPTEMBER 30, 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of share capital and warrants, net

|

|

|

6,030

|

|

|

|

(1,008

|

)

|

|

|

433

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

5,455

|

|

|

Employee stock options exercised

|

|

|

2

|

|

|

|

12

|

|

|

|

-

|

|

|

|

(12

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

2

|

|

|

Employee stock options expired

|

|

|

-

|

|

|

|

491

|

|

|

|

-

|

|

|

|

(491

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Share-based compensation

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,200

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,200

|

|

|

Comprehensive loss for the period

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BALANCE AT SEPTEMBER 30, 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Ordinary

|

|

|

Share

|

|

|

|

|

|

Capital

|

|

|

Other

comprehensive

|

|

|

Accumulated

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

BALANCE AT JANUARY 1, 2023

|

|

|

27,100

|

|

|

|

338,976

|

|

|

|

1,408

|

|

|

|

14,765

|

|

|

|

(1,416

|

)

|

|

|

(329,992

|

)

|

|

|

50,841

|

|

|

CHANGES FOR NINE MONTHS ENDED

SEPTEMBER 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of share capital, net

|

|

|

361

|

|

|

|

1,535

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,896

|

|

|

Warrants exercised

|

|

|

865

|

|

|

|

4,855

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

5,720

|

|

|

Employee stock options exercised

|

|

|

6

|

|

|

|

18

|

|

|

|

-

|

|

|

|

(9

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

15

|

|

|

Employee stock options expired

|

|

|

-

|

|

|

|

78

|

|

|

|

-

|

|

|

|

(78

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Share-based compensation

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,392

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,392

|

|

|

Comprehensive loss for the period

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BALANCE AT SEPTEMBER 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BioLineRx Ltd.

CONDENSED CONSOLIDATED INTERIM CASH FLOW STATEMENTS

(UNAUDITED)

| |

|

Nine months ended September 30,

|

|

| |

|

|

|

|

|

|

| |

|

|

|

| |

|

|

|

|

|

|

|

CASH FLOWS - OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

Net loss for the period

|

|

|

(19,220

|

)

|

|

|

(46,730

|

)

|

|

Adjustments required to reflect net cash used in operating activities (see appendix below)

|

|

|

|

|

|

|

|

|

|

Net cash used in operating activities

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS – INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Investments in short-term deposits

|

|

|

(36,000

|

)

|

|

|

(13,882

|

)

|

|

Maturities of short-term deposits

|

|

|

36,232

|

|

|

|

36,000

|

|

|

Purchase of property and equipment

|

|

|

(74

|

)

|

|

|

(100

|

)

|

|

Purchase of intangible assets

|

|

|

|

|

|

|

|

|

|

Net cash provided by investing activities

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS – FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Issuance of share capital and warrants, net of issuance costs

|

|

|

14,359

|

|

|

|

1,896

|

|

|

Exercise of warrants

|

|

|

-

|

|

|

|

2,530

|

|

|

Employee stock options exercised

|

|

|

2

|

|

|

|

15

|

|

|

Proceeds of long-term loan, net of issuance costs

|

|

|

9,682

|

|

|

|

-

|

|

|

Repayments of loan

|

|

|

(2,832

|

)

|

|

|

(802

|

)

|

|

Repayments of lease liabilities

|

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS

|

|

|

672

|

|

|

|

(2,444

|

)

|

|

CASH AND CASH EQUIVALENTS - BEGINNING OF PERIOD

|

|

|

12,990

|

|

|

|

10,587

|

|

|

EXCHANGE DIFFERENCES ON CASH AND CASH EQUIVALENTS

|

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS - END OF PERIOD

|

|

|

|

|

|

|

|

|

BioLineRx Ltd.

