As filed with the Securities and Exchange Commission on November 16, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

WRAP TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

98-0551945

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(I.R.S. Employer

Identification Number)

|

1817 W 4th Street

Tempe, Arizona 85281

(800) 583-2652

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Kevin Mullins

Chief Executive Officer

1817 W 4th Street

Tempe, Arizona 85281

(800) 583-2652

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

|

Daniel W. Rumsey, Esq.

Jack P. Kennedy, Esq.

Disclosure Law Group, a Professional Corporation

655 West Broadway, Suite 870

San Diego, CA 92101

(619) 272-7050

|

Kevin Mullins

Chief Executive Officer

1817 W 4th Street

Tempe, Arizona 85281

(800) 583-2652

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

| |

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

|

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where such offer or sale is not permitted.

|

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

DATED NOVEMBER 16, 2023

|

910,610 Shares of Common Stock

This prospectus relates to the resale from time to time of up to 910,610 shares of our common stock, par value $0.0001 per share (the “Shares”), by the selling stockholders identified herein (collectively, with any of such stockholders’ transferees, pledgees, assignees, distributees, donees or successors-in-interest, the “Selling Stockholders”). We are registering the Shares on behalf of the Selling Stockholders in connection with the completion of our acquisition of Intrensic, LLC. We will not receive any of the proceeds from the sale of the Shares offered hereby. See the section titled The Intrensic Acquisition on page 9 for more information.

We are registering the Shares to provide the Selling Stockholders with freely tradable securities. This prospectus does not necessarily mean that the Selling Stockholders will offer or sell those shares.

All selling and other expenses incurred by the Selling Stockholders will be paid by such stockholders, except for certain legal fees and expenses, which will be paid by us. The Selling Stockholders may sell, transfer or otherwise dispose of any or all of the Shares offered by this prospectus from time to time on The Nasdaq Capital Market or any other stock exchange, market, or trading facility on which the shares are traded, or in private transactions. The Shares may be offered and sold or otherwise disposed of by the Selling Stockholders at fixed prices, market prices prevailing at the time of sale, prices related to prevailing market prices, or privately negotiated prices. Refer to the section entitled “Plan of Distribution” for more information regarding how the Selling Stockholders may offer, sell, or dispose of their Shares.

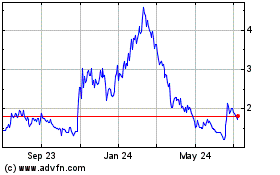

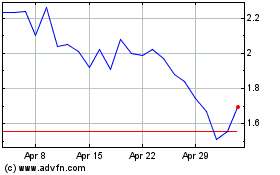

Our common stock is listed on the Nasdaq Capital Market under the symbol “WRAP.” On November 15, 2023, the closing price of our common stock on the Nasdaq Capital Market was $2.84 per share.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Investing in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under “Risk Factors” beginning on page 4 of this prospectus, and under similar headings in any amendments or supplements to this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

|

ABOUT THIS PROSPECTUS

|

1 |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

2 |

|

THE COMPANY

|

3 |

|

RISK FACTORS

|

4 |

|

USE OF PROCEEDS

|

5 |

|

DESCRIPTION OF CAPITAL STOCK

|

6 |

|

THE INTRENSIC ACQUISITION

|

9 |

|

SELLING STOCKHOLDERS

|

10 |

|

PLAN OF DISTRIBUTION

|

11 |

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

13 |

|

LEGAL MATTERS

|

13 |

|

EXPERTS

|

14 |

|

WHERE YOU CAN FIND MORE INFORMATION

|

14 |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. By using a shelf registration statement, the Selling Stockholders named herein may, from time to time, sell shares of common stock as described in this prospectus. To the extent necessary, we may provide a supplement to this prospectus that contains specific information about the offering and the Selling Stockholders, as well as the amounts, prices and terms of the securities hereby. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement or free writing prospectus may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or free writing prospectus, you should rely on the prospectus supplement or free writing prospectus, as applicable. Before purchasing any securities, you should carefully read both this prospectus and the applicable prospectus supplement (and any applicable free writing prospectuses), together with the additional information described under the heading “Incorporation of Certain Information by Reference” and “Where You Can Find More Information.”

Neither we, nor the Selling Stockholders, have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We and the Selling Stockholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the Selling Stockholders will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover, that the information appearing in any applicable free writing prospectus is accurate only as of the date of that free writing prospectus, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain and incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus, any prospectus supplement or any applicable free writing prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus, the applicable prospectus supplement and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

Wrap and BolaWrap are our registered trademarks. This prospectus also includes trademarks, tradenames, and service marks that are the property of other organizations. For convenience, our trademarks Wrap and BolaWrap appear in this prospectus without the ® symbol, but those uses are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights to these trademarks.

Unless otherwise stated or the context requires otherwise, references to “Wrap Technologies,” the “Company,” “we,” “us” or “our” are to Wrap Technologies, Inc., a Delaware corporation.

