U.S. index futures point to a negative opening this Tuesday,

signaling a cautious reaction from investors to recent mixed

corporate earnings and unfavorable economic indicators coming from

Europe. The market also remains in anticipation of insights from

Federal Reserve members and the impending release of American trade

balance data, elements that may provide additional direction for

market trends.

At 06:42 AM, Dow Jones futures (DOWI:DJI) fell 123 points, or

0.36%. S&P 500 futures dropped 0.39% and Nasdaq-100 futures

fell 0.33%. The yield on 10-year Treasury notes was at 4.616%.

In the commodities market, West Texas Intermediate crude for

December fell 1.56%, to $79.56 per barrel. Brent crude oil for

January delivery dropped 1.68% near $83.75 per barrel. Iron ore

with a 62% concentration, traded on the Dalian exchange, fell

0.48%, priced at $126.72 per ton.

On the economic agenda this Tuesday, the focus in the financial

market falls on a series of speeches by Federal Reserve members,

which are set to take place throughout the day, promising to impact

investor expectations. Investors are also waiting for the 08 AM

release of trade balance data, where a deficit of $59.9 billion for

September is anticipated.

Subsequently, at 10 AM, the market awaits the release of the

November economic optimism index, which provides an updated

perspective on economic sentiment. Later in the afternoon, at 3 PM,

the focus turns to the numbers for consumer credit in August, with

an expected increase of $10 billion. Concluding the day, the

attention of energy market operators turns to the American

Petroleum Institute (API) report, scheduled for 4:30 PM, which will

reveal the levels of oil inventories from the past week.

In Asia, markets closed down after a 6.4% drop in China’s

exports, even after recent stimulus efforts. In Europe, in addition

to corporate earnings, investors are reacting to the

larger-than-expected drop in Germany’s industrial production. At

8:30 AM, a speech is scheduled from the Chairman of the Supervisory

Board of the European Central Bank (ECB), Andrea Enria.

U.S. stocks closed modestly higher on Monday as expectations for

future U.S. interest rates showed growth, adjusting after last

week’s enthusiasm. Long-term interest rates rose by over 10 basis

points, with the 10-year rate approaching 4.7%. Market attention

turned to the upcoming speeches by Fed members, especially

President Powell. The Dow Jones inched up 34.54 points or 0.10% to

34,095.86 points, its highest closing level in over a month. The

S&P 500 rose 0.18%, and the Nasdaq Composite gained 0.30%.

On Tuesday’s corporate earnings front, investors will watch for

reports from Uber (NYSE:UBER),

DataDog (NASDAQ:DDOG), DR Horton

(NYSE:DHI), Zimmer Biomet (NYSE:ZBH),

Emerson (NYSE:EMR), before the market opens. After

the close, reports are expected from Rivian

(NASDAQ:RIVN), Devon Energy (NYSE:DVN),

Occidental Petroleum (NYSE:OXY), Gilead

Sciences (NASDAQ:GILD), Mosaic

(NYSE:MOS), among others.

Wall Street Corporate Highlights for Today

Meta Platforms (NASDAQ:META) – Meta has banned

political campaigns and advertisers from regulated sectors from

using its new generative AI advertising products. The move aims to

prevent the spread of electoral misinformation. The ban affects ads

related to housing, employment, credit, social issues, elections,

politics, health, pharmaceuticals, and financial services.

Additionally, the Chan Zuckerberg Initiative, led by Mark

Zuckerberg, sold shares in DoorDash and the iShares Core MSCI

Emerging Markets ETF (LSE:0A3E) while increasing its investment in

the Vanguard FTSE Europe ETF in the third quarter. The changes were

disclosed in an SEC filing. DoorDash (NASDAQ:DASH) was completely

divested, while the investment in the European ETF was

significantly increased.

Intel (NASDAQ:INTC) – Intel is leading the race

to secure billions of dollars in funding for secure microchip

production facilities for U.S. military and intelligence use. The

facilities aim to reduce dependence on imported chips from East

Asia and would be funded by the $53 billion Chips Act from the

Biden administration. Additionally, Intel canceled a planned

investment in Vietnam that could have nearly doubled its operations

in the country. Vietnam was seeking to expand its chip industry,

but Intel suspended the expansion plan citing concerns about power

supply and excessive bureaucracy.

