0001584693

false

FY

P5Y

P1Y

0001584693

2022-08-01

2023-07-31

0001584693

2023-01-31

0001584693

2023-10-29

0001584693

2023-07-31

0001584693

2022-07-31

0001584693

us-gaap:NonrelatedPartyMember

2023-07-31

0001584693

us-gaap:NonrelatedPartyMember

2022-07-31

0001584693

us-gaap:RelatedPartyMember

2023-07-31

0001584693

us-gaap:RelatedPartyMember

2022-07-31

0001584693

2021-08-01

2022-07-31

0001584693

us-gaap:CommonStockMember

2021-07-31

0001584693

us-gaap:AdditionalPaidInCapitalMember

2021-07-31

0001584693

HITC:CommonStockSubscribedMember

2021-07-31

0001584693

us-gaap:RetainedEarningsMember

2021-07-31

0001584693

2021-07-31

0001584693

us-gaap:CommonStockMember

2022-07-31

0001584693

us-gaap:AdditionalPaidInCapitalMember

2022-07-31

0001584693

HITC:CommonStockSubscribedMember

2022-07-31

0001584693

us-gaap:RetainedEarningsMember

2022-07-31

0001584693

us-gaap:CommonStockMember

2021-08-01

2022-07-31

0001584693

us-gaap:AdditionalPaidInCapitalMember

2021-08-01

2022-07-31

0001584693

HITC:CommonStockSubscribedMember

2021-08-01

2022-07-31

0001584693

us-gaap:RetainedEarningsMember

2021-08-01

2022-07-31

0001584693

us-gaap:CommonStockMember

2022-08-01

2023-07-31

0001584693

us-gaap:AdditionalPaidInCapitalMember

2022-08-01

2023-07-31

0001584693

HITC:CommonStockSubscribedMember

2022-08-01

2023-07-31

0001584693

us-gaap:RetainedEarningsMember

2022-08-01

2023-07-31

0001584693

us-gaap:CommonStockMember

2023-07-31

0001584693

us-gaap:AdditionalPaidInCapitalMember

2023-07-31

0001584693

HITC:CommonStockSubscribedMember

2023-07-31

0001584693

us-gaap:RetainedEarningsMember

2023-07-31

0001584693

srt:MinimumMember

2023-07-31

0001584693

srt:MaximumMember

2023-07-31

0001584693

HITC:CapitalizedCostsOfDevelopedSoftwareMember

2023-07-31

0001584693

HITC:CapitalizedCostsOfDevelopedSoftwareMember

2022-07-31

0001584693

HITC:CapitalizedCostsOfPatentsMember

2023-07-31

0001584693

HITC:CapitalizedCostsOfPatentsMember

2022-07-31

0001584693

HITC:CapitalizedCostsOfwebsiteMember

2023-07-31

0001584693

HITC:CapitalizedCostsOfwebsiteMember

2022-07-31

0001584693

HITC:IntangibleAssetsUnderDevelopmentMember

2023-07-31

0001584693

HITC:IntangibleAssetsUnderDevelopmentMember

2022-07-31

0001584693

HITC:PlatinumEquityAdvisorsLLCMember

2023-06-12

0001584693

HITC:PlatinumEquityAdvisorsLLCMember

2023-06-12

2023-06-12

0001584693

HITC:PlatinumEquityAdvisorsLLCMember

2023-07-31

0001584693

HITC:FivePercentageConvertiblePromissoryNotesMember

2023-07-31

0001584693

HITC:FivePercentageConvertiblePromissoryNotesMember

2022-07-31

0001584693

HITC:NotePayableToAcornManagementPartnersLLCMember

2023-07-31

0001584693

HITC:NotePayableToAcornManagementPartnersLLCMember

2022-07-31

0001584693

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2023-07-31

0001584693

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2022-07-31

0001584693

HITC:FivePercentageConvertiblePromissoryNotesMember

2018-03-01

2018-03-31

0001584693

HITC:FivePercentageConvertiblePromissoryNotesMember

2018-03-31

0001584693

HITC:FivePercentageConvertiblePromissoryNotesMember

2022-08-01

2023-07-31

0001584693

HITC:FivePercentageConvertiblePromissoryNotesMember

HITC:DebtDefaultMember

2023-07-31

0001584693

HITC:FivePercentageConvertiblePromissoryNotesMember

HITC:DebtDefaultMember

2022-08-01

2023-07-31

0001584693

HITC:NotePayableToAcornManagementPartnersLLCMember

2020-08-10

2020-08-11

0001584693

HITC:NotePayableToAcornManagementPartnersLLCMember

2020-08-11

0001584693

HITC:NotePayableToAcornManagementPartnersLLCMember

2023-07-31

0001584693

HITC:NotePayableToAcornManagementPartnersLLCMember

2022-07-31

0001584693

HITC:SecuritiesPurchaseAgreementMember

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2021-02-02

0001584693

HITC:SecuritiesPurchaseAgreementMember

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2021-01-29

2021-02-02

0001584693

HITC:SecuritiesPurchaseAgreementMember

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2022-02-09

0001584693

HITC:SecuritiesPurchaseAgreementMember

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2022-02-08

2022-02-09

0001584693

HITC:SecuritiesPurchaseAgreementMember

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2023-07-31

0001584693

HITC:SecuritiesPurchaseAgreementMember

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2022-07-31

0001584693

HITC:SecuritiesPurchaseAgreementMember

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2022-08-01

2023-07-31

0001584693

HITC:SecuritiesPurchaseAgreementMember

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2021-08-01

2022-07-31

0001584693

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2022-08-01

2023-07-31

0001584693

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2021-08-01

2022-07-31

0001584693

us-gaap:MeasurementInputPriceVolatilityMember

srt:MinimumMember

2023-07-31

0001584693

us-gaap:MeasurementInputPriceVolatilityMember

srt:MaximumMember

2023-07-31

0001584693

us-gaap:MeasurementInputPriceVolatilityMember

srt:MinimumMember

2022-07-31

0001584693

us-gaap:MeasurementInputPriceVolatilityMember

srt:MaximumMember

2022-07-31

0001584693

us-gaap:MeasurementInputExpectedTermMember

srt:MinimumMember

2022-08-01

2023-07-31

0001584693

us-gaap:MeasurementInputExpectedTermMember

srt:MaximumMember

2022-08-01

2023-07-31

0001584693

us-gaap:MeasurementInputExpectedTermMember

srt:MinimumMember

2021-08-01

2022-07-31

0001584693

us-gaap:MeasurementInputExpectedTermMember

srt:MaximumMember

2021-08-01

2022-07-31

0001584693

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MinimumMember

2023-07-31

0001584693

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MaximumMember

2023-07-31

0001584693

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MinimumMember

2022-07-31

0001584693

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MaximumMember

2022-07-31

0001584693

us-gaap:MeasurementInputExpectedDividendRateMember

2023-07-31

0001584693

us-gaap:MeasurementInputExpectedDividendRateMember

2022-07-31

0001584693

HITC:StockOptionsAndWarrantsMember

2022-08-01

2023-07-31

0001584693

HITC:StockOptionsAndWarrantsMember

2021-08-01

2022-07-31

0001584693

us-gaap:RestrictedStockMember

2022-08-01

2023-07-31

0001584693

us-gaap:RestrictedStockMember

2021-08-01

2022-07-31

0001584693

HITC:StockOptionsAndWarrantsMember

2022-07-31

0001584693

HITC:StockOptionsAndWarrantsMember

2021-07-31

0001584693

HITC:StockOptionsAndWarrantsMember

2023-07-31

0001584693

us-gaap:CommonStockMember

us-gaap:NotesPayableOtherPayablesMember

2022-08-01

2023-07-31

0001584693

us-gaap:CommonStockMember

