U.S. index futures are mixed in Thursday’s pre-market,

reflecting a scenario influenced by both divergent quarterly

results and unfavorable economic indicators emerging from China.

Investors are eagerly focusing on the upcoming speech by Jerome

Powell, Chairman of the Federal Reserve, in search of signals that

could guide market trends.

At 06:34, Dow Jones futures (DOWI:DJI) rose by 47 points, or

0.14%. S&P 500 futures rose by 0.06%, and Nasdaq-100 futures

fell by 0.11%. The yield on 10-year Treasury bonds stood at

4.531%.

In the commodities market, West Texas Intermediate crude oil for

December rose by 0.54% to $75.74 per barrel. Brent crude oil for

January increased by 0.57%, nearing $79.99 per barrel. Iron ore

with a 62% concentration traded on the Dalian exchange rose by

1.79%, priced at $128.73 per ton.

On the economic agenda for Thursday, investors are awaiting the

weekly jobless claims data at 08:30 AM, with a forecast of 218

thousand new claims. At 09:30 AM, Atlanta Fed President Raphael

Bostic will give a speech, while Richmond Fed President Thomas

Barkin speaks at 11:00 AM. At 13:00 PM, the U.S. government will

conduct another Treasury auction, this time with a 30-year

maturity. Yesterday, the 10-year auction, with a value of $40

billion, had a stop-out yield of 4.519%.

In Asian markets, the session ended without a unanimous

direction, influenced by China’s modest 0.20% decrease in October

year-on-year inflation. Adding to the picture in China, the

financial market regulatory authority is urging brokerages to

implement restrictions on margin trading in stock operations. In

Japan, growth in line with expectations was observed in bank loans,

which saw an increase of 2.80% compared to the same period last

year.

Meanwhile, in Europe, attention is turning to the highly

anticipated intervention by Christine Lagarde, President of the

European Central Bank (ECB), scheduled for 12:30 PM.

U.S. stocks had an indecisive trading day on Wednesday, with

major indices fluctuating around stability. The Dow Jones fell

0.12%, closing at 34,112.27, while the S&P 500 rose 0.10%,

ending at 4,382.78. The Nasdaq Composite advanced 0.08%, reaching

13,650.41. Despite the volatility, both the Nasdaq and the S&P

500 extended their winning streaks, with the latter achieving its

best closing in a month. The market remained optimistic about

interest rates, and Jerome Powell’s comments did not address

monetary policy.

In the corporate earnings front for Wednesday, investors will be

watching for reports from Li Auto (NASDAQ:LI),

Novavax (NASDAQ:NVAX), Oatly

(NASDAQ:OTLY), Fiverr (NYSE:FVRR),

Yeti (NYSE:YETI), Tapestry

(NYSE:TPR) before the market opens. After the closing bell, we

expect reports from Unity (NYSE:U),

TheTradeDesk (NASDAQ:TTD), Wynn

Resorts (NASDAQ:WYNN), Navitas

(NASDAQ:NVTS), Petrobras (NYSE:PBR), and

others.

Wall Street Corporate Highlights for Today

Nvidia (NASDAQ:NVDA) – Nvidia plans to launch

three new chips for the Chinese market after the U.S. blocked the

sale of AI and gaming chips. The announcement is expected on

November 16.

Apple (NASDAQ:AAPL) – An adviser to the

European high court has stated that a lower court that supported

Apple in its challenge against a $14 billion EU tax order made

legal errors and must review the case, representing a possible

setback for the company. Additionally, Apple co-founder Steve

Wozniak has been hospitalized in Mexico City. Mexican media reports

suggest the issue could be a stroke or a less severe vertigo. Steve

Wozniak was scheduled to speak at the World Business Forum

event.

Amazon (NASDAQ:AMZN) – Amazon.com has confirmed

job cuts in its Music division, amid a series of layoffs that have

affected more than 27,000 employees in the past year. The company

has not disclosed the number of affected employees but highlighted

that it will continue to invest in Amazon Music. Additionally,

Amazon is investing millions in a large language model (LLM) called

“Olympus,” with 2 trillion parameters, aiming to compete with

models from OpenAI and Alphabet. The initiative is led by Rohit

Prasad and could strengthen Amazon’s offering in AWS.

