Tullow Oil Enters $400 Million Debt Facility, Offtake Deal with Glencore Unit

November 13 2023 - 3:00AM

Dow Jones News

By Christian Moess Laursen

Tullow Oil said it has agreed to a $400-million five-year debt

facility and an oil marketing and offtake deal with the subsidiary

with Glencore's U.K. oil and gas division.

The Africa-focused oil producer said Monday that proceeds from

the facility, together with its cash on balance sheet and $800

million of free cash flow expected during 2023-25, will allow it to

address all outstanding 2025 loan notes, including senior notes

maturing in March 2025.

"Glencore's $400 million facility commitment is a strong

endorsement of our business plan and strategy," Chief Executive

Rahul Dhir said.

The company also said it has entered into oil marketing and

offtake contracts with Glencore for its crude oil entitlements from

the Jubilee and TEN fields in Ghana, as well as from the Rabi Light

entitlements in Gabon. The agreement will run concurrently with the

notes facility agreement, it said.

Write to Christian Moess Laursen at christian.moess@wsj.com

(END) Dow Jones Newswires

November 13, 2023 02:45 ET (07:45 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

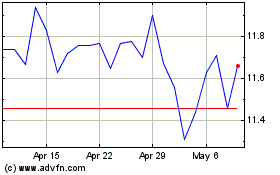

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

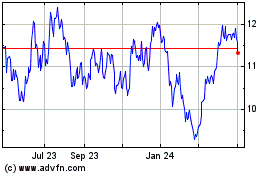

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Apr 2023 to Apr 2024