false

--12-31

Q3

0001335105

0001335105

2023-01-01

2023-09-30

0001335105

LIXT:CommonStockParValue0.0001PerShareMember

2023-01-01

2023-09-30

0001335105

LIXT:WarrantsToPurchaseCommonStockParValue0.0001PerShareMember

2023-01-01

2023-09-30

0001335105

2023-11-06

0001335105

2023-09-30

0001335105

2022-12-31

0001335105

us-gaap:RelatedPartyMember

2023-09-30

0001335105

us-gaap:RelatedPartyMember

2022-12-31

0001335105

LIXT:SeriesAConvertiblePreferredStockMember

2023-09-30

0001335105

LIXT:SeriesAConvertiblePreferredStockMember

2022-12-31

0001335105

2023-07-01

2023-09-30

0001335105

2022-07-01

2022-09-30

0001335105

2022-01-01

2022-09-30

0001335105

us-gaap:PreferredStockMember

LIXT:SeriesAConvertiblePreferredStockMember

2023-06-30

0001335105

us-gaap:CommonStockMember

2023-06-30

0001335105

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001335105

us-gaap:RetainedEarningsMember

2023-06-30

0001335105

2023-06-30

0001335105

us-gaap:PreferredStockMember

LIXT:SeriesAConvertiblePreferredStockMember

2022-12-31

0001335105

us-gaap:CommonStockMember

2022-12-31

0001335105

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001335105

us-gaap:RetainedEarningsMember

2022-12-31

0001335105

us-gaap:PreferredStockMember

LIXT:SeriesAConvertiblePreferredStockMember

2022-06-30

0001335105

us-gaap:CommonStockMember

2022-06-30

0001335105

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001335105

us-gaap:RetainedEarningsMember

2022-06-30

0001335105

2022-06-30

0001335105

us-gaap:PreferredStockMember

LIXT:SeriesAConvertiblePreferredStockMember

2021-12-31

0001335105

us-gaap:CommonStockMember

2021-12-31

0001335105

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001335105

us-gaap:RetainedEarningsMember

2021-12-31

0001335105

2021-12-31

0001335105

us-gaap:PreferredStockMember

LIXT:SeriesAConvertiblePreferredStockMember

2023-07-01

2023-09-30

0001335105

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001335105

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0001335105

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001335105

us-gaap:PreferredStockMember

LIXT:SeriesAConvertiblePreferredStockMember

2023-01-01

2023-09-30

0001335105

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0001335105

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-09-30

0001335105

us-gaap:RetainedEarningsMember

2023-01-01

2023-09-30

0001335105

us-gaap:PreferredStockMember

LIXT:SeriesAConvertiblePreferredStockMember

2022-07-01

2022-09-30

0001335105

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0001335105

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2022-09-30

0001335105

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0001335105

us-gaap:PreferredStockMember

LIXT:SeriesAConvertiblePreferredStockMember

2022-01-01

2022-09-30

0001335105

us-gaap:CommonStockMember

2022-01-01

2022-09-30

0001335105

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-09-30

0001335105

us-gaap:RetainedEarningsMember

2022-01-01

2022-09-30

0001335105

us-gaap:PreferredStockMember

LIXT:SeriesAConvertiblePreferredStockMember

2023-09-30

0001335105

us-gaap:CommonStockMember

2023-09-30

0001335105

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001335105

us-gaap:RetainedEarningsMember

2023-09-30

0001335105

us-gaap:PreferredStockMember

LIXT:SeriesAConvertiblePreferredStockMember

2022-09-30

0001335105

us-gaap:CommonStockMember

2022-09-30

0001335105

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001335105

us-gaap:RetainedEarningsMember

2022-09-30

0001335105

2022-09-30

0001335105

us-gaap:CommonStockMember

2023-06-02

2023-06-02

0001335105

us-gaap:CostOfSalesMember

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

2023-07-01

2023-09-30

0001335105

us-gaap:CostOfSalesMember

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

2023-01-01

2023-09-30

0001335105

us-gaap:CostOfSalesMember

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

2022-07-01

2022-09-30

0001335105

us-gaap:CostOfSalesMember

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

2022-01-01

2022-09-30

0001335105

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

us-gaap:GeneralAndAdministrativeExpenseMember

2023-07-01

2023-09-30

0001335105

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

us-gaap:GeneralAndAdministrativeExpenseMember

2022-07-01

2022-09-30

0001335105

us-gaap:GeneralAndAdministrativeExpenseMember

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

LIXT:StockOptionsGrantedtoDirectorsAndCorporateOfficersMember

2023-07-01

2023-09-30

0001335105

us-gaap:GeneralAndAdministrativeExpenseMember

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

LIXT:StockOptionsGrantedtoDirectorsAndCorporateOfficersMember

2022-07-01

2022-09-30

0001335105

LIXT:VendorOneMember

us-gaap:GeneralAndAdministrativeExpenseMember

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

2023-07-01

2023-09-30

0001335105

LIXT:VendorTwoMember

us-gaap:GeneralAndAdministrativeExpenseMember

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

2023-07-01

2023-09-30

0001335105

LIXT:VendorAndConsultantOneMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:SalesRevenueNetMember

2023-07-01

2023-09-30

0001335105

LIXT:VendorAndConsultantTwoMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:SalesRevenueNetMember

2023-07-01

2023-09-30

0001335105

LIXT:VendorAndConsultantThreeMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:SalesRevenueNetMember

2023-07-01

2023-09-30

0001335105

LIXT:VendorAndConsultantFourMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:SalesRevenueNetMember

2023-07-01

2023-09-30

0001335105

LIXT:VendorAndConsultantOneMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:SalesRevenueNetMember

2022-07-01

2022-09-30

0001335105

LIXT:VendorAndConsultantTwoMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:SalesRevenueNetMember

2022-07-01

2022-09-30

0001335105

LIXT:VendorAndConsultantThreeMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:SalesRevenueNetMember

2022-07-01

2022-09-30

0001335105

LIXT:VendorAndConsultantFourMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:SalesRevenueNetMember

2022-07-01

2022-09-30

0001335105

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-09-30

0001335105

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

us-gaap:GeneralAndAdministrativeExpenseMember

2022-01-01

2022-09-30

0001335105

us-gaap:GeneralAndAdministrativeExpenseMember

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

LIXT:StockOptionsGrantedtoDirectorsAndCorporateOfficersMember

2023-01-01

2023-09-30

0001335105

us-gaap:GeneralAndAdministrativeExpenseMember

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

LIXT:StockOptionsGrantedtoDirectorsAndCorporateOfficersMember

2022-01-01

2022-09-30

0001335105

LIXT:VendorAndConsultantOneMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:SalesRevenueNetMember

2023-01-01

2023-09-30

0001335105

LIXT:VendorAndConsultantTwoMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:SalesRevenueNetMember

2023-01-01

2023-09-30

0001335105

LIXT:VendorAndConsultantThreeMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:SalesRevenueNetMember

2023-01-01

2023-09-30

0001335105

LIXT:VendorAndConsultantOneMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:SalesRevenueNetMember

2022-01-01

2022-09-30

0001335105

LIXT:VendorAndConsultantTwoMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:SalesRevenueNetMember

