Filed

pursuant to Rule 424(b)(3)

Registration Number 333-275410

PROSPECTUS

12,569,564

Common Shares

InMed

Pharmaceuticals Inc.

This prospectus relates to the offer and resale by the selling shareholders

identified herein, or the Selling Shareholders, or any of their pledgees, donees, assignees and successors-in-interest, or collectively,

the permitted transferees, of up to 12,569,564 of our common shares, no par value per share, or the common shares, consisting of (i) consisting

of (i) 3,012,049 common shares issuable upon exercise of pre-funded warrants issued in the Purchase Agreement, (ii) 3,012,049 common shares

issuable upon exercise of preferred investment options issued to the Selling Shareholders in the Purchase Agreement and (iii) 6,545,466

common shares issuable upon the exercise of preferred investment options issued to the Selling Shareholders in the Private Placement.

See “Prospectus Summary—Recent Developments—Private Placement” for additional information.

We

will not receive any proceeds from the sale of common shares by the Selling Shareholders. However, upon (i) the cash exercise of the

pre-funded warrants, we will receive the exercise price of such warrants, for an aggregate of approximately $301.20 and (ii) the cash

exercise of the preferred investment options, we will receive the exercise price of such options, for an aggregate of approximately $7.9

million. We will bear all fees and expenses incident to our obligation to register the common shares covered by this prospectus. Brokerage

fees, underwriting discounts and commissions, and similar expenses, if any, attributable to the sale of common shares offered hereby

will be borne by the applicable Selling Shareholder.

The

Selling Shareholders and any of their permitted transferees may offer and sell the common shares covered by this prospectus in a number

of different ways and at varying prices. See “Plan of Distribution” beginning on page 17 for additional information.

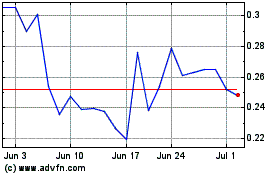

Our

common shares are listed on the Nasdaq Capital Market under the symbol “INM”. On November 10, 2023, the last reported sale

price of our common shares on the Nasdaq Capital Market was $0.39 per share.

We

are an “emerging growth company” and a “smaller reporting company” under the federal securities laws and are

subject to reduced public company reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth

Company and a Smaller Reporting Company.”

Investing

in our common shares involves a high degree of risk. Before you invest in our common shares, you should carefully read the section entitled

“Risk Factors” on page 7 of this prospectus, and other risk factors contained in any applicable prospectus supplement

and in the documents incorporated by reference herein and therein.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should carefully read

this entire prospectus, any amendments or supplements, and the documents incorporated or deemed incorporated by reference herein and

therein, before you make your investment decision.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus

dated November 13, 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS AND EXCHANGE RATES

You

should rely only on the information contained in, or incorporated by reference into, this prospectus, and any applicable prospectus supplement

or free writing prospectus that we have authorized for use in connection with this offering. Neither we nor the Selling Shareholders

have authorized anyone to provide you with additional information or information that is different. This prospectus is an offer to sell

only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. The information appearing

in this prospectus is accurate only as of the date of this prospectus and any information we have incorporated by reference is accurate

only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or of any sale of

the common shares offered hereby. Our business, financial condition, results of operations and prospects may have changed since those

dates.

We

obtained the industry, market and competitive position data in this prospectus and the documents incorporated by reference herein from

our own internal estimates and research as well as from industry and general publications and research surveys and studies conducted

by third parties. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these

estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports.

The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described

under the heading “Risk Factors” in this prospectus and under similar headings in the documents incorporated by reference

into this prospectus, that could cause results to differ materially from those expressed or implied in these publications and reports.

For

investors outside the United States: Neither we nor the Selling Shareholders have done anything that would permit this offering or possession

or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons

who come into possession of this prospectus in a jurisdiction outside the United States must inform themselves about, and observe any

restrictions relating to, this offering and the distribution of this prospectus.

This

prospectus contains references to our trademark and to trademarks, trade names and service marks belonging to other entities. Solely

for convenience, trademarks, trade names and service marks referred to in this prospectus, including logos, artwork and other visual

displays, may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we or the

applicable licensor will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor

to these trademarks, trade names and service marks. We do not intend our use or display of other entities’ trade names, trademarks

or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other entities.

Unless

otherwise indicated, references in this prospectus to “$” or “United States dollars” are to United States dollars.

Canadian dollars are referred as “Canadian dollars” or “C$”.

The

high, low, average and closing rates for Canadian dollars in terms of the United States dollar for each of the periods indicated, as

quoted by the Bank of Canada, were as follows:

| | |

Year Ended June 30 | |

| | |

2023 | | |

2022 | | |

2021 | |

| High for period | |

C$ | 1.3716 | | |

C$ | 1.3039 | | |

C$ | 1.3616 | |

| Average for the period | |

C$ | 1.3394 | | |

C$ | 1.2659 | | |

C$ | 1.2823 | |

| Low for period | |

C$ | 1.2918 | | |

C$ | 1.2329 | | |

C$ | 1.2040 | |

| Rate at end of period | |

C$ | 1.3297 | | |

C$ | 1.2886 | | |

C$ | 1.2394 | |

On November 7, 2022, the Bank of Canada daily rate of exchange was

$1.00 = C$1.3764 or C$1.00 = $0.7265.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained in other parts of this prospectus. Because it is only a summary, it does not contain

all of the information that you should consider before investing in our securities and it is qualified in its entirety by, and should

be read in conjunction with, this entire prospectus and the information incorporated herein by reference to our other filings with the

Securities and Exchange Commission, or SEC. Investing in our securities involves a high degree of risk. You should carefully consider

the risks and uncertainties described herein or incorporated by reference herein, together with all of the other information in this

prospectus, including our financial statements and related notes, before investing in our securities. If any of the risks described herein

or incorporated by reference herein materialize, our business, financial condition, operating results and prospects could be materially

and adversely affected. In that event, the price of our securities could decline, and you could lose part or all of your investment.

Unless

the context indicates otherwise, as used in this prospectus, the terms “we,” “us,” “our,” “our

company,” “our business” or similar terms, refer to InMed Pharmaceuticals Inc., and our wholly-owned subsidiaries.