CAUTIONARY NOTES REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement, and the documents we incorporate by reference contain forward-looking statements that involve substantial risks and uncertainties. All statements contained in this prospectus any prospectus supplement, and the documents we incorporate by reference, other than statements of historical facts, including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include, among other things, statements about:

| |

●

|

the availability of capital to satisfy our working capital requirements;

|

| |

●

|

the accuracy of our estimates regarding expenses, future revenue and capital requirements;

|

| |

●

|

anticipated trends and challenges in our business and the markets in which we operate;

|

| |

●

|

our ability to anticipate market needs or develop new or enhanced products to meet those needs;

|

| |

●

|

our expectations regarding market acceptance of our products;

|

| |

●

|

the success of competing products by others that are or become available in the market in which we sell our products;

|

| |

●

|

our ability to protect our confidential information and intellectual property rights;

|

| |

●

|

our ability to manage expansion into international markets;

|

| |

●

|

our ability to maintain or broaden our business relationships and develop new relationships with strategic alliances, suppliers, customers, distributors or otherwise;

|

| |

●

|

developments in the U.S. and foreign countries; and

|

| |

●

|

other risks and uncertainties, including those described under the section titled Risk Factors and elsewhere in this prospectus.

|

These forward-looking statements are only predictions and we may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, so you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our business, financial condition and operating results. We have included important factors in the cautionary statements included in this prospectus, that could cause actual future results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

You should read this prospectus, the documents incorporated by reference herein and the documents that we have filed as exhibits to the registration statement of which this prospectus is a part completely and with the understanding that our actual future results may be materially different from what we expect. We do not assume any obligation to update any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

THE COMPANY

Company Overview

We are a global public safety technology and services company organized in March 2016 delivering modern policing solutions to law enforcement and security personnel. We are a mission-driven organization focused on improving public safety encounters and outcomes. In late 2018, we commenced the sale of our initial public safety product, the BolaWrap 100 remote restraint device. In 2020, we expanded our public safety technology offerings by introducing a virtual reality training platform called Wrap Reality, which is now being sold to law enforcement and corrections departments for simulation training and societal reentry scenarios. In early 2022, we delivered an improved version of our flagship product, the BolaWrap 150, which is electronically deployed, more robust, lighter, and simpler to use compared to the BolaWrap 100s. In 2023, we expanded our suite of solutions by acquiring Intrensic, LLC, a company specializing in Body Worn Camera and Digital Evidence Management solutions for law enforcement and private security sectors.

We believe our solutions have an immediate addressable market consisting of about 900,000 full-time sworn law enforcement officers at over 18,000 federal, state, and local law enforcement agencies in the US, as well as 12.4 million police officers in more than 100 countries. Additionally, we are exploring other domestic markets such as military and private security when allowable, while also targeting countries with the largest police forces as part of our international focus. We operate in a segment of the non-lethal products global market, which is expected to reach $16.1 billion by 2027, as projected by 360iResearch, a market research consulting firm.

We focus our efforts on the following products and services:

| |

●

|

BolaWrap Remote Restraint Device – is a safe hand-held remote restraint device that discharges a seven and a half-foot Kevlar tether to wrap an individual at a range of 10-25 feet. BolaWrap assists law enforcement to safely detain individuals without the need for pain compliance and higher uses-of-force.

|

| |

●

|

Wrap Reality – is a virtual reality training system employing immersive computer graphics with proprietary software-enabled content. It allows up to two participants to enter a simulated training environment simultaneously with customized weapon controllers that enable trainees to engage in strategic decision making along including non-use-of-force and verbal training.

|

In addition to the US law enforcement market, we have shipped our products to 59 countries. We have established an active distributor network representing 50 states and one dealer representing Puerto Rico. We have distribution agreements with 49 international distributors covering 54 countries. We focus on significant sales, training and business development efforts to support our global distribution network.

We allocate significant resources to research and development for product innovation and product improvement. We believe we have built a robust brand and global market presence, with notable competitive advantages in our industry. Wrap is at the forefront of designing remote restraint tools that focus on de-escalating law enforcement encounters by wrapping up a subject to prevent mobility and fighting which reduces risk of injury to the officer and to the individuals with whom they are interacting.

Corporate Information

Wrap Technologies, Inc. is a Delaware corporation with its principal business office at 1817 W 4th Street, Tempe, Arizona 85281. Our telephone number is (800) 583-2652 and our website can be found at www.wrap.com. Through our website, we will make available, free of charge, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission, or SEC. Information contained on, or that can be accessed through, our website is not and shall not be deemed to be a part of this prospectus.

RISK FACTORS

Investing in our securities involves a high degree of risk. Before deciding whether to purchase any of our securities, you should carefully consider the risks and uncertainties described under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, our Quarterly Reports on Form 10-Q for the periods ended March 31, 2023, June 30, 2023 and September 30, 2023, and our other filings with the SEC, all of which are incorporated by reference herein. If any of these risks actually occur, our business, financial condition and results of operations could be materially and adversely affected and we may not be able to achieve our goals, the value of our securities could decline and you could lose some or all of your investment. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. If any of these risks occur, the trading price of our common stock could decline materially and you could lose all or part of your investment.

USE OF PROCEEDS

The common stock to be offered and sold using this prospectus will be offered and sold by the Selling Stockholders named in this prospectus. Accordingly, we will not receive any proceeds from any sale of shares of our common stock in this offering. We will pay all of the fees and expenses incurred by us in connection with this registration. We will not be responsible for fees and expenses incurred by the Selling Stockholders or any underwriting discounts or agent’s commissions.

DESCRIPTION OF SECURITIES

The following summary of the rights of our securities is not complete and is subject to and qualified in its entirety by reference to our amended and restated certificate of incorporation and our amended and restated bylaws, copies of which are filed as exhibits to our Annual Report on Form 10-K for the year ended December 31, 2022, which is incorporated by reference herein.

General

Our amended and restated certificate of incorporation (“Charter”) authorizes us to issue up to 150,000,000 shares of our common stock, par value $0.0001 per share, and up to 5,000,000 shares of preferred stock, par value $0.0001 per share.

