0001069394

false

0001069394

2023-11-14

2023-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (date of earliest event reported): November 14, 2023

FLEXIBLE

SOLUTIONS INTERNATIONAL, INC.

(Exact

name of Registrant as specified in its charter)

| Nevada |

|

001-31540 |

|

91-1922863 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

No.) |

|

Identification

No.) |

6001

54 Ave.

Tabor,

Alberta T1G 1X4

(Address

of principal executive offices, including Zip Code)

Registrant’s

telephone number, including area code: (250) 477-9969

Check

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below).

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-14(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common

Stock |

|

FSI |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§203.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§204.12b-2 of this chapter.

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

2.02 |

Results

of Operations and Financial Condition |

On

November 14, 2023, the Company issued a press release announcing the Company’s financial results for the third quarter ended September

30, 2023.

On

November 15, 2023 the Company held a conference call to discuss its financial results for the quarter ended September 30, 2023, as well

as other information regarding the Company.

| Item

9.01. |

Financial

Statements and Exhibits |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

November 15, 2023 |

|

|

| |

FLEXIBLE

SOLUTIONS INTERNATIONAL INC. |

| |

|

|

| |

By: |

/s/

Daniel B. O’Brien |

| |

|

Daniel

B. O’Brien, President and Chief Executive |

| |

|

Officer |

EXHIBIT

99.1

NEWS

RELEASE

November

14, 2023

FSI

ANNOUNCES THIRD QUARTER, 2023 FINANCIAL RESULTS

A

Conference call is scheduled for Wednesday November 15th, 2023, 11:00am Eastern Time

See

dial in number below

VICTORIA,

BRITISH COLUMBIA, November 14, 2023 – FLEXIBLE SOLUTIONS INTERNATIONAL, INC. (NYSE Amex: FSI), is the developer and manufacturer

of biodegradable polymers for oil extraction, detergent ingredients and water treatment as well as crop nutrient availability chemistry.

Flexible Solutions also manufactures biodegradable and environmentally safe water and energy conservation technologies. Today the Company

announces financial results for third quarter ended September 30, 2023.

Mr.

Daniel B. O’Brien, CEO, states, “This was a very poor quarter. We are not losing customers but certain customers are ordering

much less as they confront difficult conditions in their markets.” Mr. O’Brien continues, “FSI will have to review

all operating costs and search for lower cost of goods in the fourth quarter and throughout 2024 as we attempt to revert to profitability.”

| |

●

|

Sales

for the third quarter(Q3) were $8,720,621, down approximately 25% when compared to sales of $11,685,107 in the corresponding period

a year ago. |

| |

●

|

Q3,

2023 net loss was $(718,161), or $(0.06) per share, compared to a net income of $1,108,131, or $0.09 per share, in Q3, 2022. |

| |

●

|

The

lower earnings reported for Q3, 2023 were due to higher cost of goods, lower sales and product mix. |

| |

●

|

Basic

weighted average shares used in computing earnings per share amounts were 12,435,532 and 12,384,746 for Q3, 2023 and Q3, 2022 respectively.

|

| |

●

|

Q3,

2023 Non-GAAP operating cash flow: The Company shows 9 months operating cash flow of $3,284,640, or $0.26 per share. This

compares with operating cash flow of $6,227,068, or $0.50 per share, in the corresponding 9 months of 2022 (see the table and notes

that follow for details of these calculations). |

The

NanoChem division and ENP subsidiary continue to be the dominant sources of revenue and cash flow for the Company. New opportunities

continue to unfold in detergent, water treatment, oil field extraction, turf, ornamental and agricultural use to further increase sales

in these divisions.

Conference

call

A

conference call has been scheduled for 11:00 am Eastern Time, 8:00 am Pacific Time, on Wednesday November 15th, 2023.

CEO, Dan O’Brien will be presenting and answering questions on the conference call. To participate in this call please dial

1-800-445-7795 (or 1-785-424-1699) just prior to the scheduled call time. To join the call participants will be requested to give their

name and company affiliation. The conference ID: SOLUTIONS and/ or call title Flexible Solutions International

– Third Quarter, 2023 Financials may be requested

The

above information and following table contain supplemental information regarding income and cash flow from operations for the period

ended September 30, 2023. Adjustments to exclude depreciation, stock option expenses and one time charges are given. This financial information

is a Non-GAAP financial measure as defined by SEC regulation G. The GAAP financial measure most directly comparable is net income.

The

reconciliation of each Non-GAAP financial measure is as follows:

FLEXIBLE

SOLUTIONS INTERNATIONAL, INC.

