false

0000722572

DEF 14A

0000722572

2022-07-01

2023-06-30

0000722572

2021-07-01

2022-06-30

0000722572

2020-07-01

2021-06-30

0000722572

ecd:PeoMember

2022-07-01

2023-06-30

0000722572

ecd:NonPeoNeoMember

2022-07-01

2023-06-30

0000722572

ecd:PeoMember

2021-07-01

2022-06-30

0000722572

ecd:NonPeoNeoMember

2021-07-01

2022-06-30

0000722572

ecd:PeoMember

2020-07-01

2021-06-30

0000722572

ecd:NonPeoNeoMember

2020-07-01

2021-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType1Member

2022-07-01

2023-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType1Member

2022-07-01

2023-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType1Member

2021-07-01

2022-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType1Member

2021-07-01

2022-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType1Member

2020-07-01

2021-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType1Member

2020-07-01

2021-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType2Member

2022-07-01

2023-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType2Member

2022-07-01

2023-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType2Member

2021-07-01

2022-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType2Member

2021-07-01

2022-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType2Member

2020-07-01

2021-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType2Member

2020-07-01

2021-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType3Member

2022-07-01

2023-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType3Member

2022-07-01

2023-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType3Member

2021-07-01

2022-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType3Member

2021-07-01

2022-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType3Member

2020-07-01

2021-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType3Member

2020-07-01

2021-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType4Member

2022-07-01

2023-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType4Member

2022-07-01

2023-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType4Member

2021-07-01

2022-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType4Member

2020-07-01

2021-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType4Member

2020-07-01

2021-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType5Member

2022-07-01

2023-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType5Member

2022-07-01

2023-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType5Member

2021-07-01

2022-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType5Member

2021-07-01

2022-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType5Member

2020-07-01

2021-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType5Member

2020-07-01

2021-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType6Member

2022-07-01

2023-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType6Member

2022-07-01

2023-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType6Member

2021-07-01

2022-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType6Member

2021-07-01

2022-06-30

0000722572

ecd:PeoMember

FKWL:AdjustmentType6Member

2020-07-01

2021-06-30

0000722572

ecd:NonPeoNeoMember

FKWL:AdjustmentType6Member

2020-07-01

2021-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o |

Preliminary Proxy Statement |

| o |

Confidential, for the use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x |

Definitive Proxy Statement |

| o |

Definitive Additional Materials |

| o |

Soliciting Material Pursuant to §240.14a-12 |

| |

|

| FRANKLIN WIRELESS CORP. |

|

(Name of Registrant as Specified In Its Charter)

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. |

| o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction

applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

(5) |

Total fee paid: |

| o |

Fee paid previously with preliminary materials. |

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-1l (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

(2) |

Form, Schedule, or Registration Statement No.: |

| |

(3) |

Filing Party: |

| |

(4) |

Date Filed: |

FRANKLIN WIRELESS CORP.

2023

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

_____________________

DECEMBER 21, 2023

at 2:00 p.m. Pacific Time

Franklin Wireless Corp.

9707 Waples Street

Suite 150

San Diego, CA 92121

FRANKLIN WIRELESS CORP.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 21, 2023

The 2023 Annual Meeting of Stockholders (the “Annual

Meeting”) of Franklin Wireless Corp. (“Franklin” or the “Company”) will be held virtually online on Thursday,

DECEMBER 21, 2023, at 2:00 p.m. Pacific Time.

At this year’s Annual Meeting, the agenda

will include: (i) the election of directors; (ii) to hold an advisory vote on executive compensation, (iii) the ratification of the selection

of our independent registered public accounting firm for fiscal 2024; and (iv) the transaction of such other business as may properly

come before the meeting or any adjournment thereof. Please refer to the enclosed proxy statement for detailed information on each

of these proposals and other important information about the Company.

To attend the annual meeting, vote, and submit

your questions during the annual meeting, please visit http://mountainsharetransfer.com/fkwl/. You will log into the annual meeting

by entering your name, a valid email address and unique control number found on your Notice of Internet Availability, proxy card or voting

instruction form. We hope you will be able to attend the annual meeting online, but we know that not every stockholder will be able to

do so. Whether or not you plan to attend, please complete, sign and return your proxy, or vote by telephone, facsimile or via the Internet

according to the instructions on the proxy card, so that your shares will be voted at the annual meeting.

In the event of a technical malfunction or other

situation that the meeting chair determines may affect the ability of the Annual Meeting to satisfy the requirements for a meeting of

stockholders to be held by means of remote communication under applicable Nevada corporate law, or that otherwise makes it advisable to

adjourn the Annual Meeting, the chair or secretary of the Annual Meeting will convene the meeting at 12:00 p.m. Pacific Time on the date

specified above and at our address specified above solely for the purpose of adjourning the meeting to reconvene at a date, time and physical

or virtual location announced by the meeting chair. Under either of the foregoing circumstances, we will post information regarding the

announcement on our investor relations website at http://mountainsharetransfer.com/fkwl/.

The Company intends to furnish the Annual Report,

Proxy Statement and Proxy card on or about November 12, 2023 to all stockholders entitled to vote at the Annual Meeting. Only stockholders

of record at the close of business on October 12, 2023 will be entitled to attend and vote at the meeting. A list of all stockholders

entitled to vote at the Annual Meeting will be available at the principal office of the Company, during usual business hours, for examination

by any stockholder for any purpose germane to the Annual Meeting for 10 days prior to the date thereof.

| |

By Order of the Board of Directors |

|

| |

|

|

|

| |

|

/s/ OC Kim |

|

| |

|

OC Kim |

|

| |

|

President |

|

WHETHER OR NOT YOU PLAN ON ATTENDING THE MEETING,

PLEASE VOTE AS PROMPTLY AS POSSIBLE TO ENSURE THAT YOUR VOTE IS COUNTED.

Franklin Wireless Corp.

9707 Waples Street

Suite 150

San Diego, California 92121

(858) 623-0000

______________________

PROXY STATEMENT

_______________________

This Proxy Statement is furnished in connection

with the solicitation of proxies by the Board of Directors of Franklin Wireless Corp. (“Franklin” or the “Company”)

to be voted at the Annual Meeting of Stockholders (“Annual Meeting”) which will be held on a virtual online platform via Zoom

on Thursday, DECEMBER 21, 2023, at 2:00 p.m. Pacific Time, and at any postponements or adjournments thereof. The link to the Zoom meeting

can be found at http://mountainsharetransfer.com/fkwl/. The proxy materials will be furnished to stockholders on or about

November 12, 2023.

REVOCABILITY OF PROXY AND SOLICITATION

Any stockholder executing a proxy that is solicited

hereby has the power to revoke it prior to the voting of the proxy. Revocation may be made by attending the Annual Meeting and voting

the shares of stock online, or by delivering to the Secretary of the Company at the principal office of the Company prior to the Annual

Meeting a written notice of revocation or a later-dated, properly executed proxy. Solicitation of proxies may be made by directors,

officers and other employees of the Company by personal contact, telephone, facsimile transmittal or electronic communications. No additional

compensation will be paid for any such services. This solicitation of proxies is being made by the Company, which will bear all costs

associated with the mailing of this proxy statement and the solicitation of proxies.