Transfer Agent

Our Transfer Agent and Registrar for our common stock is Colonial Stock Transfer, located at 66 Exchange Place, Suite 100, Salt Lake City, Utah 84111.

Common Stock

As of November 14, 2023, there were 44,214,169 shares of our common stock issued and outstanding, which were held by approximately 25,000 stockholders of record. As of September 30, 2023 there were 6,896,553 shares of common stock subject to outstanding warrants, and 2,221,673 shares of common stock subject to outstanding stock options, and 447,077 shares subject to unvested restricted stock units under our 2017 Stock Incentive Plan.

Except as otherwise expressly provided in our Charter, or as required by applicable law, all shares of our common stock have the same rights and privileges and rank equally, share ratably and are identical in all respects as to all matters, including, without limitation, those described below. All outstanding shares of our common stock are fully paid and nonassessable.

Voting Rights. The holders of our common stock are entitled to one vote per share on all matters. Par common stock does not have cumulative voting rights, which means that holders of the shares of our common stock with a majority of the votes to be cast for the election of directors can elect all directors then being elected.

Dividends. Each share of our common stock has an equal and ratable right to receive dividends to be paid from our assets legally available therefore when, as and if declared by our Board of Directors. We have never declared or paid cash dividends on our common stock, and we do not anticipate paying cash dividends on our common stock in the foreseeable future.

Liquidation. In the event we dissolve, liquidate or wind up, the holders of our common stock are entitled to share equally and ratably in the assets available for distribution after payments are made to our creditors and to the holders of any outstanding preferred stock we may designate and issue in the future with liquidation preferences greater than those of our common stock.

Other. The holders of shares of our common stock have no preemptive, subscription or redemption rights and are not liable for further call or assessment. All of the outstanding shares of our common stock are, and the shares of common stock offered hereby will be, fully paid and nonassessable.

Preferred Stock

Wrap’s board of directors is authorized, subject to the limits imposed by the Delaware General Corporation Law, to issue up to 5,000,000 shares of preferred stock in one or more series, to establish from time to time the number of shares to be included in each series, to fix the rights, preferences and privileges of the shares of each wholly unissued series and any of its qualifications, limitations and restrictions. Wrap’s board of directors can also increase or decrease the number of shares of any series, but not below the number of shares of that series then outstanding, without any further vote or action by Wrap’s stockholders.

Wrap’s board of directors may authorize the issuance of preferred stock with voting or conversion rights that adversely affect the voting power or other rights of Wrap’s common stockholders. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions, financings and other corporate purposes, could have the effect of delaying, deferring or preventing our change in control and may cause the market price of Wrap common stock to decline or impair the voting and other rights of the holders of Wrap common stock. As of November 14, 2023, Wrap had 10,000 shares of Series A Convertible Preferred Stock, par value $0.0001 per share (“Series A Preferred”) authorized, and no shares of Series A Preferred issued and outstanding.

Series A Preferred

Dividends

The holders of the Preferred Stock will be entitled to dividends of 8% per annum, compounded monthly, which will be payable in cash or shares of Common Stock, or a combination thereof, at our option, in accordance with the terms of the Certificate of Designations of the Preferred Stock. Upon the occurrence and during the continuance of a Triggering Event (as defined in the Certificate of Designations), shares of Preferred Stock will accrue dividends at the rate of 20% per annum. If we elect to pay any dividends in shares of Common Stock, the Conversion Price used to calculate the number of shares issuable will equal to the lower of (i) the then applicable Conversion Price and (ii) 85% of the arithmetic average of the three (3) lowest closing prices of the Common Stock during the twenty (20) consecutive trading day period ending on the trading day immediately preceding the dividend payment date, provided that such price shall not be lower than the lower of (x) 0.2828 (subject to adjustment for stock splits, stock dividends, stock combinations, recapitalizations or other similar events ) and (y) 20% of the “Minimum Price” (as defined in Nasdaq Stock Market Rule 5635) on the date of the Stockholder Approval (subject to adjustment for stock splits, stock dividends, stock combinations, recapitalizations or other similar events) or, in any case, such lower amount as permitted, from time to time, by the Nasdaq Stock Market. Upon conversion or redemption, the holders of shares of Preferred Stock are also entitled to receive a dividend make-whole payment.

Voting Rights

The Preferred Stock has no voting rights, except as required by law (including without limitation, the Delaware General Corporation Law (the “DGCL”)) and as expressly provided in the Certificate of Designations. To the extent that under the DGCL the vote of the holders of Preferred Stock, voting separately as a class or series, as applicable, is required to authorize a given action of our Company, the affirmative vote or consent of a majority of the outstanding shares of Preferred Stock (including Iroquois Master Fund Ltd.) (the “Required Holders”) of the shares of Preferred Stock, voting together in the aggregate and not in separate series unless required under the DGCL, represented at a duly held meeting at which a quorum is presented or by written consent of the Required Holders (except as otherwise may be required under the DGCL), voting together in the aggregate and not in separate series unless required under the DGCL, shall constitute the approval of such action by both the class or the series, as applicable. To the extent that under the DGCL holders of shares of Preferred Stock are entitled to vote on a matter with holders of shares of Common Stock, voting together as one class, each share of Preferred Stock shall entitle the holder thereof to cast that number of votes per share as is equal to the number of shares of Common Stock into which it is then convertible (subject to certain beneficial ownership limitations) using the record date for determining the stockholders eligible to vote on such matters as the date as of which the Conversion Price is calculated.

