false

Q3

2023

--12-31

0001496443

0001496443

2023-01-01

2023-09-30

0001496443

2023-11-03

0001496443

2023-09-30

0001496443

2022-12-31

0001496443

2023-07-01

2023-09-30

0001496443

2022-07-01

2022-09-30

0001496443

2022-01-01

2022-09-30

0001496443

PAYS:PlasmaIndustryMember

2023-07-01

2023-09-30

0001496443

PAYS:PlasmaIndustryMember

2022-07-01

2022-09-30

0001496443

PAYS:PlasmaIndustryMember

2023-01-01

2023-09-30

0001496443

PAYS:PlasmaIndustryMember

2022-01-01

2022-09-30

0001496443

PAYS:PharmaceuticalIndustryMember

2023-07-01

2023-09-30

0001496443

PAYS:PharmaceuticalIndustryMember

2022-07-01

2022-09-30

0001496443

PAYS:PharmaceuticalIndustryMember

2023-01-01

2023-09-30

0001496443

PAYS:PharmaceuticalIndustryMember

2022-01-01

2022-09-30

0001496443

PAYS:OtherRevenueMember

2023-07-01

2023-09-30

0001496443

PAYS:OtherRevenueMember

2022-07-01

2022-09-30

0001496443

PAYS:OtherRevenueMember

2023-01-01

2023-09-30

0001496443

PAYS:OtherRevenueMember

2022-01-01

2022-09-30

0001496443

us-gaap:CommonStockMember

2022-12-31

0001496443

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001496443

us-gaap:TreasuryStockCommonMember

2022-12-31

0001496443

us-gaap:RetainedEarningsMember

2022-12-31

0001496443

us-gaap:CommonStockMember

2023-03-31

0001496443

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001496443

us-gaap:TreasuryStockCommonMember

2023-03-31

0001496443

us-gaap:RetainedEarningsMember

2023-03-31

0001496443

2023-03-31

0001496443

us-gaap:CommonStockMember

2023-06-30

0001496443

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001496443

us-gaap:TreasuryStockCommonMember

2023-06-30

0001496443

us-gaap:RetainedEarningsMember

2023-06-30

0001496443

2023-06-30

0001496443

us-gaap:CommonStockMember

2021-12-31

0001496443

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001496443

us-gaap:TreasuryStockCommonMember

2021-12-31

0001496443

us-gaap:RetainedEarningsMember

2021-12-31

0001496443

2021-12-31

0001496443

us-gaap:CommonStockMember

2022-03-31

0001496443

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001496443

us-gaap:TreasuryStockCommonMember

2022-03-31

0001496443

us-gaap:RetainedEarningsMember

2022-03-31

0001496443

2022-03-31

0001496443

us-gaap:CommonStockMember

2022-06-30

0001496443

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001496443

us-gaap:TreasuryStockCommonMember

2022-06-30

0001496443

us-gaap:RetainedEarningsMember

2022-06-30

0001496443

2022-06-30

0001496443

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001496443

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001496443

us-gaap:TreasuryStockCommonMember

2023-01-01

2023-03-31

0001496443

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001496443

2023-01-01

2023-03-31

0001496443

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001496443

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001496443

us-gaap:TreasuryStockCommonMember

2023-04-01

2023-06-30

0001496443

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001496443

2023-04-01

2023-06-30

0001496443

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001496443

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0001496443

us-gaap:TreasuryStockCommonMember

2023-07-01

2023-09-30

0001496443

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001496443

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001496443

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001496443

us-gaap:TreasuryStockCommonMember

2022-01-01

2022-03-31

0001496443

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001496443

2022-01-01

2022-03-31

0001496443

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001496443

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001496443

us-gaap:TreasuryStockCommonMember

2022-04-01

2022-06-30

0001496443

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001496443

2022-04-01

2022-06-30

0001496443

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0001496443

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2022-09-30

0001496443

us-gaap:TreasuryStockCommonMember

2022-07-01

2022-09-30

0001496443

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0001496443

us-gaap:CommonStockMember

2023-09-30

0001496443

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001496443

us-gaap:TreasuryStockCommonMember

2023-09-30

0001496443

us-gaap:RetainedEarningsMember

2023-09-30

0001496443

us-gaap:CommonStockMember

2022-09-30

0001496443

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001496443

us-gaap:TreasuryStockCommonMember

2022-09-30

0001496443

us-gaap:RetainedEarningsMember

2022-09-30

0001496443

2022-09-30

0001496443

PAYS:OneCustomerMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001496443

PAYS:AnotherCustomerMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-09-30

0001496443

PAYS:OneCustomerMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-12-31

0001496443

PAYS:AnotherCustomerMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-01-01

2022-12-31

0001496443

us-gaap:EquipmentMember

2023-09-30

0001496443

us-gaap:EquipmentMember

2022-12-31

0001496443

us-gaap:SoftwareDevelopmentMember

2023-09-30

0001496443

us-gaap:SoftwareDevelopmentMember

2022-12-31

0001496443

us-gaap:FurnitureAndFixturesMember

2023-09-30

0001496443

us-gaap:FurnitureAndFixturesMember

2022-12-31

0001496443

PAYS:WebsiteCostsMember

2023-09-30

0001496443

PAYS:WebsiteCostsMember

2022-12-31

0001496443

us-gaap:LeaseholdImprovementsMember

2023-09-30

0001496443

us-gaap:LeaseholdImprovementsMember

2022-12-31

0001496443

us-gaap:TrademarksAndTradeNamesMember

2023-09-30

0001496443

us-gaap:TrademarksAndTradeNamesMember

2022-12-31

0001496443

PAYS:PlatformMember

2023-09-30

0001496443

PAYS:PlatformMember

2022-12-31

0001496443

PAYS:CustomerListsAndContractsMember

2023-09-30

0001496443

PAYS:CustomerListsAndContractsMember

2022-12-31

0001496443

PAYS:LicensesMember

2023-09-30

0001496443

PAYS:LicensesMember

2022-12-31

0001496443

PAYS:HostingImplementationMember

2023-09-30

0001496443

PAYS:HostingImplementationMember

2022-12-31

0001496443

PAYS:ContractAssetsMember

2023-09-30

0001496443

PAYS:ContractAssetsMember

2022-12-31

0001496443

PAYS:VestedStockAwardsAndStockOptionsExercisedMember

2023-07-01

2023-09-30

0001496443

PAYS:VestedStockAwardsAndStockOptionsExercisedMember

2023-01-01

2023-09-30

0001496443

PAYS:StockOptionsMember

2023-01-01

2023-09-30

0001496443

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001496443

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0001496443

us-gaap:RestrictedStockMember

2023-07-01

2023-09-30

0001496443

us-gaap:RestrictedStockMember

2023-01-01

2023-09-30

0001496443

us-gaap:RestrictedStockMember

2022-07-01

2022-09-30

0001496443

us-gaap:RestrictedStockMember

2022-01-01

2022-09-30

0001496443

us-gaap:RestrictedStockMember

2022-09-30

0001496443

PAYS:RelatedPartyLawFirmMember

2022-07-01

2022-09-30

0001496443

PAYS:RelatedPartyLawFirmMember

2022-01-01

2022-09-30

0001496443

PAYS:USFederalGovernmentMember

2023-09-30

0001496443

PAYS:USFederalGovernmentMember

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13

OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to __________

Commission file number 001-38623

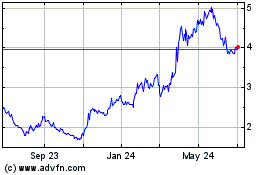

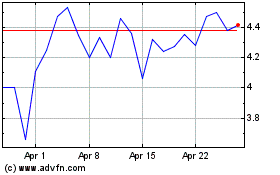

PAYSIGN, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

95-4550154 |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

2615 St. Rose Parkway,

Henderson, Nevada 89052

(Address of principal executive offices) (Zip code)

(702) 453-2221

(Registrant’s telephone number, including

area code)

N/A

(Former name, former address and former fiscal

year, if changed since last report)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each Class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

PAYS |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of

each of the issuer’s classes of common stock, as of the latest practicable date: 52,754,374 shares as of November 3, 2023.

