false

0001124524

0001124524

2023-11-08

2023-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2023

CRYOPORT, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-34632 |

|

88-0313393 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

|

| 112

Westwood Place, Suite

350, Brentwood, TN 37027 |

| (Address of principal executive offices, including zip code) |

| |

|

|

|

|

| Registrant’s telephone number, including area code: (949) 470-2300 |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which

registered |

| Common Stock, $0.001 par value |

|

CYRX |

|

The NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On November 8, 2023, Cryoport, Inc. (the “Company”)

issued a press release announcing its financial results for the third quarter ended September 30, 2023. A copy of the press release issued

by the Company is attached hereto as Exhibit 99.1.

The information, including the exhibit attached

hereto, in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as otherwise expressly stated in

such filing.

| Item 9.01. |

Financial Statements and Exhibits |

| (d) |

Exhibits. |

The following material is filed as an exhibit to this Current Report on Form 8-K: |

Exhibit

Number

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 8, 2023 |

Cryoport, Inc. |

| |

|

| |

|

| |

/s/ Robert Stefanovich |

| |

Robert Stefanovich |

| |

Chief Financial Officer |

Exhibit 99.1

Cryoport Reports Third Quarter 2023

Financial Results

| § | Third quarter 2023

commercial Cell and Gene Therapy revenue up 54% year-over-year |

| § | Supporting a record

total of 670 clinical trials worldwide, with 81 in Phase 3 |

| § | Nine months 2023 revenue

of $176 million |

| § | Affirms full year 2023

revenue guidance of $233 - $243 million |

NASHVILLE,

Tennessee, November 8, 2023, - Cryoport, Inc. (NASDAQ: CYRX) (“Cryoport” or the “Company”), a leading

global provider of innovative products and services to the life sciences, with a focus on the fast-growing cell and gene therapy industry,

enabling the future of medicine for a new era of life sciences, today announced financial results for the third quarter (Q3) and first

nine months (9M) of 2023.

Jerrell Shelton, CEO of Cryoport,

commented, “Our third quarter results were consistent with our expectations, reflecting current global economic and geopolitical

challenges. However, we are seeing solid and sustained demand from our key life sciences and cell and gene therapy customers despite the

current macroeconomic climate.

“We experienced a notable

increase in commercial cell and gene therapy revenue, growing 54% year-over-year, while bioservices revenue increased 26% year-over-year

for the third quarter. In the same period, Cryoport Systems’ revenue grew 10%, on both a year-over-year and sequential basis. Clinical

trials that Cryoport supports also increased, adding a net 27 clinical trials year-over-year, bringing our global clinical trials supported

to a record total of 670.

"While demand for our cryogenic

systems provided by MVE Biological Solutions was, as expected, lower than in previous years, it is important to point out that we maintained

strong gross margins on our product revenue of 45% for the quarter, contributing free cash to support our strategic growth investments.

As the world’s largest manufacturer of vacuum insulated products and cryogenic systems and a preferred brand for academic, government,

and life science companies, we expect solid performance from MVE Biological Solutions as our clients’ capex spending normalizes.

“During

the third quarter, we continued to execute on our corporate strategy to accelerate our long-term growth through meaningful partnerships.

This includes our collaboration with Cell and Gene Therapy Catapult, the premier cell and gene therapy manufacturing innovation center

in Europe which will support our European expansion. We also entered into a strategic partnership with Be The Match BioTherapies®,

which manages the most diverse bone marrow registry in the world, and signed a multi-year supply chain solutions agreement with Monash

IVF, a leading provider of assisted reproductive services in Australia.

“Subsequent to quarter end,

we completed the acquisition of Tec4med Lifescience, a solutions company with cutting-edge technology for comprehensive monitoring solutions,

based in Darmstadt, Germany, that is expected to have applications across the Cryoport spectrum of

solutions.

“These latest developments

and our leading market position as provider of technology-enabled, dependable, end-to-end supply chain solutions to the life sciences

add to our confidence that our long-term growth prospects are solid. We believe the combined power of our industry-leading brands, including

Cryoport Systems, MVE Biological Solutions, CRYOPDP, and CRYOGENE, coupled with the capital projects we have underway, position Cryoport

to capitalize on the continued growth of the life sciences and especially the cell and gene therapy industry, as more therapies make their

way towards commercialization over these ensuing years,” concluded Mr. Shelton.