On or before December 31, 2023, the holders of record of the Preferred Stock, exclusively and as a separate class, shall be entitled to elect one (1) director to the Board, provided that such election shall be approved by the Board’s Nominating and Governance Committee, which approval shall not be unreasonably withheld. If the Holders of the Preferred Stock fail to elect a director to fill the directorship for which they are entitled to elect a director, voting exclusively and as a separate class, then the directorship not so filled shall remain vacant until such time as the Holders of the Preferred Stock elect a person to fill such directorship by vote or written consent in lieu of a meeting; and no such directorship may be filled by our stockholders other than by the stockholders that are entitled to elect a person to fill such directorship, voting exclusively and as a separate class. The rights of the holders of the Preferred Stock to elect a director shall terminate on the earlier of (i) provided that there has not been any Triggering Event, the date of Stockholder Approval and (ii) following the date of the initial issuance of shares of Preferred Stock, the first date on which the shares of Common Stock underlying the shares of Preferred Stock represent beneficial ownership (as such term is defined in Rule 13d-3 under the Exchange Act), in the aggregate, of less than five percent (5%) of our issued and outstanding shares of Common Stock on an as-converted basis.

Liquidation

Upon any liquidation, dissolution or winding-up of our Company, whether voluntary or involuntary, the holders of the Preferred Stock shall be entitled to receive in cash out of our assets, whether from capital or from earnings available for distribution to our stockholders, before any amount shall be paid to the holders of any of shares of junior stock, but pari passu with any parity stock then outstanding, an amount per share of Preferred Stock equal to the greater of (A) 150% of the stated value of such share of Preferred Stock (plus any applicable make-whole amount, unpaid late charge or other applicable amount) on the date of such payment and (B) the amount per share such holder would receive if such holder converted such share of Preferred Stock into Common Stock immediately prior to the date of such payment.

Conversion

The Preferred Stock is convertible into shares of Common Stock (the “Conversion Shares”). The initial conversion price, subject to adjustment as set forth in the Certificate of Designations, is $1.45 (the “Conversion Price”). The Conversion Price can be adjusted as set forth in the Certificate of Designations for stock dividends and stock splits or the occurrence of a fundamental transaction (as defined below). The Conversion Price is also subject to “full ratchet” price-based adjustment in the event of any issuances of Common Stock, or securities convertible, exercisable or exchangeable for Common Stock, at a price below the then-applicable Conversion Price (subject to certain exceptions). If any shares of Preferred Stock are converted or reacquired by us, such shares shall resume the status of authorized but unissued shares of our preferred stock and shall no longer be designated as Preferred Stock.

Exchange Cap

The Preferred Stock will not be convertible into shares of Common Stock in excess of the Issuable Maximum except in the event that we (A) obtain the Stockholder Approval for issuances of shares of Common Stock in excess of the Issuable Maximum or (B) obtain a written opinion from our outside counsel that such approval is not required. Until such approval or such written opinion is obtained, no holder of Preferred Stock shall be issued in the aggregate more shares of Common Stock than such holder’s pro rata share of the Issuable Maximum.

Optional Redemption

We will have the right to redeem, all or some of the outstanding shares of Preferred Stock at any time beginning 18 months after the original issuance date, subject to certain Equity Conditions (as defined in the Certificate of Designations) being satisfied, at a redemption price equal to 125% of the stated value of such share of Preferred Stock (plus any applicable make-whole amount, unpaid late charge or other applicable amount). We shall effect an optional redemption by providing holders of the shares of Preferred Stock being redeemed with notice of such redemption no less than twenty (20) Trading Days and no more than forty (40) Trading Days before optional redemption date.

Mandatory Conversion

If on any day after the issuance of the shares of Preferred Stock (i) the closing price of the Common Stock equals or exceeds $4.35 (subject to adjustment for stock splits, stock dividends, stock combinations, recapitalizations or other similar events) for 20 consecutive trading days (the “Mandatory Conversion Measuring Period”), (ii) the daily dollar trading volume of the Common Stock has exceeded $2,000,000 per trading day during the same period, and (iii) certain equity conditions described in the Certificate of Designations are satisfied, then we will have the right to deliver written notice (“Mandatory Conversion Notice”) of the Mandatory Conversion (as defined below) to all holders setting forth (x) the date on which Mandatory Conversion shall occur (which date shall be the second trading day following the date on which holders received Mandatory Conversion Notice) and (y) the aggregate number of Preferred Stock which we elect to be subject to such Mandatory Conversion from the holder, and, on such Mandatory Conversion Date, we shall convert all or any portion of each holder’s shares of Preferred Stock into Conversion Shares at the then effective Conversion Price (the “Mandatory Conversion”). If any of the Equity Conditions shall cease to be satisfied at any time during Mandatory Conversion Measuring Period, then, at the option of the holder of Preferred Stock, the Mandatory Conversion shall be deemed withdrawn and void ab initio.

Beneficial Ownership Limitation

The Preferred Stock cannot be converted to Common Stock if the holder and its affiliates would beneficially own more than 4.99% at the election of the holder of the outstanding Common Stock. However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99% upon notice to us, provided that any increase in this limitation will not be effective until 61 days after such notice from the holder to us and such increase or decrease will apply only to the holder providing such notice.