PAYSIGN, INC.

FORM 10-Q REPORT

INDEX

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

PAYSIGN, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

| | | |

| | |

| | |

September 30,

2023 (Unaudited) | | |

December 31,

2022 (Audited) | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 9,936,627 | | |

$ | 9,708,238 | |

| Restricted cash | |

| 78,022,518 | | |

| 80,189,113 | |

| Accounts receivable, net | |

| 7,278,098 | | |

| 4,680,991 | |

| Other receivables | |

| 1,372,655 | | |

| 1,439,251 | |

| Prepaid expenses and other current assets | |

| 2,245,751 | | |

| 1,699,808 | |

| Total current assets | |

| 98,855,649 | | |

| 97,717,401 | |

| | |

| | | |

| | |

| Fixed assets, net | |

| 1,149,497 | | |

| 1,255,292 | |

| Intangible assets, net | |

| 7,884,171 | | |

| 5,656,722 | |

| Operating lease right-of-use asset | |

| 3,317,016 | | |

| 3,614,838 | |

| | |

| | | |

| | |

| Total assets | |

$ | 111,206,333 | | |

$ | 108,244,253 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 11,609,898 | | |

$ | 8,088,660 | |

| Operating lease liability, current portion | |

| 378,001 | | |

| 361,408 | |

| Total current liabilities | |

| 90,010,417 | | |

| 88,639,181 | |

| | |

| | | |

| | |

| Operating lease liability, long term portion | |

| 3,026,167 | | |

| 3,311,777 | |

| | |

| | | |

| | |

| Total liabilities | |

| 93,036,584 | | |

| 91,950,958 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 8) | |

| – | | |

| – | |

| | |

| | | |

| | |

| Stockholders' equity | |

| | | |

| | |

| Preferred stock, $0.001 par value; 25,000,000 shares authorized; none issued and outstanding | |

| – | | |

| – | |

| Common stock, $0.001 par value; 150,000,000 shares authorized; 53,382,382 and 52,650,382 issued at September 30, 2023 and December 31, 2022, respectively | |

| 53,382 | | |

| 52,650 | |

| Additional paid-in capital | |

| 21,304,569 | | |

| 19,137,281 | |

| Treasury stock, at cost; 698,008 and 303,450 shares, respectively | |

| (1,277,884 | ) | |

| (150,000 | ) |

| Accumulated deficit | |

| (1,910,318 | ) | |

| (2,746,636 | ) |

| Total stockholders' equity | |

| 18,169,749 | | |

| 16,293,295 | |

| | |

| | | |

| | |

| Total liabilities and stockholders' equity | |

$ | 111,206,333 | | |

$ | 108,244,253 | |

See accompanying notes to unaudited condensed consolidated

financial statements.

PAYSIGN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | |

| | | |

| | | |

| | | |

| | |

| | |

Three Months Ended

September 30, | | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

| | | |

| | | |

| | | |

| | |

| Plasma industry | |

$ | 11,061,712 | | |

$ | 9,829,811 | | |

$ | 30,436,240 | | |

$ | 25,030,376 | |

| Pharma industry | |

| 1,026,270 | | |

| 693,353 | | |

| 2,345,068 | | |

| 2,273,232 | |

| Other | |

| 312,343 | | |

| 73,264 | | |

| 803,358 | | |

| 112,235 | |

| Total revenues | |

| 12,400,325 | | |

| 10,596,428 | | |

| 33,584,666 | | |

| 27,415,843 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 6,068,207 | | |

| 4,847,780 | | |

| 16,589,139 | | |

| 11,971,135 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 6,332,118 | | |

| 5,748,648 | | |

| 16,995,527 | | |

| 15,444,708 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 4,696,509 | | |

| 4,386,757 | | |

| 14,946,584 | | |

| 13,283,645 | |

| Depreciation and amortization | |

| 1,045,177 | | |

| 738,883 | | |

| 2,848,194 | | |

| 2,131,234 | |

| Total operating expenses | |

| 5,741,686 | | |

| 5,125,640 | | |

| 17,794,778 | | |

| 15,414,879 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from operations | |

| 590,432 | | |

| 623,008 | | |

| (799,251 | ) | |

| 29,829 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income | |

| | | |

| | | |

| | | |

| | |

| Interest income, net | |

| 615,324 | | |

| 265,284 | | |

| 1,800,388 | | |

| 349,847 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax provision | |

| 105,152 | | |

| 36,183 | | |

| 164,819 | | |

| 64,996 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 1,100,604 | | |

$ | 852,109 | | |

$ | 836,318 | | |

$ | 314,680 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income per share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.02 | | |

$ | 0.02 | | |

$ | 0.02 | | |

$ | 0.01 | |

| Diluted | |

$ | 0.02 | | |

$ | 0.02 | | |

$ | 0.02 | | |

$ | 0.01 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 52,548,101 | | |

| 52,142,225 | | |

| 52,404,049 | | |

| 51,968,496 | |

| Diluted | |

| 53,484,674 | | |

| 53,365,025 | | |

| 54,286,492 | | |

| 52,676,707 | |

See accompanying notes to unaudited condensed consolidated

financial statements.

PAYSIGN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’

EQUITY

(UNAUDITED)