Overview

We

are a clinical stage pharmaceutical company developing a pipeline of prescription-based products, including rare cannabinoids and novel

cannabinoid analogs, targeting the treatment of diseases with high unmet medical needs (“Product Candidates”). We are dedicated

to delivering new therapeutic alternatives to patients and consumers who may benefit from cannabinoid-based products. Our approach leverages

on the several thousand years’ history of health benefits attributed to the Cannabis plant and brings this anecdotal information

into the 21st century by applying tried, tested and true scientific approaches to establish non-plant-derived (synthetically manufactured),

individual cannabinoid compounds in important market segments. Such segments include clinically proven, FDA-approved pharmaceuticals,

referred to herein as our “Product Candidates”, and “Products”, synthesized cannabinoids that are provided to

wholesalers and end-product manufacturers in the health and wellness sector. Together with our subsidiary, BayMedica, we are developing

multiple manufacturing approaches for synthesizing rare cannabinoids for potential use in pharmaceutical Product Candidates as well as

leveraging this significant manufacturing know-how as a business to business (B2B) supplier to wholesalers and end-product manufacturers

/ marketers in the health and wellness sector. Our know-how includes traditional approaches such as chemical synthesis and biosynthesis,

as well as a proprietary, integrated manufacturing approach called IntegraSyn. While our activities do not involve direct use of Cannabis

nor extracts from the plant, we note that the US Food and Drug Administration (“FDA”) has, to date, not approved any

marketing application for Cannabis for the treatment of any disease or condition and has approved only one Cannabis-derived

and three Cannabis-related drug products as prescription-based drugs. Our ingredients are synthetically made and, therefore, we

have no interaction with the Cannabis plant. We do not grow nor utilize Cannabis nor its extracts in any of our Products

or Product Candidates and we do not utilize tetrahydrocannabinol (“THC”) or cannabidiol (“CBD”), the most common

cannabinoid compounds that are typically extracted from the Cannabis plant, in any of our Products or Product Candidates. The

API under development for our initial two lead drug candidates, INM-755 for Epidermolysis bullosa (“EB”) and INM-088 for

glaucoma, is cannabinol (“CBN”). Additional uses of both INM-755 and INM-088 are being explored, as well as the application

of novel cannabinoid analogs in our ocular program and for our INM-901 series program to treat neurodegenerative diseases including but

not limited to Alzheimer’s, Parkinson’s, and Huntington’s.

We

believe we are positioned to develop multiple pharmaceutical Product Candidates in diseases which may benefit from medicines based on

rare cannabinoid compounds. Most currently approved cannabinoid therapies are based specifically on CBD and/or THC and are often delivered

orally, which has limitations and drawbacks, such as side effects (including the intoxicating effects of THC). Currently, we intend to

deliver our rare cannabinoid pharmaceutical drug candidates through various topical formulations (cream for dermatology, eye drops for

ocular diseases) as a way of enabling treatment of the specific disease at the site of disease while seeking to minimize systemic exposure

and any related unwanted systemic side effects, including any drug-drug interactions and any metabolism of the active pharmaceutical

ingredient by the liver. The cannabinoids products sold through our B2B raw material supply business are integrated into various product

formats by companies who then further commercializes such products. We access rare cannabinoids via all non-extraction approaches, including

chemical synthesis, biosynthesis and our proprietary integrated IntegraSyn approach, thus negating any interaction with or exposure to

the Cannabis plant.

Additional

information concerning our company and our business is set forth in our most recent annual report on Form 10-K filed with the SEC, which

is incorporated herein by reference and available on our website at https://www.inmedpharma.com/investors/filings/.

Corporate

Information

We

were originally incorporated in the Province of British Columbia, under the Business Corporations Act (British Columbia) (the

“BCBCA”), on May 19, 1981 and we have undergone a number of executive management, corporate name and business sector changes

since this incorporation, ultimately changing our name to “InMed Pharmaceuticals Inc.” on October 6, 2014 to signify our

intent to specialize in cannabinoid pharmaceutical product development. Our principal executive offices are located at Suite 310 –

815 W. Hastings Street, Vancouver, BC, Canada, V6C 1B4 and our telephone number is +1-604-669-7207. Our internet address is https://www.inmedpharma.com/.

Implications

of Being an Emerging Growth Company and a Smaller Reporting Company

We

are an “emerging growth company” as defined in the Securities Act of 1933, as amended, or the Securities Act, as modified

by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we are eligible to take advantage of exemptions from various

disclosure and reporting requirements that are applicable to other public companies that are not “emerging growth companies”

including, but not limited to:

| |

● |

our exemption from the

auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002; |

| |

● |

being permitted to present

only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial

Condition and Results of Operations, in each case, instead of three years; |

| |

● |

reduced disclosure obligations

regarding executive compensation, including no Compensation Disclosure and Analysis; |

| |

● |

our exemption from any

requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement

to the auditor’s report providing additional information about the audit and the financial statements; and |

| |

● |

our exemption from the

requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments

not previously approved. |

We

may take advantage of these exemptions until we are no longer an emerging growth company. We will remain an emerging growth company until

the earliest of (i) June 30, 2026, (ii) the last day of the fiscal year in which we have total annual gross revenue of at least $1.235

billion, (iii) the last day of the fiscal year in which we are deemed to be a “large accelerated filer” as defined in Rule

12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of our common

shares held by non-affiliates exceeded $700.0 million as of the last business day of the second fiscal quarter of such year or (iv) the

date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

We

may choose to take advantage of some but not all of these exemptions. We have taken advantage of reduced reporting requirements in this

prospectus and in the documents incorporated by reference into this prospectus. Accordingly, the information contained or incorporated

by reference herein may be different from the information you receive from other public companies in which you hold stock.

In

addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with

new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until

those standards would otherwise apply to private companies. We have elected to avail ourselves of this extended transition period and,

as a result, we may adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for

non-public companies instead of the dates required for other public companies.

We are also a “smaller reporting company” as defined in

the Exchange Act. We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may take

advantage of certain of the scaled disclosures available to smaller reporting companies until the fiscal year following the determination

that the market value of our voting and non-voting common shares held by non-affiliates is $250 million or more, as measured on the last

business day of our second fiscal quarter, or our annual revenues are less than $100 million during the most recently completed fiscal

year and the market value of our voting and non-voting common shares held by non-affiliates is $700 million or more, as measured on the

last business day of our second fiscal quarter.

Recent

Developments

INM-901

Program Update

On

October 24, 2023 the Company announced it has selected a lead Alzheimer’s disease drug candidate, named INM-901, following positive

results from several proof-of-concept studies in a validated Alzheimer’s disease treatment model. InMed will be advancing INM-901,

a cannabinoid analog, in its pharmaceutical drug development program. Based on early in vitro research, INM-901 showed potential

to target several biological pathways associated with Alzheimer’s, including neuroprotection to the brain neurons from beta-amyloid

peptide-induced toxicity and improving neuronal function via extension of neurite length. In addition to these encouraging in vitro testing

outcomes, INM-901 demonstrated favorable results in an in vivo preclinical Alzheimer’s proof-of-concept model. When compared

to the placebo treated Alzheimer’s disease group in these preclinical studies, INM-901 treatment groups demonstrated a trend towards

improvement in:

| ● | cognitive

function and memory |

| | | |

Planning

is underway for the next stage of advanced preclinical studies and will include drug metabolism and pharmacokinetics as well as initiation

of pharmaceutical drug development activities such as manufacturing and formulation.