In tabular form, revenue by market

for Q3 2023 and 9M 2023, as compared to the same periods in 2022 was as follows:

Cryoport, Inc. and Subsidiaries

Total revenues by market

(unaudited)

| | |

Three Months Ended

September 30, | | |

| | |

Nine Months Ended

September 30, | | |

| |

| (in thousands) | |

2023 | | |

2022 | | |

% Change | | |

2023 | | |

2022 | | |

% Change | |

| Biopharma/Pharma | |

$ | 46,979 | | |

$ | 48,570 | | |

| -3 | % | |

$ | 144,634 | | |

$ | 143,309 | | |

| 1 | % |

| Animal Health | |

| 6,884 | | |

| 9,629 | | |

| -29 | % | |

| 23,620 | | |

| 25,985 | | |

| -9 | % |

| Reproductive Medicine | |

| 2,294 | | |

| 2,265 | | |

| 1 | % | |

| 7,741 | | |

| 7,625 | | |

| 2 | % |

| Total revenues | |

$ | 56,157 | | |

$ | 60,464 | | |

| -7 | % | |

$ | 175,995 | | |

$ | 176,919 | | |

| -1 | % |

As of September 30, 2023, Cryoport

supported 12 commercial therapies and a net total of 670 global clinical trials, a net increase of 27 clinical trials over September 30,

2022. The number of trials in Phase 3 was 81 as of the end of the third quarter of 2023. The number of trials by phase and region are

as follows:

Cryoport Supported Clinical Trials by Phase

| |

September 30, | |

| Clinical Trials | |

2021 | | |

2022 | | |

2023 | |

| Phase 1 | |

| 240 | | |

| 268 | | |

| 275 | |

| Phase 2 | |

| 272 | | |

| 295 | | |

| 314 | |

| Phase 3 | |

| 70 | | |

| 80 | | |

| 81 | |

| Total | |

| 582 | | |

| 643 | | |

| 670 | |

Cryoport

Supported Clinical Trials by Region

| |

September 30, | |

| Clinical Trials | |

2021 | | |

2022 | | |

2023 | |

| Americas | |

| 459 | | |

| 496 | | |

| 516 | |

| EMEA | |

| 92 | | |

| 105 | | |

| 112 | |

| APAC | |

| 31 | | |

| 42 | | |

| 42 | |

| Total | |

| 582 | | |

| 643 | | |

| 670 | |

A total of six Cryoport supported

Biologic License Applications (BLAs) or Marketing Authorization Applications (MAAs) were filed in the third quarter of 2023. During the

remainder of 2023, we anticipate up to an additional five application filings, two new therapy approvals and an additional seven label/

geographic expansions or moves to earlier lines of treatment approved.

Financial Highlights

Total revenue for Q3 2023 was

$56.2 million compared to $60.5 million for Q3 2022, a year-over-year decrease of 7% or $4.3 million.

| • | Biopharma/Pharma revenue was $47.0 million, down 3% or $1.6 million for Q3 2023

compared to $48.6 million for Q3 2022. Revenue was mainly impacted by the anticipated weaker demand for cryogenic freezer systems and

continued turnover of clinical trials, partially offset by the increase in revenue from the support of commercially launched therapies,

demand for our bioservices solutions, and logistics services. Revenue from the support of commercial cell and gene therapies increased

by $2.3 million, or 54%, to $6.6 million for Q3 2023. |

| • | Animal Health revenue was $6.9 million for Q3 2023, compared to $9.6 million for

Q3 2022, driven by decreased demand for cryogenic systems supporting bovine production. |

| • | Reproductive Medicine revenue was $2.3 million for Q3 2023, consistent with Q3

2022, reflecting sustained demand for our CryoStork® logistics solutions. |

Total revenue

for 9M 2023 was $176.0 million, compared to $176.9 million for 9M 2022, a year-over-year decrease of 1% and flat at constant currency.

| • | Biopharma/Pharma revenue increased to $144.6 million, a gain of 1% or $1.3 million

for 9M 2023, compared to $143.3 million for the same period in 2022. Revenue from commercial therapies increased to $15.9 million, a gain

of 31% or $3.8 million for 9M 2023. |

| • | Animal Health revenue was $23.6 million, a decrease of 9% or $2.4 million for 9M

2023, compared to $26.0 million for the same period in 2022. |

| • | Reproductive Medicine revenue increased to $7.7 million, a gain of 2% for 9M 2023,

compared to $7.6 million for the same period in 2022. |

Gross

margin was 43.2% for Q3 2023 compared to 43.7% for the same period in 2022. Gross margin was 43.2% for 9M 2023 compared to 43.9%

for 9M 2022.

