Q3

2023

--12-31

false

0001408146

0

5,700,000

0

149,669

10

0.1075

0.1075

0

0

1

0

0

1

0

0

0

00014081462023-01-012023-09-30

thunderdome:item

iso4217:USD

00014081462022-01-012022-09-30

00014081462022-12-31

0001408146country:US2022-12-31

0001408146country:AU2022-12-31

00014081462023-09-30

0001408146country:US2023-09-30

0001408146country:AU2023-09-30

xbrli:shares

utr:Rate

0001408146us-gaap:EmployeeStockOptionMember2022-01-012022-09-30

utr:Y

xbrli:pure

iso4217:CADxbrli:shares

0001408146scy:OptionsExpiringJune242027Member2023-01-012023-09-30

iso4217:USDxbrli:shares

0001408146scy:OptionsExpiringJune242027Member2023-09-30

0001408146scy:OptionsExpiringMay232026Member2023-01-012023-09-30

0001408146scy:OptionsExpiringMay232026Member2023-09-30

0001408146scy:OptionsExpiringNovember132025Member2023-01-012023-09-30

0001408146scy:OptionsExpiringNovember132025Member2023-09-30

0001408146scy:OptionsExpiringMay222025Member2023-01-012023-09-30

0001408146scy:OptionsExpiringMay222025Member2023-09-30

0001408146scy:OptionsExpiringMarch192025Member2023-01-012023-09-30

0001408146scy:OptionsExpiringMarch192025Member2023-09-30

0001408146scy:OptionsExpiringJune242024Member2023-01-012023-09-30

0001408146scy:OptionsExpiringJune242024Member2023-09-30

0001408146scy:OptionsExpiringMay92024Member2023-01-012023-09-30

0001408146scy:OptionsExpiringMay92024Member2023-09-30

00014081462022-01-012022-12-31

00014081462021-12-31

0001408146us-gaap:EmployeeStockOptionMember2023-01-012023-09-30

0001408146us-gaap:MeasurementInputRiskFreeInterestRateMember2022-12-31

0001408146us-gaap:MeasurementInputRiskFreeInterestRateMember2023-09-30

0001408146us-gaap:MeasurementInputPriceVolatilityMember2022-12-31

0001408146us-gaap:MeasurementInputPriceVolatilityMember2023-09-30

0001408146us-gaap:MeasurementInputExpectedDividendRateMember2022-12-31

0001408146us-gaap:MeasurementInputExpectedDividendRateMember2023-09-30

0001408146us-gaap:MeasurementInputExpectedTermMember2022-12-31

0001408146us-gaap:MeasurementInputExpectedTermMember2023-09-30

0001408146us-gaap:MeasurementInputSharePriceMember2022-12-31

0001408146us-gaap:MeasurementInputSharePriceMember2023-09-30

0001408146us-gaap:MeasurementInputExercisePriceMember2022-12-31

0001408146us-gaap:MeasurementInputExercisePriceMember2023-09-30

0001408146us-gaap:WarrantMember2023-09-30

0001408146us-gaap:WarrantMember2023-01-012023-09-30

0001408146us-gaap:WarrantMember2022-12-31

0001408146us-gaap:WarrantMember2022-06-30

0001408146scy:PurchaseWarrantsMember2022-12-31

0001408146scy:PurchaseWarrantsMember2022-01-012022-12-31

0001408146scy:PurchaseWarrantsMember2021-12-31

00014081462022-07-012022-09-30

iso4217:CAD

0001408146us-gaap:WarrantMember2022-09-30

0001408146scy:PurchaseWarrantsMember2022-09-30

0001408146scy:PurchaseWarrantsMember2022-01-012022-09-30

0001408146us-gaap:CommonStockMember2022-09-30

0001408146us-gaap:CommonStockMember2022-01-012022-09-30

0001408146us-gaap:RelatedPartyMembersrt:OfficerMember2022-12-31

0001408146us-gaap:RelatedPartyMembersrt:OfficerMember2023-09-30

0001408146scy:ConsultingFeeMembersrt:DirectorMember2022-01-012022-09-30

0001408146scy:ConsultingFeeMembersrt:DirectorMember2023-01-012023-09-30

0001408146us-gaap:EmployeeStockOptionMembersrt:DirectorMember2022-01-012022-09-30

0001408146us-gaap:EmployeeStockOptionMembersrt:DirectorMember2023-01-012023-09-30

0001408146scy:KiviniemiScandiumPropertyMemberscy:ReclamationBondMember2022-12-31

iso4217:EUR

0001408146scy:KiviniemiScandiumPropertyMemberscy:ReclamationBondMember2023-09-30

0001408146scy:ScandiumPropertiesMemberscy:HoneybuglePropertyMember2022-01-012023-09-30

0001408146scy:NynganPropertyMember2022-01-012023-09-30

0001408146scy:ScandiumPropertiesMemberscy:NynganPropertyMember2022-01-012023-09-30

0001408146us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-30

0001408146us-gaap:WarrantMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-30

0001408146us-gaap:WarrantMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-30

0001408146us-gaap:WarrantMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-30

0001408146us-gaap:RetainedEarningsMember2023-09-30

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-30

0001408146us-gaap:TreasuryStockCommonMember2023-09-30

0001408146us-gaap:AdditionalPaidInCapitalMember2023-09-30

0001408146us-gaap:CommonStockMember2023-09-30

00014081462023-07-012023-09-30

0001408146us-gaap:RetainedEarningsMember2023-07-012023-09-30

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-30

0001408146us-gaap:TreasuryStockCommonMember2023-07-012023-09-30

0001408146us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-30

0001408146us-gaap:CommonStockMember2023-07-012023-09-30

00014081462023-06-30

0001408146us-gaap:RetainedEarningsMember2023-06-30

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

0001408146us-gaap:TreasuryStockCommonMember2023-06-30

0001408146us-gaap:AdditionalPaidInCapitalMember2023-06-30

0001408146us-gaap:CommonStockMember2023-06-30

00014081462023-04-012023-06-30

0001408146us-gaap:RetainedEarningsMember2023-04-012023-06-30

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-30

0001408146us-gaap:TreasuryStockCommonMember2023-04-012023-06-30

0001408146us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-30

0001408146us-gaap:CommonStockMember2023-04-012023-06-30

00014081462023-03-31

0001408146us-gaap:RetainedEarningsMember2023-03-31

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-31

0001408146us-gaap:TreasuryStockCommonMember2023-03-31

0001408146us-gaap:AdditionalPaidInCapitalMember2023-03-31

0001408146us-gaap:CommonStockMember2023-03-31

00014081462023-01-012023-03-31

0001408146us-gaap:RetainedEarningsMember2023-01-012023-03-31

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

0001408146us-gaap:TreasuryStockCommonMember2023-01-012023-03-31

0001408146us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0001408146us-gaap:CommonStockMember2023-01-012023-03-31