THE INTRENSIC ACQUISITION

On August 10, 2023, we entered into Membership Interest Purchase Agreement, dated as of August 9, 2023 (the “Purchase Agreement”), and the members of Intrensic, LLC, a Delaware limited liability company (“Intrensic”), including Kevin Mullins, the Company’s Chief Executive Officer (collectively, “Sellers”), and Buford Ortale, as Sellers’ Representative, pursuant to which the Company agreed to purchase, and Sellers agreed to sell, all of the Membership Interest of Intrensic for a total purchase price of: (i) $553,588 in cash; and (ii) 1,250,000 shares of the Company’s Common Stock (collectively, the “Purchase Price”) (the “Acquisition”). The Acquisition was consummated on August 16, 2023 (the “Closing Date”) in accordance with the terms of the Purchase Agreement. On the Closing Date, the Company paid the Purchase Price to the Sellers. Mr. Mullins owned approximately 9.53% of the Membership Interests.

The Purchase Agreement contains representations, warranties and covenants of the Company and Sellers that are customary for a transaction of this nature, a customary indemnification provisions whereby Sellers will indemnify the Company for certain losses arising out of inaccuracies in, or breaches of, the representations, warranties and covenants of Sellers regarding Intrensic, ownership of the Membership Interest, and certain other matters, subject to certain caps and thresholds. The foregoing description of the Purchase Agreement does not purport to be complete, and is qualified in its entirety by reference the description of the Purchase Agreement in the Quarterly Report, and to the full text of the Purchase Agreement, a copy of which is filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on August 22, 2023.

Pursuant to this prospectus, we are registering, on behalf of the Selling Stockholders, 910,610 shares of common stock issued as consideration.

SELLING STOCKHOLDERS

This prospectus relates to the resale of the Shares by the Selling Stockholders identified in the table below. We are registering the Shares in order to permit the Selling Stockholders to offer the shares for resale from time to time. The Selling Stockholders may sell some, all or none of the shares registered by the registration statement of which this prospectus forms a part. We do not know how long the Selling Stockholders will hold the Shares before selling them, and we currently have no agreements, arrangements or understandings with the Selling Stockholders regarding the sale of any of the Shares. For more information about the transactions pursuant to which the selling stockholders acquired the Shares, please see the section titled The Intrensic Acquisition.

The following table presents information regarding the Selling Stockholders and the Shares that they may offer and sell from time to time under this prospectus. The table is prepared based on information supplied to us by the Selling Stockholders, and reflects their holdings as of September 30, 2023. Unless otherwise indicated below, none of the Selling Stockholders nor any of their affiliates has held a position or office, or had any other material relationship, with us or any of our predecessors or affiliates. Beneficial ownership is determined in accordance with Section 13(d) of the Exchange Act and Rule 13d-3 thereunder.

| |

|

Shares

Beneficially

Owned

Prior to

|

|

|

Maximum

Number of

Shares

|

|

|

Shares Beneficially Owned

After Offering(3)(4)

|

|

|

Name of Selling Stockholder(1)

|

|

Offering(2)

|

|

|

Hereby

|

|

|

Number

|

|

|

Percent

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David Stading

|

|

|

2,439 |

|

|

|

2,439 |

|

|

|

- |

|

|

|

0 |

|

|

Intren Holdings Partners, LLC(5)

|

|

|

900,000 |

|

|

|

900,000 |

|

|

|

- |

|

|

|

0 |

|

|

John R. Sette

|

|

|

609 |

|

|

|

609 |

|

|

|

- |

|

|

|

0 |

|

|

Peter A. Cavicchia II

|

|

|

904 |

|

|

|

904 |

|

|

|

- |

|

|

|

0 |

|

|

Terry Nichols

|

|

|

3,658 |

|

|

|

3,658 |

|

|

|

- |

|

|

|

0 |

|

|

William M. Upton

|

|

|

3,000 |

|

|

|

3,000 |

|

|

|

- |

|

|

|

0 |

|

|

(1)

|

Information concerning named selling stockholders, future transferees, pledgees, assignees, distributees, donees or successors of or from any such stockholder or others who later hold any selling stockholder’s interests will be set forth in supplements to this prospectus, absent circumstances indicating that the change is material. In addition, post-effective amendments to the registration statement of which this prospectus forms a part will be filed to disclose any material changes to the plan of distribution from the description in the final prospectus.

|

| |

|

|

(2)

|

Includes securities held by the selling stockholders, other than the Shares being offered pursuant to this prospectus, and all Shares being registered by the registration statement of which this prospectus forms a part.

|

| |

|

|

(3)

|

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, securities that are currently convertible or exercisable into shares of our common stock, or convertible or exercisable into shares of our common stock within 60 days of September 30, 2023 are deemed outstanding. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person.

Amounts reported in this column assumes that each selling stockholder will sell all of the shares of common stock offered pursuant to this prospectus.

|

| |

|

|

(4)

|

Based on 42,039,236 shares of common stock outstanding as of September 30, 2023.

|

| |

|

|

(5)

|

As Managing Member of Intren Holdings Partners, LLC, a Delaware limited liability company, David Flannery may be deemed to be the beneficial owner over the securities reported herein. The business address of Intren Holdings Partners, LLC is 2628 Broadway PH, New York, NY 10025.

|

PLAN OF DISTRIBUTION

We are registering the Shares held by the Selling Stockholders identified herein to permit the resale of the Shares from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the Selling Stockholders of the Shares, if any. We will bear all fees and expenses incident to our obligation to register the Shares of our common stock.

The Shares may be sold or distributed from time to time by the Selling Stockholder directly to one or more purchasers or through brokers, dealers, or underwriters who may act solely as agents at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or at fixed prices, which may be changed. The sale of the Shares offered by this prospectus could be affected in one or more of the following methods:

| |

●

|

ordinary brokers’ transactions;

|

| |

●

|

transactions involving cross or block trades;

|

| |

●

|

through brokers, dealers, or underwriters who may act solely as agents;

|

| |

●

|

“at the market” into an existing market for the common stock;

|

| |

●

|

in other ways not involving market makers or established business markets, including direct sales to purchasers or sales effected through agents;

|

| |

●

|

in privately negotiated transactions; or

|

| |

●

|

any combination of the foregoing.

|

In order to comply with the securities laws of certain states, if applicable, the Shares may be sold only through registered or licensed brokers or dealers. In addition, in certain states, the Shares may not be sold unless they have been registered or qualified for sale in the state or an exemption from the state’s registration or qualification requirement is available and complied with.

If the Selling Stockholders effect such transactions by selling the Shares to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the Selling Stockholders or commissions from purchasers of the Shares for whom they may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions involved). In connection with sales of the Shares or otherwise, the Selling Stockholders may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of the Shares in the course of hedging in positions they assume. The Selling Stockholders may also sell shares of common stock short and deliver Shares covered by this prospectus to close out short positions and to return borrowed shares in connection with such short sales. The selling stockholders may also loan or pledge Shares to broker-dealers that in turn may sell such Shares.

The Selling Stockholders may pledge or grant a security interest in some or all of the Shares owned by them, and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell such Shares from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act, amending, if necessary, the list of Selling Stockholders to include the pledgee, transferee or other successors in interest as Selling Stockholders under this prospectus. The Selling Stockholders also may transfer and donate their respective Shares in other circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The Selling Stockholders and any broker-dealer participating in the distribution of the Shares may be deemed to be “underwriters” within the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of the Shares is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of the Shares being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the Selling Stockholders and any discounts, commissions or concessions allowed or reallowed or paid to broker-dealers.

There can be no assurance that any Selling Stockholder will sell any or all of the Shares registered pursuant to the registration statement, of which this prospectus forms a part.

The Selling Stockholders and any other person participating in such distribution will be subject to applicable provisions of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the shares of common stock by the Selling Stockholders and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the Shares to engage in market-making activities with respect to the Shares. All of the foregoing may affect the marketability of the Shares and the ability of any person or entity to engage in market-making activities with respect to the Shares.

We will pay all expenses of the registration of the Shares pursuant to the Registration Rights Agreement, including, without limitation, SEC filing fees and expenses of compliance with state securities or “blue sky” laws; provided, however, that a Selling Stockholder will pay all underwriting discounts and selling commissions, if any. We will indemnify the Selling Stockholders against liabilities, including some liabilities under the Securities Act, in accordance with the Registration Rights Agreements, or the Selling Stockholders will be entitled to contribution. We may be indemnified by the Selling Stockholders against civil liabilities, including liabilities under the Securities Act, that may arise from any written information furnished to us by the Selling Stockholder specifically for use in this prospectus, in accordance with the related Registration Rights Agreement, or we may be entitled to contribution.

Once sold under the registration statement, of which this prospectus forms a part, the Shares will be freely tradable in the hands of persons other than our affiliates.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The following documents filed by us with the SEC are incorporated by reference in this prospectus:

| |

●

|

our Current Reports on Form 8‑K filed with the SEC on February 10, 2023, April 19, 2023, April 26, 2023, and May 30, 2023, June 30, 2023, June 30, 2023, July 6, 2023, August 22, 2023, September 20, 2023 and October 16, 2023 (other than information in such Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed with such forms that are related to such items unless the applicable Current Report expressly provides to the contrary); and

|

| |

●

|

the description of our Common Stock which is registered under Section 12 of the Exchange Act, in our registration statement on Form 8-A, filed on September 8, 2017, including any amendment or reports filed for the purposes of updating this description.

|

We also incorporate by reference all documents we file pursuant to Section 13(a), 13(c), 14 or 15 of the Exchange Act (other than any portions of filings that are furnished rather than filed pursuant to Items 2.02 and 7.01 of a Current Report on Form 8-K) after the date of the initial registration statement of which this prospectus is a part and prior to effectiveness of such registration statement. All documents we file in the future pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus and prior to the termination of the offering are also incorporated herein by reference and are an important part of this prospectus.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this registration statement to the extent that a statement contained herein or in any other subsequently filed document which also is or deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this registration statement.

We will provide upon request to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in the prospectus but not delivered with the prospectus. You may request a copy of these filings, excluding the exhibits to such filings which we have not specifically incorporated by reference in such filings, at no cost, by writing to or calling us at:

Wrap Technologies, Inc.

1817 W 4th Street

Tempe, Arizona 85281

(800) 583-2652

This prospectus is part of a registration statement we filed with the SEC. You should only rely on the information or representations contained in this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide information other than that provided in this prospectus. We are not making an offer of the securities in any state where the offer is not permitted. You should not assume that the information in this prospectus supplement and the accompanying prospectus is accurate as of any date other than the date on the front of the document.

LEGAL MATTERS

The validity of the securities offered hereby will be passed upon for us by Disclosure Law Group, a Professional Corporation, San Diego, California (DLG).

EXPERTS

Rosenberg Rich Baker Berman, P.A., an independent registered public accounting firm, has audited our consolidated financial statements for the fiscal years ended December 31, 2022 and 2021 included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as set forth in their report, which is incorporated by reference in this prospectus. Our consolidated financial statements are incorporated by reference in reliance on the reports of Rosenberg Rich Baker Berman, P.A. given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the securities offered by this prospectus supplement and the accompanying prospectus. This prospectus supplement, filed as part of the registration statement, does not contain all the information set forth in the registration statement and its exhibits and schedules, portions of which have been omitted as permitted by the rules and regulations of the SEC. For further information about us, we refer you to the registration statement and to its exhibits and schedules.

