0001641398

false

0001641398

2023-11-10

2023-11-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report

(Date of earliest event reported): November 10, 2023

GD Culture Group Limited

(Exact name of Company as specified in charter)

| Nevada |

|

001-37513 |

|

47-3709051 |

(State or other jurisdiction

of incorporation) |

|

(Commission File No.) |

|

(IRS Employer

Identification No.) |

22F - 810 Seventh Avenue,

New York, NY 10019

(Address of Principal Executive Offices) (Zip

code)

+1-347-2590292

(Company’s Telephone number, including

area code)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4©

under the Exchange Act (17 CFR 240.13©(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value

$0.0001 |

|

GDC |

|

Nasdaq Capital Market |

Item 1.01 Entry into a Material Definitive

Agreement.

As previously reported on

the current report on Form 8-K by GD Culture Group Limited (the “Company”) on October 27, 2023, the Company entered into an

equity purchase agreement (the “Original Agreement”) with Entertainment Co., Ltd. (“Shanghai Highlight”), an indirect

subsidiary of the Company, and Beijing Hehe Property Management Co., Ltd. (“Beijing Hehe”) on October 27, 2023. Prior to the

Original Agreement, Shanghai Highligh owns 60% of the total equity interest in the Xianzhui Technology Co., Ltd. (the “Joint Venture”)

and Beijing Hehe owns 20% of the total equity interest in the Joint Venture. Pursuant to the Original Agreement. Shanghai Highlight agreed

to purchase the 20% equity interest in the Joint Venture from Beijing Hehe and the Company agreed to issue 600,000 shares of common stock

of the Company, valued at $2.7820 per share, the average closing bid price of the common stock of GDC as of the five trading days immediately

preceding the date of the Original Agreement (the “Per Share Price”), to Beijing Hehe or its assigns.

On November 10, 2023, the

Company entered into an amended and restated equity purchase agreement (the “Amended and Restated Agreement”) that amended

and replaced the Original Agreement. Pursuant to the Amended and Restated Agreement, Shanghai Highlight agreed to purchase the 13.3333%

equity interest in the Joint Venture from Beijing Hehe and the Company agreed to issue 400,000 shares of common stock of the Company,

valued at the Per Share Price, to Beijing Hehe or its assigns.

Pursuant to the Amended and

Restated Agreement, the closing of the transaction shall take place within thirty (30) days from the execution of the Amended and Restated

Agreement. The Amended and Restated Agreement is effective for thirty (30) days from the date of the Amended and Restated Agreement, which

can be extended for additional thirty (30) days upon all parties’ written agreement. The Company or Shanghai Highlight may terminate

the Amended and Restated Agreement at any time with a three (3) day advance written notice to Beijing Hehe.

The foregoing description

of the Amended and Restated Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text

of the Amended and Restated Agreement, which is filed as Exhibit 10.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit Index

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| Date: November 13, 2023 |

GD Culture Group Limited |

| |

|

|

| |

By: |

/s/ Xiao Jian Wang |

| |

Name: |

Xiao Jian Wang |

| |

Title: |

Chief Executive Officer, President and

Chairman of the Board |

2

Exhibit 10.1

AMENDED AND RESTATED EQUITY PURCHASE AGREEMENT

This Amended and Restated

Equity Purchase Agreement (this “Agreement”), dated as of November 10, 2023, is entered into between Beijing Hehe Property

Management Co., Ltd., a company established under the rules of the People’s Republic of China (“Seller”), Shanghai

Highlight Entertainment Co., Ltd., a company established under the rules of the People’s Republic of China (“Buyer”),

and GD Culture Group Limited (“GDC”) to amend and place the Equity Purcahse Agreement dated October 27, 2023 (the “Original

Agreement”) by and among Seller, Buyer and GDC. Capitalized terms used in this Agreement have the meanings given to such terms

herein.

