0001533040

false

--12-31

2023

Q3

0001533040

2023-01-01

2023-09-30

0001533040

2023-11-03

0001533040

2023-09-30

0001533040

2022-12-31

0001533040

2023-07-01

2023-09-30

0001533040

2022-07-01

2022-09-30

0001533040

2022-01-01

2022-09-30

0001533040

phio:PreferredStockSeriesDMember

2022-12-31

0001533040

us-gaap:CommonStockMember

2022-12-31

0001533040

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001533040

us-gaap:RetainedEarningsMember

2022-12-31

0001533040

phio:PreferredStockSeriesDMember

2023-03-31

0001533040

us-gaap:CommonStockMember

2023-03-31

0001533040

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001533040

us-gaap:RetainedEarningsMember

2023-03-31

0001533040

2023-03-31

0001533040

phio:PreferredStockSeriesDMember

2023-06-30

0001533040

us-gaap:CommonStockMember

2023-06-30

0001533040

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001533040

us-gaap:RetainedEarningsMember

2023-06-30

0001533040

2023-06-30

0001533040

phio:PreferredStockSeriesDMember

2021-12-31

0001533040

us-gaap:CommonStockMember

2021-12-31

0001533040

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001533040

us-gaap:RetainedEarningsMember

2021-12-31

0001533040

2021-12-31

0001533040

phio:PreferredStockSeriesDMember

2022-03-31

0001533040

us-gaap:CommonStockMember

2022-03-31

0001533040

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001533040

us-gaap:RetainedEarningsMember

2022-03-31

0001533040

2022-03-31

0001533040

phio:PreferredStockSeriesDMember

2022-06-30

0001533040

us-gaap:CommonStockMember

2022-06-30

0001533040

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001533040

us-gaap:RetainedEarningsMember

2022-06-30

0001533040

2022-06-30

0001533040

phio:PreferredStockSeriesDMember

2023-01-01

2023-03-31

0001533040

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001533040

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001533040

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001533040

2023-01-01

2023-03-31

0001533040

phio:PreferredStockSeriesDMember

2023-04-01

2023-06-30

0001533040

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001533040

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001533040

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001533040

2023-04-01

2023-06-30

0001533040

phio:PreferredStockSeriesDMember

2023-07-01

2023-09-30

0001533040

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001533040

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0001533040

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001533040

phio:PreferredStockSeriesDMember

2022-01-01

2022-03-31

0001533040

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001533040

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001533040

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001533040

2022-01-01

2022-03-31

0001533040

phio:PreferredStockSeriesDMember

2022-04-01

2022-06-30

0001533040

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001533040

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001533040

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001533040

2022-04-01

2022-06-30

0001533040

phio:PreferredStockSeriesDMember

2022-07-01

2022-09-30

0001533040

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0001533040

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2022-09-30

0001533040

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0001533040

phio:PreferredStockSeriesDMember

2023-09-30

0001533040

us-gaap:CommonStockMember

2023-09-30

0001533040

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001533040

us-gaap:RetainedEarningsMember

2023-09-30

0001533040

phio:PreferredStockSeriesDMember

2022-09-30

0001533040

us-gaap:CommonStockMember

2022-09-30

0001533040

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001533040

us-gaap:RetainedEarningsMember

2022-09-30

0001533040

2022-09-30

0001533040

2023-01-25

2023-01-26

0001533040

phio:ClinicalCoDevelopmentAgreementMember

2021-03-31

0001533040

phio:ClinicalCoDevelopmentAgreementMember

2023-07-01

2023-09-30

0001533040

phio:ClinicalCoDevelopmentAgreementMember

2023-01-01

2023-09-30

0001533040

phio:ClinicalCoDevelopmentAgreementMember

2022-07-01

2022-09-30

0001533040

phio:ClinicalCoDevelopmentAgreementMember

2022-01-01

2022-09-30

0001533040

phio:ClinicalCoDevelopmentAgreementMember

2023-09-30

0001533040

us-gaap:FairValueInputsLevel2Member

2023-09-30

0001533040

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001533040

us-gaap:PropertySubjectToOperatingLeaseMember

2023-09-30

0001533040

us-gaap:PropertySubjectToOperatingLeaseMember

2023-01-01

2023-09-30

0001533040

us-gaap:SeriesDPreferredStockMember

phio:RobertBittermanMember

2022-11-15

2022-11-16

0001533040

us-gaap:SeriesDPreferredStockMember

phio:RobertBittermanMember

2022-11-16

0001533040

us-gaap:SeriesDPreferredStockMember

2023-09-30

0001533040

phio:April2023FinancingMember

2023-04-19

2023-04-20

0001533040

phio:April2023FinancingMember

2023-04-20

0001533040

phio:April2023FinancingMember

phio:SeriesAWarrantsMember

2023-04-20

0001533040

phio:April2023FinancingMember

phio:SeriesBWarrantsMember

2023-04-20

0001533040

phio:April2023FinancingMember

phio:PlacementAgentWarrantsMember

2023-04-20

0001533040

phio:April2023FinancingMember

phio:WarrantAmendmentAgreementsMember

phio:PreviouslyIssuedWarrantsMember

2023-04-19

2023-04-20

0001533040

phio:April2023FinancingMember

phio:WarrantAmendmentAgreementsMember

phio:PreviouslyIssuedWarrantsMember

2023-04-20

0001533040

phio:June2023FinancingMember

phio:RegisteredSharesMember

2023-06-01

2023-06-02

0001533040

phio:June2023FinancingMember

phio:UnregisteredSharesMember

2023-06-01

2023-06-02

0001533040

phio:June2023FinancingMember

2023-06-02

0001533040

phio:June2023FinancingMember

phio:UnregisteredPreFundedWarrantsMember

2023-06-02

0001533040

phio:June2023FinancingMember

phio:SeriesAWarrantsMember

2023-06-02

0001533040

phio:June2023FinancingMember

phio:SeriesBWarrantsMember

2023-06-02

0001533040

phio:June2023FinancingMember

phio:PlacementAgentWarrantsMember

2023-06-02

0001533040

phio:June2023FinancingMember

2023-06-01

2023-06-02

0001533040

phio:June2023FinancingMember

phio:June2023PreFundedWarrantsMember

2023-07-01

2023-09-30

0001533040

phio:June2023FinancingMember

phio:June2023PreFundedWarrantsMember

2023-01-01

2023-09-30

0001533040

us-gaap:WarrantMember

2022-12-31

0001533040

us-gaap:WarrantMember

2023-01-01

2023-09-30

0001533040

us-gaap:WarrantMember

2023-09-30

0001533040

phio:Plan2020Member

2023-07-01

2023-07-31

0001533040

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-09-30

0001533040

us-gaap:RestrictedStockUnitsRSUMember

2022-07-01