HITC:SecuritiesPurchaseAgreementMember

2022-08-01

2023-07-31

0001584693

us-gaap:CommonStockMember

HITC:NotesPayableOtherPayableMember

2022-08-01

2023-07-31

0001584693

us-gaap:CommonStockMember

HITC:VestingOfStockGrantMember

2022-08-01

2023-07-31

0001584693

us-gaap:CommonStockMember

HITC:SecuritiesPurchaseAgreementMember

2021-08-01

2022-07-31

0001584693

us-gaap:CommonStockMember

HITC:DebtSettlementAndAmendmentAgreementMember

2021-08-01

2022-07-31

0001584693

us-gaap:CommonStockMember

HITC:VestingOfEmployeeStockGrantMember

2021-08-01

2022-07-31

0001584693

2022-08-26

2022-08-26

0001584693

2022-08-26

0001584693

2022-11-01

2022-11-01

0001584693

2022-11-01

0001584693

HITC:FivePercentConvertiblePromissoryNoteMember

HITC:HoldersMember

2023-01-20

2023-01-20

0001584693

HITC:FivePercentConvertiblePromissoryNoteMember

HITC:HoldersMember

2023-01-20

0001584693

HITC:FivePercentConvertiblePromissoryNoteMember

HITC:HoldersMember

2023-02-10

2023-02-10

0001584693

HITC:FivePercentConvertiblePromissoryNoteMember

HITC:HoldersMember

2023-02-10

0001584693

HITC:PromissoryNoteMember

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2023-02-28

2023-02-28

0001584693

HITC:PromissoryNoteMember

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2023-02-28

0001584693

HITC:PromissoryNoteMember

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2023-05-11

2023-05-11

0001584693

HITC:PromissoryNoteMember

HITC:NotePayableToAJBCapitalInvestmentsLLCMember

2023-05-11

0001584693

HITC:VestingOfEmployeeStockGrantMember

us-gaap:CommonStockMember

2023-07-16

2023-07-16

0001584693

us-gaap:CommonStockMember

HITC:VestingOfEmployeeStockGrantMember

2023-07-16

0001584693

HITC:EmploymentAgreementsMember

us-gaap:CommonStockMember

2022-08-01

2023-07-31

0001584693

HITC:PromissoryNoteMember

HITC:EmploymentAgreementsMember

2023-07-31

0001584693

HITC:PromissoryNoteMember

HITC:NotePayableToPlatinumEquityAdvisorsLLCMember

2022-08-01

2023-07-31

0001584693

HITC:PromissoryNoteMember

HITC:NotePayableToPlatinumEquityAdvisorsLLCMember

2023-07-31

0001584693

HITC:SecuritiesPurchaseAgreementMember

us-gaap:InvestorMember

2021-04-01

2021-04-30

0001584693

HITC:SecuritiesPurchaseAgreementMember

us-gaap:InvestorMember

2021-04-30

0001584693

HITC:ContractCEOAgreementMember

HITC:PlatinumEquityMember

us-gaap:RelatedPartyMember

2023-07-31

0001584693

HITC:ContractCEOAgreementMember

HITC:PlatinumEquityMember

us-gaap:RelatedPartyMember

2022-07-31

0001584693

HITC:ScottMBoruffMember

HITC:ContractCEOAgreementMember

2021-05-02

2021-05-02

0001584693

HITC:SusanAReyesMember

HITC:EmploymentAgreementMember

2020-09-01

2020-09-01

0001584693

HITC:DrReyesMember

HITC:EmploymentAgreementMember

2020-09-02

2020-09-02

0001584693

HITC:KennethMGreenwoodMember

HITC:EmploymentAgreementMember

2020-06-15

2020-06-15

0001584693

HITC:CharlesBLobettiIIIMember

HITC:EmploymentAgreementMember

2019-10-08

2019-10-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended July 31, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ________ to ________

Commission

file number: 001-36564

Healthcare

Integrated Technologies, Inc.

(Exact

Name of Registrant as Specified in its Charter)

| Nevada |

|

85-1173741 |

(State

or Other Jurisdiction

of

Incorporation or Organization) |

|

(I.R.S.

Employer

Identification

No.) |

1462

Rudder Lane

Knoxville,

TN 37919

(Address

of Principal Executive Offices)

Registrant’s

telephone number, including area code: (865) 719-8160

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to section 12(g) of the Act:

Common

Stock, $0.001 par value

(Title

of class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (ss.232.405 of this chapter) during the preceding 12

months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☒

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained

herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated

by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☐ |

Smaller

reporting company |

☐ |

| (Do

not check if a smaller reporting company) |

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based

compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to

§240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The

aggregate market value of the outstanding common stock, other than shares held by persons who may be deemed affiliates of the registrant,

computed by reference to the closing sales price for the registrant’s common stock on January 31, 2023 (the last business day of

the registrant’s most recently completed second quarter), as reported on the OTC Pink market, was approximately $5,182,437. As

of November 13, 2023, there were 69,298,198 shares of common stock of the registrant outstanding.

Documents

Incorporated by Reference: None.

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K (this “Report”) contains “forward-looking statements” within the meaning of the Section

27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss

future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,”

“intend,” “could,” “should,” “would,” “may,” “seek,” “plan,”

“might,” “will,” “expect,” “predict,” “project,” “forecast,”

“potential,” “continue”, negatives thereof or similar expressions. These forward-looking statements are found

at various places throughout this Annual Report and include information concerning: possible or assumed future results of our operations;

business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future operations,

future cash needs, business plans and future financial results; and any other statements that are not historical facts.

From

time to time, forward-looking statements also are included in our other periodic reports on Forms 10-Q and 8-K, in our press releases,

in our presentations, on our website and in other materials released to the public. Any or all the forward-looking statements included

in this Annual Report and in any other reports or public statements made by us are not guarantees of future performance and may turn

out to be inaccurate. These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future

events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual

results to differ materially from the results expressed or implied by those forward-looking statements. Considering these risks, uncertainties

and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a

different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak

only as of the date of this Annual Report. All subsequent written and oral forward-looking statements concerning other matters addressed

in this Annual Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary

statements contained or referred to in this Annual Report.