Nvidia (NASDAQ:NVDA) – U.S. restrictions on

Nvidia have opened an opportunity for Huawei in the AI chip market.

While initially overshadowed by Nvidia, Huawei has launched the

Ascend 910B, comparable to Nvidia’s A100. Huawei aims to secure a

significant share of the $7 billion AI chip market in China,

bolstered by government support and investments in

semiconductors.

Baidu (NASDAQ:BIDU) – China’s AI leader Baidu

has ordered 1,600 Ascend AI chips from Huawei as an alternative to

Nvidia (NASDAQ:NVDA) in a $61.83 million order to be delivered by

year-end, reflecting U.S. pressure on Chinese tech companies.

Alibaba (NYSE:BABA), JD

(NASDAQ:JD) – Alibaba and JD.com stocks are down in pre-market

trading on Tuesday following mixed trade data from China. Chinese

exports have fallen for the sixth consecutive month in October,

while imports surprisingly increased, suggesting stronger domestic

demand.

WeWork (NYSE:WE) – WeWork, a SoftBank

Group-backed startup, has sought bankruptcy protection in the U.S.

due to onerous leases and a decline in demand for shared office

spaces. SoftBank has agreed to convert debt into equity,

eliminating around $3 billion in debt. The company expects to

continue operating normally outside of the U.S. and Canada.

Tapestry (NYSE:TPR), Capri

Holdings (NYSE:CPRI) – The U.S. Federal Trade Commission

(FTC) has requested more information about the $8.5 billion deal

between Tapestry and Capri Holdings. The companies plan to

consolidate luxury brands like Kate Spade, Jimmy Choo, and Versace

to compete with larger rivals in the European luxury market. The

deal is expected to be completed in 2024.

Walt Disney (NYSE:DIS) – Walt Disney has hired

Hugh Johnston, former PepsiCo (NASDAQ:PEP)

executive, as CFO to address challenges in its TV business and

investor pressure. The hiring aims to strengthen the leadership

team amid a restructuring.

Roku (NASDAQ:ROKU) – Cathie Wood’s Ark

Innovation ETF sold Roku shares for the first time since August,

following the company becoming its largest position. The sale

followed a 42% increase in Roku shares after robust quarterly

results. Ark is the second-largest shareholder in Roku, with an

8.35% stake.

AMC Entertainment (NYSE:AMC) – AMC

Entertainment shares have recently shown bullish activity, with

more purchases of longer-term bonds seen as positive signs. This

has occurred in a more positive fixed-income market environment and

the success of a Taylor Swift film shown by AMC. AMC shares have

risen 9.9% in the last five days, outperforming the S&P 500

index. The company is expected to release its third-quarter results

soon.

Starbucks (NASDAQ:SBUX) – Starbucks will

increase hourly pay for its retail workers in the U.S. by at least

3% starting in 2024. The company plans to expand its store network

and raise the hourly income for baristas, with the possibility of

larger increases for longer-tenured employees.

Citigroup (NYSE:C) – Citigroup is considering

job cuts of at least 10% in several of its core businesses as part

of a reorganization led by CEO Jane Fraser. The restructuring aims

to simplify the bank and boost its stock price. Discussions are in

the early stages, and the number of job cuts may change.

Goldman Sachs (NYSE:GS) – According to a note

from Goldman Sachs, hedge funds aggressively bought U.S. stocks

last week, driving a rally with a focus on technology stocks. The

buying activity was the most intense in two years, and some short

positions became expensive as stock prices rose. Health and

financial stocks were sold, with the activity mainly focused on

North America.

Morgan Stanley (NYSE:MS) – James Gorman, CEO of

Morgan Stanley, plans to step down as chairman by the end of 2024

after relinquishing his CEO position to Ted Pick in January. Gorman

has expressed his desire to teach, spend more time with family, and

play golf, ruling out a foray into politics.

HSBC (NYSE:HSBC) – Global stocks are poised for

a double-digit rally in 2024 if the Federal Reserve adjusts its

monetary policy and avoids a recession, according to HSBC Holdings

Plc strategists. They expect the FTSE All-World index to finish the

next year with nearly a 10% increase. The team sees technology and

consumer sectors as preferred.