2022-09-30

0001533040

us-gaap:RestrictedStockUnitsRSUMember

2022-01-01

2022-09-30

0001533040

us-gaap:RestrictedStockUnitsRSUMember

2023-07-01

2023-09-30

0001533040

us-gaap:EmployeeStockOptionMember

2022-07-01

2022-09-30

0001533040

us-gaap:EmployeeStockOptionMember

2022-01-01

2022-09-30

0001533040

us-gaap:RestrictedStockUnitsRSUMember

2022-12-31

0001533040

us-gaap:RestrictedStockUnitsRSUMember

2023-09-30

0001533040

us-gaap:EmployeeStockOptionMember

2022-12-31

0001533040

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-09-30

0001533040

us-gaap:EmployeeStockOptionMember

2023-09-30

0001533040

us-gaap:ResearchAndDevelopmentExpenseMember

2023-07-01

2023-09-30

0001533040

us-gaap:ResearchAndDevelopmentExpenseMember

2022-07-01

2022-09-30

0001533040

us-gaap:ResearchAndDevelopmentExpenseMember

2023-01-01

2023-09-30

0001533040

us-gaap:ResearchAndDevelopmentExpenseMember

2022-01-01

2022-09-30

0001533040

us-gaap:GeneralAndAdministrativeExpenseMember

2023-07-01

2023-09-30

0001533040

us-gaap:GeneralAndAdministrativeExpenseMember

2022-07-01

2022-09-30

0001533040

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-09-30

0001533040

us-gaap:GeneralAndAdministrativeExpenseMember

2022-01-01

2022-09-30

0001533040

phio:StockOptionsMember

2023-01-01

2023-09-30

0001533040

phio:StockOptionsMember

2022-01-01

2022-09-30

0001533040

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-09-30

0001533040

us-gaap:RestrictedStockUnitsRSUMember

2022-01-01

2022-09-30

0001533040

us-gaap:WarrantMember

2023-01-01

2023-09-30

0001533040

us-gaap:WarrantMember

2022-01-01

2022-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30,

2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

to

Commission File Number: 001-36304

Phio Pharmaceuticals Corp.

(Exact name of registrant as specified in its

charter)

| Delaware |

45-3215903 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

257 Simarano Drive, Suite 101, Marlborough,

MA 01752

(Address of principal executive office) (Zip

code)

Registrant’s telephone number, including

area code: (508) 767-3861

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

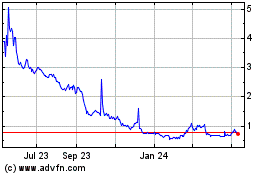

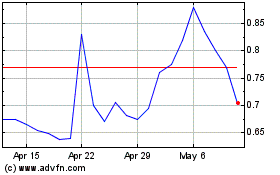

| Common Stock, par value, $0.0001 per share |

PHIO |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

| Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

| |

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by checkmark whether the registrant is

a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

No ☒

As of November 3, 2023, Phio Pharmaceuticals Corp. had 2,443,447 shares

of common stock, $0.0001 par value, outstanding.

PHIO PHARMACEUTICALS CORP.

FORM 10-Q — QUARTER ENDED SEPTEMBER 30,

2023

INDEX

PART I — FINANCIAL INFORMATION

| ITEM 1. |

FINANCIAL STATEMENTS |

PHIO PHARMACEUTICALS CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share and per

share data)

(Unaudited)

| | |

| | | |

| | |

| | |

September 30,

2023 | | |

December 31,

2022 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 8,407 | | |

$ | 11,781 | |

| Restricted cash | |

| 50 | | |

| 50 | |

| Prepaid expenses and other current assets | |

| 871 | | |

| 615 | |

| Total current assets | |

| 9,328 | | |

| 12,446 | |

| Right of use asset | |

| 66 | | |

| 161 | |

| Property and equipment, net | |

| 142 | | |

| 183 | |

| Other assets | |

| 3 | | |

| 24 | |

| Total assets | |

$ | 9,539 | | |

$ | 12,814 | |

| LIABILITIES, PREFERRED STOCK AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 173 | | |

$ | 779 | |

| Accrued expenses | |

| 2,083 | | |

| 1,025 | |

| Lease liability | |

| 70 | | |

| 135 | |

| Total current liabilities | |

| 2,326 | | |

| 1,939 | |

| Lease liability, net of current portion | |

| – | | |

| 35 | |

| Total liabilities | |

| 2,326 | | |

| 1,974 | |

| Commitments and contingencies (Note 2) | |

| – | | |

| – | |

| Series D Preferred Stock, $0.0001 par value; 0 and 1 shares authorized, issued and outstanding at September 30, 2023 and December 31, 2022, respectively | |

| – | | |

| 2 | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, $0.0001 par value, 100,000,000 shares authorized; 2,307,385 and 1,139,024 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | |

| – | | |

| – | |

| Additional paid-in capital | |

| 144,524 | | |

| 139,218 | |

| Accumulated deficit | |

| (137,311 | ) | |

| (128,380 | ) |

| Total stockholders’ equity | |

| 7,213 | | |

| 10,838 | |

| Total liabilities, preferred stock and stockholders’ equity | |

$ | 9,539 | | |

$ | 12,814 | |

The accompanying notes are an integral part of

these condensed consolidated financial statements.

PHIO PHARMACEUTICALS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except share and per

share data)

(Unaudited)

| | |

| | | |

| | | |

| | | |

| | |

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

$ | 1,808 | | |

$ | 2,508 | | |

$ | 5,325 | | |

$ | 5,398 | |

| General and administrative | |

| 968 | | |

| 1,063 | | |

| 3,600 | | |

| 3,334 | |

| Total operating expenses | |

| 2,776 | | |

| 3,571 | | |

| 8,925 | | |

| 8,732 | |

| Operating loss | |

| (2,776 | ) | |

| (3,571 | ) | |

| (8,925 | ) | |

| (8,732 | ) |

| Total other expense, net | |

| (4 | ) | |

| (5 | ) | |

| (6 | ) | |

| (17 | ) |

| Net loss | |

$ | (2,780 | ) | |

$ | (3,576 | ) | |

$ | (8,931 | ) | |

$ | (8,749 | ) |

| Net loss per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | (1.14 | ) | |

$ | (3.14 | ) | |

$ | (5.03 | ) | |

$ | (7.70 | ) |

| Weighted average number of common shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 2,440,164 | | |

| 1,138,571 | | |

| 1,775,043 | | |

| 1,135,744 | |

The accompanying notes are an integral part of

these condensed consolidated financial statements.

PHIO PHARMACEUTICALS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF

PREFERRED STOCK AND STOCKHOLDERS’ EQUITY

(Amounts in thousands, except share data)

(Unaudited)

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| For the Three and Nine Months | |

Series D Preferred Stock | | |

Common Stock | | |

Additional

Paid-in | | |

Accumulated | | |

| |

| Ended September 30, 2023 | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Total | |

| Balance at December 31, 2022 | |

| 1 | | |

$ | 2 | | |

| 1,139,024 | | |

$ | – | | |

$ | 139,218 | | |

$ | (128,380 | ) | |

$ | 10,838 | |

| Cash-in-lieu of fractional shares for reverse stock split | |

| – | | |

| – | | |

| (1,706 | ) | |

| – | | |

| (11 | ) | |

| – | | |

| (11 | ) |

| Redemption of preferred stock | |

| (1 | ) | |

| (2 | ) | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| Issuance of common stock upon vesting of restricted stock units | |

