Sanara MedTech Inc. Based in Fort Worth, Texas, Sanara MedTech Inc.

(“Sanara,” the “Company,” “we,” “our” or “us”) (NASDAQ: SMTI), a

medical technology company focused on developing and

commercializing transformative technologies to improve clinical

outcomes and reduce healthcare expenditures in the surgical,

chronic wound and skincare markets, announced today its strategic,

operational and financial results for the quarter ended September

30, 2023.

Zach Fleming, Sanara’s CEO stated, “Our third

quarter performance included another record sales quarter as well

as a narrowing net loss and positive Adjusted EBITDA. In addition,

we completed the acquisition of certain assets related to our

collagen business, which we believe is critical to our efforts to

develop next generation collagen products while also materially

adding to our bottom line by eliminating the royalties we paid on

CellerateRX® Surgical Powder and Gel (“CellerateRX”) and HYCOL®

Hydrolyzed Collagen (“HYCOL”). After quarter end, we had our first

sales of both ALLOCYTE® Plus Advanced Viable Bone Matrix (“ALLOCYTE

Plus”) and BIASURGE™ Advanced Surgical Solution (“BIASURGE”). We

believe these two products will be important to our future growth

plans while helping diversify our revenue mix and providing

patients and doctors with options that can improve outcomes while

reducing healthcare expenditures.”

Third Quarter 2023 Strategic and

Operational Highlights (Unaudited)

- The Company

generated net revenue of $16.0 million for the three months ended

September 30, 2023, an eighth consecutive record sales

quarter.

- The Company’s

loss before income taxes for the three months ended September 30,

2023 was $1.1 million compared to a loss before income taxes of

$3.2 million for the three months ended September 30, 2022. For the

three months ended September 30, 2023, the Company had a net loss

of $1.1 million, compared to a net loss of $1.5 million for the

three months ended September 30, 2022. The Company generated

Adjusted EBITDA* of $0.3 million for the three months ended

September 30, 2023 compared to negative Adjusted EBITDA of $1.6

million for the three months ended September 30, 2022.

- During the

trailing twelve-month period, the Company’s products were sold in

over 1,000 facilities across 32 states plus the District of

Columbia. The Company’s products were contracted or approved to be

sold in more than 3,000 hospitals/ambulatory surgery centers as of

September 30, 2023.

- On August 2,

2023, the Company announced the acquisition of certain assets

related to its collagen products business. The assets acquired

included, among others:

- All rights and

ownership (for human wound care uses) for certain 510(k) cleared

collagen-based wound care products, including CellerateRX and

HYCOL.

- All patents,

patents pending, trademarks and regulatory approvals related to

collagen human wound care products owned by the sellers. This

includes nine patents and all of the sellers’ patents pending for

collagen products for human wound care uses and five

trademarks.

- The Company

hired twelve new sales representatives in the nine months ended

September 30, 2023. These representatives are expected to help the

Company increase facility penetration and reach additional

specialties. The Company also continues to build out its corporate

infrastructure to support future growth.

- Subsequent to

the end of the quarter, the Company completed its first sale of

ALLOCYTE Plus, a human cell and tissue-based product. First sales

of Allocyte Plus occurred in early October 2023. This product is

processed by an alternative supplier with in-house processing

capabilities affording greater control of product supply.

- Subsequent to

the end of the quarter, the Company launched BIASURGE. Prior to

launch, BIASURGE was added to 41 existing facility contracts. First

sales of BIASURGE occurred in early November 2023. The Company

believes this product could be used in any surgery where Sanara

products are currently used.

Sales Analysis

CellerateRX revenues continued to grow, however

the rate of quarter-over-quarter growth slowed due to unique

in-market challenges. The Company is leveraging field intelligence

and data analytics to implement appropriate adjustments to sales

force deployment and facility penetration. For the three months

ended September 30, 2023, the Company generated net revenue of

$16.0 million compared to net revenue of $13.0 million for the

three months ended September 30, 2022, a 23% increase from the

prior year period. For the nine months ended September 30, 2023,

the Company generated net revenue of $47.3 million compared to net

revenue of $30.5 million for the nine months ended September 30,

2022, a 55% increase from the prior year period. The higher net

revenue for the three and nine months ended September 30, 2023 was

primarily due to increased sales as a result of the Company’s

increased market penetration and geographic expansion, additional

revenues as a result of the Scendia acquisition and the Company’s

continuing strategy to expand its independent distribution network

in both new and existing U.S. markets. The Company’s sales growth

continued to be negatively impacted by supply issues related to its

ALLOCYTE® Advanced Cellular Bone Matrix product in the third

quarter of 2023. However, subsequent to the end of the quarter, the

Company brought on an alternative supplier and expanded the

ALLOCYTE® product line with the release of ALLOCYTE Plus. Sanara

currently has a sufficient supply to meet currently expected demand

and believes it has measures in place to be able to regularly stock

the product in the future.