0001408146us-gaap:RetainedEarningsMember2022-12-31

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

0001408146us-gaap:TreasuryStockCommonMember2022-12-31

0001408146us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001408146us-gaap:CommonStockMember2022-12-31

00014081462022-10-012022-12-31

0001408146us-gaap:RetainedEarningsMember2022-10-012022-12-31

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-012022-12-31

0001408146us-gaap:TreasuryStockCommonMember2022-10-012022-12-31

0001408146us-gaap:AdditionalPaidInCapitalMember2022-10-012022-12-31

0001408146us-gaap:CommonStockMember2022-10-012022-12-31

00014081462022-09-30

0001408146us-gaap:RetainedEarningsMember2022-09-30

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-30

0001408146us-gaap:TreasuryStockCommonMember2022-09-30

0001408146us-gaap:AdditionalPaidInCapitalMember2022-09-30

0001408146us-gaap:CommonStockMember2022-09-30

0001408146us-gaap:RetainedEarningsMember2022-07-012022-09-30

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-30

0001408146us-gaap:TreasuryStockCommonMember2022-07-012022-09-30

0001408146us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-30

0001408146us-gaap:CommonStockMember2022-07-012022-09-30

00014081462022-06-30

0001408146us-gaap:RetainedEarningsMember2022-06-30

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-30

0001408146us-gaap:TreasuryStockCommonMember2022-06-30

0001408146us-gaap:AdditionalPaidInCapitalMember2022-06-30

0001408146us-gaap:CommonStockMember2022-06-30

00014081462022-04-012022-06-30

0001408146us-gaap:RetainedEarningsMember2022-04-012022-06-30

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-30

0001408146us-gaap:TreasuryStockCommonMember2022-04-012022-06-30

0001408146us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-30

0001408146us-gaap:CommonStockMember2022-04-012022-06-30

00014081462022-03-31

0001408146us-gaap:RetainedEarningsMember2022-03-31

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-31

0001408146us-gaap:TreasuryStockCommonMember2022-03-31

0001408146us-gaap:AdditionalPaidInCapitalMember2022-03-31

0001408146us-gaap:CommonStockMember2022-03-31

00014081462022-01-012022-03-31

0001408146us-gaap:RetainedEarningsMember2022-01-012022-03-31

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-31

0001408146us-gaap:TreasuryStockCommonMember2022-01-012022-03-31

0001408146us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-31

0001408146us-gaap:CommonStockMember2022-01-012022-03-31

0001408146us-gaap:RetainedEarningsMember2021-12-31

0001408146us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-31

0001408146us-gaap:TreasuryStockCommonMember2021-12-31

0001408146us-gaap:AdditionalPaidInCapitalMember2021-12-31

0001408146us-gaap:CommonStockMember2021-12-31

0001408146us-gaap:RelatedPartyMember2022-12-31

0001408146us-gaap:RelatedPartyMember2023-09-30

0001408146us-gaap:EquipmentMember2022-12-31

0001408146us-gaap:EquipmentMember2023-09-30

00014081462023-11-14

0001408146us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2023-01-012023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2023

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to __________________

000-54416

(Commission File Number)

SCANDIUM INTERNATIONAL MINING CORP.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada |

98-1009717 |

|

(State or other jurisdiction of

incorporation or organization)

|

(IRS Employer

Identification No.)

|

1390 Ione Pass Trail, Reno, Nevada 89523

(Address of principal executive offices) (Zip Code)

(775) 355-9500

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☒ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: As of November 14, 2023, the registrant’s outstanding common stock consisted of 355,860,813 shares.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

UNAUDITED CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS AND THREE MONTHS ENDED SEPTEMBER 30, 2023

|

Scandium International Mining Corp.

|

|

CONDENSED INTERIM CONSOLIDATED BALANCE SHEETS

|

|

(Expressed in US Dollars) (Unaudited)

|

| |

|

As at:

|

|

September 30, 2023

|

|

|

December 31, 2022

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$ |

1,135,020 |

|

|

$ |

1,852,710 |

|

|

Prepaid expenses and receivables

|

|

|

20,672 |

|

|

|

33,541 |

|

| |

|

|

|

|

|

|

|

|

|

Total Current Assets

|

|

|

1,155,692 |

|

|

|

1,866,251 |

|

| |

|

|

|

|

|

|

|

|

|

Reclamation bond (Note 3)

|

|

|

10,582 |

|

|

|

10,699 |

|

|

Mineral property interests (Note 3)

|

|

|

704,053 |

|

|

|

704,053 |

|

| |

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$ |

1,870,327 |

|

|

$ |

2,601,003 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$ |

53,869 |

|

|

$ |

127,263 |

|

|

Accounts payable with related parties (Note 4)

|

|

|

4,820 |

|

|

|

185,576 |

|

|

Derivative liability – warrants (Note 2 and 5)

|

|

|

477,844 |

|

|

|

1,194,885 |

|

| |

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

536,533 |

|

|

|

1,507,724 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

Capital stock (Note 5) (Authorized: Unlimited number of common shares; Issued and outstanding: 355,860,813 (2022 – 355,860,813)

|

|

|

111,144,603 |

|

|

|

111,144,603 |

|

|

Treasury stock (Note 6) (1,033,333 common shares) (2022 – 1,033,333)

|

|

|

(1,264,194 |

)

|

|

|

(1,264,194 |

)

|

|

Additional paid in capital (Note 5)

|

|

|

7,078,655 |

|

|

|

7,019,116 |

|

|

Accumulated other comprehensive loss

|

|

|

(853,400 |

)

|

|

|

(853,400 |

)

|

|

Deficit

|

|

|

(114,771,870 |

)

|

|

|

(114,952,846 |

)

|

| |

|

|

|

|

|

|

|

|

|

Total Shareholders’ Equity

|

|

|

1,333,794 |

|

|

|

1,093,279 |

|

| |

|

|

|

|

|

|

|

|

|

Total Liabilities and Shareholders’ Equity

|

|

$ |

1,870,327 |

|

|

$ |

2,601,003 |

|

Nature and continuance of operations (Note 1)

