0001642453false00016424532023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 09, 2023 |

DASEKE, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37509 |

47-3913221 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

15455 Dallas Parkway Suite 550 |

|

Addison, Texas |

|

75001 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (972) 248-0412 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

DSKE |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

The following information is being furnished pursuant to Item 7.01 of Form 8-K. This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

On November 9, 2023, Daseke, Inc. (the “Company”) will post an earnings presentation titled “Daseke, Inc. – Third-Quarter 2023 Earnings Presentation November 9, 2023” to the Company’s website at investor.daseke.com. The earnings presentation may be viewed on the Company’s website by first selecting the “Investors” tab, then “Events & Presentations.” A copy of the earnings presentation is also furnished herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

DASEKE, INC. |

|

|

|

|

Date: |

November 9, 2023 |

By: |

/s/ Aaron Coley |

|

|

|

Aaron Coley

Chief Financial Officer |

Third-Quarter 2023 Earnings Presentation November 9, 2023 Exhibit 99.1

Important Disclaimers Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “may,” “will,” “expect,” “anticipate,” “continue,” “estimate,” “project,” “believe,” “plan,” “should,” “could,” “would,” “forecast,” “seek,” “target,” “predict,” and “potential,” the negative of these terms, or other comparable terminology. Projected financial information, including our guidance outlook, are forward-looking statements. Forward-looking statements may also include statements about the Company’s goals, business strategy and plans; the Company’s financial strategy, liquidity and capital required for its business strategy and plans; the Company’s competition and government regulations; general economic conditions; and the Company’s future operating results. These forward-looking statements are based on information available as of the date of this presentation, and current expectations, forecasts and assumptions. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that the Company anticipates. Accordingly, forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date, and the Company does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Readers are cautioned not to place undue reliance on the forward-looking statements. Forward-looking statements are subject to risks and uncertainties (many of which are beyond our control) that could cause actual results or outcomes to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, general economic and business risks, such as downturns in customers’ business cycles and recessionary economic cycles, changes in customers’ inventory levels and the availability of funding for their working capital, disruptions in capital and credit markets, inflationary cost pressures and rising interest rates, the Company’s ability to adequately address downward pricing and other competitive pressures, the Company’s insurance or claims expense, driver shortages and increases in driver compensation or owner-operator contracted rates, fluctuations in the price or availability of diesel fuel, increased prices for, or decreases in the availability of, new revenue equipment and decreases in the value of used revenue equipment, supply chain disruptions and constraints generally, seasonality and the impact of weather and other catastrophic events, the Company’s ability to secure the services of third-party capacity providers on competitive terms, loss of key personnel, a failure of the Company’s information systems, including disruptions or failures of services essential to our operations or upon which our information technology platforms rely, data or other security breach, or cybersecurity incidents, the Company’s ability to execute and realize all of the expected benefits of its integration, business improvement and comprehensive restructuring plans, the Company’s ability to realize all of the intended benefits from acquisitions or investments, the Company’s ability to complete divestitures successfully, the Company’s ability to generate sufficient cash to service all of the Company’s indebtedness and the Company’s ability to finance its capital requirements, changes in existing laws or regulations, including environmental and worker health safety laws and regulations and those relating to tax rates or taxes in general, the impact of governmental regulations and other governmental actions related to the Company and its operations, and litigation and governmental proceedings. Additional risks or uncertainties that are not currently known to us, that we currently deem to be immaterial, or that could apply to any company could also materially adversely affect our business, financial condition, or future results. For additional information regarding known material factors that could cause our actual results to differ from those expressed in forward-looking statements, please see Daseke’s filings with the Securities and Exchange Commission, available at www.sec.gov, including Daseke’s most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, particularly the section titled “Risk Factors”. Non-GAAP Financial Measures This presentation includes non-GAAP financial measures for the Company and its reporting segments, including Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Operating Income, Adjusted Net Income (Loss), Adjusted EPS, Adjusted Operating Ratio, Net revenue, and Gross leverage. Please note that the non-GAAP measures included herein are not a substitute for, or more meaningful than, net income (loss), EPS, cash flows from operating activities, operating income or any other measure prescribed by GAAP, and there are limitations to using non-GAAP measures. Certain items excluded from these non-GAAP measures are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital, tax structure and the historic costs of depreciable assets. Also, other companies in Daseke’s industry may define these non‐GAAP measures differently than Daseke does, and as a result, it may be difficult to use these non‐GAAP measures to compare the performance of those companies to Daseke’s performance. Because of these limitations, these non-GAAP measures should not be considered a measure of the income generated by Daseke’s business or discretionary cash available to it to invest in the growth of its business. Daseke’s management compensates for these limitations by relying primarily on Daseke’s GAAP results and using