false

0000876343

0000876343

2023-11-09

2023-11-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 9, 2023

Lineage

Cell Therapeutics, Inc.

(Exact

name of registrant as specified in charter)

| California |

|

001-12830 |

|

94-3127919 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

2173

Salk Avenue, Suite 200

Carlsbad,

California |

|

92008 |

| (Address of principal executive

offices) |

|

(Zip Code) |

(442)

287-8990

Registrant’s

telephone number, including area code

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common shares |

|

LCTX |

|

NYSE American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

November 9, 2023, Lineage Cell Therapeutics, Inc. issued a press release announcing financial results for the quarter ended September

30, 2023, a copy of which is furnished as Exhibit 99.1.

The

information under this Item 2.02 and in Exhibit 99.1 is being furnished and is not being filed for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), and is not to be incorporated by reference into any

filing of the registrant under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof,

regardless of any general incorporation language in any such filing, except as shall be expressly set forth by specific reference in

such a filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Lineage Cell Therapeutics, Inc. |

| |

|

|

| Date: November 9, 2023 |

By: |

/s/ George

A. Samuel III |

| |

Name: |

George A. Samuel III |

| |

Title: |

General Counsel and Corporate Secretary |

Exhibit

99.1

LINEAGE

CELL THERAPEUTICS REPORTS THIRD QUARTER 2023 FINANCIAL RESULTS AND PROVIDES BUSINESS UPDATE

| |

● |

Enrollment

Continues in Phase 2a Clinical Study of RG6501 (OpRegen®) in Patients with Geographic Atrophy (GA) Secondary to Age-Related

Macular Degeneration (AMD) Under Management of Genentech, a Member of the Roche Group |

| |

|

|

| |

● |

Additional

RG6501 (OpRegen®) Data Presented at 23rd Annual EURETINA Congress and 2023 Eyecelerator Meetings |

| |

|

|

| |

● |

U.S.

Patent Issued Covering Manufacturing and Differentiation Process for Retinal Pigment Epithelial (RPE) Cells |

| |

|

|

| |

● |

Company

On Track to Submit OPC1 Investigational New Drug Amendment in Q4 2023 |

| |

|

|

| |

● |

Initiated

Development Activities for Hypoimmune Pluripotent Cell Line for Neurology Indications Under Partnership with Eterna Therapeutics |

CARLSBAD,

CA – November 9, 2023 - Lineage Cell Therapeutics, Inc. (NYSE American and TASE: LCTX), a clinical-stage biotechnology

company developing allogeneic cell therapies for unmet medical needs, today reported financial and operating results for the third quarter

ended September 30, 2023 and will host a conference call today at 4:30 p.m. Eastern Time to discuss these results and provide a business

update.

“The

Lineage team has continued to advance our clinical and preclinical pipeline of differentiated cell transplant programs, supporting our

alliances and working to establish new collaborations,” stated Brian M. Culley, Lineage CEO. “The most important area of

attention for our team remains our partnership with Roche and Genentech and our support for the ongoing Phase 2a clinical study of OpRegen

in patients with geographic atrophy secondary to AMD. Through presentations at medical and scientific conferences, we have broadened

awareness of OpRegen’s potential to provide durable anatomical and functional improvements in patients with GA. Most recently,

additional observations of rapid improvements to outer retinal structure in the initial Phase 1/2a clinical study of OpRegen were reported;

improvements were detectable within the first three months following a single administration, suggesting that OpRegen RPE cells may provide

support to the patients’ remaining retinal cells within atrophic areas. Looking forward, we are working with our partners, Roche,

and Genentech, on additional clinical data updates on the OpRegen program.”

“In

addition, our team continued the necessary work to submit our Investigational New Drug amendment for OPC1 to enable us to initiate the

DOSED clinical study in subacute and chronic spinal cord injury patients,” Mr. Culley added. “In parallel, we also initiated

certain development activities under our partnership with Eterna Therapeutics, reflecting a key step in a corporate strategy to capitalize

on our existing process development capabilities by combining them with cutting-edge cell engineering and editing technologies, to create

novel and potentially superior product profiles. As always, we intend to advance our business and programs in a responsible and fiscally

conservative way, with an overarching focus on providing a meaningful impact for patients through the development of differentiated allogeneic

cell transplants.”