Potential

advantages of INM-901 in treating neurological conditions

Several in

vitro and in vivo studies published by third parties support InMed’s finding of the effects of INM-901 in neuronal

disorders:

| ● | Ability

to cross the blood-brain barrier (“BBB”): The blood-brain barrier is

the specialized system of brain microvascular endothelial cells that serves to regulate several

functions: to shield the brain from toxic substances (including viruses, bacteria and other

foreign substances including many drugs); to supply brain tissues with nutrients; and, to

filter harmful compounds from the brain back into the bloodstream. Due to its chemical structure,

INM-901 is highly lipophilic (dissolves readily in fats, oils and lipids) and can easily

cross the BBB, making it a promising drug candidate for pharmaceutical use in the treatment

of neurodegenerative disease of the brain. |

| | | |

| |

● | Targeting

several receptor systems: In addition to the endocannabinoid system, INM-901 is

capable of targeting multiple receptor systems which may be beneficial as a multi-pronged

approach to treating complex diseases of the brain. |

Private Placement

On October 24, 2023, InMed Pharmaceuticals Inc. (the “Company”)

entered into a securities purchase agreement (the “Purchase Agreement”) with two institutional accredited investors (the “Purchasers”),

for the sale and issuance of an aggregate of 3,012,049 of its common shares, no par value (the “Common Shares”) (or pre-funded

warrants in lieu thereof) and unregistered preferred investment options (the “Preferred Investment Options”) to purchase up

to an aggregate of 3,012,049 Common Shares at a purchase price of $0.83 per share and Preferred Investment Option. The foregoing transaction

is referred to herein as the “Private Placement.”

Concurrently

with the Company’s entry into the Purchase Agreement, the Company also entered into an inducement offer letter agreement (the “Inducement

Letter”) with the holders (the “Holders”) of existing preferred investment options to purchase up to an aggregate of

3,272,733 common shares of the Company issued to the Holders on November 21, 2022 (collectively, the “Existing Preferred Investment

Options”). Pursuant to the Inducement Letter, the Holders agreed to exercise for cash their Existing Preferred Investment Options

to purchase an aggregate of 3,272,733 common shares of the Company at a reduced exercise price of $0.83 per share in consideration of

the Company’s agreement to issue new unregistered preferred investment options, which are substantially the same form as the Preferred

Investment Options issued in the Private Placement, (the “New Preferred Investment Options”) to purchase up to an aggregate

of 6,545,466 shares of the Company’s common shares (the “New Preferred Investment Option Shares”). The foregoing transaction

is referred to herein as the “Preferred Investment Option Exercise,” and the Preferred Investment Option Exercise and the

Private Placement are collectively referred to herein as the “Offerings.” On October 26, 2023, the parties consummated the

Offerings.

The

terms of the Offerings are more particularly described below:

The

terms of the Purchase Agreement provided that Purchasers whose purchase of common shares in the Private Placement would result in such

Purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the Purchaser, 9.99%) of the Company’s outstanding

common shares, the option of purchasing pre-funded warrants in lieu of common shares in such manner as to result in the same aggregate

purchase price being paid by such Purchaser to the Company.

In

light of the foregoing beneficial ownership limitations, at the closing of the Private Placement, the Company issued to the Purchasers

(i) pre-funded warrants (the “Pre-Funded Warrant”, and together with the Preferred Investment Options, the “Securities”)

to purchase an aggregate of 3,012,049 common shares and (ii) Preferred Investment Options to purchase up to an aggregate of 3,012,049

common shares. No Common Shares were issued to the Purchasers in the Private Placement.

The

Pre-Funded Warrants have an exercise price of $0.0001 per pre-funded warrant and can be exercised at any time from the date and time

of issuance until the pre-funded warrants are exercised in full. The terms of the Pre-Funded Warrants preclude a holder thereof from

exercising such holder’s pre-funded warrants, and the Company from giving effect to such exercise, if after giving effect to the

issuance of common shares upon such exercise, the holder (together with the holder’s affiliates and any other persons acting as

a group together with the holder or any of the holder’s affiliates) would beneficially own in excess of 9.99% of the number of

common shares outstanding immediately after giving effect to the issuance of common shares upon such exercise.

The

Preferred Investment Options issued to the Purchasers in the Private Placement have an exercise price of $0.83 per share, became exercisable

immediately upon issuance and will expire five and a half years from the date of issuance. The terms of such preferred investment options

preclude a holder thereof from exercising such holder’s preferred investment option, and the Company from giving effect to such

exercise, if after giving effect to the issuance of common shares upon such exercise, the holder (together with the holder’s affiliates

and any other persons acting as a group together with the holder or any of the holder’s affiliates) would beneficially own in excess

of 4.99% of the number of common shares outstanding immediately after giving effect to the issuance of common shares upon such exercise.

A holder may increase or decrease the beneficial

ownership thresholds relating to the pre-funded warrants and preferred investment options specified above, except that the beneficial

ownership limitation may not exceed 9.99% in any event.

In connection with the Private Placement, the Company entered into

a Registration Rights Agreement with the Purchasers, dated October 24, 2023 (the “Registration Rights Agreement”). The Registration

Rights Agreement grants the Purchasers certain registration rights and obligates the Company to file one or more registration statements

with the Securities and Exchange Commission (the “SEC”) by certain dates, covering the resale of the Common Shares issuable

upon exercise of the pre-funded warrants and preferred investment options sold in the Private Placement.

The

pre-funded warrants and preferred investment options described above were offered in a private placement under Section 4(a)(2) of the

Securities Act of 1933, as amended (the “Securities Act”) and Regulation D promulgated thereunder and, along with the common

shares underlying the pre-funded warrants and preferred investment options, have not been registered under the Securities Act or applicable

state securities laws. Accordingly, the pre-funded warrants, preferred investment options and the common shares underlying the pre-funded

warrants and preferred investment options may not be offered or sold in the United States absent registration with the SEC or an applicable

exemption from such registration requirements and in accordance with applicable state securities laws. The securities were offered and

sold only to accredited investors.

The

foregoing descriptions of the Purchase Agreement, the Registration Rights Agreement, the Pre-Funded Warrants and the Preferred Investment

Options issued in the Private Placement are not complete and are qualified in their entirety by the full text of such documents, copies

of which are filed as exhibits to this report and incorporated herein by reference.

Preferred

Investment Option Exercise

Pursuant

to the Preferred Investment Option Exercise, the Holders exercised for cash their Existing Preferred Investment Options to purchase an

aggregate of 3,272,733 common shares of the Company (2,535,733 of which common shares are being held in abeyance for the benefit of the

Holders due to certain beneficial ownership limitations) at a reduced exercise price of $0.83 per share, and in consideration therefor,

the Company’s issued New Preferred Investment Options to purchase up to an aggregate of 6,545,466 common shares of the Company.

The

resale of the common shares underlying the exercised Existing Preferred Investment Options are registered pursuant to an effective registration

statement on Form S-1 (File No. 333-268700), filed with the SEC on December 7, 2022 and declared effective by the SEC on December 14,

2022.