these non-GAAP measures supplementally. You can find the reconciliation of these non‐GAAP measures to the nearest comparable GAAP measures in the Appendix. In the non-GAAP measures discussed below, management refers to certain material items that management believes do not reflect the Company’s core operating performance, which management believes represents its performance in the ordinary, ongoing and customary course of its operations. Management views the Company’s core operating performance as its operating results excluding the impact of items including, but not limited to, stock-based compensation, impairments, amortization of intangible assets, restructuring and business transformation costs, severance, and all income and expenses related to the Aveda Transportation and Energy Services (”Aveda”) business. Management believes excluding these items enables investors to evaluate more clearly and consistently the Company’s core operating performance in the same manner that management evaluates its core operating performance. Although we ceased generating revenues from our Aveda business and completed the wind-down of our Aveda operations in 2020, we continued to recognize certain income and expenses from our Aveda business in 2021, 2022, and 2023. Such income and expenses relate primarily to, but is not limited to, workers compensation claims and insurance proceeds. The impact of the Aveda business is not material or meaningful to a discussion of the Company’s operating results or financial condition. Accordingly, the income and expenses from the Aveda business are considered as items that management believes do not reflect core operating performance. Such income and expenses can be identified in the non-GAAP reconciliations under the adjustment called “Aveda expenses, net” and “Aveda operating expenses, net”. While we have excluded these items from certain historical non-GAAP financial measures, there is no guarantee that the items excluded from non-GAAP financial measures will not continue into future periods. For example, we expect to continue to incur charges for restructuring and business transformation costs as the Company continues its strategic initiatives to integrate our operating companies into a subset of our highest-performing platform companies, which may also result in additional impairment charges and severance costs. We have not reconciled non‐GAAP forward-looking measures to their corresponding GAAP measures because certain items that impact these measures are unavailable or cannot be reasonably predicted without unreasonable efforts. In particular, we have not reconciled our expectations as to forward-looking Adjusted EBITDA to net income due to the difficulty in making an accurate projection as to stock-based compensation expense. Stock-based compensation expense is affected by future hiring, turnover, and retention needs, as well as the future fair market value of our common stock and performance stock units. In addition, many of our performance stock units are classified as liabilities which vest upon the achievement of specific performance-based conditions related to the Company’s financial performance over a three-year period, modified based on the Company’s Relative Total Shareholder Return, all of which is difficult to predict and require quarterly adjustments to their fair value performed by outside specialists. The actual amount of the excluded stock-based compensation expense will have a significant impact on our GAAP net income; accordingly, a reconciliation of forward-looking Adjusted EBITDA to net income is not available without unreasonable efforts. Daseke defines: Adjusted EBITDA as net income (loss) plus (i) depreciation and amortization, (ii) interest, (iii) income taxes, and (iv) other material items that management believes do not reflect our core operating performance. Adjusted EBITDA Margin as Adjusted EBITDA divided by net revenue. Previously, the Company defined Adjusted EBITDA margin as Adjusted EBITDA divided by total revenue. However, beginning with the first quarter of 2023, the Company revised the definition in order to remove the impact of fuel surcharge revenues, which is often volatile and eliminating the impact of this source of revenue affords a more consistent basis for comparing Adjusted EBITDA margin between periods. The comparative period was also adjusted based on the revised definition. Adjusted Operating Income (Loss) as total revenue less Adjusted Operating Expenses. Adjusted Operating Expenses as total operating expenses less material items that management believes do not reflect our core operating performance. Adjusted Operating Ratio as Adjusted Operating Expenses less fuel surcharge revenue, as a percentage of net revenue. Previously, the Company defined Adjusted OR as Adjusted Operating Expenses as a percentage of total revenue. However, beginning with the first quarter of 2023, the Company revised the definition in order to remove the impact of fuel surcharge revenues, which is often volatile and eliminating the impact of this source of revenue affords a more consistent basis for comparing Adjusted OR between periods. The comparative period was also adjusted based on the revised definition. Adjusted Net Income (Loss) net income (loss) adjusted for material items that management believes do not reflect our core operating performance. Adjusted EPS as Adjusted Net Income (Loss) available to common stockholders divided by the weighted average number of shares of common stock outstanding during the period under the two-class method. Miles per Tractor is total number of company and owner-operator miles driven in the period divided by the average number of company and owner operator tractors in the period. Net Revenue as revenue less fuel surcharges and Aveda revenue. Gross leverage as Total debt divided by Adjusted EBITDA. Rate per Mile is the period’s revenue less fuel surcharge, brokerage and logistics revenues divided by total number of company and owner-operator miles driven in the period. Revenue per Tractor is the period’s revenue less fuel surcharge, brokerage and logistics revenues divided by the average number of tractors in the period, including owner-operator tractors. Industry and Market Data This presentation includes market data and other statistical information from third party sources, including independent industry publications, government publications and other published independent sources. Although Daseke believes these third-party sources are reliable as of their respective dates, Daseke has not independently verified the accuracy or completeness of this information.