RECITALS

WHEREAS, Buyer owns

sixty percent (60%) of the total equity interest in Shanghai Xianzhui Technology Co., Ltd., a company established under the rules of the

People’s Republic of China (the “Company”);

WHEREAS, Seller owns

twenty percent (20%) of the total equity interest the Company; and

WHEREAS, Seller wishes

to sell to Buyer, and Buyer wishes to purchase from Seller, 13.3333% the total equity interest of the Company (the “Target Equity

Interest”), subject to the terms and conditions set forth herein;

NOW, THEREFORE, in

consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt

and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

Purchase and sale

Section

1.01 Purchase and Sale. Subject to the terms and conditions set forth herein, at the Closing (as defined in Section 2.01),

Seller shall sell to Buyer, and Buyer shall purchase from Seller, the Target Equity Interest, free and clear of any mortgage, pledge,

lien, charge, security interest, claim, community property interest, option, equitable interest, restriction of any kind (including any

restriction on use, voting, transfer, receipt of income, or exercise of any other ownership attribute), or other encumbrance (each, an

“Encumbrance”), for the consideration specified in Section 1.02.

Section

1.02 Purchase Price. In exchange for the Target Equity Interest, Buyer shall cause GDC to issue 400,000 shares of common

stock of GDC (the “GDC Shares”), valued at $2.7820 per share, the average closing bid price of the common stock of GDC

as of the five trading days immediately prior to the date of the Original Agreement, to Seller or its assigns at the Closing.

ARTICLE II

CLOSING

Section 2.01 Closing.

The closing of the transactions contemplated by this Agreement (the “Closing”) shall take place within thirty

(30) days from the execution of this Agreement on the date of this Agreement (the “Closing Date”) as the parties may

mutually agree upon.

Section 2.02 Seller

Closing Deliverables. At the Closing, Seller shall deliver to Buyer a certificate evidencing the Target Equity Interest, free

and clear of all Encumbrances.

Section 2.03 GDC’s

Deliveries. At the Closing, GDC shall deliver the GDC Shares to Seller or its assigns.

ARTICLE III

Representations and warranties of seller

Seller represents and warrants

to Buyer that the statements contained in this ARTICLE III are true and correct as of the date hereof. For purposes of this ARTICLE III,

“Seller’s knowledge,” “knowledge of Seller,” and any similar phrases shall mean the actual or constructive knowledge

of any director or officer of Seller, after due inquiry.

Section

3.01 Organization and Authority of Seller. Seller is a company duly organized, validly existing, and in good standing under

the Laws (as defined in Section 3.05) of the People’s Republic of China. Seller has full power and authority to enter into this

Agreement and the other Transaction Documents to which Seller is a party, to carry out its obligations hereunder and thereunder, and to

consummate the transactions contemplated hereby and thereby. The execution and delivery by Seller of this Agreement and any other Transaction

Document to which Seller is a party, the performance by Seller of its obligations hereunder and thereunder, and the consummation by Seller

of the transactions contemplated hereby and thereby have been duly authorized by all requisite action on the part of Seller. This Agreement

and each Transaction Document to which Seller is a party constitute legal, valid, and binding obligations of Seller enforceable against

Seller in accordance with their respective terms.

Section

3.02 Organization, Authority, and Qualification of the Company. The Company is a company duly organized, validly existing,

and in good standing under the Laws of the People’s Republic of China and has full power and authority to own, operate, or lease

the properties and assets now owned, operated, or leased by it and to carry on its business as it has been and is currently conducted.

Section 3.03 Capitalization.

The Target Equity Interest have

been duly authorized, are validly issued, fully paid and nonassessable, and are owned of record and beneficially by Seller, free and

clear of all Encumbrances. Upon the transfer, assignment, and delivery of the Shares and payment therefor in accordance with the terms

of this Agreement, Buyer shall own all of the Shares, free and clear of all Encumbrances. The

Target Equity Interest was issued in compliance with applicable Laws. None of the Target

Equity Interest was issued in violation of any agreement or commitment to which Seller or the Company is a party or is subject

to or in violation of any preemptive or similar rights of any individual, corporation, partnership, joint venture, limited liability

company, Governmental Authority, unincorporated organization, trust, association, or other entity (each, a “Person”).

There are no outstanding or authorized options, warrants, convertible securities, stock appreciation, phantom stock, profit participation,

or other rights, agreements, or commitments relating to the shares of the Company or obligating Seller or the Company to issue or sell

any equity interest of, or any other interest in, the Company. There are no voting trusts, shareholder agreements, proxies, or other

agreements in effect with respect to the voting or transfer of any of the Target Equity Interest. The

term “Governmental Authority” means any federal, state, local, or foreign government or political subdivision thereof,

or any agency or instrumentality of such government or political subdivision, or any arbitrator, court, or tribunal of competent jurisdiction.