Recent

milestones and activities included:

| ○ | Continued

execution under our collaboration with Roche and Genentech across multiple functional

areas, including support for the ongoing Phase 2a multi-center clinical study in patients

with GA secondary to AMD. Additional sites expected to come online for the Phase 2a study. |

| ○ | Results

of imaging analyses demonstrating rapid improvement in outer retinal structure from patients

enrolled in the prior Phase 1/2a clinical study, were presented at the 23rd

EURETINA Congress: |

| ● | All

five patients who had extensive coverage of the GA lesion with the surgical bleb containing

OpRegen in suspension demonstrated evidence of improvement in outer retinal structure as

assessed by optical coherence tomography (OCT) within the first three months after treatment. |

| ● | Retinal

structural improvements were initially observed on day 1 (n=1), day 14 (n=1), month 1 (n=2),

and month 3 (n=1). |

| ● | Structural

improvement on OCT was qualitatively defined as meeting all pre-specified criteria on at

least two non-adjacent B scans including: 1) reduction in outer plexiform layer (OPL) and/or

inner nuclear layer (INL) subsidence; 2) reappearance of external limiting membrane (ELM);

and 3) increased hyperreflectivity and/or thickness of RPE and/or Bruch’s membrane

or reduction of hypertransmission on at least two non-adjacent B scans. |

| | | |

| ● | Structural

improvement was only observed within GA lesions with extensive coverage with the surgical

bleb, suggesting that OpRegen RPE cells provide support to the remaining retinal cells within

atrophic areas. |

| ● | These

five patients had an average of 4.4 letter best corrected visual acuity (BCVA) gain by 3

months and 12.8 letter BCVA gain by 1 year compared to baseline. |

| ○ | U.S.

Patent No.11,746,324 entitled “Large Scale Production of Retinal Pigment Epithelial

Cells,” issued. |

| - | Investigational

New Drug (IND) amendment preparation for clinical testing of novel OPC1 spinal cord delivery

system continues |

| ○ | Company

remains on track to submit IND amendment to FDA in Q4 2023 to enable initiation of the DOSED

clinical study in subacute and chronic spinal cord injury patients. |

| - | Initiated

Development Activities for Hypoimmune Pluripotent Cell Line for Neurology Indications

Under Partnership with Eterna Therapeutics |

| ○ | Lineage

evaluated its development strategy with a group of leading neurology experts in the U.S.

and abroad and following an assessment of the competitive landscape, finalized its selection

of specific gene edits for the initial cell lines to be developed by Eterna. |

| | | |

| ● | The

edits include: the targeted deletion of the B2M gene, designed to reduce the immunogenicity

of product candidates derived from the lines by inhibiting rejection by CD8+ T cells; the

targeted insertion of the HLA-E gene, designed to overexpress HLA-E and prevent the allogeneic

NK cell response; and a third undisclosed edit intended to confer clinical differentiation

and a competitive advantage in the applicable indications. |

| - | Positive

ANP1 initial proof of concept results from collaboration with the University of Michigan |

| | | |

| ○ | Initial

results demonstrated delivery, engraftment, and survival of ANP1 cells into specific target

areas. |

| | | |

| ○ | Results

support advancement of the ANP1 program into functional preclinical testing. |

Balance

Sheet Highlights

Cash,

cash equivalents, and marketable securities totaled $41.3 million as of September 30, 2023, which is expected to support planned operations

into Q1 2025.

Third

Quarter Operating Results

Revenues:

Lineage’s revenue is generated primarily from licensing fees, royalties, collaboration revenues, and research grants. Total revenues

for the three months ended September 30, 2023 were $1.2 million, a net decrease of $1.8 million as compared to approximately $3.0 million

for the same period in 2022. The decrease was primarily driven by lower collaboration and licensing revenue recognized from deferred

revenues from the Collaboration and License Agreement among Lineage and Roche and Genentech entered into in December 2021.

Operating

Expenses: Operating expenses are comprised of research and development (“R&D”) expenses and general and administrative

(“G&A”) expenses. Total operating expenses for the three months ended September 30, 2023 were $7.8 million, a decrease

of $0.2 million as compared to $8.0 million for the same period in 2022.