Premier North American Transportation Solutions Specialist 1 Revenue and Adjusted EBITDA for the trailing twelve months ended September 30, 2023. Tractor and driver counts are averages of the trailing twelve months ended September 30, 2023. Owner-operator includes lease/purchase. Defensible Business Moat Expert in complex hauls, and high-value or over-dimensional loads Highly trained drivers and comprehensive portfolio of specialized equipment required to safely deliver atypical industrial cargo Perform extensive coordination around licensing, escort vehicles, permitting and regulations Disciplined business improvement and cross-platform optimization M&A pipeline focused on specialized targets and incremental services Strategic relevance and market share Focus on highly complex logistics services 2,084 Owner-operator drivers $1.62 B Revenue $199.1 MM Adj. EBITDA 2,944 Company-operated tractors 2,736 Company drivers 1,942 Owner-operated tractors Key stats as of Sept 30, 20231 Daseke, Inc. (Nasdaq: DSKE)

Serving Customers in Diverse Industrial End Markets Industrial customer portfolio with noncorrelated business cycles AEROSPACE MINING AGRICULTURE MANUFACTURING ENERGY STEEL CONSTRUCTION HIGH-SECURITY CARGO

a Unrivaled Specialized Carrier with Nationwide Scale 1 Investment grade ratings as of 1Q23 More than 1,000 combined years of operating history Nationwide network of open-deck routes across the United States, with reach into Canada and Mexico Diverse offering of transportation and logistics solutions to over 4,000 customers through a complementary mix of company-owned and asset-light capabilities Top 20 customers in FY22 represented ~38% of revenue and averaged 20+ year relationship; Top 20 investment grade1 customers at end of FY22 contributed ~33% of 2022 revenue Category leader in more than ten specialized, industrial end markets Large scale and deep experience meeting customers’ specialized and flatbed transportation needs

