As filed with the Securities and Exchange Commission on November 15, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______

FORM S‑8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_______

BIORESTORATIVE THERAPIES, INC.

(Exact Name of Registrant as Specified in Its Charter)

Nevada

(State or Other Jurisdiction of Incorporation or Organization)

30-1341024

(I.R.S. Employer Identification No.)

40 Marcus Drive, Suite One, Melville, New York 11747

(Address of Principal Executive Offices) (Zip Code)

BioRestorative Therapies, Inc. 2021 Stock Incentive Plan

(Full Title of the Plan)

|

Lance Alstodt

Chief Executive Officer

BioRestorative Therapies, Inc.

40 Marcus Drive, Suite One

Melville, New York 11747

(Name and Address of Agent for Service)

|

Copy to:

Fred S. Skolnik, Esq.

Certilman Balin Adler & Hyman, LLP

90 Merrick Avenue

East Meadow, New York 11554

(516) 296-7048

|

(631) 760-8100

(Telephone Number, Including Area Code, of Agent for Service)

_______

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or

an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ____

|

Accelerated filer ____

|

|

Non-accelerated filer _X_

|

Smaller reporting company _X_

|

| |

Emerging growth company ____

|

EXPLANATORY NOTE

This Registration Statement covers an additional 1,350,000 shares of common stock, $0.0001 par value per share (“Common Stock”), of BioRestorative

Therapies, Inc., a Nevada corporation (the “Registrant”), available for issuance under the Registrant’s 2021 Stock Incentive Plan (the “2021 Plan”). This Registration Statement shall also cover any additional shares of Common Stock of the Registrant

that become issuable under the 2021 Plan by reason of any stock dividend, stock split, recapitalization or similar transaction that results in an increase in the number of outstanding shares of Common Stock of the Registrant.

STATEMENT PURSUANT TO GENERAL INSTRUCTION E TO FORM S-8

Pursuant to General Instruction E to Form S-8 under the Securities Act, this Registration Statement is filed by the Registrant to register an additional

1,350,000 shares of Common Stock as to which options or awards may be granted under the 2021 Plan.

On

April 30, 2021, the Registrant filed a

Registration Statement on Form S-8 (File Number 333-255681) (the “First Registration Statement”) in order to register 1,175,000 shares of Common Stock issuable under the 2021 Plan (giving retroactive effect to the 1-for-4,000 reverse split of

the Registrant’s shares of common stock effected as of October 27, 2021). On

March 28, 2023, the Registrant filed a Registration Statement on Form S-8 (File Number

333-270909) (the “Second Registration Statement”) in order to register 1,325,000 shares of Common Stock issuable under the 2021 Plan.

Pursuant to General Instruction E to Form S-8, the contents of the

First Registration Statement and the

Second

Registration Statement, including the documents incorporated by reference therein, are hereby incorporated by reference into this Registration Statement, except to the extent supplemented, amended or superseded by the information set forth

herein.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

Incorporated herein by reference are the following documents filed by the Registrant with the Securities and Exchange Commission (the “Commission”) under

the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (to the extent filed and not furnished):

All documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a

post‑effective amendment to this Registration Statement which indicates that all securities offered hereby have been sold or which deregisters all such securities then remaining unsold, shall be deemed to be incor-porated herein by reference and to

be a part hereof from their respective dates of filing.

Item 5. Interests of Named Experts and Counsel.

Certain legal matters in connection with the offering of the securities registered hereunder are being passed upon for the Registrant by Certilman Balin

Adler & Hyman, LLP, 90 Merrick Avenue, East Meadow, New York 11554, a stockholder of the Registrant.

Item 6. Indemnification of Directors and Officers.

The Registrant is governed by Chapter 78 of the Nevada Revised Statutes (the “NRS”). Section 78.7502(1) of the NRS provides that a corporation may, and

the Registrant’s Articles and By-Laws provide that the Registrant shall, indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal,

administrative or investigative (an “Action”), by reason of the fact that he is or was a director, officer, employee or agent of the corporation or is or was serving at the request of the corporation in such capacity in another corporation,

partnership, joint venture, trust or other enterprise (the “Indemnified Party”), against expenses (including attorney’s fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with such action,

suit or proceeding if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his

conduct was unlawful; provided, however, no indemnification shall be made in respect of any Actions by or in the right of the corporation if the Indemnified Party shall have been adjudged by a court of competent jurisdiction, after exhaustion of any

appeals, to be liable to the corporation, unless and only to the extent that the court shall determine that, despite the adjudication of liability but in view of all circumstances, such person is fairly and reasonably entitled to indemnity.