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

|

Scandium International Mining Corp.

|

|

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

|

|

(Expressed in US Dollars) (Unaudited)

|

| |

| |

|

Three months

ended September

30, 2023

|

|

|

Three months

ended September

30, 2022

|

|

|

Nine months ended September 30,

2023

|

|

|

Nine months ended September 30,

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

2,932 |

|

|

Consulting (Note 4)

|

|

|

- |

|

|

|

1,363 |

|

|

|

- |

|

|

|

18,363 |

|

|

Exploration (recovery)

|

|

|

30,653 |

|

|

|

22,915 |

|

|

|

211,779 |

|

|

|

(8,455 |

) |

|

General and administrative

|

|

|

27,882 |

|

|

|

29,822 |

|

|

|

74,169 |

|

|

|

160,933 |

|

|

Insurance

|

|

|

7,921 |

|

|

|

7,565 |

|

|

|

23,603 |

|

|

|

23,052 |

|

|

Professional fees

|

|

|

15,844 |

|

|

|

23,939 |

|

|

|

68,239 |

|

|

|

87,261 |

|

|

Salaries and benefits

|

|

|

52,449 |

|

|

|

103,351 |

|

|

|

183,738 |

|

|

|

329,925 |

|

|

Travel

|

|

|

- |

|

|

|

- |

|

|

|

3,737 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

(134,749 |

)

|

|

|

(188,955 |

)

|

|

|

(565,265 |

)

|

|

|

(614,011 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange gain (loss)

|

|

|

32,548 |

|

|

|

44,862 |

|

|

|

1,952 |

|

|

|

43,139 |

|

|

Accruals reversal (Note 8)

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,032,044 |

|

|

Interest income

|

|

|

12,348 |

|

|

|

- |

|

|

|

30,080 |

|

|

|

- |

|

|

Unrealized gain on derivative liability – warrants gain (Note 5)

|

|

|

164,585 |

|

|

|

214,794 |

|

|

|

714,209 |

|

|

|

161,053 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income and comprehensive income for the period

|

|

$ |

74,732 |

|

|

$ |

70,701 |

|

|

$ |

180,976 |

|

|

$ |

622,225 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted income per common share

|

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$

|

0.00 |

|

|

$ |

0.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding – basic and diluted

|

|

|

355,860,813 |

|

|

|

355,860,813 |

|

|

|

355,860,813 |

|

|

|

345,147,171 |

|

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

|

Scandium International Mining Corp.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in US Dollars) (Unaudited)

|

|

9-month period ended

|

|

September 30,

2023

|

|

|

September 30,

2022

|

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Income for the period

|

|

$ |

180,976 |

|

|

$ |

622,225 |

|

|

Items not affecting cash:

|

|

|

|

|

|

|

|

|

|

Amortization

|

|

|

- |

|

|

|

2,932 |

|

|

Stock-based compensation

|

|

|

59,539 |

|

|

|

149,669 |

|

|

Accrual reversal

|

|

|

- |

|

|

|

(1,032,044 |

) |

|

Unrealized gain on derivative liability - warrants

|

|

|

(714,209 |

)

|

|

|

(161,053 |

) |

|

Unrealized gain on foreign exchange

|

|

|

(2,715 |

) |

|

|

(99,292 |

) |

| |

|

|

|

|

|

|

|

|

|

Changes in non-cash working capital items:

|

|

|

|

|

|

|

|

|

|

Decrease in prepaid expenses and receivables

|

|

|

12,869 |

|

|

|

24,987 |

|

|

Decrease in accounts payable, accrued liabilities and accounts payable with related parties

|

|

|

(254,150 |

)

|

|

|

(355,843 |

) |

| |

|

|

(717,690 |

)

|

|

|

(848,419 |

)

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Common shares issued

|

|

|

- |

|

|

|

2,647,852 |

|

|

Share issue costs

|

|

|

- |

|

|

|

(28,418 |

) |

|

Options exercised for common shares

|

|

|

- |

|

|

|

106,989 |

|

| |

|

|

- |

|

|

|

2,726,423 |

|

| |

|

|

|

|

|

|

|

|

|

Change in cash during the period

|

|

|

(717,690 |

) |

|

|

1,878,004 |

|

|

Cash, beginning of period

|

|

|

1,852,710 |

|

|

|

93,894 |

|

| |

|

|

|

|

|

|

|

|

|

Cash, end of period

|

|

$ |

1,135,020 |

|

|

$ |

1,971,898 |

|

| |

|

2023 |

|

|

2022 |

|

| Cash paid during the 9-month period for interest |

|

$ |

- |

|

|

$ |

- |

|

| Cash paid during the 9-month period for taxes |

|

$ |

- |

|

|

$ |

- |

|

|

During the period ended September 30, 2022, the Company issued 37,803,218 warrants as part of a private placement valued at $1,781,779 classified as a derivative liability. There were no significant non-cash investing and financing activities during the periods ended September 30, 2023.

|

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

|

Scandium International Mining Corp.