RECORD DATE

Stockholders of record at the close of business

on October 12, 2023, will be entitled to receive notice of, attend and vote at the meeting.

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving these materials?

The Company is mailing a notice of meeting and

internet availability of documents to the last known address of its shareholders. Shareholders wanting a printed, paper version of the

documents may request so in writing by contacting the Transfer Agent, Mountain Share Transfer, prior to the meeting date.

Mountain Share Transfer, LLC.

www.mountainsharetransfer.com

2030 Powers Ferry Road SE

Suite # 212

Atlanta, Ga. 30339

These documents are being made available to you

in connection with the Company’s solicitation of proxies for use at the Annual Meeting. These materials describe the proposals

on which the Company would like you to vote and to give you information on these proposals so that you can make an informed decision.

What is included in these materials?

These materials include:

| |

· |

this Proxy Statement for the Annual Meeting; |

| |

· |

the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023, and |

| |

· |

the proxy card or vote instruction form for the Annual Meeting. |

What is the proxy card?

The proxy card enables you to appoint OC Kim, our

President, as your representative at the Annual Meeting. By completing and returning a proxy card, you are authorizing this individual

to vote your shares at the Annual Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted

whether or not you attend the Annual Meeting.

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will act upon

the matters outlined in the Notice of Annual Meeting on the cover page of this Proxy Statement, including (i) the election of five persons

named herein as nominees for directors of the Company to hold office, subject to the provisions of the bylaws of the Company, until the

next annual meeting of stockholders and until their successors are duly elected and qualified; (ii) ratification of the appointment of

Simon & Edward, LLP as the Company’s independent registered public accounting firm for the fiscal year 2024; (iii) to hold an

advisory vote on executive compensation; and (iv) such other matters as may properly come before the meeting or any adjournment thereof.

What constitutes a quorum?

Holders of a majority of shares of our Common Stock

entitled to vote at the Annual Meeting must be present at our Annual Meeting, online or by proxy, to constitute a quorum necessary to

conduct the Annual Meeting.

What is the difference between a stockholder of record and a

beneficial owner of shares held in street name?

Most of our stockholders hold their shares in an

account at a brokerage firm, bank or other nominee holder, rather than holding share certificates in their own name. As summarized below,

there are some distinctions between shares held of record and those owned beneficially in street name.

Stockholder of Record

If, on October 12, 2023, your shares were registered

directly in your name with our transfer agent, Mountain Share Transfer, you are considered a stockholder of record with respect to those

shares, and the Notice of Annual Meeting and Proxy Statement was sent directly to you by the Company. As the stockholder of

record, you have the right to direct the voting of your shares by returning the proxy card to us. Whether or not you plan to attend the

online Annual Meeting, please complete, date, sign and return a proxy card to ensure that your vote is counted.

Beneficial Owner of Shares Held in Street Name

If, on October 12, 2023, your shares were held

in an account at a brokerage firm, bank, broker-dealer, or other nominee holder, then you are considered the beneficial owner of shares

held in “street name,” and the Notice of Annual Meeting and Proxy Statement was forwarded to you by that organization.

The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial

owner, you have the right to direct that organization on how to vote the shares held in your account. However, since you are not the stockholder

of record, you may not vote these shares in person at the Annual Meeting unless you receive a valid proxy from the organization.

How do I vote?

Stockholders of Record. If you are a stockholder

of record, you may vote by any of the following methods:

| |

· |

By Mail. You may vote by completing, signing, dating, and returning your proxy card in the pre-addressed, postage-paid envelope provided. |

| |

|

|

| |

· |

Through the Internet. Go to the website set forth on your proxy card and follow the instructions provided at the website. |

| |

|

|

| |

· |

At the Online Annual Meeting. You may attend and vote at the online Annual Meeting, following the instructions provided. |

| |

|

|

| |

· |

Other methods. You may vote by completing, signing, dating, and returning your proxy card via email or facsimile following the instructions set forth on your proxy card. |

Beneficial Owners of Shares Held in Street Name.

If you are a beneficial owner of shares held in street name, you may vote by any of the following methods:

| |

· |

By Mail. You may vote by proxy by filling out the vote instruction form and returning it in the pre-addressed, postage-paid envelope provided. |

| |

|

|

| |

· |

Through the Internet. If provided to you by the organization that holds your shares, follow the instructions for voting through the Internet. |

| |

|

|

| |

· |

At the Online Meeting. If you are a beneficial owner of shares held in street name and you wish to vote your shares at the online Annual Meeting, you must obtain a legal proxy from the organization that holds your shares. |

Abstentions and broker non-votes

While the inspectors of election will treat shares

represented by proxies that reflect abstentions or include "broker non-votes" as shares that are present and entitled to vote

for purposes of determining the presence of a quorum, abstentions or "broker non-votes" do not constitute a vote "for"

or "against" any matter and thus will be disregarded in any calculation of "votes cast." However, abstentions and

"broker non-votes" will have the effect of a negative vote if an item requires the approval of a majority of a quorum or of

a specified proportion of all outstanding shares.

Brokers holding shares of record for customers

generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions from their customers.

The term “uninstructed shares” means shares held by a broker who has not received voting instructions from its customers on

a proposal. A “broker non-vote” occurs when a nominee holding uninstructed shares for a beneficial owner does not vote on

a particular proposal because the nominee does not have discretionary voting power with respect to that non-routine matter.

What happens if I do not give specific voting instructions?

Stockholders of Record. If you are a stockholder

of record and you:

| |

· |

indicate when voting on the Internet or by email or facsimile that you wish to vote as recommended by the Board of Directors, or |

| |

|

|

| |

· |

sign and return a proxy card without giving specific voting instructions, |

then the proxy holder will vote your shares in the manner recommended

by the Board of Directors on all matters presented in this proxy statement and as the proxy holders may determine in their discretion

with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owners of Shares Held in Street Name.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific

voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may

generally not vote on non-routine matters, such as the election of directors.

What are the Board’s recommendations?

The Board’s recommendation is set forth together

with the description of each item in this Proxy Statement. In summary, the Board recommends a vote:

|

|

· |

for election of the five directors nominated to hold office, subject to the provisions of the Bylaws of the Company, until the next annual meeting of stockholders and until their successors are duly elected and qualified; |

| |

|

|

| |

· |

to approve the ratification of the appointment of Simon & Edward, LLP as the Company’s independent registered public accounting firm for the fiscal year 2024. |

| |

|

|

| |

· |

for approval of the resolution approving the

compensation of the Company’s named executive officers. |

With respect to any other matter that properly

comes before the meeting, the proxy holder will vote as recommended by the Board of Directors or, if no recommendation is given, in his

own discretion.

How are Proxy materials delivered to households?

For shareholders receiving proxy material by

mail, only one copy of the Company's 10-K for the fiscal year ending June 30, 2023 and this Proxy Statement will be delivered to an

address where two or more stockholders reside with the same last name or who otherwise reasonably appear to be members of the same

family based on the stockholders’ prior express or implied consent.