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Common Stock | | |

Additional

Paid-in | | |

Treasury Stock | | |

Accumulated | | |

Total Stockholders’ | |

| | |

Shares | | |

Amount | | |

Capital | | |

Shares | | |

Amount | | |

Deficit | | |

Equity | |

| Balance, December 31, 2022 | |

| 52,650,382 | | |

$ | 52,650 | | |

$ | 19,137,281 | | |

| (303,450 | ) | |

$ | (150,000 | ) | |

$ | (2,746,636 | ) | |

$ | 16,293,295 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued upon vesting of restricted stock | |

| 118,000 | | |

| 118 | | |

| (118 | ) | |

| – | | |

| – | | |

| – | | |

| – | |

| Stock-based compensation | |

| – | | |

| – | | |

| 618,244 | | |

| – | | |

| – | | |

| – | | |

| 618,244 | |

| Repurchase of common stock | |

| – | | |

| – | | |

| – | | |

| (200,000 | ) | |

| (666,018 | ) | |

| – | | |

| (666,018 | ) |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (160,130 | ) | |

| (160,130 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, March 31, 2023 | |

| 52,768,382 | | |

| 52,768 | | |

| 19,755,407 | | |

| (503,450 | ) | |

| (816,018 | ) | |

| (2,906,766 | ) | |

| 16,085,391 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued upon vesting of restricted stock | |

| 70,000 | | |

| 70 | | |

| (70 | ) | |

| – | | |

| – | | |

| – | | |

| – | |

| Exercise of stock options | |

| 4,000 | | |

| 4 | | |

| 9,596 | | |

| – | | |

| – | | |

| – | | |

| 9,600 | |

| Stock-based compensation | |

| – | | |

| – | | |

| 830,426 | | |

| – | | |

| – | | |

| – | | |

| 830,426 | |

| Repurchase of common stock | |

| – | | |

| – | | |

| – | | |

| (119,558 | ) | |

| (311,649 | ) | |

| – | | |

| (311,649 | ) |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (104,156 | ) | |

| (104,156 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, June 30, 2023 | |

| 52,842,382 | | |

$ | 52,842 | | |

$ | 20,595,359 | | |

| (623,008 | ) | |

$ | (1,127,667 | ) | |

$ | (3,010,922 | ) | |

$ | 16,509,612 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued upon vesting of restricted stock | |

| 540,000 | | |

| 540 | | |

| (540 | ) | |

| – | | |

| – | | |

| – | | |

| – | |

| Stock-based compensation | |

| – | | |

| – | | |

| 709,750 | | |

| – | | |

| – | | |

| – | | |

| 709,750 | |

| Repurchase of common stock | |

| – | | |

| – | | |

| – | | |

| (75,000 | ) | |

| (150,217 | ) | |

| – | | |

| (150,217 | ) |

| Net income | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 1,100,604 | | |

| 1,100,604 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, September 30, 2023 | |

| 53,382,382 | | |

$ | 53,382 | | |

$ | 21,304,569 | | |

| (698,008 | ) | |

$ | (1,277,884 | ) | |

$ | (1,910,318 | ) | |

$ | 18,169,749 | |

| | |

Common Stock | | |

Additional

Paid-in | | |

Treasury Stock | | |

Accumulated | | |

Total Stockholders’ | |

| | |

Shares | | |

Amount | | |

Capital | | |

Shares | | |

Amount | | |

Deficit | | |

Equity | |

| Balance, December 31, 2021 | |

| 52,095,382 | | |

$ | 52,095 | | |

$ | 16,860,119 | | |

| (303,450 | ) | |

$ | (150,000 | ) | |

$ | (3,774,411 | ) | |

$ | 12,987,803 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued upon vesting of restricted stock | |

| 123,000 | | |

| 123 | | |

| (123 | ) | |

| – | | |

| – | | |

| – | | |

| – | |

| Stock-based compensation | |

| – | | |

| – | | |

| 569,502 | | |

| – | | |

| – | | |

| – | | |

| 569,502 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (309,395 | ) | |

| (309,395 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, March 31, 2022 | |

| 52,218,382 | | |

| 52,218 | | |

| 17,429,498 | | |

| (303,450 | ) | |

| (150,000 | ) | |

| (4,083,806 | ) | |

| 13,247,910 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued upon vesting of restricted stock | |

| 105,000 | | |

| 105 | | |

| (105 | ) | |

| – | | |

| – | | |

| – | | |

| – | |

| Stock-based compensation | |

| – | | |

| – | | |

| 488,287 | | |

| – | | |

| – | | |

| – | | |

| 488,287 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (228,034 | ) | |

| (228,034 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, June 30, 2022 | |

| 52,323,382 | | |

$ | 52,323 | | |

$ | 17,917,680 | | |

| (303,450 | ) | |

$ | (150,000 | ) | |

$ | (4,311,840 | ) | |

$ | 13,508,163 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock issued upon vesting of restricted stock | |

| 138,000 | | |

| 138 | | |

| (138 | ) | |

| – | | |

| – | | |

| – | | |

| – | |

| Stock-based compensation | |

| – | | |

| – | | |

| 566,205 | | |

| – | | |

| – | | |

| – | | |

| 566,205 | |

| Net income | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 852,109 | | |

| 852,109 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, September 30, 2022 | |

| 52,461,382 | | |

$ | 52,461 | | |

$ | 18,483,747 | | |

| (303,450 | ) | |

$ | (150,000 | ) | |

$ | (3,459,731 | ) | |

$ | 14,926,477 | |

See accompanying notes to unaudited condensed consolidated

financial statements.

PAYSIGN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

| | | |

| | |

| | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 836,318 | | |

$ | 314,680 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Gain on disposal assets | |

| (4,862 | ) | |

| – | |

| Stock-based compensation expense | |

| 2,158,420 | | |

| 1,623,994 | |

| Depreciation and amortization | |

| 2,848,194 | | |

| 2,131,234 | |

| Noncash lease expense | |

| 297,822 | | |

| 282,193 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (2,597,107 | ) | |

| (639,045 | ) |

| Other receivables | |

| 66,596 | | |

| (420,033 | ) |

| Prepaid expenses and other current assets | |

| (545,943 | ) | |

| (711,185 | ) |

| Accounts payable and accrued liabilities | |

| 3,556,238 | | |

| 850,358 | |

| Operating lease liability | |

| (269,017 | ) | |

| (253,390 | ) |

| Customer card funding | |

| (2,166,595 | ) | |

| 27,775,501 | |

| Net cash provided by operating activities | |

| 4,180,064 | | |

| 30,954,307 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of fixed assets | |

| (218,133 | ) | |

| (75,661 | ) |

| Capitalization of internally developed software | |

| (4,781,853 | ) | |

| (2,508,348 | ) |

| Net cash used in investing activities | |

| (4,999,986 | ) | |

| (2,584,009 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from exercise of options | |

| 9,600 | | |

| – | |

| Repurchase of common stock | |

| (1,127,884 | ) | |

| – | |

| Net cash used in financing activities | |

| (1,118,284 | ) | |

| – | |

| | |

| | | |

| | |

| Net change in cash and restricted cash | |

| (1,938,206 | ) | |

| 28,370,298 | |

| Cash and restricted cash, beginning of period | |

| 89,897,351 | | |

| 68,671,070 | |

| | |

| | | |

| | |

| Cash and restricted cash, end of period | |

$ | 87,959,145 | | |

$ | 97,041,368 | |

| | |

| | | |

| | |

| Cash and restricted cash reconciliation: | |

| | | |

| | |

| Cash | |

$ | 9,936,627 | | |

$ | 7,981,953 | |

| Restricted cash | |

| 78,022,518 | | |

| 89,059,415 | |

| Total cash and restricted cash | |

$ | 87,959,145 | | |

$ | 97,041,368 | |

| | |

| | | |

| | |

| Supplemental cash flow information: | |

| | | |

| | |

| Non-cash financing activities | |

| | | |

| | |

| Cash paid for taxes | |

$ | 185,310 | | |

$ | 27,374 | |

| Interest paid | |

$ | – | | |

$ | 221 | |

See accompanying notes to unaudited condensed consolidated

financial statements.