Consolidated

Statement of Operations

For

The Three Months Ended September 30 and Nine Months Operating Cash Flow

(Unaudited)

| | |

Consolidated Statement of Operations Three Months Ended September 30 | |

| | |

2023 | | |

2022 | |

| Revenue | |

$ | 8,720,621 | | |

$ | 11,685,107 | |

| Income (loss) before income tax – GAAP | |

$ | (284,039 | ) | |

$ | 1,669,992 | |

| Provision for Income tax – net - GAAP | |

$ | (219,712 | ) | |

$ | (349,181 | ) |

| Net income (loss) - controlling interest - GAAP | |

$ | (718,161 | ) | |

$ | 1,108,131 | |

| Net income (loss) per common share – basic. – GAAP | |

$ | (0.06 | ) | |

$ | 0.09 | |

| 3 month weighted average shares used in computing per share amounts – basic.- GAAP | |

| 12,435,532 | | |

| 12,384,746 | |

| | |

Operating Cash Flow Nine Months Ended September 30 | |

| Operating Cash Flow (9 months). NON-GAAP | |

$ | 3,284,640a,b,c | | |

$ | 6,227,068a,b,c | |

| Operating Cash Flow per share excluding non-operating items and items not related to current operations (9 months) – basic. -NON-GAAP | |

$ | 0.26a,b,c | | |

$ | 0.50a,b,c | |

| Non-cash Adjustments (9 month) -GAAP | |

$ | 1,757,644 d | | |

$ | 976,536 d | |

| Shares (9 month basic weighted average) used in computing per share amounts – basic -GAAP | |

| 12,434,669 | | |

| 12,376,818 | |

Notes:

certain items not related to “operations” of the Company’s net income are listed below.

a)

Non-GAAP – Flexible Solutions International, Inc. owns 65% ENP Investments, LLC and ENP Mendota, LLC and 80% of 317 Mendota,

LLC. Therefore Operating Cash Flow NON-GAAP is adjusted by the pre tax net income or loss of the non-controlling interests in

these companies. An adjustment to operating cash flow has been made to account for the use of a pre tax amount versus an after tax amount

which was originally used in that year.

b)

Non-GAAP – amounts exclude certain cash and non-cash items: Depreciation and Stock compensation expense (2023 = $1,757,644,

2022 = $976,536), Gain on acquisition of ENP Peru (2023 = N/A, 2022 = $335,051), Interest expense (2023 = $369,967, 2022 = $190,366),

Interest income (2023 = $58,565, 2022 = $69,354), Gain on investment (2023 = $423,957, 2022 = $213,865), Income tax (2023 = $873,861,

2022 = $1,604,429), and pretax Net income attributable to non-controlling interests (2023 = $689,780, 2022 = $752,910). Although included

in operating expenses these onetime expenditures were not related to operations of FSI. *See the financial statements for all adjustments.

c)

The revenue and gain from the 50% investment in the private Florida LLC announced in January 2019 are not treated as revenue or profit

from operations by Flexible Solutions given the Company only purchased 50% of the LLC. The profit is treated as investment income and

therefore occurs below Operating income in the Statement of Operations. As a result, the gains from all investments, including those

from the Florida LLC, are removed from the calculation to arrive at Operating Cash Flow.

d)

Non-GAAP – amounts represent depreciation and stock compensation expense.

Safe

Harbor Provision

The

Private Securities Litigation Reform Act of 1995 provides a “Safe Harbor” for forward-looking statements. Certain of the

statements contained herein, which are not historical facts, are forward looking statement with respect to events, the occurrence of

which involve risks and uncertainties. These forward-looking statements may be impacted, either positively or negatively, by various

factors. Information concerning potential factors that could affect the company is detailed from time to time in the company’s

reports filed with the Securities and Exchange Commission.

Flexible

Solutions International

6001

54th Ave, Taber, Alberta, CANADA T1G 1X4

Company

Contacts

Jason

Bloom

Toll

Free: 800 661 3560

Fax:

403 223 2905

E-mail:

info@flexiblesolutions.com

If

you have received this news release by mistake or if you would like to be removed from our update list please reply to: info@flexiblesolutions.com

To

find out more information about Flexible Solutions and our products, please visit www.flexiblesolutions.com.

EXHIBIT

99.2

Q3

2023 Speech

Good

morning. I’m Dan O’Brien, CEO of Flexible Solutions.

Safe

Harbor provision:

The

Private Securities Litigation Reform Act of 1995 provides a “Safe Harbor” for forward-looking statements. Certain of the

statements contained herein, which are not historical facts, are forward looking statements with respect to events, the occurrence of

which involve risks and uncertainties. These forward-looking statements may be impacted, either positively or negatively, by various

factors. Information concerning potential factors that could affect the company is detailed from time to time in the company’s

reports filed with the Securities and Exchange Commission.