We will deliver promptly upon written or oral request

a separate copy of the Company's 10-K for the fiscal year ending June 30, 2023, as amended, and this Proxy Statement upon such request.

If you share an address with at least one other stockholder and you currently receive one copy of our Annual Report and Proxy Statement

at your residence, and would like to receive a separate copy of our Annual Report and Proxy Statement for future stockholder meetings

of the Company, please specify such request in writing and send such written request to Franklin Wireless Corp., 9707 Waples Street, Suite

150, San Diego, CA 92121 Attention: Corporate Secretary.

How much stock is owned by 5% stockholders, directors, and executive

officers?

The following table sets forth

certain information regarding the beneficial ownership of our Common Stock as of September 28, 2023, by each director and executive officer

of the Company, each person known to us to be the beneficial owner of more than 5% of the outstanding Common Stock, and all directors

and executive officers of the Company as a group. Except as otherwise indicated below, each person has sole voting and investment power

with respect to the shares owned, subject to applicable community property laws.

| Shares Beneficially Owned |

| Name and Address |

|

Number |

|

|

Percent |

|

Joon Won Jyoung

9707 Waples Street, Suite 150, San Diego, CA 92121 |

|

|

1,004,948 |

(1) |

|

|

8.5% |

|

| |

|

|

|

|

|

|

|

|

OC Kim

9707 Waples Street, Suite 150, San Diego, CA 92121 |

|

|

1,096,695 |

|

|

|

9.3% |

|

| |

|

|

|

|

|

|

|

|

Gary Nelson

9707 Waples Street, Suite 150, San Diego, CA 92121 |

|

|

314,008 |

|

|

|

2.7% |

|

| |

|

|

|

|

|

|

|

|

Yun J. (David) Lee

9707 Waples Street, Suite 150, San Diego, CA 92121 |

|

|

185,000 |

|

|

|

1.6% |

|

| |

|

|

|

|

|

|

|

|

Johnathan Chee

9707 Waples Street, Suite 150, San Diego, CA 92121 |

|

|

13,500 |

|

|

|

0.1% |

|

| |

|

|

|

|

|

|

|

|

Paul Packer

805 Third Ave., 15th Floor, New York, NY 10022 |

|

|

874,292 |

(2) |

|

|

7.4% |

|

| All directors and executive officers as a group |

|

|

3,488,443 |

|

|

|

29.6% |

|

| (1) |

A person known to us to be the beneficial owner of more than 5% of the outstanding shares of common stock. |

| (2) |

Based solely on a Schedule 13G dated December 31, 2022, which indicates that Mr. Packer may be deemed to beneficially own 874,292 shares. With respect to these shares, Mr. Packer has shared voting power and shared dispositive power with Globis Capital Partners, L.P., Globis Capital Advisors, L.L.C., Globis Overseas Fund, Ltd., Globis Capital Management, L.P. and Globis Capital, L.L.C. |

INFORMATION ABOUT THE BOARD OF DIRECTORS

The Board of Directors oversees our business and

affairs and monitors the performance of management. In accordance with corporate governance principles, the Board does not involve itself

in day-to-day operations. The directors keep themselves informed through discussions with the President and other key executives, visits

to the Company’s facilities, by reading the reports and other materials that we send them and by participating in Board and committee

meetings. Each director’s term will continue until the election and qualification of his or her successor, or his or her earlier

death, resignation or removal. Biographical information about our directors is provided in “Proposal No. 1: Proposal for Election

of Five Directors.” Except as set forth in this Proxy Statement, none of our directors held directorships in other reporting companies

or registered investment companies at any time during the past five years.

Our Board currently consists of five persons, and

all of them have been nominated by the Company to stand for election.

| Name |

Age |

Position |

| OC Kim |

58 |

President and Director |

| Gary Nelson |

83 |

Chairman of the Board and Director |

| Johnathan Chee |

60 |

Director |

| Heidy Chow |

45 |

Director |

| Kristina Kim |

60 |

Director |

Involvement in Certain Legal Proceedings

To our knowledge, during the last ten years, none

of our directors has:

| |

· |

Had a bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time. |

| |

|

|

| |

· |

Been convicted in a criminal proceeding or been subject to a pending criminal proceeding, excluding traffic violations and other minor offenses. |

| |

|

|

| |

· |

Been subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities. |

| |

|

|

| |

· |

Except as described below, been found by a court of competent jurisdiction (in a civil action), the SEC, or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated. |

| |

|

|

| |

· |

Been the subject to, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization, any registered entity, or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

In October 2023, a civil jury in a private derivative action

returned a verdict for $2,000,000 in favor of the Company against the Company’s Chief Executive Officer, O.C. Kim, for violation

of Section 16(b) of the Securities Exchange Act of 1934, for receiving “short-swing” profits from a sale and purchase of Franklin

shares.

How often did the Board meet during fiscal 2023?

During fiscal 2023, the Board of Directors held

four meetings. Each director attended all of the meetings of the Board.

What committees has the Board established?

The Board of Directors has established three committees:

| |

· |

Audit Committee consisting of Heidy Chow, CPA (committee chair), Gary Nelson, and Kristina Kim. |

| |

· |

Compensation Committee consisting of Gary Nelson (committee chair) and Johnathan Chee. |

| |

· |

Nominating Committee consisting of Gary Nelson (committee chair) and Johnathan Chee. |

Audit Committee

The Audit Committee is responsible for retaining,

evaluating and, if appropriate, recommending the termination of the Company’s independent auditors. The Audit Committee assists

the Board in oversight of (1) the integrity of the Company’s financial statements, (2) the Company’s independent

auditor’s qualifications and independence, and (3) the performance of the independent auditors. In addition, the Committee

renders its report for inclusion in the Company’s annual proxy statement. The Audit Committee’s charter is available

on the Company’s website at www.franklinwireless.com

The Audit Committee has the authority to obtain

advice and assistance from outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties.

During fiscal 2023, the Audit Committee met four times. The current members of the Audit Committee meet the NASDAQ Listing Standards for

the independence of audit committee members. The Board has determined that Heidy Chow is an “audit committee financial expert”

within the meaning of the Securities Exchange Act of 1934. The Report of the Audit Committee is presented elsewhere in this Proxy Statement.

Compensation Committee

The Compensation Committee assists the Board in

discharging its responsibilities relating to compensation of the Company’s President and other executives. The Committee also

determines individuals to be granted options under the Company’s Stock Option Plan, the number of options awarded and the term of

the options and interprets provisions of such plan. The Compensation Committee’s charter is available on the Company’s website

at www.franklinwireless.com.

During fiscal 2023, the Compensation Committee

met three times.

Nominating Committee

The Nominating Committee is responsible for identifying

individuals qualified to become directors. The Nominating Committee seeks to identify director candidates based on input provided by a

number of sources, including (1) the members of the Board of Directors, (2) our stockholders, and (3) third parties, such as service providers.

In evaluating potential candidates for director, the Board of Directors considers the entirety of each candidate’s credentials.

