false

0001651407

0001651407

2023-11-13

2023-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 13, 2023

Checkpoint Therapeutics, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-38128 |

|

47-2568632 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer Identification No.) |

95 Sawyer Road, Suite 110,

Waltham, MA 02453

(Address of Principal Executive Offices)

(781) 652-4500

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2b under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange

Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which

registered |

| Common Stock, par value $0.0001 per share |

CKPT |

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company x

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02. Results of Operations and Financial Condition.

On November 13, 2023,

Checkpoint Therapeutics, Inc. issued a press release to provide a corporate update and to announce its financial results for the third

quarter ended September 30, 2023. A copy of such press release is being furnished as Exhibit 99.1 to this report.

The information, including

Exhibit 99.1, in this Form 8-K is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Form 8-K shall not

be incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall otherwise be expressly set

forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit is furnished herewith:

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Checkpoint Therapeutics, Inc. |

| |

(Registrant) |

| |

|

| |

|

| Date: November 13, 2023 |

By |

/s/ James F. Oliviero |

| |

|

James F. Oliviero |

| |

|

President and Chief Executive Officer |

Exhibit 99.1

Checkpoint Therapeutics Reports Third Quarter

2023 Financial Results and Recent Corporate Highlights

Biologics License Application

for cosibelimab under review by U.S. FDA; PDUFA goal date of January 3, 2024

Recent publication

of cosibelimab pivotal trial results in the Journal for ImmunoTherapy of Cancer

Waltham, MA – November 13, 2023 –

Checkpoint Therapeutics, Inc. (“Checkpoint”) (Nasdaq: CKPT), a clinical-stage immunotherapy and targeted oncology company,

today announced financial results for the third quarter ended September 30, 2023, and recent corporate highlights.

“The January 3, 2024, action date for our

Biologics License Application (“BLA”) for cosibelimab is fast-approaching, and we continue to work closely with the U.S. Food

and Drug Administration (“FDA”) in completing their review,” said James Oliviero, President and Chief Executive Officer

of Checkpoint. “During the third quarter, pivotal trial results for cosibelimab in metastatic cutaneous squamous cell carcinoma

(“cSCC”) were published in the peer-reviewed Journal for ImmunoTherapy of Cancer, which further supports the efficacy

and safety of cosibelimab. We also reported longer-term data from our pivotal trials in both locally advanced and metastatic cSCC that

demonstrate a deepening of response over time with substantially higher complete response rates. We firmly believe that cosibelimab’s

clinical profile, which includes a unique dual mechanism of action and favorable safety profile, should position the product, upon its

potential launch next year, as the preferred immunotherapy of oncologists, particularly for the large number of difficult-to-treat cSCC

patients who continue to suffer poor outcomes with currently available treatments.”

Recent Corporate Highlights:

| ● | Checkpoint submitted a BLA to the FDA seeking approval of

cosibelimab in January 2023. In March 2023, Checkpoint announced the FDA accepted the BLA filing for cosibelimab and set a Prescription

Drug User Fee Act (“PDUFA”) goal date of January 3, 2024. The FDA has indicated that an advisory committee meeting to discuss

the application is not planned. |

| ● | In July 2023, Checkpoint announced new, longer-term data

for cosibelimab from its pivotal studies in locally advanced and metastatic cSCC. These results demonstrate a deepening of response with

cosibelimab treatment over time, resulting in substantially higher complete response rates than previously reported. Furthermore, responses

continue to remain durable over time. |

| ● | Also in July 2023, Checkpoint completed a registered direct

offering priced at-the-market under Nasdaq rules for total gross proceeds of $10 million. |

| ● | In October 2023, Checkpoint announced the exercise of previously

issued warrants for $11.13 million in gross proceeds. |

| ● | Also

in October 2023, Checkpoint announced the publication of results from the multicenter, multiregional,

pivotal trial evaluating cosibelimab in patients with metastatic cSCC in the Journal for

ImmunoTherapy of Cancer (JITC), the peer-reviewed, online journal of the Society of Immunotherapy

of Cancer. The paper, entitled, “Efficacy and Safety of Cosibelimab, an Anti–PD-L1

Antibody, in Metastatic Cutaneous Squamous Cell Carcinoma” (doi:10.1136/jitc-2023-007637),

describes safety and efficacy results from 78 patients with metastatic cSCC enrolled at clinical

sites in eight countries. |

Financial Results:

| ● | Cash Position: As of September 30, 2023, Checkpoint’s

cash and cash equivalents totaled $1.8 million, compared to $7.4 million at June 30, 2023 and $12.1 million at December 31, 2022, a decrease

of $5.6 million for the quarter and a decrease of $10.3 million for the first nine months of 2023. Subsequent to the end of the third

quarter, Checkpoint raised approximately $11.13 million of gross proceeds from the exercise of previously issued warrants. |

| ● | R&D Expenses: Research and development expenses

for the third quarter of 2023 were $5.5 million, compared to $8.9 million for the third quarter of 2022, a decrease of $3.4 million.