The

New Preferred Investment Options have an exercise price of $0.83 per share, became exercisable immediately upon issuance and will expire

five and a half years from the date of issuance. The terms of the New Preferred Investment Options preclude a holder thereof from exercising

such holder’s New Preferred Investment Option, and the Company from giving effect to such exercise, if after giving effect to the

issuance of common shares upon such exercise, the holder (together with the holder’s affiliates and any other persons acting as

a group together with the holder or any of the holder’s affiliates) would beneficially own in excess of 4.99% of the number of

common shares outstanding immediately after giving effect to the issuance of common shares upon such exercise. A holder may increase

or decrease the aforementioned beneficial ownership threshold, except that the beneficial ownership limitation may not exceed 9.99% in

any event.

The

New Preferred Investment Options were offered in a private placement under Section 4(a)(2) of the Securities Act and Regulation D promulgated

thereunder and, along with the common shares underlying such options, have not been registered under the Securities Act or applicable

state securities laws. Accordingly, the New Preferred Investment Options and the common shares underlying such options may not be offered

or sold in the United States absent registration with the SEC or an applicable exemption from such registration requirements and in accordance

with applicable state securities laws.

The

Company has agreed to file a registration statement providing for the resale of the common shares underlying the New Preferred Investment

Options, as soon as practicable, and to use commercially reasonable efforts to have such registration statement declared effective by

the SEC within 45 calendar days following the date of the Inducement Letter (or, in the event of a “full review” by the SEC,

75 calendar days following the date of the Inducement Letter) and to keep such registration statement effective at all times until no

holder of the New Preferred Investment Options owns any New Preferred Investment Options or common shares underlying New Preferred Investment

Options. Pursuant to the Inducement Letter, the Company has agreed not to issue any common shares or common share equivalents or to file

any other registration statement with the SEC (in each case, subject to certain exceptions) until 60 days after the closing of the Preferred

Investment Option Exercise. The Company has also agreed not to effect or agree to effect any Variable Rate Transaction (as defined in

the Inducement Letter) until one year after the closing of the Preferred Investment Option Exercise (subject to an exception).

The

foregoing descriptions of the Inducement Letter and the New Preferred Investment Options are not complete and are qualified in their

entirety by the full text of such documents, copies of which are filed as exhibits to this report and incorporated herein by reference.

The

Offering

| Securities

Offered by the Selling Shareholders |

|

12,569,564

common shares consisting of (i) 3,012,049 common shares issuable upon exercise of pre-funded warrants issued in the Purchase Agreement,

(ii) 3,012,049 common shares issuable upon exercise of preferred investment options issued to the Selling Shareholders in the Purchase

Agreement and (iii) 6,545,466 common shares issuable upon the exercise of preferred investment options issued to the Selling Shareholders

in the Private Placement. |

| |

|

|

| Common

Shares Outstanding Before this Offering (1) |

|

6,600,924 |

| |

|

|

| Common

Shares Outstanding After this Offering (assuming full exercise of the pre-funded warrants and preferred investment options exercisable

for common shares registered hereby) |

|

19,170,488 |

| |

|

|

| Use

of Proceeds |

|

We will not receive any

of the proceeds from the sale of common shares being offered for sale by the Selling Shareholders. However, upon (i) the cash exercise

of the pre-funded warrants we will receive the exercise price of such warrants, for an aggregate amount of approximately $301.20

and (ii) the cash exercise of the preferred investment options, we will receive the exercise price of such options, for an aggregate

amount of approximately $7.9 million. See “Use of Proceeds” for further information. |

| |

|

|

| Nasdaq

Capital Market Symbol |

|

“INM”. |

| |

|

|

| Risk

Factors |

|

Please read “Risk

Factors” and other information included in, or incorporated by reference into, this prospectus, for a discussion of factors

you should carefully consider before deciding to invest in the securities offered pursuant to this prospectus. |

| (1) |

The number of common shares outstanding before this offering

is based on an aggregate of 6,600,924 shares outstanding as of October 26, 2023 and does not include: |

| ● | 65,531 common shares issuable upon the exercise of non-prefunded share

purchase warrants outstanding as of October 26, 2023, with a weighted average exercise price of $121.31 per share; |

| ● | 178,265 common shares issuable upon the exercise of preferred investment

options outstanding as of October 26, 2023, with a weighted average exercise price of $87.75 per share, |

| ● | 102,133 common shares issuable upon exercise of options outstanding

as of October 26, 2023, with a weighted-average exercise price of $34.98 per share; and |

| ● | 51,633

common shares available for future issuance as of October 26, 2023, under the InMed Pharmaceuticals Inc. Amended 2017 Stock Option Plan. |

RISK FACTORS

Investing in our common shares involves a

high degree of risk and uncertainties. You should carefully consider the following risk described below, together with the information

under the heading “Risk Factors” and elsewhere in our most recent Annual Report on Form 10-K, which is incorporated herein

by reference, as updated or superseded by the risks and uncertainties described under similar headings or elsewhere in the other documents

that are filed after the date hereof and incorporated by reference into this prospectus, together with all of the other information contained

or incorporated by reference in this prospectus, and any free writing prospectus that we have authorized for use in connection with this

offering before you make a decision to invest in our common shares. The risks described in these documents are not the only ones we face.

Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate

results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations

or cash flow could be materially adversely affected. This could cause the trading price of our common shares to decline, resulting in

a loss of all or part of your investment. Please also carefully read the section titled “Special Note Regarding Forward-Looking

Statements.”

Additional Risk Related to this Offering and

Our Common Shares

Sales by the Selling Shareholders of the

common shares covered by this prospectus could adversely affect the market price of our common shares.

Assuming full exercise of the pre-funded warrants and the preferred investment options the underlying common shares of which form a part

of the common shares being registered hereby, and without giving effect to the beneficial ownership limitations related to the pre-funded

warrants and preferred investment options described elsewhere in this prospectus, the 12,569,564 common shares registered hereby represent

approximately 190% of our total outstanding shares of common shares as of October 26, 2023. The resale of all or a substantial number

of these shares in the public market by the Selling Shareholders, or the perception that such sales might occur, could depress the market

price of our common shares, which could impair our ability to raise capital through the sale of additional equity or equity-linked securities.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated

by reference into this prospectus, including the sections entitled “Prospectus Summary,” “Risk Factors,”

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,”

contain forward-looking statements that involve risks and uncertainties. We make such forward-looking statements pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. All statements, other than

statements of historical facts contained herein or in the documents incorporated herein by reference may be deemed forward-looking statements.