Qualifications for consideration as a director

nominee may vary according to the particular areas of expertise being sought as a complement to the existing composition of the Board

of Directors. However, at a minimum, candidates for director must possess:

| |

· |

high personal and professional ethics and integrity; |

| |

· |

the ability to exercise sound judgment; |

| |

· |

the ability to make independent analytical inquiries; |

| |

· |

a willingness and ability to devote adequate time and resources to diligently perform Board and committee duties; and |

| |

· |

the appropriate and relevant business experience and acumen. |

The Board of Directors will consider nominees recommended

by stockholders if such recommendations are made in writing to the Board in compliance with the Bylaws of the Company. The Board of Directors

does not plan to change the manner in which it evaluates nominees for election as a director based on whether the nominee has been recommended

by a stockholder or otherwise.

In considering new nominees and whether to re-nominate

existing members of the Board, the committee seeks to achieve a Board with strengths in its collective knowledge and a broad diversity

of perspectives, skills and business and professional experience. Among other items, the committee looks for a range of experience in

strategic planning, sales, finance, executive leadership, industry, and similar attributes. During fiscal 2023, the Nominating Committee

met one time.

The Nominating Committee’s charter is available

on the Company’s website at www.franklinwireless.com.

Stockholder Communications

Stockholders requesting communication with directors

can do so by writing to Franklin Wireless Corp., c/o Corporate Secretary, 9707 Waples Street, Suite 150, San Diego, CA 92121. At

this time we do not screen communications received and would forward any requests directly to the named director. If no director is named

in a general inquiry, the Secretary would forward such request to the Chairman of the Board of Directors. We do not provide the physical

address, email address, or phone numbers of directors without a director’s permission.

Code of Ethics

We have adopted a Code of Ethics that applies to

all our directors, officers, and employees, including our President.

Director Compensation

Our directors are reimbursed

for reasonable out-of-pocket expenses incurred in attending meetings of the Board of Directors. Employee directors do not receive any

cash compensation for service as directors and do not receive any equity compensation designated for such services. Members of the Board

of Directors who are not employees may receive stock option grants as consideration for their board service from time to time, although

there is no established policy for such stock option grants.

| Board Diversity Matrix (As of October 16, 2023) |

Total Number of Directors: 5 |

Part I: Gender Identity

| |

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

| Directors |

2 |

3 |

0 |

0 |

Part II: Demographic Background

Number of Directors who identify in Any of the

Categories Below:

| |

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

| African American or Black |

|

|

|

|

| Alaskan Native or Native American |

|

|

|

|

| Asian (other than South Asian) |

2 |

2 |

|

|

| South Asian |

|

|

|

|

| Hispanic or Latinx |

|

|

|

|

| Native Hawaiian or Pacific Islander |

|

|

|

|

| White |

|

1 |

|

|

| LGBTQ+ |

|

|

|

|

Fiscal 2023 Director Compensation

| Name |

|

Fee Earned or

Paid in Cash

($)(1) |

|

Option

Awards

($)(2) |

|

All Other

Compensation

($) |

|

Total

($) |

| Gary Nelson |

|

17,500 |

|

– |

|

– |

|

17,500 |

| Johnathan Chee |

|

17,500 |

|

– |

|

– |

|

17,500 |

| Heidy Chow |

|

17,500 |

|

– |

|

– |

|

17,500 |

| Kristina Kim |

|

17,500 |

|

– |

|

– |

|

17,500 |

| (1) |

Directors are compensated at a base rate of $15,000 and $20,000 annually for the six months ended December 31, 2022 and for the six months ended June 30, 2023, respectively, and prorated based upon board meeting attendance. Bonuses may be awarded when the business has performed exceptionally well as determined by the Board of Directors. For the year ended June 30, 2023, there has been no approved bonus for the Directors. |

| |

|

| |

There were no outstanding equity awards held by any of the non-officer directors as of June 30, 2023. |

INFORMATION ABOUT THE EXECUTIVE OFFICERS

The executive officers are appointed by our Board

of Directors and hold office at the pleasure of the Board. There are no family relationships between any of our directors or executive

officers. The current executive officers of the Company are as follows:

| Name |

Age |

Position |

| OC Kim |

58 |

President and a Director |

| William (Bill) Bauer |

53 |

Secretary and Interim Chief Financial Officer |

The following includes the principal occupations

for the past five years (and, in some instances, for prior years) of each of our executive officers:

OC Kim has been our President,

CEO and a Director since 2003. Prior to joining Franklin Wireless, Mr. Kim was the CEO and President of Accetio Inc., a company he founded

that developed modules for the wireless telecommunication industry. In 2003, Accetio Inc. merged with Franklin Telecommunications Corp.

and was renamed Franklin Wireless Corp. He was a general manager of Kolon California Corp., one of Korea's most prominent conglomerates.

While at Kolon Data Communications, in Korea, Mr. Kim helped introduce the first generation of CDMA phones to the Korean market through

his work with Qualcomm Personal Electronics (QPE), a joint venture between Qualcomm Incorporated and Sony Electronics Inc. Mr. Kim began

his career at Lucky Goldstar (LG) Electronics. He has almost 30 years of experience in sales, marketing, and operations management in

the telecommunications and information systems industries. He earned a B.A. from Sogang University in Korea. We believe Mr. Kim’s

qualifications to serve as a director of the Company include his extensive business, operational and management experience in the wireless

industry, including his current position as the Company’s President. In addition, his knowledge of the Company’s business,

products, strategic relationships and future opportunities is of great value to the Company.

William (Bill) Bauer has been serving as our Interim

Chief Financial Officer since October 2022. Mr. Bauer has been with Franklin since January 2020 and has served as In-House legal counsel

and Director of Strategic Planning. Prior to joining Franklin, Bill served as in-house legal counsel and senior finance executive across

various industries in California and Texas. Bill has over 15 years of experience in finance and executive management. Bill also holds

a Master’s degree in Business Administration from San Diego State University and a Juris Doctorate from California Western School

of Law. Bill is also a member of both the California and Texas State Bars.

Involvement in Certain Legal Proceedings

To our knowledge, during the last ten years, none

of our executive officers has:

| |

· |

Had a bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time. |

| |

|

|

| |

· |

Been convicted in a criminal proceeding or been subject to a pending criminal proceeding, excluding traffic violations and other minor offenses. |

| |

|

|

| |

· |

Been subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities. |

| |

|

|

| |

· |

Except a disclosed under Information About the Board of Directors, above, been found by a court of competent jurisdiction (in a civil action), the SEC, or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated. |

| |

|

|

| |

· |

Been the subject to, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization, any registered entity, or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

EXECUTIVE COMPENSATION

The following table sets forth

all compensation paid or accrued by us for the years ended June 30, 2023 and 2022 to our President, Chief Operating Officer, and Acting

Chief Financial Officer (The "Named Executive Officers").