2022-01-01

2022-09-30

0001335105

LIXT:VendorAndConsultantThreeMember

us-gaap:CustomerConcentrationRiskMember

us-gaap:ResearchAndDevelopmentExpenseMember

us-gaap:SalesRevenueNetMember

2022-01-01

2022-09-30

0001335105

LIXT:SeriesAConvertiblePreferredStockMember

2023-01-01

2023-09-30

0001335105

LIXT:SeriesAConvertiblePreferredStockMember

2022-01-01

2022-09-30

0001335105

LIXT:CommonStockWarrantsMember

2023-01-01

2023-09-30

0001335105

LIXT:CommonStockWarrantsMember

2022-01-01

2022-09-30

0001335105

LIXT:CommonStockOptionsMember

2023-01-01

2023-09-30

0001335105

LIXT:CommonStockOptionsMember

2022-01-01

2022-09-30

0001335105

country:US

2023-07-01

2023-09-30

0001335105

country:US

2022-07-01

2022-09-30

0001335105

country:US

2023-01-01

2023-09-30

0001335105

country:US

2022-01-01

2022-09-30

0001335105

country:ES

2023-07-01

2023-09-30

0001335105

country:ES

2022-07-01

2022-09-30

0001335105

country:ES

2023-01-01

2023-09-30

0001335105

country:ES

2022-01-01

2022-09-30

0001335105

country:CN

2023-07-01

2023-09-30

0001335105

country:CN

2022-07-01

2022-09-30

0001335105

country:CN

2023-01-01

2023-09-30

0001335105

country:CN

2022-01-01

2022-09-30

0001335105

country:NL

2023-07-01

2023-09-30

0001335105

country:NL

2022-07-01

2022-09-30

0001335105

country:NL

2023-01-01

2023-09-30

0001335105

country:NL

2022-01-01

2022-09-30

0001335105

LIXT:SeriesAConvertiblePreferredStockMember

2015-03-17

0001335105

LIXT:SeriesAConvertiblePreferredStockMember

2015-03-16

2023-03-17

0001335105

LIXT:UndesignatedPreferredStockMember

2023-09-30

0001335105

LIXT:UndesignatedPreferredStockMember

2022-12-31

0001335105

LIXT:SeriesAConvertiblePreferredStockMember

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0001335105

LIXT:SeriesAConvertiblePreferredStockMember

2023-01-01

2023-09-30

0001335105

LIXT:SeriesAConvertiblePreferredStockMember

2022-01-01

2022-12-31

0001335105

us-gaap:CommonStockMember

2023-03-09

2023-03-10

0001335105

us-gaap:WarrantMember

2023-03-09

2023-03-10

0001335105

us-gaap:WarrantMember

2023-03-10

0001335105

us-gaap:CommonStockMember

2022-04-11

2022-04-12

0001335105

us-gaap:CommonStockMember

2022-04-12

0001335105

LIXT:PlacementAgentsMember

2022-04-12

0001335105

us-gaap:CommonStockMember

2023-07-19

2023-07-20

0001335105

us-gaap:CommonStockMember

2023-07-20

0001335105

us-gaap:PrivatePlacementMember

2023-07-20

0001335105

us-gaap:PrivatePlacementMember

2023-07-19

2023-07-20

0001335105

LIXT:PlacementAgentsMember

2023-07-20

0001335105

LIXT:PlacementAgentsMember

2023-07-19

2023-07-20

0001335105

us-gaap:CommonStockMember

2023-08-07

0001335105

us-gaap:CommonStockMember

2023-07-24

2023-08-07

0001335105

us-gaap:InvestorMember

2023-08-07

0001335105

us-gaap:PrivatePlacementMember

2023-08-07

0001335105

us-gaap:WarrantMember

2023-09-30

0001335105

us-gaap:CommonStockMember

2023-06-02

0001335105

us-gaap:WarrantMember

2023-06-02

0001335105

LIXT:CommonStockWarrantMember

2023-09-30

0001335105

LIXT:CommonStockWarrantsMember

2022-12-31

0001335105

LIXT:CommonStockWarrantsMember

2023-01-01

2023-09-30

0001335105

LIXT:CommonStockWarrantsMember

2023-09-30

0001335105

LIXT:ExercisePriceOneMember

2023-09-30

0001335105

LIXT:ExercisePriceTwoMember

2023-09-30

0001335105

LIXT:ExercisePriceThreeMember

2023-09-30

0001335105

LIXT:ExercisePriceFourMember

2023-09-30

0001335105

LIXT:ExercisePriceFiveMember

2023-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:DrKovachMember

2020-10-01

2020-10-01

0001335105

LIXT:EmploymentAgreementMember

LIXT:DrKovachMember

2023-07-01

2023-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:DrKovachMember

2022-07-01

2022-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:DrKovachMember

2023-01-01

2023-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:DrKovachMember

2022-01-01

2022-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:DrJamesSMiserMDMember

2020-07-30

2020-08-01

0001335105

LIXT:DrJamesSMiserMDMember

LIXT:EmploymentAgreementMember

2021-04-29

2021-05-01

0001335105

LIXT:EmploymentAgreementMember

LIXT:DrJamesSMiserMDMember

2023-07-01

2023-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:DrJamesSMiserMDMember

2022-07-01

2022-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:DrJamesSMiserMDMember

2023-01-01

2023-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:DrJamesSMiserMDMember

2022-01-01

2022-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:EricJFormanMember

2020-08-11

2020-08-12

0001335105

LIXT:EmploymentAgreementMember

LIXT:EricJFormanMember

2021-04-29

2021-05-01

0001335105

LIXT:EmploymentAgreementMember

srt:ChiefOperatingOfficerMember

2022-11-05

2022-11-06

0001335105

LIXT:FormanMember

2023-07-01

2023-09-30

0001335105

LIXT:FormanMember

2023-01-01

2023-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:EricJFormanMember

2023-07-01

2023-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:EricJFormanMember

2022-07-01

2022-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:EricJFormanMember

2023-01-01

2023-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:EricJFormanMember

2022-01-01

2022-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:RobertNWeingartenMember

2020-08-11

2020-08-12

0001335105

LIXT:EmploymentAgreementMember

LIXT:RobertNWeingartenMember

2021-04-29

2021-05-01

0001335105

LIXT:EmploymentAgreementMember

LIXT:RobertNWeingartenMember

2023-07-01

2023-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:RobertNWeingartenMember

2022-07-01

2022-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:RobertNWeingartenMember

2023-01-01

2023-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:RobertNWeingartenMember

2022-01-01

2022-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:EricJFormanMember

2023-09-25

2023-09-26

0001335105

LIXT:EmploymentAgreementMember

LIXT:MrVanderBaanMember

2023-07-01

2023-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:MrVanderBaanMember

2023-01-01

2023-09-30

0001335105

2022-06-15

0001335105

srt:DirectorMember

2021-04-08

2021-04-09

0001335105

LIXT:ChairmanOfAuditCommitteeMember

2021-04-08

2021-04-09

0001335105

LIXT:ChairmanOfOtherCommitteesMember

2021-04-08

2021-04-09

0001335105

LIXT:MemberOfAuditCommitteeMember

2021-04-08

2021-04-09

0001335105

LIXT:MemberOfOtherCommitteesMember

2021-04-08

2021-04-09

0001335105

LIXT:NewIndependentDirectorMember

2023-01-01

2023-09-30

0001335105

LIXT:NewIndependentDirectorMember

us-gaap:RelatedPartyMember

2023-01-01

2023-09-30

0001335105

LIXT:AnnualGrantOfOptionsMember

2023-01-01

2023-09-30

0001335105

LIXT:AnnualGrantOfOptionsMember

us-gaap:RelatedPartyMember

2023-01-01

2023-09-30

0001335105

LIXT:IndependentDirectorMember

2023-07-01

2023-09-30

0001335105

LIXT:IndependentDirectorMember

2022-07-01

2022-09-30

0001335105

LIXT:IndependentDirectorMember

2023-01-01

2023-09-30

0001335105

LIXT:IndependentDirectorMember

2022-01-01

2022-09-30

0001335105

us-gaap:RelatedPartyMember

2023-07-01

2023-09-30

0001335105

us-gaap:RelatedPartyMember

2022-07-01

2022-09-30

0001335105

us-gaap:RelatedPartyMember

2023-01-01

2023-09-30

0001335105

us-gaap:RelatedPartyMember

2022-01-01

2022-09-30

0001335105

LIXT:StockBasedMember

2023-07-01

2023-09-30

0001335105

LIXT:StockBasedMember

2022-07-01

2022-09-30

0001335105

LIXT:StockBasedMember

2023-01-01

2023-09-30

0001335105

LIXT:StockBasedMember

2022-01-01

2022-09-30

0001335105

LIXT:TwoThousandTwentyStockIncentivePlanMember

srt:MaximumMember

2020-07-13

2020-07-14

0001335105

LIXT:TwoThousandTwentyStockIncentivePlanMember

2022-10-07

0001335105

LIXT:TwoThousandTwentyStockIncentivePlanMember

2022-10-06

2022-10-07

0001335105

LIXT:TwoThousandTwentyStockIncentivePlanMember

us-gaap:SubsequentEventMember

2023-11-27

0001335105

LIXT:TwoThousandTwentyStockIncentivePlanMember

us-gaap:SubsequentEventMember

2023-11-26

2023-11-27

0001335105

LIXT:TwoThousandTwentyStockIncentivePlanMember

2023-09-30

0001335105

LIXT:EricJFormanMember

LIXT:EmploymentAgreementMember

2020-07-13

2020-07-15

0001335105

LIXT:EricJFormanMember

LIXT:EmploymentAgreementMember

2020-07-15

0001335105

LIXT:EricJFormanMember

LIXT:EmploymentAgreementMember

2020-08-11

2020-08-12

0001335105

LIXT:EricJFormanMember

LIXT:EmploymentAgreementMember

2023-07-01

2023-09-30

0001335105

LIXT:EricJFormanMember

LIXT:EmploymentAgreementMember

2022-07-01

2022-09-30

0001335105

LIXT:EricJFormanMember

LIXT:EmploymentAgreementMember

2023-01-01

2023-09-30

0001335105

LIXT:EricJFormanMember

LIXT:EmploymentAgreementMember

2022-01-01

2022-09-30

0001335105

LIXT:DrJamesMiserMember

LIXT:EmploymentAgreementMember

2020-07-30

2020-08-01

0001335105

LIXT:DrJamesMiserMember

LIXT:EmploymentAgreementMember

2020-07-30

2020-08-07

0001335105

LIXT:DrJamesMiserMember

LIXT:EmploymentAgreementMember

2020-08-01

0001335105

LIXT:DrJamesMiserMember

LIXT:EmploymentAgreementMember

2023-07-01

2023-09-30

0001335105

LIXT:DrJamesMiserMember

LIXT:EmploymentAgreementMember

2022-07-01

2022-09-30

0001335105

LIXT:DrJamesMiserMember

LIXT:EmploymentAgreementMember

2023-01-01

2023-09-30

0001335105

LIXT:DrJamesMiserMember

LIXT:EmploymentAgreementMember

2022-01-01

2022-09-30

0001335105

LIXT:RobertNWeingartenMember

LIXT:EmploymentAgreementMember

2020-08-11

2020-08-12

0001335105

srt:DirectorMember

LIXT:RobertNWeingartenMember

2020-08-12

0001335105

LIXT:RobertNWeingartenMember

LIXT:EmploymentAgreementMember

2020-08-12

0001335105

LIXT:RobertNWeingartenMember

LIXT:EmploymentAgreementMember

2023-07-01

2023-09-30

0001335105

LIXT:RobertNWeingartenMember

LIXT:EmploymentAgreementMember

2022-07-01

2022-09-30

0001335105

LIXT:RobertNWeingartenMember

LIXT:EmploymentAgreementMember

2023-01-01

2023-09-30

0001335105

LIXT:RobertNWeingartenMember

LIXT:EmploymentAgreementMember

2022-01-01

2022-09-30

0001335105

LIXT:MrSchwartbergMember

srt:DirectorMember

2021-04-01

2021-04-09

0001335105

srt:DirectorMember

LIXT:MrSchwartbergMember

2021-04-09

0001335105

srt:DirectorMember

LIXT:MrSchwartbergMember

2022-07-01

2022-09-30

0001335105

srt:DirectorMember

LIXT:MrSchwartbergMember

2022-01-01

2022-09-30

0001335105

LIXT:MsReginaBrownMember

srt:DirectorMember

2021-05-10

2021-05-11

0001335105

srt:DirectorMember

LIXT:MsReginaBrownMember

2021-05-11

0001335105

LIXT:MsReginaBrownMember

srt:DirectorMember

2023-07-01

2023-09-30

0001335105

LIXT:MsReginaBrownMember

srt:DirectorMember

2022-07-01

2022-09-30

0001335105

LIXT:MsReginaBrownMember

srt:DirectorMember

2023-01-01

2023-09-30

0001335105

LIXT:MsReginaBrownMember

srt:DirectorMember

2022-01-01

2022-09-30

0001335105

LIXT:FiveNonOfficerDirectorsMember

2021-06-28

2021-06-30

0001335105

LIXT:FiveNonOfficerDirectorsMember

2021-06-30

0001335105

LIXT:NonOfficerDirectorsMember

2021-06-30

0001335105

LIXT:FiveNonOfficerDirectorsMember

2021-06-01

2021-06-30

0001335105

LIXT:FiveNonOfficerDirectorsMember

2023-07-01

2023-09-30

0001335105

LIXT:FiveNonOfficerDirectorsMember

2022-07-01

2022-09-30

0001335105

LIXT:FiveNonOfficerDirectorsMember

2023-01-01

2023-09-30

0001335105

LIXT:FiveNonOfficerDirectorsMember

2022-01-01

2022-09-30

0001335105

LIXT:BasvanderBaanMember

2022-06-16

2022-06-17

0001335105

LIXT:BasvanderBaanMember

2022-06-17

0001335105

srt:DirectorMember

2022-06-16

2022-06-17

0001335105

LIXT:BasvanderBaanMember

2023-07-01

2023-09-30

0001335105

LIXT:BasvanderBaanMember

2022-07-01

2022-09-30

0001335105

LIXT:BasvanderBaanMember

2023-01-01

2023-09-30

0001335105

LIXT:BasvanderBaanMember

2022-01-01

2022-09-30

0001335105

srt:DirectorMember

2022-01-01

2022-06-30

0001335105

srt:DirectorMember

2021-06-01

2021-06-30

0001335105

srt:DirectorMember

2022-06-30

0001335105

srt:DirectorMember

2022-06-28

2022-06-30

0001335105

LIXT:FiveNonOfficerDirectorsMember

2022-06-01

2022-06-30

0001335105

srt:DirectorMember

2021-06-30

0001335105

srt:DirectorMember

2023-07-01

2023-09-30

0001335105

srt:DirectorMember

2022-07-01

2022-09-30

0001335105

srt:DirectorMember

2023-01-01

2023-09-30

0001335105

srt:DirectorMember

2022-01-01

2022-09-30

0001335105

srt:DirectorMember

us-gaap:CommonStockMember

2022-11-06

0001335105

LIXT:FourOfficersMember

2022-11-06

0001335105

srt:DirectorMember

2022-11-06

0001335105

LIXT:FourOfficersMember

2022-11-05

2022-11-06

0001335105

LIXT:FourOfficersMember

2023-07-01

2023-09-30

0001335105

LIXT:FourOfficersMember

2023-01-01

2023-09-30

0001335105

LIXT:FiveNonOfficerDirectorsMember

2022-11-05

2022-11-06

0001335105

LIXT:FiveNonOfficerDirectorsMember

2022-11-06

0001335105

srt:DirectorMember

2023-06-30

0001335105

LIXT:FourOfficersMember

2023-06-06

0001335105

LIXT:FourNonOfficersMember

2023-06-29

2023-06-30

0001335105

LIXT:FourNonOfficersMember

2023-06-30

0001335105

LIXT:FourNonOfficersMember

2023-07-01

2023-09-30

0001335105

LIXT:FourNonOfficersMember

2023-01-01

2023-09-30

0001335105

LIXT:MrVanderBaanMember

LIXT:EmploymentAgreementMember

2023-09-25

2023-09-26

0001335105

LIXT:MrVanderBaanMember

LIXT:EmploymentAgreementMember

2023-09-26

0001335105

LIXT:MrVanderBaanMember

LIXT:EmploymentAgreementMember

2023-06-26

0001335105

LIXT:MrVanderBaanMember

LIXT:EmploymentAgreementMember

2023-07-01

2023-09-30

0001335105

LIXT:MrVanderBaanMember

LIXT:EmploymentAgreementMember

2023-01-01

2023-09-30

0001335105

LIXT:RelatedPartiesMember

2023-07-01

2023-09-30

0001335105

LIXT:RelatedPartiesMember

2022-07-01

2022-09-30

0001335105

LIXT:RelatedPartiesMember

2023-01-01

2023-09-30

0001335105

LIXT:RelatedPartiesMember

2022-01-01

2022-09-30

0001335105

LIXT:NonRelatedPartiesMember

2023-07-01

2023-09-30

0001335105

LIXT:NonRelatedPartiesMember

2022-07-01

2022-09-30

0001335105

LIXT:NonRelatedPartiesMember

2023-01-01

2023-09-30

0001335105

LIXT:NonRelatedPartiesMember

2022-01-01

2022-09-30

0001335105

LIXT:ExercisePriceOneMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceTwoMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceThreeMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceFourMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceFiveMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceSixMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceSixMember

2023-09-30

0001335105

LIXT:ExercisePriceSevenMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceSevenMember

2023-09-30

0001335105

LIXT:ExercisePriceEightMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceEightMember

2023-09-30

0001335105

LIXT:ExercisePriceNineMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceNineMember

2023-09-30

0001335105

LIXT:ExercisePriceTenMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceTenMember

2023-09-30

0001335105

LIXT:ExercisePriceElevenMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceElevenMember

2023-09-30

0001335105

LIXT:ExercisePriceTwelveMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceTwelveMember

2023-09-30

0001335105

LIXT:ExercisePriceThirteenMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceThirteenMember

2023-09-30

0001335105

LIXT:ExercisePriceFourteenMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceFourteenMember

2023-09-30

0001335105

LIXT:ExercisePriceFifteenMember

2023-01-01

2023-09-30

0001335105

LIXT:ExercisePriceFifteenMember

2023-09-30

0001335105

LIXT:ClinicalTrialResearchAgreementMember

2023-07-01

2023-09-30

0001335105

LIXT:ClinicalTrialResearchAgreementMember

2022-07-01

2022-09-30

0001335105

LIXT:ClinicalTrialResearchAgreementMember

2023-01-01

2023-09-30

0001335105

LIXT:ClinicalTrialResearchAgreementMember

2022-01-01

2022-09-30

0001335105

LIXT:ClinicalTrialResearchAgreementMember

2023-01-30

2023-09-30

0001335105

LIXT:OtherClinicalAgreementsMember

2023-01-01

2023-09-30

0001335105

LIXT:GrupoEspanolDeInvestigacionEnSarcomasMember

LIXT:CollaborationAgreementMember

2023-01-01

2023-09-30

0001335105

LIXT:GrupoEspanolDeInvestigacionEnSarcomasMember

LIXT:CollaborationAgreementMember

2022-01-01

2022-09-30

0001335105

LIXT:GrupoEspanolDeInvestigacionEnSarcomasMember

2022-01-01

2022-09-30

0001335105

LIXT:CollaborationAgreementMember

LIXT:GrupoEspanolDeInvestigacionEnSarcomasMember

2023-09-30

0001335105

LIXT:CityOfHopeNationalMedicalCenterMember

LIXT:ClinicalResearchSupportAgreementMember

2023-01-01

2023-09-30

0001335105

LIXT:CityOfHopeNationalMedicalCenterMember

LIXT:ClinicalResearchSupportAgreementMember

2022-01-01

2022-09-30

0001335105

LIXT:CityOfHopeNationalMedicalCenterMember

LIXT:ClinicalResearchSupportAgreementMember

2023-09-30

0001335105

LIXT:ClinicalResearchSupportAgreementMember

2023-09-30

0001335105

LIXT:WorkOrderAgreementMember

LIXT:TheradexSystemsIncMember

2023-06-20

2023-06-22

0001335105

LIXT:WorkOrderAgreementMember

LIXT:TheradexSystemsIncMember

2023-07-01

2023-09-30

0001335105

LIXT:WorkOrderAgreementMember

LIXT:TheradexSystemsIncMember

2023-01-01

2023-09-30

0001335105

LIXT:WorkOrderAgreementMember

2023-09-30

0001335105

LIXT:WorkOrderAgreementMember

LIXT:MoffittCancerCenterandResearchInstituteHospitalIncMember

2023-07-01

2023-09-30

0001335105

LIXT:WorkOrderAgreementMember

LIXT:MoffittCancerCenterandResearchInstituteHospitalIncMember

2022-07-01

2022-09-30

0001335105

LIXT:WorkOrderAgreementMember

LIXT:MoffittCancerCenterandResearchInstituteHospitalIncMember

2023-01-01

2023-09-30

0001335105

LIXT:WorkOrderAgreementMember

LIXT:MoffittCancerCenterandResearchInstituteHospitalIncMember

2022-01-01

2022-09-30

0001335105

LIXT:MoffittCancerCenterandResearchInstituteHospitalIncMember

2023-01-01

2023-09-30

0001335105

LIXT:CityOfHopeNationalMedicalCenterMember

LIXT:WorkOrderAgreementMember

2021-02-04

2021-02-05

0001335105

LIXT:CityOfHopeNationalMedicalCenterMember

LIXT:WorkOrderAgreementMember

2023-07-01

2023-09-30

0001335105

LIXT:CityOfHopeNationalMedicalCenterMember

LIXT:WorkOrderAgreementMember

2022-07-01

2022-09-30

0001335105

LIXT:CityOfHopeNationalMedicalCenterMember

LIXT:WorkOrderAgreementMember

2023-01-01

2023-09-30

0001335105

LIXT:CityOfHopeNationalMedicalCenterMember

LIXT:WorkOrderAgreementMember

2022-01-01

2022-09-30

0001335105

LIXT:CityOfHopeNationalMedicalCenterMember

2023-09-30

0001335105

LIXT:WorkOrderAgreementMember

LIXT:CityOfHopeNationalMedicalCenterMember

2023-09-30

0001335105

LIXT:MoffittCancerCenterandResearchInstituteHospitalIncMember

LIXT:ExclusiveLicenseAgreementMember

2018-08-18

2018-08-20

0001335105

LIXT:MoffittCancerCenterandResearchInstituteHospitalIncMember

LIXT:ExclusiveLicenseAgreementMember

2023-07-01

2023-09-30

0001335105

LIXT:MoffittCancerCenterandResearchInstituteHospitalIncMember

LIXT:ExclusiveLicenseAgreementMember

2023-01-01

2023-09-30

0001335105

LIXT:MoffittCancerCenterandResearchInstituteHospitalIncMember

LIXT:ExclusiveLicenseAgreementMember

2022-07-01

2022-09-30

0001335105

LIXT:MoffittCancerCenterandResearchInstituteHospitalIncMember

LIXT:ExclusiveLicenseAgreementMember

2022-01-01

2022-09-30

0001335105

LIXT:EmploymentAgreementMember

LIXT:ExecutiveOfficersMember

2020-07-01

2020-08-31

0001335105

LIXT:EmploymentAgreementMember

LIXT:Dr.JamesMember

2021-04-08

2021-04-09

0001335105

LIXT:FormanMember

2022-11-05

2022-11-06

0001335105

LIXT:EmploymentAgreementMember

LIXT:BastiaanVanDerBaanMember

2023-09-25

2023-09-26

0001335105

srt:OfficerMember

2023-09-25

2023-09-26

0001335105

srt:OfficerMember

srt:MinimumMember

us-gaap:SubsequentEventMember

2023-10-04

2023-10-05

0001335105

LIXT:NDAConsultingCorpMember

2013-12-23

2013-12-24

0001335105

LIXT:NDAConsultingCorpMember

2023-07-01

2023-09-30

0001335105

LIXT:NDAConsultingCorpMember

2022-07-01

2022-09-30

0001335105

LIXT:NDAConsultingCorpMember

2023-01-01

2023-09-30

0001335105

LIXT:NDAConsultingCorpMember

2022-01-01

2022-09-30

0001335105

LIXT:CollaborationAgreementMember

LIXT:BioPharmaWorksLLCMember

2015-09-12

2015-09-14

0001335105

LIXT:CollaborationAgreementMember

LIXT:BioPharmaWorksLLCMember

2023-07-01

2023-09-30

0001335105

LIXT:CollaborationAgreementMember

LIXT:BioPharmaWorksLLCMember

2022-07-01

2022-09-30

0001335105

LIXT:CollaborationAgreementMember

LIXT:BioPharmaWorksLLCMember

2023-01-01

2023-09-30