APPENDIX TO CONDENSED CONSOLIDATED INTERIM CASH FLOW STATEMENTS

(UNAUDITED)

| |

|

Nine months ended September 30,

|

|

| |

|

|

|

|

|

|

| |

|

|

|

| |

|

|

|

|

|

|

|

Adjustments required to reflect net cash used in operating activities:

|

|

|

|

|

|

|

|

Income and expenses not involving cash flows:

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

467

|

|

|

|

678

|

|

|

Exchange differences on cash and cash equivalents

|

|

|

557

|

|

|

|

416

|

|

|

Fair value adjustments of warrants

|

|

|

(2,778

|

)

|

|

|

13,968

|

|

|

Share-based compensation

|

|

|

1,200

|

|

|

|

1,392

|

|

|

Warrant issuance costs

|

|

|

171

|

|

|

|

-

|

|

|

Interest and exchange differences on short-term deposits

|

|

|

(244

|

)

|

|

|

136

|

|

|

Interest on loan

|

|

|

104

|

|

|

|

2,170

|

|

|

Exchange differences on lease liability

|

|

|

(233

|

)

|

|

|

(122

|

)

|

|

Long-term loan issuance cost

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Changes in operating asset and liability items:

|

|

|

|

|

|

|

|

|

|

Increase in inventory

|

|

|

-

|

|

|

|

(1,352

|

)

|

|

Increase in prepaid expenses and other receivables

|

|

|

(411

|

)

|

|

|

(566

|

)

|

|

Increase in accounts payable and accruals

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Supplemental information on interest received in cash

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Supplemental information on interest paid in cash

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Supplemental information on warrant issuance costs paid in cash

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Supplemental information on non-cash transactions:

|

|

|

|

|

|

|

|

|

|

Changes in right-of-use asset

|

|

|

|

|

|

|

|

|

|

Warrant issuance costs

|

|

|

|

|

|

|

|

|

|

Exercise of warrants (portion related to accumulated fair value adjustments)

|

|

|

|

|

|

|

|

|

Exhibit 2

BioLineRx Ltd.

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

AS OF SEPTEMBER 30, 2023

BioLineRx Ltd.

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

AS OF SEPTEMBER 30, 2023

TABLE OF CONTENTS

| |

|

Page

|

|

|

|

F-1

|

|

|

|

F-2

|

|

|

|

F-3

|

|

|

|

F-4-F-5

|

|

|

|

F-6-F-12

|

BioLineRx Ltd.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF FINANCIAL POSITION

(UNAUDITED)

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

Assets

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

10,587

|

|

|

|

7,727

|

|

|

Short-term bank deposits

|

|

|

40,495

|

|

|

|

18,241

|

|

|

Inventory

|

|

|

-

|

|

|

|

1,352

|

|

|

Prepaid expenses

|

|

|

198

|

|

|

|

1,170

|

|

|

Other receivables

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

726

|

|

|

|

561

|

|

|

Right-of-use assets, net

|

|

|

1,772

|

|

|

|

1,462

|

|

|

Intangible assets, net

|

|

|

|

|

|

|

|

|

|

Total non-current assets

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and equity

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Current maturities of long-term loan

|

|

|

1,542

|

|

|

|

3,078

|

|

|

Accounts payable and accruals:

|

|

|

|

|

|

|

|

|

|

Trade

|

|

|

6,966

|

|

|

|

8,438

|

|

|

Other

|

|

|

1,744

|

|

|

|

2,683

|

|

|

Current maturities of lease liabilities

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

|

|

|

|

|

|

|

NON-CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Warrants

|

|

|

4,509

|

|

|

|

15,287

|

|

|

Long-term loan, net of current maturities

|

|

|

8,626

|

|

|

|

8,458

|

|

|

Lease liabilities

|

|

|

|

|

|

|

|

|

|

Total non-current liabilities

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

EQUITY

|

|

|

|

|

|

|

|

|

|

Ordinary shares

|

|

|

27,100

|

|

|

|

28,332

|

|

|

Share premium

|

|

|

338,976

|

|

|

|

345,462

|

|

|

Warrants

|

|

|

1,408

|

|

|

|

1,408

|

|

|

Capital reserve

|

|

|

14,765

|

|

|

|

16,070

|

|

|

Other comprehensive loss

|

|

|

(1,416

|

)

|

|

|

(1,416

|

)

|

|

Accumulated deficit

|

|

|

|

|

|

|

(376,722

|

)

|

|

Total equity

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

BioLineRx Ltd.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF

COMPREHENSIVE LOSS

(UNAUDITED)

| |

|

Three months ended September 30,

|

|

|

Nine months ended September 30,

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

RESEARCH AND DEVELOPMENT EXPENSES

|

|

|

(4,369

|

)

|

|

|

(2,727

|

)

|

|

|

(14,199

|

)

|

|

|

(9,417

|

)