The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “will,” “would” and similar expressions may

identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking

statements in or incorporated by reference into this prospectus include, but are not limited to, statements about:

| ● | The Company’s ability to stem operating losses and

the Company’s ability to find further financing to fund operations; |

| ● | The revenues of BayMedica, LLC (“BayMedica”)

and the commercial viability of the products in its portfolio; |

| ● | Our researching, developing, manufacturing and commercializing

cannabinoid-based biopharmaceutical products will treat diseases with high unmet medical needs; |

| ● | The continued optimization of cannabinoid manufacturing approaches; |

| ● | Our success in initiating discussions with potential partners

for licensing various aspects of our Product Candidates; |

| ● | Our ability to commercialize and, where required, register

products in the pharmaceutical R&D programs (“Product Candidates”) and those targeted to the health and wellness sector

(“Products”) in the United States and other jurisdictions; |

| ● | Our ability to successfully access existing manufacturing

capacity via leases with third-parties or to transfer our manufacturing processes to contract manufacturing organizations; |

| ● | Our belief that our manufacturing approaches that we are

developing are robust and effective and will result in high yields of cannabinoids and will be a significant improvement upon existing

manufacturing platforms; |

| ● | The ability of the IntegraSyn approach to introduce a revenue

stream to us before the expected commercial approval of our therapeutic programs; |

| ● | Our ability to successfully scale up our IntegraSyn or other

cost-effective approaches so that it will be commercial-scale ready after Phase 2 clinical trials are completed, after which time we

may no longer need to source active pharmaceutical ingredients (“APIs”) from API manufacturers; |

| ● | The success of the key next steps in our manufacturing approaches,

including continuing efforts to diversify the number of cannabinoids produced, scaling-up the processes to larger vessels and identifying

external vendors to assist in the commercial scale-up of the process; |

| ● | Our ability to successfully make determinations as to which

research and development programs to continue based on several strategic factors; |

| ● | Our ability to monetize our IntegraSyn manufacturing approach

to the broader pharmaceutical industry; |

| ● | Our ability to continue to outsource the majority of our

research and development activities through scientific collaboration agreements and arrangements with various scientific collaborators,

academic institutions and their personnel; |

| ● | The success of work to be conducted under the research and

development collaboration between us and various contract development and manufacturing organizations (“CDMOs”); |

| ● | Our ability to develop our therapies through early human

testing; |

| ● | Our ability to evaluate the financial returns on various

commercialization approaches for our Product Candidates, such as a ‘go-it-alone’ commercialization effort, out-licensing

to third parties, or co-promotion agreements with strategic collaborators; |

| ● | Our ability to find a partnership early in the development

process for our various programs; |

| ● | Our ability to explore our manufacturing technologies as

processes which may confer certain benefits, either cost, yield, speed, or all of the above, when pursuing specific types of cannabinoids,

and filing a provisional patent application for same; |

| ● | Plans regarding our next steps, options, and targeted benefits

of our manufacturing technologies; |

| ● | Our IntegraSyn or BayMedica derived products being bio-identical

to the naturally occurring cannabinoids, and offering superior ease, control and quality of manufacturing when compared to alternative

methods; |

| ● | Our ability to potentially earn revenue from our IntegraSyn

approach by (i) becoming a supplier of APIs to the pharmaceutical industry and/or (ii) providing pharmaceutical-grade ingredients to

the non-pharmaceutical market; |

| ● | U.S. Food and Drug Administration (“FDA”) regulatory

acceptance of synthesizing rare cannabinoids for potential use in the pharmaceutical industry; |

| ● | Our ability to successfully prosecute patent applications; |

| ● | INM-088 being a once-a-day or twice-a-day eye drop medication

that will compete with treatment modalities in the medicines category, and with the potential of INM-088 assisting in reducing the high

rate of non-adherence with current glaucoma therapies; |

| ● | Our belief that with a novel delivery system, the reduction

of interocular pressure (“IOP”) and/or providing neuroprotection in glaucoma patients by topical (eye drop) application of

cannabinoids will hold significant promise as a new therapy; |

| ● | The potential for any of our patent applications to provide

intellectual property protection for us; |

| ● | Our ability to secure insurance coverage for shipping and

storage of Product Candidates, and clinical trial insurance; |

| ● | Our ability to expand our insurance coverage to include the

commercial sale of Products and Product Candidates; |

| ● | Developing patentable New Chemical Entities (“NCE”)

which, if issued, will confer market exclusivity to us for the potential development into pharmaceutical Product Candidates, license,

partner or sell to interested external parties; |

| ● | Our ability to initiate discussions and conclude strategic

partnerships to assist with development of certain programs; |

| ● | Our ability to position ourselves to achieve value-driving,

near term milestones for our Product Candidates with limited investment; |

| ● | Our ability to execute our business strategy; |

| ● | Our disclosure controls and procedures and internal control

over financial reporting |

| ● | Critical accounting estimates; |

| ● | Management’s assessment of future plans and operations; |

| ● | The outlook of our business and the global economic and geopolitical

conditions; and |

| ● | The competitive environment in which we and our business

units operate. |

These forward-looking statements reflect our

management’s beliefs and views with respect to future events and are based on estimates and assumptions as of the date of this

prospectus or the dates of the documents incorporated herein by reference, as applicable, and are subject to risks and uncertainties.

We discuss many of these risks in greater detail under “Risk Factors” in this prospectus and under similar headings

in the documents incorporated herein by reference. Moreover, we operate in a very competitive and rapidly changing environment. New risks

emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on

our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained

in or implied by any forward-looking statements we may make. Given these uncertainties, you should not place undue reliance on these

forward-looking statements.

You should read this prospectus, the documents

incorporated by reference herein and the documents that we reference in this prospectus and have filed as exhibits to the registration

statement of which this prospectus is a part, completely and with the understanding that our actual future results may be materially

different from what we expect. We qualify all of the forward-looking statements in or incorporated by reference into this prospectus

by these cautionary statements. Except as required by law, each forward-looking statement speaks only as of the date of the particular

statement, and we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information,

future events or otherwise.

USE OF PROCEEDS

We will not receive any proceeds from the sale

of common shares by the Selling Shareholders. However, upon (i) the cash exercise of the pre-funded warrants, we will receive the exercise

price of such warrants, for an aggregate of approximately $301.20 and (ii) the cash exercise of the preferred investment options, we

will receive the exercise price of such options, for an aggregate of approximately $7.9 million. We will bear all fees and expenses incident

to our obligation to register the common shares covered by this prospectus. Brokerage fees, underwriting discounts and commissions, and

similar expenses, if any, attributable to the sale of common shares offered hereby will be borne by the applicable Selling Shareholder.

DIVIDEND POLICY

We have never declared or paid any cash dividends

on our common shares to date. We do not anticipate declaring or paying, in the foreseeable future, any cash dividends on our common shares.

We currently intend to retain all available funds and any future earnings to support our operations and finance the growth and development

of our business. Any future determination related to our dividend policy will be made at the discretion of our board of directors, or

our Board, and will depend upon, among other factors, our results of operations, financial condition, capital requirements, contractual

restrictions, business prospects and other factors our Board may deem relevant.

