As filed with the Securities and Exchange Commission

on November 17, 2023

Registration

No. 333-273325

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-3/A

(Amendment No. 1)

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HALLADOR

ENERGY COMPANY

(Exact name of registrant as specified in its charter)

| Colorado |

84-1014610 |

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification Number) |

1183 East Canvasback Drive

Terre Haute, Indiana 47802

(303) 839-5504

(Address, including ZIP code, and telephone

number, including area code, of registrant’s principal executive offices)

Lawrence D. Martin

Chief Financial Officer and Corporate Secretary

1183 East Canvasback Drive

Terre Haute, Indiana 47802

(303) 839-5504

(Name, address, including ZIP code, and telephone

number, including area code, of agent for service)

Please address a copy of all communications

to:

Sean M. Ewen, Esq.

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, New York 10019

(212) 728-8000

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box. ¨

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check

the following box. x

If this Form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration

statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the

Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “non-accelerated

filer,“ “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer x |

| Non-accelerated filer ¨ |

Smaller reporting company x |

| |

Emerging growth company ¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

The information in

this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities

and Exchange Commission (“SEC”) is effective. This prospectus is not an offer to sell these securities and it is not soliciting

an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED NOVEMBER 17, 2023

Prospectus

HALLADOR ENERGY COMPANY

Up to 5,262,635 Shares of Common Stock

This prospectus relates to

the resale from time to time by the selling shareholders named in this prospectus (the “Selling Shareholders”) of up

to an aggregate of 5,262,635 shares of our Common Stock (the “Shares”), including up to 3,065,097 shares of our Common

Stock issuable upon conversion of (i) $13,000,000 aggregate principal amount of our 8% Unsecured Convertible Promissory Notes Due

2026 (the “2026 Notes”) and (ii) $6,000,000 aggregate principal amount of our 8% Unsecured Convertible Promissory

Notes Due 2028 (the “2028 Notes”) (together with the 2026 Notes, the “Notes”), which Notes were

previously issued and sold to certain of the Selling Shareholders in a private placement transaction that relied upon an exemption from

registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”).

This prospectus may be used from time to time by the Selling Shareholders to offer the Shares (the “Offering”) in any

manner described in the section titled “Plan of Distribution” in this prospectus.

The Selling Shareholders may

sell the Shares in one or more transactions at fixed prices, at prevailing market prices at the time of sale, at prices related to such

prevailing market prices, at varying prices determined at the time of sale or at privately negotiated prices directly to purchasers or

through broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions. We will receive no

proceeds from any sale by the Selling Shareholder of the Shares offered by this prospectus, but we will incur expenses in connection with

the Offering. Please read this prospectus and any applicable prospectus supplement carefully before you invest.

Our Common Stock is listed

on the NASDAQ Capital Market under the symbol “HNRG.” The last reported sale price on November 16, 2023 was $12.59 per share.

Investing in

our securities involves risks. See “Risk Factors” beginning on page 5 of this prospectus and the Risk Factors set forth

in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2022, as supplemented by our Quarterly

Reports on Form 10-Q for each fiscal quarter ended March 31, 2023, June 30, 2023, and September 30, 2023, which are incorporated

by reference in this prospectus.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy

or accuracy of this prospectus or any applicable prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus is November

, 2023

Table

of Contents

Page

References in this prospectus

to “Hallador,” “we,” “us,” “our,” the “Company” or similar references mean

Hallador Energy Company and its subsidiaries. References to “Common Stock” refer to the Company’s Common Stock, par

value $.01 per share. When we refer to “you” in this section, we mean all purchasers of the securities being offered by this

prospectus and any accompanying prospectus supplement, whether they are the holders or only indirect owners of those securities.

You should rely only on the

information contained or incorporated by reference in this prospectus and any applicable prospectus supplement. Neither we nor the Selling

Shareholders have authorized anyone else to provide you with different information. The Shares are not being offered in any jurisdiction

where the offer or sale is not permitted. You should not assume that the information contained in this prospectus and any accompanying

prospectus supplement is accurate on any date subsequent to the date set forth on the front of the document or that any information we

have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this

prospectus and any accompanying prospectus supplement is delivered or securities are sold on a later date.

About

This Prospectus

This prospectus is part of

a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using

the “shelf” registration process. Under this shelf registration process, the Selling Shareholders may, from time to time,

sell the Shares in one or more offerings or resales.

In certain circumstances,

we may provide a prospectus supplement that will contain specific information about the terms of a particular offering by the Selling

Shareholders. We, or, if required, the Selling Shareholders, may also provide a prospectus supplement to add information to, or update

or change information contained in, this prospectus. To the extent there is a conflict between the information contained in this prospectus

and the prospectus supplement, you should rely on the information in the prospectus supplement, provided that if any statement in one

of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated

by reference in this prospectus or any prospectus supplement — the statement in the later-dated document modifies or supersedes

the earlier statement.

You should read both this

prospectus and any applicable prospectus supplement together with the additional information about our company to which we refer you in

the section of this prospectus entitled “Where You Can Find More Information.”