|

|

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (DEFICIENCY)

|

|

(Expressed in US Dollars) (Unaudited)

|

| |

| |

|

Number of Shares

|

|

|

Capital Stock

|

|

|

Additional Paid

in Capital

|

|

|

Treasury Stock

|

|

|

Accumulated Other Comprehensive Loss

|

|

|

Deficit

|

|

|

Total Shareholders’ Equity (Deficiency)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2021

|

|

|

317,157,595 |

|

|

$ |

110,149,177 |

|

|

$ |

6,891,510 |

|

|

$ |

(1,264,194 |

) |

|

$ |

(853,400 |

) |

|

$ |

(115,803,442 |

) |

|

$ |

(880,349 |

) |

|

Income for the three months

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

522,946 |

|

|

|

522,946 |

|

|

Balance, March 31, 2022

|

|

|

317,157,595 |

|

|

$ |

110,149,177 |

|

|

$ |

6,891,510 |

|

|

$ |

(1,264,194 |

) |

|

$ |

(853,400 |

) |

|

$ |

(115,280,496 |

) |

|

$ |

(357,403 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation

|

|

|

- |

|

|

|

- |

|

|

|

88,447 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

88,447 |

|

|

Options exercised

|

|

|

900,000 |

|

|

|

177,663 |

|

|

|

(70,674 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

106,989 |

|

|

Private placement net of share issuance costs

|

|

|

37,803,218 |

|

|

|

2,619,434 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,619,434 |

|

|

Derivative liability

|

|

|

- |

|

|

|

(1,781,779 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,781,779 |

) |

|

Income for the three months

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

28,578 |

|

|

|

28,578 |

|

|

Balance, June 30, 2022

|

|

|

355,860,813 |

|

|

$ |

111,164,495 |

|

|

$ |

6,909,283 |

|

|

$ |

(1,264,194 |

) |

|

$ |

(853,400 |

) |

|

$ |

(115,251,918 |

) |

|

$ |

704,266 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation

|

|

|

- |

|

|

|

- |

|

|

|

61,222 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

61,222 |

|

|

Income for the three months

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

70,701 |

|

|

|

70,701 |

|

|

Balance, September 30, 2022

|

|

|

355,860,813 |

|

|

$ |

111,164,495 |

|

|

$ |

6,970,505 |

|

|

$ |

(1,264,194 |

) |

|

$ |

(853,400 |

) |

|

$ |

(115,181,217 |

) |

|

$ |

836,189 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation

|

|

|

- |

|

|

|

- |

|

|

|

48,611 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

48,611 |

|

|

Share issue costs

|

|

|

- |

|

|

|

(19,892 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(19,892 |

) |

|

Income for the three months

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

228,371 |

|

|

|

228,371 |

|

|

Balance, December 31, 2022

|

|

|

355,860,813 |

|

|

$ |

110,144,603 |

|

|

$ |

7,019,116 |

|

|

$ |

(1,264,194 |

) |

|

$ |

(853,400 |

) |

|

$ |

(114,952,846 |

) |

|

$ |

1,093,279 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation

|

|

|

- |

|

|

|

- |

|

|

|

26,949 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

26,949 |

|

|

Income for the three months

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

236,000 |

|

|

|

236,000 |

|

|

Balance, March 31, 2023

|

|

|

355,860,813 |

|

|

$ |

110,144,603 |

|

|

$ |

7,046,065 |

|

|

$ |

(1,264,194 |

) |

|

$ |

(853,400 |

) |

|

$ |

(114,716,846 |

) |

|

$ |

1,356,228 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation

|

|

|

- |

|

|

|

- |

|

|

|

21,684 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

21,684 |

|

|

Loss for the three months

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(129,756 |

) |

|

|

(129,756 |

) |

|

Balance, June 30, 2023

|

|

|

355,860,813 |

|

|

$ |

111,144,603 |

|

|

$ |

7,067,749 |

|

|

$ |

(1,264,194 |

) |

|

$ |

(853,400 |

) |

|

$ |

(114,846,602 |

) |

|

$ |

1,248,156 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation

|

|

|

- |

|

|

|

- |

|

|

|

10,906 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

10,906 |

|

|

Income for the three months

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

74,732 |

|

|

|

74,732 |

|

|

Balance, September 30, 2023

|

|

|

355,860,813 |

|

|

$ |

111,144,603 |

|

|

$ |

7,078,655 |

|

|

$ |

(1,264,194 |

) |

|

$ |

(853,400 |

) |

|

$ |

(114,771,870 |

) |

|

$ |

1,333,794 |

|

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

|

Scandium International Mining Corp.

|

|

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

|

|

September 30, 2023

|

|

(Expressed in US Dollars) (Unaudited)

|

|

1.

|

NATURE AND CONTINUANCE OF OPERATIONS

|

Scandium International Mining Corp. (the “Company”) is a specialty metals and alloys company focusing on scandium and other specialty metals.

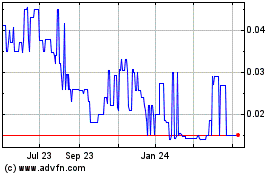

The Company was incorporated under the laws of the Province of British Columbia, Canada in 2006. The Company currently trades on the Toronto Stock Exchange (TSX) under the symbol “SCY”.

The Company’s focus is on the exploration and evaluation of its specialty metals assets, specifically the Nyngan scandium deposit located in New South Wales, Australia, The Company is an exploration stage company and anticipates incurring significant additional expenditures prior to production and any and all of its properties.

These condensed interim consolidated financial statements have been prepared on a going concern basis that contemplates the realization of assets and discharge of liabilities at their carrying values in the normal course of business for the foreseeable future. These financial statements do not reflect any adjustments that may be necessary if the Company is unable to continue as a going concern.

The Company currently earns no operating revenues and will require additional capital in order to advance the Nyngan property. The Company’s ability to continue as a going concern is uncertain and is dependent upon the generation of profits from mineral properties, obtaining additional financing and maintaining continued support from its shareholders and creditors. These are material uncertainties that raise substantial doubt about the Company’s ability to continue as a going concern. In the event that additional financial support is not received, or operating profits are not generated, the carrying values of the Company’s assets may be adversely affected.

The outbreak of COVID-19 and political upheavals in various countries have caused significant volatility in commodity prices. While these effects are expected to be temporary, the duration of the business disruptions internationally and related financial impact cannot be reasonably estimated at this time.

Basis of presentation

The accompanying unaudited condensed interim consolidated financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”). The condensed interim consolidated financial statements include the consolidated accounts of the Company and its wholly owned subsidiaries with all significant intercompany transactions eliminated. In the opinion of management, all adjustments necessary for a fair statement of the condensed interim consolidated balance sheets, results of operations and comprehensive loss and cash flows for the interim periods have been made. Certain information and footnote disclosures normally included in the condensed interim consolidated financial statements prepared in accordance with generally accepted accounting principles of the United States of America (“US GAAP”) have been condensed or omitted pursuant to such SEC rules and regulations. These condensed interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2022, and with our Annual Report on Form 10-K filed with the SEC on March 7, 2023. Operating results for the nine-month period ended September 30, 2023, may not necessarily be indicative of the results for the year ending December 31, 2023.