Except

to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of

new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

For

discussion of factors that we believe could cause our actual results to differ materially from expected and historical results see “Item

1A - Risk Factors” below.

PART

I

ITEM

1. BUSINESS.

Overview

Healthcare

Integrated Technologies, Inc. and its subsidiaries (collectively the “Company,” “we,” “our” or “us”)

is a healthcare technology company based in Knoxville, Tennessee. We are creating a diversified spectrum of healthcare technology solutions

to integrate and automate the continuing care, home care and professional healthcare spaces.

Our

initial product, SafeSpace™ with AI Vision™, is an ambient fall detection solution designed for continuing care communities

and at home use. SafeSpace includes hardware devices utilizing RGB, radar and other sensor technology coupled with our internally developed

software to effectively monitor a person remotely. In continuing care communities, SafeSpace detects resident falls and generates alerts

to a centralized, intelligent dashboard without the use of wearable devices or any action by the resident. In the home, SafeSpace detects

falls and sends alerts directly to designated individuals.

We

recently introduced and are currently pilot testing two additional products - SafeFace™ and SafeGuard™. SafeFace provides

fully automated and ambient time and attendance reporting for facility staff, and an integrated and automatic agency invoice reconciliation

feature. SafeGuard is a novel fully ambient elopement detection and alerting system based on our facial recognition technology.

In

addition to our current product offerings, we are developing a home concierge healthcare service application to provide a virtual assisted

living experience for seniors, recently released postoperative patients, and others. The concierge application will enable the consumer

to obtain home healthcare services and health and safety monitoring equipment to improve quality of life. We are also working to develop

a fully integrated solution for the professional healthcare community that integrates electronic health records, remote patient monitoring,

telehealth, and other items where integration is beneficial.

Our

History

The

Company has had three distinct businesses. First, we were incorporated in the state of Nevada on June 25, 2013 as Tomichi Creek Outfitters,

aiming to provide professionally guided big game hunts in Sargents, Colorado which is approximately four hours southwest from Denver.

This area of the country is home to trophy size Elk and Mule Deer. Our secondary business included offering guided scenic tours on the

western slopes of the Rocky Mountains. Every season offers a diversified plethora of wildlife and stunning scenic views. Our Chief Executive

Officer (“CEO”) and sole director at that time was Jeremy Gindro. These operations were discontinued in 2015.

Second,

on March 2, 2015, the Company entered into a Business Acquisition Agreement and share exchange under which we acquired the business and

assets of Grasshopper Staffing, Inc. (“Grasshopper Colorado”), formed in the state of Colorado on January 13, 2015. The exchange

for $10,651 was represented by 250,000 shares of the Company’s common stock in exchange for all the outstanding shares of Grasshopper

Colorado. The assets purchased include the trademark and website, office supplies and office furniture. On November 2, 2015 we filed

a Certificate of Amendment to our Articles of Incorporation changing the name of our Company from Tomichi Creek Outfitters to Grasshopper

Staffing, Inc. Grasshopper Colorado was operating as a wholly owned subsidiary of the Company and was the primary operation of our business

until the acquisition of IndeLiving Holdings Inc., on March 13, 2018. Our management consisted of Melanie Osterman as CEO, and Jeremy

Gindro who was our sole director. The operations of Grasshopper Colorado were discontinued in February 2019.

Third,

we acquired IndeLiving Holdings, Inc. (“IndeLiving”) on March 13, 2018 and changed our name to Healthcare Integrated

Technologies, Inc. Our current operations are described in the above “Overview” section. With the acquisition of IndeLiving, we had another change in

management, and Scott M. Boruff became our CEO and Chairman of the Board of Directors.

Employees

and Human Capital

At

July 31, 2023, we had 4 employees.

At

July 31, 2022, we had 4 employees.

None

of our employees are represented by a union or covered by a collective bargaining agreement. We have not experienced any work stoppages

and we consider our relationship with our employees to be good.

Our

objectives surrounding human capital resources include, as applicable, identifying, recruiting, retaining, incentivizing

and integrating our existing and new employees, advisors and consultants. The principal purposes of our equity incentive plan are to

attract, retain and reward personnel through the granting of stock-based compensation awards, in order to increase stockholder value

and promote the success of our company by motivating such individuals to perform to the best of their abilities and achieve our

objectives.

Available

Information

We

electronically file certain documents with the Securities and Exchange Commission (the SEC). We file annual reports on Form 10-K; quarterly

reports on Form 10-Q; and current reports on Form 8-K (as appropriate); along with any related amendments and supplements thereto. From

time-to-time, we may also file registration statements and related documents in connection with equity or debt offerings. You may read

and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may

obtain information regarding the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an internet

website at www.sec.gov that contains reports and other information regarding registrants that file electronically with the SEC.

ITEM

1A. RISK FACTORS.

Risks

Related to Economic and Market Conditions

General

Economic and Financial Conditions

The

success of any investment activity is influenced by general economic and financial conditions, all of which are beyond the control of

the Company. These conditions, such as the recent global economic concerns and significant downturns in the financial markets, may materially

adversely affect our operating results, financial condition and ability to implement our business strategy and/or meet our return objectives.

Risks

Related to Our Business

The

Company’s industry is highly competitive and we have less capital and resources than many of our competitors, which may give them

an advantage in developing and marketing products similar to ours or make our products obsolete

We

are involved in a highly competitive industry where we may compete with numerous other companies who offer alternative methods or approaches,

who may have far greater resources, more experience, and personnel more qualified than we do. Such resources may give our competitors

an advantage in developing and marketing products similar to ours or products that make our products obsolete. There can be no assurance

that we will be able to successfully compete against these other entities.

The

Company may be unable to respond to the rapid technological change in its industry and such change may increase costs and competition

that may adversely affect its business

Rapidly

changing technologies, frequent new product and service introductions and evolving industry standards characterize the Company’s

market. The continued growth of the internet and intense competition in the Company’s industry exacerbate these market characteristics.

The Company’s future success will depend on its ability to adapt to rapidly changing technologies by continually improving the

performance features and reliability of its products and services. The Company may experience difficulties that could delay or prevent

the successful development, introduction or marketing of its products and services. In addition, any new enhancements must meet the requirements

of its current and prospective users and must achieve significant market acceptance. The Company could also incur substantial costs if

it needs to modify its products and services or infrastructures to adapt to these changes.

The

Company also expects that new competitors may introduce products, systems or services that are directly or indirectly competitive with

the Company. These competitors may succeed in developing products, systems and services that have greater functionality or are less costly

than the Company’s products, systems and services, and may be more successful in marketing such products, systems and services.

Technological changes have lowered the cost of operating communications and computer systems and purchasing software. These changes reduce

the Company’s cost of providing services but also facilitate increased competition by reducing competitors’ costs in providing

similar services. This competition could increase price competition and reduce anticipated profit margins.

