FALSE000112097000011209702023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2023

COMSTOCK INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

|

| | |

Nevada | 001-35200 | 65-0955118 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) |

117 American Flat Road, Virginia City, Nevada 89440

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, including Area Code: (775) 847-5272

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.000666 per share | LODE | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On November 12, 2023, Comstock Inc. (the “Company”), entered into a secured promissory note (the “Promissory Note”) with Alvin Fund LLC, as lender (“Lender”). The Promissory Note has an aggregate principal amount of $2,100,000, which includes $100,000 original issue discount, a per annum interest rate of 8% and a maturity date of February 8, 2025. Interest is payable monthly on the Promissory Note.

Principal is payable in full on the maturity date and contains covenants that prohibit transfer or negotiation of the Promissory Note except as set forth in the terms.

If connection with the Promissory Note, the Company issued warrants to the Lender that allow the Lender to purchase 1,000,000 shares of the Company’s common stock at a price per share of $0.70.

The net proceeds of the Promissory Note will primarily be used for general corporate purposes.

Events of default on the Promissory Note include insolvency and failure to pay. The default interest rate on the Promissory Note is 12%. The Promissory Note can be repaid at any time without penalty or premium. The Promissory Note will be secured by the Company's non-mining assets.

The foregoing summary of the terms of the Promissory Note is not intended to be exhaustive and is qualified in its entirety by the terms of the form of the Promissory Note, a copy of which is attached hereto as Exhibit 10.1.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Item 1.01 of this Form 8-K is herein incorporated by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 9, 2023, the Company appointed Matthew Bieberly, as Principal Accounting Officer of the Company.

Mr. Bieberly, age 43, has served as the Company’s Director of SEC Reporting, Accounting & Disclosure since January 2023. Prior to joining the Company, he served as the Director of Corporate Accounting & SEC Reporting at ONE Gas, Inc.

Mr. Bieberly earns an annual salary of $175,000 and was previously granted 30,000 stock option awards pursuant to the Company’s equity incentive plan.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | |

|

| | | | |

| | | | | |

| | | COMSTOCK INC. |

| | | | |

| Date: November 13, 2023 | | By: | | /s/ Corrado De Gasperis |

| | | | | Corrado De Gasperis Executive Chairman and Chief Executive Officer |

Exhibit 10.1

PROMISSORY NOTE

THIS PROMISSORY NOTE OFFERED HEREBY HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933 (THE “SECURITIES ACT”) AND HAS NOT BEEN QUALIFIED UNDER THE SECURITIES LAWS OF ANY STATE. THE PROMISSORY NOTE CANNOT BE OFFERED, SOLD OR TRANSFERRED WITHOUT SUCH REGISTRATION OR QUALIFICATION UNLESS AN EXEMPTION FROM SUCH REGISTRATION OR QUALIFICATION IS THEN AVAILABLE.

$2,100,000.00 November 12, 2023

For value received, Comstock Inc., a Nevada corporation (the “Borrower”), promises to pay to the order of Alvin Fund LLC (“Lender”), the principal amount of $2,100,000.00 together with accrued and unpaid interest thereon, each due and payable on the date and in the manner set forth below. The principal amount includes $100,000.00, which shall not be obligated to be funded to the Borrower by the Lender and shall be reduced ratably in case of principal prepayment, as described in detail below.

1.Repayment. The principal amount of this promissory note shall be payable in lawful money of the United States on or prior to February 12, 20251 (the “Maturity Date”). All payments shall be applied first to accrued interest, and thereafter to principal. The outstanding principal amount of this promissory note plus all unpaid accrued interest shall be due and payable on an Event of Default (as defined below).