These unaudited condensed interim consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries, EMC Metals USA Inc., Scandium International Mining Corp., Norway AS, SCY Exploration Finland Oy, and EMC Metals Australia Pty Ltd. (“EMC-A”).

Use of estimates

The preparation of unaudited condensed interim consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to the deferred income tax asset valuations, asset impairment, stock-based compensation, derivative liabilities and loss contingencies. The Company bases its estimates and assumptions on current facts, historical experience, and various other factors that it believes to be reasonable under the circumstances. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between estimates and the actual results, future results of operations will be affected.

The Company considers itself to be an exploration stage company and will consider the transition to development stage after it receives funding to begin mine construction, and board approval.

Fair value of financial assets and liabilities

The Company measures the fair value of financial assets and liabilities based on US GAAP guidance which defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements.

The Company classifies financial assets and liabilities as held-for-trading, available-for-sale, held-to-maturity, loans and receivables or other financial liabilities depending on their nature. Financial assets and financial liabilities are recognized at fair value on their initial recognition, except for those arising from certain related party transactions which are accounted for at the transferor’s carrying amount or exchange amount.

|

Scandium International Mining Corp.

|

|

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

|

|

September 30, 2023

|

|

(Expressed in US Dollars) (Unaudited)

|

|

2.

|

BASIS OF PRESENTATION (cont’d…)

|

Financial assets and liabilities classified as held-for-trading are measured at fair value, with gains and losses recognized in net income. Financial assets classified as held-to-maturity, loans and receivables, and financial liabilities other than those classified as held-for-trading are measured at amortized cost, using the effective interest method of amortization. Financial assets classified as available-for-sale are measured at fair value, with unrealized gains and losses being recognized as other comprehensive income until realized, or if an unrealized loss is considered other than temporary, the unrealized loss is recorded in income.

Financial instruments, including cash, receivables, reclamation bond, accounts payable and accrued liabilities, and accounts payable with related parties are carried at amortized cost, which management believes approximates fair value due to the short-term nature of these instruments. Derivative liabilities are recorded at fair value, and are financial liabilities classified as held-for-trading.

The Company has no leases in the nine months ending September 30, 2023. Short term lease expenses totaled $Nil during the nine months ended September 30, 2023, and $15,669 during the nine months ended September 30, 2022.

The Company’s warrants have an exercise price in Canadian dollars while the Company’s functional currency is US dollars. Therefore, in accordance with ASU 815 – Derivatives and Hedging, the warrants are presented as derivative liabilities. This liability value has no effect on the cash flow of the Company and does not represent a cash payment of any kind. The derivative liability is a result of the uncertainty associated with US dollar cash flows as a result of the underlying foreign currency fluctuations between the exercise price in Canadian dollars and the Company’s functional currency of US dollars.

The following table presents information about the assets and liabilities that are measured at fair value on a recurring basis as at September 30, 2023 and indicates the fair value hierarchy of the valuation techniques the Company utilized to determine such fair value. In general, fair values determined by Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets. Fair values determined by Level 2 inputs utilize data points that are observable such as quoted prices, interest rates and yield curves. Fair values determined by Level 3 inputs are unobservable data points for the asset or liability, and included situations where there is little, if any, market activity for the asset:

| |

|

September 30,

2023

|

|

|

Quoted Prices

in Active Markets

(Level 1)

|

|

|

Significant Other

Observable Inputs

(Level 2)

|

|

|

Significant

Unobservable Inputs

(Level 3)

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative liability - warrants

|

|

$ |

(477,844 |

)

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(477,844 |

)

|

Recently Adopted and Recently Issued Accounting Standards

There are no recently issued accounting standards updates that are currently expected to have a material impact on the Company.

|

Scandium International Mining Corp.

|

|

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

|

|

September 30, 2023

|

|

(Expressed in US Dollars) (Unaudited)

|

|

3.

|

MINERAL PROPERTY INTERESTS

|

|

September 30, 2023

|

|

Scandium and

other

|

|

| |

|

|

|

|

|

Balance, September 30, 2023, December 31, 2022

|

|

$ |

704,053 |

|

Title to mineral property interests involves certain inherent risks due to the difficulties of determining the validity of certain claims as well as the potential for problems arising from the frequently ambiguous conveyancing history characteristic of many mineral property interests. The Company has investigated title to all its mineral property interests and, to the best of its knowledge, title to all of its properties is in good standing.

SCANDIUM PROPERTIES

Nyngan, New South Wales Property

The Company holds a 100% interest in the Nyngan property in New South Wales, Australia (NSW).

Royalties attached to the Nyngan property include a 0.7% royalty on gross mineral sales on the property, a 1.5% Net Profits Interest royalty to private parties involved with the early exploration on the property, and a 1.7% Net Smelter Returns royalty payable for 12 years after production commences. Another revenue royalty is payable to private interests of 0.2%, subject to a $370,000 cap. A NSW minerals royalty will also be levied on the project, subject to negotiation, currently 4% on revenue.

Honeybugle property, Australia

The Company holds a 100% interest in the Honeybugle property.

Kiviniemi Scandium Property Finland

In August 2018, the Company was granted an Exploration License for the Kiviniemi Scandium Property in central Finland from the Finnish regulatory body governing mineral exploration and mining in Finland. As at September 30, 2023 the Company has a reclamation bond of $10,582 (€10,000). (December 31, 2022 - $10,699 (€10,000)).

|

4.

|

RELATED PARTY TRANSACTIONS

|

During the 9-month period ended September 30, 2023, the Company expensed $54,317 for stock-based compensation for stock options granted to Company directors. During the 9-month period ended September 30, 2022, the Company expensed $136,540 for stock-based compensation for stock options issued to Company directors.

During the 9-month period ended September 30, 2022, the Company reversed $669,733 of accruals to related parties. No such transactions occurred in the 9-month period ended September 30, 2023.

During the 9-month period ended September 30, 2023, the Company expensed a consulting fee of $Nil to one of its directors. During the 9-month period ended September 30, 2022, the Company expensed a consulting fee of $17,000 to one of its directors.