Netflix (NASDAQ:NFLX), Warner Bros.

Discovery (NASDAQ:WBD), Paramount Global

(NASDAQ:PARA) – Shares rose as a result of a provisional agreement

between Hollywood actors and major studios and streaming companies.

Warner Bros. rebounded 2.9% after a 19% drop the previous day,

primarily due to strikes in Hollywood, which contributed to a

larger-than-expected quarterly loss. Union members are expected to

vote on ratifying the three-year agreement in the coming days.

Novo Nordisk (NYSE:NVO) – Novo Nordisk has

announced that it will discontinue the sale of its long-acting

insulin, Levemir, in the U.S. due to manufacturing restrictions and

availability of alternatives. The discontinuation will begin in

January 2024. The company also offers the long-acting insulin

Tresiba in the market.

Eli Lilly (NYSE:LLY) – The FDA has approved Eli

Lilly’s obesity treatment, Zepbound, which will compete with Novo

Nordisk’s Wegovy. Lilly has set a lower list price for Zepbound in

an attempt to expand access.

Caesars Entertainment (NASDAQ:CZR) –

Hospitality worker unions in Las Vegas have reached a “historic”

preliminary agreement with Caesars Entertainment for a new contract

covering 10,000 employees, avoiding an imminent strike. The

five-year agreement includes salary increases, health benefits, and

pensions. The city is preparing for major events, including the

Formula 1 Las Vegas Grand Prix.

Domino’s Pizza (NYSE:DPZ) – Domino’s Pizza

Group reported a decline in meal deliveries in the third quarter as

customers reduced orders due to rising living costs. The group also

faced a decrease in total orders and increased product prices in

response to higher costs.

Tesla (NASDAQ:TSLA) – Tesla will recall 159

Model S and Model X vehicles due to the possibility of the driver’s

airbag deploying incorrectly, increasing the risk of injury in the

event of an accident, according to the National Highway Traffic

Safety Administration (NHTSA) on Thursday.

General Motors (NYSE:GM),

Stellantis (NYSE:STLA) – GM and Stellantis have

invested $7 million and $5 million, respectively, in startup Niron

Magnetics, with the aim of developing magnets for electric vehicles

without relying on rare earth materials, a move to reduce

dependence on China for critical materials. The initiative aims to

create efficient permanent magnets using more abundant materials,

reducing environmental impact.

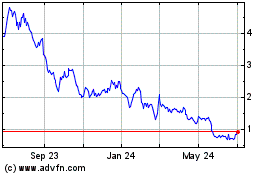

Polestar (NASDAQ:PSNY) – Swedish electric

vehicle manufacturer Polestar has lowered its 2023 delivery

forecast and cut its gross margin target due to concerns about

slowing demand for electric vehicles and global economic

uncertainties. It now expects to deliver about 60,000 vehicles this

year, with a gross margin of 2% in 2023.

Deutsche Bank (NYSE:DB) – Deutsche Bank is

increasing its investments in the Asia-Pacific region to attract

European clients and take advantage of stronger economic growth

compared to other regions. CEO Christian Sewing highlighted the

growing demand for consulting services in the region and the search

for alternatives to U.S. banks. The bank is also expanding its team

in Asia.

UBS (NYSE:UBS) – UBS raised $3.5 billion in its

first Additional Tier 1 (AT1) bond sale since acquiring Credit

Suisse, with demand exceeding $26 billion, signaling recovery and

confidence following a bailout that impacted the risky bank debt

market.

Citigroup (NYSE:C) – Citigroup has agreed to

pay $25.9 million to settle charges by the U.S. Consumer Financial

Protection Bureau (CFPB) of intentional discrimination against

credit card applicants of Armenian origin based on their last names

ending in “ian” and “yan.” The penalty includes a civil fine of

$24.5 million and $1.4 million in restitution to affected

applicants.

HSBC (NYSE:HSBC) – HSBC plans to launch a

custody service for blockchain-based assets, excluding

cryptocurrencies, in partnership with Swiss company Metaco. The

service will allow institutional clients to store tokens

representing traditional financial assets. The bank previously

launched the HSBC Orion platform for tokenized digital assets.