R&D

Expenses: R&D expenses for the three months ended September 30, 2023 were $3.7 million, a net increase of $0.1 million as compared

to $3.6 million for the same period in 2022. The net increase was primarily driven by $0.2 million in higher OPC1 program-related expenses,

and $0.5 million in expenses to support preclinical and other research and development programs. These increases were partially offset

by a $0.5 million decrease in our VAC program, primarily related to reduced manufacturing activities.

G&A

Expenses: G&A expenses for the three months ended September 30, 2023 were $4.0 million, a net decrease of approximately $0.4

million as compared to $4.4 million for the same period in 2022. The decrease was primarily attributable to an overall reduction in costs

incurred for services by third parties, consulting costs, and recruiting related expenses.

Loss

from Operations: Loss from operations for the three months ended September 30, 2023 was $6.7 million, an increase of $1.5 million

as compared to a loss of $5.2 million for the same period in 2022.

Other

Income/(Expenses), Net: Other income (expenses), net for the three months ended September 30, 2023 reflected other expense, net of

approximately ($0.4) million, compared to other expense, net of ($0.3) million for the same period in 2022. The net change was primarily

driven by exchange rate fluctuations related to Lineage’s international subsidiaries and fair market value changes in marketable

equity securities, partially offset by interest income from our marketable debt securities.

Net

Loss Attributable to Lineage: The net loss attributable to Lineage for the three months ended September 30, 2023 was $7.1 million,

or $0.04 per share (basic and diluted), compared to a net loss attributable to Lineage of $6.1 million, or $0.04 per share (basic and

diluted), for the same period in 2022.

Conference

Call and Webcast

Interested

parties may access today’s conference call and webcast, by dialing (800) 715-9871 from the U.S. and Canada and should request the

“Lineage Cell Therapeutics Call”. A live webcast of the conference call will be available online in the Investors

section of Lineage’s website. A replay of the webcast will be available on Lineage’s website for 30 days and a telephone

replay will be available through November 16, 2023, by dialing (800) 770-2030 from the U.S. and Canada and entering conference ID number

2323932.

About

Lineage Cell Therapeutics, Inc.

Lineage

Cell Therapeutics is a clinical-stage biotechnology company developing novel cell therapies for unmet medical needs. Lineage’s

programs are based on its robust proprietary cell-based therapy platform and associated in-house development and manufacturing capabilities.

With this platform Lineage develops and manufactures specialized, terminally differentiated human cells from its pluripotent and progenitor

cell starting materials. These differentiated cells are developed to either replace or support cells that are dysfunctional or absent

due to degenerative disease or traumatic injury or administered as a means of helping the body mount an effective immune response to

cancer. Lineage’s clinical and preclinical programs are in markets with billion dollar opportunities and include five allogeneic

(“off-the-shelf”) product candidates: (i) OpRegen, a retinal pigment epithelial cell therapy in Phase 2a development for

the treatment of geographic atrophy secondary to age-related macular degeneration, is being developed under a worldwide collaboration

with Roche and Genentech, a member of the Roche Group; (ii) OPC1, an oligodendrocyte progenitor cell therapy in Phase 1/2a development

for the treatment of acute spinal cord injuries; (iii) VAC2, a dendritic cell therapy produced from Lineage’s VAC technology platform

for immuno-oncology and infectious disease, currently in Phase 1 clinical development for the treatment of non-small cell lung cancer;

(iv) ANP1, an auditory neuronal progenitor cell therapy for the potential treatment of auditory neuropathy; and (v) PNC1, a photoreceptor

neural cell therapy for the potential treatment of vision loss due to photoreceptor dysfunction or damage. For more information, please

visit www.lineagecell.com or follow the company on Twitter @LineageCell.

Forward-Looking

Statements

Lineage

cautions you that all statements, other than statements of historical facts, contained in this press release, are forward-looking statements.

Forward-looking statements, in some cases, can be identified by terms such as “believe,” “aim,” “may,”

“will,” “estimate,” “continue,” “anticipate,” “design,” “intend,”

“expect,” “could,” “can,” “plan,” “potential,” “predict,” “seek,”

“should,” “would,” “contemplate,” “project,” “target,” “tend to,”

or the negative version of these words and similar expressions. Such statements include, but are not limited to, statements relating

to: the potential benefits of OpRegen and the expansion of the Phase 2a clinical study of OpRegen to additional clinical sites; that

our cash, cash equivalents and marketable securities is sufficient to support our planned operations into the first quarter of 2025;

the timing of anticipated regulatory submissions to the FDA related to our programs, the potential future achievements of our clinical,

preclinical and development programs, the initiation of clinical trials and the timing and availability of clinical data updates related

to our programs; plans and expectations regarding existing collaborations; and the potential of our cell therapy platform and our ability

to provide an meaningful impact for patients. Forward-looking statements involve known and unknown risks, uncertainties and other factors

that may cause Lineage’s actual results, performance or achievements to be materially different from future results, performance

or achievements expressed or implied by the forward-looking statements in this press release, including, but not limited to, the following

risks: that we may need to allocate our cash to unexpected events and expenses causing us to use our cash, cash equivalents and marketable

securities more quickly than expected; that positive findings in early clinical and/or nonclinical studies of a product candidate may

not be predictive of success in subsequent clinical and/or nonclinical studies of that candidate; that OpRegen may never be proven to

provide durable anatomical functional improvements in dry-AMD patients, that competing alternative therapies may adversely impact the

commercial potential of OpRegen; that Roche and Genentech may not successfully advance OpRegen or be successful in completing further

clinical trials for OpRegen and/or obtaining regulatory approval for OpRegen in any particular jurisdiction; that the feedback received

from the FDA for OPC1 may not enable further clinical development; that the ongoing Israel-Hamas war may materially and adversely impact

our manufacturing processes, including cell banking and product manufacturing for our cell therapy product candidates, all of which are

conducted by our subsidiary in Jerusalem, Israel; that Lineage may not be able to manufacture sufficient clinical quantities of its product

candidates in accordance with current good manufacturing practice; and those risks and uncertainties inherent in Lineage’s business

and other risks discussed in Lineage’s filings with the Securities and Exchange Commission (SEC). Lineage’s forward-looking

statements are based upon its current expectations and involve assumptions that may never materialize or may prove to be incorrect. All

forward-looking statements are expressly qualified in their entirety by these cautionary statements. Further information regarding these

and other risks is included under the heading “Risk Factors” in Lineage’s periodic reports with the SEC, including

Lineage’s most recent Annual Report on Form 10-K filed with the SEC and its other reports, which are available from the SEC’s

website. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they were

made. Lineage undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date

on which they were made, except as required by law.

Lineage

Cell Therapeutics, Inc. IR

Ioana

C. Hone

(ir@lineagecell.com)

(442)

287-8963

LifeSci

Advisors

Daniel

Ferry

(daniel@lifesciadvisors.com)

(617)

430-7576

Russo

Partners – Media Relations

Nic

Johnson or David Schull

(Nic.johnson@russopartnersllc.com)

(David.schull@russopartnersllc.com)

(212)

845-4242

Tables

to follow

LINEAGE

CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(IN

THOUSANDS)

| | |

September

30, 2023 | | |

December

31, | |

| | |

(Unaudited) | | |

2022 | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash and cash

equivalents | |

$ | 31,474 | | |

$ | 11,355 | |

| Marketable securities | |

| 9,858 | | |

| 46,520 | |

| Accounts receivable, net | |

| 432 | | |

| 297 | |

| Prepaid

expenses and other current assets | |

| 1,717 | | |

| 1,828 | |

| Total current assets | |

| 43,481 | | |

| 60,000 | |

| | |

| | | |

| | |

| NONCURRENT ASSETS | |

| | | |

| | |

| Property and equipment,

net | |

| 4,854 | | |

| 5,673 | |

| Deposits and other long-term

assets | |

| 552 | | |

| 627 | |

| Goodwill | |

| 10,672 | | |

| 10,672 | |

| Intangible

assets, net | |

| 46,594 | | |

| 46,692 | |

| TOTAL

ASSETS | |

$ | 106,153 | | |

$ | 123,664 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’

EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable and accrued

liabilities | |

$ | 5,030 | | |

$ | 8,608 | |

| Lease liabilities, current

portion | |

| 881 | | |

| 916 | |

| Financing lease, current

portion | |

| 55 | | |

| 36 | |

| Deferred

revenues | |

| 9,915 | | |

| 9,421 | |

| Total current liabilities | |

| 15,881 | | |

| 18,981 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES | |

| | | |

| | |

| Deferred tax liability | |

| 273 | | |

| 2,076 | |

| Deferred revenues, net

of current portion | |

| 21,195 | | |

| 27,725 | |

| Lease liability, net of

current portion | |

| 2,047 | | |

| 2,860 | |

| Financing lease, net of

current portion | |

| 97 | | |

| 84 | |

| Other

long-term liabilities | |

| - | | |

| 2 | |

| TOTAL LIABILITIES | |

| 39,493 | | |

| 51,728 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | |

Preferred shares, no par value, authorized

2,000 shares; none issued and

outstanding as of September 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

Common shares, no par value, 450,000 and

250,000 shares authorized

as of September 30, 2023 and December 31, 2022, respectively;

174,987 and 170,093 shares issued

and outstanding as of

September 30, 2023 and December 31, 2022, respectively | |

| 450,282 | | |

| 440,280 | |

| Accumulated other comprehensive

loss | |

| (2,084 | ) | |

| (3,571 | ) |

| Accumulated

deficit | |

| (380,081 | ) | |

| (363,370 | ) |

| Lineage Cell Therapeutics, Inc. shareholders’

equity | |

| 68,117 | | |

| 73,339 | |

| Noncontrolling

deficit | |

| (1,457 | ) | |

| (1,403 | ) |

| Total shareholders’

equity | |

| 66,660 | | |

| 71,936 | |

| TOTAL

LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 106,153 | | |

$ | 123,664 | |

LINEAGE

CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(IN

THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

| | |

Three Months ended

September 30, | | |

Nine

Months ended

September

30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| REVENUES: | |

| | | |

| | | |

| | | |

| | |

| Collaboration

revenues | |

$ | 957 | | |

$ | 2,592 | | |

$ | 5,949 | | |

$ | 11,605 | |

| Royalties

and license fees | |

| 289 | | |

| 406 | | |

| 908 | | |

| 1,183 | |

| Total revenues | |

| 1,246 | | |

| 2,998 | | |

| 6,857 | | |

| 12,788 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| (169 | ) | |

| (235 | ) | |

| (415 | ) | |

| (626 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 1,077 | | |

| 2,763 | | |

| 6,442 | | |

| 12,162 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 3,741 | | |

| 3,592 | | |

| 11,799 | | |

| 9,883 | |

| General

and administrative | |

| 4,041 | | |

| 4,422 | | |

| 13,014 | | |

| 18,160 | |

| Total

operating expenses | |

| 7,782 | | |

| 8,014 | | |

| 24,813 | | |

| 28,043 | |

| Loss from operations | |

| (6,705 | ) | |

| (5,251 | ) | |

| (18,371 | ) | |

| (15,881 | ) |

| OTHER INCOME (EXPENSES): | |

| | | |

| | | |

| | | |

| | |

| Interest income, net | |

| 433 | | |

| 384 | | |

| 1,225 | | |

| 435 | |

| Loss on marketable equity

securities, net | |

| (60 | ) | |

| (233 | ) | |

| (170 | ) | |

| (1,677 | ) |

| Gain on revaluation of

warrant liability | |

| - | | |

| - | | |

| 1 | | |

| 223 | |

| Other

expenses, net | |

| (826 | ) | |

| (475 | ) | |

| (1,253 | ) | |

| (2,550 | ) |

| Total

other income (expenses), net | |

| (453 | ) | |

| (324 | ) | |

| (197 | ) | |

| (3,569 | ) |

| LOSS BEFORE INCOME TAXES | |

| (7,158 | ) | |

| (5,575 | ) | |

| (18,568 | ) | |

| (19,450 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision

for income tax benefit (expense) | |

| - | | |

| (541 | ) | |

| 1,803 | | |

| (541 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS | |

| (7,158 | ) | |

| (6,116 | ) | |

| (16,765 | ) | |

| (19,991 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net

loss attributable to noncontrolling interest | |

| 48 | | |

| 47 | | |

| 54 | | |

| 72 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET

LOSS ATTRIBUTABLE TO LINEAGE CELL THERAPEUTICS, INC. | |

$ | (7,110 | ) | |

$ | (6,069 | ) | |

$ | (16,711 | ) | |

$ | (19,919 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS PER COMMON SHARE: | |

| | | |

| | | |

| | | |

| | |

| Basic

and Diluted | |

$ | (0.04 | ) | |

$ | (0.04 | ) | |

$ | (0.10 | ) | |

$ | (0.12 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING: | |

| | | |

| | | |

| | | |

| | |

| Basic

and Diluted | |

| 174,868 | | |

| 169,786 | | |

| 171,880 | | |

| 169,722 | |

LINEAGE

CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN

THOUSANDS)

(UNAUDITED)

| | |

Nine Months ended

September 30, | |

| | |

2023 | | |

2022 | |

| CASH FLOWS FROM OPERATING

ACTIVITIES: | |

| | | |

| | |

| Net loss attributable to Lineage

Cell Therapeutics, Inc. | |

$ | (16,711 | ) | |

$ | (19,919 | ) |

| Net loss allocable to noncontrolling interest | |

| (54 | ) | |

| (72 | ) |

| Adjustments to reconcile net loss attributable

to Lineage Cell Therapeutics, Inc. to net cash (used in) provided by operating activities: | |

| | | |

| | |

| Loss on marketable equity

securities, net | |

| 170 | | |

| 1,677 | |

| Accretion of income on

marketable debt securities | |

| (647 | ) | |

| (186 | ) |

| Depreciation expense, including

amortization of leasehold improvements | |

| 419 | | |

| 441 | |

| Change in right-of-use

assets and liabilities | |

| 86 | | |

| (24 | ) |

| Amortization of intangible

assets | |

| 98 | | |

| 113 | |

| Stock-based compensation | |

| 3,580 | | |

| 3,328 | |

| Gain on revaluation of

warrant liability | |

| (1 | ) | |

| (223 | ) |

| Deferred income tax benefit | |

| (1,803 | ) | |

| - | |

| Foreign currency remeasurement

and other loss | |

| 1,893 | | |

| 2,668 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable, net | |

| (141 | ) | |

| 50,206 | |

| Prepaid expenses and other

current assets | |

| 56 | | |

| 517 | |

| Accounts payable and accrued

liabilities | |

| (3,456 | ) | |

| (17,573 | ) |

| Deferred

revenue and other liabilities | |

| (6,036 | ) | |

| (11,591 | ) |

| Net cash (used in) provided

by operating activities | |

| (22,547 | ) | |

| 9,362 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING

ACTIVITIES: | |

| | | |

| | |

| Proceeds from the sale

of marketable equity securities | |

| 196 | | |

| - | |

| Purchases of marketable

debt securities | |

| (16,403 | ) | |

| (40,628 | ) |

| Maturities of marketable

debt securities | |

| 53,497 | | |

| - | |

| Purchase of equipment | |

| (583 | ) | |

| (429 | ) |

| Net cash provided by

(used in) investing activities | |

| 36,707 | | |

| (41,057 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING

ACTIVITIES: | |

| | | |

| | |

| Proceeds from employee

options exercised | |

| 88 | | |

| 506 | |

| Common shares received

and retired for employee taxes paid | |

| (37 | ) | |

| (17 | ) |

| Proceeds from exercise

of subsidiary warrants, net | |

| - | | |

| 991 | |

| Proceeds from sale of common

shares | |

| 6,625 | | |

| 148 | |

| Payments for offering costs | |

| (199 | ) | |

| (95 | ) |

| Repayment

of financing lease liability | |

| (41 | ) | |

| (23 | ) |

| Net cash provided by

financing activities | |

| 6,436 | | |

| 1,510 | |

| Effect of exchange rate

changes on cash, cash equivalents and restricted cash | |

| (532 | ) | |

| (795 | ) |

| NET INCREASE IN CASH, CASH

EQUIVALENTS AND RESTRICTED CASH | |

| 20,064 | | |

| (30,980 | ) |

| | |

| | | |

| | |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH: | |

| | | |

| | |

| At beginning of the

period | |

| 11,936 | | |

| 56,277 | |

| At end of the period | |

$ | 32,000 | | |

$ | 25,297 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

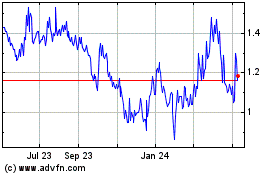

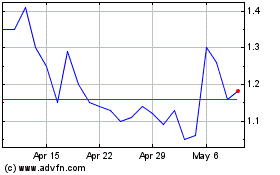

Lineage Cell Therapeutics (AMEX:LCTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lineage Cell Therapeutics (AMEX:LCTX)

Historical Stock Chart

From Apr 2023 to Apr 2024