Cautionary

Statement Regarding Forward-Looking Statements

Certain

statements and information in this prospectus and the documents incorporated by reference may constitute “forward-looking”

statements. These statements are based on our beliefs as well as assumptions made by, and information currently available to us. When

used in this document, the words “anticipate,” “believe,” “continue,” “estimate,” “expect,”

“forecast,” “may,” “project,” “will,” and similar expressions identify forward-looking

statements. Without limiting the foregoing, all statements relating to our future outlook, anticipated capital expenditures, future cash

flows and borrowings and sources of funding are forward-looking statements. These statements reflect our current views with respect to

future events and are subject to numerous assumptions that we believe are open to a wide range of uncertainties and business risks, and

actual results may differ materially from those discussed in these statements. Among the factors that could cause actual results to differ

from those in the forward-looking statements are: changes in macroeconomic and market conditions and market volatility, and the impact

of such changes and volatility on our financial position; the outcome or escalation of current hostilities in Ukraine; changes in competition

in coal markets and our ability to respond to such changes; changes in coal prices, demand, and availability which could affect our operating

results and cash flows; risks associated with the expansion of our operations and properties, including our recent acquisition of Hoosier

Energy’s Merom Generation Station; legislation, regulations, and court decisions and interpretations thereof, including those relating

to the environment and the release of greenhouse gases, mining, miner health and safety, and health care; deregulation of the electric

utility industry or the effects of any adverse change in the coal industry, electric utility industry, or general economic conditions;

dependence on significant customer contracts, including renewing customer contracts upon expiration of existing contracts; changing global

economic conditions or in industries in which our customers operate; investors’, suppliers’ and other counterparties’

increasing attention to environmental, social, and governance (“ESG”) matters; the effect of changes in taxes or tariffs

and other trade measures; risks relating to inflation and increasing interest rates; liquidity constraints, including those resulting

from any future unavailability of financing; customer bankruptcies, cancellations or breaches to existing contracts, or other failures

to perform; customer delays, failure to take coal under contracts or defaults in making payments; adjustments made in price, volume or

terms to existing coal supply agreements; our productivity levels and margins earned on our coal sales; changes in equipment, raw material,

service or labor costs or availability, including due to inflationary pressures; changes in the availability of skilled labor; our ability

to maintain satisfactory relations with our employees; increases in labor costs, adverse changes in work rules, or cash payments or projections

associated with workers’ compensation claims; increases in transportation costs and risk of transportation delays or interruptions;

operational interruptions due to geologic, permitting, labor, weather-related or other factors; risks associated with major mine-related

accidents, mine fires, mine floods or other interruptions; results of litigation, including claims not yet asserted; difficulty maintaining

our surety bonds for mine reclamation; decline in or change in the coal industry’s share of electricity generation, including as

a result of environmental concerns related to coal mining and combustion and the cost and perceived benefits of other sources of electricity,

such as natural gas, nuclear energy, and renewable fuels; difficulty in making accurate assumptions and projections regarding post-mine

reclamation; uncertainties in estimating and replacing our coal reserves; the impact of current and potential changes to federal or state

tax rules and regulations, including a loss or reduction of benefits from certain tax deductions and credits; difficulty obtaining commercial

property insurance; and/or evolving cybersecurity risks, such as those involving unauthorized access, denial-of-service attacks, malicious

software, data privacy breaches by employees, insiders or others with authorized access, cyber or phishing-attacks, ransomware, malware,

social engineering, physical breaches or other actions.

We qualify all of the forward-looking statements contained in this

prospectus, in the documents incorporated by reference herein and in any prospectus supplement by these cautionary statements. These forward-looking

statements speak only as of the date on which the statements were made and are not guarantees of future performance. Although we undertake

no obligation to revise or update any forward- looking statements, whether as a result of new information, future events or otherwise,

you are advised to review any additional disclosures we make in the documents we subsequently file with the SEC that are incorporated

by reference in this prospectus and any prospectus supplement. See “Where You Can Find More Information.”

Prospectus

Summary

This prospectus relates

to the offer and resale by the Selling Shareholders of up to 5,262,635 Shares, including up to 3,065,097 Shares issuable upon conversion

of the Notes. We will not receive any of the proceeds from the sale of the Shares by the Selling Shareholders. This summary highlights

selected information appearing elsewhere in this prospectus or in documents incorporated herein by reference. This summary is not complete

and does not contain all of the information that you should consider before making your investment decision. You should carefully read

the entire prospectus, including the information set forth in the section entitled “Risk Factors” and the information that

is incorporated by reference into this prospectus. See the section entitled “Where You Can Find More Information” for a further

discussion on incorporation by reference.

The

Company

Hallador is an energy company

operating in the state of Indiana. Historically, the largest portion of our business has been devoted to coal mining in the state of Indiana

through Sunrise Coal, LLC (a wholly-owned subsidiary) serving the electric power generation industry.

On October 21, 2022,

Hallador, through its subsidiary Hallador Power Company, LLC, completed its acquisition of the one Gigawatt Merom Generating Station ("Merom")

located in Sullivan County, Indiana pursuant to an Asset Purchase Agreement with Hoosier Energy. As a result of the Merom acquisition,

the Company has two reportable segments: coal operations (operated by Sunrise Coal, LLC) and electric operations (operated by Hallador

Power Company, LLC).

In addition to our reportable

segments, the remainder of our operations are presented as “Corporate and Other” and primarily are comprised of unallocated

corporate costs in addition to activities such as a 50% interest in Sunrise Energy, LLC, a private gas exploration company with operations

in Indiana, accounted for using the equity method, and our wholly-owned subsidiary Summit Terminal LLC, a logistics transport facility

located on the Ohio River.

Corporate

Information

We were incorporated under

the laws of the State of Colorado in 1985 and are headquartered at 1183 East Canvasback Drive, Terre Haute, Indiana. Our telephone

number is (303) 839-5504.