The

Company’s services are new and its industry is evolving

You

should consider the Company’s viability by considering the risks, uncertainties and difficulties frequently encountered by companies

in their early stage of development. To be successful in this industry, the Company must, among other things:

| |

● |

develop

and introduce functional and attractive services; |

| |

|

|

| |

● |

attract

and maintain a large base of customers; |

| |

|

|

| |

● |

increase

awareness of the Company brand and develop consumer loyalty; |

| |

|

|

| |

● |

respond

to competitive and technological developments; |

| |

|

|

| |

● |

build

an operations structure to support the Company business; and |

| |

|

|

| |

● |

attract,

retain and motivate qualified personnel. |

The

Company cannot guarantee that it will succeed in achieving these goals, and its failure to do so would have a material adverse effect

on its business, prospects, financial condition and operating results.

The

Company’s products and services are new and are in the early stages of development. The Company is not certain that these products

and services will function as anticipated or be desirable to its intended market. Also, some of the Company’s products and services

may have limited functionalities, which may limit their appeal to consumers and put the Company at a competitive disadvantage. If the

Company’s current or future products and services fail to function properly or if the Company does not achieve or sustain market

acceptance, it could lose customers or could be subject to claims which could have a material adverse effect on the Company’s business,

financial condition and operating results.

Risks

Related to Our Company

Uncertainty

of profitability

Our

business strategy may result in increased volatility of future revenues and earnings. As we will only develop a limited number of products

and services at a time, our overall success will depend on a limited number of products and services, which may cause variability and

unsteady profits and losses depending on the products and services offered.

Our

potential revenues and our profitability may be adversely affected by economic conditions and changes in the market. Our business is

also subject to general economic risks that could adversely impact the results of operations and financial condition.

Because

of the anticipated nature of the products and services that we will attempt to develop, it is difficult to accurately forecast revenues

and operating results and these items could fluctuate in the future due to several factors. These factors may include, among other things,

the following:

| |

● |

Our

ability to raise sufficient capital to take advantage of opportunities and generate sufficient revenues to cover expenses. |

| |

|

|

| |

● |

Our

ability to source strong opportunities with sufficient risk adjusted returns. |

| |

|

|

| |

● |

Our

ability to manage our capital and liquidity requirements based on changing market conditions. |

| |

|

|

| |

● |

The

acceptance of the terms and conditions of our licenses and/or the acceptance of our royalties and fees. |

| |

|

|

| |

● |

The

amount and timing of operating costs and other costs and expenses. |

| |

|

|

| |

● |

The

nature and extent of competition from other companies that may reduce market share and create pressure on pricing and investment

return expectations. |

| |

|

|

| |

● |

Adverse

changes in the national and regional economies in which we will participate, including, but not limited to, changes in our performance,

capital availability, and market demand. |

| |

|

|

| |

● |

Adverse

changes in the projects in which we plan to invest which result from factors beyond our control, including, but not limited to, a

change in circumstances, capacity and economic impacts. |

| |

|

|

| |

● |

Changes

in laws, regulations, accounting, taxation, and other requirements affecting our operations and business. |

| |

|

|

| |

● |

Our

operating results may fluctuate from year to year due to the factors listed above and others not listed. At times, these fluctuations

may be significant. |

Our

independent auditors’ report for the fiscal years ended July 31, 2023 and 2022 have expressed doubts about our ability to continue

as a going concern

Due

to the uncertainty of our ability to meet our current operating and capital expenses, in our audited annual financial statements as of

and for the years ended July 31, 2023 and 2022, our independent auditors included a going concern qualification in their report regarding

concerns about our ability to continue as a going concern. We have incurred recurring losses and have generated limited revenue since

inception. These factors and our need for additional financing to effectively execute our business plan raise substantial doubt about

our ability to continue as a going concern. The presence of the going concern note to our financial statements may have an adverse impact

on the relationships we are developing and plan to develop with third parties as we continue the commercialization of our products and

could make it challenging and difficult for us to raise additional financing, all of which could have a material adverse impact on our

business and prospects and result in a significant or complete loss of your investment.

Management

of growth will be necessary for us to be competitive

Successful

expansion of our business will depend on our ability to effectively attract and manage staff, strategic business relationships, and shareholders.

Specifically, we will need to hire skilled management and technical personnel as well as manage partnerships to navigate shifts in the

general economic environment. Expansion has the potential to place significant strains on financial, management, and operational resources,

yet failure to expand will inhibit our profitability goals.

We

are entering a potentially highly competitive market

The

markets for the healthcare and senior monitoring industries are competitive and evolving. We face strong competition from larger companies

that may be in the process of offering similar products and services to ours. Many of our current and potential competitors have longer

operating histories, significantly greater financial, marketing and other resources and larger client bases than we have or expect to

have in the near future.

Given

the rapid changes affecting the global, national, and regional economies generally, and the healthcare industry specifically, we may

not be able to create and maintain a competitive advantage in the marketplace. Our success will depend on our ability to keep pace with

any market, legal and regulatory changes as well as competitive pressures. Any failure by us to anticipate or respond adequately to such

changes could have a material adverse effect on our financial condition, operating results, liquidity and cash flow.

If we fail to establish and maintain an effective

system of internal control, we may not be able to report our financial results accurately or prevent fraud, and any inability to report

and file our financial results accurately and timely could harm our reputation and adversely impact the future trading price of our common

stock

Effective

internal control is necessary for us to provide reliable financial reporting and prevent fraud. If we cannot provide reliable financial

reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed,

and our business and reputation with investors may be harmed. As a result, our small size and any current internal control deficiencies

may adversely affect our financial condition, results of operation and access to capital.

We

currently have insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and

accounting principles generally accepted in the United States of America (“U.S. GAAP”) and the United States Securities and

Exchange Commission (the “SEC”) disclosure requirements. Additionally, there is a lack of formal process and timeline for

closing the books and records at the end of each reporting period and such weaknesses restrict the Company’s ability to timely

gather, analyze and report information relative to the financial statements.

Because

of the Company’s limited resources, there are limited controls over information processing. There is inadequate segregation of

duties consistent with control objectives. Our Company’s management is composed of a small number of individuals resulting in

a situation where limitations on segregation of duties exist. In order to remedy this situation, we would need to hire additional

qualified staff.

The

Company’s failure to continue to attract, train, or retain highly qualified personnel could harm the Company’s business

The

Company’s success also depends on the Company’s ability to attract, train, and retain qualified personnel, specifically those

with management and product development skills. In particular, the Company must hire additional skilled personnel to further the Company’s

research and development efforts. Competition for such personnel is intense. If the Company fails in attracting new personnel, or retaining

and motivating the Company’s current personnel, the Company’s business could be harmed.

Risks

Related to Our Common Stock

Because

we will likely issue additional shares of our common stock, investment in our Company could be subject to substantial dilution

Investors’

interests in our company will be diluted and investors may suffer dilution in their net book value per share when we issue

additional shares. We are currently authorized to issue 200,000,000 shares of common stock, $0.001 par value per share. As of

November 13, 2023, there were 69,298,198 shares of our common stock issued and outstanding. We anticipate that all or at least some

of our future funding, if any, will be in the form of equity financing from the sale of our common stock. If we do sell more common

stock, investors’ investment in our company will likely be diluted. Dilution is the difference between what you pay for your

stock and the net tangible book value per share immediately after the additional shares are sold by us. If dilution occurs, any

investment in the Company’s common stock could seriously decline in value.