E.W. Wylie Director of Safety awarded Safety Professional of the Year from the North Dakota Motor Carriers Association Bulldog Hiway Express Awarded 1st Place, Truck Safety General - Intercity 1M to 5M Miles;1st Place, Truck Safety Heavy Hauler <500k Miles by South Carolina Trucking Association Boyd Brothers Recognized as 2023 SmartWay High Performer, Carbon Metrics; <10% of SmartWay carriers receive this distinction 3Q23 Spotlight on Operations Commercial Expansion: Boyd Brothers launches Entertainment Division, hauling equipment for large-scale live shows Recognition of Excellence

Deploying Cash on Hand to Strengthen Balance Sheet * Also includes $0.2MM cash from exercise of stock options and $0.1MM in foreign exchange effects. All items can be found on our Statement of Cash Flows available in our 3Q23 10-Q filing. Year-to-date 2023, elected to reduce nearly 20%, or $70.0MM, of total-term loan B (TLB) balance, plus $3MM in regularly quarterly payments $50MM in 2Q23 + $20MM in 3Q23 + $1MM per quarter in each of the first three quarters of FY23 In 2Q23, redeemed all Series B-1 Preferred stock that received a 13% cash dividend with $20.0MM of cash on hand Eliminated $2.6MM of annual preferred dividend payments Total liquidity of $189.4MM at period end ($ in millions) One Daseke: Effective utilization of excess cash while maintaining ample liquidity $153.4 $91.8 ($20.0) ($73.0) $77.2 $112.2 $189.4 ($7.9) ($67.1)

Third Quarter Consolidated Results Consolidated Financial Results ($ in millions) 3Q23 3Q22 %Change Total Revenue $402.3 $462.8 (13.1%) Net Revenue $355.0 $397.7 (10.7%) Adjusted Operating Ratio (OR) 93.4% 89.3% 410 bps Adjusted EBITDA $50.2 $64.8 (22.5%) Adjusted EBITDA Margin 14.1% 16.3% (220 bps) Cash Flow from Operating Activities $33.6 $54.8 (38.7%) (comparisons to 3Q22) Total Revenue of $402.3MM, focus on loading company assets 98.0MM total miles driven during 3Q23, a 2.1% increase Logistics revenue increased more than 8% Company-freight revenue of $168.7MM, with an 8.5% increase in company miles driven to 59.0MM miles Demand growth in aerospace and mining end markets was more than offset by declines in construction and high-security cargo Adjusted OR of 93.4% during this part of the cycle demonstrates strength of business model to weather challenging freight environments Adjusted EBITDA of $50.2MM, or 14.1% Adjusted EBITDA Margin Fuel surcharge (FSC) is expected to be neutral to expenses over multiple quarters and lags current market pricing in any given period when diesel prices rise or fall significantly. As compared to 3Q22, Company FSC revenue decline outpaced the decrease in company fuel expense, contributing $5.0 million of reduced Adjusted EBITDA Additional secondary market equipment supply, created as transportation companies reduce excess capacity and carriers exit, has impacted realized prices and reduced 3Q23 gain on sale by $2.3MM versus 3Q22 Resilient model weathers volatility amid rate pressure Consolidated Operational Results 3Q23 3Q22 %Change Miles per Tractor (in thousands) 20.0 20.0 – Rate per Mile $2.83 $3.11 (9.0%) Revenue per Tractor ($ in thousands) $56.4 $62.2 (9.3%)

Rates Stabilize During Recent Three Consecutive Quarters Consolidated Financial Results ($ in millions) 3Q22 4Q22 1Q23 2Q23 3Q23 Total Revenue $462.8 $408.2 $399.8 $407.3 $402.3 Net Revenue $397.7 $350.5 $348.3 $361.9 $355.0 Adjusted Operating Ratio (OR) 89.3% 92.4% 93.4% 92.3% 93.4% Adjusted EBITDA $64.8 $49.6 $46.8 $52.5 $50.2 Adjusted EBITDA Margin 16.3% 14.2% 13.4% 14.5% 14.1% After a precipitous drop that began in 4Q22, rates have stabilized in recent quarters 2023 rates remain depressed below comparative 2021 and 2022 periods, compounded by inflation across the cost structure (wages, equipment, parts, etc.) Lower freight rates and higher costs impacted financial performance, partially offset by the focus on operational performance and the 2023 balance sheet improvement actions Seeking enhanced profitability, the Company is actively evaluating the cross-cycle durability of its lanes, verticals, and operating companies

