Phio Pharmaceuticals Reports Third Quarter 2023 Financial Results and Provides Business Update

November 09 2023 - 4:30PM

Phio Pharmaceuticals Corp. (Nasdaq: PHIO), a clinical stage

biotechnology company whose proprietary INTASYL™ RNAi platform

technology is designed to make immune cells more effective in

killing tumor cells, today reported its financial results for the

quarter ended September 30, 2023 and provided a business update.

“We have enrolled the first patient in our U.S. clinical trial

with PH-762,” announced Phio’s President & CEO, Robert

Bitterman. “The initiation of enrollment in this trial represents a

milestone as we develop PH-762 for the treatment of squamous cell

and other skin cancers. We are optimistic that this novel,

alternative immuno-oncology therapy may offer patients and their

care providers, enhanced therapeutic outcomes while minimizing

invasive intervention.”

Recent Corporate Updates

- Enrolled the first patient in its

Phase 1b clinical trial of lead product candidate, PH-762.

- Presented new data about its PH-894

INTASYL compound, which targets BRD4, at the AACR-NCI-EORTC

International Conference on Molecular Targets and Cancer

Therapeutics in Boston.

- Presented new data new data showing

INTASYL compound targeting CTLA-4 enhances tumor control at the

Annual Meeting of the Society for Immunotherapy of Cancer

(SITC).

Financial Results

Cash Position

At September 30, 2023, the Company had cash of $8.4 million as

compared with $11.8 million at December 31, 2022.

Research and Development Expenses

Research and development expenses were $1.8 million for the

quarter ended September 30, 2023 as compared with $2.5 million for

the quarter ended September 30, 2022, a decrease of 28%. The

decrease was primarily due to decreased costs with the completion

of the Company’s IND-enabling preclinical studies for PH-894

partially offset by an increase in clinical-related costs for the

Company’s two U.S. PH-762 Phase 1 clinical trials as compared to

the prior year period.

General and Administrative Expenses

General and administrative expenses were $1.0 million for the

quarter ended September 30, 2023 as compared with $1.1 million for

the quarter ended September 30, 2022, a decrease of 9%. The

decrease was primarily due to the reduced use of business

development consultants as compared to the prior year period.

Net Loss

Net loss was $2.8 million, or $1.14 per share, for the quarter

ended September 30, 2023 as compared with $3.6 million, or $3.14

per share, for the quarter ended September 30, 2022. The decrease

was primarily due to the changes in research and development

expenses, as described above.

About Phio Pharmaceuticals Corp.

Phio Pharmaceuticals Corp. (Nasdaq: PHIO) is a clinical stage

biotechnology company whose proprietary INTASYL™ RNAi technology is

designed to make immune cells more effective in killing tumor

cells. INTASYL is the only self-delivering RNAi technology focused

on immuno-oncology therapeutics. INTASYL drugs are designed to

precisely target specific proteins that reduce the body's ability

to fight cancer, without the need for specialized formulations or

drug delivery systems.

For additional information, visit the Company's website,

www.phiopharma.com.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements can be identified by words such as

"intends," "believes," "anticipates," "indicates," "plans,"

"expects," "suggests," "may," "would," "should," "potential,"

"designed to," "will," "ongoing," "estimate," "forecast," "target,"

"predict," "could" and similar references, although not all

forward-looking statements contain these words. These statements

are based only on our current beliefs, expectations and assumptions

and are subject to inherent uncertainties, risks and changes in

circumstances that are difficult to predict and many of which are

outside of our control. Our actual results may differ materially

from those indicated in the forward-looking statements as a result

of a number of important factors, including, but not limited to,

the impact to our business and operations by inflationary

pressures, rising interest rates, recession fears, the development

of our product candidates, results from our preclinical and

clinical activities, our ability to execute on business strategies,

our ability to develop our product candidates with collaboration

partners, and the success of any such collaborations, the timeline

and duration for advancing our product candidates into clinical

development, the timing or likelihood of regulatory filings and

approvals, the success of our efforts to commercialize our product

candidates if approved, our ability to manufacture and supply our

product candidates for clinical activities, and for commercial use

if approved, the scope of protection we are able to establish and

maintain for intellectual property rights covering our technology

platform, our ability to obtain future financing, market and other

conditions and those identified in our Annual Report on Form 10-K

and subsequent Quarterly Reports on Form 10-Q under the caption

"Risk Factors" and in other filings the Company periodically makes

with the SEC. Readers are urged to review these risk factors and to

not act in reliance on any forward-looking statements, as actual

results may differ from those contemplated by our forward-looking

statements. Phio does not undertake to update forward-looking

statements to reflect a change in its views, events or

circumstances that occur after the date of this release, except as

required by law.

Contact:

Phio Pharmaceuticals Corp.ir@phiopharma.com

PR Contact:

Michael AdamsBridge View Mediapr@phiopharma.com

PHIO PHARMACEUTICALS

CORP.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (Amounts in thousands, except share and

per share data) (Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months

EndedSeptember 30, |

|

|

Nine Months EndedSeptember

30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

1,808 |

|

|

$ |

2,508 |

|

|

$ |

5,325 |

|

|

$ |

5,398 |

|

|

General and administrative |

|

|

968 |

|

|

|

1,063 |

|

|

|

3,600 |

|

|

|

3,334 |

|

|

Total operating expenses |

|

|

2,776 |

|

|

|

3,571 |

|

|

|

8,925 |

|

|

|

8,732 |

|

| Operating loss |

|

|

(2,776 |

) |

|

|

(3,571 |

) |

|

|

(8,925 |

) |

|

|

(8,732 |

) |

| Total other expense, net |

|

|

(4 |

) |

|

|

(5 |

) |

|

|

(6 |

) |

|

|

(17 |

) |

| Net loss |

|

$ |

(2,780 |

) |

|

$ |

(3,576 |

) |

|

$ |

(8,931 |

) |

|

$ |

(8,749 |

) |

| Net loss per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(1.14 |

) |

|

$ |

(3.14 |

) |

|

$ |

(5.03 |

) |

|

$ |

(7.70 |

) |

| Weighted average number of

common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

2,440,164 |

|

|

|

1,138,571 |

|

|

|

1,775,043 |

|

|

|

1,135,744 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHIO PHARMACEUTICALS

CORP.CONDENSED CONSOLIDATED BALANCE

SHEETS (Amounts in thousands, except share

data) (Unaudited)

| |

|

|

|

|

|

|

| |

|

September 30,2023 |

|

|

December 31,2022 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

8,407 |

|

|

$ |

11,781 |

|

|

Restricted cash |

|

|

50 |

|

|

|

50 |

|

|

Prepaid expenses and other current assets |

|

|

871 |

|

|

|

615 |

|

| Right of use asset |

|

|

66 |

|

|

|

161 |

|

| Property and equipment,

net |

|

|

142 |

|

|

|

183 |

|

| Other assets |

|

|

3 |

|

|

|

24 |

|

|

Total assets |

|

$ |

9,539 |

|

|

$ |

12,814 |

|

| LIABILITIES, PREFERRED

STOCK AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

173 |

|

|

$ |

779 |

|

|

Accrued expenses |

|

|

2,083 |

|

|

|

1,025 |

|

|

Lease liability |

|

|

70 |

|

|

|

170 |

|

|

Total preferred stock |

|

|

– |

|

|

|

2 |

|

|

Total stockholders’ equity |

|

|

7,213 |

|

|

|

10,838 |

|

|

Total liabilities, preferred stock and stockholders’ equity |

|

$ |

9,539 |

|

|

$ |

12,814 |

|

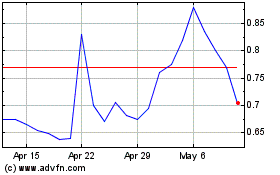

Phio Pharmaceuticals (NASDAQ:PHIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

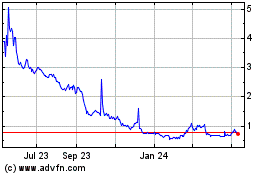

Phio Pharmaceuticals (NASDAQ:PHIO)

Historical Stock Chart

From Apr 2023 to Apr 2024