As a result

of development initiatives, operating costs and expenses increased to $41.2 million for Q3 2023, compared to $34.2 million for Q3 2022.

The increase was primarily attributable to the further build out of our competencies (IntegriCell™), infrastructure (Supply Chain

Center Network, specialty courier expansion, manufacturing plant expansion), and technology development (Cryoportal 2®,

Cryosphere™, SkyTrax) to support the continuing scaling of our business and demand for Cryoport’s services. One of our most

important strategic initiatives is the IntegriCell™ platform, a standardized integrated optimized apheresis collection, cryopreservation

and leukopak distribution solution for cell therapies for which Cryoport is currently building out two cryopreservation centers of excellence

located in Houston, TX and Liège, Belgium, which are expected to be fully operational and ready for validation during Q2 2024.

Operating costs and expenses increased to $121.4 million for 9M 2023, compared to $98.5 million for the same period in the prior year.

Net loss for

Q3 2023 and 9M 2023 was $13.3 million and $37.2 million, respectively, compared to a net loss of $5.3 million and $27.9 million for the

same periods in 2022, respectively.

Net loss attributable

to common stockholders was $15.3 million, or $0.31 per share, and $43.2 million, or $0.89 per share, for Q3 2023 and 9M 2023, respectively.

This compares to a net loss attributable to common stockholders of $7.3 million, or $0.15 per share, and $33.9 million, or $0.69 per share,

for Q3 2022 and 9M 2022, respectively.

Adjusted

EBITDA was a negative $3.1 million for Q3 2023, compared to $4.7 million for Q3 2022. Adjusted EBITDA for 9M 2023 was a negative

$1.7 million, compared to $13.0 million for 9M 2022.

Cryoport held

$465.9 million in cash, cash equivalents, and short-term investments as of September 30, 2023.

Share Repurchase

Update

On March 11,

2022, the Company announced that its board of directors authorized a repurchase program through December 31, 2025, authorizing the repurchase

of common stock and/or convertible senior notes in the amount of up to $100.0 million. During the year ended December 31, 2022, the Company

purchased 1,604,994 shares of its common stock under this program. These shares were returned to the status of authorized but unissued

shares of common stock. During the third quarter of 2023, the Company repurchased $31.3 million in aggregate principal amount of its Convertible

Senior Notes due in 2026 for an aggregate repurchase price of $25.1 million, resulting in a gain on extinguishment of debt of $5.7 million,

net of debt issuance costs. There is currently $36.0 million remaining available under the repurchase program.

Note: All

reconciliations of GAAP to adjusted (non-GAAP) figures above are detailed in the reconciliation tables included later in the press release.

Outlook

Cryoport’s management affirms

the Company’s full year 2023 revenue guidance range of $233 - $243 million. The Company's 2023 guidance is dependent on its current

business and expectations, which may be further impacted by, among other things, factors that are outside of our control, such as the

global macroeconomic and geopolitical environment, continued supply chain constraints, inflationary pressures, volatility in the China

economy, the ongoing wars between Russia and Ukraine and between Israel and Hamas, economic uncertainty and the effects of foreign currency

fluctuations, as well as the other factors described in the Company's filings with the Securities and Exchange Commission ("SEC"),

including in the "Risk Factors" section of its most recently filed periodic reports on Form 10-K and Form 10-Q, as well as in

its subsequent filings with the SEC.

Additional Information

Further

information on Cryoport’s financial results is included in the attached condensed consolidated balance sheets and statements of

operations, and additional explanations of Cryoport’s financial performance are provided in the Company’s Quarterly Report

on Form 10-Q for the three months ended September 30, 2023, which is expected to be filed with the SEC on November 8, 2023. Additionally,

the full report will be available in the SEC Filings section of the Investor Relations section of Cryoport’s website at www.cryoport.com.

Earnings Conference Call

Information

IMPORTANT

INFORMATION: In addition to the earnings release, a document titled “Cryoport Third Quarter

2023 in Review”, providing a review of Cryoport’s financial and operational performance and a general business update, will

be issued at 4:05 p.m. ET on Wednesday, November 8, 2023. The document is designed to be read in advance of the questions and answers

conference call and will be accessible at http://ir.cryoport.com/events-and-presentations.