Earnings Analysis

The Company had a loss before income taxes of

$1.1 million for the three months ended September 30, 2023,

compared to a loss before income taxes of $3.2 million for the

three months ended September 30, 2022. For the nine months ended

September 30, 2023, the Company had a loss before income taxes of

$4.2 million, compared to a loss before income taxes of $9.8

million for the nine months ended September 30, 2022. The lower

loss for the three and nine months ended September 30, 2023 was due

to operating expenses increasing at a slower rate than net sales in

addition to the benefit recorded as a result of the change in fair

value of earnout liabilities. For the three months ended September

30, 2023, the Company had a net loss of $1.1 million, compared to a

net loss of $1.5 million for the three months ended September 30,

2022. For the nine months ended September 30, 2023, the Company had

a net loss of $4.2 million, compared to a net loss of $3.9 million

for the nine months ended September 30, 2022.

* Adjusted EBITDA is a non-GAAP financial

measure. See the discussion below under the heading “Use of

Non-GAAP Financial Measures" and the reconciliations at the end of

this release for additional information.

Use of Non-GAAP Financial

Measures

To supplement the Company’s financial

information presented in accordance with generally accepted

accounting principles in the United States (“GAAP”), we present

certain non-GAAP financial measures in this press release and on

the related teleconference call, including Adjusted EBITDA. The

Company’s management uses these non-GAAP financial measures, both

internally and externally, to assess and communicate the financial

performance of the Company. The Company defines Adjusted EBITDA as

net loss excluding interest for term loan, debt issuance cost

amortization, accretion of finance liabilities, provision/benefit

for income taxes, depreciation and amortization, non-cash

share-based compensation expense, change in fair value of earnout

liabilities, and gains/losses from the disposal of property and

equipment. The Company’s believes Adjusted EBITDA is useful to

investors because it facilitates comparisons of its core business

operations across periods on a consistent basis. Accordingly, the

Company adjusts for items such as change in fair value of earnout

liabilities when calculating Adjusted EBITDA because the Company

believes that it is not related to the Company’s core business

operations.

The Company’s non-GAAP financial measures are

not in accordance with, nor an alternative for, measures conforming

to GAAP and may be different from non-GAAP financial measures used

by other companies. In addition, these non-GAAP financial measures

are not based on any comprehensive set of accounting rules or

principles. The Company continues to provide all information

required by GAAP, but it believes that evaluating its ongoing

operating results may not be as useful if an investor or other user

is limited to reviewing only GAAP financial measures. The Company

does not, nor does it suggest that investors should, consider these

non-GAAP financial measures in isolation from, or as a substitute

for, financial information prepared in accordance with GAAP.

Material limitations associated with the use of such measures

include that they do not reflect all costs included in operating

expenses and may not be comparable with similarly named financial

measures of other companies. Furthermore, these non-GAAP financial

measures are based on subjective determinations of management

regarding the nature and classification of events and

circumstances. The Company presents these non-GAAP financial

measures to provide investors with information to evaluate the

Company’s operating results in a manner similar to how management

evaluates business performance. To compensate for any limitations

in such non-GAAP financial measures, management believes that it is

useful in understanding and analyzing the results of the business

to review both GAAP information and the related non-GAAP financial

measures. Whenever the Company uses a non-GAAP financial measure,

it provides a reconciliation of the non-GAAP financial measure to

the most directly comparable GAAP financial measure. Investors are

encouraged to review and consider these reconciliations.

Conference Call

Sanara will host a conference call on Tuesday,

November 14, 2023, at 9:00 a.m. Eastern Time. The toll-free number

to call for this teleconference is 888-506-0062 (international

callers: 973-528-0011) and the access code is 780032. A telephonic

replay of the conference call will be available through Tuesday,

November 28, 2023, by dialing 877-481-4010 (international callers:

919-882-2331) and entering the replay passcode: 49390.