Trading

in our common stock on the OTC Pink has been subject to wide fluctuations

Our

common stock is currently quoted for public trading on the OTC Pink market. The trading price of our common stock has been subject to wide

fluctuations. Trading prices of our common stock may fluctuate in response to several factors, many of which will be beyond our

control. The stock market has generally experienced extreme price and volume fluctuations that have often been unrelated or

disproportionate to the operating performance of companies with no current business operation. There can be no assurance that

trading prices and price earnings ratios previously experienced by our common stock will be matched or maintained. These broad

market and industry factors may adversely affect the market price of our common stock, regardless of our operating performance. In

the past, following periods of volatility in the market price of a company’s securities, securities class-action litigation

has often been instituted. Such litigation, if instituted, could result in substantial costs for us and a diversion of

management’s attention and resources.

Our

Certificate of Incorporation and By-Laws provides for indemnification of officers and directors at our expense and limit their liability,

which may result in a major cost to us and hurt the interests of our shareholders due to corporate resources being expended for the

benefit of officers and/or directors

Our

Certificate of Incorporation and By-Laws include provisions that fully eliminate the personal liability of our directors for monetary

damages to the fullest extent possible under the laws of the State of Nevada or other applicable law. These provisions eliminate the

liability of our directors and our shareholders for monetary damages arising out of any violation of a director of his fiduciary duty

of due care. Under Nevada law, however, such provisions do not eliminate the personal liability of a director for (i) breach of the director’s

duty of loyalty, (ii) acts or omissions not in good faith or involving intentional misconduct or knowing violation of law, (iii) payment

of dividends or repurchases of stock other than from lawfully available funds, or (iv) any transaction from which the director derived

an improper benefit. These provisions do not affect a director’s liabilities under the federal securities laws or the recovery

of damages by third parties.

We

do not intend to pay dividends on any investment in the shares of common stock of our Company and any gain on an investment in our

Company will need to come through an increase in our stock’s price, which may never happen

We

have never paid any cash dividends on our common stock, and currently do not intend to pay any dividends for the foreseeable future.

To the extent that we require additional funding currently not provided for in our financing plan, our funding sources may prohibit

the payment of a dividend. Because we do not intend to declare dividends, any gain on an investment in our company will need to come

through an increase in the price of our common shares. This may never occur and investors may lose all their investment in our

company.

Because

our securities are subject to penny stock rules, you may have difficulty reselling your shares

Our

shares, as penny stocks, are covered by Section 15(g) of the Securities Exchange Act of 1934 which imposes additional sales practice

requirements on broker/dealers who sell our company’s securities, including the delivery of a standardized disclosure document;

disclosure and confirmation of quotation prices; disclosure of compensation the broker/dealer receives; and furnishing monthly account

statements. These rules apply to companies whose shares are not traded on a national stock exchange, trade at less than $5.00 per share,

or who do not meet certain other financial requirements specified by the Securities and Exchange Commission.

These

rules require brokers who sell “penny stocks” to persons other than established customers and “accredited investors”

to complete certain documentation, make suitability inquiries of investors, and provide investors with certain information concerning

the risks of trading in such penny stocks. These rules may discourage or restrict the ability of brokers to sell our shares of common

stock and may affect the secondary market for our shares of common stock. These rules could also hamper our ability to raise funds in

the primary market for our shares of common stock.

FINRA

sales practice requirements may also limit a stockholder’s ability to buy and sell our stock

In

addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority (known as “FINRA”)

has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing

that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional

customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status,

investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that

speculative low-priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers

to recommend that their customers buy our common shares, which may limit your ability to buy and sell our stock and have an adverse effect

on the market for our shares.

There

could be unidentified risks involved with an investment in our securities

The

foregoing risk factors are not a complete list or explanation of the risks involved with an investment in our securities. Additional

risks will likely be experienced that are not presently foreseen by the Company. Prospective investors must not construe this

information provided herein as constituting investment, legal, tax or other professional advice. Before making any decision to

invest in our securities, you should read this entire Annual Report and consult with your own investment, legal, tax and other

professional advisors. An investment in our securities is suitable only for investors who can assume the financial risks of an

investment in the Company for an indefinite period and who can afford to lose their entire investment. The Company makes no

representations or warranties of any kind with respect to the likelihood of the success or the business of the Company, the value of

our securities, any financial returns that may be generated or any tax benefits or consequences that may result from an investment

in the Company.

ITEM

1B. UNRESOLVED STAFF COMMENTS.

Not

applicable.

ITEM

2. PROPERTIES.

None.

ITEM

3. LEGAL PROCEEDINGS.

The

Company is currently not involved in any litigation that the Company believes could have a materially adverse effect on the Company’s

financial condition or results of operations.

ITEM

4. MINE SAFETY DISCLOSURES.

Not

applicable.

PART

II

ITEM

5. MARKET FOR OUR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

(a)

Market Information

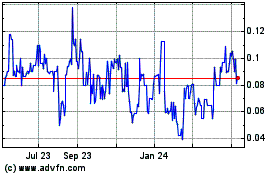

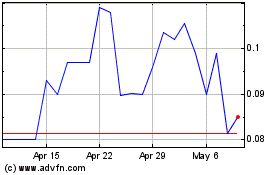

Our

common stock is quoted on the OTC Pink market under the symbol “HITC”. The OTC Pink market is a quotation service that

displays real-time quotes, last-sale prices, and volume information in over-the-counter equity securities.

The

following table shows, for the periods indicated, the high and low bid prices per share of the Company’s common Stock as reported

by the OTC Pink quotation service. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions, and

may not necessarily represent actual transactions.

| | |

High | | |

Low | |

| Fiscal

Year 2022 | |

| | | |

| | |

| First

quarter ended October 31, 2021 | |

$ | 0.48 | | |

$ | 0.17 | |

| Second quarter ended

January 31, 2022 | |

$ | 0.16 | | |

$ | 0.09 | |

| Third quarter ended

April 30, 2022 | |

$ | 0.12 | | |

$ | 0.08 | |

| Fourth quarter ended

July 31, 2022 | |

$ | 0.12 | | |

$ | 0.05 | |

| | |

| | | |

| | |

| Fiscal

Year 2023 | |

| | | |

| | |

| First quarter ended

October 31, 2022 | |

$ | 0.22 | | |

$ | 0.05 | |

| Second quarter ended

January 31, 2023 | |

$ | 0.23 | | |

$ | 0.06 | |

| Third quarter ended

April 30, 2023 | |

$ | 0.16 | | |

$ | 0.09 | |

| Fourth quarter ended

July 31, 2023 | |

$ | 0.12 | | |

$ | 0.06 | |

(b)

Holders

As

of November 13, 2023, there were 69 stockholders of record. Because shares of the Company’s common stock are held by depositaries,

brokers and other nominees, the number of beneficial holders of the Company’s shares is larger than the number of stockholders

of record.

