FALSE0001641489NASDAQ00016414892023-11-092023-11-0900016414892023-08-112023-08-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): November 09, 2023

vTv Therapeutics Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-37524 | 47-3916571 |

(State or other jurisdiction of incorporation) | (Commission File No.) | (IRS Employer Identification No.) |

3980 Premier Drive, Suite 310

High Point, NC 27265

(Address of principal executive offices)

(336) 841-0300

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.01 per share | VTVT | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition

On November 9, 2023, vTv Therapeutics Inc. issued a press release to announce its financial results for the fiscal period ended September 30, 2023. A copy of the press release is attached as Exhibit 99.1 to this current report on Form 8-K and is incorporated herein by reference.

The information in this report (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18, of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | |

| VTV THERAPEUTICS INC. | |

| | | |

| By: | /s/ Paul J. Sekhri | |

| Name: | Paul J. Sekhri | |

| Title: | President and Chief Executive Officer | |

Dated: November 9, 2023

Exhibit 99.1

Exhibit 99.1vTv Therapeutics Announces 2023 Third Quarter Financial Results and Provides Corporate Update

HIGH POINT, N.C. - November 9, 2023 – vTv Therapeutics Inc. (Nasdaq: VTVT), a clinical stage biopharmaceutical company focused on the development of cadisegliatin (TTP399) as an adjunctive therapy to insulin for the treatment of type 1 diabetes ("T1D"), today reported financial results for the third quarter ended September 30, 2023, and provided an update on recent corporate developments.

“Our newly appointed Chief Medical Officer, Dr. Thomas Strack, who has been working with us on a consulting basis for several months, is now leading our work on the cadisegliatin Phase 3 program with the goal of initiating studies as soon as possible,” said Paul Sekhri, Chief Executive Officer of vTv. “Additionally, our partnered programs including azeliragon, licensed to Cantex Pharmaceuticals and mavodelpar, licensed to Reneo Pharmaceuticals, are advancing in the clinic and have the potential, if successful, to generate incremental value for vTv. As we approach the end of the year, we believe that 2024 could be a transformational year for our company and look forward to providing additional updates along the way.”

Recent Company Highlights

•On November 2, 2023, the Company announced the appointment of Thomas Strack, M.D., as Chief Medical Officer.

•On November 1, 2023, the Company announced that it has entered into a common stock repurchase agreement with Reneo Pharmaceuticals, Inc. through which Reneo has purchased all of its common stock held by the Company for total proceeds to the Company of approximately $4.4 million.

Third Quarter 2023 Financial Results

•Cash Position: The Company’s cash position as of September 30, 2023, was $8.2 million compared to $12.1 million as of December 31, 2022.

•Research & Development (R&D) Expenses: R&D expenses were $2.8 million and $3.1 million in each of the three months ended September 30, 2023 and 2022, respectively. The decrease is primarily attributable to lower spending on cadisegliatin, due to decreases in drug product related costs, offset by an increase in indirect costs related to the development of cadisegliatin.

•General & Administrative (G&A) Expenses: G&A expenses were $2.5 million and $2.6 million for each of the three months ended September 30, 2023 and 2022, respectively. The decrease of $0.1 million was primarily due to decreases in legal expense, and other G&A costs, partially offset by increases in payroll costs and share-based expense.

•Other (Expense) Income, net: Other expense for the three months ended September 30, 2023, was $3.3 million and was driven by the recording of an impairment charge on a cost-method investment and an unrealized gain related to our investment in Reneo, as well as gains related to the change in the fair value of the outstanding warrants to purchase shares of our stock issued to related parties. Other income for the three months ended September 30, 2022, was $0.1 million and was driven by an unrealized gain related to the investment in Reneo as

well as the losses related to the change in the fair value of the outstanding warrants to purchase shares of our own stock issued to related parties.

•Net Loss: Net loss attributable to vTv shareholders for the three months ended September 30, 2023, was $6.7 million or $0.08 per basic share. Net loss attributable to vTv shareholders for the comparable period a year ago was $4.3 million or $0.05 per basic share.

vTv Therapeutics Inc.

Condensed Consolidated Balance Sheets

(in thousands)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| (Unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 8,238 | | | $ | 12,126 | |

| Accounts receivable | — | | | 173 | |

| G42 Promissory Note receivable | — | | | 12,243 | |

| Prepaid expenses and other current assets | 1,872 | | | 2,537 | |

| Current deposits | 15 | | | 15 | |

| Total current assets | 10,125 | | | 27,094 | |

| Property and equipment, net | 140 | | | 207 | |

| Operating lease right-of-use assets | 272 | | | 349 | |

| Long-term investments | 4,387 | | | 5,588 | |

| Total assets | $ | 14,924 | | | $ | 33,238 | |

| Liabilities, Redeemable Noncontrolling Interest and Stockholders’ Deficit | | | |

| Current liabilities: | | | |

| Accounts payable and accrued expenses | $ | 9,620 | | | $ | 7,313 | |

| Current portion of operating lease liabilities | 165 | | | 154 | |

| Current portion of contract liabilities | 17 | | | 17 | |

| Current portion of notes payable | 473 | | | 224 | |

| Total current liabilities | 10,275 | | | 7,708 | |

| Contract liabilities, net of current portion | 18,669 | | | 18,669 | |

| Operating lease liabilities, net of current portion | 213 | | | 338 | |

| Warrant liability, related party | 278 | | | 684 | |

| Total liabilities | 29,435 | | | 27,399 | |

| Commitments and contingencies | | | |

| Redeemable noncontrolling interest | 10,722 | | | 16,579 | |

| Stockholders’ deficit: | | | |

| Class A Common Stock | 815 | | | 815 | |

| Class B Common Stock | 232 | | | 232 | |

| | | |

| Additional paid-in capital | 254,912 | | | 253,737 | |

| Accumulated deficit | (281,192) | | | (265,524) | |

| Total stockholders’ deficit attributable to vTv Therapeutics Inc. | (25,233) | | | (10,740) | |

| Total liabilities, redeemable noncontrolling interest and stockholders’ deficit | $ | 14,924 | | | $ | 33,238 | |

vTv Therapeutics Inc.

Condensed Consolidated Statements of Operations

(in thousands, except per share data) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (Unaudited) | | (Unaudited) |

| Revenue | $ | — | | $ | — | | $ | — | | $ | 2,009 |

| Operating expenses: | | | | | | | |

| Research and development | 2,824 | | 3,055 | | 11,457 | | 8,393 |

| General and administrative | 2,544 | | 2,634 | | 9,338 | | 9,813 |

| Total operating expenses | 5,368 | | 5,689 | | 20,795 | | 18,206 |

| Operating loss | (5,368) | | (5,689) | | (20,795) | | (16,197) |

| Interest income | 131 | | 150 | | 384 | | 200 |

| Interest expense | (4) | | (8) | | (6) | | (9) |

| Other (expense) income, net | (3,299) | | 79 | | (1,108) | | (2,777) |

| Loss before income taxes and noncontrolling interest | (8,540) | | (5,468) | | (21,525) | | (18,783) |

| Income tax provision | — | | — | | — | | 200 |

| Net loss before noncontrolling interest | (8,540) | | (5,468) | | (21,525) | | (18,983) |

| Less: net loss attributable to noncontrolling interest | (1,886) | | (1,207) | | (4,753) | | (4,564) |

| Net loss attributable to vTv Therapeutics Inc. | $ | (6,654) | | $ | (4,261) | | $ | (16,772) | | $ | (14,419) |

| Net loss attributable to vTv Therapeutics Inc. common shareholders | $ | (6,654) | | | $ | (4,261) | | | $ | (16,772) | | | $ | (14,419) | |

| Net loss per share of vTv Therapeutics Inc. Class A common stock, basic and diluted | $ | (0.08) | | | $ | (0.05) | | | $ | (0.21) | | | $ | (0.20) | |

| Weighted average number of vTv Therapeutics Inc. Class A common stock, basic and diluted | 81,483,600 | | | 80,490,121 | | | 81,483,600 | | | 72,649,531 | |

About vTv Therapeutics

vTv Therapeutics Inc. is a clinical stage biopharmaceutical company focused on developing oral, small molecule drug candidates. vTv has a pipeline of clinical drug candidates led by cadisegliatin (TTP399), a potential adjunctive therapy to insulin for the treatment of type 1 diabetes. vTv’s development partners are pursuing additional indications in type 2 diabetes, chronic obstructive pulmonary disease, renal disease, primary mitochondrial myopathy, and glioblastoma and other cancers and cancer treatment-related conditions.

Forward-Looking Statements

This release contains forward-looking statements, which involve risks and uncertainties. These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” and, in each case, their negative or other various or comparable terminology. All statements other than statements of historical facts contained in this release, including statements regarding the timing of and our ability to launch our cadisegliatin Phase 3 program, our discussions related to the financing, partnering and/or licensing of cadisegliatin, the therapeutic potential of mavodelpar, Reneo’s upcoming data readout, potential milestone payments and royalties that we may receive, our strategy, future operations, future financial position, future revenue, prospects, plans and objectives of management are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Important factors that could cause our results to vary from expectations include those described under the heading “Risk Factors” in our Annual Report on Form 10-K, as may be updated by our subsequent Quarterly Reports on Form 10-Q, and our other filings with the SEC. These forward-looking statements reflect our views with respect to future events as of the date of this release and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements represent our estimates and assumptions only as of the date of this release and, except as required by law, we undertake no obligation to update or review publicly any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this release. We anticipate that subsequent events and developments will cause our views to change. Our forward-looking statements do not reflect the potential impact of any

future acquisitions, merger, dispositions, joint ventures, or investments we may undertake. We qualify all of our forward-looking statements by these cautionary statements.

Contacts:

Investors:

Lee Roth

Burns McClellan

lroth@burnsmc.com

Media:

Selina Husain / Robert Flamm, Ph.D.

Burns McClellan, Inc.

shusain@burnsmc.com / rflamm@burnsmc.com

v3.23.3

Cover

|

Nov. 09, 2023 |

Aug. 11, 2023 |

| Cover [Abstract] |

|

|

| Document Type |

8-K

|

|

| Document Period End Date |

Nov. 09, 2023

|

|

| Entity Registrant Name |

vTv Therapeutics Inc.

|

|

| Entity Incorporation, State or Country Code |

DE

|

|

| Entity File Number |

001-37524

|

|

| Entity Tax Identification Number |

47-3916571

|

|

| Entity Address, Address Line One |

3980 Premier Drive, Suite 310

|

|

| Entity Address, City or Town |

High Point

|

|

| Entity Address, State or Province |

NC

|

|

| Entity Address, Postal Zip Code |

27265

|

|

| City Area Code |

336

|

|

| Local Phone Number |

841-0300

|

|

| Written Communications |

false

|

|

| Soliciting Material |

false

|

|

| Pre-commencement Tender Offer |

false

|

|

| Pre-commencement Issuer Tender Offer |

false

|

|

| Title of 12(b) Security |

Class A common stock, par value $0.01 per share

|

|

| Trading Symbol |

VTVT

|

|

| Security Exchange Name |

NASDAQ

|

|

| Entity Emerging Growth Company |

|

false

|

| Amendment Flag |

false

|

|

| Entity Central Index Key |

0001641489

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

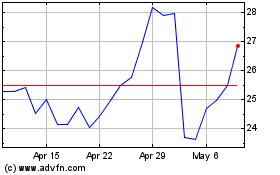

vTv Therapeutics (NASDAQ:VTVT)

Historical Stock Chart

From Mar 2024 to Apr 2024

vTv Therapeutics (NASDAQ:VTVT)

Historical Stock Chart

From Apr 2023 to Apr 2024