Cryoport management will host

a conference call at 5:00 p.m. ET on November 8, 2023. The conference call will be in the format of a questions and answers session and

will address any queries investors have regarding the Company’s reported results. A slide deck will accompany the call.

Conference Call Information

| Date: |

Wednesday, November 8, 2023 |

| |

|

| Time: |

5:00 p.m. ET |

| |

|

| Dial-in numbers: |

1-888-886-7786 (U.S.), 1-416-764-8658 (International) |

| |

|

| Confirmation code: |

Request the “Cryoport Call” or Conference ID: 15559162 |

| |

|

| Live webcast: |

‘Investor Relations’

section at www.cryoport.com or click here.

|

| |

|

| |

Please allow 10 minutes prior to the

call to visit this site to download and install any necessary audio software. |

The questions and answers

call will be recorded and available approximately three hours after completion of the live event in the Investor Relations section of

the Company's website at www.cryoport.com for a limited time. To access the replay of the questions and answers click here.

A dial-in replay of the call will also be available to those interested, until November 15, 2023. To access the replay, dial 1-844-512-2921

(United States) or 1-412-317-6671 (International) and enter replay entry code: 15559162#.

About Cryoport, Inc.

Cryoport, Inc. (Nasdaq: CYRX),

is a global provider of innovative products and services to the fast-growing Cell & Gene Therapy industry - enabling the future of

medicine for a new era of life sciences. With 50 strategic locations covering the Americas, EMEA (Europe, the Middle East and Africa)

and APAC (Asia Pacific), Cryoport's global platform provides mission-critical bio-logistics, bio-storage, bio-processing, and cryogenic

systems to the life sciences markets worldwide.

For more information, visit

www.cryoport.com or follow @cryoport on X, formerly known as Twitter at www.twitter.com/cryoport for live updates.

Forward-Looking Statements

Statements in this press release

which are not purely historical, including statements regarding the Company's intentions, hopes, beliefs, expectations, representations,

projections, plans or predictions of the future, are forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements include, but are not limited to, those related to the Company's industry, business,

long-term growth prospects, including expected growth in all of the Company's markets, plans, strategies, acquisitions, future financial

results and financial condition, such as the Company's outlook and guidance for full year 2023 revenue and the related assumptions and

factors expected to drive revenue, projected growth trends in the markets in which the Company operates, the Company's plans and expectations

regarding the launch of new products and services, such as the expected timing and benefits of such products and services launches, the

Company’s expectations about future benefits of its acquisitions, the Company’s expectations of solid performance from MVE

Biological Solutions as the Company’s clients’ capex spending normalize, the Company’s belief that it is positioned

to capitalize on the continued growth of the life sciences and especially the cell and gene therapy industry, and anticipated regulatory

filings or approvals with respect to the products of the Company's clients. It is important to note that the Company's actual results

could differ materially from those in any such forward-looking statements. Factors that could cause actual results to differ materially

include, but are not limited to, risks and uncertainties associated with the effect of changing economic and geopolitical conditions,

supply chain constraints, inflationary pressures, the ongoing wars between Russia and Ukraine and between Israel and Hamas and the effects

of foreign currency fluctuations, trends in the products markets, variations in the Company's cash flow, market acceptance risks, and

technical development risks. The Company's business could be affected by a number of other factors discussed in the Company's SEC reports,

including in the "Risk Factors" section of its most recently filed periodic reports on Form 10-K and Form 10-Q, as well as in

its subsequent filings with the SEC. The forward-looking statements contained in this press release speak only as of the date hereof and

the Company cautions investors not to place undue reliance on these forward-looking statements. Except as required by law, the Company

disclaims any obligation, and does not undertake to update or revise any forward-looking statements in this press release.

Cryoport Investor Contacts:

Todd Fromer / Scott Eckstein

KCSA Strategic Communications

cryoport@kcsa.com

Cryoport, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(unaudited)

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| (in thousands, except share and per share data) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues: | |

| | |

| | |

| | |

| |

| Service revenues | |

$ | 36,022 | | |

$ | 33,296 | | |

$ | 107,062 | | |

$ | 100,791 | |

| Product revenues | |

| 20,135 | | |

| 27,168 | | |

| 68,933 | | |

| 76,128 | |

| Total revenues | |

| 56,157 | | |

| 60,464 | | |

| 175,995 | | |

| 176,919 | |

| Cost of revenues: | |

| | | |

| | | |

| | | |

| | |

| Cost of service revenues | |

| 20,803 | | |

| 18,913 | | |

| 59,887 | | |

| 56,742 | |

| Cost of product revenues | |

| 11,088 | | |

| 15,134 | | |

| 40,037 | | |

| 42,581 | |

| Total cost of revenues | |

| 31,891 | | |

| 34,047 | | |

| 99,924 | | |

| 99,323 | |

| Gross Margin | |

| 24,266 | | |

| 26,417 | | |

| 76,071 | | |

| 77,596 | |

| Operating costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 36,023 | | |

| 30,235 | | |

| 108,066 | | |

| 87,420 | |

| Engineering and development | |

| 5,152 | | |

| 3,985 | | |

| 13,291 | | |

| 11,045 | |

| Total operating costs and expenses: | |

| 41,175 | | |

| 34,220 | | |

| 121,357 | | |

| 98,465 | |

| Loss from operations | |

| (16,909 | ) | |

| (7,803 | ) | |

| (45,286 | ) | |

| (20,869 | ) |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Investment income | |

| 2,848 | | |

| 2,485 | | |

| 7,962 | | |

| 5,797 | |

| Interest expense | |

| (1,357 | ) | |

| (1,609 | ) | |

| (4,197 | ) | |

| (4,686 | ) |

| Gain on extinguishment of debt, net | |

| 5,679 | | |

| - | | |

| 5,679 | | |

| - | |

| Other income (expense), net | |

| (3,059 | ) | |

| 1,668 | | |

| 242 | | |

| (7,377 | ) |

| Loss before provision for income taxes | |

| (12,798 | ) | |

| (5,259 | ) | |

| (35,600 | ) | |

| (27,135 | ) |

| Provision for income taxes | |

| (471 | ) | |

| (57 | ) | |

| (1,598 | ) | |

| (762 | ) |

| Net loss | |

$ | (13,269 | ) | |

$ | (5,316 | ) | |

$ | (37,198 | ) | |

$ | (27,897 | ) |

| Paid-in-kind dividend on Series C convertible preferred stock | |

| (2,000 | ) | |

| (2,000 | ) | |

| (6,000 | ) | |

| (6,000 | ) |

| Net loss attributable to common stockholders | |

$ | (15,269 | ) | |

$ | (7,316 | ) | |

$ | (43,198 | ) | |

$ | (33,897 | ) |

| Net loss per share attributable to common stockholders - basic and diluted | |

$ | (0.31 | ) | |

$ | (0.15 | ) | |

$ | (0.89 | ) | |

$ | (0.69 | ) |

| Weighted average common shares outstanding - basic and diluted | |

| 48,904,102 | | |

| 48,520,696 | | |

| 48,660,646 | | |

| 49,148,558 | |

Cryoport, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| (in thousands) | |

(unaudited) | | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 59,473 | | |

$ | 36,595 | |

| Short-term investments | |

| 406,389 | | |

| 486,728 | |

| Accounts receivable, net | |

| 42,626 | | |

| 43,858 | |

| Inventories | |

| 29,104 | | |

| 27,678 | |

| Prepaid expenses and other current assets | |

| 11,548 | | |

| 9,317 | |

| Total current assets | |

| 549,140 | | |

| 604,176 | |

| Property and equipment, net | |

| 74,520 | | |

| 63,603 | |

| Operating lease right-of-use assets | |

| 32,561 | | |

| 26,877 | |

| Intangible assets, net | |

| 192,962 | | |

| 191,009 | |

| Goodwill | |

| 148,954 | | |

| 151,117 | |

| Deposits | |

| 1,656 | | |

| 1,017 | |

| Deferred tax assets | |

| 863 | | |

| 947 | |

| Total assets | |

$ | 1,000,656 | | |

$ | 1,038,746 | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and other accrued expenses | |