|

|

SALES AND MARKETING EXPENSES

|

|

|

(1,317

|

)

|

|

|

(8,131

|

)

|

|

|

(3,112

|

)

|

|

|

(17,609

|

)

|

|

GENERAL AND ADMINISTRATIVE EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING LOSS

|

|

|

(7,078

|

)

|

|

|

(12,357

|

)

|

|

|

(20,759

|

)

|

|

|

(31,128

|

)

|

|

NON-OPERATING INCOME (EXPENSES), NET

|

|

|

389

|

|

|

|

(3,141

|

)

|

|

|

2,115

|

|

|

|

(13,790

|

)

|

|

FINANCIAL INCOME

|

|

|

109

|

|

|

|

312

|

|

|

|

256

|

|

|

|

1,289

|

|

|

FINANCIAL EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS AND COMPREHENSIVE LOSS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(46,730

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

LOSS PER ORDINARY SHARE - BASIC AND DILUTED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF SHARES USED IN CALCULATION OF LOSS PER ORDINARY SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

BioLineRx Ltd.

CONDENSED INTERIM STATEMENTS OF

CHANGES IN EQUITY

(UNAUDITED)

| |

|

Ordinary

|

|

|

Share

|

|

|

|

|

|

Capital

|

|

|

Other

comprehensive

|

|

|

Accumulated

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

BALANCE AT JANUARY 1, 2022

|

|

|

21,066

|

|

|

|

339,346

|

|

|

|

975

|

|

|

|

13,157

|

|

|

|

(1,416

|

)

|

|

|

(305,041

|

)

|

|

|

68,087

|

|

|

CHANGES FOR NINE MONTHS ENDED

SEPTEMBER 30, 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of share capital and warrants, net

|

|

|

6,030

|

|

|

|

(1,008

|

)

|

|

|

433

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

5,455

|

|

|

Employee stock options exercised

|

|

|

2

|

|

|

|

12

|

|

|

|

-

|

|

|

|

(12

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

2

|

|

|

Employee stock options expired

|

|

|

-

|

|

|

|

491

|

|

|

|

-

|

|

|

|

(491

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Share-based compensation

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,200

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,200

|

|

|

Comprehensive loss for the period

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BALANCE AT SEPTEMBER 30, 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Ordinary

|

|

|

Share

|

|

|

|

|

|

Capital

|

|

|

Other

comprehensive

|

|

|

Accumulated

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

BALANCE AT JANUARY 1, 2023

|

|

|

27,100

|

|

|

|

338,976

|

|

|

|

1,408

|

|

|

|

14,765

|

|

|

|

(1,416

|

)

|

|

|

(329,992

|

)

|

|

|

50,841

|

|

|

CHANGES FOR NINE MONTHS ENDED

SEPTEMBER 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of share capital, net

|

|

|

361

|

|

|

|

1,535

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,896

|

|

|

Warrants exercised

|

|

|

865

|

|

|

|

4,855

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

5,720

|

|

|

Employee stock options exercised

|

|

|

6

|

|

|

|

18

|

|

|

|

-

|

|

|

|

(9

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

15

|

|

|

Employee stock options expired

|

|

|

-

|

|

|

|

78

|

|

|

|

-

|

|

|

|

(78

|

)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Share-based compensation

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,392

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,392

|

|

|

Comprehensive loss for the period

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BALANCE AT SEPTEMBER 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

BioLineRx Ltd.

CONDENSED CONSOLIDATED INTERIM CASH FLOW STATEMENTS

(UNAUDITED)

| |

|

Nine months ended September 30,

|

|

| |

|

|

|

|

|

|

| |

|

|

|

| |

|

|

|

|

|

|

|

CASH FLOWS - OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

Net loss for the period

|

|

|

(19,220

|

)

|

|

|

(46,730

|

)

|

|

Adjustments required to reflect net cash used in operating activities (see appendix below)

|

|

|

|

|

|

|

|

|

|

Net cash used in operating activities

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS – INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Investments in short-term deposits

|

|

|

(36,000

|

)

|

|

|

(13,882

|

)

|

|

Maturities of short-term deposits

|

|

|

36,232

|

|

|

|

36,000

|

|

|

Purchase of property and equipment

|

|

|

(74

|

)

|

|

|

(100

|

)