Section

3.04 No Subsidiaries. The Company does not have, or have the right to acquire, an ownership interest in any other Person.

Section

3.05 No Conflicts or Consents. The execution, delivery, and performance by Seller of this Agreement and the other Transaction

Documents to which it is a party, and the consummation of the transactions contemplated hereby and thereby, do not and will not: (a) violate

or conflict with any provision of the certificate of incorporation, by-laws, or other governing documents of Seller or the Company; (b)

violate or conflict with any provision of any statute, law, ordinance, regulation, rule, code, treaty, or other requirement of any Governmental

Authority (collectively, “Law”) or any order, writ, judgment, injunction, decree, determination, penalty, or award entered

by or with any Governmental Authority (“Governmental Order”) applicable to Seller or the Company; (c) require the consent,

notice, or filing with or other action by any Person or require any Permit, license, or Governmental Order; (d) violate or conflict with,

result in the acceleration of, or create in any party the right to accelerate, terminate, or modify any contract, lease, deed, mortgage,

license, instrument, note, indenture, joint venture, or any other agreement, commitment, or legally binding arrangement, whether written

or oral (collectively, “Contracts”), to which Seller or the Company is a party or by which Seller or the Company is bound

or to which any of their respective properties and assets are subject; or (e) result in the creation or imposition of any Encumbrance

on any properties or assets of the Company.

Section

3.06 Financial Statements. Complete copies of the Company’s audited financial statements consisting of the balance sheet

of the Company as at September 30, 2023 and the related statements of income and retained earnings, shareholders’ equity, and cash flow

for the period then ended (the “Financial Statements”) have been delivered to Buyer. The balance sheet of the Company

as of September 30, 2023 is referred to herein as the “Balance Sheet” and the date thereof as the “Balance Sheet

Date”.

Section

3.07 Undisclosed Liabilities. The Company has no liabilities, obligations, or commitments of any nature whatsoever, whether

asserted, known, absolute, accrued, matured, or otherwise (collectively, “Liabilities”), except: (a) those which are

adequately reflected or reserved against in the Balance Sheet as of the Balance Sheet Date; and (b) those which have been incurred in

the ordinary course of business consistent with past practice since the Balance Sheet Date and which are not, individually or in the aggregate,

material in amount.

Section

3.08 Absence of Certain Changes, Events, and Conditions. Since the Balance Sheet Date, and other than in the ordinary course

of business consistent with past practice, there has not been, with respect to the Company, any change, event, condition, or development

that is, or could reasonably be expected to be, individually or in the aggregate, materially adverse to the business, results of operations,

condition (financial or otherwise), or assets of the Company.

Section

3.09 Legal Proceedings; Governmental Orders.

(a) There

are no claims, actions, causes of action, demands, lawsuits, arbitrations, inquiries, audits, notices of violation, proceedings, litigation,

citations, summonses, subpoenas, or investigations of any nature, whether at law or in equity (collectively, “Actions”)

pending or, to Seller’s knowledge, threatened against or by the Company, Seller, or any Affiliate of Seller: (i) relating to or affecting

the Company or any of the Company’s properties or assets; or (ii) that challenge or seek to prevent, enjoin, or otherwise delay the transactions

contemplated by this Agreement. No event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such

Action. For purposes of this Agreement: (x) “Affiliate” of a Person means any other Person that directly or indirectly,

through one or more intermediaries, controls, is controlled by, or is under common control with, such Person; and (y) the term “control”

(including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly,

of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities

or other ownership interests, by contract, or otherwise.

(b) There

are no outstanding, and the Company is in compliance with all, Governmental Orders against, relating to, or affecting the Company or any

of its properties or assets.

Section

3.10 Compliance with Laws; Permits.

(a) The

Company has complied, and is now complying, with all Laws applicable to it or its business, properties, or assets.

(b) All

permits, licenses, franchises, approvals, registrations, certificates, variances, and similar rights obtained, or required to be obtained,

from Governmental Authorities (collectively, “Permits”) in order for the Company to conduct its business have been obtained

and are valid and in full force and effect.