Under the NRS, the directors have a fiduciary duty to the Registrant that is not eliminated by this provision of the Articles and, in appropriate

circumstances, equitable remedies such as injunctive or other forms of non-monetary relief will remain available. In addition, each director will continue to be subject to liability under the NRS for breach of the director’s duty of loyalty to the

Registrant for acts or omissions which are found by a court of competent jurisdiction to not be in good faith or involve intentional misconduct, for knowing violations of law, for actions leading to improper personal benefit to the director, and for

payment of dividends or approval of stock repurchases or redemptions that are prohibited by the NRS. This provision also does not affect the directors’ responsibilities under any other laws, such as the federal securities laws or state or federal

environmental laws.

Furthermore, Section 78.7502(3) of the NRS provides that determination of an Indemnified Party’s eligibility for indemnification by the Registrant shall be

made on a case-by-case basis by: (i) the stockholders; (ii) the board of directors by a majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding; (iii) independent legal counsel’s written opinion if:

(1) a majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding so orders; or (2) a quorum consisting of directors who were not parties to the action, suit or proceeding cannot be obtained.

Lastly, Section 78.752(1) of the NRS empowers a corporation to purchase and maintain insurance or make other financial arrangements with respect to

liability arising out of the actions or omissions of directors, officers, employees or agents in their capacity or status as such, whether or not the corporation has the authority to indemnify him against such liability.

The Registrant’s Amended and Restated Articles of Incorporation (“Articles”) provide that, to the fullest extent permitted by the NRS, no director or

officer shall be personally liable to the Registrant or to its stockholders for monetary damages for breach of fiduciary duty as a director or an officer, except to the extent that such exemption from liability or limitation thereof is not permitted

under the NRS currently in effect or as the same may be amended. If the NRS is amended to further eliminate or limit or authorize corporate action to further eliminate or limit the liability of directors or officers, the liability of directors and

officers of the Registrant shall be eliminated or limited to the fullest extent permitted by the NRS, as so amended from time to time. No repeal or modification of this provision of the Articles will apply to or have any effect on the liability or

alleged liability of any director or officer of the Registrant for or with respect to any acts or omissions of such directors or officers occurring prior to such repeal or modification.

The Registrant’s Bylaws provide that the Registrant will indemnify and hold harmless any person who was or is a party or is threatened to be made a party

to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, in such manner, under such circumstances and to the fullest extent permitted by the Articles and the NRS.

Item 8. Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the

requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the County of Suffolk, State of New York, on the 15th day of November, 2023.

| |

BIORESTORATIVE THERAPIES, INC. |

|

| |

|

|

|

|

|

By:

|

/s/ Lance Alstodt

|

|

| |

|

Lance Alstodt

|

|

| |

|

Chief Executive Officer

|

|

| |

|

|

|

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on

the dates indicated.

|

Signature

|

Capacity |

Date |

|

/s/ Lance Alstodt

Lance Alstodt

|

President, Chief Executive Officer and Chairman of the Board (Principal Executive Officer)

|

November 15, 2023

|

| |

|

|

|

/s/ Francisco Silva

Francisco Silva

|

Vice President, Research and Development, Secretary and Director

|

November 15, 2023

|

| |

|

|

|

/s/ Robert E. Kristal

Robert E. Kristal

|

Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer)

|

November 15, 2023

|

| |

|

|

|

/s/ Nickolay Kukekov

Nickolay Kukekov

|

Director

|

November 15, 2023

|

| |

|

|

|

/s/ Patrick F. Williams

Patrick F. Williams

|

Director

|

November 15, 2023

|

| |

|

|

|

/s/ David Rosa

David Rosa

|

Director

|

November 15, 2023

|

OPINION OF CERTILMAN BALIN ADLER & HYMAN, LLP

November 15, 2023

BioRestorative Therapies, Inc.

40 Marcus Drive

Melville, New York 11747

Re: Registration of 1,350,000 shares of Common Stock,

par value $0.0001 per share, under the

Securities Act of 1933, as amended

Gentlemen:

In our capacity as counsel to BioRestorative Therapies, Inc., a Nevada corporation (the “Company”), we have been asked to render this opinion in connection

with a Registration Statement on Form S-8 being filed contemporaneously herewith by the Company with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Registration Statement”), covering the issuance of up to an

aggregate of 1,350,000 shares of common stock, par value $0.0001 per share, of the Company (the “Common Shares”) under the Company’s 2021 Stock Incentive Plan (the “2021 Plan”).