Moody’s (NYSE:MCO) – Credit rating agency

Moody’s is establishing a dedicated unit for private credit

research and assessment, led by Ana Arsov. With over $1.3 trillion

in assets under management, the global private credit market

represents about 12% of the alternative market, attracting

long-term investors. Moody’s aims to provide reliable analysis for

this sector.

Cigna (NYSE:CI) – Health insurer Cigna is

considering selling its Medicare Advantage business due to margin

profit challenges and changes in U.S. government reimbursement. The

company is exploring options with an investment bank, and the

business could be worth billions of dollars.

Sanofi (NASDAQ:SNY) – Sanofi is being

investigated for alleged market manipulation in France. The

preliminary investigation is related to the alleged dissemination

of misleading information about the company’s financial

communication, involving the launch of the Dupixent drug in 2017.

Sanofi denies knowledge of the investigation. The company’s shares

fell up to 1.2% in pre-market trading.

Bristol Myers Squibb (NYSE:BMY) – Bristol Myers

Squibb has acquired the experimental therapy ORM-6151 from Orum

Therapeutics to treat a type of blood cancer for up to $180

million. The treatment received FDA authorization for an initial

study and involves an initial payment of $100 million and milestone

payments.

Bumble (NASDAQ:BMBL) – Whitney Wolfe Herd,

founder of Bumble, will step down as CEO of the dating app operator

and will be replaced by Lidiane Jones, a seasoned executive from

Slack. The news caused the company’s shares to drop on Monday.

Whitney will remain as executive chairman.

Airbnb (NASDAQ:ABNB) – An Italian judge has

ordered the seizure of $836.40 million from Airbnb’s European

headquarters in Ireland due to alleged tax evasion, citing

non-payment of 21% of hosts’ income to Italian tax authorities.

Three former managers are also under investigation. Airbnb denies

wrongdoing.

General Electric (NYSE:GE) – General Electric’s

aviation unit has agreed to pay $9.4 million to settle federal

government allegations that a Massachusetts factory sold defective

parts to the U.S. Army and Navy. The settlement resolves claims

that GE Aerospace violated the Federal False Claims Act.

Kinder Morgan (NYSE:KMI), NextEra

Energy (NYSE:NEE) – Pipeline operator Kinder Morgan will

acquire NextEra Energy Partners’ pipelines in South Texas for $1.82

billion, amid growing consolidation in the sector. The transaction

is expected to be completed in the first quarter of 2024.

General Motors (NYSE:GM) – GM plans to

temporarily suspend production of its fully autonomous Cruise

Origin van, following the unit’s announcement of a pause in all

driverless operations. Cruise CEO Kyle Vogt noted that the company

has already produced hundreds of Origin vehicles, which is

sufficient for the short term. Additionally, GM plans to build a

more affordable version of the Chevrolet Bolt in Kansas and a new

series of premium electric vehicles for the Cadillac and Chevrolet

brands in Michigan as part of its $13.3 billion investment plan in

U.S. facilities through 2028.

Toyota Motor (NYSE:TM) – Toyota will extend

production cuts at a joint venture in China for three more months

due to increasing competition. Sales to dealers will be reduced to

66,000 units in December, 60,000 in January, and 38,000 in

February.

Ford Motor (NYSE:F), S&P

Global (NYSE:SPGI) – S&P Global Ratings has upgraded

Ford Motor Co.’s rating to BBB-, restoring its investment grade

after a downgrade in 2020. The agency cited expectations of strong

EBITDA margins and a robust cash balance. The news followed a wage

increase agreement with the UAW union and mixed quarterly

results.

Tesla (NASDAQ:TSLA) – Tesla will raise prices

of Model Y variants in China following an October update. The Model

Y is one of the best-selling electric vehicles in China, and Tesla

is adjusting prices after a period of competitive cuts and

increases in the Chinese EV market.

General Dynamics (NYSE:GD) – The United Auto

Workers (UAW) union announced on Monday that members at General

Dynamics factories in Ohio, Michigan, and Pennsylvania voted in

favor of a new labor agreement. The four-year agreement includes a

14% wage increase and protection against inflation.