As at September 30, 2023, the Company owed $4,820 to an officer of the Company. (December 31, 2022 - $185,576)

| 5. |

CAPITAL STOCK AND ADDITIONAL PAID IN CAPITAL

|

The holders of common stock are entitled to one vote for each share held. There are no restrictions that limit the Company’s ability to pay dividends on its common stock. The Company has not declared any dividends since incorporation. The Company’s common stock has no par value per common share.

Common Stock Issuances

During the nine-month period ended September 30, 2022, the Company issued 37,803,218 common shares as part of a private placement valued at CAD$0.09 per share. In addition, the Company granted 37,803,218 common share purchase warrants. Each warrant will entitle the holder thereof to purchase one common share in the capital of the Company at an exercise price of CAD$0.1075 at any time up to 5 years following the date of issuance. The warrants attached to the private placement are classified as a derivative liability at an initial value of $1,781,779. During the nine-month period ended September 30, 2023, there were no share issuances.

During the quarter ended September 30, 2022, the holders of 900,000 stock options exercised their options for 900,000 shares for $106,989 (CAD$135,000) at an exercise price of CAD $0.15 per share. During the nine-month period ended September 30, 2023, no stock options were exercised.

|

Scandium International Mining Corp.

|

|

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

|

|

September 30, 2023

|

|

(Expressed in US Dollars) (Unaudited)

|

|

5.

|

CAPITAL STOCK AND ADDITIONAL PAID IN CAPITAL (cont’d…)

|

Warrants

A summary of warrant activity for the nine-month period ended September 30, 2023, are as follows:

| |

|

Number of warrants

|

|

|

Exercise price

|

|

|

Expiry date

|

|

|

Outstanding December 31, 2021

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Granted 2022

|

|

|

37,803,218 |

|

|

|

CAD$0.1075 |

|

|

May 20 - June 14, 2027

|

|

|

Outstanding December 31, 2022, and September 30, 2023

|

|

|

37,803,218 |

|

|

|

CAD$0.1075 |

|

|

May 20 - June 14, 2027

|

|

A fair value of the derivative liability of $1,781,779 was estimated on the date of the subscription using the Black-Scholes pricing model. A fair value of the derivative liability of $1,194,885 was estimated at December 31, 2022, using the Black-Scholes pricing mode. For the nine-month period ended September 30, 2023, there was a non-cash gain on derivative liability – warrants of $714,209 and an unrealized foreign exchange gain of $2,832 resulting in a fair value as at September 30, 2023 of $477,844 with the following weighted average assumptions:

| |

|

September 30, 2023

|

|

|

Issuance date

|

|

|

Exercise price

|

|

CAD$ |

0.1075 |

|

|

CAD$ |

0.1075 |

|

|

Stock price

|

|

CAD$ |

0.035 |

|

|

CAD$ |

0.09 |

|

|

Expected term (in years)

|

|

|

3.73 |

|

|

|

5 |

|

|

Expected dividend yield

|

|

|

- |

|

|

|

- |

|

|

Expected stock price volatility

|

|

|

100.66 |

%

|

|

|

85.69 |

%

|

|

Risk-free interest rate

|

|

|

3.93 |

%

|

|

|

2.73 |

%

|

Stock Options

The Company established a stock option plan (the “Plan”) under which it is authorized to grant options to executive officers and directors, employees and consultants and the number of options granted under the Plan shall not exceed 15% of the shares outstanding. Under the Plan, the exercise period of the options may not exceed ten years from the date of grant and vesting is determined by the Board of Directors.

Stock option transactions are summarized as follows:

| |

|

Stock Options

|

|

| |

|

Number

|

|

|

Weighted average

exercise price in Canadian $

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Outstanding, December 31, 2021

|

|

|

34,615,000 |

|

|

$ |

0.18 |

|

|

Granted

|

|

|

5,700,000 |

|

|

|

0.09 |

|

|

Exercised

|

|

|

(900,000 |

)

|

|

|

0.15 |

|

|

Expired

|

|

|

(3,535,000 |

)

|

|

|

0.37 |

|

| |

|

|

|

|

|

|

|

|

|

Outstanding, December 31, 2022

|

|

|

34,665,000 |

|

|

|

0.14 |

|

|

Expired

|

|

|

(6,050,000 |

) |

|

|

0.22 |

|

| |

|

|

|

|

|

|

|

|

|

Outstanding, September 30, 2023

|

|

|

28,615,000 |

|

|

$ |

0.12 |

|

| |

|

|

|

|

|

|

|

|

|

Number currently exercisable

|

|

|

27,190,000 |

|

|

$ |

0.12 |

|

|

Scandium International Mining Corp.

|

|

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

|

|

September 30, 2023

|

|

(Expressed in US Dollars) (Unaudited)

|

|

5.

|

CAPITAL STOCK AND ADDITIONAL PAID IN CAPITAL (cont’d…)

|

As at September 30, 2023, incentive stock options were outstanding as follows:

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Number of

Options

Outstanding

|

|

|

Number of

Options

Exercisable

|

|

|

Exercise

Price in

Canadian $

|

|

Expiry Date

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Options

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

3,240,000 |

|

|

|

3,240,000 |

|

|

|

0.150 |

|

May 9, 2024

|

| |

|

|

50,000 |

|

|

|

50,000 |

|

|

|

0.130 |

|

June 24, 2024

|

| |

|

|

7,450,000 |

|

|

|

7,450,000 |

|

|

|

0.065 |

|

March 19, 2025

|

| |

|

|

100,000 |

|

|

|

100,000 |

|

|

|

0.075 |

|

May 22, 2025

|

| |

|

|

5,900,000 |

|

|

|

5,900,000 |

|

|

|

0.140 |

|

November 13, 2025

|

| |

|

|

6,175,000 |

|

|

|

6,175,000 |

|

|

|

0.180 |

|

May 23, 2026

|

| |

|

|

5,700,000 |

|

|

|

4,275,000 |

|

|

|

0.090 |

|

June 24, 2027

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

28,615,000 |

|

|

|

27,190,000 |

|

|

|

|

|

|

As at September 30, 2023 the Company’s outstanding and exercisable stock options have an aggregate intrinsic value of $Nil (December 31, 2022 - $Nil).