PAYSIGN, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

1. BASIS OF PRESENTATION AND SUMMARY

OF SIGNIFICANT POLICIES

The foregoing unaudited interim condensed consolidated

financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”)

for interim financial information and with the instructions for Form 10-Q and Regulation S-X as promulgated by the Securities and Exchange

Commission (“SEC”). Accordingly, these financial statements do not include all of the disclosures required by GAAP for complete

financial statements. These unaudited interim condensed consolidated financial statements should be read in conjunction with the audited

financial statements and the notes thereto included on Form 10-K for the year ended December 31, 2022. In the opinion of management,

the unaudited interim condensed consolidated financial statements furnished herein include all adjustments, all of which are of a normal

recurring nature, necessary for a fair statement of the results for the interim period presented.

The preparation of financial statements in accordance

with GAAP requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent

assets and liabilities known to exist as of the date the financial statements are published, and the reported amounts of revenues and

expenses during the reporting period. Uncertainties with respect to such estimates and assumptions are inherent in the preparation of

the Company’s financial statements; accordingly, it is possible that the actual results could differ from these estimates and assumptions

that could have a material effect on the reported amounts of the Company’s financial position and results of operations.

Operating results for the three and nine months

ended September 30, 2023 are not necessarily indicative of the results that may be expected for the year ending December 31, 2023.

About Paysign, Inc.

Paysign, Inc. (the “Company,” “Paysign,”

“we” or “our”) was incorporated on August 24, 1995, and trades under the symbol PAYS on The Nasdaq Stock Market

LLC. Paysign is a provider of prepaid card programs, comprehensive patient affordability offerings, digital banking services and integrated

payment processing designed for businesses, consumers and government institutions. Headquartered in Nevada, the company creates customized,

innovative payment solutions for clients across all industries, including pharmaceutical, healthcare, hospitality and retail.

Principles of Consolidation – The

condensed consolidated financial statements include the accounts of the Company and its subsidiaries. All significant intercompany balances

and transactions have been eliminated.

Use of Estimates – The preparation

of the condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that

affect (i) the reported amounts of assets and liabilities, (ii) the disclosure of contingent assets and liabilities at the date of the

condensed consolidated financial statements and (iii) the reported amounts of revenue and expenses during the reporting period. Actual

results could differ from those estimates.

Cash and Cash Equivalents – The Company

considers all highly liquid investments purchased with an original maturity of three months or less at the time of purchase to be cash

equivalents for the purposes of the statement of cash flows. The Company had no cash equivalents at September 30, 2023 and December 31,

2022.

Restricted Cash – At September 30,

2023 and December 31, 2022, restricted cash consisted of funds held specifically for our card product and pharma programs that are contractually

restricted to use. The Company includes changes in restricted cash balances with cash and cash equivalents when reconciling the beginning

and ending total amounts in our condensed consolidated statements of cash flows.

Concentrations of Credit Risk – Financial

instruments that potentially subject the Company to concentrations of credit risk consist principally of cash and cash equivalents and

restricted cash. The Company maintains its cash and cash equivalents and restricted cash in various bank accounts primarily with one financial

institution in the United States which at times, may exceed federally insured limits. If this financial institution were to be placed

into receivership, we may be unable to access the cash we have on deposit. If we are unable to access our cash and cash equivalents as

needed, our financial position and ability to operate our business could be adversely affected. The Company has not experienced, nor does

it anticipate, any losses with respect to such accounts. As of September 30, 2023 and December 31, 2022, the Company had approximately

$40,208,706 and $43,516,155 in excess of federally insured bank account limits, respectively.

As of September 30, 2023, the Company also has

a concentration of accounts receivable risk, as two pharma program customers associated with our pharma patient affordability programs

each individually represent 20% and 19% of our accounts receivable balance. Two pharma program customers each individually represented

35% and 24% of our accounts receivable balance on December 31, 2022.

Fixed Assets – Fixed assets are stated

at cost less accumulated depreciation. Depreciation is principally recorded using the straight-line method over the estimated useful life

of the asset, which is generally 3 to 10 years. The cost of repairs and maintenance is charged to expense as incurred. Leasehold improvements

are capitalized and depreciated over the shorter of the remaining lease term or the estimated useful life of the improvements. Expenditures

for property betterments and renewals are capitalized. Upon sale or other disposition of a depreciable asset, cost and accumulated depreciation

are removed from the accounts and any gain or loss is reflected in other income (expense).

The Company periodically evaluates whether events

and circumstances have occurred that may warrant revision of the estimated useful life of fixed assets or whether the remaining balance

of fixed assets should be evaluated for possible impairment. The Company uses an estimate of the related undiscounted cash flows over

the remaining life of the fixed assets in measuring their recoverability.

Intangible Assets – For intangible

assets, the Company recognizes an impairment loss if the carrying amount of the intangible asset is not recoverable and exceeds its fair

value. The carrying amount of the intangible asset is considered not recoverable if it exceeds the sum of the undiscounted cash flows

expected to result from the use of the asset.

Intangible assets with a finite life are amortized

on a straight-line basis over its estimated useful life, which is generally 3 to 15 years.

Internally Developed Software Costs - Computer

software development costs are expensed as incurred, except for internal use software or website development costs that qualify for capitalization

as described below, and include compensation and related expenses, costs of hardware and software, and costs incurred in developing features

and functionality.

For computer software developed or obtained for

internal use, costs that are incurred in the preliminary project and post implementation stages of software development are expensed as

incurred. Costs incurred during the application and development stage are capitalized. Capitalized costs are amortized using the straight-line

method over a three year estimated useful life, beginning in the period in which the software is available for use.

Contract Assets - Incremental

costs to obtain or fulfill a contract with a customer are capitalized. The Company determines the costs that are incremental by confirming

the costs (i) are directly related to a customer’s contract, (ii) generate or enhance resources to fulfill contract performance

obligations in the future, and (iii) are recoverable. Amortization is on a straight-line basis generally over three to five years, beginning

when goods and services are transferred to the customer or group of customers.

Hosting

Implementation – Costs to implement the cloud computing arrangements (the “hosting site”) are accounted for

by following the same model as internally developed software costs. Costs that are incurred in the preliminary project and post

implementation stages of hosting development are expensed when they are incurred. Costs incurred during the application and development stage

are capitalized. Capitalized costs are amortized using the straight-line method over a three

year estimated useful life, beginning in the period when the hosting site is available for use.

Customer Card Funding – As of September

30, 2023 and December 31, 2022, customer card funding represents funds loaded or available to be loaded on cards for the Company’s

card product programs.

Earnings Per Share – Basic earnings

per share exclude any dilutive effects of options, warrants and convertible securities. Basic earnings per share is computed using the

weighted-average number of common shares outstanding during the applicable period. Diluted earnings per share is computed using the weighted-average

number of common and common stock equivalent shares outstanding during the period using the treasury stock method. Common stock equivalent

shares are excluded from the computation if their effect on the diluted earnings per share calculation is anti-dilutive.

Revenue and Expense Recognition –

In determining when and how revenue is recognized from contracts with customers, the Company performs the following five-step analysis:

(i) identification of contracts with customers, (ii) determination of performance obligations, (iii) measurement of the transaction price,

(iv) allocation of the transaction price to the performance obligations, and (v) recognition of revenue when (or as) the Company satisfies

each performance obligation.