Summary Compensation Table

| Name and Principal Position |

|

Fiscal

Year |

|

Salary

($) |

|

Bonus

($) |

|

Option Awards

($) |

|

Total

($) |

| OC Kim, |

|

2022 |

|

$ |

300,000 |

|

$ |

– |

|

$ |

566,000 |

|

$ |

866,000 |

| President |

|

2023 |

|

$ |

300,000 |

|

$ |

– |

|

$ |

– |

|

$ |

300,000 |

| Yun J. (David) Lee (1), |

|

2022 |

|

$ |

300,000 |

|

$ |

– |

|

$ |

42,450 |

|

$ |

342,450 |

| Chief Operating Officer |

|

2023 |

|

$ |

300,000 |

|

$ |

– |

|

$ |

– |

|

$ |

300,000 |

| David Brown (2), |

|

2022 |

|

$ |

100,193 |

|

$ |

– |

|

$ |

28,300 |

|

$ |

128,493 |

| Acting Chief Financial Officer |

|

2023 |

|

$ |

25,649 |

|

$ |

– |

|

$ |

– |

|

$ |

25,649 |

| Bill Bauer, |

|

2022 |

|

$ |

– |

|

$ |

– |

|

$ |

– |

|

$ |

– |

| Acting Chief Financial Officer |

|

2023 |

|

$ |

107,798 |

|

$ |

– |

|

$ |

– |

|

$ |

107,798 |

| (1) |

On July 14,2023, the Board of Directors appointed Mr. Lee as Senior Vice President of Sales. He had previously served as Chief Operating Officer. This change did not affect his compensation. |

(2) David Brown resigned his position on September

30, 2022.

Outstanding Equity Awards at Fiscal Year-End

The following table presents

the outstanding equity awards held by each of the Named Executive Officer as of June 30, 2023. The only outstanding equity awards

are stock options. Options to purchase 200,000, 15,000, 10,000 and 15,000 shares were granted to OC Kim, Yun J. (David) Lee, David Brown,

and Bill Bauer during fiscal 2022, respectively. 10,000 shares granted to David Brown have been forfeited and returned to the Company

as he resigned his position on September 30, 2023. The options vest over periods ranging from one to three years and are subject to early

termination on the occurrence of certain events related to termination of employment. In addition, the full vesting of options is accelerated

if there is a change in control of the Company.

Outstanding Equity Awards at Fiscal Year-End

Options Awards

| Name |

|

Number of

Securities

Underlying

Unexercised

Options (#) |

Number of

Securities

Underlying

Unexercised

Options (#)

nonexercisable |

|

|

Option

Exercise

Price

($) |

|

Option

Expiration

Date |

| OC Kim |

|

|

200,000 (1) |

99,818 |

|

|

$3.38 |

|

12/27/2026 |

| Yun J. (David) Lee |

|

|

100,000 (1) |

1,369 |

|

|

$5.40 |

|

07/13/2025 |

| |

|

|

15,000 (1) |

7,486 |

|

|

$3.38 |

|

12/27/2026 |

| Bill Bauer |

|

|

15,000 (1) |

7,486 |

|

|

$3.38 |

|

12/27/2026 |

| (1) |

The option vests and is exercisable over three years as follows and has a five-year term: |

| |

i. |

33.3% of the shares underlying the option vest on the first anniversary of the date of the grant. |

| |

ii. |

33.3% of the shares underlying the option vest on the second anniversary of the date of the grant. |

| |

ii. |

33.3% of the shares underlying the option vest on the third anniversary of the date of the grant. |

Director Compensation

Our directors are reimbursed

for reasonable out-of-pocket expenses incurred in attending meetings of the Board of Directors. Employee directors do not receive any

cash compensation for service as directors and do not receive any equity compensation designated for such services. Members of the Board

of Directors who are not employees may receive stock option grants as consideration for their board service from time to time, although

there is no established policy for such stock option grants.

Fiscal 2023 Director Compensation

| Name |

|

Fee Earned or

Paid in Cash

($)(1) |

|

Option

Awards

($)(2) |

|

All Other

Compensation

($) |

|

Total

($) |

| Gary Nelson |

|

17,500 |

|

– |

|

– |

|

17,500 |

| Johnathan Chee |

|

17,500 |

|

– |

|

– |

|

17,500 |

| Heidy Chow |

|

17,500 |

|

– |

|

– |

|

17,500 |

| Kristina Kim |

|

17,500 |

|

– |

|

– |

|

17,500 |

| (1) |

Directors are compensated at a base rate of $15,000 and $20,000 annually for the six months ended December 31, 2022 and for the six months ended June 30, 2023, respectively, and prorated based upon board meeting attendance. Bonuses may be awarded when the business has performed exceptionally well as determined by the Board of Directors. For the year ended June 30, 2023, there has been no approved bonus for the Directors. |

| |

|

| |

There were no outstanding equity awards held by any of the non-officer directors as of June 30, 2023. |

EMPLOYMENT CONTRACTS

On October 1, 2020, we entered

into Change of Control Agreements with OC Kim, our President, and Yun J. (David) Lee, our Chief Operating Officer. Each Change of Control

Agreement provides for a lump sum payment to the officer in case of a change of control of the Company. The term includes the acquisition

of Common Stock of the Company resulting in one person or company owning more than 50% of the outstanding shares, a significant change

in the composition of the Board of Directors of the Company during any 12-month period, a reorganization, merger, consolidation or similar

transaction resulting in the transfer of ownership of more than fifty percent (50%) of the Company's outstanding Common Stock, or a liquidation

or dissolution of the Company or sale of substantially all of the Company's assets. These agreements were for an initial term of three

years but have now been extended through October 2024.

The Change of Control Agreement

with Mr. Kim calls for a payment of $5 million upon a change of control, and the agreement with Mr. Lee calls for a payment of $2 million

upon a change of control.

On November 10, 2022, the

Company and OC Kim, its President, entered into an amendment of the employment letter agreement dated September 7, 2021. The amendment

provides for a severance payment of $3 million if Mr. Kim voluntarily terminates his employment by the Company or if he voluntarily terminates

his employment due to a “change in circumstances,” generally defined as a material breach by the Company of its salary and

benefit obligations or a significant reduction in Mr. Kim’s title or responsibilities. In the case of a termination of employment

by the Company for cause (generally defined as conviction of a felony, or a misdemeanor where imprisonment is imposed, commission of any

act of theft, fraud, dishonesty, or material falsification of any employment or Company records, or improper disclosure of the Company's

confidential or proprietary information), the Company is to make a severance payment of $1,500,000. In either case, any unvested options

become immediately vested.

In the amendment, Mr. Kim

also agrees that, for a period of two years after termination, he will not disparage the Company or its officers, solicit any of its employees

to terminate their employment, or disclose any of the Company’s proprietary information.

In addition, the amendment

provides for the payment of an incentive bonus to Mr. Kim of $125,000 for each calendar quarter during the remaining four-year term of

the employment letter, with the first such bonus due on December 31, 2022.

The Change in Control Agreement

with Mr. Kim, dated October 1, 2020, has not been terminated and remains in effect at this time.

COMPENSATION DISCUSSION AND ANALYSIS

GENERAL PHILOSOPHY - We compensate

our executive officers through a mix of base salary, bonus and stock options. Our compensation policies are designed to be competitive

with comparable employers and to align management’s incentives with both near term and long-term interests of our stockholders.