(c)

Dividends

We

have never declared or paid dividends on our common stock. We do not intend to declare dividends in the foreseeable future because we

anticipate that we will reinvest any future earnings into the development and growth of our business. Any decision as to the future payment

of dividends will depend on our results of operations and financial position and such other factors as our Board of Directors in its

discretion deems relevant.

(d)

Securities Authorized for Issuance under Equity Compensation Plan

The

Company does not have in effect any compensation plans under which the Company’s equity securities are authorized for issuance.

Transfer

Agent

Our

transfer agent is VStock Transfer, LLC located at 18 Lafayette Place, Woodmere, NY 11598.

Recent

Sales of Unregistered Securities

During

the years ended July 31, 2023 and 2022, we have not issued any securities which were not registered under the Securities Act and not

previously disclosed in the Company’s Quarterly Reports on Form 10-Q or Current Reports on Form 8-K.

Rule

10B-18 Transactions

None.

ITEM

6. SELECTED FINANCIAL DATA.

Not

applicable

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

THE

FOLLOWING DISCUSSION OF OUR PLAN OF OPERATIONS AND RESULTS OF OPERATIONS SHOULD BE READ IN CONJUNCTION WITH THE FINANCIAL STATEMENTS

AND RELATED NOTES TO THE FINANCIAL STATEMENTS INCLUDED ELSEWHERE IN THIS REPORT. THIS DISCUSSION CONTAINS FORWARD-LOOKING STATEMENTS

THAT RELATE TO FUTURE EVENTS OR OUR FUTURE FINANCIAL PERFORMANCE. THESE STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND

OTHER FACTORS THAT MAY CAUSE OUR ACTUAL RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS TO BE MATERIALLY DIFFERENT FROM ANY

FUTURE RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY THESE FORWARD-LOOKING STATEMENTS. THESE RISKS

AND OTHER FACTORS INCLUDE, AMONG OTHERS, THOSE LISTED UNDER “FORWARD-LOOKING STATEMENTS” AND “RISK FACTORS” AND

THOSE INCLUDED ELSEWHERE IN THIS REPORT.

This

discussion summarizes the significant factors affecting the consolidated financial statements, financial condition, liquidity, and cash

flows of Healthcare Integrated Technologies, Inc, for the fiscal years ended July 31, 2023 and 2022 and the interim periods included

herein. The following discussion and analysis should be read in conjunction with the consolidated financial statements and notes included

elsewhere in this Form 10-K.

Executive

Overview

Healthcare

Integrated Technologies, Inc. and its subsidiaries is a healthcare technology company based in Knoxville, Tennessee. We are creating

a diversified spectrum of healthcare technology solutions to integrate and automate the continuing care, home care and professional healthcare

spaces.

Our

initial product, SafeSpace™ with AI Vision™, is an ambient fall detection solution designed for continuing care communities

and at home use. SafeSpace includes hardware devices utilizing RGB, radar and other sensor technology coupled with our internally developed

software to effectively monitor a person remotely. In continuing care communities, SafeSpace detects resident falls and generates alerts

to a centralized, intelligent dashboard without the use of wearable devices or any action by the resident. In the home, SafeSpace detects

falls and sends alerts directly to designated individuals.

We

recently introduced and are currently pilot testing two additional products - SafeFace™ and SafeGuard™. SafeFace provides

fully automated and ambient time and attendance reporting for facility staff, and an integrated and automatic agency invoice reconciliation

feature. SafeGuard is a novel fully ambient elopement detection and alerting system based on our facial recognition technology.

In

addition to our current product offerings, we are developing a home concierge healthcare service application to provide a virtual assisted

living experience for seniors, recently released postoperative patients, and others. The concierge application will enable the consumer

to obtain home healthcare services and health and safety monitoring equipment to improve quality of life. We are also working to develop

a fully integrated solution for the professional healthcare community that integrates electronic health records, remote patient monitoring,

telehealth, and other items where integration is beneficial.

Strategy

Our

mission is to grow a profitable healthcare technology company by focusing on our core product, continuing the development of our proprietary

software, and developing new uses and product lines for our technology. Our management team is focused on maintaining financial flexibility

and assembling the right complement of personnel and outside consultants required to successfully execute our mission.

Financial

and Operating Results

We

continue to utilize funds raised from the private sales of our common stock, issuance of debt, and short-term advances from related

parties to provide cash for our operations, which has allowed us to continue refining our initial product and readying it for pilot

testing, developing future product offerings and adding talented individuals to our management team. Highlighted achievements

for the fiscal year ended July 31, 2023 include:

| |

● |

An

independent director was appointed to our Board of Directors. G. Shayne Bench was appointed to our Board of Directors on August 26,

2022. Mr. Bench is co-founder and Chief Financial Officer of Trillium Healthcare Consulting and brings a wealth of experience and

knowledge in the senior living industry to the Company. |

| |

|

|

| |

● |

We

received $300,000 in net proceeds from the sale of our common stock at an average price of $0.10 per share. The net proceeds were

used to pay off existing debt and provide working capital. |

| |

|

|

| |

● |

At

the option of the holders, convertible debt with a face amount of $150,000 and related accrued interest of $37,586 was converted

into common shares of the Company. The conversion reduced short-term debt and increased equity by $187,586. |

| |

|

|

| |

● |

We

issued a new promissory note to Platinum Equity Advisors, LLC, a related party, and received $372,069 in net proceeds. The net proceeds

were used to retire the principal balance and related accrued interest under a promissory note to AJB Capital Investments, LLC. The

new promissory note allows for greater flexibility and significantly reduces the risk and consequences of a default. |

| |

|

|

| |

● |

Our

executive officers agreed to accept common stock as full or partial payment of all compensation owed under their respective

compensation agreements as of July 31, 2023. Accrued compensation totaling $2,053,006 was paid in common stock of the Company at a

weighted average agreed up value of $0.104 per share. The transaction significantly improved our balance sheet by reducing current

liabilities and increasing equity by the $2,053,006 amount. |

| |

|

|

| |

● |

We

introduced two new products - SafeFace and SafeGuard. SafeFace provides fully automated and ambient time and attendance

reporting for facility staff, and an integrated and automatic agency invoice reconciliation feature. SafeGuard is a novel fully ambient

elopement detection and alerting system based on our facial recognition technology. |

| |

|

|

| |

● |

On

August 8, 2023, we announced a strategic alliance with Signature HealthCARE (“Signature”). The alliance aims to

implement a series of pilot programs during the coming fiscal year. The collaboration will involve several new proprietary, fully

ambient AI-based solutions to be pilot tested and deployed across multiple Signature senior living facilities. Signature is a

family-based healthcare company that offers integrated services in 10 states across the continuum of care, including skilled

nursing, rehabilitation, assisted living, memory care, home health, cognitive care, and telemedicine. |

Results

of Operations

Revenues

We

had no revenues in fiscal 2023 or 2022. Our healthcare technology business is not currently producing revenue as we continue to develop,

test, evaluate and refine our products.