| – | | |

| – | | |

| 18,080 | | |

| – | | |

| – | | |

| – | | |

| – | |

| Shares withheld for payroll taxes | |

| – | | |

| – | | |

| (4,816 | ) | |

| – | | |

| (25 | ) | |

| – | | |

| (25 | ) |

| Stock-based compensation expense | |

| – | | |

| – | | |

| – | | |

| – | | |

| 111 | | |

| – | | |

| 111 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (3,602 | ) | |

| (3,602 | ) |

| Balance at March 31, 2023 | |

| – | | |

$ | – | | |

| 1,150,582 | | |

$ | – | | |

$ | 139,293 | | |

$ | (131,982 | ) | |

$ | 7,311 | |

| Issuance of common stock and warrants, net of offering costs | |

| – | | |

| – | | |

| 659,629 | | |

| – | | |

| 5,048 | | |

| – | | |

| 5,048 | |

| Issuance of common stock upon exercise of warrants | |

| – | | |

| – | | |

| 175,000 | | |

| – | | |

| – | | |

| – | | |

| – | |

| Stock-based compensation expense | |

| – | | |

| – | | |

| – | | |

| – | | |

| 94 | | |

| – | | |

| 94 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (2,549 | ) | |

| (2,549 | ) |

| Balance at June 30, 2023 | |

| – | | |

$ | – | | |

| 1,985,211 | | |

$ | – | | |

$ | 144,435 | | |

$ | (134,531 | ) | |

$ | 9,904 | |

| Issuance of common stock upon exercise of warrants | |

| – | | |

| – | | |

| 320,290 | | |

| – | | |

| – | | |

| – | | |

| – | |

| Issuance of common stock upon vesting of restricted stock units | |

| – | | |

| – | | |

| 2,000 | | |

| – | | |

| – | | |

| – | | |

| – | |

| Shares withheld for payroll taxes | |

| – | | |

| – | | |

| (116 | ) | |

| – | | |

| – | | |

| – | | |

| – | |

| Stock-based compensation expense | |

| – | | |

| – | | |

| – | | |

| – | | |

| 89 | | |

| – | | |

| 89 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (2,780 | ) | |

| (2,780 | ) |

| Balance at September 30, 2023 | |

| – | | |

$ | – | | |

| 2,307,385 | | |

$ | – | | |

$ | 144,524 | | |

$ | (137,311 | ) | |

$ | 7,213 | |

| For the Three and Nine Months Ended | |

Series D Preferred Stock | | |

Common Stock | | |

Additional

Paid-in | | |

Accumulated | | |

| |

| September 30, 2022 | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Total | |

| Balance at December 31, 2021 | |

| – | | |

$ | – | | |

| 1,127,917 | | |

$ | – | | |

$ | 138,832 | | |

$ | (116,900 | ) | |

$ | 21,932 | |

| Issuance of common stock upon vesting of restricted stock units | |

| – | | |

| – | | |

| 12,943 | | |

| – | | |

| – | | |

| – | | |

| – | |

| Shares withheld for payroll taxes | |

| – | | |

| – | | |

| (2,633 | ) | |

| – | | |

| (25 | ) | |

| – | | |

| (25 | ) |

| Stock-based compensation expense | |

| – | | |

| – | | |

| – | | |

| – | | |

| 186 | | |

| – | | |

| 186 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (2,642 | ) | |

| (2,642 | ) |

| Balance at March 31, 2022 | |

| – | | |

$ | – | | |

| 1,138,227 | | |

$ | – | | |

$ | 138,993 | | |

$ | (119,542 | ) | |

$ | 19,451 | |

| Stock-based compensation expense | |

| – | | |

| – | | |

| – | | |

| – | | |

| 83 | | |

| – | | |

| 83 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (2,531 | ) | |

| (2,531 | ) |

| Balance at June 30, 2022 | |

| – | | |

$ | – | | |

| 1,138,227 | | |

$ | – | | |

$ | 139,076 | | |

$ | (122,073 | ) | |

$ | 17,003 | |

| Issuance of common stock upon vesting of restricted stock units | |

| – | | |

| – | | |

| 1,064 | | |

| – | | |

| – | | |

| – | | |

| – | |

| Shares withheld for payroll taxes | |

| – | | |

| – | | |

| (293 | ) | |

| – | | |

| (3 | ) | |

| – | | |

| (3 | ) |

| Stock-based compensation expense | |

| – | | |

| – | | |

| – | | |

| – | | |

| 103 | | |

| – | | |

| 103 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (3,576 | ) | |

| (3,576 | ) |

| Balance at September 30, 2022 | |

| – | | |

$ | – | | |

| 1,138,998 | | |

$ | – | | |

$ | 139,176 | | |

$ | (125,649 | ) | |

$ | 13,527 | |

The accompanying notes are an integral part of

these condensed consolidated financial statements.

PHIO PHARMACEUTICALS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

(Unaudited)

| | |

| | |

| |

| | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (8,931 | ) | |

$ | (8,749 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 46 | | |

| 56 | |

| Amortization of right of use asset | |

| 95 | | |

| 91 | |

| Stock-based compensation | |

| 294 | | |

| 372 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses and other assets | |

| (235 | ) | |

| (220 | ) |

| Accounts payable | |

| (606 | ) | |

| 260 | |

| Accrued expenses | |

| 1,058 | | |

| (1,141 | ) |

| Lease liability | |

| (100 | ) | |

| (93 | ) |

| Net cash used in operating activities | |

| (8,379 | ) | |

| (9,424 | ) |

| Cash flows from investing activities: | |

| | | |

| | |

| Cash paid for purchase of property and equipment | |

| (5 | ) | |

| (121 | ) |

| Net cash used in investing activities | |

| (5 | ) | |

| (121 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Net proceeds from the issuance of common stock and warrants | |

| 5,048 | | |

| – | |

| Cash in lieu of fractional shares for reverse stock split | |

| (11 | ) | |

| – | |

| Redemption of Series D preferred stock | |

| (2 | ) | |

| – | |

| Payment of taxes on net share settlements of restricted stock units | |

| (25 | ) | |

| (28 | ) |

| Net cash provided by (used in) financing activities | |

| 5,010 | | |

| (28 | ) |

| Net decrease in cash and restricted cash | |

| (3,374 | ) | |

| (9,573 | ) |

| Cash and restricted cash at the beginning of period | |

| 11,831 | | |

| 24,107 | |

| Cash and restricted cash at the end of period | |

$ | 8,457 | | |

$ | 14,534 | |

The following table provides a reconciliation of cash and restricted

cash reported within the condensed consolidated balance sheets to the totals above:

| | |

| | |

| |

| | |

September 30, | |

| | |

2023 | | |

2022 | |

| Cash | |

$ | 8,407 | | |

$ | 14,484 | |

| Restricted cash | |

| 50 | | |

| 50 | |

| Cash and restricted cash | |

$ | 8,457 | | |

$ | 14,534 | |

The accompanying notes are an integral part of

these condensed consolidated financial statements.

PHIO PHARMACEUTICALS CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Organization and Significant Accounting Policies

Nature of Operations

Phio Pharmaceuticals Corp.

(“Phio” or the “Company”) is a clinical stage biotechnology company whose proprietary INTASYL™

self-delivering RNAi technology platform is designed to make immune cells more effective in killing tumor cells. Phio is developing therapeutics

that are designed to leverage INTASYL to precisely target specific proteins that reduce the body’s ability to fight cancer, without

the need for specialized formulations or drug delivery systems.

Effective January 26, 2023,

the Company completed a 1-for-12 reverse stock split of the Company’s outstanding common stock, including reclassifying an amount

equal to the reduction in par value to additional paid-in capital. The reverse stock split did not reduce the number of authorized shares

of the Company’s common or preferred stock. All share and per share amounts have been adjusted to give effect to the reverse stock

split.

Principles of Consolidation

The condensed consolidated

financial statements include the accounts of Phio and its wholly-owned subsidiary, MirImmune, LLC. All material intercompany accounts

have been eliminated in consolidation.