2.Interest. Borrower promises to pay simple interest on the outstanding principal amount hereof from the date hereof until payment in full, which interest shall be payable at the rate of 8% per annum. Interest shall be calculated on the basis of a 365-day year and number of days lapsed. Payment of accrued interest shall be due on the fifth (5th) Business Day (as defined below) of each month. “Business Day” means any day other than Saturday, Sunday or other day on which commercial banks in the State of Nevada are authorized or required by law to remain closed. Interest shall be payable in cash or restricted shares of common stock (“Shares”) issued by the Borrower or a combination of cash and Shares, as determined by the Lender, in its sole discretion. Within three (3) days of the last Business Day of the month prior to the month in which accrued interest becomes due, the Lender shall provide written notice to the Borrower of the combination of cash and Shares to be paid. If and to the extent that interest is paid in the form of Shares, the number of Shares shall be equal to the dollar amount of the interest payment then payable divided by the volume weighted average sales price of the Borrower’s common stock for the 20 trading days preceding the date of the interest payment. If an Event of Default (as defined below) has occurred and is continuing, interest on this promissory note shall accrue at a rate of 12% per annum (the “Default Rate”) until such Event of Default is cured or this promissory note is paid in full.

4867-2004-2125.5

3.Prepayment. Borrower may prepay the principal amount, or any portion thereof, in full or in part at any time without premium or penalty. Any such prepayment shall be accompanied by accrued and unpaid interest on the principal amount, or such portion thereof, prepaid to the date of such prepayment. The Borrower shall be required to prepay this promissory note with the net cash proceeds received by the Borrower with respect to any sales of the Collateral (as defined below). The Borrower shall notify the Lender of any such sale and the estimated amount of such net proceeds within 30 days after such sale. The Borrower shall be required to prepay this Note with cash proceeds received by Borrower with respect to any sales of the Borrower’s non-mining assets, i.e., the Borrower’s interest in the Sierra Springs Opportunity Fund, Inc.

4.Collateral. As collateral security for the payment in full when due (whether at stated maturity, by acceleration or otherwise) of the payment obligations of the Borrower under this promissory note, the Borrower hereby pledges and grants to the Lender, a third-lien security interest in all of the Borrower’s right, title and interest in, to and under all of the Silver Springs properties, consisting of the 98 acres and senior water rights owned by the Borrower’s wholly- owned subsidiary, Comstock Industrial LLC, and the 160 acres owned by the Borrower’s wholly-owned subsidiary, Downtown Silver Springs LLC (the “Collateral”). The Borrower shall record a deed of trust perfecting the secured interest hereunder within thirty (30) days of the funding of this Note. The Borrower is expressly prohibited from encumbering the Collateral with any debt obligations or any other lien whatsoever without the written consent of the Borrower. The Borrower hereby represents and warrants that there are no liens presently encumbering the Collateral other than the existing liens with Alvin Fund LLC and GHF Inc.

5.Default. If there shall be any Event of Default hereunder, at the option and upon the declaration of the Lender and upon written notice to the Borrower (which election and notice shall not be required in the case of an Event of Default under Section 5(b) or 5(c)), this promissory note shall accelerate and all principal and unpaid accrued interest shall become due and payable. The occurrence of any one or more of the following shall constitute an “Event of Default”:

(a)Borrower fails to pay timely any principal amount or unpaid accrued interest on the date the same becomes due and payable;

(b)The Borrower files any petition or action for relief under any bankruptcy, reorganization, insolvency or moratorium law or any other law for the relief of, or relating to, debtors, now or hereafter in effect, or makes any assignment for the benefit of creditors or takes any corporate action in furtherance of any of the foregoing;

(c)An involuntary petition is filed against the Borrower (unless such petition is dismissed or discharged within 60 days under any bankruptcy statute now or hereafter in effect, or a custodian, receiver, trustee, assignee for the benefit of creditors (or other similar official) is appointed to take possession, custody or control of any property of the Borrower; or

(d)The Borrower (A) fails to make any payment when due (whether by scheduled maturity, required prepayment, acceleration, demand, or otherwise) in respect of any indebtedness (other than indebtedness hereunder) having an aggregate principal amount of more

than $250,000, or (B) fails to observe or perform any other agreement or condition relating to any such indebtedness, the effect of which default or other event is to cause, or to permit the holder or holders of such indebtedness to cause, with the giving of notice if required, such indebtedness to be demanded or to become due or to be repurchased, prepaid, defeased or redeemed (automatically or otherwise), or an offer to repurchase, prepay, defease or redeem such indebtedness to be made, prior to its stated maturity.