3Q23 Operational Excellence (comparisons to 3Q22) Specialized Segment 3Q23 Summary Results 3Q23 Financial Summary (comparisons to 2Q22) Revenue declines primarily from owner-operator freight, brokerage, and fuel surcharge $3.31 rate per mile in 3Q23 versus $3.62, equates to a blended $12.4MM of lower revenue on 48.3MM miles Operating expenses decreased by $21.1MM, primarily lower purchased freight associated with the decline in brokerage and owner operator revenue Revenue declines outpaced operating expense improvement, resulting in higher Adjusted OR and lower Adjusted EBITDA—which was impacted by increased net-fuel expense of $0.09 per mile, a $3.5 million Adjusted EBITDA reduction vs 3Q22 3Q22 Net Revenue $234.4MM 46% Asset-light 3Q23 Net Revenue $213.8MM 42% Asset-light Asset-Right Fleet Optimization Specialized Segment Results ($ in millions) 3Q23 3Q22 % Change Revenue $238.7 $268.6 (11.1)% Net Revenue $213.8 $234.4 (8.8)% Adjusted Operating Ratio (OR) 92.1% 87.4% 470 bps Adjusted EBITDA $31.1 $41.8 (25.6)% Adjusted EBITDA Margin 14.5% 17.8% (330 bps) +5% company miles as a percent of total miles +6% increase in company-loaded miles as a percent of total loaded miles Segment total miles of 48.3MM, miles per seated tractor per day and deadhead were essentially flat to the prior year period Improvements: seated tractors +2%, length of haul +7%

Flatbed Segment 3Q23 Summary Results Segment total miles increased +4% to 49.7MM miles Improvements: miles per seated tractor per day +6%, length of haul +7%, deadhead -1% 3Q23 Operational Excellence (comparisons to 3Q22) Asset-Right Fleet Maximizes Market Opportunities 3Q23 Net Revenue $141.2MM 3Q22 Net Revenue $163.3MM 68% Asset-light 74% Asset-light Company seated truck count +2%, loaded miles +21% contributed to company freight revenue +5% Flatbed Segment Results ($ in millions) 3Q23 3Q22 %Change Revenue $163.6 $194.2 (15.8%) Net Revenue $141.2 $163.3 (13.5%) Adjusted Operating Ratio 95.3% 91.9% 340 bps Adjusted EBITDA $19.1 $23.0 (17.0%) Adjusted EBITDA Margin 13.5% 14.1% (60 bps) 3Q23 Financial Summary (comparisons to 3Q22) Total Revenue of $163.6MM Increased company-freight revenue of $2.3MM and logistics of $0.7MM, more than offset by brokerage, owner-operator freight, and fuel surcharge revenue declines $2.36 rate per mile in 3Q23 versus $2.59, equates to a blended $11.9MM of lower revenue on a base of 49.7MM miles Operating expenses decreased by $27.2MM, primarily due to lower purchased freight associated with the decline in owner-operator and brokerage revenue As compared to 3Q22, adjusted EBITDA was lower due to increased net-fuel expense of $0.09 per mile, or a $1.5MM reduction, and a $2.0MM lower gain on sale of assets, for a total decrease of $3.5MM