Basis of Presentation

The accompanying condensed

consolidated financial statements are unaudited and have been prepared in accordance with accounting principles generally accepted in

the United States (“GAAP”). Certain information and footnote disclosures that are included in the Company’s annual

consolidated financial statements, but that are not required for interim reporting purposes, have been condensed or omitted. Additionally,

the Company made adjustments to the outstanding stock option and unvested restricted stock unit balances, and related per share amounts,

at December 31, 2022 to reflect final revisions to those outstanding equity awards as a result of the Company’s reverse stock split.

The adjustment had no effect on the Company’s condensed consolidated financial statements. These statements should be read in conjunction

with the audited consolidated financial statements and notes thereto included in the Company’s most recent Annual Report on Form

10-K for the year ended December 31, 2022, as filed with the Securities and Exchange Commission (the “SEC”) on March

22, 2023 (the “2022 Form 10-K”). In the opinion of management, all adjustments (including normal recurring accruals)

considered necessary for a fair presentation of the condensed consolidated financial statements have been included. Interim results are

not necessarily indicative of results for a full year.

Use of Estimates

The preparation of financial

statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. The areas subject to significant estimates and judgement include, among others, those

related to the fair value of equity awards, accruals for research and development expenses, useful lives of property and equipment, and the valuation allowance on the Company’s deferred tax assets. On an ongoing basis the Company evaluates its estimates

and bases its estimates on historical experience and other relevant assumptions that the Company believes are reasonable under the circumstances.

Actual results could differ materially from these estimates.

Liquidity

The Company has reported recurring

losses from operations since inception and expects to continue to have negative cash flows from operations for the foreseeable future.

Historically, the Company’s primary source of funding has been from sales of its securities. The Company’s ability to continue

to fund its operations is dependent on obtaining funding from third parties, such as proceeds from the issuance of debt, sale of equity,

or strategic opportunities, in order to maintain its operations. This is dependent on a number of factors, including the market demand

or liquidity of the Company’s common stock. There is no guarantee that debt, additional equity or other funding will be available

to the Company on acceptable terms, or at all. If the Company fails to obtain additional funding when needed, the Company would be forced

to scale back or terminate its operations or seek to merge with or to be acquired by another company.

The Company has limited cash

resources, has reported recurring losses from operations since inception and has not yet received product revenues. These factors raise

substantial doubt regarding the Company’s ability to continue as a going concern, and the Company’s current cash resources

may not provide sufficient capital to fund operations for at least the next 12 months from the date of the release of these financial

statements. The continuation of the Company as a going concern depends upon the Company’s ability to raise additional capital through

an equity offering, debt offering and/or strategic opportunity to fund its operations. There can be no assurance that the Company will

be successful in accomplishing these plans in order to continue as a going concern. These financial statements do not include any adjustments

to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the

Company be unable to continue as a going concern.

Summary of Significant Accounting Policies

There have been no material

changes to the significant accounting policies disclosed in the Company’s 2022 Form 10-K.

Recent Accounting Pronouncements

There have been no recent

accounting pronouncements that have significantly impacted this Quarterly Report on Form 10-Q, beyond those disclosed in the Company’s

2022 Form 10-K.

2. Collaboration Agreement

AgonOx, Inc. (“AgonOx”)

In March 2021, the Company

entered into a clinical co-development collaboration agreement (the “Clinical Co-Development Agreement”) with AgonOx,

a private company developing a pipeline of novel immunotherapy drugs targeting key regulators of the immune response to cancer. Under

the Clinical Co-Development Agreement, Phio and AgonOx are working to develop a T cell-based therapy using the Company’s lead product

candidate, PH-762, and AgonOx’s “double positive” tumor infiltrating lymphocytes (“DP TIL”) technology.

Per the terms of the Clinical Co-Development Agreement, the Company committed to provide financial support for development costs of up

to $4,000,000 to AgonOx for expenses incurred to conduct a Phase 1 clinical trial of PH-762 treated DP TIL in patients with advanced melanoma

and other advanced solid tumors.

The Company will recognize

its share of costs arising from research and development activities performed by AgonOx in the Company’s financial statements in

the period AgonOx incurs such expense. Phio will be entitled to certain future development milestones and low single-digit sales-based

royalty payments from AgonOx’s licensing of its DP TIL technology.

The Company recognized approximately

$606,000 and $906,000 of expense in connection with these efforts during the three and nine months ended September 30, 2023, respectively.

No expense under the Clinical Co-Development Agreement was recognized during the three and nine months ended September 30, 2022.

There is approximately $2,964,000

of remaining costs not yet incurred under the Clinical Co-Development Agreement as of September 30, 2023.

3. Fair Value of Financial Instruments

The Company follows the provisions

of the Financial Accounting Standards Board (the “FASB”) Accounting Standards Codification (“ASC”)

Topic 820, “Fair Value Measurement,” for the Company’s financial assets and liabilities that are re-measured

and reported at fair value each reporting period and are re-measured and reported at fair value at least annually using a fair value hierarchy

that is broken down into three levels. Level inputs are defined as follows:

Level 1 – quoted prices

in active markets for identical assets or liabilities.

Level 2 – other significant

observable inputs for the assets or liabilities through corroboration with market data at the measurement date.

Level 3 – significant

unobservable inputs that reflect management’s best estimate of what market participants would use to price the assets or liabilities

at the measurement date.

At September 30, 2023 and

December 31, 2022, the Company categorized its restricted cash of $50,000 as Level 2 hierarchy. Restricted cash consists of certificates of deposit held by financial institutions as collateral for the Company’s

corporate credit cards. The assets classified as Level 2 have

initially been valued at the applicable transaction price and subsequently valued, at the end of each reporting period, using other market

observable data. Observable market data points include quoted prices, interest rates, reportable trades and other industry and economic

events.

The carrying amounts of cash,

accounts payable and accrued expenses of the Company approximate their fair values due to their short-term nature.

4. Leases

In January 2019, the Company

amended the lease for its corporate headquarters and primary research facility in Marlborough, Massachusetts. The lease is for a total

of 7,581 square feet of office and laboratory space and will expire on March 31, 2024. The lease contains an option to terminate after

two or three years by providing advance written notice of termination pursuant to the terms of the agreement. The exercise of this option

was not determined to be reasonably certain and thus was not included in the lease liability on the Company’s balance sheet. The

Company did not exercise its option to terminate in either the second or third year of the lease, and the option to terminate has expired.

Additionally, the lease agreement did not contain information to determine the borrowing rate implicit in the lease. As such, the Company

calculated its incremental borrowing rate based on what the Company would have to pay to borrow on a collateralized basis over the lease

term for an amount equal to the remaining lease payments, taking into consideration such assumptions as, but not limited to, the U.S.

treasury yield rate and borrowing rates from a creditworthy financial institution using the above lease factors.

The lease for the Company’s

corporate headquarters represents all of its significant lease obligations. The amounts reported in the condensed consolidated balance

sheets for the operating lease in which the Company is the lessee and other supplemental balance sheet information is set forth as follows,

in thousands, except the lease term (number of years) and discount rate:

| Schedule of lease and supplemental balance sheet information | |

| | | |

| | |

| | |

September 30, 2023 | | |

December 31, 2022 | |

| Assets | |

| | | |

| | |

| Right of use asset | |

$ | 66 | | |

$ | 161 | |

| Liabilities | |

| | | |

| | |

| Lease liability, current | |

| 70 | | |

| 135 | |

| Lease liability, non-current | |

| – | | |

| 35 | |

| Total lease liability | |

$ | 70 | | |

$ | 170 | |

| Lease Term and Discount Rate | |

| | | |

| | |

| Weighted average remaining lease term | |

| 0.50 | | |

| 1.25 | |

| Weighted average discount rate | |

| 4.70% | | |

| 4.70% | |

Operating lease costs included

in operating expense were $33,000 for the three months ended September 30, 2023 and 2022. Operating lease costs included in operating

expense were $99,000 for the nine months ended September 30, 2023 and 2022.