We file annual, quarterly and current reports and other information with the SEC. The SEC maintains an internet website at www.sec.gov that contains periodic and current reports, proxy and information statements, and other information regarding registrants that are filed electronically with the SEC.

These documents are also available, free of charge, through the Investors section of our website, which is located at https://www.wrap.com/. Information contained on our website is not incorporated by reference into this prospectus supplement or the accompanying prospectus and you should not consider information on our website to be part of this prospectus supplement or the accompanying prospectus.

910,610 Shares

Common Stock

WRAP TECHNOLOGIES, INC.

PROSPECTUS

We have not authorized any dealer, salesperson or other person to give any information or to make any representations not contained in this prospectus. You must not rely on any unauthorized information. This prospectus is not an offer to sell these securities in any jurisdiction where an offer or sale is not permitted.

, 2023

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table indicates the expenses to be incurred in connection with the offering described in this registration statement, other than underwriting discounts and commissions, all of which will be paid by us. All amounts are estimated except the SEC registration fee.

| |

|

Amount

|

|

| |

|

|

|

|

|

SEC Registration Fee

|

|

$ |

392.47 |

|

|

Legal Fees and Expenses

|

|

$ |

15,000 |

|

|

Accounting Fees and Expenses

|

|

$ |

5,000 |

|

|

Transfer Agent and Registrar fees and expenses

|

|

$ |

2,500 |

|

|

Miscellaneous Expenses

|

|

$ |

2,500 |

|

|

Total expenses

|

|

$ |

25,392.47 |

|

Item 15. Indemnification of Directors and Officers.

Our amended and restated certificate of incorporation (“Charter”) and Bylaws contain provisions relating to the limitation of liability and indemnification of directors and officers. Our Charter provides that a director will not be personally liable to us or our stockholders for monetary damages for breach of fiduciary duty as a director, except for liability:

| |

●

|

for any breach of the director’s duty of loyalty to us or our stockholders;

|

| |

●

|

for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

|

| |

●

|

under Section 174 of the Delaware General Corporation Law (the “DGCL”); or

|

| |

●

|

for any transaction from which the director derived any improper personal benefit.

|

Our Charter also provides that if the DGCL is amended to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of our directors will be eliminated or limited to the fullest extent permitted by the DGCL.

Our Bylaws provide that we will indemnify our directors and officers to the fullest extent not prohibited by the DGCL; provided, however, that we may limit the extent of such indemnification by individual contracts with our directors and executive officers; and provided, further, that we are not required to indemnify any director or executive officer in connection with any proceeding (or part thereof) initiated by such person or any proceeding by such person against us or our directors, officers, employees or other agents unless:

| |

●

|

such indemnification is expressly required to be made by law;

|

| |

●

|

the proceeding was authorized by the board of directors; or

|

| |

●

|

such indemnification is provided by us, in our sole discretion, pursuant to the powers vested in us under the DGCL.

|

Our Bylaws provide that we shall advance, prior to the final disposition of any proceeding, promptly following request therefor, all expenses by any director or executive officer in connection with any such proceeding upon receipt of any undertaking by or on behalf of such person to repay said amounts if it should be determined ultimately that such person is not entitled to be indemnified under Article XI of our Bylaws or otherwise. Notwithstanding the foregoing, unless otherwise determined, no advance shall be made by us if a determination is reasonably and promptly made by the Board of Directors by a majority vote of a quorum of directors who were not parties to the proceeding, or if such a quorum is not obtainable, or even if obtainable, a quorum of disinterested directors so directs, by independent legal counsel in a written opinion, that the facts known to the decision-making party at the time such determination is made demonstrate clearly and convincingly that such person acted in bad faith or in a manner that such person did not believe to be in or not opposed to our best interests.

Our Bylaws also authorize us to purchase insurance on behalf of any person required or permitted to be indemnified pursuant to our Bylaws.

Section 145(a) of the DGCL authorizes a corporation to indemnify any person who was or is a party, or is threatened to be made a party, to a threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation), by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding, if the person acted in good faith and in a manner the person reasonably believed to be in, or not opposed to, the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful.

Section 145(b) of the DGCL provides in relevant part that a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement of such action or suit if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation and except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

The DGCL also provides that indemnification under Section 145(d) can only be made upon a determination that indemnification of the present or former director, officer or employee or agent is proper in the circumstances because such person has met the applicable standard of conduct set forth in Section 145(a) and (b).

Section 145(g) of the DGCL also empowers a corporation to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against such person and incurred by such person in any such capacity, or arising out of such person’s status as such, whether or not the corporation would have the power to indemnify such person against such liability under Section 145 of the DGCL.

Section 102(b)(7) of the DGCL permits a corporation to provide for eliminating or limiting the personal liability of one of its directors for any monetary damages related to a breach of fiduciary duty as a director, as long as the corporation does not eliminate or limit the liability of a director for acts or omissions which (1) which breached the director’s duty of loyalty to the corporation or its stockholders, (2) which were not in good faith or which involve intentional misconduct or knowing violation of law, (3) under Section 174 of the DGCL; or (4) from which the director derived an improper personal benefit.

We have obtained directors’ and officers’ insurance to cover our directors and officers for certain liabilities.

Item 16. Exhibits.

|

3.3

|

Amended and Restated Bylaws of the Registrant. Incorporated by reference to Exhibit 3.1 to the Current Report on Form 8-K, filed on February 10, 2023.

|

|

5.1

|

Opinion of Disclosure Law Group, a Professional Corporation.

|

|

23.1

|

Consent of Disclosure Law Group, a Professional Corporation (to be included in Exhibit 5.1).

|

|

10.1**

|

Membership Interest Purchase Agreement, dated August 9, 2023, by and between Wrap Technologies, Inc., Intren Holdings Partners, LLC, Kevin Mullins, Marc Upton, Tre Mullins, Terry Nichols, Charles DeVita, Nick DeVita, David Stading, Peter Cavicchia, Timothy McAfee, Andon McAfee, Andon Dragomanov, John R. Sette, Matthew J. Dugas, and Ronald Hurley, incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the SEC on August 22, 2023.

|

|

23.2

|

Consent of Independent Registered Public Accounting Firm – Rosenberg Rich Baker Berman, P.A. (filed herewith).

|

|

24.1

|

Power of Attorney (included on the signature page hereof)

|

|

107

|

Filing Fee Table

|

|

*

|

To be filed by amendment

|

|

**

|

Certain exhibits and schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally to the SEC a copy of any omitted exhibits or schedules upon request.

|

| |

|

Item 17. Undertakings.

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or any decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the SEC by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of the registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Tempe, Arizona, on November 16, 2023.

| |

Wrap Technologies, Inc.

|

| |

|

| |

By:

|

/s/ Kevin Mullins

|

| |

|

Kevin Mullins

|

| |

|

Chief Executive Officer and Director

|

POWER OF ATTORNEY

KNOWN ALL MEN BY THESE PRESENTS, that each person whose signature below constitutes and appoints Kevin Mullins as attorney-in-fact, with power of substitution, for him in any and all capacities, to sign any amendments to this Registration Statement on Form S-3, and file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, hereby ratifying and confirming all that each of said attorneys-in-fact, or his substitute or substitutes, may do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

| |

|

|

|

|

|

/s/ Kevin Mullins

|

|

Chief Executive Officer and Director

|

|

November 16, 2023 |

|

Kevin Mullins

|

|

(Principal Executive Officer)

|

|

|

| |

|

|

|

|

|

/s/ Chris DeAlmeida

|

|

Chief Financial Officer

|

|

November 16, 2023 |

|

Chris DeAlmeida

|

|

(Principal Financial Officer)

|

|

|

| |

|

|

|

|

|

/s/ Scot Cohen

|

|

Executive Chairman

|

|

November 16, 2023 |

|

Scot Cohen

|

|

|

|

|

| |

|

|

|

|

|

/s/ Bruce T. Bernstein

|

|

Director

|

|

November 16, 2023 |

|

Bruce T. Bernstein

|

|

|

|

|

| |

|

|

|

|

|

/s/ Marc Savas

|

|

Director

|

|

November 16, 2023 |

|

Marc Savas

|

|

|

|

|

| |

|

|

|

|

|

/s/ Kevin Sherman

|

|

Director

|

|

November 16, 2023 |

|

Kevin Sherman

|

|

|

|

|

| |

|

|

|

|

|

/s/ Rajiv Srinivasan

|

|

Director

|

|

November 16, 2023 |

|

Rajiv Srinivasan

|

|

|

|

|

| |

|

|

|

|

|

/s/ Timothy Szymanski

|

|

Director

|

|

November 16, 2023 |

|

Timothy Szymanski

|

|

|

|

|

Exhibit 5.1

November 15, 2023

Wrap Technologies, Inc.

1817 W 4th Street

Tempe, Arizona 85281

Ladies and Gentlemen:

We have acted as corporate and securities counsel to Wrap Technologies, Inc., a Delaware corporation (the “Company”), in connection with its registration statement on Form S-3 (the “Registration Statement”), filed on November 15, 2023 with the Securities and Exchange Commission (the “Commission”), relating to the proposed resale of up to 910,610 shares (the “Shares”) of the Company’s common stock, par value $0.0001 per share (“Common Stock”), by the selling stockholders identified in the Registration Statement (the “Selling Stockholders”). This opinion letter is furnished to you at your request to enable you to fulfill the requirements of Item 601(b)(5) of Regulation S-K, 17 C.F.R. § 229.601(b)(5), in connection with the Registration Statement.

As the basis for the opinion hereinafter expressed, we have examined such statutes, Company corporate records and documents, certificates of Company and public officials, and other instruments and documents as we deemed relevant or necessary for the purposes of the opinion set forth below.

In making our examination, we have assumed the legal capacity of all natural persons, that all signatures on documents examined by us are genuine, the authenticity of all documents submitted to us as originals and the conformity with the original documents of all documents submitted to us as certified, conformed or photostatic copies. We have also assumed the accuracy and completeness of all information provided to us by the Company during the course of our investigations, on which we have relied in issuing the opinion expressed below. We have relied upon a certificate and other assurances of officers of the Company and others as to factual matters without having independently verified such factual matters. In connection with the opinion hereinafter expressed, we have assumed that all of the Shares will be resold in the manner stated in the prospectus forming a part of the Registration Statement.

Based on the foregoing and on such legal considerations as we deem relevant, and subject to the qualifications, assumptions and limitations stated herein and in reliance on the statements of fact contained in the documents we have examined, we are of the opinion that the Shares will be duly authorized, validly issued, fully paid and nonassessable.

The opinions expressed herein are with respect to, and limited to, the corporate laws of the State of Delaware and the federal laws of the United States, in each case as currently in effect, and we express no opinion as to the effect of the laws of any other jurisdiction.