Operating

Expenses

The

table below presents a comparison of our operating expenses for the years ended July 31, 2023 and 2022:

| | |

For

the Years Ended July 31, | | |

| |

| | |

2023 | | |

2022 | | |

$

Variance | | |

%Variance | |

| | |

| | |

| | |

| | |

| |

| Officers’

salaries | |

$ | 496,543 | | |

$ | 506,443 | | |

$ | (9,900 | ) | |

| (2 | )% |

| Professional

fees | |

| 145,017 | | |

| 93,351 | | |

| 51,666 | | |

| 55 | % |

| Advertising

and marketing | |

| 6,184 | | |

| 36,535 | | |

| (30,351 | ) | |

| (83 | )% |

| Amortization | |

| 16,885 | | |

| 11,215 | | |

| 5,670 | | |

| 51 | % |

| Other | |

| 9,923 | | |

| 17,010 | | |

| (7,087 | ) | |

| (42 | )% |

| Total

selling, general & administrative | |

| 674,552 | | |

| 664,554 | | |

| 9,998 | | |

| 2 | % |

| Stock-based

compensation | |

| 287,016 | | |

| 473,511 | | |

| (186,495 | ) | |

| (39 | )% |

| Total

Operating Expenses | |

$ | 961,568 | | |

$ | 1,138,065 | | |

$ | (176,497 | ) | |

| (16 | )% |

Officers’

Salaries - Officers’ salaries, net of capitalized amounts, decreased $9,900 from 2022, or 2%. The decrease resulted from a

bonus being paid to our CFO in 2022.

Professional

Fees - Professional fees increased $51,666, or 55%, over the 2022 amount. In 2023, expense for outside consultants increased $31,860,

legal fees increased $17,224, and transfer agent and Edgar/XBRL processing fees increased $4,358. The increases were partially offset

by a decrease in accounting fees of $1,776 over the 2022 amount.

Advertising

and Marketing - Advertising and marketing expense decreased $30,351, or 83%, over 2022. The decrease is primarily due to a contract

sales and marketing position in 2022 that was eliminated in 2023.

Amortization

- Amortization expense increased $5,670, or 51%, over the same period in the prior year. The increase primarily results from the

abandonment of a patent in 2023.

Other

- Other expense decreased $7,087, or 42%, over the same period in the prior year. The decrease primarily relates to lower travel

and entertainment related expenses in 2023.

Stock-based

Compensation - Stock-based compensation expense decreased $186,495, or 39%, from the same period in the prior year. The decrease

results from a 2023 reduction in the amortization of the grant date fair value of employee stock options granted to our CEO, CFO and

CTO, and a restricted stock grant to our CFO. The decreases were partially offset by the expense related to the issuance of new shares

and restricted stock grants to outside consultants.

Other

Income (Expense)

The

table below presents a comparison of our other income (expense) for the years ended July 31, 2023 and 2022:

| | |

For

the Years Ended July 31, | | |

| |

| | |

2023 | | |

2022 | | |

$

Variance | | |

%Variance | |

| | |

| | |

| | |

| | |

| |

| Interest

expense | |

$ | (417,341 | ) | |

$ | (447,623 | ) | |

$ | (30,282 | ) | |

| (7 | )% |

| Change

in fair value of derivative liability | |

| 76,451 | | |

| 224,667 | | |

| (148,216 | ) | |

| (66 | )% |

| Total

Other Income (Expense) | |

$ | (340,890 | ) | |

$ | (222,956 | ) | |

$ | 117,934 | | |

| 53 | % |

Interest

Expense - Interest expense decreased $30,282, or 7%, over the same period in the prior year. The decrease primarily resulted from

a decrease in the amortization of debt discount related to the AJB Note 2 as it became fully amortized in the third quarter of 2023.

The decrease was partially offset by an increase in the monthly coupon interest on the larger principal balance and fees associated with

extending the maturity date of the AJB Note 2.

Change

in Fair Value of Derivative Liability - The change in the fair value of the derivative liabilities associated with our AJB Capital

notes reflects a current period gain of $76,451 as compared to a gain of $224,667 in the prior year. The current year gain resulted from

the elimination of the derivative liability on the AJB Capital note when it was paid off in June of 2023.

Liquidity

and Capital Resources

Working

Capital

The

following table summarizes our working capital for the fiscal years ending July 31, 2023 and 2022:

| | |

July

31, 2023 | | |

July

31, 2022 | |

| Current

assets | |

$ | 34,503 | | |

$ | 37,667 | |

| Current

liabilities | |

| (1,569,803 | ) | |

| (3,153,778 | ) |

| Working

capital deficiency | |

$ | (1,535,300 | ) | |

$ | (3,116,111 | ) |

Current

assets for the year ended July 31, 2023 decreased $3,164 as compared to the fiscal year ended July 31, 2022. The increase is due to a

decrease in cash and cash equivalents and the amortization of prepaid expenses.

Current

liabilities for the year ended July 31, 2023 decreased $1,583,975 as compared to the fiscal year ended July 31, 2022. The decrease is

primarily due to the reduction in accrued compensation related to executive compensation agreements being wholly or partially paid in

common stock during 2023. Additional decreases in accounts payable and accrued expenses, short-term debt, and the elimination of the

derivate liability associated with debt that was paid off during the period contributed to the overall decrease.

Net

Cash Used by Operating Activities

We

currently do not have a revenue source and will continue to have negative cash flow from operations for the near future. The factors

in determining operating cash flows are largely the same as those that affect net earnings, except for non-cash expenses such as depreciation

and amortization, stock-based compensation, amortization of debt discount, and changes in fair value of assets and liabilities, which

affect earnings but do not affect operating cash flow. Net cash used by operating activities was $106,203 for the year ended July 31,

2023 as compared to $212,177 for the year ended July 31, 2022. The $105,974 decrease in cash used by operating activities during 2023

is primarily attributable to accrued interest expense and professional fees and an overall effort by management to reduce operating costs.

Net

Cash Used by Investing Activities

Net

cash used by investing activities was $27,560 and $32,690 for the years ended July 31, 2023 and 2022, respectively. The amount is comprised

of cash paid for the filing of patent applications and for the development of software for our internal use.

Net

Cash Provided by Financing Activities

Net

cash provided by financing activities was $133,123 for the year ended July 31, 2023, which represents a $101,352 decrease over the prior

year. New loan proceeds decreased $133,317 in 2023 over the 2022 amount and in 2023 we repaid an additional $246,070 in debt over the

2022 debt repayments. The decreases were partially offset by a 2023 increase in cash received from common stock subscriptions of $275,000

over the 2022 amount.