We use informal methods of benchmarking our executive compensation, based on the experience of our directors or, in some cases, studies

of industry standards. Our compensation is negotiated on a case by case basis, with attention being given to the amount of compensation

necessary to make a competitive offer and the relative compensation among our executive officers.

BASE SALARIES - We want to provide

our senior management with a level of cash compensation in the form of base salary that facilitates an appropriate lifestyle given their

professional status and accomplishments.

INCENTIVE COMPENSATION

– Our practice is to award cash bonuses based upon performance objectives set by the Board of Directors. We maintain a bonus plan

which provides our executive officers to earn cash bonuses based on the achievement of performance targets. The performance targets are

set by the Board of Directors, and our executive officers are eligible to receive bonuses on a quarterly basis. The actual amount of incentive

compensation paid to our executive officers is in the sole discretion of the Board of Directors.

SEVERANCE BENEFITS

– We are generally an “at-will” employer and have no employment agreements with severance benefits; however, we have

entered into Change of Control Agreements with OC Kim & David Lee, and a severance agreement with OC Kim that provides him with a

lump sum payment in the event he leaves the Company.

RETIREMENT PLANS –

In January 2022, we implemented the CalSavers retirement program, an automatic enrollment individual retirement account (IRA). The program

is a voluntary participation program, and all employees have the option to participate in this program if they choose to do so.

PAY VERSUS PERFORMANCE

We are providing the following

disclosure regarding executive compensation for our CEO and other Named Executive Officers (“NEOs”), our total shareholder

return and that of our selected peer group, our net income and the most important “financial performance measure” used by

us to link executive pay with company performance. SEC rules. Those rules require amounts included in the “compensation actually

paid” columns of the table to be calculated according to a particular formula intended to demonstrate the relationship between “compensation

actually paid” to a company’s NEOs and the company’s performance. The formula reflects a number of fair value adjustments

to equity awards intended to show the change in value of those awards from one year to another. They do not reflect, however, the precise

amounts actually earned by or paid to our executives during the years shown in the table.

For further information concerning

our pay-for-performance philosophy and how we structure our executive compensation to drive and reward performance, refer to “Executive

Compensation—Compensation Discussion and Analysis.”

The following table presents

information regarding our executive compensation pay relative to corporate performance of our principal executive officers (“PEO”)

and non-PEO named executive officers (“NEOs”) for Fiscal Years 2021, 2022 and 2023.

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Year | |

Summary Compensation Table Total for PEO, OC Kim | | |

Compensation Actually Paid to PEO, OC Kim | | |

Average Summary Compensation Table Total for Non-PEO Named Executive Officers | | |

Average Compensation Actually Paid to Non-PEO Named Executive Officers | | |

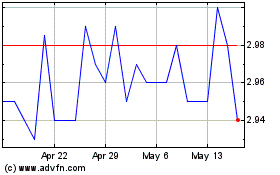

Value of Initial Fixed $100 Investment Based on Total Shareholder Return (1) | | |

Net Income | |

| (a) | |

(b) | | |

(c) | | |

(d) | | |

(e) | | |

(f) | | |

(g) | |

| 2023 | |

$ | 300,000 | | |

$ | 300,000 | | |

$ | 144,482 | | |

$ | 144,482 | | |

$ | 67.55 | | |

$ | (2,863,021 | ) |

| 2022 | |

$ | 866,000 | | |

$ | 300,000 | | |

$ | 235,472 | | |

$ | 200,097 | | |

$ | 57.46 | | |

$ | (3,762,848 | ) |

| 2021 | |

$ | 344,667 | | |

$ | 344,667 | | |

$ | 395,395 | | |

$ | 193,350 | | |

$ | 166.07 | | |

$ | 17,699,035 | |

The Summary Compensation Table (“SCT”)

totals reported for the PEO and the average of the other NEOs for each year were subject to the adjustments summarized in the two tables

below as required by SEC Regulation S-K Item 402(v)(2)(iii) to calculate “compensation actually paid.” Equity values are calculated

in accordance with FASB ASC Topic 718. Valuation assumptions used to calculate fair values at the times indicated in the two tables below

did not materially differ from those disclosed at the time of grant except for the stock price, percentage of volatility, risk free rate

and the term used to calculate the valuations. The following table shows the adjustments made to the SCT totals to calculate “compensation

actually paid”:

| | |

2023 | | |

2022 | | |

2021 | |

| | |

PEO, OC Kim | | |

Average Non-PEO NEOs | | |

PEO, OC Kim | | |

Average Non-PEO NEOs | | |

PEO, OC Kim | | |

Average Non-PEO NEOs | |

| Total Compensation from Summary Compensation Table | |

$ | 300,000 | | |

$ | 144,482 | | |

$ | 866,000 | | |

$ | 235,472 | | |

$ | 344,667 | | |

$ | 395,395 | |

| Adjustments for Equity Awards | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| Adjustment for grant date values in the Summary Compensation Table | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| Year-end fair value of unvested awards granted in the current year | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| Year-over-year difference of year-end fair values for unvested awards granted in prior years | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| Fair values at vest date for awards granted and vested in current year | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| Difference in fair values between prior year-end fair values and vest date fair values for awards granted in prior years | |

| – | | |

| – | | |

$ | (566,000 | ) | |

$ | (35,375 | ) | |

| – | | |

$ | (201,650 | ) |

| Total Adjustments for Equity Awards | |

| – | | |

| – | | |

$ | (566,000 | ) | |

$ | (35,375 | ) | |

| – | | |

$ | (201,650 | ) |

| Compensation Actually Paid (as calculated) | |

$ | 300,000 | | |

$ | 144,482 | | |

$ | 300,000 | | |

$ | 200,097 | | |

$ | 344,667 | | |

$ | 193,350 | |

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors hereby reports as follows:

1. The Audit

Committee has reviewed and discussed the Company’s audited financial statements with the Company’s management and representatives

of Kreit and Chiu CPA LLP (formerly known as “Paris, Kreit, and Chiu”);

2. The Audit

Committee has discussed with Kreit and Chiu CPA LLP, the matters required to be discussed by Statement on Auditing Standards No. 61,

as amended (AICPA, Professional Standards, Volume 1. AU section 380), as adopted by the Public Company Accounting Oversight Board in

Rule 3200T; and

3. The Audit

Committee has received the written disclosures and a letter from Kreit and Chiu CPA LLP, required by applicable requirements of the Public

Company Accounting Oversight Board, regarding the independent accountants’ communication with the Audit Committee concerning independence

and has discussed Kreit and Chiu CPA LLP’s independence with Kreit and Chiu CPA LLP.

Based on the review and discussions referred to

above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s

Annual Report on Form 10-K for the fiscal year ended June 30, 2023 filed with the Securities and Exchange Commission.

| |

The Audit Committee: |

| |

|

| |

|

| |

Heidy Chow, Chairman |

| |

Gary Nelson |

| |

Kristina Kim |

ACTIONS TO BE TAKEN AT THE MEETING

PROPOSAL NO. 1:

PROPOSAL FOR ELECTION OF FIVE DIRECTORS

At this year’s Annual Meeting, the Board

of Directors proposes that the nominees listed below, all of whom are currently serving as directors, be elected to hold office until

the next annual meeting of stockholders and until their successors are duly elected and qualified. The Board has no reason to believe

that any of the persons named below will be unable or unwilling to serve as a nominee or as director if elected.