The Company generates revenues from plasma card

programs through fees generated from cardholder fees and interchange fees. Revenues from pharma card programs are generated through card

program management fees, transaction claims processing fees, interchange fees, and settlement income.

Plasma and pharma card program revenues include

both fixed and variable components. Cardholder fees represent an obligation to the cardholder based on a per transaction basis and are

recognized at a point in time when the performance obligation is fulfilled. Card program management fees and transaction claims processing

fees include an obligation to our card program sponsors and are generally recognized when earned on a monthly basis and are typically

due within 30 days pursuant to the contract terms which are generally multi-year contracts. The Company uses the output method to recognize

card program management fee revenue at the amount of consideration to which an entity has a right to invoice. The performance obligation

is satisfied when the services are transferred to the customer which the Company determined to be monthly, as the customer simultaneously

receives and consumes the benefit from the Company’s performance. Interchange fees are earned when customer-issued cards are processed

through card payment networks as the nature of our promise to the customer is that we stand ready to process transactions at the customer’s

requests on a daily basis over the contract term. Since the timing and quantity of transactions to be processed by us are not determinable,

we view interchange fees to comprise an obligation to stand ready to process as many transactions as the customer requests. Accordingly,

the promise to stand ready is accounted for as a single series performance obligation. The Company uses the right to invoice practical

expedient and recognizes interchange fee revenue concurrent with the processing of card transactions. Interchange fees are settled in

accordance with the card payment network terms and conditions, which is typically within a few days.

The Company utilizes the remote method of revenue

recognition for settlement income whereby the unspent balances will be recognized as revenue at the expiration of the cards and the respective

program. This has historically been associated with the pharma prepaid business which ended in 2022. The Company records all revenue on

a gross basis since it is the primary obligor and establishes the price in the contract arrangement with its customers. The Company is

currently under no obligation to refund any fees, and the Company does not currently have any obligations for disputed claim settlements.

Given the nature of the Company’s services and contracts, generally it has no contract assets.

Cost of revenues is comprised of transaction processing

fees, data connectivity and data center expenses, network fees, bank fees, card production and postage costs, customer service, program

management, application integration setup, and sales and commission expense.

Operating Leases – The Company determines

if a contract is or contains a leasing element at contract inception or the date in which a modification of an existing contract occurs.

In order for a contract to be considered a lease, the contract must transfer the right to control the use of an identified asset for a

period of time in exchange for consideration. Control is determined to have occurred if the lessee has the right to (i) obtain substantially

all of the economic benefits from the use of the identified asset throughout the period of use and (ii) direct the use of the identified

asset.

In determining the present value of lease payments

at lease commencement date, the Company utilizes its incremental borrowing rate based on the information available, unless the rate implicit

in the lease is readily determinable. The liability for operating leases is based on the present value of future lease payments. Operating

lease expenses are recorded as rent expense, which is included within selling, general and administrative expenses within the consolidated

statements of operations and presented as operating cash outflows within the consolidated statements of cash flows.

Leases with an initial term of 12 months or less

are not recorded on the balance sheet, with lease expenses for these leases recognized on a straight-line basis over the lease term.

Stock-Based Compensation – The Company

recognizes compensation expense for all restricted stock awards and stock options. The fair value of restricted stock awards is measured

using the grant date trading price of our stock. The fair value of stock options is estimated at the grant date using the Black-Scholes

option-pricing model, and the portion that is ultimately expected to vest is recognized as compensation cost over the requisite service

period. We have elected to recognize compensation expense for all options with graded vesting on a straight-line basis over the vesting

period of the entire option. The determination of fair value using the Black-Scholes option pricing model is affected by our stock price

as well as assumptions regarding a number of complex and subjective variables, including expected stock price volatility and the risk-free

interest rate.

Recently Adopted Accounting Pronouncements

– In June 2016, the Financial Accounting Standards Board (“FASB”) issued ASU No. 2016-13, Financial Instruments–Credit

Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which provides updated guidance on how an entity should

measure credit losses on all financial instruments carried at amortized cost (including loans held for investment and held-to-maturity

debt securities, as well as trade receivables, reinsurance recoverables, and receivables that relate to repurchase agreements and securities

lending agreements), a lessor’s net investments in leases, and off-balance sheet credit exposures not accounted for as insurance

or as derivatives, including loan commitments, standby letters of credit, and financial guarantees. Subsequently, in November 2018 the

FASB issued ASU No. 2018-19, Codification Improvements to Topic 326, Financial Instruments–Credit Losses, which clarified

that receivables arising from operating leases are not within the scope of Subtopic 326-20, but instead should be accounted for in accordance

with Topic 842, Leases. In March 2022 the FASB issued ASU No. 2022-02, Financial Instruments—Credit Losses: Troubled Debt Restructurings

and Vintage Disclosures which clarified accounting treatment required for trouble debt restructurings by creditors and enhanced disclosures

for write-offs. The new standard and related amendments are effective for fiscal years beginning after December 15, 2022, including interim

periods within those fiscal years. We adopted this guidance; however, there was no material impact of this adoption on the Company’s

consolidated financial position, results of operations, or cash flows.

2. FIXED ASSETS, NET

Fixed assets consist of the following:

| Schedule of fixed assets | |

| | | |

| | |

| | |

September 30,

2023 | | |

December 31,

2022 | |

| Equipment | |

$ | 2,375,156 | | |

$ | 2,161,424 | |

| Software | |

| 331,852 | | |

| 327,452 | |

| Furniture and fixtures | |

| 757,662 | | |

| 757,661 | |

| Website costs | |

| 69,881 | | |

| 69,881 | |

| Leasehold improvements | |

| 229,772 | | |

| 229,772 | |

| | |

| 3,764,323 | | |

| 3,546,190 | |

| Less: accumulated depreciation | |

| 2,614,826 | | |

| 2,290,898 | |

| Fixed assets, net | |

$ | 1,149,497 | | |

$ | 1,255,292 | |

Depreciation expense for the three months ended

September 30, 2023 and 2022 was $107,967 and $113,758, respectively. Depreciation expense for the nine months ended September 30, 2023

and 2022 was $323,928 and $383,980, respectively.

3. INTANGIBLE ASSETS, NET

Intangible assets consist of the following:

| Schedule of intangible assets | |

| | | |

| | |

| | |

September 30, 2023 | | |

December 31,

2022 | |

| Patents and trademarks | |

$ | 38,186 | | |

$ | 38,186 | |

| Platform | |

| 18,394,468 | | |

| 13,656,014 | |

| Customer lists and contracts | |

| 1,177,200 | | |

| 1,177,200 | |

| Licenses | |

| 209,282 | | |

| 209,282 | |

| Hosting implementation | |

| 43,400 | | |

| – | |

| Contract assets | |

| 150,000 | | |

| 185,000 | |

| | |

| 20,012,536 | | |

| 15,265,682 | |

| Less: accumulated amortization | |

| 12,128,365 | | |

| 9,608,960 | |

| Intangible assets, net | |

$ | 7,884,171 | | |

$ | 5,656,722 | |

Intangible assets are amortized over their useful

lives ranging from periods of 3 to 15 years. Amortization expense for the three months ended September 30, 2023 and 2022 was $937,210

and $625,125, respectively. Amortization expense for the nine months ended September 30, 2023 and 2022 was $2,524,266 and $1,747,254,

respectively.