At

this time, we cannot provide investors with any assurance that we will be able to obtain sufficient funding from debt financings and/or

the sale of our equity securities to meet our obligations over the next twelve months. We are likely to continue using short-term loans

from management to meet our short-term funding needs. We have no material commitments for capital expenditures as of July 31, 2023.

Going

Concern Qualification

We

have a history of losses, an accumulated deficit, negative working capital and have not generated cash from operations to support a meaningful

and ongoing business plan. Our Independent Registered Public Accounting Firm has included a “Going Concern Qualification”

in their report for the years ended July 31, 2023 and 2022. The foregoing raises substantial doubt about the Company’s ability

to continue as a going concern. We intend on financing our future activities and working capital needs largely from the sale of private

and/or public equity securities with additional funding from other traditional financing sources, including term notes, until such time

that funds provided by operations are sufficient to fund working capital requirements. There is no guarantee that additional capital

or debt financing will be available when and to the extent required, or that if available, it will be on terms acceptable to us. The

consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. The “Going

Concern Qualification” might make it substantially more difficult to raise capital.

Critical

Accounting Policies and Estimates

Our

consolidated financial statements and related public financial information are based on the application of U.S. GAAP. U.S. GAAP requires

the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets,

liabilities, revenues and expense amounts reported. These estimates can also affect supplemental information contained in our external

disclosures including information regarding contingencies, risk and financial condition. We believe our use of estimates and underlying

accounting assumptions adhere to U.S. GAAP and are consistently and conservatively applied. We base our estimates on historical experience

and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from

these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of

our financial statements.

Our

significant accounting policies are summarized in Note 1 of our consolidated financial statements.

We

believe the following critical policies impact our more significant judgments and estimates used in the preparation of our

consolidated financial statements.

Business

Combinations

We

account for business combinations under the acquisition method of accounting. The acquisition method requires that the acquired assets

and liabilities, including contingencies, be recorded at fair value determined on the acquisition date and that changes thereafter be

reflected in income (loss). The estimation of fair values of the assets and liabilities assumed involves several estimates and assumptions

that could differ materially from the actual amounts recorded. The results of the acquired businesses are included in our results from

operations beginning from the day of acquisition.

Risk

and Uncertainties

Factors

that could affect our future operating results and cause actual results to vary materially from management’s expectation include,

but are not limited to: our ability to maintain and secure adequate capital to fund our operations and fully develop our product(s);

our ability to source strong opportunities with sufficient risk adjusted returns; acceptance of the terms and conditions of our licenses

and/or the acceptance of our royalties and fees; the nature and extent of competition from other companies that may reduce market share

and create pressure on pricing and investment return expectations; changes in the projects in which we plan to invest which result from

factors beyond our control, including, but not limited to, a change in circumstances, capacity and economic impacts; changes in laws,

regulations, accounting, taxation, and other requirements affecting our operations and business. Negative developments in these or other

risk factors could have a significant adverse effect on our financial position, results of operations and cash flows.

Use

of Estimates

The

preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated

financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from

those estimates. We base our estimates on experience and various other assumptions that are believed to be reasonable under the circumstances.

We evaluate our estimates and assumptions on a regular basis and actual results may differ from those estimates.

Fair

Value of Financial Instruments

Fair

value is defined as the price that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between

market participants. A fair value hierarchy has been established for valuation inputs that gives the highest priority to quoted prices

in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The fair value hierarchy is as

follows:

Level

1 Inputs - Unadjusted quoted prices in active markets for identical assets or liabilities that the reporting entity can access at the

measurement date.

Level

2 Inputs - Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly.

These might include quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets

or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability (such as

interest rates, volatilities, prepayment speeds, credit risks, etc.) or inputs that are derived principally from or corroborated by market

data by correlation or other means.

Level

3 Inputs - Unobservable inputs for determining the fair values of assets or liabilities that reflect an entity’s own assumptions

about the assumptions that market participants would use in pricing the assets or liabilities.

Financial

instruments consist of cash and cash equivalents, accounts receivable, accounts payable and borrowings. The fair value of current financial

assets and current financial liabilities approximates their carrying value because of the short-term maturity of these financial instruments.

Intangible

Assets

Intangible

assets consist of patents, our website and the costs of software developed for internal use. Certain payroll and stock-based compensation

costs incurred are allocated to the intangible assets. We determine the amount of costs to be capitalized based on the time spent by

employees or outside contractors on the projects. Intangible assets are amortized over their expected useful life on a straight-line

basis. We evaluate the useful lives of these assets on an annual basis and test for impairment whenever events or changes in circumstances

occur that could impact the recoverability of these assets. If the estimate of an intangible asset’s remaining life is changed,

the remaining carrying value of the intangible asset is amortized prospectively over the revised remaining useful life.

Impairment

of Long-Lived Assets

Long-lived

assets such as property, equipment and identifiable intangibles are reviewed for impairment at least annually or whenever facts and circumstances

indicate that the carrying value may not be recoverable. When required, impairment losses on assets to be held and used are recognized

based on the fair value of the asset. The fair value is determined based on estimates of future cash flows, market value of similar assets,

if available, or independent appraisals, if required. If the carrying amount of the long-lived asset is not recoverable, an impairment

loss is recognized for the difference between the carrying amount and fair value of the asset.

Derivative

Liability

Options,

warrants, convertible notes, or other contracts, if any, are evaluated to determine if those contracts, or embedded components of those

contracts, qualify as derivatives to be separately accounted for in accordance with Financial Accounting Standards Board (“FASB”)

Accounting Standards Codification (“ASC”) Topic 815, “Derivatives and Hedging,” (paragraph 815-10-05-4

and Section 815-40-25). The result of this accounting treatment is that the fair value of the embedded derivative is marked-to-market

each balance sheet date and recorded as either an asset or a liability. The change in fair value is recorded in the consolidated statements

of operations as other income or expense. Upon conversion, exercise or cancellation of a derivative instrument, the instrument is marked

to fair value at the date of conversion, exercise, or cancellation and then the related fair value is reclassified to equity.

In

circumstances where the embedded conversion option in a convertible instrument is required to be bifurcated, and there are also other

embedded derivative instruments in the convertible instrument that are required to be bifurcated, the bifurcated derivative instruments

are accounted for as a single, compound derivative instrument.

The

classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is re-assessed

at the end of each reporting period. Equity instruments that are initially classified as equity that become subject to reclassification

are reclassified to liability at the fair value of the instrument on the reclassification date. Derivative instrument liabilities will

be classified in the balance sheet as current or non-current based on whether or not net-cash settlement of the derivative instrument

is expected within 12 months of the balance sheet date.

The

Company adopted Section 815-40-15 of the FASB ASC (“Section 815-40-15”) to determine whether an instrument (or an

embedded feature) is indexed to the Company’s own stock. Section 815-40-15 provides that an entity should use a two- step approach

to evaluate whether an equity-linked financial instrument (or embedded feature) is indexed to its own stock, including evaluating the

instrument’s contingent exercise and settlement provisions.

We