6.Default Interest Rate. At any time an Event of Default is outstanding, this Note will bear interest at a rate of interest equal to twelve percent (12%) per annum from the date of the Event of Default.

7.Non-Negotiable Instrument. This obligation is not transferrable or negotiable except in accordance with the provisions of this section and is registered as to both principal and interest. Transfer of the obligation may be accomplished only by surrender of this promissory note and either the reissuance by the issuer of the promissory note or the issuance by the issuer of a new instrument to the new holder. This promissory note is intended to be treated as an obligation in registered form as defined in the Treasury Regulations Section 1.871- 14(c)(1)(i)(A). Accordingly, this promissory note is not negotiable by endorsement of the holder or any assignee of the holder. Prior to due presentment of this promissory note for transfer, the Borrower shall treat the Lender as the owner of such promissory note for the purpose of receiving payment of principal of and interest on the promissory note and for all other purposes whatsoever, whether or not the principal or interest of this promissory note is due (unless the Lender assigns or transfers this promissory note). Upon due presentment for transfer of this promissory note, the Borrower and the Lender shall execute and deliver in the name of the transferee or transferees a new promissory note for an aggregate principal amount equal to the total amount of principal and accrued but unpaid interest due to the Lender at the time of transfer. Any United States person who holds this obligation will be subject to limitations under the United States income tax laws, including the limitations provided in Sections 165(j) and 1287(a) of the United States Internal Revenue Code.

8.Closing Fee. In consideration of the Lender providing the financing hereunder, the Borrower shall issue warrants to the Lender that will allow the Lender to purchase 1,000,000 Shares at $0.70 per Share.

9.Waiver. The Borrower hereby waives demand, notice, presentment, protest and notice of dishonor.

10.Notice. Any notices or communications to be given hereunder shall be in writing and may be delivered by hand, by facsimile, by nationally recognized private courier, or by United States mail. Notices delivered by mail shall be deemed given three business days after being deposited in the United States mail, postage prepaid, registered or certified mail, return receipt requested. Notices delivered by hand, by facsimile or by nationally recognized private carrier shall be deemed given on the first business day following receipt; provided, however, that a notice delivered by facsimile shall only be effective if such notice is also delivered by hand, or deposited in the United States mail, postage prepaid, registered or certified mail, return receipt requested, on or before two business days after its delivery by facsimile. All notices to the Borrower shall be addressed as set forth under such party’s signature below.

11.Governing Law. This promissory note shall be governed by and construed under the laws of the State of Nevada (without giving effect to principles of conflicts of law).

12.Modification; Waiver. Any provision of this promissory note may be amended, waived or modified only upon the written consent of the Borrower and the Lender.

IN WITNESS WHEREOF, the undersigned has executed this promissory note to be effective as of the date first set forth above.

ALVIN FUND LLC

By: /s/ George Melas-Kyriazi

Name: George Melas-Kyriazi,

Director

Address: c/o George Melas-Kyriazi,

215 West 98th Street, Apt. 10A

New York, NY 10025

Comstock Inc.:

By: /s/ Corrado DeGasperis

Name: Corrado DeGasperis

Title: Executive Chairman and CEO

Address: 117 American Flat Road

P.O. Box 1118

Virginia City, Nevada 89440

degasperis@comstockinc.com

COMMON STOCK PURCHASE WARRANT COMSTOCK INC.

THE SECURITIES REPRESENTED HEREBY HAVE BEEN ACQUIRED FOR INVESTMENT AND HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”). SUCH SHARES MAY NOT BE SOLD, PLEDGED, OR TRANSFERRED PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH SHALL BE REASONABLY ACCEPTABLE TO THE COMSTOCK INC. (THE “COMPANY”).

Warrant Shares: 1,000,000 Issue Date: November 12, 2023

This is to certify that, FOR VALUE RECEIVED, Alvin Fund LLC (the “Holder”) is entitled to purchase, subject to the provisions of this warrant (this “Warrant”), from the Company, 1,000,000 shares of common stock of the Company, par value $0.000666 per share (the “Stock”), at a price of per share of $0.70 (the “Exercise Price”). The number of shares of Stock to be received and the Exercise Price to be paid therefor upon the exercise of this Warrant are subject to adjustment as set forth in Section 5 below. The shares of Stock deliverable upon such exercise at any time are hereinafter sometimes referred to as “Warrant Shares.”