Welcome

to the FSI conference call for Third Quarter 2023.

First,

I would like to discuss our Company condition and our product lines along with what we think might occur in Q4 2023 and into 2024. I

will comment on our financials afterward.

NanoChem

division: NCS represents approximately 70% of FSI’s revenue. This division makes thermal poly-aspartic acid, called TPA for

short, a biodegradable polymer with many valuable uses. NCS also manufactures SUN 27™ and N Savr 30™ which are used to reduce

nitrogen fertilizer loss from soil. In 2022, NCS started food grade toll operations using the spray dryer we installed over the last

several years.

TPA

is used in agriculture to significantly increase crop yield. It acts by slowing crystal growth between fertilizer ions and other

ions in the soil resulting in the fertilizer remaining available longer for the plants to use.

TPA

is also a biodegradable way of treating oilfield water to prevent pipes from plugging with mineral scale. TPA’s effect is prevention

of mineral scale from minerals that are part of the water fraction of oil as it exits the rock formation. Preventing scale keeps the

oil recovery pipes from clogging.

TPA

is also sold as a biodegradable ingredient in cleaning products, for certain food uses and as a water treatment chemical.

SUN

27™ and N Savr 30™ are nitrogen conservation products. Nitrogen is a critical fertilizer that can be lost through bacterial

breakdown, evaporation and soil runoff.

SUN

27™ is used to conserve nitrogen from attack by soil bacterial enzymes that cause evaporation while N Savr 30™ is effective

at reducing nitrogen loss from leaching.

Food

products: Our IL plant is food grade inspected and we have received our FDA number. We have commercialized one food grade product

based on polyaspartates that was developed fully in house. We have a pipeline of additional products in development that are either our

ideas, toll production of outside ideas or a mixture where an outside idea is being optimized by our team. NCS will focus on food products

equally with our other market verticals because we have determined that this is an area with large markets that we are skilled in servicing

and where we can obtain good margins. We have not received the food product orders we had hoped for in 2023. Although we are still convinced

that this is a viable future business, it may take several more quarters to obtain significant sales.

ENP

Division: ENP represents most of our other revenue. ENP is focused on sales into the greenhouse, turf and golf markets, while, our

NCS sales are into row crop agriculture. The opening of the economy after the pandemic has affected ENP sales into the home gardening

market, especially home cannabis. We expect little revenue growth in 2023 and do not have any clarity regarding 2024.

The

Florida LLC investment: The LLC was profitable again in Q3 2023 and was one area where some revenue growth has occurred in 2023.

The Company is focused on international sales into multiple countries all of which face different issues and respond in varied ways.

Revenue was strong in Q3 but, the remainder of the year cannot be predicted. Also, the LLC remains exposed to high costs of goods while

experiencing difficulty passing all the costs to its customers. As a result, margins are compressed and earnings may not reach historical

levels for some time. Our sales to the LLC grew in the quarter.

Merger

with Lygos did not proceed

On

April 18th 2022, FSI and Lygos announced their intent to merge subject to shareholder approval. The merger was not completed

by the end date of the agreement, September 30 2022, and did not close.

Strategic

investment in Lygos: In December 2020, FSI invested $500,000 in Lygos in return for equity. We made a second investment of $500,000

in June 2021. Lygos is using the investment toward development of a microbial route to aspartic acid using sugar as a feedstock. FSI

will be the major user of aspartic acid derived this way and believes that sustainable aspartic acid will allow us to obtain large new

customers and develop valuable new products that both biodegrade and come from sustainable sources.

Lygos

has recently announced a change of focus to include other organic acids. We anticipate that this may slow their progress toward sustainable

aspartic acid. FSI is researching alternatives to achieve the goal of sustainability while continuing to support Lygos.

Q4

2023 and early 2024

Agricultural

products were not as strong in Q3 2023 as they were in Q3 2022. As a result, total revenue for the quarter was well below the previous

year period. Agriculture customers are showing resistance to spending on inputs when crop prices are not increasing at the rate of inflation.

We think that the remainder of 2023 and all of 2024 could be difficult.

Oil,

gas and industrial sales of TPA have been lower in Q3 2023 and this is likely to continue for the remainder of the year and into 2024.

Customers are reducing inventory and reassessing their needs now that shipping has become reliable again. In addition, the possibility

of reduced hydrocarbon demand could slow our sales over the next several quarters.