$ | 27,875 | | |

$ | 28,046 | |

| Accrued compensation and related expenses | |

| 10,426 | | |

| 8,458 | |

| Deferred revenue | |

| 1,580 | | |

| 439 | |

| Current portion of operating lease liabilities | |

| 4,759 | | |

| 3,720 | |

| Current portion of finance lease liabilities | |

| 195 | | |

| 128 | |

| Current portion of notes payable | |

| 70 | | |

| 60 | |

| Total current liabilities | |

| 44,905 | | |

| 40,851 | |

| Convertible senior notes , net | |

| 377,955 | | |

| 406,708 | |

| Notes payable, net | |

| 307 | | |

| 355 | |

| Operating lease liabilities, net | |

| 29,757 | | |

| 24,721 | |

| Finance lease liabilities, net | |

| 632 | | |

| 216 | |

| Deferred tax liability | |

| 4,708 | | |

| 4,929 | |

| Other long-term liabilities | |

| 484 | | |

| 451 | |

| Contingent consideration | |

| 4,380 | | |

| 4,677 | |

| Total liabilities | |

| 463,128 | | |

| 482,908 | |

| Total stockholders' equity | |

| 537,528 | | |

| 555,838 | |

| Total liabilities and stockholders' equity | |

$ | 1,000,656 | | |

$ | 1,038,746 | |

Note Regarding Use of Non-GAAP Financial Measures

To supplement our financial statements,

which are presented on the basis of U.S. generally accepted accounting principles (GAAP), the following non-GAAP measures of financial

performance as defined in Regulation G of the Securities Exchange Act of 1934 are included in this release: revenue at constant currency,

revenue growth rate at constant currency and adjusted EBITDA. Non-GAAP financial measures are not calculated in accordance with GAAP,

are not based on any comprehensive set of accounting rules or principles and may be different from non-GAAP financial measures presented

by other companies. Non-GAAP financial measures, including revenue at constant currency, revenue growth rate at constant currency and

adjusted EBITDA, should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance

with GAAP.

We believe that revenue growth is a

key indicator of how Cryoport is progressing from period to period and we believe that the non-GAAP financial measures, revenue at constant

currency and revenue growth rate at constant currency, are useful to investors in analyzing the underlying trends in revenue. Under GAAP,

revenues received in local (non-U.S. dollar) currency are translated into U.S. dollars at the average exchange rate for the period presented.

As a result, fluctuations in foreign currency exchange rates affect the results of our operations and the value of our foreign assets

and liabilities, which in turn may adversely affect results of operations and cash flows and the comparability of period-to-period results

of operations. When we use the term “constant currency,” it means that we have translated local currency revenues for the

current reporting period into U.S. dollars using the same average foreign currency exchange rates for the conversion of revenues into

U.S. dollars that we used to translate local currency revenues for the comparable reporting period of the prior year. Revenue growth rate

at constant currency refers to the measure of comparing the current reporting period revenue at constant currency with the reported GAAP

revenue for the comparable reporting period of the prior year.

However, we also believe that data

on constant currency period-over-period changes have limitations, particularly as the currency effects that are eliminated could constitute

a significant element of our revenue and could significantly impact our performance. We therefore limit our use of constant currency period-over-period

changes to a measure for the impact of currency fluctuations on the translation of local currency revenue into U.S. dollars. We do not

evaluate our results and performance without considering both period-over-period changes in non-GAAP constant currency revenue on the

one hand and changes in revenue prepared in accordance with GAAP on the other. We caution the readers of this press release to follow

a similar approach by considering revenue on constant currency period-over-period changes only in addition to, and not as a substitute

for, or superior to, changes in revenue prepared in accordance with GAAP.

Adjusted EBITDA is defined as net loss

adjusted for interest expense, income taxes, depreciation and amortization expense, stock-based compensation expense, acquisition and

integration costs, investment income, unrealized (gain)/loss on investments, foreign currency (gain)/loss, gain on insurance claim, gain

on extinguishment of debt and charges or gains resulting from non-recurring events.

Management believes that adjusted EBITDA

provides a useful measure of Cryoport's operating results, a meaningful comparison with historical results and with the results of other

companies, and insight into Cryoport's ongoing operating performance. Further, management and the Company’s board of directors utilize

adjusted EBITDA to gain a better understanding of Cryoport's comparative operating performance from period to period and as a basis for

planning and forecasting future periods. Adjusted EBITDA is also a significant performance measure used by Cryoport in connection with

its incentive compensation programs. Management believes adjusted EBITDA, when read in conjunction with Cryoport's GAAP financials, is

useful to investors because it provides a basis for meaningful period-to-period comparisons of Cryoport's ongoing operating results, including

results of operations, against investor and analyst financial models, helps identify trends in Cryoport's underlying business and in performing

related trend analyses, and it provides a better understanding of how management plans and measures Cryoport's underlying business.