1.EXERCISE OF WARRANT.

a.Procedural Requirements. This Warrant may be exercised in whole or in part at any time from the Issue Date until 5:00 p.m., Eastern Standard Time on November 12, 2025. In order to exercise this Warrant, the Holder shall deliver to the Company (A) the Purchase Form attached hereto as Exhibit A, duly completed and executed; (B) payment of the Exercise Price for the Warrant Shares; and (C) this Warrant upon receipt of the foregoing items, the Company shall execute or cause to be executed and deliver or cause to be delivered to the Holder, a certificate or certificates representing the aggregate number of full Warrant Shares issuable upon such exercise, together with cash in lieu of any fraction of a share, as hereinafter provided. The stock certificate or certificates so delivered shall be in such denomination or denominations as the Holder shall request and shall be registered in the name of the Holder or, subject to the restrictions on transfer set forth herein, such other name as shall be designated in the notice. This Warrant shall he deemed to have been exercised and such certificate or certificates shall be deemed to have been issued, and the Holder or any other person so designated shall be deemed to have become a holder of record of such shares for all purposes, as of the date the notice, together with the Exercise Price and this Warrant, are received by the Company as described above. If this Warrant shall have been exercised in part, the Company shall, at the time of delivery of the certificate or certificates representing Warrant

Shares, deliver to the Holder a new Warrant evidencing the right of the Holder to purchase the unpurchased Warrant Shares called for by this Warrant, which new Warrant shall in all other respects be identical with this Warrant, or, at the request of the Holder, appropriate notation may be made on this Warrant and the same returned to the Holder.

b.Cashless Exercise. This Holder may at its option elect to provide a notice of cashless exercise, in which event the Company shall issue to the Holder the number of Warrant Shares determined as follows: X = Y * (A-B)/A where: X = the number of Warrant Shares to be issued to the Holder. Y = the number of shares of common stock with respect to which the warrant is being exercised. A = the closing sale prices of the Company’s common stock for the trading day immediately prior to the date of exercise. B =$0.70.

2.GRANT OF RIGHT. Whenever the Company proposes to register any securities under the Act (other than (i) a registration effected solely to implement an employee benefit plan or a transaction to which Rule 145 of the Act is applicable, or (ii) a registration statement on Form S-4, S-8 or any successor form thereto or another form not available for registering the Warrant Shares for sale to the public, whether for its own account or for the account of one or more stockholders of the Company (a “Piggyback Registration”), the Company shall give prompt written notice (in any event no later than ten (10) business days prior to the filing of such registration statement) to the Holder of the Company’s intention to effect such a registration and, subject to the remaining provisions of this Section 2, shall include in such registration such number of Warrant Shares (the “Registrable Securities”) that the Holders have (within ten (10) Business Days of the respective Holder’s receipt of such notice) requested in writing (including such number) to be included within such registration. If a Piggyback Registration is an underwritten offering and the managing underwriter advises the Company that it has determined in good faith that marketing factors require a limit on the number of securities to be included in such registration, including all Warrant Shares (if the Holder has elected to include such Shares in such Piggyback Registration) and all other shares proposed to be included in such underwritten offering, the Company shall include in such registration (i) first, the number of securities that the Company proposes to sell and (ii) second, the number of securities, if any, requested to be included therein by selling stockholders (including the Holder) allocated pro rata among all such persons on the basis of the number of securities then owned by each such person. If any Piggyback Registration is initiated as a primary underwritten offering on behalf of the Company, the Company shall select the investment banking firm or firms to act as the managing underwriter or underwriters in connection with such offering.

3.FORCED CONVERSION. If any Warrant Shares are registered pursuant to Section 2 or are otherwise transferable pursuant to an exemption from registration under the Securities Act of 1933 (such shares, “Transferable Shares”), the Company shall have the right, in its sole discretion and upon notice to the Holder, to force the Holder to exercise this Warrant, pursuant to Section 1, with respect to the number

4859-5962-8941.5

of Registered Shares if the closing price of the Stock is equal to or greater than two dollars ($2.00) (subject to any adjustment pursuant to Section 7).