Bank of America (NYSE:BAC) – Bank of America

CEO Brian Moynihan predicts a soft landing for the U.S. economy,

avoiding a recession, despite slowing consumer spending and

commercial lending. He stated that the U.S. economy is expected to

grow by 2.7% this year and 0.7% in 2024, with expectations of

rising interest rates by the Federal Reserve and a reduction in

inflation by the end of 2025. Moynihan also mentioned a “tremendous

pipeline of activity” in the investment banking area.

JPMorgan Chase (NYSE:JPM) – JPMorgan is

investing approximately $60 million in women-led private investment

firms in France, in partnership with Bpifrance, the French state

investment bank. The goal is to raise between €150 million and €200

million by the end of 2024.

BNY Mellon (NYSE:BK) – The proposed U.S. SEC

reform to boost central clearing in the Treasury bond market needs

to be implemented gradually to avoid disruptions in an already

volatile market environment, warns BNY Mellon. The rule aims to

require more Treasury bond trades to be cleared by a clearinghouse,

but its rapid implementation could disrupt market functioning.

Robinhood Markets (NASDAQ:HOOD) – Robinhood

plans to launch trading in the UK by the end of the year, despite

the ban on payment for order flow in the country. The practice

represented over 80% of the company’s revenue in some quarters in

the U.S., but it now seeks to profit from other sources, including

securities lending, margin lending, and premium services. The

expansion into the UK is a test of its ability to thrive without

payment for order flow.

Earnings

Disney (NYSE:DIS) – Disney’s stocks rose 4.1%

in Thursday’s pre-market after the company exceeded analysts’

expectations for profit in the fiscal fourth quarter. The company

also surpassed FactSet’s consensus forecast for total Disney+

subscribers while reaffirming the expectation that its streaming

business will be profitable in the fiscal fourth quarter of

2024.

Sony (NYSE:SONY) – Sony’s operating profit fell

29% in the September quarter due to weak performance in image

sensors and finances. Profit stood at $1.74 billion, below

estimates. The chip division saw a 37% decline. Sony maintained its

sales target for the PlayStation 5 and annual operating profit

forecast, and announced an adaptation of Marvel’s “Spider-Man 2.”

Sony’s stocks dropped 5.9% in Thursday’s pre-market.

Arm (NASDAQ:ARM) – Arm’s stocks fell 5.9% in

the pre-market after the semiconductor company’s first earnings

report as a public company. Investors paid more attention to the

weak revenue outlook, with Q2 fiscal revenue rising 28% to $806

million. Adjusted earnings of 36 cents per share exceeded

expectations of 26 cents per share. The company recorded a net loss

of $509 million for the quarter due to stock-based compensation

costs for employees.

Twilio (NYSE:TWLO) – The cloud technology

company’s stocks rose 5.8% in the pre-market after exceeding Wall

Street expectations in the third quarter and providing a strong

outlook for the current quarter. Twilio reported earnings of $0.58

per share, excluding items, with revenue of $1.03 billion,

surpassing LSEG analysts’ forecasts, which expected earnings of

$0.35 per share and revenue of $989 million.

Take-Two Interactive (NASDAQ:TTWO) – Take-Two

Interactive reported adjusted revenue of $1.44 billion in the

second quarter, in line with expectations, with a focus on details

about the next Grand Theft Auto title. Despite meeting profit

estimates, the company provided a lower-than-expected adjusted

revenue outlook of $1.3 billion to $1.35 billion for the fourth

quarter, below the average expectation of $1.43 billion. However,

it reaffirmed its full-year adjusted revenue outlook, between $5.45

billion and $5.55 billion.

Virgin Galactic (NYSE:SPCE) – Virgin Galactic’s

stocks rose approximately 10.3% in the pre-market after the space

tourism company announced quarterly results showing a reduced loss

and increased revenue. Virgin Galactic plans to raise seat prices

to around $1 million and change the Unity spaceflight schedule to

quarterly in 2024, focusing on Delta flights and Delta vehicle

development. Projected revenue for Galactic flights 6 and 7 is $2

million to $2.5 million per flight, four times higher than in the

third quarter. The company also confirmed plans to launch the Delta

Class spacecraft in 2026.

Li Auto (NASDAQ:LI) – Li Auto announced a

profit of $386 million in the third quarter, with revenue of $4.75

billion, exceeding analysts’ expectations. Its stocks rose 3.6% in

the pre-market. The company forecasts fourth-quarter revenue

between $5.27 billion and $5.4 billion, surpassing FactSet’s

estimate of $4.91 billion. Li Auto’s stocks have risen 93% this

year.

Honda Motor (NYSE:HMC) – Japan’s Honda Motor

(7267.T) reported a 31% increase in operating profit ($2 billion)

in the September quarter, driven by stronger sales in the US and a

weaker yen, raising its annual operating profit forecast by

20%.

Lyft (NASDAQ:LYFT) – Lyft’s stocks fell 1.3% in

the pre-market after third-quarter bookings fell below expectations

despite 15% growth. This overshadowed the fact that Lyft exceeded

both revenue and profit expectations in the third quarter. Revenue

grew 10% to $1.16 billion, surpassing analysts’ average estimate of

$1.14 billion. Adjusted third-quarter profit was 24 cents per

share, compared to estimates of 13 cents.

Instacart (NASDAQ:CART) – The food delivery

platform exceeded Wall Street expectations in its first earnings

report as a public company. Third-quarter revenue increased to $764

million, surpassing analysts’ consensus forecast of $737

million.

Applovin (NASDAQ:APP) – Applovin announced

strong quarterly results, with a net profit of $107.9 million,

exceeding analysts’ expectations. The company also exceeded revenue

forecasts, reaching $864 million, and its stocks rose 16.4% in the

pre-market. Applovin’s President and Chief Financial Officer,

Herald Chen, plans to transition to new career opportunities by the

end of 2023 but will continue to serve as a board member and

advisor to the CEO. Matt Stumpf will assume the role of CFO.

Affirm (NASDAQ:AFRM) – Affirm, the “buy now,

pay later” company, exceeded Wall Street expectations in the first

fiscal quarter with a 28% increase in merchandise volume to $5.6

billion and revenue of $497 million, along with a loss of $0.57 per

share. Stocks rose 14% in the pre-market.

AMC Entertainment (NYSE:AMC) – AMC

Entertainment exceeded third-quarter revenue estimates, driven by

the success of films such as “Barbie” and “Oppenheimer.” Attendance

in movie theaters increased by 38.4%, and revenue reached $1.41

billion, marking the most successful quarter in the company’s

103-year history.

MGM Resorts (NYSE:MGM) – MGM exceeded market

estimates for profit and revenue in the third quarter, with eased

entry restrictions boosting performance, especially in its MGM

China subsidiary. MGM’s global revenue increased by approximately

16% to $3.97 billion, surpassing analysts’ average estimate of

$3.87 billion, according to LSEG data. Earnings per share in the

quarter were $0.64, exceeding expectations of $0.49.

Duolingo (NASDAQ:DUOL) – The language learning

platform saw an 8.8% increase in the pre-market after surpassing

expectations for the third quarter and providing

better-than-expected guidance for the current quarter. Duolingo

told investors to expect revenue between $145 million and $148

million in the fourth quarter, while FactSet analysts predicted

$141.2 million. The company also stated that bookings for the

quarter are expected to range from $167 million to $170 million,

exceeding FactSet analysts’ forecast of $157.7 million.

AstraZeneca (NASDAQ:AZN) – AstraZeneca raised

its annual profit forecast due to demand for cancer drugs and

invested up to $2 billion in a weight loss medication.

Third-quarter revenues of $11.49 billion were slightly above the

consensus forecast of $11.47 billion, boosting its stocks by 2.7%

in the pre-market.

ArcelorMittal (NYSE:MTCN) – ArcelorMittal

reported third-quarter profits above expectations, highlighting an

improvement in structural profitability. The company forecasts

global steel demand growth, excluding China, of 1% to 2% this year

but reduced its outlook for Europe due to weak construction

activity. The world’s second-largest steelmaker reported EBITDA of

$1.87 billion, above analysts’ average forecast of $1.8

billion.

Topgolf Callaway Brands (NYSE:MODG) – The golf

equipment manufacturer and operator of the Topgolf recreational

driving range network saw stocks fall 19.7% in the pre-market due

to a challenging third quarter.

Polestar Automotive Hold... (NASDAQ:PSNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polestar Automotive Hold... (NASDAQ:PSNY)

Historical Stock Chart

From Apr 2023 to Apr 2024