Cash paid for the amounts

included in the measurement of the operating lease liability on the Company’s condensed consolidated balance sheets and included

within changes in the lease liability in the operating activities of the Company’s condensed consolidated statements of cash flows

was $35,000 and $34,000 for the three months ended September 30, 2023 and 2022, respectively. Cash paid for the amounts included in the

measurement of the operating lease liability on the Company’s condensed consolidated balance sheets and included within changes

in the lease liability in the operating activities of the Company’s condensed consolidated statements of cash flow was $104,000

and $101,000 for the nine months ended September 30, 2023 and 2022, respectively.

Future lease payments for

the Company’s non-cancellable operating lease and a reconciliation to the carrying amount of the operating lease liability presented

in the condensed consolidated balance sheet as of September 30, 2023 is as follows, in thousands:

| Schedule of future minimum lease payments | |

| | |

| 2023 (remaining) | |

$ | 36 | |

| 2024 | |

| 35 | |

| Total lease payments | |

| 71 | |

| Less: Imputed interest | |

| (1 | ) |

| Total operating lease liability | |

$ | 70 | |

5. Preferred Stock

The Company has authorized

up to 10,000,000 shares of preferred stock, $0.0001 par value per share, for issuance. The Company’s Board of Directors (the “Board’)

is authorized under the Company’s Amended and Restated Articles of Incorporation (as may be amended and/or restated from time to

time, the “Amended Certificate”), to designate the authorized preferred stock into one or more series and to fix and

determine such rights, preferences, privileges and restrictions of any series of preferred stock, including voting rights, dividend rights,

conversion rights, redemption privileges and liquidation preferences, as shall be determined by the Board upon its issuance.

On November 16, 2022,

the Company issued and sold one

share of the Company’s Series D Preferred Stock, par value $0.0001 per share (the “Series D Preferred

Stock”) to Robert Bitterman, then its interim Executive Chairman and current Chief Executive Officer, for $1,750.

The Series D Preferred Stock was entitled to 17,500,000 votes per share exclusively with respect to any proposal to amend the

Company’s Amended Certificate to effect a reverse stock split of the Company’s common stock (“Reverse Stock

Split”). The terms of the Series D Preferred Stock provided that it would be voted, without action by the holder, on any

such proposal in the same proportion as shares of the Company’s common stock were voted. The Series D Preferred Stock

otherwise had no voting rights except as required by the General Corporation Law of the State of Delaware.

The Series D Preferred Stock

was not convertible into, or exchangeable for, shares of any other class or series of stock or other securities of the Company. The Series

D Preferred Stock had no rights with respect to any distribution of assets of the Company, including upon a liquidation, bankruptcy, reorganization,

merger, acquisition, sale, dissolution or winding up of the Company, whether voluntarily or involuntarily. The holder of the Series D

Preferred Stock was not entitled to receive dividends of any kind.

Under its terms, the outstanding

share of Series D Preferred Stock was to be redeemed in whole, but not in part, at any time: (i) if such redemption was approved by the

Board in its sole discretion or (ii) automatically and effective upon the approval by the Company's stockholders of a Reverse Stock Split.

Upon such redemption, the holder of the Series D Preferred Stock was entitled to receive consideration of $1,750 in cash.

The Series D Preferred Stock

was redeemed in whole on January 4, 2023, upon the approval by the Company’s stockholders of a Reverse Stock Split, such that, at

September 30, 2023, there were no shares of Series D Preferred Stock authorized, issued or outstanding and all of the Company’s

authorized shares of preferred stock were undesignated.

6. Stockholders’ Equity

April 2023 Financing

— On April 20, 2023, the Company completed a registered direct offering and a concurrent private placement of a total of: 353,983

registered shares of the Company’s common stock at a purchase price per share of $5.65, unregistered five and one-half year term

Series A warrants to purchase up to 353,983 shares of common stock at an exercise price of $5.40 per share and unregistered eighteen month

term Series B warrants to purchase up to 353,983 shares of common stock at an exercise price of $5.40 per share (collectively, the “April

2023 Financing”). In addition, the Company issued unregistered warrants to the placement agent, H.C. Wainwright & Co., LLC

(“HCW”), in the April 2023 Financing to purchase a total of 26,549 shares of common stock at an exercise price of $7.0625

per share. Net proceeds to the Company from the April 2023 Financing were $1,538,000 after deducting placement agent fees and offering

expenses.

In connection with the April

2023 Financing, the Company entered into warrant amendment agreements (the “Warrant Amendment Agreements”) with the

participating investors to amend the exercise price of certain existing warrants to purchase up to an aggregate of 191,619 shares of common

stock that were previously issued in April 2018 through January 2021, such that each of the amended warrants have an exercise price of

$5.40 per share. The Company received $24,000 as consideration in connection with the Warrant Amendment Agreements. The Company assessed

the amendments to the exercise price of the warrants under the FASB ASC Topic 815, “Derivatives and Hedging” (“ASC

815”) and determined that the amendment to the exercise price was completed in connection with and contingent on the close of

the April 2023 Financing. The increase in fair value of $293,000 related to the Warrant Amendment Agreements was recognized as an equity

issuance cost and recorded in additional paid in capital per ASC 815.

June 2023 Financing

— On June 2, 2023, the Company completed a registered direct offering and a concurrent private placement of a total of: 233,646

registered shares and 72,000 unregistered shares of the Company’s common stock each at a purchase price per share of $4.28, unregistered

pre-funded warrants to purchase up to an aggregate of 628,935 shares of common stock at a purchase price per share of $4.279 and with

an exercise price of $0.001 per share, unregistered five and one-half year term Series A warrants to purchase up to an aggregate of 934,581

shares of common stock at an exercise price of $4.03 per share and unregistered eighteen month term Series B warrants to purchase up to

an aggregate of 934,581 shares of common stock at an exercise price of $4.03 per share (collectively, the “June 2023 Financing”).

In addition, the Company issued unregistered warrants to the placement agent, HCW, in the June 2023 Financing to purchase a total of 70,094

shares of common stock at an exercise price of $5.35 per share. Net proceeds to the Company from the June 2023 Financing were $3,510,000

after deducting placement agent fees and offering expenses.

Warrants

The Company first assessed

the warrants in the April 2023 Financing and June 2023 Financing under the FASB ASC Topic 480, “Distinguishing Liabilities from

Equity” (“ASC 480”) to determine whether they were within the scope of ASC 480. As there were no instances

outside of the Company’s control that could require cash settlement, the Company’s warrants issued in the April 2023

Financing and June 2023 Financing were determined to be outside the scope of ASC 480.

The

Company then applied and followed the applicable accounting guidance in ASC Topic 815. Financial instruments are accounted for

as either derivative liabilities or equity instruments depending on the specific terms of the agreement. The warrants issued in the April

2023 Financing and June 2023 Financing did not meet the definition of a derivative instrument as they are indexed to the Company’s

common stock and classified within stockholders’ equity. Based on this determination, the warrants issued in the April 2023 Financing

and June 2023 Financing were classified within stockholders’ equity.