|

|

Purchase of intangible assets

|

|

|

|

|

|

|

|

|

|

Net cash provided by investing activities

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS – FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Issuance of share capital and warrants, net of issuance costs

|

|

|

14,359

|

|

|

|

1,896

|

|

|

Exercise of warrants

|

|

|

-

|

|

|

|

2,530

|

|

|

Employee stock options exercised

|

|

|

2

|

|

|

|

15

|

|

|

Proceeds of long-term loan, net of issuance costs

|

|

|

9,682

|

|

|

|

-

|

|

|

Repayments of loan

|

|

|

(2,832

|

)

|

|

|

(802

|

)

|

|

Repayments of lease liabilities

|

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS

|

|

|

672

|

|

|

|

(2,444

|

)

|

|

CASH AND CASH EQUIVALENTS - BEGINNING OF PERIOD

|

|

|

12,990

|

|

|

|

10,587

|

|

|

EXCHANGE DIFFERENCES ON CASH AND CASH EQUIVALENTS

|

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS - END OF PERIOD

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

BioLineRx Ltd.

APPENDIX TO CONDENSED CONSOLIDATED INTERIM CASH FLOW STATEMENTS

(UNAUDITED)

| |

|

Nine months ended September 30,

|

|

| |

|

|

|

|

|

|

| |

|

|

|

| |

|

|

|

|

|

|

|

Adjustments required to reflect net cash used in operating activities:

|

|

|

|

|

|

|

|

Income and expenses not involving cash flows:

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

467

|

|

|

|

678

|

|

|

Exchange differences on cash and cash equivalents

|

|

|

557

|

|

|

|

416

|

|

|

Fair value adjustments of warrants

|

|

|

(2,778

|

)

|

|

|

13,968

|

|

|

Share-based compensation

|

|

|

1,200

|

|

|

|

1,392

|

|

|

Warrant issuance costs

|

|

|

171

|

|

|

|

-

|

|

|

Interest and exchange differences on short-term deposits

|

|

|

(244

|

)

|

|

|

136

|

|

|

Interest on loan

|

|

|

104

|

|

|

|

2,170

|

|

|

Exchange differences on lease liability

|

|

|

(233

|

)

|

|

|

(122

|

)

|

|

Long-term loan issuance cost

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Changes in operating asset and liability items:

|

|

|

|

|

|

|

|

|

|

Increase in inventory

|

|

|

-

|

|

|

|

(1,352

|

)

|

|

Increase in prepaid expenses and other receivables

|

|

|

(411

|

)

|

|

|

(566

|

)

|

|

Increase in accounts payable and accruals

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Supplemental information on interest received in cash

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Supplemental information on interest paid in cash

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Supplemental information on warrant issuance costs paid in cash

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Supplemental information on non-cash transactions:

|

|

|

|

|

|

|

|

|

|

Changes in right-of-use asset

|

|

|

|

|

|

|

|

|

|

Warrant issuance costs

|

|

|

|

|

|

|

|

|

|

Exercise of warrants (portion related to accumulated fair value adjustments)

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

NOTE 1 – GENERAL INFORMATION

BioLineRx Ltd. (“BioLineRx”), headquartered in Modi’in, Israel, was incorporated and commenced operations in April 2003. BioLineRx and its subsidiaries (collectively, the

“Company”) are engaged in the development (primarily in clinical stages) and commercialization of therapeutics, with a focus on the fields of oncology and hematology.

The Company’s American Depositary Shares (“ADSs”) are traded on the NASDAQ Capital Market, and its ordinary shares are traded on the Tel Aviv Stock Exchange (“TASE”). Each ADS

represents 15 ordinary shares.

The Company has two substantially wholly owned subsidiaries: (i) BioLineRx USA, Inc., incorporated in the US, and engaged in commercialization activities associated with the

launch of motixafortide for stem-cell mobilization in the US; and (ii) Agalimmune Ltd., incorporated in the United Kingdom, and engaged in clinical development activities with a focus on the field of immuno-oncology.

In September 2023, the US Food and Drug Administration (“FDA”) approved motixafortide in stem cell mobilization for autologous transplantation for multiple myeloma patients,

and the Company has begun to independently commercialize motixafortide in the US.