Research and development expenses for the third quarters of 2023 and 2022 both included $0.3 million of non-cash stock expenses. |

| ● | G&A Expenses: General and administrative expenses

for the third quarter of 2023 were $2.2 million, compared to $1.8 million for the third quarter of 2022, an increase of $0.4 million.

General and administrative expenses for the third quarter of 2023 included $0.6 million of non-cash stock expenses, compared to $0.5

million for the third quarter of 2022. |

| ● | Net Loss: Net loss attributable to common stockholders

for the third quarter of 2023 was $5.7 million, or $0.29 per share, compared to a net loss of $10.6 million, or $1.20 per share, in the

third quarter of 2022. Net loss for the third quarter of 2023 included $0.9 million of non-cash stock expenses, compared to $0.8 million

for the third quarter of 2022. |

About Checkpoint Therapeutics

Checkpoint Therapeutics, Inc. (“Checkpoint”)

is a clinical-stage immunotherapy and targeted oncology company focused on the acquisition, development and commercialization of novel

treatments for patients with solid tumor cancers. Checkpoint is evaluating its lead antibody product candidate, cosibelimab, a potential

best-in-class anti-PD-L1 antibody licensed from the Dana-Farber Cancer Institute, in an ongoing open-label, multi-regional, multicohort

Phase 1 clinical trial in checkpoint therapy-naïve patients with selected recurrent or metastatic cancers, including cohorts in

metastatic and locally advanced cSCC intended to support one or more applications for marketing approval. Based on positive topline and

interim results in metastatic and locally advanced cSCC, respectively, Checkpoint submitted a BLA for these indications in January 2023,

which application is filed and under review with a PDUFA goal date of January 3, 2024. Checkpoint is evaluating its lead small-molecule,

targeted anti-cancer agent, olafertinib (formerly CK-101), a third-generation epidermal growth factor receptor (“EGFR”) inhibitor,

as a potential new treatment for patients with EGFR mutation-positive non-small cell lung cancer. Checkpoint is headquartered in Waltham,

MA and was founded by Fortress Biotech, Inc. (Nasdaq: FBIO). For more information, visit www.checkpointtx.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934,

each as amended, that involve a number of risks and uncertainties. For those statements, we claim the protection of the safe harbor for

forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited

to, statements regarding the FDA review of the BLA for the approval of cosibelimab for the treatment of patients with metastatic or locally

advanced cSCC who are not candidates for curative surgery or radiation and the commercial potential of cosibelimab if the BLA is approved,

statements relating to the potential differentiation of cosibelimab, including a potentially favorable safety profile as compared to the

currently available anti-PD-1 therapies, the two-fold mechanism of action of cosibelimab translating into potential enhanced efficacy,

and our projections of publication and regulatory review timelines. Factors that could cause our actual results to differ materially include

the following: the risk that topline and interim data remains subject to audit and verification procedures that may result in the final

data being materially different from the topline or interim data we previously published; the risk that safety issues or trends will be

observed in the clinical trial when the full safety dataset is available and analyzed; the risk that a positive primary endpoint does

not translate to all, or any, secondary endpoints being met; risks that regulatory authorities will not accept an application for approval

of cosibelimab based on data from the Phase 1 clinical trial; the risk that the clinical results from the Phase 1 clinical trial will

not support regulatory approval of cosibelimab to treat cSCC or, if approved, that cosibelimab will not be commercially successful; risks

related to our chemistry, manufacturing and controls and contract manufacturing relationships; risks related to our ability to obtain,

perform under and maintain financing and strategic agreements and relationships; risks related to our need for substantial additional

funds; other uncertainties inherent in research and development; our dependence on third-party suppliers; government regulation; patent

and intellectual property matters; competition; unfavorable market or other economic conditions; and our ability to achieve the milestones

we project, including the risk that the evolving and unpredictable Russia/Ukraine conflict and COVID-19 pandemic delay achievement of

those milestones. Further discussion about these and other risks and uncertainties can be found in our Annual Report on Form 10-K, and

in our other filings with the U.S. Securities and Exchange Commission. The information contained herein is intended to be reviewed in

its totality, and any stipulations, conditions or provisos that apply to a given piece of information in one part of this press release

should be read as applying mutatis mutandis to every other instance of such information appearing herein.

Any forward-looking statements set forth in this

press release speak only as of the date of this press release. We expressly disclaim any obligation or undertaking to release publicly

any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations or any changes in

events, conditions or circumstances on which any such statement is based, except as required by law. This press release and prior releases

are available at www.checkpointtx.com. The information found on our website is not incorporated by reference into this press release and

is included for reference purposes only.

Company Contact:

Jaclyn Jaffe

Checkpoint Therapeutics, Inc.

(781) 652-4500

ir@checkpointtx.com

Investor Relations Contact:

Ashley R. Robinson

Managing Director, LifeSci Advisors, LLC

(617) 430-7577

arr@lifesciadvisors.com

Media Relations Contact:

Katie Kennedy

Gregory FCA

610-731-1045

Checkpoint@gregoryfca.com

CHECKPOINT THERAPEUTICS, INC.

