false000126210400012621042023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 09, 2023 |

MEI Pharma, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41827 |

51-0407811 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

11455 El Camino Real, Suite 250 |

|

San Diego, California |

|

92130 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 858 369-7100 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.00000002 par value |

|

MEIP |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2023, MEI Pharma, Inc. (the “Company”) issued a press release announcing its financial results for its first quarter ended September 30, 2023. The text of the press release is included as an exhibit to this Current Report on Form 8-K. The information in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

November 9, 2023 |

By: |

/s/ Justin J. File |

|

|

|

Justin J. File

Chief Financial Officer and Secretary |

MEI Pharma Reports First Quarter Fiscal Year 2024 Results and Operational Highlights

SAN DIEGO – November 9, 2023 – MEI Pharma, Inc. (Nasdaq: MEIP), a clinical-stage pharmaceutical company evaluating novel drug candidates to address know resistance mechanisms to standard-of-care cancer therapies, today reported results for the quarter ended September 30, 2023 and highlighted recent corporate events.

“Our ongoing clinical studies evaluating the combination of voruciclib, our CDK9 inhibitor, with Venclexta in relapsed/refractory AML patients and ME-344, our mitochondrial inhibitor, combined with Avastin in metastatic colorectal cancer patients, continue to have strong investigator support and cohort enrollment remains on track in each program,” said David M. Urso, president and chief executive officer of MEI Pharma. “We expect to report data from the dose escalation portion of the Phase 1 clinical trial evaluating voruciclib in combination with venetoclax in early calendar 2024, and data from the first cohort of patients in Phase 1b clinical trial evaluating ME-344 in the first half of 2024.”

First Quarter Fiscal Year 2024 and Recent Highlights

•In August 2023, MEI announced the dosing of the first patient in a Phase 1b study evaluating ME-344 in combination with bevacizumab (AVASTIN®) in patients with previously treated metastatic colorectal cancer. ME-344 is a novel mitochondrial inhibitor targeting energy production through the OXPHOS pathway, which is important for supporting tumor cell survival and proliferation for many forms of cancer, including colorectal cancer. Bevacizumab, a vascular endothelial growth factor (VEGF) inhibitor, and other antiangiogenics, inhibit energy production through glycolysis and, thereby, increase tumor reliance on mitochondrial energy production, providing an opportunity to evaluate a combination with ME-344 to inhibit energy production in tumor cells and induce an antitumor effect. The Company anticipates announcing safety and efficacy data from the first cohort of 20 patients in the first half of 2024.

•In November 2023, MEI announced that an abstract highlighting clinical data from the monotherapy dose escalation stage of the ongoing Phase 1 study evaluating voruciclib, a selective oral cyclin-dependent kinase 9 (CDK9) inhibitor, alone and in combination with venetoclax (Venclexta®), a B-cell lymphoma 2 ("BCL2") inhibitor, in patients with acute myeloid leukemia (AML) or B-cell malignancies, will be presented during a poster session at the upcoming 65th American Society of Hematology (ASH) Annual Meeting and Exposition to be held December 9 – 12, 2023.

Expected Drug Candidate Pipeline Developments

Voruciclib – Oral CDK9 inhibitor in Phase 1 Study

•Report clinical data from the dose escalation portion of the ongoing Phase 1 clinical trial evaluating voruciclib plus Venclexta® (venetoclax) in patients with AML early in calendar 2024.

ME-344 – Mitochondrial inhibitor in Phase 1b Study

•Report clinical data from Cohort 1 of the Phase 1b clinical trial evaluating ME-344 plus Avastin® (bevacizumab) in patients with relapsed colorectal cancer in the first half of calendar-year 2024.

First Quarter Fiscal Year 2024 Financial Results

•As of September 30, 2023, MEI had $82.2 million in cash, cash equivalents, and short-term investments with no outstanding debt.

•For the quarter ended September 30, 2023, cash used in operations was $18.5 million, compared to $14.8 million during the quarter ended September 30, 2022. The increase in cash used in operations was primarily due to changes in working capital associated with the wind down of zandelisib activities with Kyowa Kirin and professional services primarily related to advisory and legal fees associated with various stockholder-related activities, including stockholder-initiated consent solicitations.