During the three and nine

months ended September 30, 2023, shares of common stock issued related to exercises from the pre-funded warrants issued in the June 2023

Financing totaled 320,290 and 495,290, respectively. The Company realized proceeds of $320 and $495, respectively, from the exercises

of the pre-funded warrants. There were no warrants exercised during the three and nine months ended September 30, 2022.

The following table summarizes the Company’s

outstanding warrants, all of which are classified as equity instruments, at September 30, 2023:

| Summary of outstanding warrants | |

| | | |

| | |

| | |

Number

of Shares | | |

Weighted-

Average

Exercise Price

Per Share | |

| Outstanding at December 31, 2022 | |

| 545,401 | | |

$ | 54.53 | |

| Issued | |

| 3,302,706 | | |

| 4.46 | |

| Exercised | |

| (495,290 | ) | |

| 0.001 | |

| Expired | |

| (1,837 | ) | |

| 1,245.59 | |

| Outstanding at September 30, 2023 | |

| 3,350,980 | | |

$ | 9.09 | |

The Company’s outstanding warrants as of

September 30, 2023 expire at various dates between October 2023 and December 2028.

7. Stock-based Compensation

In July 2023, the Company’s

stockholders approved an amendment to the Company’s 2020 Long-Term Incentive Plan (the “2020 Plan”) to increase the

number of shares authorized for issuance thereunder by 125,500 shares.

Restricted Stock Units

Restricted stock units (“RSUs”)

are issued under the Company’s 2020 Plan or as inducement grants issued outside of the 2020 Plan to new employees. RSUs are generally

subject to graded vesting and the satisfaction of certain service requirements. Upon vesting, each outstanding RSU will be settled for

one share of the Company’s common stock. Employee RSU recipients may elect to net share settle upon vesting, in which case the

Company pays the employee’s income taxes due upon vesting and withholds a number of shares of equal value. The fair value of the

RSUs awarded are based upon the Company’s closing stock price at the grant date and are expensed over the requisite service period.

The following table summarizes the activity of

the Company’s RSUs for the nine months ended September 30, 2023:

| Summary of RSU activity | |

| | |

| |

| | |

Number

of Shares | | |

Weighted-

Average

Grant Date

Fair Value

Per Share | |

| Unvested units at December 31, 2022 | |

| 47,335 | | |

$ | 15.03 | |

| Granted | |

| 43,500 | | |

| 5.24 | |

| Vested | |

| (20,080 | ) | |

| 16.34 | |

| Forfeited | |

| (1,500 | ) | |

| 5.24 | |

| Unvested units at September 30, 2023 | |

| 69,255 | | |

$ | 12.93 | |

There were no RSU grants during

the three months ended September 30, 2023. The weighted-average fair value of RSUs granted during the nine months ended September 30,

2023 was $5.24. The weighted-average fair value of RSUs granted during the three and nine months ended September 30, 2022 was $9.00 and

$10.32, respectively.

Stock-based compensation expense

related to RSUs was $89,000 and $294,000 for the three and nine months ended September 30, 2023, respectively. Stock-based compensation

expense related to RSUs was $98,000 and $359,000 for the three and nine months ended September 30, 2022, respectively.

The aggregate fair value of

awards that vested during the nine months ended September 30, 2023 and 2022 was $100,000 and $138,000, respectively, which represents

the market value of the Company’s common stock on the date that the RSUs vested.

Stock Options

Stock options are available

to be issued under the 2020 Plan and are generally subject to graded vesting and the satisfaction of certain service requirements. Upon

the exercise of a stock option, the Company issues new shares and delivers them to the recipient. The Company does not expect to net share

settle to satisfy stock option exercises.

The Company used the Black-Scholes

option-pricing model to determine the fair value of all its option grants. The risk-free interest rate used for each grant was based upon

the yield on zero-coupon U.S. Treasury securities with a term similar to the expected life of the related option. The Company’s

expected stock price volatility assumption was based upon the Company’s own implied volatility. The expected life assumption used

for option grants was based upon the simplified method provided for under the FASB ASC Topic 718, “Compensation – Stock

Compensation”. The dividend yield assumption was based upon the fact that the Company has never paid cash dividends and presently

has no intention of paying cash dividends.

The following table summarizes the activity of

the Company’s stock options for the nine months ended September 30, 2023:

| Summary of stock option activity | |

| | | |

| | | |

| | |

| | |

Number

of Shares | | |

Weighted-

Average

Exercise

Price

Per Share | | |

Aggregate

Intrinsic

Value | |

| Balance at December 31, 2022 | |

| 177 | | |

$ | 35,231.40 | | |

| | |

| Granted | |

| – | | |

| – | | |

| | |

| Exercised | |

| – | | |

| – | | |

| | |

| Forfeited | |

| – | | |

| – | | |

| | |

| Expired | |

| (50 | ) | |

| 82,948.68 | | |

| | |

| Balance at September 30, 2023 | |

| 127 | | |

$ | 16,445.06 | | |

$ | – | |

| Exercisable at September 30, 2023 | |

| 127 | | |

$ | 16,445.06 | | |

$ | – | |

Stock-based compensation expense

related to stock options for the three and nine months ended September 30, 2022 was $5,000 and $13,000, respectively. As of September

30, 2022, the compensation expense for all unvested stock options had been recognized in the Company’s results of operations.

Compensation Expense Related to Equity Awards

The following table sets

forth total stock-based compensation expense for the three and nine months ended September 30, 2023 and 2022, in thousands:

| Schedule of stock based compensation expense | |

| | |

| | |

| | |

| |

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Research and development | |

$ | 51 | | |

$ | 54 | | |

$ | 163 | | |

$ | 163 | |

| General and administrative | |

| 38 | | |

| 49 | | |

| 131 | | |

| 209 | |

| Total stock-based compensation | |

$ | 89 | | |

$ | 103 | | |

$ | 294 | | |

$ | 372 | |

8. Net Loss per Common Share

Basic

net loss per share is computed by dividing net loss by the weighted average number of common shares outstanding. Diluted net loss per

share is computed by dividing the Company’s net loss by the weighted average number of common shares outstanding and the impact

of the dilutive effect of potential common stock equivalents, except when the inclusion of such potential common stock equivalents would

be anti-dilutive. Dilutive potential common stock equivalents primarily consist of stock options, RSUs and warrants. Therefore, basic

and diluted net loss per share applicable to common stockholders were the same for all periods presented because the impact of these items

is generally anti-dilutive during periods of net loss.

The weighted average number

of common shares outstanding as of September 30, 2023 includes the pre-funded warrants issued in connection with the June 2023 Financing,

the exercise of which requires nominal consideration for the delivery of the shares of common stock.

The following table sets

forth the potential common shares excluded from the calculation of net loss per common share because their inclusion would be anti-dilutive:

| Schedule of anti-dilutive stock | |

| | | |

| | |

| | |

September 30, | |

| | |

2023 | | |

2022 | |

| Stock options | |

| 127 | | |

| 142 | |

| Unvested restricted stock units | |

| 69,255 | | |

| 57,017 | |

| Warrants1 | |

| 3,217,335 | | |

| 545,401 | |

| Total | |

| 3,286,717 | | |

| 602,560 | |

__________________

1 The weighted average number of common shares outstanding

as of September 30, 2023 includes pre-funded warrants issued in the June 2023 Financing because the exercise of such warrants requires

only nominal consideration. Therefore, these pre-funded warrants are not included in the table above.

| ITEM 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

In this report, “we,” “our,”

“ours,” “us,” “Phio” and the “Company” refers to Phio Pharmaceuticals Corp. and our subsidiary,

MirImmune, LLC and the ongoing business operations of Phio Pharmaceuticals Corp. and MirImmune, LLC, whether conducted through Phio Pharmaceuticals

Corp. or MirImmune, LLC.