Earnings

UBS (NYSE:UBS) – UBS Group AG reported a loss

of $785 million in the third quarter due to expenses related to the

acquisition of Credit Suisse, even though it demonstrated stability

in its wealth management division, with net inflows of $22 billion.

UBS CEO Sergio Ermotti indicated that the bank’s share buyback

program is likely to resume in 2024. Ermotti mentioned that the

bank is finalizing its three-year plan to determine the amount to

be returned to shareholders. The share buyback program had been

paused earlier this year.

Tripadvisor (NASDAQ:TRIP) – The online travel

company saw a nearly 12% increase in pre-market trading on Tuesday

after exceeding third-quarter projections. Tripadvisor reported

adjusted earnings of 52 cents per share with revenue of $533

million, surpassing LSEG analysts’ expectations of 47 cents per

share and $505 million in revenue.

Hims & Hers Health (NYSE:HIMS) – The

telemedicine company experienced an over 8% increase in pre-market

trading. Hims & Hers raised its full-year revenue forecast to

$868 million to $873 million, up from the previous estimate of $830

million to $850 million. The company also raised its expectations

for full-year adjusted EBITDA.

Vertex Pharmaceuticals (NASDAQ:VRTX) – The

biotechnology company fell short of revenue estimates in the third

quarter. Vertex reported adjusted earnings of $4.08 per share on

revenue of $2.48 billion, falling short of LSEG analysts’

expectations of $3.97 per share and $2.50 billion in revenue.

Veeco Instruments (NASDAQ:VECO) – Veeco

Instruments exceeded profit and revenue expectations in the third

quarter. The thin-film processing equipment manufacturer reported

adjusted earnings of 53 cents per share and revenue of $177.4

million, surpassing FactSet analysts’ predictions of 37 cents per

share and $168.2 million in revenue.

Alteryx (NYSE:AYX) – Alteryx shares rose 17% in

pre-market trading after the software company reported quarterly

results with a smaller-than-expected loss and sales that exceeded

analysts’ estimates. The net loss was $50 million, or 70 cents per

share, while revenue increased 8% to $232 million. Alteryx shares

had fallen 40% this year, compared to a 14% increase in the S&P

500 index.

International Flavors & Fragrances

(NYSE:IFF) – International Flavors & Fragrances announced it

would continue its cooperation agreement with Icahn Capital (IEP).

The parties agreed to appoint one director from Icahn and one

mutually agreed-upon director to the IFF board for the 2024 proxy

season. Additionally, IFF reported third-quarter adjusted earnings

and revenue that exceeded analysts’ estimates.

Fabrinet (NYSE:FN) – Fabrinet reported

better-than-expected results for the fiscal first quarter, both in

terms of revenue and net income. Fabrinet announced adjusted

earnings of $2 per share with revenue of $685.5 million, surpassing

FactSet analysts’ predictions of $1.85 per share in earnings and

$659.2 million in revenue.

Goodyear Tire & Rubber (NASDAQ:GT) –

Goodyear Tire & Rubber reported mixed third-quarter results.

The company reported a loss of $89 million but highlighted lower

raw material costs and signs of improvement in sales volume, as

well as strong travel demand in the U.S. However, when adjusted for

extraordinary items, earnings were 36 cents per share, exceeding

analysts’ expectations of 19 cents per share.

Sanmina (NASDAQ:SANM) – Shares of the

electronics manufacturing company dropped nearly 11% in pre-market

trading after Sanmina provided a downbeat outlook for the first

fiscal quarter. Management stated that the company’s first-quarter

outlook is “trending down sequentially,” and Sanmina expects

challenges in the next two quarters.

Coterra Energy (NYSE:CTRA) – The energy company

saw a 3% increase in pre-market trading after Coterra Energy

reported adjusted earnings of 50 cents per share in the third

quarter, surpassing analysts’ expectations of 44 cents per share,

according to FactSet. The company also raised its production

outlook for the full year.

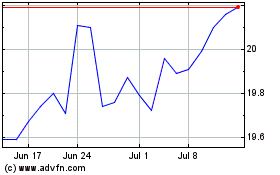

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

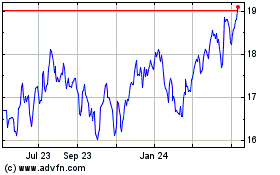

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Apr 2023 to Apr 2024