Tariffs:

Since 2019, several of our raw materials imported from China have included a 25% tariff. International customers are not charged

the tariffs because we have applied for the export rebates available to recover the tariffs. The tariffs are affecting our cost of goods,

our cash flow and our profits negatively. Rebates can take many years to arrive; we submitted our initial applications more than 4 years

ago. The total dollar amount due back to us is well in excess of $1 MM. We will persevere until we succeed in recovering our funds.

Shipping

and Inventory: Ocean shipping from Asia to the US and ocean shipments from the US to international ports are back to pre-covid speeds

and have settled at prices very close to historic levels. Land transport inside the US is continuing to stabilize but at generally higher

costs. We coped with shipping issues by ordering far ahead and carrying additional inventory in 2022 resulting in costs that we were

unable to pass on to our customers. In 2023, we have been reducing inventory to a more normal level, however, margin increases have been

difficult.

Raw

material prices do not appear to be reverting to historic levels. Instead, they seem to be stabilizing at a new base level that is also

experiencing inflation. Passing price increases, even small inflation related ones, along to customers can take several months, is not

always possible and will probably result in constrained margins for the next year.

We

believe that the sum of the issues we face during the rest of 2023 will result in lower revenue, lower cash flow and lower profits for

the coming quarter and the full year.

Highlights

of the financial results:

We

are not happy with the results for Q3 2023. Year over year revenue and operating cash flow were down. Profits were negatively affected

by product mix, cost of goods and reduced sales volume. We now estimate that year over year revenue, cash flow and profits will be down

significantly in 2023.

The

financials show that our costs have increased as the year progressed. Wages have gone up substantially over the last year to retain staff.

Raw material prices have dropped from the highest levels but not back to historic norms. Volume is down. We have been unable to raise

prices sufficiently to cover costs and maintain our margin goals. Our plans to enter the food industry have been delayed into next year.

Higher interest rates are consuming more of our funds.

FSI

and its subsidiaries will have to examine all our costs and economize where possible. Even more critical is increasing sales in our traditional

businesses and obtaining sales in the food industry to ensure that our wage and other base costs are spread over more revenue dollars.

Sales

for the quarter decreased 25% to 8.72 million, compared with 11.69 million for Q3 2022.

Profits:

Q3 2023 resulted in a loss of $718 thousand or $0.06 per share, compared to a profit of $1.11 million, or $0.09 per share, in Q3

2022.

Operating

Cash Flow: This non-GAAP number is useful to show our progress with non-cash items removed for clarity. For the nine months of 2023,

it was $3.28 million or 26 cents per share down from $6.23 million or 50 cents per share in the 2022 period.

Long

term debt: We continue to pay down our long-term debt according to the terms of the loans. However, we have consolidated all our

debt for ENP and NCS with Stock Yards Bank. This has resulted in increased lines of credit with lower interest rates and reduced interest

rates on our long-term debt. At the same time, we bought all the units we did not already own in ENP Peru Investments LLC and guaranteed

the mortgage held by the LLC. The LLC owns the 5 acres and 60,000 square feet of building in Peru IL on the SW corner of our property.

This action returns full ownership of the 20-acre parcel and 120,000 square feet of buildings to FSI with a mortgage at favorable terms.

Additional

factory space in Illinois: In the second quarter we invested to acquire 80% of an LLC called 317 Mendota that in turn purchased a

large building on 37 acres of land in Mendota IL. We have determined that 240,000 square feet is available for our use or for rental.

The ENP division will move all operations to 60,000 square feet of this building. The remaining 180,000 square feet will be rented as

suitable tenants are found. The NCS division will recover the use of 30,000 sq. ft. in Peru IL from ENP making room for potential growth.

Working

capital is adequate for all our purposes. We have lines of credit with Stock Yards Bank for the ENP and NCS subsidiaries. We are

confident that we can execute our plans with our existing capital.

The

text of this speech will be available as an 8K filing on www.sec.gov by Thursday November 16th. Email or fax copies

can be requested from Jason Bloom at Jason@flexiblesolutions.com.

Thank

you, the floor is open for questions.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

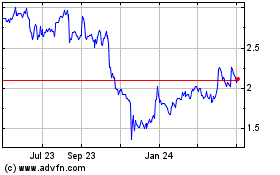

Flexible Solutions (AMEX:FSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

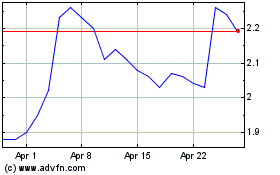

Flexible Solutions (AMEX:FSI)

Historical Stock Chart

From Apr 2023 to Apr 2024