This management’s discussion and analysis

of financial condition as of September 30, 2023 and results of operations for the three and nine months ended September 30, 2023 and 2022

should be read in conjunction with the audited financial statements included in our Annual Report on Form 10-K for the year ended December

31, 2022, which was filed with the Securities and Exchange Commission (the “SEC”) on March 22, 2023 (the “2022

Form 10-K”).

This report contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such

as “intends,” “believes,” “anticipates,” “indicates,” “plans,” “expects,”

“suggests,” “may,” “would,” “should,” “potential,” “designed to,”

“will,” “ongoing,” “estimate,” “forecast,” “target,” “predict,”

“could” and similar references, although not all forward-looking statements contain these words. Forward-looking statements

are neither historical facts nor assurances of future performance. These statements are based only on our current beliefs, expectations

and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks

and changes in circumstances that are difficult to predict and many of which are outside of our control. Risks that could cause actual

results to vary from expected results expressed in our forward-looking statements include, but are not limited to, the impact to our business

and operations by inflationary pressures, rising interest rates, recession fears, the development of our product candidates, our ability

to execute on business strategies, our ability to develop our product candidates with collaboration partners, and the success of any such

collaborations, the timeline and duration for advancing our product candidates into clinical development, results from our preclinical

and clinical activities, the timing or likelihood of regulatory filings and approvals, the success of our efforts to commercialize our

product candidates if approved, our ability to manufacture and supply our product candidates for clinical activities, and for commercial

use if approved, the scope of protection we are able to establish and maintain for intellectual property rights covering our technology

platform, and our ability to obtain future financing. Our actual results and financial condition may differ materially from those indicated

in the forward-looking statements as a result of a number of important factors, including those identified in our 2022 Form 10-K under

the heading “Risk Factors” and in other filings the Company periodically makes with the SEC. Therefore, you should not rely

on any of these forward-looking statements. Forward-looking statements contained in this Quarterly Report on Form 10-Q speak as of the

date hereof and the Company does not undertake to update any of these forward-looking statements to reflect a change in its views or events

or circumstances that occur after the date of this report except as required by law.

Overview

Phio is a clinical stage biotechnology

company whose proprietary INTASYL™ self-delivering RNAi technology platform is designed to make immune cells more effective in killing

tumor cells. We are developing therapeutics that are designed to leverage INTASYL to precisely target specific proteins that reduce the

body’s ability to fight cancer, without the need for specialized formulations or drug delivery systems. Our efforts are focused

on developing immuno-oncology therapeutics using our INTASYL platform. We have demonstrated preclinical efficacy in both direct-to-tumor

injection and adoptive cell therapy (“ACT”) applications with our INTASYL compounds.

PH-762

PH-762 is an INTASYL compound

designed to reduce the expression of cell death protein 1 (“PD-1”). PD-1 is a protein that inhibits T cells’

ability to kill cancer cells and is a clinically validated target in immunotherapy. Decreasing the expression of PD-1 can thereby increase

the capacity of T cells, which protect the body from cancer cells and infections, to kill cancer cells.

Our preclinical studies have

demonstrated that direct-to-tumor application of PH-762 resulted in potent anti-tumoral effects and have shown that direct-to-tumor treatment

with PH-762 inhibits tumor growth in a dose dependent fashion in PD-1 responsive and refractory models. Importantly, direct-to-tumor administration

of PH-762 resulted in activity against distant untreated tumors, indicative of a systemic anti-tumor response. We believe these data further

support the potential for PH-762 to provide a strong local immune response without the dose immune-related adverse effects seen with systemic

antibody therapy.

In November 2023, we announced

the first patient dosed in our U.S. multi-center Phase 1b clinical trial with PH-762 under a previously cleared Investigational New Drug

(“IND”) application by the Food and Drug Administration. Intratumoral injection of PH-762 in this dose-escalating trial

will treat patients with cutaneous squamous cell carcinoma, melanoma and Merkel cell carcinoma and is currently open for continued enrollment

of patients. This trial is designed to evaluate the safety and tolerability of neoadjuvant use of intratumorally injected PH-762, assess

the tumor response, and determine the dose or dose range for continued study of PH-762.

Given our intention to focus

our efforts and resources on our U.S. clinical trial with PH-762, we have completed the winding down process for our first-in-human clinical

trial for PH-762 in France, which was limited to the treatment of patients with metastatic melanoma. Safety data from the initial cohort

of three patients in the French clinical trial were evaluated by a data monitoring committee in the first quarter of 2023. The safety

data review disclosed no dose-limiting toxicity, and no drug-related severe or serious adverse events.

Due to INTASYL’s ease

of administration, we have shown that our compounds can easily be incorporated into current ACT manufacturing processes. In ACT, T cells

are usually taken from a patient's own blood or tumor tissue, grown in large numbers in a laboratory, and then given back to the patient

to help the immune system fight cancer. By treating T cells with our INTASYL compounds while they are being grown in the laboratory, we

believe our INTASYL compounds can improve these immune cells to make them more effective in killing cancer. Preclinical data generated

in collaboration with AgonOx, Inc. (“AgonOx”), a private company developing a pipeline of novel immunotherapy drugs

targeting key regulators of the immune response to cancer, demonstrated that treating AgonOx’s “double positive” tumor

infiltrating lymphocytes (“DP TIL”) with PH-762 increased their tumor killing activity by two-fold.

In March 2021, we entered

into a clinical co-development collaboration agreement (the “Clinical Co-Development Agreement”) with AgonOx to develop

a T cell-based therapy using PH-762 and AgonOx’s DP TIL. Under the Clinical Co-Development Agreement, we committed to provide

financial support for development costs of up to $4 million to AgonOx for expenses incurred to conduct a Phase 1 clinical trial of PH-762

treated DP TIL in patients with advanced melanoma and other advanced solid tumors. We are also eligible to receive certain future development

milestones and low single-digit sales-based royalty payments from AgonOx’s licensing of its DP TIL technology.

PH-762 treated DP TIL are

being evaluated in a Phase 1 clinical trial in the United States with up to 18 patients with advanced melanoma and other advanced solid

tumors by AgonOx. The primary trial objectives are to evaluate the safety and to study the potential for enhanced therapeutic benefit

from the administration of PH-762 treated DP TIL. The Company announced the first patient was dosed in August 2023 and the trial is open

for the continued enrollment of patients.

As of September 30, 2023,

there is approximately $2,964,000 of remaining costs not yet incurred under the Clinical Co-Development Agreement.

PH-894

PH-894 is an INTASYL compound

that is designed to silence BRD4, a protein that controls gene expression in both T cells and tumor cells, thereby effecting the immune

system as well as the tumor. Intracellular and/or commonly considered “undruggable” targets, such as BRD4, represent a challenge

for small molecule and antibody therapies. Therefore, what sets this compound apart is its dual mechanism: PH-894 suppression of BRD4

in T cells results in T cell activation, and suppression of BRD4 in tumor cells results in tumors becoming more sensitive to being killed

by T cells.