The

Offering

| Shares of Common Stock offered by resale by the Selling Shareholders |

Up to 5,262,635 shares of Common Stock, including up to 3,065,097 Shares issuable upon conversion of the Notes. |

| |

|

| Use of Proceeds |

The Selling Shareholders will receive all of the proceeds from the sale under this prospectus of the Shares, if any. We will not receive any proceeds from these sales. |

| |

|

| Trading |

Our Common Stock is listed on the NASDAQ Capital Market. The symbol for our Common Stock is “HNRG.” There is no established trading market for the Notes and we do not intend to list the notes on any securities exchange or other trading system. |

Risk

Factors

Investing in our Common

Stock involves risks. Before you make a decision to buy our Common Stock, in addition to the risks and uncertainties discussed above

under “Cautionary Note Regarding Forward-Looking Statements,” you should carefully consider the specific risks set forth

in our most recent Annual Report on Form 10-K, or any updates in our Quarterly Reports on Form 10-Q or Current Reports on Form 8-K,

as well as any amendments thereto, together with all other information appearing in or incorporated by reference into this prospectus

or any applicable prospectus supplement. If any of these risks actually occur, it may materially harm our business, financial condition,

liquidity and results of operations. As a result, the market price of our Common Stock could decline, and you could lose all or part

of your investment. Additionally, the risks and uncertainties described in this prospectus, any prospectus supplement or in any document

incorporated by reference herein or therein are not the only risks and uncertainties that we face. Additional risks and uncertainties

not presently known to us or that we currently believe to be immaterial may become material and adversely affect our business.

Risks Related to this Offering

Our stock

price may be volatile.

The market price of our Common Stock has been

and may continue to be volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control,

including the following:

| ▪ | our ability to execute our business plan and complete prospective acquisitions; |

| ▪ | changes in the energy industry; |

| ▪ | competitive pricing pressures; |

| ▪ | our ability to obtain additional capital financing; |

| ▪ | additions or departures of key personnel; |

| ▪ | limited “public float” in the hands of a small number of persons whose sales or lack of sales

could result in positive or negative pricing pressure on the market price for our Common Stock; |

| ▪ | sales of our Common Stock by existing securityholders; |

| ▪ | operating results that fall below expectations; |

| ▪ | regulatory developments; |

| ▪ | economic and other external factors; |

| ▪ | period-to-period fluctuations in our financial results; |

| ▪ | our inability to acquire pending acquisitions; |

| ▪ | the public’s response to press releases or other public announcements by us or third parties, including

filings with the SEC; |

| ▪ | changes in financial estimates or ratings by any securities analysts who follow our Common Stock, our

failure to meet these estimates or failure of those analysts to initiate or maintain coverage of our Common Stock; and |

| ▪ | the development and sustainability of an active trading market for our Common Stock. |

Description

of Capital Stock

The following is a description

of the rights of our authorized stock and related provisions of our Second Restated Articles of Incorporation (the “Articles”)

and bylaws, as amended (collectively, our “Organizational Documents”). This description is qualified in its entirety

by, and should be read in conjunction with, our Organizational Documents.

Authorized & Outstanding Stock

We have a total of 110,000,000

shares authorized for issuance, which consists of 100,000,000 shares of Common Stock, par value $0.01, and 10,000,000 shares of preferred

stock, par value $0.10. The common and preferred stock are fully paid and nonassessable.

As of November 3,

2023, only the Company’s Common Stock was registered under Section 12 of the Exchange Act, and as of the same date, there

were 33,142,403 outstanding shares of Common Stock and no shares outstanding of the Company’s preferred stock.

Description of Common Stock

Voting

- Each shareholder of record shall have one vote for each share of Common Stock standing in his or her name on the

books of the Company and entitled to vote. Cumulative voting shall not be allowed in the election of directors or for any other purpose.

At all meetings of shareholders,

one-third of the shares entitled to vote at such meeting represented in person or by proxy shall constitute a quorum, and at any meeting

at which a quorum is present, the affirmative vote of a majority of the shares represented at such meeting and entitled to vote on the

subject matters shall be the act of the shareholders; except that the following actions shall require the affirmative vote or concurrence

of the holders of at least a majority of all of the outstanding shares of the Company entitled to vote thereon: (1) adopting an amendment

or amendments to the Articles, (2) lending money to, guaranteeing the obligations of or otherwise assisting any of the directors

of the Corporation, (3) authorizing the sale, lease, exchange or other disposition of all or substantially all of the property and

assets of the Company, with or without its goodwill, not in the usual and regular course of business, (4) approving a plan of merger

or consolidation, (5) adopting a resolution submitted by the Board of Directors of the Company to dissolve the Company, and (6) adopting

a resolution submitted by the Board of Directors of the Company to revoke voluntary dissolution proceedings.

Shareholder

Consent to Action - Any action required or permitted under Colorado law to be taken by the shareholders may be taken by

the shareholders without a meeting as evidenced by the written consent of the shareholders holding at least a majority of all of the outstanding

shares of the Company entitled to vote thereon, unless a greater percentage is required by Colorado law or the Articles.

Transfer

Agent and Registrar - The transfer agent and registrar for the Common Stock is Computershare Trust Company, N.A.

Listing

– the Common Stock is listed on The Nasdaq Capital Market under the symbol “HNRG”.

Preferred Stock Description

Preferred stock may be issued

in one or more series or classes with designations, preferences, limitations and relative rights determined by our board of directors

without any vote or action by our shareholders, subject to limitations prescribed by Colorado law and the provisions of our Organizational

Documents.

Any of the voting powers,

designations, preferences, rights and qualifications, limitations or restrictions of any such series of preferred stock may be made dependent

upon facts ascertainable outside of our Organizational Documents or of any amendment hereto, or outside the resolution or resolutions

providing for the issue of such stock adopted by the Board of Directors of the Company pursuant to authority expressly vested in it by

these provisions, provided that such facts and the manner in which such facts shall operate upon the voting powers, designations, preferences,

rights and qualifications, limitations or restrictions of such series of stock are clearly and expressly set forth in the resolution or

resolutions providing for the issue of such stock adopted by the Board of Directors of the Company.

Dividend Rights

Common Stock and our preferred

stock are entitled to dividends if declared by the Board of Directors of the Company out of legally available funds.

Payments Upon Partial Liquidation

The Board of Directors of

the Company may from time to time distribute to the shareholders in partial liquidation, out of either stated capital or capital surplus

of the Company, a portion of its assets, in cash or property, subject to the limitations contained in the statutes of Colorado.

No Preemptive or Preferential Rights

No holder of any shares of

any class of stock of the Company shall, as such holder, have any preemptive or preferential right to receive, purchase, or subscribe

to (1) any unissued or treasury shares of any class of stock, whether now or hereafter authorized, of the Company, (2) any obligations,

evidences of indebtedness, or other securities of the Company convertible into or exchangeable for, or carrying or accompanied by any

rights to receive, purchase, or subscribe to, any such unissued or treasury shares, (3) any warrant or option for the purchase of,

any of the foregoing securities, or (4) any other securities that may be issued or sold by the Company, other than such (if any)

as the Board of Directors of the Company, in its sole and absolute discretion, may determine from time to time.

Use

of Proceeds

The Selling Shareholders will

receive all of the proceeds from the sale under this prospectus of the Shares, if any. We will not receive any proceeds from these sales.

Selling

Shareholders

The Selling Shareholders may

from time to time offer and sell any or all of the Shares set forth below pursuant to this prospectus. When we refer to the “Selling

Shareholders” in this prospectus, we refer to the persons listed in the table below, and the pledgees, donees, transferees, assignees,

successors and other permitted transferees that hold any of the Selling Shareholders’ interest in the Shares after the date of this

prospectus. The following table sets forth information concerning the Shares that may be offered from time to time by the Selling Shareholders.

We cannot advise you as to whether the Selling Shareholders will in fact sell any or all of such Shares. In particular, the Selling Shareholders

identified below may have sold, transferred or otherwise disposed of all or a portion of its Shares after the date on which it provided

us with information regarding its Shares. Any changed or new information given to us by the Selling Shareholders, including regarding

the identity of, and the Shares held by, the Selling Shareholders, will be set forth in a prospectus supplement or amendments to the registration

statement of which this prospectus is a part, if and when necessary. Our registration of the Shares does not necessarily mean that the

Selling Shareholders will sell all or any of such Shares.

The following table sets

forth certain information provided by or on behalf of the Selling Shareholders as of November 3, 2023, concerning the Shares that

may be offered from time to time by the Selling Shareholders with this prospectus. The Selling Shareholders may sell all, some or none

of such Shares in this Offering. See the section entitled “Plan of Distribution” for further information.

In the table below, the

percentage of shares beneficially owned is based on 33,142,403 shares of Common Stock outstanding as of November 3, 2023, determined

in accordance with Rule 13d-3 under the Exchange Act, meaning that for any holder of Notes that have not yet been converted, the

number of shares issuable upon conversion of such Notes is included in both the numerator and denominator of the percentage calculation

for such holder, but not in the numerator or denominator for any other holder.

| | |

| Ownership Prior to Registration | | |

| Maximum

Number | | |

| Ownership After Shares

are Sold Hereby | |

| Selling Shareholder | |

| Number of Shares

Beneficially Owned | | |

| Percentage | | |

| of

Shares to be

Offered Hereby | | |

| Number of

Shares | | |

| Percentage | |

| ALJ Regional Holdings, Inc. (1) | |

| 1,626,017 | | |

| 4.68 | % | |

| 1,626,017 | | |

| - | | |

| - | |

| Charles R. Wesley, IV Revocable Trust U/A dated October 30, 2020 (2) | |

| 108,202 | | |

| 0.33 | % | |

| 108,202 | | |

| - | | |

| - | |

| Hallador Alternative Assets Fund, LLC (3) | |

| 2,138,624 | | |

| 6.42 | % | |

| 498,325 | | |

| 1,640,299 | | |

| 4.93 | % |

| Lubar Opportunities Fund I, LLC (4) | |

| 2,432,054 | | |

| 7.07 | % | |

| 2,432,054 | | |

| - | | |

| - | |

| Murchison Capital Partners, LP (5) | |

| 570,813 | | |

| 1.72 | % | |

| 231,697 | | |

| 339,116 | | |

| 1.02 | % |

| NextG Partners, LLC (6) | |

| 1,788,441 | | |

| 5.40 | % | |

| 366,340 | | |

| 1,422,101 | | |

| 4.29 | % |

| (1) | All Shares sold hereby are issuable upon conversion of the 2028 Notes. The address for ALJ Regional Holdings, Inc.

is 1325 Avenue of the Americas, Level 28, Suite 2828, New York, NY, 10019. |

| (2) | Charles R. Wesley, IV, as trustee of the Charles R. Wesley IV Revocable Trust, may be deemed to have

voting and dispositive power as to the shares held by the trust. |

| (3) | Includes 159,898 Shares issuable upon conversion of the 2028 Notes. The address for Hallador Alternative

Asset Fund, LLC is 940 Southwood Blvd., Suite 201, Incline Village, NV 89451. Hallador Alternative

Assets Fund LLC is a private equity investment fund directed or controlled by its managing members, Hallador Management LLC, and David

C. Hardie. |

| (4) | Includes 799,488 Shares issuable upon conversion of the 2026 Notes and 479,693 Shares issuable upon conversion

of the 2028 Notes. The address for Lubar Opportunities Fund I, LLC is 833 E. Michigan Street, Suite 1500, Milwaukee, WI 53202. Lubar &

Co., Incorporated serves as investment manager over, and exercises in its sole discretion the entire voting and dispositive power

with respect to, all shares of the Issuer held by Lubar Opportunities Fund I, LLC.