A live webcast of Sanara’s conference call will

be available under the Investor Relations section of the Company’s

website, www.SanaraMedTech.com. A one-year online replay will be

available after the conclusion of the live broadcast.

About Sanara MedTech Inc.

With a focus on improving patient outcomes

through evidence-based healing solutions, Sanara MedTech Inc.

markets, distributes and develops surgical, wound and skincare

products for use by physicians and clinicians in hospitals, clinics

and all post-acute care settings and offers wound care and

dermatology virtual consultation services via telemedicine.

Sanara’s products are primarily sold in the North American advanced

wound care and surgical tissue repair markets. Sanara markets and

distributes CellerateRX® Surgical Activated Collagen®, FORTIFY TRG®

Tissue Repair Graft and FORTIFY FLOWABLE® Extracellular Matrix as

well as a portfolio of advanced biologic products focusing on

ACTIGENTM Verified Inductive Bone Matrix, ALLOCYTE® Plus Advanced

Viable Bone Matrix, BiFORM® Bioactive Moldable Matrix, TEXAGEN®

Amniotic Membrane Allograft, and BIASURGE™ Advanced Surgical

Solution to the surgical market. In addition, the following

products are sold in the wound care market: BIAKŌS® Antimicrobial

Skin and Wound Cleanser, BIAKŌS™ Antimicrobial Wound Gel, BIAKŌS®

Antimicrobial Skin and Wound Irrigation Solution and HYCOL®

Hydrolyzed Collagen. Sanara’s pipeline also contains potentially

transformative product candidates for mitigation of opportunistic

pathogens and biofilm, wound re-epithelialization and closure,

necrotic tissue debridement and cell compatible substrates. The

Company believes it has the ability to drive its pipeline from

concept to preclinical and clinical development while meeting

quality and regulatory requirements. Sanara is constantly seeking

long-term strategic partnerships with a focus on products that

improve outcomes at a lower overall cost. In addition, Sanara is

actively seeking to expand within its six focus areas of wound and

skin care for the acute, post-acute, and surgical markets. The

focus areas are debridement, biofilm removal, hydrolyzed collagen,

advanced biologics, negative pressure wound therapy products and

the oxygen delivery system segment of the wound and skincare

markets.

Information about Forward-Looking

Statements

The statements in this press release that do not

constitute historical facts are “forward-looking statements,”

within the meaning of and subject to the safe harbor created by the

Private Securities Litigation Reform Act of 1995. These statements

may be identified by terms such as “aims,” “anticipates,”

“believes,” “contemplates,” “continue,” “could,” “estimates,”

“expect,” “forecast,” “guidance,” “intend,” “may,” “plan,”

“possible,” “potential,” “predicts,” “preliminary,” “projects,”

“seeks,” “should,” “targets,” “will” or “would,” or the negatives

of these terms, variations of these terms or other similar

expressions. These forward-looking statements include, among

others, statements regarding the potential benefits created by the

acquisition of certain assets related to the Company’s collagen

products business, the anticipated impact of such acquisition on

the Company’s business and future financial and operating results,

the Company’s ability to develop and commercialize the new

collagen-based products currently under development, including the

manufacturing, distribution, marketing and sale of such products,

the Company’s ability to maintain or replace the manufacturing and

distribution process of the sellers in the acquisition, including

relationships with vendors, the development of new products, the

timing of commercialization of our products, the regulatory

approval process and expansion of the Company’s business in

telehealth and wound care. These items involve risks, contingencies

and uncertainties such as the extent of product demand, market and

customer acceptance, the effect of economic conditions,

competition, pricing, uncertainties associated with the development

and process for obtaining regulatory approval for new products, the

ability to consummate and integrate acquisitions, and other risks,

contingencies and uncertainties detailed in the Company’s SEC

filings, which could cause the Company’s actual operating results,

performance or business plans or prospects to differ materially

from those expressed in, or implied by these statements.

All forward-looking statements speak only as of

the date on which they are made, and the Company undertakes no

obligation to revise any of these statements to reflect the future

circumstances or the occurrence of unanticipated events, except as

required by applicable securities laws.

Investor Contact:

Callon Nichols, Director of Investor

Relations713-826-0524CNichols@sanaramedtech.com

SOURCE: Sanara MedTech Inc.

SANARA MEDTECH INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

|

Assets |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

6,235,912 |

|

|

$ |

8,958,995 |

|

|

Accounts receivable, net |

|

|

7,436,295 |

|

|

|

6,805,761 |

|

|

Accounts receivable – related party |

|

|

11,032 |

|

|

|

98,548 |

|

|

Royalty receivable |

|

|

49,344 |

|

|

|

99,594 |

|

|

Inventory, net |

|

|

5,021,030 |

|

|

|

3,549,000 |

|

|

Prepaid and other assets |

|

|

621,690 |

|

|

|

1,104,611 |

|

| Total current

assets |

|

|

19,375,303 |

|

|

|

20,616,509 |

|

| |

|

|

|

|

|

|

|

|

| Long-term

assets |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

1,327,056 |

|

|

|

1,416,436 |

|

|

Right of use assets – operating leases |

|

|

2,094,188 |

|

|

|

806,402 |

|

|

Goodwill |

|

|

3,601,781 |

|

|

|

3,601,781 |

|

|

Intangible assets, net |

|

|

45,991,466 |

|

|

|

31,509,980 |

|

|

Investment in equity securities |

|

|

3,084,278 |

|

|

|

3,084,278 |

|

| Total long-term

assets |

|

|

56,098,769 |

|

|

|

40,418,877 |

|

| |

|

|

|

|

|

|

|

|

| Total

assets |

|

$ |

75,474,072 |

|

|

$ |

61,035,386 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and shareholders’ equity |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,939,887 |

|

|

$ |

1,392,701 |

|

|

Accounts payable – related parties |

|

|

64,747 |

|

|

|

34,036 |

|

|

Accrued royalties and expenses |

|

|

3,583,439 |

|

|

|

2,144,475 |

|

|

Accrued bonuses and commissions |

|

|

6,084,654 |

|

|

|

7,758,284 |

|

|

Earnout liabilities – current |

|

|

1,000,000 |

|

|

|

1,162,880 |

|

|

Operating lease liabilities – current |

|

|

322,206 |

|

|

|

313,933 |

|

|

Current portion of debt |

|

|

232,143 |

|

|

|

- |

|

| Total current

liabilities |

|

|

13,227,076 |

|

|

|

12,806,309 |

|

| |

|

|

|

|

|

|

|

|

| Long-term

liabilities |

|

|

|

|

|

|

|

|

|

Earnout liabilities – long-term |

|

|

4,871,986 |

|

|

|

6,003,811 |

|

|

Operating lease liabilities – long-term |

|

|

1,846,293 |

|

|

|

505,291 |

|

|

Long-term debt, net of current portion |

|

|

9,458,254 |

|

|

|

- |

|

|

Other long-term liabilities |

|

|

1,972,673 |

|

|

|

- |

|

| Total long-term

liabilities |

|

|

18,149,206 |

|

|

|

6,509,102 |

|

| |

|

|

|

|

|

|

|

|

| Total

liabilities |

|

|

31,376,282 |

|

|

|

19,315,411 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Shareholders’

equity |

|

|

|

|

|

|

|

|

|

Common Stock: $0.001 par value, 20,000,000 shares authorized;

8,540,226 issued and outstanding as of September 30, 2023 and

8,299,957 issued and outstanding as of December 31, 2022 |

|

|

8,540 |

|

|

|

8,300 |

|

|

Additional paid-in capital |

|

|

72,107,881 |

|

|

|

65,213,987 |

|

|

Accumulated deficit |

|

|

(27,799,621 |

) |

|

|

(23,394,757 |

) |

| Total Sanara MedTech

shareholders’ equity |

|

|

44,316,800 |

|

|

|

41,827,530 |

|

| Equity attributable to

noncontrolling interest |

|

|

(219,010 |

) |

|

|

(107,555 |

) |

| Total shareholders’