4. LEASE

The Company entered into an operating lease for

office space which became effective in June 2020. The lease term is 10 years from the effective date and allows for two optional extensions

of five years each. The two optional extensions are not recognized as part of the right-of-use asset or lease liability since it is not

reasonably certain that the Company will extend this lease. As of September 30, 2023, the remaining lease term was 6.67 years and the

discount rate was 6%.

Operating lease cost included in selling, general

and administrative expenses was $186,470 and $565,905 for the three and nine months ended September 30, 2023, respectively. Operating

lease cost included in selling, general and administrative expenses was $184,214 and $551,764 for the three and nine months ended September

30, 2022, respectively.

The following is the lease maturity analysis of our operating lease

as of September 30, 2023:

Year ending December 31,

| Schedule of operating lease maturities | |

| | |

| 2023 (excluding the nine months ended September 30, 2023) | |

$ | 142,993 | |

| 2024 | |

| 571,968 | |

| 2025 | |

| 612,006 | |

| 2026 | |

| 640,604 | |

| 2027 | |

| 640,604 | |

| Thereafter | |

| 1,548,127 | |

| Total lease payments | |

| 4,156,302 | |

| Less: Imputed interest | |

| (752,134 | ) |

| Present value of future lease payments | |

| 3,404,168 | |

| Less: current portion of lease liability | |

| (378,001 | ) |

| Long-term portion of lease liability | |

$ | 3,026,167 | |

5. CUSTOMER CARD FUNDING LIABILITY

The Company issues prepaid cards with various

provisions for cardholder fees or expiration. Revenue generated from cardholder transactions and interchange fees are recognized when

the Company’s performance obligation is fulfilled. Unspent balances left on pharma cards are recognized as settlement income at

the expiration of the cards and the program. Contract liabilities related to prepaid cards represent funds on card and client funds held

to be loaded to card before the amounts are ultimately spent by the cardholders or recognized as revenue by the Company. Contract liabilities

related to prepaid cards are reported as Customer card funding liability on the condensed consolidated balance sheet.

The opening and closing balances of the Company's contract liabilities

are as follows:

| Schedule of contract liabilities | |

| | | |

| | |

| | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | |

| Beginning balance | |

$ | 80,189,113 | | |

$ | 61,283,914 | |

| Increase (decrease), net | |

| (2,166,595 | ) | |

| 27,775,501 | |

| Ending balance | |

$ | 78,022,518 | | |

$ | 89,059,415 | |

The amount of revenue recognized during the nine

months ended September 30, 2023 and 2022 that was included in the opening contract liability for prepaid cards was $2,020,224 and $1,485,005

respectively.

6. COMMON STOCK

At September 30, 2023, the Company's authorized

capital stock was 150,000,000 shares of common stock, par value $0.001 per share, and 25,000,000 shares of preferred stock, par value

$0.001 per share. On that date, the Company had 53,382,382 shares of common stock issued and 52,684,374 shares of common stock outstanding,

and no shares of preferred stock outstanding.

Stock-based compensation expense related to Company

grants for the three and nine months ended September 30, 2023 was $709,750 and $2,158,420, respectively. Stock-based compensation expense

for the three and nine months ended September 30, 2022 was $566,205 and $1,623,994, respectively.

2023

Transactions - During the three and nine months ended September 30, 2023 the Company issued 540,000 and 732,000 shares

of common stock for vested stock awards and the exercise of stock options. The Company received proceeds of $9,600 for

the exercise of stock options.

During the three and

nine months ended September 30, 2023 the Company repurchased 75,000 and 394,558 shares of its common stock at a cost of $150,217 or weighted

average price of $2.00 and $1,127,884 or weighted average price of $2.86 per share, respectively.

The Company also granted

0

and 350,000

restricted stock awards, respectively during the three and nine months ended September 30, 2023. For the stock awards granted,

the weighted average grant date fair value was $2.96 and vest over a period of two months to five years.

2022

Transactions - During the three and nine months ended September 30, 2022 the Company issued 138,000 and 366,000 shares,

respectively, of common stock for vested stock awards. No stock

options were exercised.

The Company also

granted 2,430,000 and 2,530,000 restricted

stock awards, respectively during the three and nine months ended September 30, 2022. For the stock awards granted, the weighted average grant date fair value was $1.81 and

vest over a period of one

to five years.

7. BASIC AND FULLY

DILUTED NET INCOME PER COMMON SHARE

The following table sets forth the computation

of basic and fully diluted net income per common share for the three and nine months ended September 30, 2023 and 2022:

| Schedule of computation of earnings per share | |

| | | |

| | | |

| | | |

| | |

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Numerator: | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 1,100,604 | | |

$ | 852,109 | | |

$ | 836,318 | | |

$ | 314,680 | |

| Denominator: | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares: | |

| | | |

| | | |

| | | |

| | |

| Denominator for basic calculation | |

| 52,548,101 | | |

| 52,142,225 | | |

| 52,404,049 | | |

| 51,968,496 | |

| Weighted average effects of potentially diluted common stock: | |

| | | |

| | | |

| | | |

| | |

| Stock options (calculated using the treasury method) | |

| 472,791 | | |

| 594,553 | | |

| 745,193 | | |

| 457,256 | |

| Unvested restricted stock grants | |

| 463,782 | | |

| 628,247 | | |

| 1,137,250 | | |

| 250,955 | |

| Denominator for fully diluted calculation | |

| 53,484,674 | | |

| 53,365,025 | | |

| 54,286,492 | | |

| 52,676,707 | |

| Net income per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.02 | | |

$ | 0.02 | | |

$ | 0.02 | | |

$ | 0.01 | |

| Fully diluted | |

$ | 0.02 | | |

$ | 0.02 | | |

$ | 0.02 | | |

$ | 0.01 | |

8. COMMITMENTS AND CONTINGENCIES

From time to time, we may become involved in various

lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties,

and an adverse result in these or other matters may arise from time to time that may harm our business.

The Company has been named as a defendant in three

complaints filed in the United States District Court for the District of Nevada: Yilan Shi v. Paysign, Inc. et. al., filed on March 19,

2020 (“Shi”), Lorna Chase v. Paysign, Inc. et. al., filed on March 25, 2020 (“Chase”), and Smith &

Duvall v. Paysign, Inc. et. al., filed on April 2, 2020 (collectively, the “Complaints” or “Securities Class Action”).