FY23 Adjusted EBITDA Guidance Forecast Adjusted EBITDA of $185 million to $190 million, lower than the previously guided range of $200 million to $210 million, primarily linked to: seasonal softening of a challenged rate environment, inflationary headwinds including fuel, a soft secondary market for equipment sales, and owner operator drivers seeking higher rates this cycle will eventually correct in a meaningful way, even without an external catalyst; not likely to benefit from recovery until 2024 FY23 Net Capital Expenditure Guidance Capital expenditures, net of property and equipment sales, of $155 million to $160 million, an increase from prior guidance of $135 million to $145 million: equipment delivery delays in the first half of the year and ongoing discussions with OEMs OEMs have committed to fulfilling original 2023 orders; hence we expect to realize our original 2023 capital budget of $145 million to $155 million lower cash proceeds generated by equipment sales into an oversupplied secondary market expenditures position our company with a younger fleet, reduces operating and maintenance costs, increases up-time and allows us to attract and retain some of the best drivers in the industry Updated FY23 Guidance: �Adjusted EBITDA and Net Capital Expenditures

Since the 2019 freight recession, Daseke has demonstrated operational & financial improvement, with sustained, peer-leading adjusted EBITDA margin (inclusive of FSC revenue) improvement Intentionally Creating Peer-leading Profitability Improvement Daseke, Inc. YTD23 2019 Operating Segments1 9 13 Total Tractors2 4,886 5,635 Adjusted OR 93.0% 96.0% Adjusted EBITDA Margin 14.0% 11.1% Adjusted EBITDA Margin (inclusive of FSC revenue) 12.4% 10.2% Gross Leverage3 3.3x 4.5x Share Count1 47.6 million 64.6 million Adjusted EPS $0.44 $0.07 Operational & financial improvement Sustained, peer-leading improvement 1 at period-end 2 Average over trailing 12 months as of period end and includes owner operator 3 Gross Leverage is calculated as Total Debt divided by trailing twelve month Adjusted EBITDA. 4 Data for peers from FactSet. Please see slide 36 for the definitions of (i) Adjusted EBITDA Margin (inclusive of FSC revenue) and (ii) Indexed to 4Q19.

One Daseke: Unlocking the Power of Our Platform Unifying our business for profitable growth Bringing our professional driving team actionable insights Leverage network to deliver a scalable platform for future growth Expanding into incremental services, geographies, & end markets Best-in-class Support Organization Cutting-edge Tools Focus on insights using analytics across the data lake Broad technological connectivity; tech-enabled solutions Deliver tools to integrate and enhance driver and customer experiences Continuous Improvement Mindset Improve processes using automation and analytics Share best practices across geographic and functional teams Leverage the depth of our operating company leadership teams

2024 - Expected completion of first phase of One Daseke deployment, including additional operating company integrations $25MM FY22 + FY23 + FY24 expected cumulative Adjusted EBITDA contribution $30MM FY24 exit-run-rate Adjusted EBITDA target contribution Finance Phase – Lower WACC, Gross Leverage, and Increase EPS Integration Phase - Distinctly Focused on Costs One Daseke: Three Legs of Value Creation Optimization Phase Transition to one Transportation Management System version Consolidate operations, reduce structural costs, target 90% OR Define and deploy target operating model 2025 Unlock commercial potential through coordinated go-to-market strategy Process defining & automating Recruiting & retention focus Incremental Adjusted EBITDA contributions 2023 Reduced weighted average cost of capital: Paid down $73MM, or ~20%, Term Loan B balance Redeemed Series B-1 Preferred, $20MM $15MM FY22 + FY23 realized cumulative Adjusted EBITDA contribution 2019 Integrated 4 operating segments 2021 $84MM debt reduction 2022 Repurchased 30% of then outstanding common shares $5MM FY22 realized Adjusted EBITDA contribution 1 2 3