equity |

|

|

44,097,790 |

|

|

|

41,719,975 |

|

| Total liabilities and

shareholders’ equity |

|

$ |

75,474,072 |

|

|

$ |

61,035,386 |

|

SANARA MEDTECH INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Revenue |

|

$ |

16,024,948 |

|

|

$ |

13,044,571 |

|

|

$ |

47,300,029 |

|

|

$ |

30,526,572 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of goods

sold |

|

|

1,751,349 |

|

|

|

2,228,561 |

|

|

|

6,064,524 |

|

|

|

3,991,728 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

14,273,599 |

|

|

|

10,816,010 |

|

|

|

41,235,505 |

|

|

|

26,534,844 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

13,877,879 |

|

|

|

12,062,195 |

|

|

|

40,658,424 |

|

|

|

31,865,958 |

|

|

Research and development |

|

|

986,454 |

|

|

|

1,061,387 |

|

|

|

3,480,906 |

|

|

|

2,333,024 |

|

|

Depreciation and amortization |

|

|

997,674 |

|

|

|

814,881 |

|

|

|

2,580,243 |

|

|

|

1,556,752 |

|

|

Change in fair value of earnout liabilities |

|

|

(681,753 |

) |

|

|

109,689 |

|

|

|

(1,494,910 |

) |

|

|

173,116 |

|

| Total operating

expenses |

|

|

15,180,254 |

|

|

|

14,048,152 |

|

|

|

45,224,663 |

|

|

|

35,928,850 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

loss |

|

|

(906,655 |

) |

|

|

(3,232,142 |

) |

|

|

(3,989,158 |

) |

|

|

(9,394,006 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense and other |

|

|

(188,294 |

) |

|

|

- |

|

|

|

(188,300 |

) |

|

|

- |

|

|

Share of losses from equity method investment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(379,633 |

) |

| Total other

expense |

|

|

(188,294 |

) |

|

|

- |

|

|

|

(188,300 |

) |

|

|

(379,633 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income

taxes |

|

|

(1,094,949 |

) |

|

|

(3,232,142 |

) |

|

|

(4,177,458 |

) |

|

|

(9,773,639 |

) |

|

Income tax benefit |

|

|

- |

|

|

|

1,702,890 |

|

|

|

- |

|

|

|

5,844,796 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

(1,094,949 |

) |

|

|

(1,529,252 |

) |

|

|

(4,177,458 |

) |

|

|

(3,928,843 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net loss attributable to noncontrolling interest |

|

|

(34,579 |

) |

|

|

(58,792 |

) |

|

|

(111,455 |

) |

|

|

(98,485 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable

to Sanara MedTech shareholders |

|

$ |

(1,060,370 |

) |

|

$ |

(1,470,460 |

) |

|

$ |

(4,066,003 |

) |

|

$ |

(3,830,358 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share of common

stock, basic and diluted |

|

$ |

(0.13 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.49 |

) |

|

$ |

(0.49 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding, basic and diluted |