Smith & Duvall v. Paysign, Inc. et. al. was voluntarily dismissed on May 21, 2020. On May 18, 2020, the Shi plaintiffs and another

entity called the Paysign Investor Group each filed a motion to consolidate the remaining Shi and Chase actions and to be appointed lead

plaintiff. The Complaints are putative class actions filed on behalf of a class of persons who acquired the Company’s common stock

from March 19, 2019 through March 31, 2020, inclusive. The Complaints generally allege that the Company, Mark R. Newcomer, and Mark Attinger

violated Section 10(b) of the Exchange Act, and that Messrs. Newcomer and Attinger violated Section 20(a) of the Exchange Act, by making

materially false or misleading statements, or failing to disclose material facts, regarding the Company’s internal control over

financial reporting and its financial statements. The Complaints seek class action certification, compensatory damages, and attorney’s

fees and costs. On December 2, 2020, the Court consolidated Shi and Chase as In re Paysign, Inc. Securities Litigation and appointed the

Paysign Investor Group as lead plaintiff. On January 12, 2021, Plaintiffs filed an Amended Complaint in the consolidated action. Defendants

filed a Motion to Dismiss the Amended Complaint on March 15, 2021, which Plaintiffs opposed via an opposition brief filed on April 29,

2021, to which Defendants replied on June 1, 2021. On February 9, 2023, the Court granted in part and denied in part Defendants’

Motion to Dismiss. As of the date of this filing, the Company cannot give any meaningful estimate of likely outcome or damages.

The Company has also been named as a nominal defendant

in two stockholder derivative actions in the United States District Court for the District of Nevada. The first derivative action is entitled

Andrzej Toczek, derivatively on behalf of Paysign, Inc. v. Mark R. Newcomer, et al. and was filed on September 17, 2020. This action alleges

violations of Section 14(a) of the Exchange Act, breach of fiduciary duty, unjust enrichment, and waste, largely in connection with the

failure to correct information technology controls over financial reporting alleged in the Securities Class Action, thereby causing the

Company to face exposure in the Securities Class Action. The complaint also alleges insider trading violations against certain individual

defendants. On December 16, 2020, the Court approved a stipulation staying the action until the Court in the consolidated Securities Class

Action issues a ruling on the Motion to Dismiss. The second derivative action is entitled John K. Gray, derivatively on behalf of Paysign,

Inc. v. Mark Attinger, et al. and was filed on May 9, 2022. This action involves the same alleged conduct raised in the Toczek action

and asserts claims for breach of fiduciary duty in connection with financial reporting, breach of fiduciary duty in connection with alleged

insider trading against certain individual defendants, and unjust enrichment. On June 3, 2022, the Court approved a stipulation staying

the action until the Court in the consolidated Securities Class Action issues a ruling on the Motion to Dismiss. On May 10, 2023, the

Toczek and Gray actions were consolidated. The Company anticipates filing motions to dismiss given the ruling on the Motion to Dismiss

in the consolidated cases. As of the date of this filing, the Company cannot give any meaningful estimate of likely outcome or damages.

The Company has also been named as a nominal defendant

in a stockholder derivative action in state court in Clark County, Nevada, filed on October 2, 2023, entitled Simone Blanchette, derivatively

on behalf of Paysign, Inc. v. Mark Newcomer, et al. That complaint makes substantially the same allegations as made in the consolidated

Toczek and Gray actions discussed above, and also contains a claim that the individual defendants violated Section 10(b) and Rule 10b-5

promulgated thereunder. On that basis, on October 10, 2023, the defendants filed a Notice of Removal of the case to federal court. As

of the date of this filing, the Company cannot give any meaningful estimate of likely outcome or damages.

9. RELATED PARTY

A former member of our Board of Directors who

served through December 31, 2022 is also a partner in a law firm that the Company engages for services to review regulatory filings and

for various other legal matters. During the three and nine months ended September 30, 2022, the Company incurred legal expenses of

$27,561 and $109,314, respectively, with the related party law firm.

10. INCOME TAX

The effective tax rate (income

tax provision as a percentage of income before income tax provision) was 8.7% for the three months ended September 30, 2023, as compared

to 4.1% for the three months ended September 30, 2022. The effective tax rate was 16.5% and 17.1% for the nine months ended September

30, 2023 and 2022, respectively. The effective tax rates vary, primarily as a result of the full valuation on our deferred tax

assets in both the current and prior period and the tax benefit related to our stock-based compensation. As of September 30, 2023, management believes that it is more-likely-than-not

that the Company’s net deferred tax assets would not be realized in the near future and the Company would continue to record a full

valuation allowance on its deferred tax assets.

Under the provisions of the Coronavirus Aid, Relief,

and Economic Security Act (the “CARES Act”) signed into law in 2020 and the subsequent extension of the CARES Act through

September 30, 2021, the Company was eligible for a refundable employee retention credit subject to certain criteria. The Company has elected

an accounting policy to recognize the government assistance when it is probable that the Company is eligible to receive the assistance

and present the credit as a reduction of the related expense. As of September 30, 2023 and December 31, 2022, the Company recorded $836,734

and $1,296,488, respectively in other receivables on the condensed consolidated balance sheet related to U.S. Federal Government refunds.

11. SUBSEQUENT EVENTS

The Company discloses subsequent events that provide evidence about

conditions that did not change the consolidated financial statements at the balance sheet date but have a significant effect on the financial

statements at the time of occurrence or on future operations of the company.

On September 30, 2023, the Company had uninsured

deposits at our financial institution in the amount of $40,208,706. We have since initiated a program called deposit swapping with our

financial institution, whereby the financial institution utilizes a third party who is participating in reciprocal deposit networks as

an alternative way to offer us full Federal Deposit Insurance Corporation (“FDIC”) insurance on deposits over $250,000. Under

this program, deposit networks divide uninsured deposits into smaller units and distribute these monies among participating banks in the

network, whereby the monies are fully FDIC insured.

We have evaluated subsequent events from the balance

sheet date through November 8, 2023, the date at which the condensed financial statements were issued and determined that there were no

additional items that require adjustment to or disclosure in the condensed financial statement.

Item

2. Management’s discussion and analysis of financial condition and results of operations.

Disclosure Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q includes forward

looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”) (“Forward-Looking Statements”). All statements other than statements

of historical fact included in this report are Forward-Looking Statements. These Forward-Looking Statements are based on our current expectations,

assumptions, estimates and projections about our business and our industry. Words such as “believe,” “anticipate,”

“expect,” “intend,” “plan,” “propose,” “may,” and other similar expressions

identify Forward-Looking statements. In the normal course of our business, we, in an effort to help keep our shareholders and the public

informed about our operations, may from time-to-time issue certain statements, either in writing or orally, that contain, or may contain,

Forward-Looking Statements. Although we believe that the expectations reflected in such Forward-Looking Statements are reasonable, we

can give no assurance that such expectations will prove to have been correct. In addition, any statements that refer to expectations,

projections, estimates, forecasts, or other characterizations of future events or circumstances are Forward-Looking Statements. These

Forward-Looking Statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those

reflected in the Forward-Looking Statements. Such important factors (“Important Factors”) and other factors are disclosed

in this report, including those factors discussed in “Part II - Item 1A. Risk Factors.” All prior and subsequent

written and oral Forward-Looking Statements attributable to us or persons acting on our behalf are expressly qualified in their entirety

by the Important Factors described below that could cause actual results to differ materially from our expectations as set forth in any

Forward-Looking Statement made by or on behalf of us. You are cautioned not to place undue reliance on these Forward-Looking Statements,

which relate only to events as of the date on which the statements are made. We undertake no obligation to publicly revise these Forward-Looking

Statements to reflect events or circumstances that arise after the date hereof. You should refer to and carefully review the information

in future documents we file with the Securities and Exchange Commission.