Mr. David J. Lubar serves as the CEO of Lubar & Co., Incorporated, and as a result, may be deemed to beneficially own

these shares. Mr. Lubar disclaims beneficial ownership in these shares except to the extent of his respective pecuniary interest

therein. |

| (5) | The address for Murchison Capital Partners, LP is 5430 LBJ Freeway, Suite 1450, Dallas, Texas 75240. |

| (6) | The address for NextG Partners, LLC is 748 S. Meadows Pkwy, A9 #336, Reno, Nevada 89521. Steven R. Hardie

is a member and manager of NextG Partners, LLC, owning 38% of its membership interest. Mr. Hardie disclaims beneficial ownership

of the other 62% of the shares held by NextG Partners, LLC. |

Positions, Officers and Other Material Relationships

The

Company is party to a Convertible Note Purchase Agreement, dated July 29, 2022, pursuant to which it agreed with the Selling Shareholders

to register for resale the Shares issuable upon conversion of the Notes, as well as 2,197,538 Shares that were previously issued upon

the conversion of $10,000,000 of unsecured convertible notes we issued in May 2022. The terms of the Notes are more fully described

in the Form 8-K filed by the Company on August 4, 2022, which is incorporated herein by reference. See “Where You Can

Find More Information”. The Selling Shareholders include:

| · | Lubar Opportunities Fund I, of which Mr. David

Lubar, a Company director since 2018, manages in his capacity as President and CEO of Lubar & Co.; |

| · | NextG Partners LLC, of which Mr. Steven R.

Hardie, a Company director since 1994, is a member and manager; |

| · | Hallador Alternative Assets Fund, LLC, of which

Mr. David C. Hardie, a Company director since 1989, manages in his capacity as Managing Member of Hallador Management, LLC; and |

| · | Charles R. Wesley, IV Revocable Trust, of which

Mr. Charles R. Wesley, IV, a Company director since 2018, serves as trustee. |

Plan

of Distribution

We are registering the Shares

on behalf of the Selling Shareholders.

The Selling Shareholders,

including their respective donees, transferees, distributees, beneficiaries or other successors-in-interest, may from time to time offer

some or all of the Shares covered by this prospectus. To the extent required, this prospectus may be amended and supplemented from time

to time to describe a specific plan of distribution.

The Selling Shareholders may

offer the Shares from time to time, either in increments or in a single transaction. The Selling Shareholders may also decide not to sell

all the Shares they are allowed to sell under this prospectus. The Selling Shareholders will act independently of us in making decisions

with respect to the timing, manner and size of each sale. These sales may be at market prices prevailing at the time of sale, at prices

related to such prevailing market prices, at fixed prices or negotiated prices. The Selling Shareholders may use any one or more of the

following methods when selling the Shares:

| · | purchases by dealers and agents who may receive

compensation in the form of discounts, concessions or commissions from the Selling Shareholders and/or the purchasers of the securities

for whom they may act as agent; |

| · | ordinary brokerage transactions and transactions

in which a broker-dealer solicits purchasers; |

| · | block trades in which a broker-dealer will attempt

to sell the Shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| · | purchases by a broker-dealer as principal and

resale by the broker-dealer for its account; |

| · | an exchange distribution in accordance with the

rules of the applicable exchange on which the Shares are traded or quoted; |

| · | privately negotiated transactions; |

| · | an agreement with broker-dealers to sell a specified

number of such Shares at a stipulated price per share; |

| · | a combination of any such methods of sale; and |

| · | any other method permitted pursuant to applicable

law. |

The Selling Shareholders may

enter into transactions from time to time in which a Selling Shareholder may enter into option or other types of transactions that require

such Selling Shareholders to deliver the securities to a broker-dealer or any other person, who will then resell or transfer the Shares

under this prospectus.

The Selling Shareholders may

also sell Shares under any available exemption to the registration requirements of the Securities Act, including but not limited to Rule 144

under the Securities Act, rather than under this prospectus.

The Selling Shareholders may

enter into sale, forward sale and derivative transactions with third parties, or may sell securities not covered by this prospectus to

third parties in privately negotiated transactions. In connection with those sale, forward sale or derivative transactions, the third

parties may sell the securities covered by this prospectus, including by issuing securities that are not covered by this prospectus but

are exchangeable for or represent beneficial interests in shares of Common Stock. The third parties also may use shares received under

those sale, forward sale or derivative arrangements or shares borrowed from the Selling Shareholders or others to settle such third-party

sales or to close out any related open borrowings of shares of Common Stock. The third parties may deliver this prospectus in connection

with any such transactions. Any third party in such sale transactions will be an underwriter and will be identified in a supplement to

this prospectus or post-effective amendment to the registration statement of which this prospectus is a part as may be required.

Resales by the Selling Shareholders

may be made directly to investors or through securities firms acting as brokers or dealers. Broker-dealers engaged by the Selling Shareholders

may arrange for other broker-dealers to participate in sales. When resales are to be made through a securities firm, the securities firm

may be engaged to act as any Selling Shareholder’s agent in the resale of the securities by such Selling Shareholder, or the securities

firm may purchase the securities from such Selling Shareholders as principal and thereafter resell those shares from time to time. Securities

firms may, to the extent permissible, receive compensation in the form of commissions, concessions or discounts from any Selling Shareholder

or the purchaser, either as agent of such purchaser or in a sale to such purchaser as principals in amounts to be negotiated. Such compensation

may be in excess of customary commissions, concessions or discounts and will be in amounts to be negotiated in connection with such resales.

To the extent necessary, the

specific terms of the offering of the securities, including the specific securities to be sold, the names of the Selling Shareholder,

the respective purchase prices and public offering prices, the names of any broker-dealer or agent, if any, and any applicable compensation

in the form of discounts, concessions or commissions paid to agents or paid or allowed to dealers will be set forth in a supplement to

this prospectus or a post-effective amendment to this registration statement of which this prospectus forms a part. The Selling Shareholders

may, or may authorize dealers and agents to, solicit offers from specified institutions to purchase the securities from the Selling Shareholders.

These sales may be made under “delayed delivery contracts” or other purchase contracts that provide for payment and delivery

on a specified future date. If necessary, any such contracts will be described and be subject to the conditions set forth in a supplement

to this prospectus or a post-effective amendment to this registration statement of which this prospectus forms a part.

Any broker-dealers or

agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the

Securities Act in connection with such sales. In such event, any compensation received by such broker-dealers or agents and any

profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities

Act. Discounts, concessions, commissions and other compensation, if any, that can be attributed to the sale of the securities sold

hereunder will be paid by the Selling Shareholders and/or the purchasers.

If a Selling Shareholder

uses this prospectus for any sale of securities, it will be subject to the prospectus delivery requirements of the Securities Act. The

Selling Shareholders will be responsible for complying with the applicable provisions of the Securities Act and Exchange Act, and the

rules and regulations thereunder promulgated, including, without limitation, Regulation M, as applicable to such Selling Shareholder

in connection with resales of their respective shares under this registration statement.

We are required to pay all

fees and expenses incident to the registration of the shares, but we will not receive any proceeds from the sale of the securities sold

pursuant to this prospectus.

Legal

Matters

Unless otherwise specified

in a prospectus supplement, the validity of our Common Stock has been passed upon for us by Jones & Keller P.C.

Experts

The financial statements

of Hallador Energy Company as of December 31, 2022 and for the year ended December 31, 2022 and management’s

assessment of the effectiveness of internal control over financial reporting as of December 31, 2022, incorporated by reference

in this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance upon the reports

of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and

auditing.

The financial statements

of the Company as of and for the year ended December 31, 2021 incorporated in this prospectus by reference to the Company’s Annual

Report on Form 10-K for the year ended December 31, 2022, have been so incorporated in reliance on the report of Plante & Moran,

PLLC, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

The carve-out financial statements

of Merom Generating Station (a Component of Hoosier Energy Rural Electric Cooperative, Inc.) as of December 31, 2021 and 2020,

and for each of the two years in the period ended December 31, 2021, incorporated by reference in this prospectus by reference to

Hallador Energy Company’s current report on Form 8-K/A dated January 6, 2023 have been audited by Deloitte &

Touche LLP, an independent auditor, as stated in their report. Such financial statements are incorporated by reference in reliance upon

the report of such firm given their authority as experts in auditing and accounting.

Where

You Can Find More Information

We are subject to the information

reporting requirements of the Exchange Act and, in accordance with these requirements, we are required to file periodic reports and other

information with the SEC. The SEC also maintains an Internet website at http://www.sec.gov that contains our filed reports, proxy

and information statements, and other information we file electronically with the SEC.

Additionally, we make our

SEC filings available, free of charge, on our website at www.halladorenergy.com as soon as reasonably practicable after we electronically

file such materials with, or furnish them to, the SEC. The information on our website, other than the filings incorporated by reference

in this prospectus, is not, and should not be, considered part of this prospectus, is not incorporated by reference into this document,

and should not be relied upon in connection with making any investment decision with respect to our securities.

We are “incorporating

by reference” into this prospectus certain information we file with the SEC, which means that we are disclosing important information

to you by referring you to those documents. The information we incorporate by reference in this prospectus is legally deemed to be a part

of this prospectus, and later information that we file with the SEC will automatically update and supersede the information included in

this prospectus and the documents listed below. We incorporate the documents listed below:

| · | Annual

Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the

SEC on March 16, 2023, as amended on November 1, 2023; |

| | | |

| | · | Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2023, filed with the SEC on November 6, 2023; |

| | | |

| | · | Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2023, filed with the SEC on August 7, 2023; |

| · | Current

Report on Form 8-K filed with the SEC on October 21,

2022 (as amended on January 6,

2023), June 1,

2023, July 19,

2023, August 3, 2023, and September 8, 2023; |

| · | All documents filed by us pursuant to Sections

13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the initial filing of the registration statement of which this prospectus

forms a part until all of the securities being offered under this prospectus or any prospectus supplement are sold (other than reports,

documents or information that are furnished and not filed with the SEC). |

We will furnish without charge

to you, on written or oral request, a copy of any or all of the documents incorporated by reference herein, other than exhibits to such

documents that are not specifically incorporated by reference therein. You should direct any requests for documents to us at the following

address or telephone number:

Hallador Energy Company

1183 East Canvasback Drive

Terre Haute, Indiana 47802

(303) 839-5504

Part II

Information

Not Required in Prospectus

| Item 14. | Other Expenses of Issuance and Distribution. |

The following table sets forth

the estimated expenses in connection with the issuance and distribution of the securities being registered, other than underwriting discounts,

commissions and transfer taxes (which would be borne by the Selling Shareholders). Other than the SEC registration fee, all of the amounts

listed are estimates.

| SEC Registration Fee | |

$ 4,964.31 | |

| Accounting Fees and Expenses | |

| 30,000.00 | |

| Legal Fees and Expenses | |

| 30,000.00 | |

| Transfer Agent and Registrar Fees and Expenses | |

| 10,000.00 | |

| Miscellaneous | |

| 10,000.00 | |

| Total | |

| $ 84,964.31 | |

| Item 15. | Indemnification of Directors and Officers. |

The Company’s restated

Articles provide that a director of the Company shall not be personally liable to the Company or its shareholders for monetary damages

for breach of fiduciary duty as a director, except for liability (i) for any breach of the director’s duty of loyalty to the

Company or its shareholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation

of law, (iii) under Section 7-5-114 of the Colorado Corporation Code (as repealed and amended by Section 7-108-403 of

the Colorado Business Corporation Act (the “CBCA”)), or (iv) for any transaction from which the director derived

an improper personal benefit. If the CBCA is amended to authorize corporate action further eliminating or limiting the personal liability

of directors, then the liability of a director of the Company will be eliminated or limited to the fullest extent permitted by the CBCA,

as so amended.

The Company’s Articles

also provide that the Company may indemnify any person to the fullest extent allowed by the laws of Colorado. Section 7-109-102 of the

CBCA provides that a corporation has the power to indemnify a director against amounts paid and expenses incurred in connection with an

action, suit or proceeding to which he or she is a party or is threatened to be made a party by reason of such position, if he or she

acted in good faith and in a manner he or she reasonably believed to be in the best interests of the corporation in the case of a person’s

conduct in an official capacity with the corporation, or reasonably believed to be in the best interests of or not opposed to the best

interests of the corporation in all other cases, and, in any criminal proceeding, if such person had no reasonable cause to believe his

or her conduct was unlawful. The termination of a proceeding by judgment, order, settlement, conviction or upon a plea of nolo contendere,

or its equivalent, will not, of itself, create a presumption that the director did not meet such standard of conduct. A corporation may

not indemnify a director in the case of actions, suits or proceedings brought by or in the right of the corporation in which such person

shall have been adjudged to be liable to the corporation unless and only to the extent that the adjudicating court determines that such

indemnification is proper under the circumstances, and then only to the extent of reasonable expenses incurred in connection with such

action, suit or proceeding, including expenses incurred to obtain the court-ordered indemnification. Section 7-109-107 of the CBCA provides

that an officer of a corporation is entitled to mandatory and court-ordered indemnification as provided under the CBCA to the same extent

as a director. Section 7-109-107 of the CBCA also allows a corporation to indemnify and advance expenses to an officer, employee, fiduciary

or agent of the corporation to the same extent as to a director, and to a greater extent, if doing so would not be inconsistent with public

policy and if the corporation’s bylaws allow it to do so, the corporation is required to do so by contract, or the directors of

the corporation take action to authorize the corporation to do so.

The Company’s bylaws

provide that it will indemnify and hold harmless to the fullest extent permitted by the CBCA (as it replaces the Colorado Corporations

Code), as amended. any person who was or is made a party or is threatened to be made a party to any threatened, pending or completed action,

suit or proceeding, whether civil, criminal, administrative or investigative, referred to herein as a “Proceeding”, by reason

of the fact that he or she, or a person of whom he or she is the legal representative, was or is a director or officer, employee or agent

of the Company, or is or was serving at the request of the Company as a director, officer, employee or agent of another corporation, partnership,

joint venture, trust or other enterprise, against his or her expenses, liabilities and loss (including attorneys’ fees, judgments,

fines, Employee Retirement Income Security Act of 1974 excise taxes or penalties, and amounts paid or to be paid in settlement), reasonably

incurred by him or her in connection with a Proceeding. Under the Company’s bylaws, the indemnification provided by the Company

shall continue as to any person who ceases to be a director, officer, employee or agent of the Company, and shall inure to the benefit

of any such person’s heirs, executors and administrators.

The rights to indemnification

provided under the Company’s bylaws include the right to payment of reasonable expenses incurred in defending any Proceeding in

advance of the final disposition of the Proceeding, except that payments of expenses in advance of final disposition of a Proceeding to

be made to an director or officer of the Company that incurred such expenses in such capacity, and not for any other capacity in which

service was or is rendered by such person while a director or officer, will only be made upon:

(a) delivery

to the Company of an undertaking, by or on behalf of such director or officer, to repay all amounts so advanced if it is ultimately determined

that such director or officer is not entitled to indemnification,

(b) a

written affirmation of such director’s or officer’s good faith belief that he or she conducted himself or herself in good

faith with regard to the actions giving rise to the Proceedings, and

(c) a

determination as required under the CBCA (as it replaces the Colorado Corporations Code) of whether the facts then known to those making

the determination would not preclude advancement of such reasonable expenses.

The Company may also, to the

extent authorized to do so by the Company’s board of directors, indemnify employees or agents of the Company to the same scope and

effect as the indemnification of directors and officers as described in the foregoing.

The Company will, unless ordered

otherwise by a court, indemnify a person pursuant to the provisions of the Company’s bylaws described above with respect to Proceedings

that are initiated by such person to enforce rights to indemnification by the Company only if such Proceeding was authorized by the Company’s

board of directors, or if such Proceeding was brought by such person upon the Company failing to pay any claim for indemnification within

sixty days after receipt of a written claim for indemnification and such claim is successful in whole or in part. The Company may assert

as a defense against any claim by a person making a claim for indemnification that such person’s conduct with respect to the matters

giving rise to the Proceedings in question does not satisfy the relevant standard of conduct under the CBCA that would make it permissible

for the Company to indemnify the claimant for the amount claimed. The Company carries the burden of proving that the claimant’s

conduct with respect to the matters giving rise to the Proceedings for which such claimant seeks indemnification does not satisfy the

standards of conduct under the CBCA. Neither the failure of the Company to make a determination prior to the commencement of such Proceedings

that indemnification is proper as the claimant has met the relevant standard of conduct under the CBCA, nor an actual determination by

the Company, including the Company’s board of directors, shareholders or independent legal counsel, that the claimant has not met

the relevant standard of conduct under the CBCA, will be a defense to an action by a claimant for indemnification or create a presumption

that the claimant has not met the applicable standard of conduct.

The rights to indemnification

and to payment of expenses in advance of the final disposition of a Proceeding that are provided by the Company’s bylaws are not

deemed to be exclusive of any other right to which a person seeking indemnification or advancement of expenses may be entitled or may

become entitled to under any law, the Company’s Articles, bylaws, agreement, vote of stockholders or approval by the Company’s

directors who are not parties to a Proceeding, or otherwise.

The Company’s bylaws

provide that it may purchase and maintain insurance on behalf of itself and any director, officer, employee or agent of the Company or

another corporation, partnership, joint venture, trust or other enterprise, against any expenses, liabilities or loss, whether or not

the Company would have the power to indemnify such person against such expenses, liabilities or loss under the CBCA (as it replaces the

Colorado Corporations Code).

Exhibit Index

* Filed herewith.

(1) Filed as an exhibit to the Company’s Current

Report on Form 8-K/A filed with the SEC on March 11, 2022 (as amended).

(2) Filed as an exhibit to the Registration Statement

on Form S-3 filed with the SEC on July 19, 2023.

(a) The

undersigned Company hereby undertakes:

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this

registration statement: |

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration

statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change

in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or

high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if,

in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set

forth in the “Calculation of Registration Fee” table in the effective registration statement; |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed

in the registration statement or any material change to such information in the registration statement; |

provided,

however, that paragraphs (i), (ii) and (iii) do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the Company pursuant to Section 13 or

Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form

of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

| (2) | That, for the purpose of determining any liability under the Securities Act, each such post-effective

amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered

which remain unsold at the termination of the offering. |

| (4) | That, for the purpose of determining liability under the Securities Act to any purchaser: |

| (i) | Each prospectus filed by the Company pursuant to Rule 424(b)(3) shall be deemed to be part of

the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and |

| (ii) | Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part

of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or

(x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be

part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness

or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for

liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date

of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made

in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated

by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time

of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus

that was part of the registration statement or made in any such document immediately prior to such effective date. |

| (b) | The undersigned Company hereby further undertakes that, for purposes of determining any liability under

the Securities Act, each filing of the Company’s annual report pursuant to Section 13(a) or Section 15(d) of

the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of

the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof. |

| (c) | Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors,

officers and controlling persons of the Company pursuant to the foregoing provisions, or otherwise, the Company has been advised that

in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the Company of expenses incurred or

paid by a director, officer or controlling person of the Company in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, the Company will, unless in the opinion

of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether

such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication

of such issue. |

Signatures

and Power of Attorney

Pursuant to the requirements

of the Securities Act of 1933, as amended, the Company certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-3/A and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto

duly authorized, in the city of Terre Haute, State of Indiana on November 17, 2023.

| |

HALLADOR ENERGY COMPANY |

| |

|

|

| |

By: |

/s/ Brent Bilsland |

| |

|

Name: Brent Bilsland |

| |

|

Title: Chairman, President and Chief Executive Officer |

Pursuant to the requirements

of the Securities Act of 1933, this Amendment No.1 to this Registration Statement has been signed by the following persons in the capacities

indicated and on the date set forth above.

| /s/

Brent Bilsland |

|

* |

| Brent Bilsland |

|

Bryan H. Lawrence |

| Chairman, President and

Chief Executive Officer |

|

Director |

| |

|

|

| * |

|

* |

| Lawrence D. Martin |

|

David John Lubar |

| Chief Financial Officer |

|

Director |

| |

|

|

| * |

|

* |

| David Hardie |

|

Charles Ray Wesley IV |

| Director |

|

Director |

| |

|

|

| * |

|

|

| Steven Hardie |

|

|

| Director |

|

|

| |

|

|

| */s/ Brent Bilsland |

|

|

| Brent Bilsland |

|

|

| Attorney-in-Fact |

|

|

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We have issued our reports

dated March 16, 2023 with respect to the consolidated financial statements and internal control over financial reporting of Hallador Energy

Company included in the Annual Report on Form 10-K for the year ended December 31, 2022, which are incorporated by reference in this Registration

Statement. We consent to the incorporation by reference of the aforementioned reports in this Registration Statement, and to the use of

our name as it appears under the caption “Experts.”

/s/ GRANT THORNTON LLP

Tulsa, Oklahoma

November 17, 2023

Exhibit 23.3

Consent

of Independent Registered Public Accounting Firm

We hereby consent to the incorporation

by reference in this Registration Statement on Form S-3/A of Hallador Energy Company (the “Company”) of our report dated March

28, 2022, except for Note 18, as to which the date is March 16, 2023, relating to the financial statements as of and for the year ended

December 31, 2021, which appears on the Company’s Form 10-K filed with the Securities and Exchange Commission on March 16, 2023.

We also consent to the reference to our firm under the caption “Experts” in the prospectus.

/S/PLANTE & MORAN, PLLC

Denver, Colorado

November 17, 2023

Exhibit 23.4

CONSENT

OF INDEPENDENT AUDITOR

We consent to the incorporation

by reference in this Registration Statement on Form S-3/A of Hallador Energy Company of our report dated January 6, 2023, relating to the

financial statements of Merom Generating Station appearing in the Current Report on Form 8-K/A of Hallador Energy Company filed with the

Securities and Exchange Commission on January 6, 2023. We also consent to the reference to us under the heading “Experts”

in such Registration Statement.

/s/ Deloitte & Touche LLP

Indianapolis, Indiana

November 17, 2023

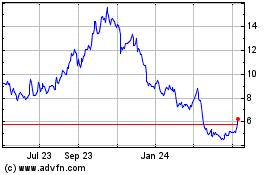

Hallador Energy (NASDAQ:HNRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

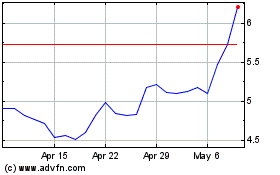

Hallador Energy (NASDAQ:HNRG)

Historical Stock Chart

From Apr 2023 to Apr 2024