Stock-based compensation

During the 9-month period ended September 30, 2023, the Company recognized as part of salaries and benefits, stock-based compensation of $59,539 (September 30, 2022- $149,669) in the statement of operations and comprehensive income (loss). There were nil stock options granted during the 9-month period ended September 30, 2023 (September 30, 2022 – 5,700,000).

The weighted average fair value of the options granted in the period ended September 30, 2023, was $Nil (September 30, 2022 – C$0.06)

The fair value of all compensatory options granted is estimated on grant date using the Black-Scholes option pricing model. The weighted average assumptions used in calculating the fair values of stock options granted in the 9-month period ended September 30 are as follows:

| |

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

Risk-free interest rate

|

|

|

N/A |

|

|

|

2.79 |

% |

|

Expected life (in years)

|

|

|

N/A |

|

|

|

5 |

|

|

Volatility

|

|

|

N/A |

|

|

|

85.82 |

% |

|

Forfeiture rate

|

|

|

N/A |

|

|

|

N/A |

|

|

Dividend rate

|

|

|

N/A |

|

|

|

N/A |

|

| |

|

Number

|

|

|

Amount

|

|

| |

|

|

|

|

|

|

|

|

|

Treasury shares, September 30, 2023, and December 31 2022

|

|

|

1,033,333 |

|

|

$ |

1,264,194 |

|

Treasury shares comprise shares of the Company which cannot be sold without the prior approval of the TSX.

|

Scandium International Mining Corp.

|

|

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

|

|

September 30, 2023

|

|

(Expressed in US Dollars) (Unaudited)

|

The Company’s mineral properties are located in Australia. The Company’s capital assets’ geographic information is as follows:

|

September 30, 2023

|

|

Australia

|

|

|

United States

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mineral property interests

|

|

|

704,053 |

|

|

|

- |

|

|

|

704,053 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

$ |

704,053 |

|

|

$ |

- |

|

|

$ |

704,053 |

|

|

December 31, 2022

|

|

Australia

|

|

|

United States

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mineral property interests

|

|

|

704,053 |

|

|

|

- |

|

|

|

704,053 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

$ |

704,053 |

|

|

$ |

- |

|

|

$ |

704,053 |

|

During the nine-month period ended September 30, 2022, the Company recognized a recovery on historical accruals it has recorded totaling $669,733 to related parties (Note 5) and $362,311 to former contractors and consultants.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of the operating results, corporate activities and financial condition of Scandium International Mining Corp. (hereinafter referred to as “we”, “us”, “Scandium International”, “SCY”, or the “Company”) and its subsidiaries provides an analysis of the operating and financial results between December 31, 2022, and September 30, 2023, and a comparison of the material changes in our results of operations and financial condition between the three and nine month periods ended September 30, 2023, and the three and nine month periods ended September 30, 2022. This discussion should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Report on Form 10-K for the year ended December 31, 2022.

This discussion and analysis contain forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including, but not limited to, those set forth under the heading “Risk Factors and Uncertainties” in our Annual Report on Form 10-K for the year ended December 31, 2022, and elsewhere in this Quarterly Report on Form 10-Q.

The condensed interim statements have been prepared in accordance with US Generally Accepted Accounting Principles, as required under U.S. federal securities laws applicable to the Company, and as permitted under applicable Canadian securities laws. The Company is a reporting company under applicable securities laws in Canada and the United States. The reporting currency used in our financial statements is the United States Dollar.

The information contained within this report is current as of November 14, 2023, unless otherwise noted. Additional information relevant to the Company’s activities can be found on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Technical information in this Form 10Q, including the MD&A, has been reviewed and approved by John Thompson, a Qualified Person as defined by Canadian National Instrument 43-101 (“NI 43-101”).

Cautionary Note to U.S. Investors Regarding Reserve and Resource Estimates

The Company uses Canadian Institute of Mining, Metallurgy and Petroleum definitions for the terms “proven reserves”, “probable reserves”, “measured resources” and “indicated resources.” U.S. investors are cautioned that while these terms are recognized and required by Canadian regulations, including National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”), the U.S. Securities and Exchange Commission (“SEC”) does not recognize them. Canadian mining disclosure standards differ from the requirements of the SEC under SEC Industry Guide 7, and reserve and resource information referenced in this Form 10-Q may not be comparable to similar information disclosed by companies reporting under U.S. standards. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserve.” Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources” or “indicated mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. Disclosure of “contained ounces” in a resource estimate is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves in compliance with NI 43-101 may not qualify as “reserves” under SEC standards.

Cautionary Note Regarding Forward-Looking Statements

Certain statements made in this Quarterly Report on Form 10-Q may constitute forward-looking statements about the Company and its business. Forward-looking statements are statements that are not historical facts and include, but are not limited to, reserve and resource estimates, estimated value of the project, projected investment returns, anticipated mining and processing methods for the project, the estimated economics of the project, anticipated scandium recoveries, production rates, scandium grades, estimated capital costs, operating cash costs and total production costs, planned additional processing work and environmental permitting. The forward-looking statements in this report are subject to various risks, uncertainties and other factors that could cause the Company's actual results or achievements to differ materially from those expressed in or implied by forward-looking statements. These risks, uncertainties and other factors include, without limitation, risks related to uncertainty in the demand for scandium and pricing assumptions; uncertainties related to raising sufficient financing to fund the Nyngan Scandium Project in a timely manner and on acceptable terms; changes in planned work resulting from logistical, technical or other factors; the possibility that results of work will not fulfill expectations and realize the perceived potential of the Company's properties; uncertainties involved in the estimation of scandium reserves and resources; the possibility that required permits may not be obtained in a timely manner or at all; the possibility that capital and operating costs may be higher than currently estimated and may preclude commercial development or render operations uneconomic; the possibility that the estimated recovery rates may not be achieved; risk of accidents, equipment breakdowns and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in the work program; risks related to projected project economics, recovery rates, and estimated NPV(“Net Present Value”) and anticipated IRR(“Internal Rate of Return”) and other factors identified in the Company's SEC filings and its filings with Canadian securities regulatory authorities. Forward-looking statements are based on the beliefs, opinions and expectations of the Company's management at the time they are made, and other than as required by applicable securities laws, the Company does not assume any obligation to update its forward-looking statements if those beliefs, opinions or expectations, or other circumstances, change.