Cryoport, Inc. and Subsidiaries

Reconciliation of GAAP net loss to adjusted EBITDA

(unaudited)

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| (in thousands) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| GAAP net loss | |

$ | (13,269 | ) | |

$ | (5,316 | ) | |

$ | (37,198 | ) | |

$ | (27,897 | ) |

| Non-GAAP adjustments to net loss: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization expense | |

| 6,911 | | |

| 5,787 | | |

| 20,038 | | |

| 16,631 | |

| Acquisition and integration costs | |

| 675 | | |

| 721 | | |

| 6,304 | | |

| 1,544 | |

| Investment income | |

| (2,848 | ) | |

| (2,485 | ) | |

| (7,962 | ) | |

| (5,797 | ) |

| Unrealized loss on investments | |

| 2,336 | | |

| 3,914 | | |

| 2,300 | | |

| 12,550 | |

| Gain on insurance claim | |

| - | | |

| (4,815 | ) | |

| (2,642 | ) | |

| (4,815 | ) |

| Foreign currency (gain)/loss | |

| 710 | | |

| (128 | ) | |

| 114 | | |

| 628 | |

| Interest expense, net | |

| 1,357 | | |

| 1,609 | | |

| 4,197 | | |

| 4,686 | |

| Stock-based compensation expense | |

| 5,976 | | |

| 5,366 | | |

| 16,960 | | |

| 14,749 | |

| Gain on extinguishment of debt, net | |

| (5,679 | ) | |

| - | | |

| (5,679 | ) | |

| - | |

| Other non-recurring costs | |

| 250 | | |

| - | | |

| 250 | | |

| - | |

| Income taxes | |

| 471 | | |

| 57 | | |

| 1,598 | | |

| 762 | |

| Adjusted EBITDA | |

$ | (3,110 | ) | |

$ | 4,710 | | |

$ | (1,720 | ) | |

$ | 13,041 | |

Cryoport, Inc. and Subsidiaries

Total revenues by market at constant currency for the three months ended September 30, 2023

(unaudited)

| (in thousands) | |

Biopharma/

Pharma | | |

Animal

Health | | |

Reproductive Medicine | | |

Total | |

| Non US-GAAP Constant Currency | |

$ | 46,417 | | |

$ | 6,864 | | |

$ | 2,289 | | |

$ | 55,570 | |

| As Reported | |

| 46,979 | | |

| 6,884 | | |

| 2,294 | | |

| 56,157 | |

| FX Impact [$] | |

| 562 | | |

| 20 | | |

| 5 | | |

| 587 | |

| FX Impact [%] | |

| 1.2 | % | |

| 0.3 | % | |

| 0.2 | % | |

| 1.0 | % |

Cryoport, Inc. and Subsidiaries

Total revenues by market at constant currency for the nine months ended September 30, 2023

(unaudited)

| (in thousands) | |

Biopharma/

Pharma | | |

Animal

Health | | |

Reproductive Medicine | | |

Total | |

| Non US-GAAP Constant Currency | |

$ | 145,411 | | |

$ | 23,993 | | |

$ | 7,742 | | |

$ | 177,146 | |

| As Reported | |

| 144,634 | | |

| 23,620 | | |

| 7,741 | | |

| 175,995 | |

| FX Impact [$] | |

| (777 | ) | |

| (373 | ) | |

| (1 | ) | |

| (1,151 | ) |

| FX Impact [%] | |

| (0.5 | )% | |

| (1.6 | )% | |

| (0.0 | )% | |

| (0.7 | )% |

v3.23.3

Cover

|

Nov. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 08, 2023

|

| Entity File Number |

001-34632

|

| Entity Registrant Name |

CRYOPORT, INC.

|

| Entity Central Index Key |

0001124524

|

| Entity Tax Identification Number |

88-0313393

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

112

Westwood Place

|

| Entity Address, Address Line Two |

Suite

350

|

| Entity Address, City or Town |

Brentwood

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37027

|

| City Area Code |

949

|

| Local Phone Number |

470-2300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

CYRX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

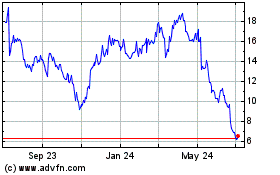

CryoPort (NASDAQ:CYRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CryoPort (NASDAQ:CYRX)

Historical Stock Chart

From Apr 2023 to Apr 2024