0001335105

LIXT:CollaborationAgreementMember

LIXT:BioPharmaWorksLLCMember

2022-01-01

2022-09-30

0001335105

LIXT:DevelopmentCollaborationAgreementMember

LIXT:NetherlandsCancerInstituteMember

2021-10-08

0001335105

LIXT:DevelopmentCollaborationAgreementMember

LIXT:NetherlandsCancerInstituteMember

us-gaap:SubsequentEventMember

2023-10-03

0001335105

LIXT:DevelopmentCollaborationAgreementMember

LIXT:NetherlandsCancerInstituteMember

2023-07-01

2023-09-30

0001335105

LIXT:DevelopmentCollaborationAgreementMember

LIXT:NetherlandsCancerInstituteMember

2022-07-01

2022-09-30

0001335105

LIXT:DevelopmentCollaborationAgreementMember

LIXT:NetherlandsCancerInstituteMember

2023-01-01

2023-09-30

0001335105

LIXT:DevelopmentCollaborationAgreementMember

LIXT:NetherlandsCancerInstituteMember

2022-01-01

2022-09-30

0001335105

LIXT:DevelopmentCollaborationAgreementMember

LIXT:NetherlandsCancerInstituteMember

2023-09-30

0001335105

LIXT:MRIGlobalMember

2022-06-09

2022-06-10

0001335105

LIXT:MRIGlobalMember

2023-04-15

2023-04-17

0001335105

LIXT:MRIGlobalMember

2023-07-01

2023-09-30

0001335105

LIXT:MRIGlobalMember

2022-07-01

2022-09-30

0001335105

LIXT:MRIGlobalMember

2023-01-01

2023-09-30

0001335105

LIXT:MRIGlobalMember

2022-01-01

2022-09-30

0001335105

LIXT:ClinicalTrialPhase1bMember

2023-01-01

2023-09-30

0001335105

LIXT:ClinicalTrialPhase1bMember

srt:MinimumMember

2023-01-01

2023-09-30

0001335105

LIXT:ClinicalTrialPhase1bMember

srt:MaximumMember

2023-01-01

2023-09-30

0001335105

LIXT:ClinicalTrialPhase1bTwoMember

2023-01-01

2023-09-30

0001335105

LIXT:ClinicalTrialPhase1bTwoMember

srt:MinimumMember

2023-01-01

2023-09-30

0001335105

LIXT:ClinicalTrialPhase1bTwoMember

srt:MaximumMember

2023-01-01

2023-09-30

0001335105

LIXT:ClinicalTrialRandomizedPhaseTwoMember

2023-01-01

2023-09-30

0001335105

LIXT:ClinicalTrialPhase1b2Member

2023-01-01

2023-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:EUR

LIXT:Integer

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended September 30, 2023

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission

file number: 001-39717

LIXTE

BIOTECHNOLOGY HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

20-2903526 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

Number) |

680

East Colorado Boulevard, Suite 180

Pasadena,

California 91101

(Address

of principal executive offices, including Zip Code)

(631)

830-7092

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

LIXT |

|

The

Nasdaq Stock Market LLC |

| Warrants

to Purchase Common Stock, par value $0.0001 per share |

|

LIXTW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Yes

☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”,

“smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐ No ☒

As

of November 6, 2023, the Company had 2,249,290 shares of common stock, $0.0001 par value, issued and outstanding.

LIXTE

BIOTECHNOLOGY HOLDINGS, INC.

AND

SUBSIDIARY

TABLE

OF CONTENTS

PART

I - FINANCIAL INFORMATION

ITEM

1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

LIXTE

BIOTECHNOLOGY HOLDINGS, INC.

AND

SUBSIDIARY

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

September 30, 2023 | | |

December 31, 2022 | |

| | |

(Unaudited) | | |

| |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 5,105,611 | | |

$ | 5,353,392 | |

| Advances on research and development contract services | |

| 78,015 | | |

| 147,017 | |

| Prepaid insurance | |

| 23,230 | | |

| 49,224 | |

| Other prepaid expenses and current assets | |

| 27,840 | | |

| 10,380 | |

| Total current assets | |

| 5,234,696 | | |

| 5,560,013 | |

| Total assets | |

$ | 5,234,696 | | |

$ | 5,560,013 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses, including $43,895 and $46,982 to related parties at September 30, 2023 and December 31, 2022, respectively | |

$ | 221,171 | | |

$ | 229,764 | |

| Research and development contract liabilities | |

| 90,565 | | |

| 165,022 | |

| Total current liabilities | |

| 311,736 | | |

| 394,786 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred Stock, $0.0001 par value; authorized – 10,000,000 shares; issued and outstanding – 350,000 shares of Series A Convertible Preferred Stock, $10.00 per share stated value, liquidation preference based on assumed conversion into common shares – 72,917 shares | |

| 3,500,000 | | |

| 3,500,000 | |

| Common stock, $0.0001 par value; authorized – 100,000,000 shares; issued and outstanding – 2,249,290 shares and 1,664,706 shares at September 30, 2023 and December 31, 2022, respectively | |

| 225 | | |

| 166 | |

| Additional paid-in capital | |

| 48,872,208 | | |

| 45,059,760 | |

| Accumulated deficit | |

| (47,449,473 | ) | |

| (43,394,699 | ) |

| Total stockholders’ equity | |

| 4,922,960 | | |

| 5,165,227 | |

| Total liabilities and stockholders’ equity | |

$ | 5,234,696 | | |

$ | 5,560,013 | |

See

accompanying notes to condensed consolidated financial statements.

LIXTE

BIOTECHNOLOGY HOLDINGS, INC.

AND

SUBSIDIARY

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | — | |

| | |

| | | |

| | | |

| | | |

| | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| General and administrative costs: | |

| | | |

| | | |

| | | |

| | |

| Compensation to related parties, including stock-based compensation expense of $112,106 and $396,883 for the three months ended September 30, 2023 and 2022, respectively, and $669,146 and $1,160,649 for the nine months ended September 30, 2023 and 2022, respectively | |

| 356,001 | | |

| 643,957 | | |

| 1,398,042 | | |

| 1,963,409 | |

| Patent and licensing legal and filing fees and costs | |

| 178,012 | | |

| 271,163 | | |

| 835,362 | | |

| 944,789 | |

| Other costs and expenses | |

| 357,681 | | |

| 290,993 | | |

| 1,081,893 | | |

| 875,016 | |

| Research and development costs | |

| 132,487 | | |

| 272,388 | | |

| 749,029 | | |

| 895,649 | |

| Total costs and expenses | |

| 1,024,181 | | |

| 1,478,501 | | |

| 4,064,326 | | |

| 4,678,863 | |

| Loss from operations | |

| (1,024,181 | ) | |

| (1,478,501 | ) | |

| (4,064,326 | ) | |

| (4,678,863 | ) |

| Interest income | |

| 5,809 | | |

| 3,911 | | |

| 13,538 | | |

| 4,211 | |

| Interest expense | |

| (279 | ) | |

| (2,119 | ) | |

| (6,088 | ) | |

| (5,240 | ) |

| Foreign currency gain (loss) | |

| (109 | ) | |

| (1,300 | ) | |

| 2,102 | | |

| (1,339 | ) |

| Net loss | |

$ | (1,018,760 | ) | |

$ | (1,478,009 | ) | |

$ | (4,054,774 | ) | |

$ | (4,681,231 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share – basic and diluted | |

$ | (0.49 | ) | |

$ | (0.89 | ) | |

$ | (2.25 | ) | |

$ | (3.01 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding – basic and diluted | |

| 2,074,938 | | |

| 1,664,659 | | |

| 1,803,466 | | |

| 1,554,183 | |

See

accompanying notes to condensed consolidated financial statements.

LIXTE

BIOTECHNOLOGY HOLDINGS, INC.

AND

SUBSIDIARY

CONDENSED

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

Three

Months and Nine Months Ended September 30, 2023 and 2022

| | |

Shares | | |

Amount | | |

Shares | | |

Par Value | | |

Capital | | |

Deficit | | |

Equity | |

| | |

Convertible Series A Preferred Stock | | |

Common Stock | | |

Additional Paid-in | | |

Accumulated | | |

Total Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Par Value | | |

Capital | | |

Deficit | | |

Equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Three months ended September 30, 2023: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, June 30, 2023 | |

| 350,000 | | |

$ | 3,500,000 | | |

| 1,665,956 | | |

$ | 166 | | |

$ | 45,623,081 | | |

$ | (46,430,713 | ) | |

$ | 2,692,534 | |

| Proceeds from sale of securities in registered direct offering, net of offering costs | |

| — | | |

| — | | |

| 180,000 | | |

| 18 | | |

| 3,137,021 | | |

| — | | |

| 3,137,039 | |

| Exercise of pre-funded common stock warrants | |

| — | | |

| — | | |

| 403,334 | | |

| 41 | | |

| — | | |

| — | | |

| 41 | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| — | | |

| — | | |

| 112,106 | | |

| — | | |

| 112,106 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (1,018,760 | ) | |

| (1,018,760 | ) |

| Balance, September 30, 2023 | |

| 350,000 | | |

$ | 3,500,000 | | |

| 2,249,290 | | |

$ | 225 | | |

$ | 48,872,208 | | |

$ | (47,449,473 | ) | |

$ | 4,922,960 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nine months ended September 30, 2023: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2022 | |

| 350,000 | | |

$ | 3,500,000 | | |

| 1,664,706 | | |

$ | 166 | | |

$ | 45,059,760 | | |

$ | (43,394,699 | ) | |

$ | 5,165,227 | |

| Proceeds from sale of securities in registered direct offering, net of offering costs | |

| — | | |

| — | | |

| 180,000 | | |

| 18 | | |

| 3,137,021 | | |

| — | | |

| 3,137,039 | |

| Exercise of pre-funded common stock warrants | |

| — | | |

| — | | |

| 403,334 | | |

| 41 | | |

| — | | |

| — | | |

| 41 | |

| Exercise of common stock options | |

| — | | |

| — | | |

| 1,250 | | |

| — | | |

| 6,281 | | |

| — | | |

| 6,281 | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| — | | |

| — | | |

| 669,146 | | |

| — | | |

| 669,146 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (4,054,774 | ) | |

| (4,054,774 | ) |

| Balance, September 30, 2023 | |

| 350,000 | | |

$ | 3,500,000 | | |

| 2,249,290 | | |

$ | 225 | | |

$ | 48,872,208 | | |

$ | (47,449,473 | ) | |

$ | 4,922,960 | |

(Continued)

LIXTE

BIOTECHNOLOGY HOLDINGS, INC.

AND

SUBSIDIARY

CONDENSED

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

(Continued)

Three

Months and Nine Months Ended September 30, 2023 and 2022

| | |

Convertible Series A Preferred Stock | | |

Common Stock | | |

Additional Paid-in | | |

Accumulated | | |

Total Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Par Value | | |

Capital | | |

Deficit | | |

Equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Three months ended September 30, 2022: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, June 30, 2022 | |

| 350,000 | | |

$ | 3,500,000 | | |

| 1,664,593 | | |

$ | 166 | | |

$ | 44,277,486 | | |

$ | (40,285,386 | ) | |

$ | 7,492,266 | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| — | | |

| — | | |

| 396,883 | | |

| — | | |

| 396,883 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (1,478,009 | ) | |

| (1,478,009 | ) |

| Balance, September 30, 2022 | |

| 350,000 | | |

$ | 3,500,000 | | |

| 1,664,593 | | |

$ | 166 | | |

$ | 44,674,369 | | |

$ | (41,763,395 | ) | |

$ | 6,411,140 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nine months ended September 30, 2022: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2021 | |

| 350,000 | | |

$ | 3,500,000 | | |

| 1,374,593 | | |

$ | 137 | | |

$ | 38,372,365 | | |

$ | (37,082,164 | ) | |

$ | 4,790,338 | |

| Balance | |

| 350,000 | | |

$ | 3,500,000 | | |

| 1,374,593 | | |

$ | 137 | | |

$ | 38,372,365 | | |

$ | (37,082,164 | ) | |

$ | 4,790,338 | |

| Proceeds from sale of securities in registered direct offering, net of offering costs | |

| — | | |

| — | | |

| 290,000 | | |

| 29 | | |

| 5,141,355 | | |

| — | | |

| 5,141,384 | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,160,649 | | |

| — | | |

| 1,160,649 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (4,681,231 | ) | |

| (4,681,231 | ) |

| Balance, September 30, 2022 | |

| 350,000 | | |

$ | 3,500,000 | | |

| 1,664,593 | | |

$ | 166 | | |

$ | 44,674,369 | | |

$ | (41,763,395 | ) | |

$ | 6,411,140 | |

| Balance | |

| 350,000 | | |

$ | 3,500,000 | | |

| 1,664,593 | | |

$ | 166 | | |

$ | 44,674,369 | | |

$ | (41,763,395 | ) | |

$ | 6,411,140 | |

See

accompanying notes to condensed consolidated financial statements.

LIXTE

BIOTECHNOLOGY HOLDINGS, INC.

AND

SUBSIDIARY

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

2023 | | |

2022 | |

| | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (4,054,774 | ) | |

$ | (4,681,231 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Stock-based compensation expense included in - | |

| | | |

| | |

| General and administrative costs | |

| 669,146 | | |

| 1,160,649 | |

| Research and development costs | |

| — | | |

| — | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| (Increase) decrease in - | |

| | | |

| | |

| Advances on research and development contract services | |

| 69,002 | | |

| 3,224 | |

| Prepaid insurance | |

| 25,994 | | |

| 22,375 | |

| Other prepaid expenses and current assets | |

| (17,460 | ) | |

| (13,708 | ) |

| Increase (decrease) in - | |

| | | |

| | |

| Accounts payable and accrued expenses | |

| (8,593 | ) | |

| 81,433 | |

| Research and development contract liabilities | |

| (74,457 | ) | |

| 23,969 | |

| Net cash used in operating activities | |

| (3,391,142 | ) | |

| (3,403,289 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from sale of securities in registered direct offering, net of offering costs | |

| 3,137,039 | | |

| 5,141,384 | |

| Exercise of pre-funded common stock warrants | |

| 41 | | |

| — | |

| Exercise of common stock options | |

| 6,281 | | |

| — | |

| Net cash provided by financing activities | |

| 3,143,361 | | |

| 5,141,384 | |

| | |

| | | |

| | |

| Cash: | |

| | | |

| | |

| Net increase (decrease) | |

| (247,781 | ) | |

| 1,738,095 | |

| Balance at beginning of period | |

| 5,353,392 | | |

| 4,823,745 | |

| Balance at end of period | |

$ | 5,105,611 | | |

$ | 6,561,840 | |

| | |

| | | |

| | |

| Supplemental disclosures of cash flow information: | |

| | | |

| | |

| Cash paid for - | |

| | | |

| | |

| Interest | |

$ | 6,088 | | |

$ | 5,240 | |

| Income taxes | |

$ | — | | |

$ | — | |

See

accompanying notes to condensed consolidated financial statements.

LIXTE

BIOTECHNOLOGY HOLDINGS, INC.

AND

SUBSIDIARY

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Three

Months and Nine Months Ended September 30, 2023 and 2022

1.

Organization and Basis of Presentation

The

condensed consolidated financial statements of Lixte Biotechnology Holdings, Inc., a Delaware corporation), including its wholly-owned

Delaware subsidiary, Lixte Biotechnology, Inc. (collectively, the “Company”), at September 30, 2023, and for the three months

and nine months ended September 30, 2023 and 2022, are unaudited. In the opinion of management of the Company, all adjustments, including

normal recurring accruals, have been made that are necessary to present fairly the financial position of the Company as of September

30, 2023, and the results of its operations for the three months and nine months ended September 30, 2023 and 2022, and its cash flows

for the nine months ended September 30, 2023 and 2022. Operating results for the interim periods presented are not necessarily indicative

of the results to be expected for a full fiscal year. The consolidated balance sheet at December 31, 2022 has been derived from the Company’s

audited consolidated financial statements at such date.

The

condensed consolidated financial statements and related notes have been prepared pursuant to the rules and regulations of the Securities

and Exchange Commission (“SEC”). Accordingly, certain information and footnote disclosures normally included in financial

statements prepared in accordance with generally accepted accounting principles have been omitted pursuant to such rules and regulations.

These condensed consolidated financial statements should be read in conjunction with the financial statements and other information included

in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC.

President

and Chief Executive Officer

Effective

September 26, 2023, Bas van der Baan was appointed as the Company’s President and Chief Executive Officer, at which time he replaced

Dr. John S. Kovach as the Company’s President and Chief Executive Officer. Dr. Kovach passed away on October 5, 2023.

Reverse

Stock Split

On

June 2, 2023, the Company effected a 1-for-10 reverse split of its outstanding shares of common stock. No fractional shares were issued

in connection with the reverse split, with any fractional shares resulting from the reverse split being rounded up to the nearest whole

share.

All

share and per share amounts and information presented herein have been retroactively adjusted to reflect the reverse stock split for

all periods presented.

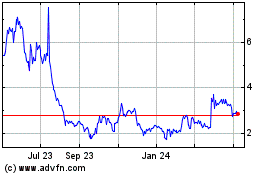

Nasdaq

Listing

The

Company’s common stock and the warrants are traded on The Nasdaq Capital Market under the symbols “LIXT” and “LIXTW”,

respectively.

In

order to achieve compliance with the $1.00 minimum closing bid price requirement of the Nasdaq Capital Market, the Company held a special

meeting of stockholders on May 26, 2023 to seek approval for an amendment to the Company’s Certificate of Incorporation to effect

a reverse stock split of its issued and outstanding shares of common stock. As a result of the approval of this amendment, the Company

effected a 1-for-10 reverse stock split of its issued and outstanding common stock effective on Friday, June 2, 2023. Commencing with

the opening of trading on the Nasdaq Capital Market on Monday, June 5, 2023, the Company’s common stock began trading on a post-split

basis under the same symbol LIXT. The Company subsequently received confirmation from Nasdaq that it had regained compliance with the

minimum bid price requirement of $1.00 per share under Nasdaq Listing Rule 5550(a)(2) and currently meets all other applicable criteria

for continued listing.

However,

there can be no assurances that the Company will be able to remain in compliance with the $1.00 minimum bid price requirement over time,

or that it will be successful in maintaining compliance with any of the other Nasdaq continued listing requirements.

2.

Business

The

Company is a drug research company that uses biomarker technology to identify enzyme targets associated with serious common diseases

and then designs novel compounds to attack those targets. The Company’s corporate office is located in Pasadena, California.

The

Company’s product pipeline is primarily focused on inhibitors of protein phosphatases, used alone and in combination with cytotoxic

agents and/or x-ray and immune checkpoint blockers. The Company believes that inhibitors of protein phosphatases have broad therapeutic

potential not only for cancer but also for other debilitating and life-threatening diseases. The Company is directing its efforts on

clinical development of a specific protein phosphatase inhibitor, referred to as LB-100, which has been shown to have clinical anti-cancer

activity at doses that produce little or no toxicity.

The

Company’s activities are subject to significant risks and uncertainties, including the need for additional capital. The Company

has not yet commenced any revenue-generating operations, does not have positive cash flows from operations, relies on stock-based compensation

for a substantial portion of employee and consultant compensation, and is dependent on periodic infusions of equity capital to fund its

operating requirements.

Going

Concern

As

reflected in the accompanying financial statements, for the nine months ended September 30, 2023, the Company recorded a net loss of

$4,054,774 and

used cash in operations of $3,391,142.

At September 30, 2023, the Company had cash of $5,105,611

available to fund its operations. Because the

Company is currently engaged in various early-stage clinical trials, it is expected that it will take a significant amount of time and

resources to develop any product or intellectual property capable of generating sustainable revenues. Accordingly, the Company’s

business is unlikely to generate any sustainable operating revenues in the next several years and may never do so. Even if the Company

is able to generate revenues through licensing its technology, product sales or other commercial activities, there can be no assurance

that the Company will be able to achieve and maintain positive earnings and operating cash flows. At September 30, 2023, the Company’s

remaining contractual commitments pursuant to clinical trial agreements and clinical trial monitoring agreements not yet incurred aggregated

approximately $6,262,000 (see

Note 9), which are currently scheduled to be incurred through approximately December 31, 2027.

The

Company’s consolidated financial statements have been presented on the basis that it will continue as a going concern, which contemplates

the realization of assets and satisfaction of liabilities in the normal course of business. The Company has no recurring source of revenue

and has experienced negative operating cash flows since inception. The Company has financed its working capital requirements through

the recurring sale of its equity securities.

Based

on the foregoing, management has concluded that there is substantial doubt about the Company’s ability to continue as a going concern

within one year after the date that the accompanying interim condensed consolidated financial statements are being issued. The Company’s

interim condensed consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

The

Company’s ability to continue as a going concern is dependent upon its ability to raise additional equity capital to fund its research

and development activities and to ultimately achieve sustainable operating revenues and profitability. The amount and timing of future

cash requirements depends on the pace, design and results of the Company’s clinical trial program, which, in turn, depends on the

availability of operating capital to fund such activities.

Based

on current operating plans, the Company estimates that its existing cash resources at September 30, 2023 will provide sufficient working

capital to fund the current clinical trial program with respect to the development of the Company’s lead anti-cancer clinical compound

LB-100 through at least September 30, 2024. However, existing cash resources will not be sufficient to complete the development of and

obtain regulatory approval for the Company’s product candidate, which will require that the Company raise significant additional

capital. The Company estimates that it will need to raise additional capital to fund its operations by mid-2024 to be able

to proactively manage its current business plan during the remainder of 2024 and during 2025. In addition, the Company’s operating

plans may change as a result of many factors that are currently unknown and/or outside of the control of the Company, and additional

funds may be needed sooner than planned.

As

market conditions present uncertainty as to the Company’s ability to secure additional funds, there can be no assurance that the

Company will be able to secure additional financing on acceptable terms, as and when necessary, to continue to conduct operations.

If

cash resources are insufficient to satisfy the Company’s ongoing cash requirements, the Company would be required to scale back

or discontinue its clinical trial program, as well as its licensing and patent prosecution efforts and its technology and product development

efforts, or obtain funds, if available, through strategic alliances or joint ventures that could require the Company to relinquish rights

to and/or control of LB-100, or to discontinue operations entirely.

3.

Summary of Significant Accounting Policies

Principles

of Consolidation

The

accompanying condensed consolidated financial statements of the Company have been prepared in accordance with United States generally

accepted accounting principles (“GAAP”) and include the financial statements of Lixte Biotechnology Holdings, Inc. and its

wholly-owned subsidiary, Lixte Biotechnology, Inc. Intercompany balances and transactions have been eliminated in consolidation.

Foreign

Currency Translation

The

consolidated financial statements are presented in the United States dollar, which is the functional and reporting currency of the Company.

The

Company periodically incurs a cost or expense denominated in a foreign currency. Such cost or expense is converted into United States

dollars for financial statement purposes based on the foreign currency conversion rate in effect on the transaction date. The Company

purchases the requisite foreign currency to pay such cost or expense on an as-needed basis. Any gain or loss resulting from the purchase

of the foreign currency is included as foreign currency gain (loss) in the consolidated statement of operations. As of September 30,

2023 and December 31, 2022, the Company did not hold any currencies other than the United States dollar in its bank account.

Segment

Information

The

Company operates and reports in one segment, which focuses on the utilization of biomarker technology to identify enzyme targets associated

with serious common diseases and then designing novel compounds to attack those targets. The Company’s operating segment is reported

in a manner consistent with the internal reporting provided to the Company’s Chief Operating Decision Maker, which is the Company’s

President and Chief Executive Officer.

Use

of Estimates

The

preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period.

Some of those judgments can be subjective and complex, and therefore, actual results could differ materially from those estimates under

different assumptions or conditions. Management bases its estimates on historical experience and on various assumptions that are believed

to be reasonable in relation to the financial statements taken, as a whole, under the circumstances, the results of which form the basis

for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Management

regularly evaluates the key factors and assumptions used to develop the estimates utilizing currently available information, changes

in facts and circumstances, historical experience, and reasonable assumptions. After such evaluations, if deemed appropriate, those estimates

are adjusted accordingly. Actual results could differ from those estimates. Significant estimates include those related to assumptions

used in the calculation of accruals for clinical trial costs and other potential liabilities, valuing equity instruments issued for services,

and the realization of deferred tax assets.

Cash

Cash

is held in a cash bank deposit program maintained by Morgan Stanley Wealth Management, a division of Morgan Stanley Smith Barney LLC

(“Morgan Stanley”). Morgan Stanley is a FINRA-regulated broker-dealer. The Company’s policy is to maintain its cash

balances with financial institutions in the United States with high credit ratings and in accounts insured by the Federal Deposit Insurance

Corporation (the “FDIC”) and/or by the Securities Investor Protection Corporation (the “SIPC”). The Company periodically

has cash balances in financial institutions in excess of the FDIC and SIPC insurance limits of $250,000 and $500,000, respectively. Morgan

Stanley Wealth Management also maintains supplemental insurance coverage for the cash balances of its customers. The Company has not

experienced any losses to date resulting from this policy.

Research

and Development

Research

and development costs consist primarily of fees paid to consultants and contractors, and other expenses relating to the negotiation,

design, development and management of clinical trials with respect to the Company’s clinical compound and product candidate. Research

and development costs also include the costs to manufacture the compounds used in research and clinical trials, which are charged to

operations as incurred. The Company’s inventory of LB-100 for clinical use has been manufactured separately in the United States

and in the European Union in accordance with the laws and regulations of such jurisdictions.

Research

and development costs are generally charged to operations ratably over the life of the underlying contracts, unless the achievement of

milestones, the completion of contracted work, the termination of an agreement, or other information indicates that a different expensing

schedule is more appropriate. However, payments for research and development costs that are contractually defined as non-refundable are

charged to operations as incurred.

Obligations

incurred with respect to mandatory scheduled payments under agreements with milestone provisions are recognized as charges to research

and development costs in the Company’s consolidated statement of operations based on the achievement of such milestones, as specified

in the respective agreement. Obligations incurred with respect to mandatory scheduled payments under agreements without milestone provisions

are accounted for when due, are recognized ratably over the appropriate period, as specified in the respective agreement, and are recorded

as liabilities in the Company’s consolidated balance sheet, with a corresponding charge to research and development costs in the

Company’s consolidated statement of operations.

Payments

made pursuant to contracts are initially recorded as advances on research and development contract services in the Company’s consolidated

balance sheet and are then charged to research and development costs in the Company’s consolidated statement of operations as those

contract services are performed. Expenses incurred under contracts in excess of amounts advanced are recorded as research and development

contract liabilities in the Company’s consolidated balance sheet, with a corresponding charge to research and development costs

in the Company’s consolidated statement of operations. The Company reviews the status of its various clinical trial and research

and development contracts on a quarterly basis.

Prepaid

Insurance

Prepaid

insurance represents the premiums paid for directors and officers insurance coverage and for general liability insurance coverage in

excess of the amortization of the total policy premium charged to operations at each balance sheet date. Such amount is determined by

amortizing the total policy premium charged on a straight-line basis over the respective policy period. As the policy premiums incurred

are generally amortizable over the ensuing twelve-month period, they are recorded as a current asset in the Company’s consolidated

balance sheet at each reporting date and appropriately amortized to the Company’s consolidated statement of operations for each

reporting period.

Patent

and Licensing Legal and Filing Fees and Costs

Due

to the significant uncertainty associated with the successful development of one or more commercially viable products based on the Company’s

research efforts and related patent applications, all patent and licensing legal and filing fees and costs related to the development

and protection of the Company’s intellectual property are charged to operations as incurred. Patent and licensing legal and filing

fees and costs were $178,012 and $271,163 for the three months ended September 30, 2023 and 2022, respectively, and $835,362 and $944,789

for the nine months ended September 30, 2023 and 2022, respectively. Patent and licensing legal and filing fees and costs are included

in general and administrative costs in the Company’s consolidated statements of operations.

Concentration

of Risk

The

Company periodically contracts with vendors and consultants to provide services related to the Company’s operations. Charges incurred

for these services can be for a specific time period (typically one year) or for a specific project or task. Costs and expenses incurred

that represented 10% or more of general and administrative costs or research and development costs for the three months and nine months

ended September 30, 2023 and 2022 are described as follows.

General

and administrative costs for the three months ended September 30, 2023 and 2022 included charges from legal firms and other vendors for

general licensing and patent prosecution costs relating to the Company’s intellectual properties representing 20.0% and 22.5% of

total general and administrative costs, respectively. General and administrative costs for the three months ended September 30, 2023

and 2022 also included charges for the fair value of stock options granted to directors and corporate officers representing 12.6% and