Scandium International Corporate Overview

Scandium International is a specialty metals and alloys company focused on developing the production and sale of scandium and other specialty metals. The Company intends to utilize its know-how and, in certain instances, patented technologies to maximize opportunities in scandium and other specialty metals.

In the first half of 2023, we conducted two drill programs, one for Honeybugle and one for Nyngan, with the goal of further delineating both resources.

In October 2023, the Company commenced physical development of the Nyngan Scandium Project including:

• Survey conducted of the site to establish and peg the boundaries for proposed work in accordance with with State Significant Development 5157 (“SSD 5157”).

• Soil management works including the establishment of water exclusion bunds and the stripping of topsoil, with subsequent stockpiling.

• Construction and placement of temporary office quarters at the site for future site planning activities.

These actions signify a critical step in the timeline of work on the Nyngan Scandium Project, as the Company breaks ground at the site, marking the physical commencement of activities under SSD 5157.

2022

During the first quarter of 2022, SCY completed an internal review of its portfolio of assets and projects. The purpose of this review was to determine the appropriate allocation of capital between the Company’s scandium activities and the recently announced initiatives on Critical Metals Recovery (CMR) and High Purity Alumina (HPA). The board decided, and announced on April 18, 2022, that the best return on invested capital for its shareholders is to prioritize the Company’s portfolio of scandium assets, including the Nyngan Scandium Project that already holds a mining license, and to idle its CMR and HPA initiatives. As a result of the review, leadership changes were also made with the appointment of an interim CEO and CFO and a downsizing of the board to four directors.

Corporate activity during the second quarter of 2022 focused on increasing our financial strength through a non-brokered equity private placement and reducing costs. SCY raised aggregate gross proceeds of C$3,402,290 through the sale of 37,803,218 units (a “Unit”) spanning three tranches and closing dates. The aggregate proceeds exceed the C$3,000,000 placement amount originally announced to the market. Each Unit consists of one common share of the Company (a “Common Share”) and one share purchase warrant (a “Warrant”). Each Warrant will entitle the holder to acquire a Common Share at C$0.1075 for sixty (60) months from date of closing of each tranche. The net proceeds from the sale of the Units will be used towards the maintenance of the Company’s scandium minerals properties and for general and administrative expenses.

During the second and third quarters of 2022, SCY was successful in reducing corporate SG&A costs on an absolute and ongoing basis including reversing over $1 million in accruals during the first nine months of 2022 and achieving positive working capital. Management has implemented a plan to reduce annual ongoing expenses to $500,000 or less and as part of the plan the CEO and CFO have agreed to forgo cash compensation in order to reduce expenses.

During the third quarter of 2022, we filed a new mine lease application to re-establish the original Mining License and give access to the full scandium resource at Nyngan. The application is pending with governmental authorities.

Background

The Company was formed in 2006, under the name Golden Predator Mines Inc. As part of a reorganization and spin-out of the Company’s precious metals portfolio in March 2009, the Company changed its name to EMC Metals Corp. In order to reflect our emphasis on mining for scandium minerals, effective November 19, 2014, we changed our name to Scandium International Mining Corp. The Company currently trades on the Toronto Stock Exchange under the symbol “SCY”.

Our focus of operations is the exploration and development of the Nyngan scandium deposit located in New South Wales (“NSW”), Australia (“Nyngan” or the “Nyngan Scandium Project.”) We also hold exploration-stage properties in Australia, known as the “Honeybugle Scandium Property,” and in Finland, known as the “Kiviniemi Scandium Property.”

We acquired a 100% interest in the Nyngan Scandium Project in June of 2014 pursuant to the terms of a settlement agreement with Jervois Mining Ltd. of Melbourne, Australia. The project is held through our Australian subsidiary, EMC Metals Australia Pty Ltd. (“EMC Australia”), which also holds the Honeybugle Scandium Property.

During the third quarter of 2015, the Company converted a $2,500,000 loan from Scandium Investments LLC (“SIL”), an unrelated investment company, into a 20% minority interest in EMC Australia. As a result, from the third quarter 2015 until October 2017, the Company held an 80% equity interest in EMC Australia, with SIL holding a 20% interest. EMC Australia was operated as a joint venture between SIL and SCY with SIL holding a carried interest in the Nyngan Scandium Project until the Company met certain development milestones. The Company completed the development milestones during May 2017, and triggered a limited period option whereby SIL had a right to convert the fair market value of its 20% interest in EMC Australia into an equivalent value of SCY common shares, at then prevailing market prices.

In June of 2017, the Company entered into a share exchange agreement with SIL for the purchase of SIL’s 20% interest in EMC Australia in exchange for 57,371,565 common shares of SCY as well as an additional 1,459,080 common shares as a royalty adjustment payment. Closing of the purchase of the EMC Australia shares was subject to shareholder approval, which the Company obtained at a special meeting of shareholders held on September 11, 2017. The transaction subsequently closed on October 9, 2017. Under the terms of the share purchase agreement, on closing SIL was granted the right to nominate two individuals to the board of the Company for so long as SIL held at least 15% of Scandium’s issued and outstanding shares, and one director for so long as SIL held at least 5% but less than 15% of Scandium’s issued and outstanding shares. Pursuant to the nomination rights, Peter Evensen and R. Christian Evensen were appointed as directors to the SCY Board on closing of the transaction.

Principal Properties Review

Nyngan Scandium Project (NSW, Australia)

Nyngan Property Description and Location

The Nyngan Scandium Project site is located approximately 450 kilometers northwest of Sydney, NSW, Australia and approximately 20 kilometers due west of the town of Nyngan, a rural town of approximately 1,900 people. The general area can be characterized as flat countryside and is classified as agricultural land, used predominantly for wheat farming and livestock grazing.

Figure 1: Location of Nyngan Project

Note: None of the Existing Mines identified in Figure 1 produce scandium.

Figure 2: Location of the Exploration Licenses and Mining Lease for the Nyngan Scandium Project

Note: All Exploration Licenses and Leases described in Figure 2 are held 100% by EMC-A.

Recent Nyngan Drilling Results