Assuming a quorum is present, the five nominees

receiving the highest number of affirmative votes of shares entitled to be voted for such persons will be elected as directors of the

Company to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified. Unless

marked otherwise, proxies received will be voted "FOR" the election of the nominees named below. In the event that additional

persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as will

ensure the election of the nominees listed below, and, in such event, the specific nominees to be voted for will be determined by the

proxy holders.

Information With Respect to Director Nominees

Listed below are the nominees for election to our

Board with information showing the principal occupation or employment of the nominees for director, the principal business of the corporation

or other organization in which such occupation or employment is carried on, and such nominees’ business experience during the past

five years. Such information has been furnished to the Company by the director nominees. Each nominee is currently a director of the Company.

| Name |

Age |

| OC Kim |

58 |

| Gary Nelson |

83 |

| Kristina Kim |

60 |

| Johnathan Chee |

60 |

| Heidy Chow |

45 |

OC Kim has been our President,

CEO and a Director since 2003. Prior to joining Franklin Wireless, Mr. Kim was the CEO and President of Accetio Inc., a company he founded

that developed modules for the wireless telecommunication industry. In 2003, Accetio Inc. merged with Franklin Telecommunications Corp.

and was renamed Franklin Wireless Corp. He was a general manager of Kolon California Corp., one of Korea's most prominent conglomerates.

While at Kolon Data Communications, in Korea, Mr. Kim helped introduce the first generation of CDMA phones to the Korean market through

his work with Qualcomm Personal Electronics (QPE), a joint venture between Qualcomm Incorporated and Sony Electronics Inc. Mr. Kim began

his career at Lucky Goldstar (LG) Electronics. He has almost 30 years of experience in sales, marketing, and operations management in

the telecommunications and information systems industries. He earned a B.A. from Sogang University in Korea. We believe Mr. Kim’s

qualifications to serve as a director of the Company include his extensive business, operational and management experience in the wireless

industry, including his current position as the Company’s President. In addition, his knowledge of the Company’s business,

products, strategic relationships and future opportunities is of great value to the Company.

We believe Mr. Kim’s qualifications to serve

as a director of the Company include his extensive business, operational and management experience in the wireless industry,

including his current position as the Company’s President. In addition, his knowledge of the Company’s business,

products, strategic relationships and future opportunities is of great value to the Company.

Gary Nelson has been

a director since September 2003. Mr. Nelson was an early investor in Franklin Telecommunications Corp. in the 1980’s and served

as a director from 2001 up until the Company’s merger with Accetio Inc. in September 2003, at which time the Company was renamed

Franklin Wireless Corp. Following the merger, Mr. Nelson became a director and ultimately Chairman of the Board of Franklin Wireless Corp.

He was co-founder and President of Churchill Mortgage Corporation, an income property mortgage banking firm based in Los Angeles, California,

which was a loan correspondent for major life insurance companies and other financial institutions. In addition, Mr. Nelson was the Chief

Operating Officer of Churchill Mortgage Capital, which was the loan origination arm of Churchill Mortgage Corporation. Mr. Nelson’s

prior experience includes various marketing positions with Control Data Corporation and design engineering positions with North American

Aviation where he worked on the Apollo Project. He holds a B.S. in Mechanical Engineering from Kansas State University and an MBA from

the University of Southern California. We believe that Mr. Nelson’s qualifications to serve as a director of the Company include

his many years of business, operational and management experience including his previous position as President of Churchill Mortgage Corporation.

In addition, Mr. Nelson has served as a director of the Company for 14 years and brings a valuable historical perspective on the development

of the Company’s business and its leadership.

We believe that Mr. Nelson’s qualifications

to serve as a director of the Company include his many years of business, operational and management experience including his previous

position as President of Churchill Mortgage Corporation. In addition, Mr. Nelson has served as a director of the Company for thirteen years

and brings a valuable historical perspective on the development of the Company’s business and its leadership.

Kristina Kim is a licensed

attorney with extensive knowledge of global import/export, international trade, and regulatory issues. Ms. Kim also served as General

Counsel and Vice President with Samsung International Inc. for over 14 years. Ms. Kim holds a B.A. in Biochemistry and Molecular Biology

from the University of California at Santa Barbara, and a Juris Doctorate from the University of San Diego.

We believe Ms. Kim’s qualifications to serve

as a director of the Company include her experience as a business attorney that allow her to provide the Company’s

Board of Directors with valuable knowledge of legal matters that may affect the Company.

Johnathan Chee has been

a director since September 2009. He is an attorney and has owned the Law Offices of Johnathan Chee, in Niles, Illinois, since August

2007. Mr. Chee has represented clients in various business dealings and negotiations with Ameritech, SBC, Sprint and several wireless

carriers in Latin America. Between 1998 and 2007, he served as an attorney with the C&S Law Group, P.C., in Glenview, Illinois. He

holds a B.A. from the University of Illinois-Chicago and a J.D. from IIT Chicago-Kent College of Law. He is a member of the Illinois Bar

Association.

We believe Mr. Chee’s qualifications to serve

as a director of the Company include his experience as a business attorney that allow him to provide the Company’s

Board of Directors with valuable knowledge of legal matters that may affect the Company.

Heidy Chow is a Certified Public Accountant and

an experienced finance and accounting executive whose client base includes several IT companies. Ms. Chow is an Assurance Partner of The

Pun Group, LLP and has over fifteen (15) years of combined experience in auditing, consulting and finance. Ms. Chow’s career in

public accounting was spent primarily with the national firms of RSM US and Ernst & Young, and regional firms where she has specialized

in corporate accounting and auditing services. She supervises engagement teams in areas of designing and planning audits in accordance

with the AICPA Generally Accepted Auditing Standards and Public Company Accounting Oversight Board (PCAOB) standards. In addition, she

often serves on a contract basis as Chief Financial Officer for privately held small and middle market companies. She holds a B.S. in

Accounting from California State Polytechnic University, Pomona.

We believe Ms. Chow’s qualifications to serve

as a director of the Company include her experience as a CPA and auditor allow her to provide the Company’s Board

of Directors with valuable knowledge of financial and accounting matters that may affect the Company.

Required Vote

The election of the directors of the Company requires

the affirmative vote of a plurality of the votes cast by stockholders, who are entitled to vote, present or represented by Proxy at the

Annual Meeting, which will be the nominees receiving the largest number of votes, which may or may not constitute less than a majority.

RECOMMENDATION OF THE BOARD FOR PROPOSAL NO.

1:

THE BOARD RECOMMENDS A VOTE FOR THE ELECTION

OF ALL THE NOMINEES DESCRIBED ABOVE.