Overview

Paysign, Inc. (the “Company,” “Paysign,”

“we” or “our”), headquartered in Nevada, was incorporated on August 24, 1995, and trades under the symbol PAYS

on The Nasdaq Stock Market LLC. We are a vertically integrated provider of prepaid card products and processing services for corporate,

consumer and government applications. Our payment solutions are utilized by our corporate customers as a means to increase customer loyalty,

increase patient adherence rates, reduce administration costs and streamline operations. Public sector organizations can utilize our payment

solutions to disburse public benefits or for internal payments. We market our prepaid card solutions under our Paysign® brand. As

we are a payment processor and prepaid card program manager, we derive our revenue from all stages of the prepaid card lifecycle.

We operate on a powerful, high-availability payments

platform with cutting-edge fintech capabilities that can be seamlessly integrated with our clients’ systems. This distinctive positioning

allows us to provide end-to-end technologies that securely manage transaction processing, cardholder enrollment, value loading, account

management, data and analytics, and customer service. Our architecture is known for its cross-platform compatibility, flexibility, and

scalability – allowing our clients and partners to leverage these advantages for cost savings and revenue opportunities.

Our suite of product offerings includes solutions

for corporate rewards, prepaid gift cards, general purpose reloadable debit cards, employee incentives, consumer rebates, donor compensation,

clinical trials, healthcare reimbursement payments and pharmaceutical payment assistance, and demand deposit accounts accessible with

a debit card. In the future, we expect to further expand our product into other prepaid card offerings such as travel cards and expense

reimbursement cards. Our cards are sponsored by our issuing bank partners.

Our revenues include fees generated from cardholder

fees, interchange, card program management fees, transaction claims processing fees, and settlement income. Revenue from cardholder fees,

interchange, card program management fees, and transaction claims processing fees is recorded when the performance obligation is fulfilled.

Settlement income is recorded at the expiration of the card program and relates solely to our pharma prepaid business which ended in 2022.

We have two categories for our prepaid debit cards:

(1) corporate and consumer reloadable cards, and (2) non-reloadable cards.

Reloadable Cards: These types of cards are generally

classified as payroll or considered general purpose reloadable (“GPR”) cards. Payroll cards are issued by an employer to an

employee in order to allow the employee to access payroll amounts that are deposited into an account linked to their card. GPR cards can

also be issued to a consumer at a retail location or mailed to a consumer after completing an on-line application. GPR cards can be reloaded

multiple times with a consumer’s payroll, government benefit, a federal or state tax refund or through cash reload networks located

at retail locations. Reloadable cards are generally open-loop cards as described below.

Non-Reloadable Cards: These are generally one-time

use cards that are only active until the funds initially loaded to the card are spent. These types of cards are generally used as gift

or incentive cards. Normally these types of cards are used for the purchase of goods or services at retail locations and cannot be used

to receive cash.

Both reloadable and non-reloadable cards may be

open-loop, closed-loop, or restricted-loop. Open-loop cards can be used to receive cash at ATM locations by PIN; or purchase goods or

services by PIN or signature at retail locations virtually anywhere that the network brand (American Express, Discover, Mastercard, Visa,

etc.) is accepted. Closed-loop cards can only be used at a specific merchant. Restricted-loop cards can be used at several merchants,

or a defined group of merchants, such as all merchants at a specific shopping mall.

The prepaid card market in the U.S. has experienced

significant growth in recent years due to consumers and merchants embracing improved technology, greater convenience, more product choices

and greater flexibility. Prepaid cards have also proven to be an attractive alternative to traditional bank accounts for certain segments

of the population, particularly those without, or who could not qualify for, a checking or savings account.

We manage all aspects of the prepaid card lifecycle,

from managing the card design and approval processes with partners and networks, to production, packaging, distribution, and personalization.

We also oversee inventory and security controls, renewals, lost and stolen card management, and replacement. We deploy a 24/7/365 fully

staffed, in-house customer service department which utilizes bilingual customer service representatives, Interactive Voice Response, and

two-way short message service messaging and text alerts.

Currently, we are focusing our marketing efforts

on corporate incentive and expense prepaid card products in various market verticals including but not limited to general corporate expense,

healthcare related markets including patient affordability solutions, clinical trials and donor compensation, loyalty rewards, and incentive

cards.

As part of our continuing platform expansion process,

we evaluate current and emerging technologies for applicability to our existing and future software platform. To this end, we engage with

various hardware and software vendors in evaluation of various infrastructure components. Where appropriate, we use third-party technology

components in the development of our software applications and service offerings. Third-party software may be used for highly specialized

business functions, which we may not be able to develop internally within time and budget constraints. Our principal target markets for

processing services include prepaid card issuers, retail and private-label issuers, small third-party processors, and small and mid-size

financial institutions in the United States and Mexico.

We have devoted more extensive resources to sales

and marketing activities as we have added essential personnel to our marketing, sales and support teams. We market our Paysign payment

solutions through direct marketing by the Company’s sales team. Our primary market focus is on companies that require a streamlined

payment solution for rewards, rebates, payment assistance, and other payments to their customers, employees, agents and others. To reach

these markets, we focus our sales efforts on direct contact with our target market and attendance at various industry specific conferences.

We may, at times, utilize independent contractors who make direct sales and are paid commissions and/or restricted stock awards. We market

our Paysign Premier product through existing communication channels to a targeted segment of our existing cardholders, as well as to a

broad group of individuals, ranging from non-banked to fully banked consumers with a focus on long term users of our product.

For the remainder of 2023, we plan to continue

to invest additional funds in technology improvements, sales and marketing, customer service, and regulatory compliance. From time to

time, we evaluate raising capital to enable us to diversify into new market verticals. If we do not raise new capital, we believe that

we will still be able to support our existing business and expand into new vertical markets using internally generated funds.

Results of Operations

Comparison of the Three Months Ended September

30, 2023 to the Three Months Ended September 30, 2022

The following table summarizes our consolidated financial results for

the three months ended September 30, 2023 in comparison to the three months ended September 30, 2022:

| | |

Three Months Ended September 30, (Unaudited) | | |

Variance | |

| | |

2023 | | |

2022 | | |

$ | | |

% | |

| Revenues | |

| | | |

| | | |

| | | |

| | |

| Plasma industry | |

$ | 11,061,712 | | |

$ | 9,829,811 | | |

$ | 1,231,901 | | |

| 12.5% | |

| Pharma industry | |

| 1,026,270 | | |

| 693,353 | | |

| 332,917 | | |

| 48.0% | |

| Other | |

| 312,343 | | |

| 73,264 | | |

| 239,079 | | |

| 326.3% | |

| Total revenues | |

| 12,400,325 | | |

| 10,596,428 | | |

| 1,803,897 | | |

| 17.0% | |

| Cost of revenues | |

| 6,068,207 | | |

| 4,847,780 | | |

| 1,220,427 | | |

| 25.2% | |

| Gross profit | |

| 6,332,118 | | |

| 5,748,648 | | |

| 583,470 | | |

| 10.1% | |

| Gross margin % | |

| 51.1% | | |

| 54.3% | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |