false0001575793Energous Corp00015757932023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 09, 2023 |

Energous Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36379 |

46-1318953 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

3590 North First Street Suite 210 |

|

San Jose, California |

|

95134 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (408) 963-0200 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.00001 par value |

|

WATT |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2023, Energous Corporation announced its unaudited financial results for the quarter ended September 30, 2023. A copy of the press release announcing the results is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act") or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ENERGOUS CORPORATION |

|

|

|

|

Date: |

November 9, 2023 |

By: |

/s/ Cesar Johnston |

|

|

|

Cesar Johnston

President and Chief Executive Officer |

Exhibit 99.1

Energous Corporation Reports 2023 Third-Quarter Results

SAN JOSE, Calif. – November 9, 2023 – Energous Corporation (NASDAQ: WATT), a leading developer of RF-based charging for wireless power networks, today announced financial results for its third quarter ended September 30, 2023.

Unaudited 2023 Third-Quarter Financial Results

For the third quarter ended September 30, 2023, Energous reported:

•Revenue of approximately $168,708, a 44% increase over Q2 2023

•Costs and expenses of approximately $5.3 million, with approximately $48,394 in cost of revenue, $2.5 million in research and development expenses, and $2.5 million in sales, marketing, general and administrative expenses

•Net loss of approximately $(4.1) million, or $(0.86) per basic and diluted share, compared to a net loss of approximately $(5.9) million, or $(1.54) per basic and diluted share in the third quarter of 2022

•Adjusted net non-GAAP loss of approximately $(4.2) million

•Adjusted non-GAAP costs and expenses of $4.6 million, an 18.0% reduction from Q3 2022

•Approximately $16.6 million in cash and cash equivalents at the end of the third quarter, with no debt

Partnership Momentum

•Energous and WiGL — On August 8, the Company announced the next phase of its partnership with WiGL, a developer of touchless wireless charging for IoT devices for wireless power networks, to develop and commercialize IoT products that will be wirelessly powered over distance. The Air Force Research Lab at the U.S. Department of Defense funded the first phase of the project early last year to develop and design tWPT products for military and commercial use. In the project's second phase, Energous’ PowerBridges will continue to provide radio frequency-based (RF) wireless power over distance for WiGL’s tWPT networks.

•Energous and Veea — On September 20, the Company announced it had joined with Veea Inc., a leader in integrated smart edge connectivity, computing and security technologies, to combine wireless power and edge computing for real-time asset tracking in rapidly growing IoT sectors. The combined technologies were showcased in a proof of concept at the AT&T Mexico Innovation Lab in Mexico City that was designed to demonstrate the real-world relevance and transformative potential of the solutions offered by Energous and Veea in expanding the IoT landscape.

•Energous and InPlay — On September 26, the Company announced a partnership with InPlay Inc., a fabless semiconductor company, to demonstrate a battery-free temperature and humidity IoT sensor solution. This innovation harnesses the strengths of Energous' PowerBridge technology and InPlay's cutting-edge Bluetooth low-energy beacon system.

“In the third quarter of 2023, we continued to see strong growth in the number of customers utilizing Energous technology in proof of concept deployments, where it is not only proving to be an effective wireless power solution but also demonstrates its potential to optimize IoT environments,” said Cesar Johnston, CEO of Energous. “Aiding this growth is the expansion of our partnership platform, as we continue to seek to bring on additional technology, distribution and IoT System Integrator partners that can help validate our core technology, amplify the benefits of our solutions in key markets, and increase our commercial potential.”

2023 Third-Quarter Conference Call

Energous will host a conference call to discuss third-quarter financial results, recent progress and prospects for the future.

•When: Thursday, November 9, 2023

•Time: 1:30 p.m. PT (4:30 p.m. ET)

•Phone: 800-830-9649 (domestic); + 1-213-992-4624 (international)

•Conference replay: Accessible through November 23, 2023

800-645-7964 (domestic); + 757-849-6722 (international); passcode 7514 #

•Webcast: Accessible at Energous.com; archive available through November 2024

About Energous Corporation

Energous Corporation (NASDAQ: WATT) has been pioneering wireless charging over distance technology since 2012. Today, as the global leader in wireless charging over distance, its networks are safely and seamlessly powering its customers’ RF-based systems in a variety of industries, including retail, industrial, healthcare and more. Its total network solution is designed to support a variety of applications, including inventory and asset tracking, smart manufacturing, electronic shelf labels, IoT sensors, digital supply chain management, inventory management, loss prevention, patient/people tracking and sustainability initiatives. The number of industries and applications it serves is rapidly growing as it works to support the next generation of the IoT ecosystem.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this press release are forward-looking statements. Forward-looking statements may describe our future plans and expectations and are based on the current beliefs, expectations and assumptions of Energous. These statements generally use terms such as “believe,” “expect,” “may,” “will,” “should,” “could,” “seek,” “intend,” “plan,” “estimate,” “anticipate” or similar terms. Examples of forward-looking statements in this release include but are not limited to statements about our financial results and projections, statements about the success of our collaborations with our partners, statements about our technology and its expected functionality, and statements with respect to expected company growth. Factors that could cause actual results to differ from current expectations include: uncertain timing of necessary regulatory approvals; timing of customer product development and market success of customer products; our dependence on distribution partners; and intense industry competition. We urge you to consider those factors, and the other risks and uncertainties described in our most recent annual report on Form 10-K as filed with the Securities and Exchange Commission (SEC), any subsequently filed quarterly reports on Form 10-Q as well as in other documents that may have been subsequently filed by Energous, from time to time, with the SEC, in evaluating our forward-looking statements. In addition, any forward-looking statements represent Energous’ views only as of the date of this release and should not be relied upon as representing its views as of any subsequent date. Energous does not assume any obligation to update any forward-looking statements unless required by law.

Non-GAAP Financial Measures

We have provided in this release financial information that has not been prepared in accordance with accounting standards generally accepted in the United States of America (“GAAP”). We use these non-GAAP financial measures internally in analyzing our financial results and believe they are useful to investors, as a supplement to GAAP measures, in evaluating our ongoing operational performance. We believe that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends, and in comparing our financial results with other companies in our industry, many of which present similar non-GAAP financial measures to investors.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures below.

Our reported results include certain non-GAAP financial measures, including net non-GAAP loss, non-GAAP costs and expenses, non-GAAP sales, marketing, general and administrative expenses (SG&A) and non-GAAP research and development expenses (R&D). Net non-GAAP loss excludes depreciation and amortization, stock-based compensation expense, severance expense, offering costs relating to warrant liability and change in fair value of warrant liability. Non-GAAP costs and expenses excludes depreciation and amortization, stock-based compensation expense and severance expense. Non-GAAP SG&A excludes depreciation and amortization and stock-based compensation expense. Non-GAAP R&D excludes depreciation and amortization and stock-based compensation expense. A reconciliation of our non-GAAP financial measures to their most directly comparable GAAP measures has been provided in the financial statement tables included below in this press release.

– Financial Tables Follow –

Energous Corporation

BALANCE SHEETS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

ASSETS |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

16,578,659 |

|

|

$ |

26,287,293 |

|

Accounts receivable, net |

|

|

120,198 |

|

|

|

143,353 |

|

Inventory |

|

|

199,616 |

|

|

|

105,821 |

|

Prepaid expenses and other current assets |

|

|

896,253 |

|

|

|

827,551 |

|

Total current assets |

|

|

17,794,726 |

|

|

|

27,364,018 |

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

388,505 |

|

|

|

429,035 |

|

Operating lease right-of-use assets |

|

|

1,411,930 |

|

|

|

1,959,869 |

|

Total assets |

|

$ |

19,595,161 |

|

|

$ |

29,752,922 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

768,941 |

|

|

$ |

900,765 |

|

Accrued expenses |

|

|

1,672,936 |

|

|

|

1,790,414 |

|

Accrued severance expense |

|

|

202,946 |

|

|

|

416,516 |

|

Warranty liability |

|

|

450,000 |

|

|

|

— |

|

Operating lease liabilities, current portion |

|

|

696,573 |

|

|

|

705,894 |

|

Deferred revenue |

|

|

24,341 |

|

|

|

29,727 |

|

Total current liabilities |

|

|

3,815,737 |

|

|

|

3,843,316 |

|

|

|

|

|

|

|

|

|

|

Operating lease liabilities, long-tern portion |

|

|

739,767 |

|

|

|

1,264,131 |

|

Total liabilities |

|

|

4,555,504 |

|

|

|

5,107,447 |

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

Preferred Stock, $0.00001 par value, 10,000,000 shares authorized at September 30, 2023 and December 31, 2022; no shares issued or outstanding at September 30, 2023 and December 31, 2022 |

|

|

— |

|

|

|

— |

|

Common Stock, $0.00001 par value, 200,000,000 shares authorized at September 30, 2023 and December 31, 2022; 5,046,994 and 3,947,267 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively. |

|

|

925 |

|

|

|

789 |

|

Additional paid-in capital |

|

|

392,476,298 |

|

|

|

387,319,985 |

|

Accumulated deficit |

|

|

(377,437,566 |

) |

|

|

(362,675,299 |

) |

Total stockholders' equity |

|

|

15,039,657 |

|

|

|

24,645,475 |

|

Total liabilities and stockholders' equity |

|

$ |

19,595,161 |

|

|

$ |

29,752,922 |

|

Energous Corporation

STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

168,708 |

|

|

$ |

223,201 |

|

|

$ |

382,517 |

|

|

$ |

672,133 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

48,394 |

|

|

|

420,060 |

|

|

|

270,025 |

|

|

|

894,693 |

|

Research and development |

|

|

2,460,123 |

|

|

|

2,885,830 |

|

|

|

8,418,779 |

|

|

|

9,622,886 |

|

Sales and marketing |

|

|

774,141 |

|

|

|

1,093,640 |

|

|

|

3,074,163 |

|

|

|

3,865,322 |

|

General and administrative |

|

|

1,698,380 |

|

|

|

1,931,386 |

|

|

|

5,763,811 |

|

|

|

5,983,845 |

|

Severance expense |

|

|

269,109 |

|

|

|

— |

|

|

|

359,419 |

|

|

|

633,444 |

|

Total costs and expenses |

|

|

5,250,147 |

|

|

|

6,330,916 |

|

|

|

17,886,197 |

|

|

|

21,000,190 |

|

Loss from operations |

|

|

(5,081,439 |

) |

|

|

(6,107,715 |

) |

|

|

(17,503,680 |

) |

|

|

(20,328,057 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Offering costs related to warrant liability |

|

|

— |

|

|

|

— |

|

|

|

(591,670 |

) |

|

|

— |

|

Change in fair value of warrant liability |

|

|

788,000 |

|

|

|

— |

|

|

|

2,685,000 |

|

|

|

— |

|

Interest income |

|

|

178,845 |

|

|

|

142,840 |

|

|

|

648,083 |

|

|

|

192,715 |

|

Total other income |

|

|

966,845 |

|

|

|

142,840 |

|

|

|

2,741,413 |

|

|

|

192,715 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(4,114,594 |

) |

|

$ |

(5,964,875 |

) |

|

$ |

(14,762,267 |

) |

|

$ |

(20,135,342 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per common share |

|

$ |

(0.86 |

) |

|

$ |

(1.54 |

) |

|

$ |

(3.30 |

) |

|

$ |

(5.21 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, basic and diluted |

|

|

4,762,187 |

|

|

|

3,879,804 |

|

|

|

4,467,436 |

|

|

|

3,867,330 |

|

Energous Corporation

Reconciliation of Non-GAAP Information

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss (GAAP) |

|

$ |

(4,114,594 |

) |

|

$ |

(5,964,875 |

) |

|

$ |

(14,762,267 |

) |

|

$ |

(20,135,342 |

) |

Add (subtract) the following items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

47,442 |

|

|

|

73,684 |

|

|

|

137,772 |

|

|

|

200,995 |

|

Stock-based compensation |

|

|

368,907 |

|

|

|

698,222 |

|

|

|

1,394,877 |

|

|

|

2,071,253 |

|

Severance expense * |

|

|

269,109 |

|

|

|

— |

|

|

|

359,419 |

|

|

|

633,444 |

|

Offering costs related to warrant liability |

|

|

— |

|

|

|

— |

|

|

|

591,670 |

|

|

|

— |

|

Change in fair value of warrant liability |

|

|

(788,000 |

) |

|

|

— |

|

|

|

(2,685,000 |

) |

|

|

— |

|

Adjusted net non-GAAP loss |

|

$ |

(4,217,136 |

) |

|

$ |

(5,192,969 |

) |

|

$ |

(14,963,529 |

) |

|

$ |

(17,229,650 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Note: Severance expense includes $87,662 in stock-based compensation for the nine months ended September 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses (GAAP) |

|

$ |

5,250,147 |

|

|

$ |

6,330,916 |

|

|

$ |

17,886,197 |

|

|

$ |

21,000,190 |

|

Subtract the following items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

(47,442 |

) |

|

|

(73,684 |

) |

|

|

(137,772 |

) |

|

|

(200,995 |

) |

Stock-based compensation |

|

|

(368,907 |

) |

|

|

(698,222 |

) |

|

|

(1,394,877 |

) |

|

|

(2,071,253 |

) |

Severance expense * |

|

|

(269,109 |

) |

|

|

— |

|

|

|

(359,419 |

) |

|

|

(633,444 |

) |

Adjusted non-GAAP costs and expenses |

|

$ |

4,564,689 |

|

|

$ |

5,559,010 |

|

|

$ |

15,994,129 |

|

|

$ |

18,094,498 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Note: Severance expense includes $87,662 in stock-based compensation for the nine months ended September 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total research and development expenses (GAAP) |

|

$ |

2,460,123 |

|

|

$ |

2,885,830 |

|

|

$ |

8,418,779 |

|

|

$ |

9,622,886 |

|

Subtract the following items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

(42,631 |

) |

|

|

(53,026 |

) |

|

|

(126,980 |

) |

|

|

(118,672 |

) |

Stock-based compensation |

|

|

(138,976 |

) |

|

|

(273,923 |

) |

|

|

(557,767 |

) |

|

|

(922,447 |

) |

Adjusted non-GAAP research and development expenses |

|

$ |

2,278,516 |

|

|

$ |

2,558,881 |

|

|

$ |

7,734,032 |

|

|

$ |

8,581,767 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total sales, marketing, general and administrative expenses (GAAP) |

|

$ |

2,472,521 |

|

|

$ |

3,025,026 |

|

|

$ |

8,837,974 |

|

|

$ |

9,849,167 |

|

Subtract the following items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

(4,811 |

) |

|

|

(20,658 |

) |

|

|

(10,792 |

) |

|

|

(82,323 |

) |

Stock-based compensation |

|

|

(229,931 |

) |

|

|

(424,299 |

) |

|

|

(837,110 |

) |

|

|

(1,148,806 |

) |

Adjusted non-GAAP sales, marketing, general and administrative expenses |

|

$ |

2,237,779 |

|

|

$ |

2,580,069 |

|

|

$ |

7,990,072 |

|

|

$ |

8,618,038 |

|

Contacts

Energous Investor Relations:

Padilla IR

IR@energous.com

Energous Corporate Communications:

SHIFT COMMUNICATIONS

energous@shiftcomm.com

###

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

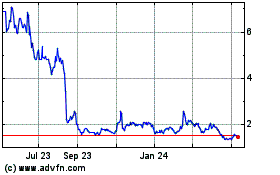

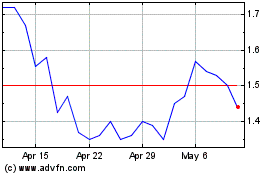

Energous (NASDAQ:WATT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energous (NASDAQ:WATT)

Historical Stock Chart

From Apr 2023 to Apr 2024