In that connection, we have examined the Certificate of Incorporation and the By-Laws of the Company, as amended to date, the Registration Statement and the

2021 Plan and are familiar with corporate proceedings of the Company relating to the adoption of the 2021 Plan. We have also examined such other instruments and documents as we deemed relevant under the circumstances.

For purposes of the opinions expressed below, we have assumed (i) the authenticity of all documents submitted to us as original, (ii) the conformity to the

originals of all documents submitted as certified, photostatic or facsimile copies and the authenticity of the originals, (iii) the legal capacity of natural persons, (iv) the due authorization, execution and delivery of all documents by all parties

and the validity and binding effect thereof and (v) the conformity to the proceedings of the Board of Directors of all minutes of such proceedings. We have also assumed that the corporate records furnished to us by the Company include all corporate

proceedings taken by the Company to date.

Based upon and subject to the foregoing, we are of the opinion that the Common Shares have been duly and validly authorized and, when issued pursuant to the

terms of the 2021 Plan, will be duly and validly issued, fully paid and nonassessable.

We hereby consent to the use of our opinion as herein set forth as an exhibit to the Registration Statement.

This opinion is as of the date hereof, and we do not undertake, and hereby disclaim, any obligation to advise you of any changes in any of the matters set

forth herein.

We are rendering this opinion only as to the matters expressly set forth herein, and no opinion should be inferred as to any other matters.

This opinion is for your exclusive use only and is to be utilized and relied upon only in connection with the matters expressly set forth herein.

Very truly yours,

CERTILMAN BALIN ADLER & HYMAN, LLP

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM’S CONSENT

We consent to the incorporation by reference in this Registration Statement of BioRestorative Therapies Inc. on Form S-8 of our report dated March 30, 2022,

with respect to our audit of the consolidated financial statements of BioRestorative Therapies, Inc. and Subsidiary as of December 31, 2021 and for the year then ended appearing in the Annual Report on Form 10-K of BioRestorative Therapies, Inc. for

the year ended December 31, 2022. We were dismissed as auditors on September 13, 2022, and, accordingly, we have not performed any audit or review procedures with respect to

any financial statements incorporated by reference for the periods after the date of our dismissal.

/s/ Friedman LLP

Friedman llp

Marlton, New Jersey

November 15, 2023

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM’S CONSENT

We consent to the incorporation by reference in this Registration Statement of BioRestorative Therapies Inc. on Form S-8 of our report dated March

24, 2023, with respect to our audit of the consolidated financial statements of BioRestorative Therapies Inc, and Subsidiary as of December 31, 2022 and for the year ended December 31, 2022 appearing in the Annual Report on Form 10-K of BioRestorative

Therapies, Inc. for the year ended December 31, 2022.

/s/ Marcum llp

Marcum llp

Marlton, New Jersey

November 15, 2023

Calculation of Filing Fee Table

FORM S-8

(Form Type)

BIORESTORATIVE THERAPIES, INC.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of

Registration

Fee

|

|

Equity

|

Common Stock, par value $0.0001 per share

|

457(h)(1)

|

1,350,000(1)

|

$1.795(2)

|

$2,423,250 (2)

|

0.00014760

|

$357.68

|

|

Total Offering Amounts

|

|

$2,423,250

|

|

$357.68

|

|

Total Fee Offsets

|

|

|

|

---

|

|

Net Fee Due

|

|

|

|

$357.68

|

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover

any additional shares of the Registrant’s common stock that become issuable as a result of any stock dividend, stock split, recapitalization, or other similar transaction effected without the receipt of consideration that results in an

increase in the number of outstanding shares of the Registrant’s common stock.

|

|

(2)

|

Calculated solely for purposes of the registration fee for this offering and in accordance with paragraph (h)(1) of Rule 457 of the

Securities Act, on the basis of the average of the high and low prices of the Registrant’s shares of common stock as quoted on the Nasdaq Capital Market on November 13, 2023.

|

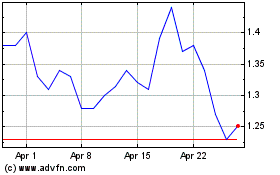

BioRestorative Therapies (NASDAQ:BRTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

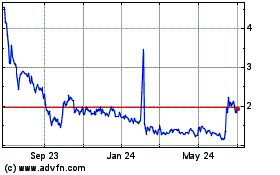

BioRestorative Therapies (NASDAQ:BRTX)

Historical Stock Chart

From Apr 2023 to Apr 2024