Section 3.11 Investment

Purpose. Seller is acquiring the GDC Shares solely for its own account for investment purposes and not with a view to, or for

offer or sale in connection with, any distribution thereof or any other security related thereto within the meaning of the Securities

Act of 1933, as amended (the “Securities Act”). Seller acknowledges that GDC has not registered the offer and sale of

the GDC Shares under the Securities Act or any state securities laws, and that the GDC Shares may not be pledged, transferred, sold, offered

for sale, hypothecated, or otherwise disposed of except pursuant to the registration provisions of the Securities Act or pursuant to an

applicable exemption therefrom and subject to state securities laws and regulations, as applicable.

Section 3.12 Brokers.

No broker, finder, or investment banker is entitled to any brokerage, finder’s, or other fee or commission in connection with the transactions

contemplated by this Agreement or any other Transaction Document based upon arrangements made by or on behalf of Seller.

ARTICLE IV

Representations and warranties of buyer

Buyer represents and warrants

to Seller that the statements contained in this ARTICLE IV are true and correct as of the date hereof.

Section 4.01 Organization

and Authority of Buyer. Buyer is a company duly organized, validly existing, and in good standing under the Laws of the People’s

Republic of China. Buyer has full power and authority to enter into this Agreement and the other Transaction Documents to which Buyer

is a party, to carry out its obligations hereunder and thereunder, and to consummate the transactions contemplated hereby and thereby.

The execution and delivery by Buyer of this Agreement and any other Transaction Document to which Buyer is a party, the performance by

Buyer of its obligations hereunder and thereunder, and the consummation by Buyer of the transactions contemplated hereby and thereby have

been duly authorized by all requisite action on the part of Buyer. This Agreement and each Transaction Document constitute legal, valid,

and binding obligations of Buyer enforceable against Buyer in accordance with their respective terms.

Section

4.02 No Conflicts; Consents. The execution, delivery, and performance by Buyer of this Agreement and the other Transaction

Documents to which it is a party, and the consummation of the transactions contemplated hereby and thereby, do not and will not: (a) violate

or conflict with any provision of the certificate of incorporation, by-laws, or other governing documents of Buyer; (b) violate or conflict

with any provision of any Law or Governmental Order applicable to Buyer; or (c) require the consent, notice, declaration, or filing with

or other action by any Person or require any Permit, license, or Governmental Order.

Section

4.03 Investment Purpose. Buyer is acquiring the Target Equity Interest solely for its own account for investment purposes

and not with a view to, or for offer or sale in connection with, any distribution thereof or any other security related thereto within

the meaning of the Securities Act. Buyer acknowledges that Seller has not registered the offer and sale of the Target Equity Interest

under the Securities Act or any state securities laws, and that the Target Equity Interest may not be pledged, transferred, sold, offered

for sale, hypothecated, or otherwise disposed of except pursuant to the registration provisions of the Securities Act or pursuant to an

applicable exemption therefrom and subject to state securities laws and regulations, as applicable.

Section 4.04 Brokers.

No broker, finder, or investment banker is entitled to any brokerage, finder’s, or other fee or commission in connection with the transactions

contemplated by this Agreement or any other Transaction Document based upon arrangements made by or on behalf of Buyer.

ARTICLE V

Representations and warranties of GDC

GDC represents and warrants

to Seller that the statements contained in this ARTICLE V are true and correct as of the date hereof.

Section 5.01 Organization

and Authority of GDC. GDC is a corporation duly organized, validly existing, and in good standing under the Laws of the State

of Nevada. GDC has full corporate power and authority to enter into this Agreement and the other Transaction Documents to which GDC is

a party, to carry out its obligations hereunder and thereunder, and to consummate the transactions contemplated hereby and thereby. The

execution and delivery by GDC of this Agreement and any other Transaction Document to which GDC is a party, the performance by GDC of

its obligations hereunder and thereunder, and the consummation by GDC of the transactions contemplated hereby and thereby have been duly

authorized by all requisite action on the part of GDC. This Agreement and each Transaction Document constitute legal, valid, and binding

obligations of GDC enforceable against GDC in accordance with their respective terms.

Section 5.02 No

Conflicts; Consents. The execution, delivery, and performance by GDC of this Agreement and the other Transaction Documents

to which it is a party, and the consummation of the transactions contemplated hereby and thereby, do not and will not: (a) violate or

conflict with any provision of the certificate of incorporation, by-laws, or other governing documents of GDC; (b) violate or conflict

with any provision of any Law or Governmental Order applicable to GDC; or (c) require the consent, notice, declaration, or filing with

or other action by any Person or require any Permit, license, or Governmental Order.

Section 5.03 Capitalization.

The authorized shares of the Company consist of 200,000,000 shares of common stock, $0.0001 par value, of which 3,053,563 shares are issued

and outstanding as of the date of the Original Agreement, and 20,000,000 shares of preferred stock, $0.0001 par value, of which none is

issued and outstanding as of the date of the Original Agreement. All of the GDC Shares have been duly authorized, and when issued pursuant

to this Agreement, will be validly issued, fully paid and nonassessable, free and clear of all Encumbrances.

Section 5.04 Brokers.

No broker, finder, or investment banker is entitled to any brokerage, finder’s, or other fee or commission in connection with the transactions

contemplated by this Agreement or any other Transaction Document based upon arrangements made by or on behalf of GDC.

ARTICLE VI

Covenants

Section

6.01 Confidentiality. From and after the Closing, Seller shall, and shall cause its Affiliates and its and their respective

directors, officers, employees, consultants, counsel, accountants, and other agents (collectively, “Representatives”)

to, hold in confidence any and all information, in any form, concerning the Company, except to the extent that Seller can show that such

information: (a) is generally available to and known by the public through no fault of Seller, any of its Affiliates, or their respective

Representatives; or (b) is lawfully acquired by Seller, any of its Affiliates, or their respective Representatives from and after the

Closing from sources which are not prohibited from disclosing such information by any obligation. If Seller or any of its Affiliates or

their respective Representatives are compelled to disclose any information by Governmental Order or Law, Seller shall promptly notify

Buyer in writing and shall disclose only that portion of such information which is legally required to be disclosed; provided, however,

Seller shall use reasonable best efforts to obtain as promptly as possible an appropriate protective order or other reasonable assurance

that confidential treatment will be accorded such information.

Section 6.02 Further

Assurances. Following the Closing, each of the parties hereto shall, and shall cause their respective Affiliates to, execute

and deliver such additional documents and instruments and take such further actions as may be reasonably required to carry out the provisions

hereof and give effect to the transactions contemplated by this Agreement and the other Transaction Documents.

ARTICLE VII

Term and TERMINATION

Section 7.01 Term.

This Agreement shall be effective for thirty (30) days from the date hereof, which can be extended for an additional thirty (30) days

upon all parties’ written agreement.

Section

7.02 Termination. During the terms specified in Section 7.01, GDC or the Buyer may terminate this Agreement at any time with a three

(3) day advance written notice to the Seller delivered pursuant to Section 9.02 of this Agreement.

ARTICLE VIII

Indemnification

Section

8.01 Indemnification by Seller. Subject to the other terms and conditions of this ARTICLE VIII, Seller shall indemnify and

defend each of Buyer, GDC and their respective Affiliates (including the Company) and their respective Representatives (collectively,

the “Buyer Indemnitees”) against, and shall hold each of them harmless from and against, and shall pay and reimburse

each of them for, any and all Losses incurred or sustained by, or imposed upon, the Buyer Indemnitees based upon, arising out of, with

respect to, or by reason of:

(a) any

inaccuracy in or breach of any of the representations or warranties of Seller contained in this Agreement or the other Transaction Documents;

or

(b) any

breach or non-fulfillment of any covenant, agreement, or obligation to be performed by Seller pursuant to this Agreement or the other

Transaction Documents.

Section

8.02 Indemnification by Buyer. Subject to the other terms and conditions of this ARTICLE VIII, Buyer shall indemnify and

defend each of Seller and its Affiliates and their respective Representatives (collectively, the “Seller Indemnitees”)

against, and shall hold each of them harmless from and against, and shall pay and reimburse each of them for, any and all Losses incurred

or sustained by, or imposed upon, the Seller Indemnitees based upon, arising out of, with respect to, or by reason of:

(a) any

inaccuracy in or breach of any of the representations or warranties of Buyer contained in this Agreement or the other Transaction Documents;

or

(b) any

breach or non-fulfillment of any covenant, agreement, or obligation to be performed by Buyer pursuant to this Agreement.

Section 8.03 Indemnification

Procedures. Whenever any claim shall arise for indemnification hereunder, the party entitled to indemnification (the “Indemnified

Party”) shall promptly provide written notice of such claim to the other party (the “Indemnifying Party”). In

connection with any claim giving rise to indemnity hereunder resulting from or arising out of any Action by a Person who is not a party

to this Agreement, the Indemnifying Party, at its sole cost and expense and upon written notice to the Indemnified Party, may assume the

defense of any such Action with counsel reasonably satisfactory to the Indemnified Party. The Indemnified Party shall be entitled to participate

in the defense of any such Action, with its counsel and at its own cost and expense. If the Indemnifying Party does not assume the defense

of any such Action, the Indemnified Party may, but shall not be obligated to, defend against such Action in such manner as it may deem

appropriate, including settling such Action, after giving notice of it to the Indemnifying Party, on such terms as the Indemnified Party

may deem appropriate. No action taken by the Indemnified Party in accordance with such defense and settlement shall relieve the Indemnifying

Party of its indemnification obligations herein provided with respect to any damages resulting therefrom. The Indemnifying Party shall

not settle any Action without the Indemnified Party’s prior written consent (which consent shall not be unreasonably withheld or delayed).

Section 8.04 Survival.

Subject to the limitations and other provisions of this Agreement, the representations and warranties contained herein and all related

rights to indemnification shall survive the Closing and shall remain in full force and effect until the date that is one year from the

Closing Date; provided, however, the representations and warranties in Section 3.01, Section 3.02, Section 3.03, Section 3.04,

Section 3.05, Section 3.12, Section 4.01, Section 4.02, Section 4.04, Section 5.01, Section 5.02 and Section 5.04 shall survive indefinitely.

All covenants and agreements of the parties contained herein shall survive the Closing indefinitely unless another period is explicitly

specified herein. Notwithstanding the foregoing, any claims which are timely asserted in writing by notice from the non-breaching party

to the breaching party prior to the expiration date of the applicable survival period shall not thereafter be barred by the expiration

of the relevant representation or warranty and such claims shall survive until finally resolved.

ARTICLE IX

Miscellaneous

Section

9.01 Expenses. All costs and expenses incurred in connection with this Agreement and the transactions contemplated hereby

shall be paid by the party incurring such costs and expenses.

Section

9.02 Notices. All notices, claims, demands, and other communications hereunder shall be in writing and shall be deemed to

have been given: (a) when delivered by hand (with written confirmation of receipt); (b) when received by the addressee if sent by a nationally

recognized overnight courier (receipt requested); (c) on the date sent by facsimile or email of a PDF document (with confirmation of transmission)

if sent during normal business hours of the recipient, and on the next business day if sent after normal business hours of the recipient;

or (d) on the third day after the date mailed, by certified or registered mail, return receipt requested, postage prepaid, if sent to

the respective parties at the addresses on the signature page (or at such other address for a party as shall be specified in a notice

given in accordance with this Section 9.02):

Section

9.03 Interpretation; Headings. This Agreement shall be construed without regard to any presumption or rule requiring

construction or interpretation against the party drafting an instrument or causing any instrument to be drafted. The headings in this

Agreement are for reference only and shall not affect the interpretation of this Agreement.

Section

9.04 Severability. If any term or provision of this Agreement is invalid, illegal, or unenforceable in any jurisdiction,

such invalidity, illegality, or unenforceability shall not affect any other term or provision of this Agreement.

Section

9.05 Entire Agreement. This Agreement and the other Transaction Documents constitute the sole and entire agreement of the

parties to this Agreement with respect to the subject matter contained herein and therein, and supersede all prior and contemporaneous

understandings and agreements, both written and oral, with respect to such subject matter, including but not limited to the Original Agreement.

In the event of any inconsistency between the statements in the body of this Agreement and those in the other Transaction Documents, the

statements in the body of this Agreement will control.

Section

9.06 Successors and Assigns. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and

their respective successors and permitted assigns. Neither party may assign its rights or obligations hereunder without the prior written

consent of the other party, which consent shall not be unreasonably withheld or delayed. No assignment shall relieve the assigning party

of any of its obligations hereunder.

Section 9.07 Amendment

and Modification; Waiver. This Agreement may only be amended, modified, or supplemented by an agreement in writing signed by

each party hereto. No waiver by any party of any of the provisions hereof shall be effective unless explicitly set forth in writing and

signed by the party so waiving. No failure to exercise, or delay in exercising, any right or remedy arising from this Agreement shall

operate or be construed as a waiver thereof. No single or partial exercise of any right or remedy hereunder shall preclude any other or

further exercise thereof or the exercise of any other right or remedy.

Section 9.08 Governing

Law; Submission to Jurisdiction; Waiver of Jury Trial. This Agreement shall be governed by and construed in accordance with

the internal laws of the State of New York, without giving effect to any choice or conflict of law provision or rule (whether of the State

of New York or any other jurisdiction). Any legal suit, action, proceeding, or dispute arising out of or related to this Agreement, the

other Transaction Documents, or the transactions contemplated hereby or thereby shall be instituted in the federal courts of the United

States of America or the courts of the State of New York in each case located in the city of New York and county of New York, and each

party irrevocably submits to the exclusive jurisdiction of such courts in any such suit, action, proceeding, or dispute.

EACH PARTY ACKNOWLEDGES AND AGREES THAT ANY CONTROVERSY

WHICH MAY ARISE UNDER THIS AGREEMENT OR THE OTHER TRANSACTION DOCUMENTS IS LIKELY TO INVOLVE COMPLICATED AND DIFFICULT ISSUES AND, THEREFORE,

EACH PARTY IRREVOCABLY AND UNCONDITIONALLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL

BY JURY IN ANY LEGAL ACTION, PROCEEDING, CAUSE OF ACTION, OR COUNTERCLAIM ARISING OUT OF OR RELATING TO THIS AGREEMENT, INCLUDING ANY

EXHIBITS AND SCHEDULES ATTACHED TO THIS AGREEMENT, THE OTHER TRANSACTION DOCUMENTS, OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY.

EACH PARTY CERTIFIES AND ACKNOWLEDGES THAT: (I) NO REPRESENTATIVE OF THE OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT THE

OTHER PARTY WOULD NOT SEEK TO ENFORCE THE FOREGOING WAIVER IN THE EVENT OF A LEGAL ACTION; (II) EACH PARTY HAS CONSIDERED THE IMPLICATIONS

OF THIS WAIVER; (III) EACH PARTY MAKES THIS WAIVER KNOWINGLY AND VOLUNTARILY; AND (IV) EACH PARTY HAS BEEN INDUCED TO ENTER INTO THIS

AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION.

Section

9.09 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of

which together shall be deemed to be one and the same agreement. A signed copy of this Agreement delivered by email or other means of

electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

[signature page follows]

IN WITNESS WHEREOF,

the parties hereto have caused this Agreement to be executed as of the date first written above by their respective officers or representatives

thereunto duly authorized.

| |

SELLER |

| |

Beijing Hehe Property Management Co., Ltd. |

| |

|

| |

By |

/s/ Qingguo Wang |

| |

Name: |

Qingguo Wang |

| |

Title: |

Director |

| |

Address: |

| |

|

| |

BUYER |

| |

Shanghai Highlight Entertainment Co., Ltd. |

| |

|

| |

By |

/s/ Zihao Zhao |

| |

Name: |

Zihao Zhao |

| |

Title: |

CFO |

| |

Address: |

| |

|

| |

GDC |

| |

GD Culture Group Limited |

| |

|

| |

By |

/s/ Xiao Jian Wang |

| |

Name: |

Xiao Jian Wang |

| |

Title: |

Chief Executive Officer |

| |

Address: |

11

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

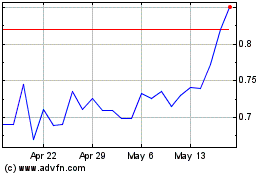

GD Culture (NASDAQ:GDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

GD Culture (NASDAQ:GDC)

Historical Stock Chart

From Apr 2023 to Apr 2024