4.RESERVATION OF SHARES. The Company shall at all times reserve for issuance and delivery upon exercise of this Warrant such number of shares of Stock as shall be required for such issuance and delivery upon exercise hereof. All such shares of Stock shall, when issued in accordance with the terms hereof, be validly issued, fully paid and non-assessable.

5.FRACTIONAL SHARES. Notwithstanding any provision contained in this Warrant to the contrary, the Company shall not issue fractional shares upon exercise of Warrants. If, by reason of any adjustment made pursuant to this Warrant, the holder of any Warrant would be entitled, upon the exercise of such Warrant, to receive a fractional interest in a share, the Company shall, upon such exercise, round to the nearest whole number the number of the shares of Stock to be issued to the Holder.

6.RIGHTS OF HOLDER, The Holder shall not, solely by virtue hereof, be entitled to any rights of a shareholder in. the Company, either at law or equity, and the rights of the Holder are limited to those expressed in this Warrant and are not enforceable against the Company except to the extent set forth herein.

7.ADJUSTMENT OF NUMBER OF SHARES AND EXERCISE PRICE. In case the Company shall at any time subdivide or combine its outstanding shares of capital stack of the Company into a greater or lesser number of shares by stock split, stock dividend, reverse stock split or otherwise, the number of Warrant Shares and the Exercise Price shall be proportionately adjusted to take into account the effect of such subdivision; or combination. In the case of any reclassification or change of the Stock issuable upon exercise of this Warrant, the Company shall execute a new Warrant providing that the Holder of this Warrant shall have the right to exercise such new Warrant and upon such exercise to receive, in lieu of each share of Stock theretofore issuable upon exercise of this Warrant, the number and kind of shares of stock, other securities, money or property receivable upon such reclassification or change in respect of one share of the Stock. Such new Warrant shall provide for further adjustments which shall be as nearly equivalent as may be practicable to the adjustments provided for in this Section 5.

8.LOSS OR MUTILATION. Upon receipt by the Company from the Holder of evidence reasonably satisfactory to it of the ownership and the loss, theft, destruction or mutilation of this Warrant and indemnity reasonably satisfactory to it, and in case of mutilation upon surrender and cancellation hereof, the Company will execute and deliver in lien hereof a new Warrant of like tenor to the Holder; provided, in the case of mutilation, that no indemnity shall be required if this Warrant in identifiable form is surrendered to the Company for cancellation.

9.GOVERNING LAW. This Warrant shall be governed by, and construed and enforced in accordance with, the substantive laws of the State of Nevada without regard to conflicts of law principles.

4859-5962-8941.5

10.HOLDER’S ACKNOWLEDGMENTS. By the Holder’s acceptance hereof, the Holder acknowledges, represents and warrants to the Company that:

a.the Holder is an “accredited investor” as defined under Rule 501 of Regulation D promulgated under the Securities Act;

b.the Holder has had the opportunity, to the Holder’s satisfaction, to make a due diligence investigation of the Company, to request additional information regarding the Company and the Company’s business, and to discuss the Company’s affairs with the Company’s principals. The Holder, either alone or with the Holder’s professional purchaser representative, has sufficient knowledge and experience in business and financial matters to evaluate the merits and risks of the Holder’s investment in this Warrant and the Stock;

c.the Holder (i) understands that an investment in this Warrant and the Stock is speculative due to factors including (but not limited to) the risk of economic loss from the operations of the Company, but believes that such an investment is suitable for the Holder based upon the Holder’s financial needs, (ii) can withstand a complete loss of the Holder’s investment; and (iii) has the net worth to undertake these risks;

d.the Holder is acquiring tills Warrant and will acquire the Stock for the Holder’s own account and not with a view to or for sale in connection with, any distribution thereof, the Holder has no present intention of distributing, selling or otherwise disposing of this Warrant or any of the Stock, except for transfers any affiliates of Holder approved by the Company in advance writing; and the Holder will not sell, transfer or otherwise dispose of this Warrant or the Stock except in compliance with the registration requirements of applicable federal and state securities laws (or in reliance on an applicable exemption therefrom); and

e.this Warrant is, and the Stock will be, offered under one or more exemptions provided in the Securities Act and applicable state securities laws. As such, transfer of this Warrant and the Stock will be severely restricted, and the Holder may be required to bear the economic risk of investment for an indefinite period of time. The Holder has no need of liquidity with respect to the Holder’s investment in the Company.