One Daseke: More Efficiently Generate and Deploy Free Cash Reduce the cost to fund organic capital expenditures Repay highest cost long-term debt Repurchase equity for immediate accretion to common shareholders Reinvest interest and preferred dividend savings Optimize cash flow available to service debt, and acquire new revenue equipment with cost-effective capital Revenue equipment operating leases lower Adjusted EBITDA dollar-for-dollar Current revenue equipment operating lease liability balance is $20.6MM Current revenue equipment loan balance $315.2MM average 5.4% interest Reduce Term Loan B (TLB) balance 9.4% rate on $320.0MM TLB balance as of September 30, 2023 Additional, future reductions of TLB balance to reduce interest payments, while disproportionately funding equipment purchases at lower cost Repurchase equity Evaluate opportunities for existing preferred shares, which are not tax advantaged $65.0MM of Series A convertible preferred shares earn 7.625% $47.6MM of Series B-2 non-convertible preferred shares earn 7.0% Assess common equity market condition to potentially resume share repurchase program with our Board of Directors consent M&A Potential Seek accretive acquisitions serving our existing end markets and expanding the portfolio of service offerings See Capital Summary Table in the Appendix for additional details Specific actions support efficient free cash flow use

Strong Executive Leadership Team With Cross-Cycle Experience Soumit Roy CLO Jonathan Shepko Director and CEO Daseke CEO since August 2021. Daseke Board of Directors since February 2017 Daseke Board observer, advisor from 2014 to 2017 Prior to Daseke, Managing Partner and Co-founder of EF Capital Management Served as Managing Director at both Ares Management and CLG Energy Finance, focused on energy private credit Experience at EnCap Investments; Keefe, Bruyette & Woods; and Andersen B.B.A from Texas A&M in Finance Scott Hoppe COO Daseke COO since June 2023 President of E.W. Wylie for six years prior to appointment as COO Prior to appointment as President, was E.W. Wylie VP of Sales and Marketing 24-year career in E.W. Wylie, a premier specialized carrier acquired by Daseke in 2011 Daseke CLO since September 2017 Served as AGC of Whole Food Markets prior to Daseke General Counsel of Expedia General Counsel of Hotels.com and counsel at Texas Instruments JD and undergraduate degrees from The University of Texas Daseke CFO since October 2022 Served as CFO at Pilot Thomas Logistics and Jones Companies Served in several CFO roles at BG Group Experience at FTI Consulting, PwC, and Weaver and Tidwell Undergraduate degree from TCU and a postgrad degree from Oxford – Said Business School Holds a CPA license Aaron Coley CFO

FINANCIALS��Daseke, Inc. and Subsidiaries

Capital Summary Table (as of September 30, 2023) Outstanding ($MM) Maturity Rate Key Terms Liquidity Cash & Cash Equivalents $77.2 — ABL $0 of $112.2 available 2026 6.9% In compliance with all covenants Rate as of September 30, 2023 Debt Debt & Equipment Leases Term Loan B $320.0 2028 9.4% In compliance with all covenants Rate as of September 30, 2023 Revenue Equipment Term Loans $315.2 Majority 48-60 months, maturities through Sept. 2030 2.6% - 7.4%, average 5.4% Collateralized by equipment Revenue Equipment Finance Leases $20.6 48-60 months 4.7% Rate is the implied weighted average Revenue Equipment Operating Lease Liabilities $38.4 30-month weighted average 4.5% Rate is the implied weighted average Right of use assets Preferred Equity Preferred A Shares $65.0 convertible 7.6% Convertible to common1 Preferred B Shares $47.6 perpetual 7.0% Not convertible, redeemable at DSKE discretion1 Weighted Average Cost of Debt 7.3% Calculated as of 9/30/23 Weighted Average Cost of Preferred Equity 7.4% Calculated as of 9/30/23 1 Refer to the Certificate of Designations, Rights and Limitations: https://www.sec.gov/Archives/edgar/data/1642453/000110465917014119/a17-7489_1ex3d2.htm https://www.sec.gov/Archives/edgar/data/1642453/000095017022025309/dske-ex3_1.htm https://www.sec.gov/Archives/edgar/data/1642453/000095017022025309/dske-ex3_2.htm

Reconciliation of Net Income (Loss) to Adjusted EBITDA by Segment, and Net Income (Loss) Margin to Adjusted EBITDA Margin by Segment

Reconciliation of Net Income to Adjusted EBITDA by Segment, and Net Income Margin to Adjusted EBITDA Margin by Segment

Reconciliation of Net Income to Adjusted EBITDA, and Net Income Margin to Adjusted EBITDA Margin

Reconciliation of Net Income to Adjusted EBITDA, and Net Income Margin to Adjusted EBITDA Margin

Specialized Solutions Supplemental Information

Flatbed Solutions Supplemental Information

Reconciliation of Net Income to Adjusted EBITDA

Reconciliation of Revenue to Net Revenue, Operating Ratio to Adjusted Operating Ratio, and Income from Operations to Adjusted Income from Operations

Reconciliation of Revenue to Net Revenue, Operating Ratio to Adjusted Operating Ratio, and Income from Operations to Adjusted Income from Operations

Reconciliation of Revenue to Net Revenue, Operating Ratio to Adjusted Operating Ratio, and Income (Loss) from Operations to Adjusted Income from Operations

Reconciliation of Revenue to Net Revenue, Operating Ratio to Adjusted Operating Ratio, and Income (Loss) from Operations to Adjusted Income from Operations

Reconciliation of Net Income to Adjusted Net Income and EPS to Adjusted EPS

Reconciliation of Net Income to Adjusted Net Income and EPS to Adjusted EPS (Continued)

Reconciliation of Net Loss to Adjusted Net Income and EPS to Adjusted EPS

Reconciliation of Gross Leverage As of end of period See previous slide for Reconciliation of Net Income to Adjusted EBITDA Total Debt, divided by Adjusted EBITDA

Reconciliation of Net Income (Loss) to Adjusted EBITDA and Net Income (Loss) Margin to Adjusted EBITDA Margin (inclusive of FSC revenue)

Rolling Four-Quarter Average Adjusted EBITDA Margin (inclusive of FSC revenue) and Rolling Four-Quarter Average Net Income (Loss) Margin Indexed to 4Q19 Adjusted EBITDA Margin (inclusive of FSC revenue) is equal to Adjusted EBITDA as a percentage of total revenue (inclusive of FSC revenue). Daseke defines Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of net revenue (which is equal to total revenue less FSC) rather than as a percentage of total revenue to remove the impact of FSC revenues, which are often volatile, and provide a more consistent basis for comparing Adjusted EBITDA Margin between periods. However, for comparability with peers, solely in the chart on slide 13, Daseke is presenting Adjusted EBITDA margin (inclusive of fuel surcharge revenue). Net Income (Loss) Margin is equal to Net Income as a percentage of total revenue (inclusive of FSC revenue). Chart illustrates the rolling four quarter average of each margin, as compared with 4Q19 as the starting, or 100, place (“Index”).

Reconciliation of Net Income (Loss) to Adjusted EBITDA and Net Income (Loss) Margin to Adjusted EBITDA (inclusive of FSC revenue) Margin

Contact Information Investor Relations Adrianne D. Griffin Vice President, Investor Relations and Treasurer (469) 626-6980 investors@daseke.com www.Daseke.com

v3.23.3

Document And Entity Information

|

Nov. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity Registrant Name |

DASEKE, INC.

|

| Entity Central Index Key |

0001642453

|

| Entity Emerging Growth Company |

false

|

| Securities Act File Number |

001-37509

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

47-3913221

|

| Entity Address, Address Line One |

15455 Dallas Parkway

|

| Entity Address, Address Line Two |

Suite 550

|

| Entity Address, City or Town |

Addison

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75001

|

| City Area Code |

(972)

|

| Local Phone Number |

248-0412

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

DSKE

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

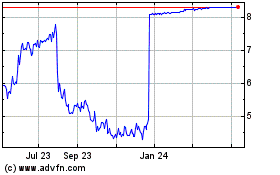

Daseke (NASDAQ:DSKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Daseke (NASDAQ:DSKE)

Historical Stock Chart

From Apr 2023 to Apr 2024