•Research and development expenses were $3.5 million for the quarter ended September 30, 2023, compared to $19.5 million for the quarter ended September 30, 2022. The decrease was primarily related to a reduction in zandelisib costs as we continued the wind down of development activities announced in December 2022, as well as reduced personnel and related costs from our fiscal year 2023 reduction in headcount.

•General and administrative expenses decreased by $1.0 million to $6.5 million for the quarter ended September 30, 2023, compared to $7.5 million for the quarter ended September 30, 2022. The net decrease was primarily related to reduced personnel and related costs from our fiscal year 2023 reduction in headcount, partially offset by higher external professional services and legal expenses.

•MEI recognized revenue of $65.3 million for the quarter ended September 30, 2023, compared to $8.7 million for the quarter ended September 30, 2022. The increase in revenue is due to the recognition of deferred revenue associated primarily with the termination of the Kyowa Kirin Commercialization Agreement in July 2023. As of September 30, 2023, all deferred revenue associated with that agreement has been recognized.

•Net income was $56.4 million, or $8.46 per share, for the quarter ended September 30, 2023, compared to net loss of $16.6 million, or $2.49 per share for the quarter ended September 30, 2022. The Company had 6,662,857 shares of common stock outstanding as of September 30, 2023.

The Company believes its cash balance is sufficient to fund operations for at least the next 12 months, and through the reporting of clinical data readouts from the ongoing and planned voruciclib and ME-344 Phase 1 and Phase 1b clinical programs, respectively.

About MEI Pharma

MEI Pharma, Inc. (Nasdaq: MEIP) is a clinical-stage pharmaceutical company committed to developing novel and differentiated cancer therapies. We build our pipeline by acquiring promising cancer agents and creating value in programs through development, strategic partnerships, out-licensing and commercialization, as appropriate. Our approach to oncology drug development is to evaluate our drug candidates in combinations with standard-of-care therapies to overcome known resistance mechanisms and address clear medical needs to provide improved patient benefit. The drug candidate pipeline includes voruciclib, an oral cyclin-dependent kinase 9 ("CDK9") inhibitor, and ME-344, an intravenous small molecule mitochondrial inhibitor targeting the oxidative phosphorylation pathway. For more information, please visit www.meipharma.com. Follow us on X (formerly Twitter) @MEI_Pharma and on LinkedIn.

Forward-Looking Statements

Certain information contained in this press release that are not historical in nature are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 including, without limitation, statements regarding: the potential, safety, efficacy, and regulatory and clinical progress of our product candidates, including the anticipated timing for initiation of clinical trials and release of clinical trial data and our expectations surrounding potential regulatory submissions, approvals and timing thereof, our business strategy and plans; the sufficiency of our cash, cash equivalents and short-term investments to fund our operations; and our ability to fund future capital returns. You should be aware that our actual results could differ materially from those contained in the forward-looking statements, which are based on management’s current expectations and are subject to a number of risks and uncertainties, including, but not limited to our failure to successfully commercialize our product candidates; the availability or appropriateness of utilizing the FDA’s accelerated approval pathway for our product candidates; final data from our pre-clinical studies and completed clinical trials may differ materially from reported interim data from ongoing studies and trials; costs and delays in the development and/ or FDA approval, or the failure to obtain such approval, of our product candidates; uncertainties or differences in interpretation in clinical trial results; uncertainty regarding the impact of rising inflation and the increase in interest rates as a result; potential economic downturn; activist investors; our inability to maintain or enter into, and the risks resulting from, our dependence upon collaboration or contractual arrangements necessary for the development, manufacture, commercialization, marketing, sales and distribution of any products; competitive factors; our inability to protect our patents or proprietary rights and obtain necessary rights to third party patents and intellectual

property to operate our business; our inability to operate our business without infringing the patents and proprietary rights of others; general economic conditions; the failure of any products to gain market acceptance; our inability to obtain any additional required financing; technological changes; government regulation; changes in industry practice; and one-time events. We do not intend to update any of these factors or to publicly announce the results of any revisions to these forward-looking statements. Under U.S. law, a new drug cannot be marketed until it has been investigated in clinical studies and approved by the FDA as being safe and effective for the intended use.