The Company has incurred accumulated losses in the amount of $377 million through September 30, 2023, and it expects to continue incurring losses and negative cash flows from

operations until its product or products reach commercial profitability. Company management monitors rolling forecasts of the Company’s liquidity reserves on the basis of anticipated cash flows and maintains liquidity balances at levels that are

sufficient to meet its needs. Management believes that the Company’s current cash (including the consideration from the license agreement and the securities purchase agreement as detailed in Note 8) and other resources will be sufficient to fund

its projected cash requirements into 2025.

The execution of an independent commercialization plan for motixafortide in the US implies an increased level of expenses prior to and following launch of the product, as well

as uncertainty regarding the timing of commercial profitability. Therefore, the Company’s cash flow projections are subject to various risks and uncertainties concerning their fulfilment, and these factors and the risk inherent in the Company’s

operations may cast significant doubt on the Company’s ability to continue as a going concern. These consolidated financial statements have been prepared assuming that the Company will continue as a going concern and do not include any adjustments

that might result from the outcome of this uncertainty.

BioLineRx Ltd.

NOTES TO CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 1 – GENERAL INFORMATION (cont.)

References in these IFRS financial statements to matters that may cast significant doubt about the Company’s ability to continue as a going concern also raise substantial doubt

as contemplated by the PCAOB standards.

Management’s plans include the independent commercialization of the Company’s product, as aforementioned, and, if and when required, raising capital through the issuance of

debt or equity securities, or capital inflows from strategic partnerships. There are no assurances, however, that the Company will be successful in obtaining the level of financing needed for its operations. If the Company is unsuccessful in

commercializing its products and/or raising capital, it may need to reduce activities, or curtail or cease operations.

|

c. |

Approval of financial statements

|

The condensed consolidated interim financial statements of the Company as of September 30, 2023, and for the three and nine months then ended, were approved by the Board of

Directors on November 17, 2023, and signed on its behalf by the Chairman of the Board, the Chief Executive Officer, and the Chief Financial Officer.

NOTE 2 – BASIS OF PREPARATION

The Company’s condensed consolidated interim financial statements as of September 30, 2023 and for the three and nine months then ended (the “interim financial statements”)

have been prepared in accordance with International Accounting Standard No. 34, “Interim Financial Reporting” (“IAS 34”). These interim financial statements, which are unaudited, do not include all disclosures necessary for a fair presentation of

financial position, results of operations, and cash flows in conformity with International Financial Reporting Standards (“IFRS”). The condensed consolidated interim financial statements should be read in conjunction with the Company’s annual

financial statements as of December 31, 2022 and for the year then ended and their accompanying notes, which have been prepared in accordance with IFRS. The results of operations for the three and nine months ended September 30, 2023 are not

necessarily indicative of the results that may be expected for the entire fiscal year or for any other interim period.

BioLineRx Ltd.

NOTES TO CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 2 – BASIS OF PREPARATION (cont.)

The preparation of financial statements in conformity with IFRS requires management to make estimates, judgments and assumptions that may affect the reported amounts of assets,

liabilities, equity and expenses, as well as the related disclosures of contingent assets and liabilities, in the process of applying the Company’s accounting policies. These inputs also consider, among other things, the implications of pandemics

and wars across the globe on the Company’s activities, and the resultant effects on critical and significant accounting estimates, most significantly in relation to the value of intangible assets.

U.S. and global markets are currently experiencing volatility and disruption following the escalation of geopolitical tensions and the ongoing military conflict between Russia

and Ukraine. Although the length and impact of the ongoing military conflict are highly unpredictable, the conflict in Ukraine could lead to market disruptions, including significant volatility in commodity prices, credit and the capital markets.

As of the date of release of these financial statements, the Company estimates there are no material effects of this conflict on its financial position and results of operations.

In October 2023, Hamas terrorists infiltrated Israel’s southern border from the Gaza Strip and conducted a series of attacks on civilian and military targets. Hamas also

launched extensive rocket attacks on the Israeli population and industrial centers located along Israel’s border with the Gaza Strip and in other areas within the State of Israel. These attacks resulted in thousands of deaths and injuries, and

Hamas additionally kidnapped many Israeli civilians and soldiers. Following the attack, Israel’s security cabinet declared war against Hamas and commenced a military campaign against Hamas and other terrorist organizations in parallel to their

continued rocket and terror attacks. As of the date of release of these financial statements, the Company estimates there are no material effects of this war on its current financial position and results of operations. Nevertheless, the Company

cannot predict the intensity or duration of the war, nor can it predict how the war will ultimately affect the Company’s business and operations in Israel or Israel's economy in general.