|

|

8,332,341 |

|

|

|

8,107,261 |

|

|

|

8,244,503 |

|

|

|

7,836,882 |

|

SANARA MEDTECH INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

|

|

|

Nine Months Ended |

|

|

|

|

September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(4,177,458 |

) |

|

$ |

(3,928,843 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

2,580,243 |

|

|

|

1,556,752 |

|

|

Loss on disposal of property and equipment |

|

|

- |

|

|

|

2,876 |

|

|

Bad debt expense |

|

|

214,061 |

|

|

|

220,000 |

|

|

Inventory obsolescence |

|

|

222,691 |

|

|

|

289,406 |

|

|

Share-based compensation |

|

|

2,582,163 |

|

|

|

1,971,537 |

|

|

Noncash lease expense |

|

|

243,988 |

|

|

|

189,409 |

|

|

Loss on equity method investment |

|

|

- |

|

|

|

379,633 |

|

|

Benefit from deferred income taxes |

|

|

- |

|

|

|

(5,844,796 |

) |

|

Accretion of finance liabilities |

|

|

39,699 |

|

|

|

- |

|

|

Amortization of debt issuance costs |

|

|

2,055 |

|

|

|

- |

|

|

Change in fair value of earnout liabilities |

|

|

(1,494,910 |

) |

|

|

173,116 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

(794,344 |

) |

|

|

(754,934 |

) |

|

Accounts receivable – related party |

|

|

87,516 |

|

|

|

10,920 |

|

|

Inventory, net |

|

|

(1,664,714 |

) |

|

|

(451,838 |

) |

|

Prepaid and other assets |

|

|

482,921 |

|

|

|

(69,490 |

) |

|

Accounts payable |

|

|

547,186 |

|

|

|

(800,788 |

) |

|

Accounts payable – related parties |

|

|

30,711 |

|

|

|

(126,812 |

) |

|

Accrued royalties and expenses |

|

|

557,295 |

|

|

|

947,130 |

|

|

Accrued bonuses and commissions |

|

|

(1,673,629 |

) |

|

|

1,516,858 |

|

|

Operating lease liabilities |

|

|

(182,498 |

) |

|

|

(189,990 |

) |

| Net cash used in

operating activities |

|

|

(2,397,024 |

) |

|

|

(4,909,854 |

) |

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(210,970 |

) |

|

|

(93,651 |

) |

|

Proceeds from disposal of property and equipment |

|

|

650 |

|

|

|

894 |

|

|

Purchases of intangible assets |

|

|

- |

|

|

|

(600,000 |

) |

|

Investment in equity securities |

|

|

- |

|

|

|

(250,000 |

) |

|

Acquisitions, net of cash acquired |

|

|

(9,942,750 |

) |

|

|

(2,191,919 |

) |

| Net cash used in

investing activities |

|

|

(10,153,070 |

) |

|

|

(3,134,676 |

) |

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

Loan proceeds, net |

|

|

9,688,341 |

|

|

|

- |

|

|

Equity offering net proceeds |

|

|

1,033,761 |

|

|

|

- |

|

|

Net settlement of equity-based awards |

|

|

(150,296 |

) |

|

|

(102,931 |

) |

|

Cash payment of finance and earnout liabilities |

|

|

(744,795 |

) |

|

|

- |

|

|

Distribution to noncontrolling interest member |

|

|

- |

|

|

|

(220,000 |

) |

| Net cash provided by

(used in) financing activities |

|

|

9,827,011 |

|

|

|

(322,931 |

) |

| Net decrease in

cash |

|

|

(2,723,083 |

) |

|

|

(8,367,461 |

) |

| Cash, beginning of

period |

|

|

8,958,995 |

|

|

|

18,652,841 |

|

| Cash, end of

period |

|

$ |

6,235,912 |

|

|

$ |

10,285,380 |

|

| |

|

|

|

|

|

|

|

|

| Cash paid during the

period for: |

|

|

|

|

|

|

|

|

|

Interest |

|

$ |

146,546 |

|

|

$ |

- |

|

| Supplemental noncash

investing and financing activities: |

|

|

|

|

|

|

|

|

|

Right of use assets obtained in exchange for lease obligations |

|

|

1,531,773 |

|

|

|

- |

|

|

Equity issued for acquisitions |

|

|

3,089,645 |

|

|

|

15,738,518 |

|

|

Earnout and other liabilities generated by acquisitions |

|

|

3,759,642 |

|

|

|

6,882,151 |

|

|

Investment in equity securities converted in asset acquisition |

|

|

- |

|

|

|

1,803,440 |

|

Reconciliation of GAAP to Non-GAAP

Financial Measures

| Reconciliation of Net

Loss to Adjusted EBITDA (Unaudited) |

Three Months Ended |

|

| |

September 30, 2023 |

|

September 30, 2022 |

| |

|

|

|

| Net Loss |

$ |

(1,094,949 |

) |

|

$ |

(1,529,252 |

) |

| Adjustments |

|

|

|

|

Interest expense – Term Loan |

|

146,540 |

|

|

|

- |

|

|

Debt issuance costs amortization |

|

2,055 |

|

|

|

- |

|

|

Accretion of finance liabilities |

|

39,699 |

|

|

|

- |

|

|

Income tax benefit |

|

- |

|

|

|

(1,702,890 |

) |

|

Depreciation and amortization |

|

997,674 |

|

|

|

814,881 |

|

|

Noncash share-based compensation expense |

|

857,526 |

|

|

|

683,202 |

|

|

Change in fair value of earnout liabilities |

|

(681,753 |

) |

|

|

109,689 |

|

|

Loss on disposal of property and equipment |

|

- |

|

|

|

376 |

|

| Adjusted

EBITDA |

$ |

266,792 |

|

|

$ |

(1,623,994 |

) |

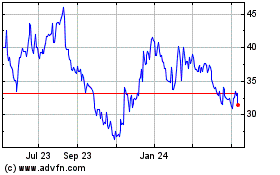

Sanara MedTech (NASDAQ:SMTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

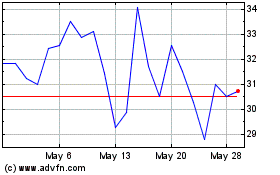

Sanara MedTech (NASDAQ:SMTI)

Historical Stock Chart

From Apr 2023 to Apr 2024