Contacts:

David A. Walsey

MEI Pharma

Tel: 858-369-7104

investor@meipharma.com

|

|

|

|

|

|

|

|

MEI PHARMA, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In thousands, except par value amounts) |

|

|

|

|

|

|

|

|

September 30, |

|

|

June 30, |

|

|

2023 |

|

|

2023 |

|

|

(Unaudited) |

|

|

(Audited) |

|

ASSETS |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

3,372 |

|

|

$ |

16,906 |

|

Short-term investments |

|

78,830 |

|

|

|

83,787 |

|

Unbilled receivables |

|

— |

|

|

|

85 |

|

Prepaid expenses and other current assets |

|

6,220 |

|

|

|

6,750 |

|

Total current assets |

|

88,422 |

|

|

|

107,528 |

|

Operating lease right-of-use asset |

|

11,600 |

|

|

|

11,972 |

|

Property and equipment, net |

|

1,229 |

|

|

|

1,309 |

|

Total assets |

$ |

101,251 |

|

|

$ |

120,809 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

$ |

3,220 |

|

|

$ |

6,134 |

|

Accrued liabilities |

|

4,289 |

|

|

|

12,461 |

|

Deferred revenue |

|

— |

|

|

|

317 |

|

Operating lease liability |

|

1,055 |

|

|

|

1,428 |

|

Total current liabilities |

|

8,564 |

|

|

|

20,340 |

|

Deferred revenue, long-term |

|

— |

|

|

|

64,545 |

|

Operating lease liability, long-term |

|

11,326 |

|

|

|

11,300 |

|

Total liabilities |

|

19,890 |

|

|

|

96,185 |

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

Preferred stock, $0.01 par value; 100 shares authorized; none outstanding |

|

— |

|

|

|

— |

|

Common stock, $0.00000002 par value; 226,000 shares authorized; 6,663 shares

issued and outstanding at September 30, 2023 and June 30, 2023 |

|

— |

|

|

|

— |

|

Additional paid-in-capital |

|

430,984 |

|

|

|

430,621 |

|

Accumulated deficit |

|

(349,623 |

) |

|

|

(405,997 |

) |

Total stockholders' equity |

|

81,361 |

|

|

|

24,624 |

|

Total liabilities and stockholders' equity |

$ |

101,251 |

|

|

$ |

120,809 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEI PHARMA, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(In thousands, except per share amounts) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

For the Three Months

Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

Revenues: |

|

|

|

|

|

|

Revenue from customers |

|

$ |

752 |

|

|

$ |

8,730 |

|

Revenue from collaboration agreements |

|

|

64,545 |

|

|

|

— |

|

Total revenues |

|

|

65,297 |

|

|

|

8,730 |

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

|

3,485 |

|

|

|

19,463 |

|

General and administrative |

|

|

6,531 |

|

|

|

7,486 |

|

Total operating expenses |

|

|

10,016 |

|

|

|

26,949 |

|

Income (loss) from operations |

|

|

55,281 |

|

|

|

(18,219 |

) |

Other income (expense): |

|

|

|

|

|

|

Change in fair value of warrant liability |

|

|

— |

|

|

|

1,117 |

|

Interest and dividend income |

|

|

1,094 |

|

|

|

480 |

|

Other expense, net |

|

|

(1 |

) |

|

|

(2 |

) |

Total other income, net |

|

|

1,093 |

|

|

|

1,595 |

|

Net income (loss) |

|

$ |

56,374 |

|

|

$ |

(16,624 |

) |

|

|

|

|

|

|

|

Net income (loss) per share - basic and diluted |

|

$ |

8.46 |

|

|

$ |

(2.49 |

) |

|

|

|

|

|

|

|

Weighted-average shares used in computing net income (loss)

per share - basic and diluted |

|

|

6,663 |

|

|

|

6,663 |

|

v3.23.3

Document And Entity Information

|

Nov. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity Registrant Name |

MEI Pharma, Inc.

|

| Entity Central Index Key |

0001262104

|

| Entity Emerging Growth Company |

false

|

| Securities Act File Number |

001-41827

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

51-0407811

|

| Entity Address, Address Line One |

11455 El Camino Real, Suite 250

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92130

|

| City Area Code |

858

|

| Local Phone Number |

369-7100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.00000002 par value

|

| Trading Symbol |

MEIP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

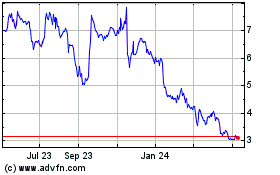

MEI Pharma (NASDAQ:MEIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

MEI Pharma (NASDAQ:MEIP)

Historical Stock Chart

From Apr 2023 to Apr 2024