PRINCIPAL SHAREHOLDERS

The table below sets forth

information known to us regarding the beneficial ownership of the Common Shares as of October 26, 2023 for:

| ● | each person or group of affiliated persons known by us to

be the beneficial owner(s) of more than 5% of our outstanding Common Shares; |

| ● | each of the Company’s directors and named executive

officers (“NEOs”); and |

| ● | all of the directors and executive officers as a group. |

The number of Common Shares

beneficially owned by a person includes shares subject to options, warrants or other convertible securities held by that person that

are currently exercisable or that become exercisable within 60 days of October 26, 2023. Percentage calculations assume, for each person

and group, that all Common Shares that may be acquired by such person or group pursuant to options, warrants, or other convertible securities

that are held currently exercisable or that become exercisable within 60 days of October 26, 2023 are outstanding for the purpose of

computing the percentage of Common Shares owned by such person or group. However, such unissued Common Shares described above are not

deemed to be outstanding for calculating the percentage of Common Shares owned by any other person. The percentage of Common Shares beneficially

owned is computed on the basis of 6,600,924 Common Shares outstanding as of October 26, 2023.

Unless otherwise noted, the business address

of each of the individuals and entities listed in the table below is Suite 310 - 815 West Hastings Street, Vancouver, British Columbia,

Canada, V6C 1B4.

| Name and Address of Beneficial Owner | |

Number of

Common

Shares

Beneficially

Owned | | |

Percentage of

Common

Shares

Beneficially

Owned (%) | |

| Five Percent Shareholders: | |

| | |

| |

| Armistice Capital LLC | |

| 9,241,358 | (1) | |

| 9.99 | (1) |

| Sabby Volatility Warrant Master Fund, Ltd. | |

| 5,895,563 | (2) | |

| 9.99 | (2) |

| | |

| | | |

| | |

| Named Executive Officers and Directors: | |

| | | |

| | |

| Eric A. Adams (3) | |

| 20,998 | | |

| * | |

| Andrew Hull (4) | |

| 2,242 | | |

| * | |

| Janet Grove (5) | |

| 1,191 | | |

| * | |

| Bryan Baldasare (6) | |

| 1,144 | | |

| * | |

| Nicole Lemerond (7) | |

| 1,096 | | |

| * | |

| Alexandra Mancini (8) | |

| 5,746 | | |

| * | |

| Eric Hsu (9) | |

| 5,805 | | |

| * | |

| Michael Woudenberg (10) | |

| 6,715 | | |

| * | |

| Jonathan Tegge (11) | |

| 1,400 | | |

| * | |

| All executive officers and directors as a group (9 persons) | |

| 46,337 | | |

| 1.39 | |

| (1) | Consists of (i) 1,909,098 Common Shares/Abeyance Shares (ii) 1,757,032

common shares issuable upon presently exercisable pre-funded warrants, and (iii) 5,575,228 common shares issuable upon presently exercisable

preferred investment options. The terms of the preferred investment options preclude a holder thereof from exercising such holder’s

preferred investment option, if after giving effect to the issuance of Common Shares upon such exercise, the holder (together with the

holder’s affiliates and any other persons acting as a group together with the holder or any of the holder’s affiliates) would

beneficially own in excess of 4.99% (or, upon election by a holder prior to the issuance of any preferred investment options, 9.99%) of

the number of Common Shares outstanding immediately after giving effect to the issuance of Common Shares issuable upon such exercise.

The stated percentage of Common Shares beneficially owned reflects the foregoing beneficial ownership limitation. The securities are directly

held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company, and may be deemed to be indirectly beneficially owned by

(i) Armistice Capital, LLC, as the investment manager of Armistice Capital Master Fund Ltd. and (ii) Steven Boyd, as the Managing Member

of Armistice Capital, LLC. Armistice Capital, LLC and Steven Boyd disclaim beneficial ownership of the securities except to the extent

of their respective pecuniary interests therein. The address for the foregoing entities is c/o Armistice Capital, LLC, 510 Madison Avenue,

7th Floor, New York, NY 10022. |

| (2) | Consists of (i) 402,305 Common Shares, (ii) 255,954 Common Shares

held in abeyance, (iii) 1,255,017 common shares issuable upon presently exercisable pre-funded warrants, and (iv) 3,982,287 common shares

issuable upon presently exercisable preferred investment options. The terms of the preferred investment options preclude a holder thereof

from exercising such holder’s preferred investment option, if after giving effect to the issuance of Common Shares upon such exercise,

the holder (together with the holder’s affiliates and any other persons acting as a group together with the holder or any of the

holder’s affiliates) would beneficially own in excess of 4.99% (or, upon election by a holder prior to the issuance of any preferred

investment options, 9.99%) of the number of Common Shares outstanding immediately after giving effect to the issuance of Common Shares

issuable upon such exercise. The stated percentage of Common Shares beneficially owned reflects the foregoing beneficial ownership limitation.

Sabby Management, LLC is the investment manager of Sabby Volatility Warrant Master Fund, Ltd. and shares voting and investment power with

respect to these shares in this capacity. As manager of Sabby Management, LLC, Hal Mintz also shares voting and investment power on behalf

of Sabby Volatility Warrant Master Fund, Ltd. Each of Sabby Management, LLC and Hal Mintz disclaims beneficial ownership of the securities

listed except to the extent of their pecuniary interest therein. |

| (3) | Eric

A. Adams’ beneficial ownership consists of 2,359 Common Shares owned directly and 18,639

Common Shares issuable pursuant to presently exercisable options. Not reflected in the table

are 597 Common Shares beneficially owned by Mr. Adams’ spouse. Mr. Adams disclaims

beneficial ownership of the 597 Common Shares held by his spouse. |

| (4) | Andrew Hull’s beneficial ownership

consists of 758 Common Shares owned directly and 1,484 Common Shares issuable pursuant to

presently exercisable options. |

| (5) | Janet Grove’s beneficial ownership

consists of 1,191 Common Shares issuable pursuant to presently exercisable options. |

| (6) | Bryan Baldasare’s beneficial ownership

consists of 1,144 Common Shares issuable pursuant to presently exercisable options. |

| (7) | Nicole Lemerond’s beneficial ownership

consists of 1,096 Common Shares issuable pursuant to presently exercisable options. |

| (8) | Alexandra Mancini’s beneficial ownership

consists of 240 Common Shares owned directly and 5,506 Common Shares issuable pursuant to

presently exercisable options. |

| (9) | Eric Hsu’s beneficial ownership consists

of 51 Common Shares owned directly and 5,754 Common Shares issuable pursuant to presently

exercisable options. |

| (10) | Michael Woudenberg’s beneficial ownership

consists of 21 Common Shares owned directly and 6,694 Common Shares issuable pursuant to

presently exercisable options. |

| (11) | Jonathan Tegge’s beneficial ownership

consists of 1,400 Common Shares issuable pursuant to presently exercisable options. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On February 11, 2022, the Board appointed Janet Grove as a director

of the Company. Ms. Grove is a Partner of Norton Rose Fulbright Canada LLP (“NRFC”). From February 11, 2022 to June

30, 2022, NRFC rendered legal services in the amount of $345,935 to the Company. During the year ended June 30, 2023, NRFC rendered legal

services in the amount of $634,208 to the Company. From July 1, 2023 to the date of this Prospectus, NRFC rendered legal services in the

amount of $146,551 to the Company. These transactions were in the normal course of operations and were measured at the exchange amount

which represented the amount of consideration established and agreed to by NRFC. No legal services rendered by NRFC were rendered by Ms.