ACTIONS TO BE TAKEN AT THE MEETING (Continued)

PROPOSAL NO. 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

We are providing our stockholders an opportunity to indicate whether

they support our Named Executive Officer compensation as described in this proxy statement. This advisory vote, commonly referred to as

"say on pay," is not intended to address any specific item of compensation, but instead relates to the tabular disclosures regarding

Named Executive Officer compensation, and the narrative disclosure accompanying the tabular presentation. These disclosures allow you

to view the trends in our executive compensation program and the application of our compensation philosophies for the years presented.

The Compensation Committee believes an effective compensation program should be one that is designed to recruit and keep top quality executive

leadership focused on attaining long-term corporate goals and increasing stockholder value. We believe that our executive compensation

program is designed to reasonably and fairly recruit, motivate, retain and reward our executives for achieving our objectives and goals.

Accordingly, the Board of Directors unanimously recommends that stockholders vote in favor of the following resolution: "Resolved,

that the stockholders approve the compensation of the Company's named executive officers as disclosed in this proxy statement pursuant

to the rules of the Securities and Exchange Commission, including the compensation tables and the related footnotes and narrative disclosures."

Although this vote is advisory and is not binding on the Company, the Compensation Committee will take into account the outcome of the

vote when considering future executive compensation decisions. Approval of this non-binding proposal requires the affirmative vote of

a plurality of the votes cast by stockholders who are entitled to vote, present in person or represented by Proxy at the Annual Meeting.

RECOMMENDATION OF THE BOARD FOR PROPOSAL NO.

2:

THE BOARD RECOMMENDS A VOTE FOR APPROVAL OF

THE RESOLUTION APPROVING THE COMPENSATION OF THE COMPANY'S NAMED EXECUTIVE OFFICERS

ACTIONS TO BE TAKEN AT THE MEETING (Continued)

PROPOSAL NO. 3:

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Board of Directors has recently selected Simon

& Edward, LLP as the independent registered public accounting firm for the Company to audit the consolidated financial statements

of the Company for fiscal year 2024. Although ratification by stockholders is not required by law, the Board of Directors has determined

that it is desirable to request ratification of this selection by the stockholders. Notwithstanding its selection, the Board of Directors,

in its discretion, may appoint a new independent registered public accounting firm at any time during the year if the Board of Directors

believes that such a change would be in the best interests of the Company and its stockholders. If the stockholders do not ratify

the appointment of Simon & Edward, LLP, the Audit Committee may reconsider its selection.

The vote of a majority of the shares of Common

Stock or represented at the meeting is required for approval. Broker non-votes will be voted in favor of approval. Kreit and Chiu CPA

LLP has acted as the Company’s independent registered public accounting firm during the past fiscal year. It is not anticipated

that a representative of Kreit and Chiu CPA LLP will attend the Annual Meeting of Stockholders.

The aggregate fees billed

for the most recently completed fiscal period for the audit of our annual financial statements and services normally provided by the independent

registered public accounting firm for this fiscal period were as follows:

| |

|

FY 2023 |

|

|

FY 2022 |

|

| Audit Fees |

|

$ |

84,250 |

|

|

$ |

91,500 |

|

| Total Fees |

|

$ |

84,250 |

|

|

$ |

91,500 |

|

In the above table, "audit

fees" are fees billed by our external auditor for services provided in auditing our company's annual financial statements for the

subject year. The fees set forth on the foregoing table relate to the audit as of and for the years ended June 30, 2023, and 2022, which

was performed by Kreit, and Chiu CPA LLP (formerly as “Paris, Kreit, and Chiu CPA LLP”). All of the services described above

were approved in advance by the Board of Directors or the Company's Audit Committee.

Pre-Approval Policies and Procedures

The Board of Directors pre-approves all audit and

non-audit services performed by the Company’s auditor and the fees to be paid in connection with such services in order to

assure that the provision of such services does not impair the auditor’s independence. All of the services described above were

approved in advance by the Board of Directors.

RECOMMENDATION OF THE BOARD FOR PROPOSAL NO.

3:

THE BOARD RECOMMENDS A VOTE FOR RATIFICATION

OF THE APPOINTMENT OF Simon & Edward, LLP AS AUDITORS FOR THE 2024 FISCAL YEAR.

ACTIONS TO BE TAKEN AT THE MEETING (Continued)

OTHER MATTERS

The Board of Directors knows of no other business

which will be presented at the Annual Meeting. If any other matters properly come before the meeting, the persons named in the enclosed

Proxy and will vote the shares represented thereby in accordance with their judgment on such matters.

ADDITIONAL INFORMATION

Annual Reports on Form 10-K

Additional copies of Franklin's Annual Report on

Form 10-K for the fiscal year ended June 30, 2023 may be obtained without charge by writing to the Corporate Secretary, Franklin Wireless

Corp., 9707 Waples Street, Suite 150, San Diego, CA 92121.

Stockholders Proposals for the 2024 Annual Meeting

Any stockholder who wishes to present proposals

for inclusion in the Company’s proxy materials for the 2024 Annual Meeting of Stockholders may do so by following the procedures

prescribed in Rule 14a-8 under the Securities Exchange Act of 1934, as amended. To be eligible, the stockholder proposals must be

received by our Corporate Secretary at our principal executive office on or before July 15, 2024. Such proposal must also meet the other

requirements of the rules of the SEC relating to stockholders’ proposals. In addition, to comply with the universal proxy rules,

stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice

that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934 no later than October 22, 2024.

Proxy Solicitation Costs

The proxies being solicited hereby are being solicited

by the Company. The Company will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing

of the Notice, the Proxy Statement, the Proxy card and establishment of the Internet site hosting the proxy material. Copies of solicitation

materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of common stock beneficially

owned by others to forward to such beneficial owners. Officers and regular employees of the Company may, but without compensation other

than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, telex, facsimile or electronic

means. We will, upon request, reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to

the beneficial owners of stock.

| |

By Order of the Board of Directors, |

|

| |

|

|

| |

|

|

| |

/s/ OC Kim |

|

| |

OC Kim |

|

| |

President |

|

Franklin

Wireless Corp.

2023

Proxy Card

The undersigned hereby appoints OC Kim as attorney

and proxy for the undersigned, with full power of substitution, for and in the name, place and stead of the undersigned, to represent

and vote, as designated below, all shares of stock of Franklin Wireless Corp., a Nevada corporation, held of record by the undersigned

on October 12, 2023, at the Annual Meeting of the Shareholders to be held on December 21, 2023, or at any adjournment or postponement

of such meeting, in accordance with and as described in the Notice of Annual Meeting of Shareholders and Proxy Statement. If no direction

is given, this proxy will be voted FOR Proposals 1, 2 and 3, and in the discretion of the proxy as to such other matters as may

properly come before the meeting.

[X] Please mark the votes as in this example.

The Board of Directors

Recommends that you vote FOR all directors listed in Proposal 1 and vote FOR Proposals 2 and 3

| Proposal # |

Description |

FOR |

Against |

Abstain |

| 1. |

Election of Directors

Nominees Include:

·

OC Kim

·

Gary Nelson

·

Kristina Kim

·

Jonathan Chee

·

Heidy Chow |

______

______

______

______

______ |

______

______

______

______

______ |