NOTE 3 – SIGNIFICANT ACCOUNTING POLICIES

The accounting policies and calculation methods applied in the preparation of these interim financial statements are consistent with those applied in the preparation of the

annual financial statements as of December 31, 2022 and for the year then ended, except with regard to inventory, as a result of the recent FDA approval and launch of the Company’s first product (see Note 1).

Inventory is measured at the lower of cost or net realizable value. The cost of inventories includes purchase costs, packaging and labeling costs, and other costs incurred in

bringing the inventories to their present location and condition. Net realizable value is the estimated selling price of the inventories in the ordinary course of business, less the estimated costs necessary to make the sale. Pre-launch inventory

is recorded as an asset only when there is a high probability of regulatory approval for the relevant product. Prior to that point, inventory costs are recorded as research and development expenses.

BioLineRx Ltd.

NOTES TO CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 4 – AT-THE-MARKET (“ATM”) SALES AGREEMENT WITH HCW

The Company maintains an ATM facility with H.C. Wainwright & Co., LLC (“HCW”) pursuant to an ATM sales agreement entered into in September 2021. In accordance with the

agreement, the Company is entitled, at its sole discretion, to offer and sell through HCW, acting as a sales agent, ADSs having an aggregate offering price of up to $25.0 million throughout the period during which the ATM facility remains in

effect. The Company has agreed to pay HCW a commission of 3.0% of the gross proceeds from the sale of ADSs under the facility. During the nine months ended September 30, 2023, the Company issued a total of 917,640 ADSs under the agreement for total

gross proceeds of $1.9 million. From the effective date of the agreement through the issuance of this report, 1,890,325 ADSs have been sold under the program for total gross proceeds of approximately $3.8 million.

NOTE 5 – LONG-TERM LOAN

In September 2022, the Company entered into a $40 million loan agreement with Kreos Capital VII Aggregator SCSp (“Kreos Capital”). Pursuant to the agreement, the first tranche

of $10 million was drawn down by the Company following execution of the definitive agreement, after completion of certain customary conditions to closing. The remaining $30 million will be made available in two additional tranches subject to the

achievement of pre-specified milestones. The tranches are available for drawdown at the Company’s discretion at various time points through October 1, 2024.

Each tranche carries a pre-defined interest-only payment period, followed by a loan principal amortization period of up to 36 months subsequent to the interest-only period.

The interest-only periods are subject to possible extension based on certain pre-defined milestones. Borrowings under the financing will bear interest at a fixed annual rate of 9.5% (~11.0%, including associated cash fees). As security for the

loan, Kreos Capital received a first-priority secured interest in all Company assets, including intellectual property, and the Company undertook to maintain a minimum cash balance. In addition, Kreos Capital will be entitled to mid-to-high

single-digit royalties on motixafortide sales, up to a pre-defined cap.

The loan's current value includes the accrual of effective interest, including estimated future royalties.

BioLineRx Ltd.

NOTES TO CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 6 – WARRANTS FROM SEPTEMBER 2022 OFFERING

In September 2022, the Company completed a registered direct offering of 13,636,365 ADSs at a price of $1.10 per ADS. In concurrent private placements, the Company issued to

investors in the offering unregistered warrants to purchase 13,636,365 ADSs. The warrants are exercisable immediately, expire five years from the date of issuance and have an exercise price of $1.15 per ADS. In addition, the Company granted to the

placement agent in the offering, as part of the placement fee, warrants to purchase 681,818 ADSs. These warrants are exercisable immediately, expire five years from the date of issuance and have an exercise price of $1.375 per ADS. Gross proceeds

from the offering totaled $15.0 million, with net proceeds of $13.5 million, after deducting fees and expenses. The offering consideration allocated to the placement agent warrants amounted to $0.4 million.

The warrants issued to the investors have been classified as a non-current financial liability due to a net settlement provision. This liability was initially recognized at its

fair value on the issuance date and is subsequently accounted for at fair value at each balance sheet date. The fair value changes are charged to non-operating income and expense in the statement of comprehensive loss.

The fair value of the warrants is computed using the Black-Scholes option pricing model and is determined by using a level 3 valuation technique. The fair value of the