0001141197false00011411972023-11-092023-11-09iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): November 9, 2023

PEDEVCO CORP. |

(Exact name of registrant as specified in its charter) |

Texas | | 001-35922 | | 22-3755993 |

(State or other jurisdiction of incorporation or organization) | | (Commission file number) | | (IRS Employer Identification No.) |

575 N. Dairy Ashford, Suite 210 Houston, Texas | | 77079 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (713) 221-1768

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.001 par value per share | PED | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry Into a Material Definitive Agreement.

On November 9, 2023, PEDEVCO Corp. (the “Company”, “PEDEVCO”, “we” and “us”), through its wholly-owned subsidiary Pacific Energy Development Corp. (“PEDCO”), entered into (x) a Purchase and Sale Agreement (the “Purchase Agreement”) with Tilloo Exploration and Production, LLC, a Texas limited liability company (“Tilloo”), and (y) a Stock Purchase Agreement with Tilloo (the “Stock Purchase Agreement”). Pursuant to the Purchase Agreement, we (through PEDCO and our wholly-owned subsidiary EOR Operating Company (“EOR”)) agreed to sell certain oil and gas assets described in greater detail below (collectively, the “Assets”), and pursuant to the Stock Purchase Agreement we agreed to sell 100% of the capital stock of EOR, which operates most of the Assets, to Tilloo for aggregate consideration of $1,122,436 (the “Sales Price”). The effective date of the “sign and close” sale of the Assets and capital stock of EOR (together, the “Transaction”) was August 1, 2023. The Sales Price is subject to adjustment: (a) to reflect expenditures by PEDCO which are attributable to the Assets after the effective time of the sale (upwards); (b) receivables attributable to the sale of hydrocarbons received by PEDCO that are attributable to the Assets after the effective time of the sale (downward if received by the PEDCO); (c) receivables attributable to the sale of hydrocarbons that are attributable to the Assets before the effective time of the sale (upward if received by Tilloo); and (d) certain other adjustments as described in greater detail in the Stock Purchase Agreement. PEDCO also agreed to pay $20,000 to Tilloo at closing as an advance against the final post-closing adjustment to the Sales Price as estimated by the parties.

The Sales Price is to be paid by Tilloo through entry into a five-year secured promissory note (the “Note”), bearing interest at 10.0% per annum, with no payments due during the first twelve (12) months, and fully-amortized payments due monthly over the remaining four (4) years of the term thereafter until maturity. The Note contains customary events of default. In connection with entry into the Note and to secure Tilloo’s obligations to PEDCO thereunder, on November 9, 2023, PEDCO and Tilloo also entered into a Security Agreement, a Security Agreement (Pledge of Corporate Securities), and a Mortgage (collectively, the “Security Documents”), which Security Documents create a lien over all the Assets and the capital shares of EOR.

Each of the Purchase Agreement and Stock Purchase Agreement contain customary representations and warranties of the parties, and indemnification obligations by Tilloo to PEDCO, for a transaction of this size and type. In addition, Tilloo expressly agreed to assume all litigation matters in which EOR was involved, and to allow PEDCO and its affiliates to continue to use the Milnesand field office located on the Assets through December 31, 2024, with PEDCO agreeing to pay all utilities for the field office and 50% of any rent due to the lessor of the surface acreage, for as long as PEDCO occupies the premises.

The Assets represent approximately 8,035 gross leasehold acres, current operated production, and all of PEDCO’s and EOR’s leases and related rights, oil and gas and other wells, equipment, easements, contract rights, and production (effective as of the effective date) as described in the Purchase Agreement. The Assets are located in the Milnesand and Sawyer Fields of the San Andres play in the Permian Basin situated in eastern New Mexico, and include approximately 80 legacy vertical oil and gas wells (53 producers and 27 injectors), of which 16 producers and 12 injectors were producing approximately 32 barrels of oil equivalent per day (“BOEPD”) net to the Company’s interest as of October 31, 2023, and of which 52 wells (38 producers and 14 injectors) are currently shut-in due to lack of economic production and are subject to plugging and abandonment. As a result of the Transaction, the Company has sold all of its operated oil and gas interests in the non-core Milnesand and Sawyer Fields, including the 52 inactive legacy wells that the Company would otherwise be required to plug and abandon, thereby successfully reducing its asset retirement obligations with respect to these Assets and reducing its estimated aggregate plugging and abandoning liabilities by over $3.2 million. Notably, the leasehold acreage included in the sale was not included in the Company’s five-year development plan, and its sale is expected to allow the Company to better focus on its core assets located in the Chaveroo Field in the San Andres play in the Permian Basin situated in eastern New Mexico and in the D-J Basin located in Weld and Morgan Counties, Colorado, and Laramie County, Wyoming.

The foregoing description of the Purchase Agreement, Stock Purchase Agreement, Note, Security Agreement, Security Agreement (Pledge of Corporate Securities), and Mortgage does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement, Stock Purchase Agreement, Note, Security Agreement, Security Agreement (Pledge of Corporate Securities), and Mortgage, copies of which are attached as Exhibits 2.1, 10.1, 10.2, 10.3, 10.4, and 10.5, respectively, to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The disclosures in Item 1.01 above regarding Purchase Agreement and the sale of Assets sold in connection therewith are incorporated by reference in this Item 2.01 in their entirety.

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2023, the Company issued a press release announcing its financial results for the three-months ended September 30, 2023, and providing an operations update. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K, and is incorporated by reference into this Item 2.02 in its entirety.

The information contained in this Current Report (and included as an exhibit hereto) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

The Company is making reference to non-GAAP financial information in the attached press release and a reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached press release.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. | | Description |

| | |

2.1* | | Purchase and Sale Agreement dated November 9, 2023, by and among Pacific Energy Development Corp. and EOR Operating Company, as sellers and Tilloo Exploration and Production, LLC, as purchaser |

10.1* | | Stock Purchase Agreement dated November 9, 2023, by and between Pacific Energy Development Corp. and Tilloo Exploration and Production, LLC |

10.2* | | Promissory Note dated November 9, 2023, executed by Tilloo Exploration and Production, LLC |

10.3* | | Security Agreement dated November 9, 2023, by and between Pacific Energy Development Corp. and Tilloo Exploration and Production, LLC |

10.4* | | Security Agreement dated November 9, 2023, by and between Pacific Energy Development Corp. and Tilloo Exploration and Production, LLC |

10.5* | | Mortgage dated November 9, 2023, by and between Pacific Energy Development Corp. and Tilloo Exploration and Production, LLC |

99.1* | | Press Release dated November 9, 2023 |

104 | | Inline XBRL for the cover page of this Current Report on Form 8-K |

* Filed herewith.

** Furnished herewith.

The inclusion of any website address in this Form 8-K, and any exhibit thereto, is intended to be an inactive textual reference only and not an active hyperlink. The information contained in, or that can be accessed through, such website is not part of or incorporated into this Form 8-K.

Forward-Looking Statements

The press release furnished as Exhibit 99.1, to this Current Report on Form 8-K, contains forward-looking statements within the safe harbor provisions under the federal securities laws, including The Private Securities Litigation Reform Act of 1995, and, as such, may involve known and unknown risks, uncertainties and assumptions. These forward-looking statements relate to the Company’s current expectations and are subject to the limitations and qualifications set forth in the press release as well as in the Company’s other filings with the Securities and Exchange Commission, including, without limitation, that actual events and/or results may differ materially from those projected in such forward-looking statements. These statements also involve known and unknown risks, which may cause the results of the Company and its subsidiaries to be materially different than those expressed or implied in such statements, as described in greater detail in the press release furnished as Exhibit 99.1. Accordingly, readers should not place undue reliance on any forward-looking statements. Forward-looking statements may include comments as to the Company’s beliefs and expectations as to future financial performance, events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside the Company’s control. More information on potential factors that could affect the Company’s financial results is included from time to time in the “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s periodic and current filings with the SEC, including the Form 10-Qs and Form 10-Ks, filed with the SEC and available at www.sec.gov and the Company’s website at https://www.PEDEVCO.com/ped/sec_filings, and specifically including the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. Forward-looking statements speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as otherwise provided by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| PEDEVCO CORP. | |

| | | |

Date: November 9, 2023 | By: | /s/ Dr. Simon G. Kukes | |

| | Dr. Simon G. Kukes | |

| | Chief Executive Officer | |

nullnullnullnullnullnullnull

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

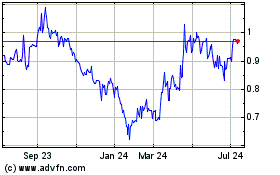

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Mar 2024 to Apr 2024

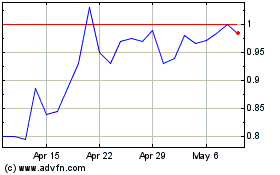

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Apr 2023 to Apr 2024