Grove directly.

Indemnification Agreements

Our Amended and Restated Articles, or our Articles,

contain provisions limiting the liability of directors and provide that we will indemnify each of our directors and officers to the fullest

extent permitted under law. In addition, we have entered into an indemnification agreement with each of our directors, which requires

us to indemnify them.

Policies and Procedures for Transactions with Related Persons

We have adopted a written policy that our executive

officers, directors, nominees for election as a director, beneficial owners of more than 5% of any class of our common shares and any

members of the immediate family of any of the foregoing persons are not permitted to enter into a related person transaction with us

without the approval or ratification of the Board or the audit committee of our Board (the “Audit Committee”). Any

request for us to enter into a transaction with an executive officer, director, nominee for election as a director, beneficial owner

of more than 5% of any class of our common shares, or any member of the immediate family of any of the foregoing persons, in which the

amount involved exceeds $120,000 and such person would have a direct or indirect interest, must be presented to our Board or our audit

committee for review, consideration and approval. In approving or rejecting any such proposal, our Board or our audit committee is to

consider the material facts of the transaction, including whether the transaction is on terms no less favorable than terms generally

available to an unaffiliated third party under the same or similar circumstances and the extent of the related person’s interest

in the transaction.

DESCRIPTION OF SECURITIES

General

Our authorized share capital consists of an unlimited

number of common shares without par value and an unlimited number of preferred shares without par value. As of the date of this prospectus,

we had 6,600,924 common shares issued and outstanding and no preferred shares issued and outstanding.

The description of our securities contained herein

is a summary only and may be exclusive of certain information that may be important to you. For more complete information, you should

read our Articles, which have been filed with the SEC and incorporated as an exhibit to the registration statement of which this prospectus

forms a part.

Common Shares

Each common share entitles the holder thereof

to one vote at all meetings of shareholders.

There are no limitations on the rights of non-Canadian

owners to hold or vote common shares.

In the event of our liquidation, dissolution

or winding-up, whether voluntary or involuntary, or other distribution of our assets among shareholders for the purpose of winding up

our affairs, subject to the rights, privileges and restrictions attaching to any preferred shares that may then be outstanding, the shareholders

shall be entitled to receive our remaining property.

The shareholders are entitled to receive dividends,

as and when declared by our Board, subject to the rights, privileges and restrictions attaching to our securities, which may be paid

in money, property or by the issue of fully paid shares in our capital. However, we do not anticipate paying any cash dividends for the

foreseeable future, and instead intend to retain future earnings, if any, for use in the operation and expansion of our business.

Pre-Funded Warrants and Preferred Investment

Options

The pre-funded warrants and preferred investment

options, the underlying shares of which form a part of the common shares being registered hereby, and preferred investment options issued

to the designees of the Private Placement, are described under “Prospectus Summary—Recent Developments—Private Placement.”

As of October 26, 2023, we had no pre-funded

warrants outstanding and 178,265 preferred investment options and other warrants outstanding.

Certain Takeover Bid

Requirements

Unless such offer constitutes an exempt transaction,

an offer made by a person to acquire outstanding shares of a Canadian entity that, when aggregated with the offeror’s holdings

(and those of persons or companies acting jointly with the offeror), would constitute 20% or more of the outstanding shares, would be

subject to the take-over provisions of Canadian securities laws. The foregoing is a limited and general summary of certain aspects of

applicable securities law in the provinces and territories of Canada, all in effect as of the date hereof.

In addition to the take-over bid requirements

noted above, the acquisition of shares may trigger the application of additional statutory regimes including amongst others, the Investment

Canada Act and the Competition Act.

This summary is not a comprehensive description

of relevant or applicable considerations regarding such requirements and, accordingly, is not intended to be, and should not be interpreted

as, legal advice to any prospective purchaser and no representation with respect to such requirements to any prospective purchaser is

made. Prospective investors should consult their own Canadian legal advisors with respect to any questions regarding securities law in

the provinces and territories of Canada.

Actions Requiring a

Special Majority

Under the BCBCA, unless otherwise stated in the

Articles, certain corporate actions require the approval of a special majority of shareholders, meaning holders of shares representing

662/3% of those votes cast in respect of a shareholder vote addressing such matter. Those items requiring the approval of

a special majority generally relate to fundamental changes with respect to our business, and include amongst others, resolutions: (i)

removing a director prior to the expiry of his or her term; (ii) altering the Articles, (iii) approving an amalgamation; (iv) approving

a plan of arrangement; and (v) providing for a sale of all or substantially all of our assets.

Transfer Agent and

Registrar

The transfer agent and registrar for our common

shares is Odyssey Trust Company Suite 702, 67 Yonge St., Toronto, Canada, ON M5E 1J8.

Listing

Our common shares are currently quoted under

the symbol “INM” on the Nasdaq Capital Market.

Holders

As of October 26, 2023, there were 10,610 holders

of record of our issued and outstanding common shares.

SELLING SHAREHOLDERS

The common shares being offered by the Selling

Shareholders are those previously issued to the Selling Shareholders, and those issuable to the Selling Shareholders upon exercise of

the pre-funded warrants and preferred investment options, in each case, issued to the Selling Shareholders in the Private Placement.

For additional information regarding the issuances of those common shares, pre-funded warrants and preferred investment options, see

“Prospectus Summary—Recent Developments—Private Placement” above. We are registering the common

shares in order to permit the Selling Shareholders to offer the shares for resale from time to time. Except for participation in our

previous offerings and the ownership of the common shares, the pre-funded warrants and the preferred investment options, the Selling

Shareholders have not had any material relationship with us within the past three years.

The table below lists the Selling Shareholders

and other information regarding the beneficial ownership of our common shares by each of the Selling Shareholders. The second column

lists the number of common shares beneficially owned by each Selling Shareholder, based on its ownership of the common shares, warrants

and preferred investment options, as of the date of this prospectus, assuming exercise of the pre-funded warrants and preferred investment

options held by the Selling Shareholders on that date, without regard to any limitations on exercises.

The third column lists the common shares being

offered by this prospectus by the Selling Shareholders.

In accordance with the terms of the Registration Rights Agreement,

this prospectus generally covers the resale of the sum of (i) the number of common shares issued to the Selling Shareholders in the Private

Placement and (ii) the maximum number of common shares issuable upon exercise of the pre-funded warrants and preferred investment options

issued to the Selling Shareholders in the Private Placement, determined as if the outstanding pre-funded warrants and preferred investment

options were exercised in full as of the trading day immediately preceding the date this registration statement was initially filed with

the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject to adjustment as provided

in the Registration Right Agreement, without regard to any limitations on the exercise of the pre-funded warrants and preferred investment

options.

The table is based on information supplied to

us by the Selling Shareholders, with beneficial ownership determined in accordance with the rules and regulations of the SEC and includes

voting or investment power with respect to common shares. This information does not necessarily indicate beneficial ownership for any

other purpose. In computing the number of common shares beneficially owned by a Selling Shareholder, common shares subject to warrants

or preferred investment options held by that Selling Shareholder that are currently exercisable for common shares or exercisable for

common shares within 60 days after the date of this prospectus, are deemed outstanding.

The terms of the pre-funded warrants and preferred

investment options contain certain beneficial ownership limitations, as more particularly described under “Prospectus Summary—Recent

Developments—Private Placement” and in the footnotes to the table below. The number of shares in the second

column does not reflect these limitations. The Selling Shareholders may sell all, some or none of their shares in this offering. See

“Plan of Distribution.”

| Name of Selling Shareholder | |

Number of

Common

Shares

Beneficially

Owned Prior

to Offering | | |

Maximum

Number of

Common

Shares to

be Sold

Pursuant

to this

Prospectus | | |

Number of

Common

Shares

Beneficially

Owned After

Offering(5) | | |

Percentage

Beneficially

Owned After

Offering)(5) | |

| Armistice Capital Master Fund Ltd.(1) | |

| 1,909,098 | (2) | |

| 7,332,260 | | |

| — | | |

| — | |

| Sabby Volatility Warrant Master Fund, Ltd.(3) | |

| 658,259 | (4) | |

| 5,237,304 | | |

| — | | |

| — | |

| (1) |

The securities are directly

held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company, and may be deemed to be indirectly beneficially owned

by (i) Armistice Capital, LLC, as the investment manager of Armistice Capital Master Fund Ltd. and (ii) Steven Boyd, as the Managing

Member of Armistice Capital, LLC. Armistice Capital, LLC and Steven Boyd disclaim beneficial ownership of the securities except to

the extent of their respective pecuniary interests therein. |

| (2) |

Consists of 1,909,098 Common Shares/Abeyance Shares. The terms of the

preferred investment options preclude a holder thereof from exercising such holder’s preferred investment option, if after giving

effect to the issuance of Common Shares upon such exercise, the holder (together with the holder’s affiliates and any other persons

acting as a group together with the holder or any of the holder’s affiliates) would beneficially own in excess of 4.99% (or, upon

election by a holder prior to the issuance of any preferred investment options, 9.99%) of the number of Common Shares outstanding immediately

after giving effect to the issuance of Common Shares issuable upon such exercise. The stated percentage of Common Shares beneficially

owned reflects the foregoing beneficial ownership limitation. The securities are directly held by Armistice Capital Master Fund Ltd.,

a Cayman Islands exempted company, and may be deemed to be indirectly beneficially owned by (i) Armistice Capital, LLC, as the investment

manager of Armistice Capital Master Fund Ltd. and (ii) Steven Boyd, as the Managing Member of Armistice Capital, LLC. Armistice Capital,

LLC and Steven Boyd disclaim beneficial ownership of the securities except to the extent of their respective pecuniary interests therein.

The address for the foregoing entities is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022 |

| (3) |

Sabby Management, LLC is

the investment manager of Sabby Volatility Warrant Master Fund, Ltd. and shares voting and investment power with respect to these

shares in this capacity. As manager of Sabby Management, LLC, Hal Mintz also shares voting and investment power on behalf of Sabby

Volatility Warrant Master Fund, Ltd. Each of Sabby Management, LLC and Hal Mintz disclaims beneficial ownership over the securities

listed except to the extent of their pecuniary interest therein. |

| (4) |

Consists of (i) 402,305 common shares, (ii) 255,954 common shares held

in abeyance. The terms of the preferred investment options preclude a holder thereof from exercising such holder’s preferred investment

option, if after giving effect to the issuance of Common Shares upon such exercise, the holder (together with the holder’s affiliates

and any other persons acting as a group together with the holder or any of the holder’s affiliates) would beneficially own in excess

of 4.99% (or, upon election by a holder prior to the issuance of any preferred investment options, 9.99%) of the number of Common Shares

outstanding immediately after giving effect to the issuance of Common Shares issuable upon such exercise. The stated percentage of Common

Shares beneficially owned reflects the foregoing beneficial ownership limitation. Sabby Management, LLC is the investment manager of Sabby

Volatility Warrant Master Fund, Ltd. and shares voting and investment power with respect to these shares in this capacity. As manager

of Sabby Management, LLC, Hal Mintz also shares voting and investment power on behalf of Sabby Volatility Warrant Master Fund, Ltd. Each

of Sabby Management, LLC and Hal Mintz disclaims beneficial ownership of the securities listed except to the extent of their pecuniary

interest therein.

|

| (5) |

Because the Selling Shareholders

may sell, transfer or otherwise dispose of all, some or none of the common shares covered by this prospectus, we cannot determine

the number of such common shares that will be sold, transferred or otherwise disposed of by the Selling Shareholders, or the amount

or percentage of our common shares that will be held by the Selling Shareholders upon completion of this offering. For purposes of

this table, we have assumed that the Selling Shareholders will sell all their common shares covered by this Prospectus, including

common shares issuable upon exercise of the pre-funded warrants and preferred investment options issued in the Private Placement. |

PLAN OF DISTRIBUTION

Each Selling Shareholder of the securities and

any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby

on the Nasdaq Capital Market or any other stock exchange, market or trading facility on which the securities are traded or in private

transactions. These sales may be at fixed or negotiated prices. A Selling Shareholder may use any one or more of the following methods

when selling securities:

| ● | ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| ● | block

trades in which the broker-dealer will attempt to sell the securities as agent but may position

and resell a portion of the block as principal to facilitate the transaction; |

| ● | purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| ● | an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

● |

privately negotiated transactions; |

| |

● |

settlement of short sales; |

| |

● |

in transactions through

broker-dealers that agree with the Selling Shareholders to sell a specified number of such securities at a stipulated price per security; |

| |

● |

through the writing or

settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

● |

a combination of any such

methods of sale; or |

| |

● |

any other method permitted

pursuant to applicable law. |

The Selling Shareholders may also sell securities

under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Shareholders

may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Shareholders

(or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except

as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission

in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the securities

or interests therein, the Selling Shareholders may enter into hedging transactions with broker-dealers or other financial institutions,

which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling Shareholders

may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers

that in turn may sell these securities. The Selling Shareholders may also enter into option or other transactions with broker-dealers

or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other

financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may

resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Shareholders and any broker-dealers

or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities

Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale

of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each Selling

Shareholder has informed us that it does not have any written or oral agreement or understanding, directly or indirectly, with any person

to distribute the securities.

We are required to pay certain fees and expenses

incurred by us incident to the registration of the securities. We have agreed to indemnify the Selling Shareholders against certain losses,

claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus effective until

the earlier of (i) the date on which the securities may be resold by the Selling Shareholders without registration and without regard

to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for us to be in compliance with the current

public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities have been

sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities will

be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain

states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable

state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under

the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities