Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

November 06 2023 - 6:05AM

Edgar (US Regulatory)

FORM 6 - K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign

Private Issuer

Pursuant to Rule

13a - 16 or 15d - 16 of

the Securities

Exchange Act of 1934

As of November 5th, 2023

TENARIS, S.A.

(Translation of

Registrant's name into English)

26, Boulevard Royal,

4th floor

L-2449 Luxembourg

(Address of principal executive offices)

Indicate by check

mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F.

Form 20-F _Ö_

Form 40-F ___

The attached material is being furnished to the

Securities and Exchange Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended. This report

contains Tenaris’s Press Release announcing Tenaris to Commence a USD 300 million First Tranche of its USD 1.2 Billion Share Buyback

Program.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: November 5th, 2023

Tenaris,

S.A.

By: /s/ Cecilia Bilesio

Cecilia Bilesio

Corporate Secretary

Giovanni Sardagna

Tenaris

1-888-300-5432

www.tenaris.com

Tenaris

to Commence a USD 300 million First Tranche of its USD 1.2 Billion Share Buyback Program

Luxembourg, November 5, 2023. - Tenaris

S.A. (NYSE and Mexico: TS and EXM Italy: TEN) (“Tenaris”) announced today that pursuant to its Share Buyback Program (the

“Program”) announced on November 1, 2023, covering up to $1.2 billion to be executed in the open market with the intent to

cancel the ordinary shares acquired through the Program, Tenaris has entered into a non-discretionary buyback agreement with a primary

financial institution (the “Bank”).

The Bank will make its trading decisions concerning

the timing of the purchases of Tenaris’s ordinary shares independently of and uninfluenced by Tenaris and will act in compliance

with applicable rules and regulations, including the Market Abuse Regulation 596/2014 and the Commission Delegated Regulation (EU) 2016/1052

(the “Regulations”). Under the buyback agreement, purchases of shares may continue during any closed periods of Tenaris in

accordance with the Regulations.

This first tranche of the Program shall start

on November 6, 2023, and end no later than February 9, 2024. Ordinary shares purchased under the Program will be cancelled in due course.

Any buyback of ordinary shares in relation to

this announcement will be carried out under the authority granted by the general meeting of shareholders held on June 2, 2020, up to a

maximum of 10% of the Company’s capital, or any renewed or extended authorization to be granted at a future general meeting of the

Company.

Some of the statements contained in this press

release are “forward-looking statements”. Forward-looking statements are based on management’s current views and assumptions

and involve known and unknown risks that could cause actual results, performance or events to differ materially from those expressed or

implied by those statements. These risks include but are not limited to risks arising from uncertainties as to future oil and gas prices

and their impact on investment programs by oil and gas companies.

Tenaris is a leading global supplier of steel

tubes and related services for the world’s energy industry and certain other industrial applications.

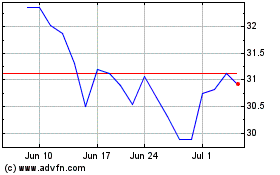

Tenaris (NYSE:TS)

Historical Stock Chart

From Apr 2024 to May 2024

Tenaris (NYSE:TS)

Historical Stock Chart

From May 2023 to May 2024