CONDENSED BALANCE SHEETS

(in thousands, except share and per share amounts)

(Unaudited)

| |

|

September 30, 2023 |

|

|

December 31, 2022 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,772 |

|

|

$ |

12,068 |

|

| Prepaid expenses and other current assets |

|

|

415 |

|

|

|

1,149 |

|

| Other receivables - related party |

|

|

31 |

|

|

|

73 |

|

| Total current assets |

|

|

2,218 |

|

|

|

13,290 |

|

| Total Assets |

|

$ |

2,218 |

|

|

$ |

13,290 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable and accrued expenses |

|

$ |

16,390 |

|

|

$ |

20,297 |

|

| Accounts payable and accrued expenses - related party |

|

|

2,880 |

|

|

|

1,306 |

|

| Common stock warrant liabilities |

|

|

1,991 |

|

|

|

11,170 |

|

| Total current liabilities |

|

|

21,261 |

|

|

|

32,773 |

|

| Total Liabilities |

|

|

21,261 |

|

|

|

32,773 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ (Deficit) Equity |

|

|

|

|

|

|

|

|

| Common Stock ($0.0001 par value), 80,000,000 and 50,000,000 shares authorized as of September 30, 2023 and December 31, 2022, respectively |

|

|

|

|

|

|

|

|

| Class A common shares, 700,000 shares issued and outstanding as of September 30, 2023 and December 31, 2022 |

|

|

- |

|

|

|

- |

|

| Common shares, 21,702,547 and 9,586,683 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively |

|

|

2 |

|

|

|

1 |

|

| Common stock issuable, 0 and 368,907 shares as of September 30, 2023 and December 31, 2022, respectively |

|

|

- |

|

|

|

1,885 |

|

| Additional paid-in capital |

|

|

276,160 |

|

|

|

241,117 |

|

| Accumulated deficit |

|

|

(295,205 |

) |

|

|

(262,486 |

) |

| Total Stockholders’ (Deficit) Equity |

|

|

(19,043 |

) |

|

|

(19,483 |

) |

| Total Liabilities and Stockholders’ (Deficit) Equity |

|

$ |

2,218 |

|

|

$ |

13,290 |

|

CHECKPOINT THERAPEUTICS, INC.

CONDENSED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts)

(Unaudited)

| | |

For the three months ended September 30, | | |

For the nine months ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue - related party | |

$ | 31 | | |

$ | 48 | | |

$ | 97 | | |

$ | 118 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 5,496 | | |

| 8,866 | | |

| 35,267 | | |

| 35,589 | |

| General and administrative | |

| 2,236 | | |

| 1,846 | | |

| 6,809 | | |

| 6,218 | |

| Total operating expenses | |

| 7,732 | | |

| 10,712 | | |

| 42,076 | | |

| 41,807 | |

| Loss from operations | |

| (7,701 | ) | |

| (10,664 | ) | |

| (41,979 | ) | |

| (41,689 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 7 | | |

| 52 | | |

| 81 | | |

| 87 | |

| Gain on common stock warrant liabilities | |

| 1,970 | | |

| - | | |

| 9,179 | | |

| - | |

| Total other income | |

| 1,977 | | |

| 52 | | |

| 9,260 | | |

| 87 | |

| Net Loss | |

$ | (5,724 | ) | |

$ | (10,612 | ) | |

$ | (32,719 | ) | |

$ | (41,602 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per Share: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted net loss per common share outstanding | |

$ | (0.29 | ) | |

$ | (1.20 | ) | |

$ | (2.07 | ) | |

$ | (4.78 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted weighted average number of common shares outstanding | |

| 19,988,079 | | |

| 8,856,750 | | |

| 15,842,693 | | |

| 8,705,529 | |

v3.23.3

Cover

|

Nov. 13, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 13, 2023

|

| Entity File Number |

001-38128

|

| Entity Registrant Name |

Checkpoint Therapeutics, Inc.

|

| Entity Central Index Key |

0001651407

|

| Entity Tax Identification Number |

47-2568632

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

95 Sawyer Road

|

| Entity Address, Address Line Two |

Suite 110

|

| Entity Address, City or Town |

Waltham

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02453

|

| City Area Code |

781

|

| Local Phone Number |

652-4500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

CKPT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

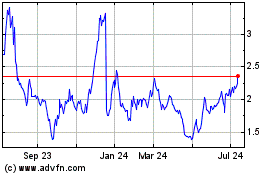

Checkpoint Therapeutics (NASDAQ:CKPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

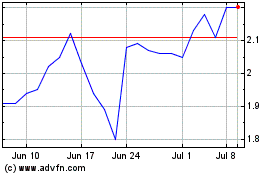

Checkpoint Therapeutics (NASDAQ:CKPT)

Historical Stock Chart

From Apr 2023 to Apr 2024