Preclinical studies conducted

have demonstrated that PH-894 resulted in a strong, concentration dependent and durable silencing of BRD4 in T cells and in various cancer

cells. Similar to PH-762, preclinical studies have also shown that direct-to-tumor application of PH-894 resulted in potent and statistically

significant anti-tumoral effects against distant untreated tumors, indicative of a systemic anti-tumor response. These preclinical data

indicate that PH-894 can reprogram T cells and other cells in the tumor microenvironment to provide enhanced immunotherapeutic activity.

We have completed the IND-enabling studies and are in the process of continuing to finalize the study reports required for an IND submission

with PH-894. As a result of the reprioritization to advance our clinical trial with PH-762 in the U.S., we have elected to defer the IND

submission for PH-894.

Critical Accounting Policies and Estimates

The discussion and analysis

of our financial condition and results of operations are based upon our condensed consolidated financial statements, which have been prepared

in accordance with accounting principles generally accepted in the United States. The preparation of these condensed consolidated financial

statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses,

and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates and base our estimates on

historical experience and various other assumptions that are believed to be reasonable under the circumstances. Actual results may differ

from these estimates under different assumptions or conditions and could have a material impact on our reported results.

There have been no material

changes to our critical accounting policies and estimates as compared to those disclosed in our 2022 Form 10-K.

Results of Operations

The following table summarizes the results of our

operations for the periods indicated, in thousands:

| | |

Three Months Ended

September 30, | | |

| | |

Nine Months Ended

September 30, | | |

| |

| Description | |

2023 | | |

2022 | | |

Dollar Change | | |

2023 | | |

2022 | | |

Dollar

Change | |

| Operating expenses | |

$ | 2,776 | | |

$ | 3,571 | | |

$ | (795 | ) | |

$ | 8,925 | | |

$ | 8,732 | | |

$ | 193 | |

| Operating loss | |

$ | (2,776 | ) | |

$ | (3,571 | ) | |

$ | 795 | | |

$ | (8,925 | ) | |

$ | (8,732 | ) | |

$ | (193 | ) |

| Net loss | |

$ | (2,780 | ) | |

$ | (3,576 | ) | |

$ | 796 | | |

$ | (8,931 | ) | |

$ | (8,749 | ) | |

$ | (182 | ) |

Comparison of the Three and Nine Months Ended September 30, 2023

and 2022

Operating Expenses

The following table summarizes our total operating

expenses, for the periods indicated, in thousands:

| | |

Three Months Ended

September 30, | | |

| | |

Nine Months Ended

September 30, | | |

| |

| Description | |

2023 | | |

2022 | | |

Dollar Change | | |

2023 | | |

2022 | | |

Dollar Change | |

| Research and development | |

$ | 1,808 | | |

$ | 2,508 | | |

$ | (700 | ) | |

$ | 5,325 | | |

$ | 5,398 | | |

$ | (73 | ) |

| General and administrative | |

| 968 | | |

| 1,063 | | |

| (95 | ) | |

| 3,600 | | |

| 3,334 | | |

| 266 | |

| Total operating expenses | |

$ | 2,776 | | |

$ | 3,571 | | |

$ | (795 | ) | |

$ | 8,925 | | |

$ | 8,732 | | |

$ | 193 | |

Research and Development Expenses

Research and development

expenses relate to compensation and benefits for research and development personnel, facility-related expenses, supplies, external services,

costs to acquire technology licenses, research activities under our research collaboration, expenses associated with preclinical and

clinical development activities and other operating costs. Our research and development programs are focused on the development of immuno-oncology

therapeutics based on our INTASYL therapeutic platform. Since we commenced operations, research and development expenses have been a

significant portion of our total operating expenses and are expected to constitute the majority of our spending for the foreseeable future.

Research and development expenses

for the three months ended September 30, 2023 decreased 28% as compared to the three months ended September 30, 2022. The decrease in

research and development expenses was primarily due to the completion of our IND-enabling preclinical studies for PH-894 of approximately

$1,515,000, partially offset by an increase in clinical-related costs of approximately $788,000 for our two U.S. PH-762 Phase 1 clinical

trials as compared to the prior year period.

Research and development

expenses for the nine months ended September 30, 2023 decreased 1% as compared to the nine months ended September 30, 2022. The

change in research and development expenses was primarily due to a decrease in costs related to the completion of our IND-enabling

preclinical studies for PH-894 of approximately $1,562,000 and reduced lab supplies of approximately $218,000 as a result of a

decrease in lab personnel, partially offset by an increase in clinical-related costs of approximately $1,647,000 for our two

U.S. PH-762 Phase 1 clinical trials as compared to the prior year period.

We anticipate research and

development expenses to increase as a result of our clinical-related activities as our programs progress in clinical development.

General and Administrative Expenses

General and administrative

expenses relate to compensation and benefits for general and administrative personnel, facility-related expenses, professional fees for

legal and patent-related activities, audit, tax and consulting services, as well as other general corporate expenses.

General and administrative

expenses for the three months ended September 30, 2023 decreased 9% as compared to the three months ended September 30, 2022. The decrease

was primarily due to the reduced use of business development consultants of approximately $73,000 as compared to the prior year period.

General and administrative

expenses for the nine months ended September 30, 2023 increased 8% as compared to the nine months ended September 30, 2022. The increase

in general and administrative expenses was primarily due to higher legal fees of approximately $359,000 and audit fees of $62,000, partially

offset by decreases in payroll-related expenses, including executive search-related fees, of approximately $190,000 due to changes in

headcount as compared to the prior year period.

Liquidity and Capital Resources

Historically, our primary

source of funding has been through the sale of our securities. In the future, we will be dependent on obtaining funding from third parties,

such as proceeds from the issuance of debt, sale of equity or strategic opportunities, in order to maintain our operations. We have reported

recurring losses from operations since inception and expect that we will continue to have negative cash flows from our operations for

the foreseeable future. At September 30, 2023, we had cash of $8,407,000 as compared with $11,781,000 at December 31, 2022.

During the nine months ended

September 30, 2023, we completed the April 2023 Financing and June 2023 Financing (each as defined in Note 6 to our condensed consolidated

interim financial statements) and received total net proceeds of $5,048,000 after deducting placement agent fees and offering expenses.

For further information regarding the April 2023 Financing and June 2023 Financing, see Note 6 to our condensed consolidated interim financial

statements included elsewhere in this Quarterly Report.

We have limited cash resources,

have reported recurring losses from operations since inception and have not yet received product revenues. These factors raise substantial

doubt regarding our ability to continue as a going concern, and our current cash resources may not provide sufficient capital to fund

operations for at least the next 12 months from the date of the release of the financial statements included elsewhere in this Quarterly

Report. Our continuation as a going concern depends upon our ability to raise additional capital through equity offerings, debt offerings

and/or strategic opportunities to fund our operations. There can be no assurance that we will be successful in accomplishing any of these

plans in order to continue as a going concern. The financial statements included elsewhere in this Quarterly Report do not include any

adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary

should we be unable to continue as a going concern.

The following table summarizes

our cash flows for the periods indicated, in thousands:

| | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | |

| Net cash used in operating activities | |

$ | (8,379 | ) | |

$ | (9,424 | ) |

| Net cash used in investing activities | |

| (5 | ) | |

| (121 | ) |

| Net cash provided by (used in) financing activities | |

| 5,010 | | |

| (28 | ) |

| Net decrease in cash and restricted cash | |

$ | (3,374 | ) | |

$ | (9,573 | ) |

Net Cash Flow from Operating Activities

Net cash used in operating activities for the nine months ended September