11.NOTICES. Any notice, demand, request, consent, approval, declaration, delivery or other communication hereunder to be made pursuant to the provisions of this Warrant shall be sufficiently given or made if either delivered in person with receipt acknowledged or sent by registered or certified mail, return receipt requested, postage prepaid, or by a nationally recognized overnight courier or by telecopy with confirmation of receipt, addressed as follows:

4859-5962-8941.5

If to the Company:

Comstock Inc.

PO Box 1118

117 American Flat Road

Virginia City, Nevada 89440

Attn: Corrado DeGasperis, CEO

Email: DeGasperis@comstockinc.com

Phone: (775) 848 5310

with a copy to:

Foley & Lardner LLP

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

Attention: Clyde Tinnen

Email: ctinnen@foley.com

Phone: 414-297-5026

If to Holder, to its residence address (or mailing address, if different) and facsimile

number set forth at the end of this Warrant, or to such other address and/or facsimile

number and/or to the attention of such other person as specified by written notice given

to the Company five calendar days prior to the effectiveness of such change.

[Signature pages follow]

4859-5962-8941.5

HOLDER SIGNATURE PAGE TO COMMON STOCK PURCHASE WARRANT

IN WITNESS WHEREOF, and intending to be legally bound hereby, Holder has caused this Warrant to be duly executed and, by executing this signature page, hereby executes, adopts and agrees to all terms, conditions, and representations contained in the foregoing Warrant.

HOLDER: ALVIN FUND LLC

By: /s/ George Melas-Kyriazi

Name: George Melas-Kyriazi, Director

Address: c/o George Melas-Kyriazi,

215 West 98th Street, Apt. 10A

New York, NY 10025

As of: November 12, 2023

COMPANY SIGNATURE PAGE TO COMMON STOCK PURCHASE WARRANT

–PLEASE DO NOT WRITE BELOW THIS LINE– COMPANY USE ONLY

Accepted and Agreed:

COMSTOCK INC.

By: /s/ Corrado DeGasperis

Name: Corrado DeGasperis

Title: Executive Chairman and CEO

Address: 117 American Flat Road

P.O. Box 1118

Virginia City, Nevada 89440

degasperis@comstockinc.com

As of: November 12, 2023

4859-5962-8941.5

Exhibit A

PURCHASE FORM

1.The undersigned hereby elects to purchase Shares (as such term is defined in the attached Warrant (the “Warrant”)) of Comstock Inc. pursuant to the terms of the Warrant, and tenders herewith payment of the purchase price of such shares in full.

2.The undersigned hereby elects to convert the Warrant into shares as specified in the Warrant. This conversion is exercised with respect to of the shares covered by the Warrant.

3.Please issue a certificate or certificates representing said shares in the name of the undersigned or in such other name as is specified below:

___________________________________________

(Holder’s Signature)

___________________________________________

(Holder’s Name and title (if not an individual))

_________________________________________

____________________________________

(Address)

4.The undersigned represents it is acquiring the shares solely for its own account and not as a nominee for any other party and not with a view toward the resale or distribution thereof except in compliance with the Warrant and applicable securities laws.

ALVIN FUND LLC

_______________________________________

(Signature)

____________________________________

(Name and Title)

____________________________________

(Date)

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

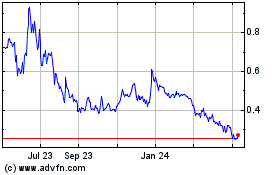

Comstock (AMEX:LODE)

Historical Stock Chart

From Mar 2024 to Apr 2024

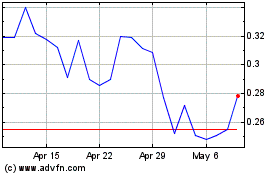

Comstock (AMEX:LODE)

Historical Stock Chart

From Apr 2023 to Apr 2024