false

0001001907

0001001907

2023-11-13

2023-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 13, 2023

Astrotech Corporation

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

001-34426

|

|

91-1273737

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

| |

|

|

2105 Donley Drive, Suite 100, Austin, Texas

|

|

78758

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(512) 485-9530

Registrant’s Telephone Number, Including Area Code

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

| |

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

| |

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value per share

|

|

ASTC

|

|

NASDAQ Stock Market, LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 13, 2023, Astrotech Corporation (the “Company”) issued a press release announcing its results of operations for its first quarter of fiscal year 2024, which ended September 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Astrotech Corporation

|

| |

|

|

| |

By: |

|

| November 13, 2023 |

|

|

|

|

|

/s/ Thomas B. Pickens III

|

| |

|

Thomas B. Pickens III

|

| |

|

Chief Executive Officer, Chief Technology Officer and Chairman of the Board

|

Exhibit 99.1

ASTROTECH REPORTS FIRST QUARTER OF FISCAL YEAR 2024 FINANCIAL RESULTS

Austin, Texas – November 13, 2023 – Astrotech Corporation (Nasdaq: ASTC) (the “Company” or “Astrotech”) reported its financial results for the first quarter of fiscal year 2024, which ended September 30, 2023.

Financial Highlights & Recent Developments

|

●

|

Astrotech’s consolidated balance sheet remains strong with $39 million in cash and liquid investments, which are anticipated to support our research and development, organic growth, and potential acquisition targets.

|

|

●

|

Revenue for the quarter totaled $425 thousand compared to $38 thousand in the first quarter of the prior year due primarily to ongoing fulfillment of the previously announced 17-unit order for the TRACER 1000™ explosives trace detector (ETDs) to a Romania-based security and telecommunications company and ongoing maintenance services and sales of consumables for the TRACER 1000.

|

|

●

|

Gross margin improved to 43% for the first quarter of fiscal year 2024, compared to 16% in the first quarter of the fiscal year 2023.

|

|

●

|

Production and sales efforts continue for the AgLAB 1000-D2™, which utilizes the Maximum Value Process™ testing method, designed to improve yields and bottom-line profits for hemp (CBD) and cannabis (THC) producers of distilled oils.

|

|

●

|

1st Detect continues working with the Transportation Security Administration (TSA) toward cargo detection testing. TSA cargo detection testing is the final step to be listed on the Air Cargo Screening Technology List as an “approved” device. If approved, the TRACER 1000 will be approved for cargo sales in the United States.

|

|

●

|

On September 20, 2023, the Audit Committee of the Board of Directors of the Company approved the appointment of RBSM, LLP as the Company’s new independent registered public accounting firm. An engagement letter with RBSM was executed on October 12, 2023, for the appointment for the fiscal year ended June 30, 2024.

|

|

●

|

Effective November 9, 2023, 1st Detect accepted a purchase order for seven TRACER 1000 ETDs from a Romania-based security and telecommunications company. The systems are scheduled to be delivered over the next few months.

|

“Fiscal year 2024 has started with strong sales at 1st Detect as we continue deliveries on a 17-unit Tracer 1000 Explosives Trace Detector order,” stated Thomas B. Pickens, III, Astrotech’s Chairman, Chief Executive Officer, and Chief Technology Officer. “We also continue to make slow but steady progress with our efforts obtaining TSA approvals and opening up the U.S. airport market. The AgLAB subsidiary has been conducting customer demonstrations and they have continued to indicate that our Maximum Value Processing method can, on average, increase ending weighted yields by 30%. This is a significant improvement in cannabinoid oil processing yields and adds to our potential customer’s bottom line.” stated Thomas B. Pickens, III.

About Astrotech Corporation

Astrotech (Nasdaq: ASTC) is a mass spectrometry company that launches, manages, and commercializes scalable companies based on its innovative core technology through its wholly owned subsidiaries. 1st Detect develops, manufactures, and sells trace detectors for use in the security and detection market. AgLAB is developing chemical analyzers for use in the agriculture market. BreathTech is developing a breath analysis tool to provide early detection of lung diseases. Astrotech is headquartered in Austin, Texas. For information, please visit www.astrotechcorp.com.

About the AgLAB-1000™ and the BreathTest-1000™

This press release contains information about our new products under development, AgLAB-1000 and BreathTest-1000. Product development involves a high degree of risk and uncertainty, and there can be no assurance that our new products will be successfully developed, achieve their intended benefits, receive full market authorization, or be commercially successful. In addition, FDA approval will be required to market BreathTest-1000 in the United States. Obtaining FDA approval is a complex and lengthy process, and there can be no assurance that FDA approval for BreathTest-1000 will be granted on a timely basis or at all.

Forward-Looking Statements

This press release contains forward-looking statements that are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks, trends, and uncertainties that could cause actual results to be materially different from the forward-looking statement. These factors include, but are not limited to, the adverse impact of inflationary pressures, including significant increases in fuel costs, global economic conditions and events related to these conditions, including the ongoing wars in Ukraine and the middle east and the COVID-19 pandemic, the Company’s use of proceeds from the common stock offerings, whether we can successfully complete the development of our new products and proprietary technologies, whether we can obtain the FDA and other regulatory approvals required to market our products under development in the United States or abroad, whether the market will accept our products and services and whether we are successful in identifying, completing and integrating acquisitions, as well as other risk factors and business considerations described in the Company’s Securities and Exchange Commission filings including the Company’s most recent Annual Report on Form 10-K. Any forward-looking statements in this document should be evaluated in light of these important risk factors. While we do not intend to directly harvest, manufacture, distribute or sell cannabis or cannabis products, we may be detrimentally affected by a change in enforcement by federal or state governments and we may be subject to additional risks in connection with the evolving regulatory area and associated uncertainties. Any such effects may give rise to risks and uncertainties that are currently unknown or amplify others mentioned herein. Although the Company believes the expectations reflected in its forward-looking statements are reasonable and are based on reasonable assumptions, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all) or will prove to have been correct. Moreover, such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements. In addition, any forward-looking statements included in this press release represent the Company’s views only as of the date of its publication and should not be relied upon as representing its views as of any subsequent date. The Company assumes no obligation to correct or update these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

Company Contact: Jaime Hinojosa, Chief Financial Officer, Astrotech Corporation, (512) 485-9530

Tables follow

ASTROTECH CORPORATION

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except per share data)

(Unaudited)

| |

|

Three Months Ended

|

|

| |

|

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Revenue

|

|

$ |

425 |

|

|

$ |

38 |

|

|

Cost of revenue

|

|

|

242 |

|

|

|

32 |

|

|

Gross profit

|

|

|

183 |

|

|

|

6 |

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

1,646 |

|

|

|

1,642 |

|

|

Research and development

|

|

|

1,872 |

|

|

|

1,129 |

|

|

Total operating expenses

|

|

|

3,518 |

|

|

|

2,771 |

|

|

Loss from operations

|

|

|

(3,335 |

)

|

|

|

(2,765 |

)

|

|

Other income and expense, net

|

|

|

423 |

|

|

|

235 |

|

|

Loss from operations before income taxes

|

|

|

(2,912 |

)

|

|

|

(2,530 |

)

|

|

Net loss

|

|

$ |

(2,912 |

)

|

|

$ |

(2,530 |

)

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

1,631 |

|

|

|

1,612 |

|

|

Basic and diluted net loss per common share:

|

|

|

|

|

|

|

|

|

|

Net loss per common share

|

|

$ |

(1.79 |

)

|

|

$ |

(1.57 |

)

|

|

Other comprehensive loss, net of tax:

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(2,912 |

)

|

|

$ |

(2,530 |

)

|

|

Available-for-sale securities:

|

|

|

|

|

|

|

|

|

|

Net unrealized losses, net of zero tax expense

|

|

|

(54 |

)

|

|

|

(368 |

)

|

|

Total comprehensive loss

|

|

$ |

(2,966 |

)

|

|

$ |

(2,898 |

)

|

ASTROTECH CORPORATION

Condensed Consolidated Balance Sheets

(In thousands, except share and per share data)

| |

|

September 30,

|

|

|

June 30,

|

|

| |

|

2023

|

|

|

2023

|

|

| |

|

(Unaudited)

|

|

|

(Note)

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

13,090 |

|

|

$ |

14,208 |

|

|

Short-term investments

|

|

|

25,863 |

|

|

|

27,919 |

|

|

Accounts receivable

|

|

|

391 |

|

|

|

225 |

|

|

Inventory, net:

|

|

|

|

|

|

|

|

|

|

Raw materials

|

|

|

1,560 |

|

|

|

1,379 |

|

|

Work-in-process

|

|

|

287 |

|

|

|

243 |

|

|

Finished goods

|

|

|

343 |

|

|

|

373 |

|

|

Income tax receivable

|

|

|

— |

|

|

|

1 |

|

|

Prepaid expenses and other current assets

|

|

|

296 |

|

|

|

365 |

|

|

Total current assets

|

|

|

41,830 |

|

|

|

44,713 |

|

|

Property and equipment, net

|

|

|

2,545 |

|

|

|

2,670 |

|

|

Operating leases, right-of-use assets, net

|

|

|

226 |

|

|

|

262 |

|

|

Other assets

|

|

|

31 |

|

|

|

30 |

|

|

Total assets

|

|

$ |

44,632 |

|

|

$ |

47,675 |

|

|

Liabilities and stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

646 |

|

|

|

546 |

|

|

Payroll related accruals

|

|

|

567 |

|

|

|

633 |

|

|

Accrued expenses and other liabilities

|

|

|

723 |

|

|

|

1,170 |

|

|

Lease liabilities, current

|

|

|

312 |

|

|

|

316 |

|

|

Total current liabilities

|

|

|

2,248 |

|

|

|

2,665 |

|

|

Accrued expenses and other liabilities, net of current portion

|

|

|

39 |

|

|

|

— |

|

|

Lease liabilities, net of current portion

|

|

|

228 |

|

|

|

291 |

|

|

Total liabilities

|

|

|

2,515 |

|

|

|

2,956 |

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Convertible preferred stock, $0.001 par value, 2,500,000 shares authorized; 280,898 shares of Series D issued and outstanding at September 30, 2023 and June 30, 2023, respectively

|

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value, 250,000,000 shares authorized at September 30, 2023 and June 30, 2023, respectively; 1,712,045 and 1,692,045 shares issued at September 30, 2023 and June 30, 2023, respectively 1,701,729 and 1,681,729 outstanding at September 30, 2023 and June 30, 2023, respectively

|

|

|

190,643 |

|

|

|

190,643 |

|

|

Treasury shares, 10,316 at September 30, 2023 and June 30, 2023, respectively

|

|

|

(119 |

)

|

|

|

(119 |

)

|

|

Additional paid-in capital

|

|

|

81,366 |

|

|

|

81,002 |

|

|

Accumulated deficit

|

|

|

(228,266 |

)

|

|

|

(225,354 |

)

|

|

Accumulated other comprehensive loss

|

|

|

(1,507 |

)

|

|

|

(1,453 |

)

|

|

Total stockholders’ equity

|

|

|

42,117 |

|

|

|

44,719 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

44,632 |

|

|

$ |

47,675 |

|

Note: The balance sheet at June 30, 2023, has been derived from the audited consolidated financial statements at that date but does not include all of the information and footnotes required by the United States generally accepted accounting principles for complete financial statements.

v3.23.3

Document And Entity Information

|

Nov. 13, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Astrotech Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 13, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-34426

|

| Entity, Tax Identification Number |

91-1273737

|

| Entity, Address, Address Line One |

2105 Donley Drive, Suite 100

|

| Entity, Address, City or Town |

Austin

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

78758

|

| City Area Code |

512

|

| Local Phone Number |

485-9530

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ASTC

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001001907

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

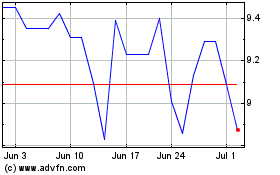

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Apr 2023 to Apr 2024